Key Insights

The global Organic Soy Protein Concentrate market is projected for significant growth, reaching $236.5 million by 2025, with a Compound Annual Growth Rate (CAGR) of 6.2% from 2025 to 2033. This expansion reflects strong demand for organic soy protein concentrates across diverse applications. The "Bakery and Confectionary" segment is anticipated to dominate, driven by consumer preference for healthier, plant-based ingredients. Simultaneously, "Meat Alternative" and "Dairy Alternative" segments are experiencing substantial growth due to increasing veganism, flexitarianism, and concerns regarding animal welfare and environmental sustainability. The "Infant Formula" segment also offers a significant opportunity as parents increasingly opt for organic, non-GMO nutritional choices.

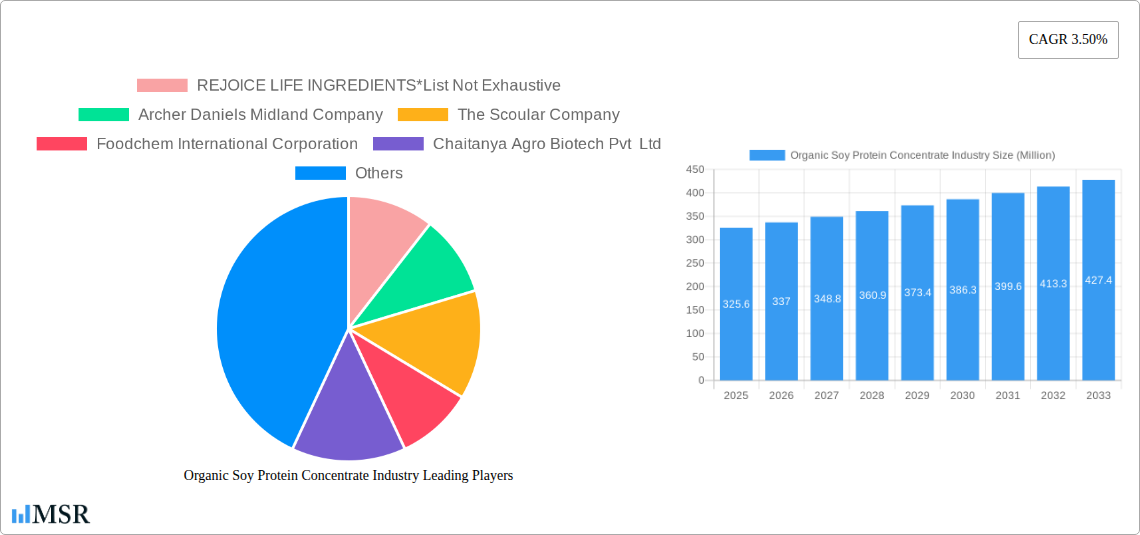

Organic Soy Protein Concentrate Industry Market Size (In Million)

Key growth drivers for the Organic Soy Protein Concentrate market include rising demand for plant-based proteins from health, environmental, and ethical considerations. Product innovation and expanded availability of organic food products through various retail channels further support market penetration. However, potential challenges include fluctuating organic soybean prices, stringent regional organic certification regulations, and the availability of alternative protein sources such as pea and rice protein. Despite these factors, the market outlook remains robust, with industry players prioritizing product diversification, market expansion, and technological advancements to capitalize on emerging opportunities.

Organic Soy Protein Concentrate Industry Company Market Share

Organic Soy Protein Concentrate Industry Market Analysis Report: 2019-2033

This comprehensive report delivers an in-depth analysis of the Organic Soy Protein Concentrate Market, providing critical insights for food manufacturers, ingredient suppliers, investors, and industry stakeholders. Spanning the historical period of 2019-2024, the base year of 2025, and a robust forecast period from 2025-2033, this study offers a detailed roadmap of market dynamics, growth drivers, emerging trends, and competitive landscapes within the global organic soy protein concentrate sector.

Organic Soy Protein Concentrate Industry Market Concentration & Dynamics

The organic soy protein concentrate market exhibits a moderate to high concentration, with key players like Archer Daniels Midland Company, Cargill, Inc., and Foodchem International Corporation holding significant market shares. Innovation ecosystems are characterized by continuous research and development in extraction technologies to enhance purity and functionality, alongside the exploration of novel applications. Regulatory frameworks, particularly concerning organic certifications and food safety standards, play a crucial role in shaping market entry and product differentiation. Substitute products, such as pea protein and rice protein concentrates, present competitive pressures, necessitating strategic positioning based on cost-effectiveness and specific functional attributes. End-user trends are increasingly favoring plant-based protein ingredients due to rising health consciousness and ethical considerations, driving demand for organic soy protein concentrate. Merger and acquisition (M&A) activities have been a consistent feature, with an estimated XX M&A deals in the historical period, indicating consolidation and strategic expansion by leading entities aiming to broaden their product portfolios and geographic reach.

Organic Soy Protein Concentrate Industry Industry Insights & Trends

The global organic soy protein concentrate market is poised for substantial growth, projected to reach an estimated market size of $XX Billion by 2033, exhibiting a compound annual growth rate (CAGR) of XX% from the base year of 2025. This expansion is primarily propelled by the escalating consumer demand for clean-label, plant-based, and non-GMO food products. The growing awareness surrounding the health benefits associated with protein-rich diets, including muscle building, satiety, and overall well-being, is a significant market driver. Furthermore, the ethical and environmental concerns surrounding animal agriculture are compelling a considerable segment of the population to adopt vegetarian and vegan lifestyles, thereby boosting the demand for plant-derived protein ingredients like organic soy protein concentrate. Technological advancements in processing techniques, such as advanced filtration and drying methods, are leading to improved quality, functionality, and solubility of organic soy protein concentrates, making them more versatile for a wider range of food and beverage applications. The increasing affordability and availability of organic soy protein concentrates are also contributing to their widespread adoption across various food sectors. Moreover, the burgeoning meat and dairy alternative industries are acting as major demand hubs, leveraging the emulsifying, gelling, and binding properties of organic soy protein concentrate to create palatable and nutrient-rich products. The infant formula segment is also witnessing a steady rise in demand for organic soy protein concentrates as a hypoallergenic and nutrient-dense alternative. The animal feed industry, recognizing the nutritional benefits and cost-effectiveness, is another significant contributor to market growth.

Key Markets & Segments Leading Organic Soy Protein Concentrate Industry

The global organic soy protein concentrate market is witnessing robust growth across various key regions and application segments.

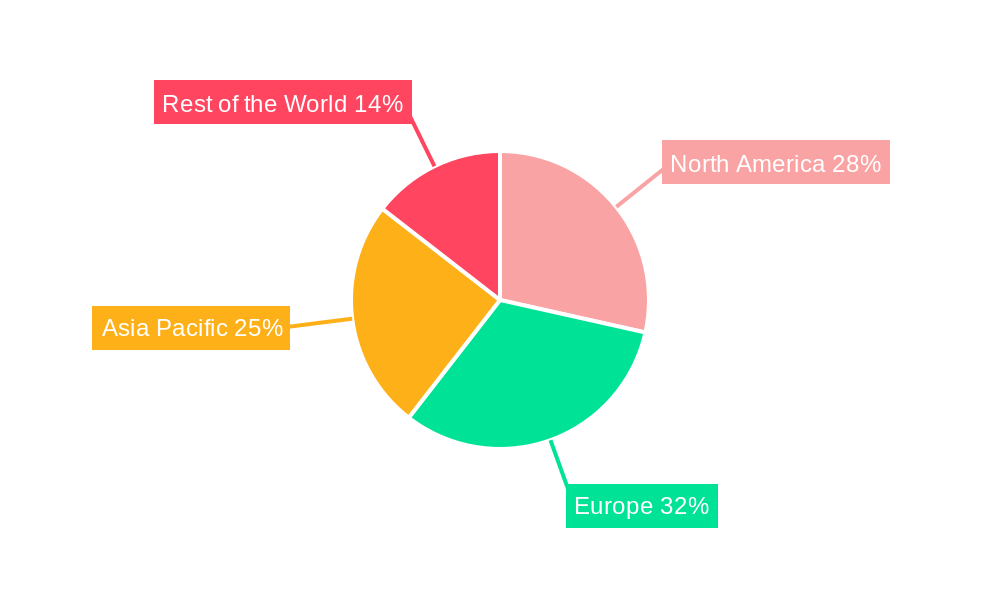

Dominant Region: North America

- Drivers: High consumer awareness regarding health and wellness, significant adoption of plant-based diets, and a well-established organic food industry infrastructure. The presence of leading organic food manufacturers and robust distribution networks further solidify its dominance.

- Detailed Analysis: North America, particularly the United States and Canada, is leading the charge due to a confluence of factors. A deeply ingrained culture of health consciousness, coupled with increasing disposable incomes, allows consumers to invest in premium organic products. The rapid proliferation of vegan and vegetarian lifestyles, driven by both ethical and environmental considerations, has created a substantial demand for plant-based protein alternatives, with organic soy protein concentrate being a key ingredient. Furthermore, the well-developed regulatory framework supporting organic certification and labeling provides consumers with confidence in product authenticity. The presence of major food processing companies with significant investments in R&D for plant-based ingredients further fuels market expansion in this region.

Dominant Segment: Meat Alternative

- Drivers: Growing consumer preference for sustainable and ethical protein sources, increasing health concerns related to red meat consumption, and innovations in developing plant-based meat products that mimic the taste, texture, and nutritional profile of traditional meat.

- Detailed Analysis: The meat alternative segment is experiencing explosive growth within the organic soy protein concentrate market. As consumers increasingly seek to reduce their meat consumption for health, environmental, and ethical reasons, the demand for convincing and nutritious plant-based meat substitutes has soared. Organic soy protein concentrate, with its excellent emulsifying and binding properties, serves as a foundational ingredient in creating a wide array of meat analogues, from burgers and sausages to plant-based chicken and fish alternatives. The continuous innovation by food technology companies in replicating the sensory experience of meat, coupled with the perceived health benefits of organic ingredients, is a significant catalyst for this segment's dominance.

Key Application Segments and their Growth Drivers:

- Bakery and Confectionery: Driven by the demand for high-protein snacks and baked goods, and the need for functional ingredients that enhance texture and shelf-life.

- Dairy Alternative: Fueled by the rising popularity of plant-based milk, yogurt, and cheese alternatives, where organic soy protein concentrate contributes to protein content and creamy texture.

- Infant Formula: Supported by the increasing demand for hypoallergenic and easily digestible protein sources for infants, alongside parental preference for organic ingredients.

- Animal Feed: A consistent and significant segment driven by the need for cost-effective and nutritious protein sources for livestock and aquaculture, with a growing preference for organic options.

- Others: Encompassing various niche applications such as protein supplements, nutritional bars, and sports nutrition products, all benefiting from the growing global focus on protein intake.

Organic Soy Protein Concentrate Industry Product Developments

Product innovation in the organic soy protein concentrate market centers on improving functionality and expanding application reach. Manufacturers are focusing on developing concentrates with enhanced solubility, reduced beany flavor, and superior emulsifying and texturizing properties. These advancements are crucial for creating more appealing and versatile meat and dairy alternatives, as well as for incorporating into a wider array of baked goods and nutritional products. Specific product developments include agglomerated forms for better dispersibility, low-allergen varieties, and highly purified concentrates for specialized applications in sports nutrition and infant formulas. These technological leaps are not only addressing consumer preferences for cleaner labels and better taste but also providing a competitive edge for companies investing in advanced processing techniques.

Challenges in the Organic Soy Protein Concentrate Industry Market

The organic soy protein concentrate market faces several key challenges that can impede its growth trajectory.

- Supply Chain Volatility: Fluctuations in the availability of organic soybeans due to weather conditions, crop diseases, and geopolitical factors can lead to price instability and affect production volumes.

- Consumer Perception and Allergen Concerns: Despite growing acceptance, some consumers still harbor concerns about soy as an allergen and associate it with a distinct flavor profile, necessitating continued efforts in product reformulation and consumer education.

- Competition from Other Plant Proteins: The rise of alternative plant-based proteins like pea, rice, and fava bean proteins, which offer different flavor profiles and functional attributes, poses a significant competitive threat.

- Regulatory Compliance and Certification Costs: Maintaining organic certification across different regions can be complex and costly, potentially impacting the final product price and market accessibility.

Forces Driving Organic Soy Protein Concentrate Industry Growth

Several powerful forces are propelling the organic soy protein concentrate industry forward. The undeniable surge in veganism and flexitarianism is a primary driver, as consumers actively seek plant-based alternatives for health and environmental reasons. Growing global awareness regarding the health benefits of a high-protein diet, including improved satiety and muscle health, is further boosting demand. Technological advancements in processing and extraction techniques are yielding higher quality, more functional, and better-tasting organic soy protein concentrates, broadening their appeal and applicability. Furthermore, favorable government initiatives and policies supporting sustainable agriculture and plant-based food production are creating a conducive environment for market expansion.

Challenges in the Organic Soy Protein Concentrate Industry Market

Looking ahead, the organic soy protein concentrate market is poised to overcome existing hurdles and capitalize on future growth catalysts. Key to this evolution will be the continued innovation in extraction and processing technologies to further refine flavor profiles and enhance functional properties, making organic soy protein concentrates even more versatile. Strategic partnerships and collaborations between ingredient suppliers, food manufacturers, and research institutions will be crucial for developing novel applications and reaching new consumer segments. Furthermore, market expansions into emerging economies with growing middle classes and increasing interest in health and wellness offer significant untapped potential. Investment in sustainable sourcing and transparent supply chains will not only address ethical consumer concerns but also build greater resilience against potential disruptions.

Emerging Opportunities in Organic Soy Protein Concentrate Industry

The organic soy protein concentrate industry is brimming with emerging opportunities driven by evolving consumer preferences and technological advancements.

- Specialty and Functional Ingredients: There is a growing demand for organic soy protein concentrates with tailored functionalities, such as improved solubility for beverages, enhanced emulsification for dairy-free products, or specific amino acid profiles for targeted nutritional applications.

- Sustainable Sourcing and Traceability: Consumers are increasingly prioritizing ethically sourced and environmentally friendly products. Companies that can demonstrate robust and transparent organic supply chains will gain a significant competitive advantage.

- Expansion into Developing Markets: As economies in Asia, Latin America, and Africa grow, so does the disposable income and health consciousness of their populations, creating new frontiers for organic plant-based protein consumption.

- Innovative Product Formulations: The development of novel food and beverage products utilizing organic soy protein concentrate, such as plant-based seafood alternatives, ready-to-drink protein shakes with improved taste, and organic infant nutrition products, presents substantial growth avenues.

Leading Players in the Organic Soy Protein Concentrate Industry Sector

- REJOICE LIFE INGREDIENTS

- Archer Daniels Midland Company

- The Scoular Company

- Foodchem International Corporation

- Chaitanya Agro Biotech Pvt Ltd

- Nature Republic Inc

- Cargill, Inc.

- DuPont de Nemours, Inc.

- Solae LLC (a subsidiary of SOYMEAL)

- The Green Labs LLC

Key Milestones in Organic Soy Protein Concentrate Industry Industry

- 2019: Increased regulatory scrutiny on labeling of organic claims, leading to stricter enforcement and greater consumer trust.

- 2020: Surge in demand for plant-based ingredients due to heightened health awareness and pandemic-related dietary shifts.

- 2021: Major investment in R&D for improved flavor profiles and reduced off-notes in soy protein concentrates.

- 2022: Expansion of organic soybean cultivation areas to meet growing global demand.

- 2023: Introduction of new product lines focusing on allergen-friendly organic soy protein concentrates.

- 2024: Strategic partnerships formed between ingredient suppliers and major food manufacturers to develop innovative meat and dairy alternatives.

Strategic Outlook for Organic Soy Protein Concentrate Industry Market

The organic soy protein concentrate market is poised for sustained and dynamic growth, driven by a confluence of evolving consumer behavior, technological innovation, and a global push towards sustainable food systems. Strategic imperatives for stakeholders will include investing in cutting-edge extraction and purification technologies to consistently deliver high-quality, functional, and palatable organic soy protein concentrates. Strengthening transparent and ethical supply chains will be paramount to meet consumer demand for certified organic and sustainably sourced ingredients. Furthermore, proactive engagement with regulatory bodies to navigate evolving standards and certifications will ensure market access and compliance. Exploring partnerships and collaborations with food manufacturers, research institutions, and emerging market players will unlock new application potentials and geographical reach. Ultimately, a focus on product differentiation and innovation tailored to specific application needs, from the burgeoning meat and dairy alternative sectors to infant nutrition and beyond, will be key to long-term success in this robust and expanding market.

Organic Soy Protein Concentrate Industry Segmentation

-

1. Application

- 1.1. Bakery and Confectionary

- 1.2. Meat Alternative

- 1.3. Dairy Alternative

- 1.4. Infant Formula

- 1.5. Animal Feed

- 1.6. Others

Organic Soy Protein Concentrate Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Organic Soy Protein Concentrate Industry Regional Market Share

Geographic Coverage of Organic Soy Protein Concentrate Industry

Organic Soy Protein Concentrate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand For Convenience & Processed Food

- 3.3. Market Restrains

- 3.3.1. Increased Consumer Awareness On Side-Effects Of Chemical Additives

- 3.4. Market Trends

- 3.4.1. Inclination Towards Meat-substitute and Dairy Free Foods

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Organic Soy Protein Concentrate Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Bakery and Confectionary

- 5.1.2. Meat Alternative

- 5.1.3. Dairy Alternative

- 5.1.4. Infant Formula

- 5.1.5. Animal Feed

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Organic Soy Protein Concentrate Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Bakery and Confectionary

- 6.1.2. Meat Alternative

- 6.1.3. Dairy Alternative

- 6.1.4. Infant Formula

- 6.1.5. Animal Feed

- 6.1.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Organic Soy Protein Concentrate Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Bakery and Confectionary

- 7.1.2. Meat Alternative

- 7.1.3. Dairy Alternative

- 7.1.4. Infant Formula

- 7.1.5. Animal Feed

- 7.1.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Organic Soy Protein Concentrate Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Bakery and Confectionary

- 8.1.2. Meat Alternative

- 8.1.3. Dairy Alternative

- 8.1.4. Infant Formula

- 8.1.5. Animal Feed

- 8.1.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Rest of the World Organic Soy Protein Concentrate Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Bakery and Confectionary

- 9.1.2. Meat Alternative

- 9.1.3. Dairy Alternative

- 9.1.4. Infant Formula

- 9.1.5. Animal Feed

- 9.1.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. North America Organic Soy Protein Concentrate Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 10.1.3 Mexico

- 11. Europe Organic Soy Protein Concentrate Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 United Kingdom

- 11.1.3 France

- 11.1.4 Spain

- 11.1.5 Italy

- 11.1.6 Spain

- 11.1.7 Belgium

- 11.1.8 Netherland

- 11.1.9 Nordics

- 11.1.10 Rest of Europe

- 12. Asia Pacific Organic Soy Protein Concentrate Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 China

- 12.1.2 Japan

- 12.1.3 India

- 12.1.4 South Korea

- 12.1.5 Southeast Asia

- 12.1.6 Australia

- 12.1.7 Indonesia

- 12.1.8 Phillipes

- 12.1.9 Singapore

- 12.1.10 Thailandc

- 12.1.11 Rest of Asia Pacific

- 13. South America Organic Soy Protein Concentrate Industry Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Brazil

- 13.1.2 Argentina

- 13.1.3 Peru

- 13.1.4 Chile

- 13.1.5 Colombia

- 13.1.6 Ecuador

- 13.1.7 Venezuela

- 13.1.8 Rest of South America

- 14. North America Organic Soy Protein Concentrate Industry Analysis, Insights and Forecast, 2020-2032

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 United States

- 14.1.2 Canada

- 14.1.3 Mexico

- 15. MEA Organic Soy Protein Concentrate Industry Analysis, Insights and Forecast, 2020-2032

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United Arab Emirates

- 15.1.2 Saudi Arabia

- 15.1.3 South Africa

- 15.1.4 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2025

- 16.2. Company Profiles

- 16.2.1 REJOICE LIFE INGREDIENTS*List Not Exhaustive

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Archer Daniels Midland Company

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 The Scoular Company

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Foodchem International Corporation

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Chaitanya Agro Biotech Pvt Ltd

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Nature Republic Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Cargill Inc.

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 DuPont de Nemours Inc.

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Solae LLC (a subsidiary of SOYMEAL)

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 The Green Labs LLC

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 REJOICE LIFE INGREDIENTS*List Not Exhaustive

List of Figures

- Figure 1: Global Organic Soy Protein Concentrate Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Global Organic Soy Protein Concentrate Industry Volume Breakdown (K Tons, %) by Region 2025 & 2033

- Figure 3: North America Organic Soy Protein Concentrate Industry Revenue (million), by Country 2025 & 2033

- Figure 4: North America Organic Soy Protein Concentrate Industry Volume (K Tons), by Country 2025 & 2033

- Figure 5: North America Organic Soy Protein Concentrate Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: North America Organic Soy Protein Concentrate Industry Volume Share (%), by Country 2025 & 2033

- Figure 7: Europe Organic Soy Protein Concentrate Industry Revenue (million), by Country 2025 & 2033

- Figure 8: Europe Organic Soy Protein Concentrate Industry Volume (K Tons), by Country 2025 & 2033

- Figure 9: Europe Organic Soy Protein Concentrate Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Organic Soy Protein Concentrate Industry Volume Share (%), by Country 2025 & 2033

- Figure 11: Asia Pacific Organic Soy Protein Concentrate Industry Revenue (million), by Country 2025 & 2033

- Figure 12: Asia Pacific Organic Soy Protein Concentrate Industry Volume (K Tons), by Country 2025 & 2033

- Figure 13: Asia Pacific Organic Soy Protein Concentrate Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Organic Soy Protein Concentrate Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: South America Organic Soy Protein Concentrate Industry Revenue (million), by Country 2025 & 2033

- Figure 16: South America Organic Soy Protein Concentrate Industry Volume (K Tons), by Country 2025 & 2033

- Figure 17: South America Organic Soy Protein Concentrate Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: South America Organic Soy Protein Concentrate Industry Volume Share (%), by Country 2025 & 2033

- Figure 19: North America Organic Soy Protein Concentrate Industry Revenue (million), by Country 2025 & 2033

- Figure 20: North America Organic Soy Protein Concentrate Industry Volume (K Tons), by Country 2025 & 2033

- Figure 21: North America Organic Soy Protein Concentrate Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: North America Organic Soy Protein Concentrate Industry Volume Share (%), by Country 2025 & 2033

- Figure 23: MEA Organic Soy Protein Concentrate Industry Revenue (million), by Country 2025 & 2033

- Figure 24: MEA Organic Soy Protein Concentrate Industry Volume (K Tons), by Country 2025 & 2033

- Figure 25: MEA Organic Soy Protein Concentrate Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: MEA Organic Soy Protein Concentrate Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: North America Organic Soy Protein Concentrate Industry Revenue (million), by Application 2025 & 2033

- Figure 28: North America Organic Soy Protein Concentrate Industry Volume (K Tons), by Application 2025 & 2033

- Figure 29: North America Organic Soy Protein Concentrate Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: North America Organic Soy Protein Concentrate Industry Volume Share (%), by Application 2025 & 2033

- Figure 31: North America Organic Soy Protein Concentrate Industry Revenue (million), by Country 2025 & 2033

- Figure 32: North America Organic Soy Protein Concentrate Industry Volume (K Tons), by Country 2025 & 2033

- Figure 33: North America Organic Soy Protein Concentrate Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: North America Organic Soy Protein Concentrate Industry Volume Share (%), by Country 2025 & 2033

- Figure 35: Europe Organic Soy Protein Concentrate Industry Revenue (million), by Application 2025 & 2033

- Figure 36: Europe Organic Soy Protein Concentrate Industry Volume (K Tons), by Application 2025 & 2033

- Figure 37: Europe Organic Soy Protein Concentrate Industry Revenue Share (%), by Application 2025 & 2033

- Figure 38: Europe Organic Soy Protein Concentrate Industry Volume Share (%), by Application 2025 & 2033

- Figure 39: Europe Organic Soy Protein Concentrate Industry Revenue (million), by Country 2025 & 2033

- Figure 40: Europe Organic Soy Protein Concentrate Industry Volume (K Tons), by Country 2025 & 2033

- Figure 41: Europe Organic Soy Protein Concentrate Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Europe Organic Soy Protein Concentrate Industry Volume Share (%), by Country 2025 & 2033

- Figure 43: Asia Pacific Organic Soy Protein Concentrate Industry Revenue (million), by Application 2025 & 2033

- Figure 44: Asia Pacific Organic Soy Protein Concentrate Industry Volume (K Tons), by Application 2025 & 2033

- Figure 45: Asia Pacific Organic Soy Protein Concentrate Industry Revenue Share (%), by Application 2025 & 2033

- Figure 46: Asia Pacific Organic Soy Protein Concentrate Industry Volume Share (%), by Application 2025 & 2033

- Figure 47: Asia Pacific Organic Soy Protein Concentrate Industry Revenue (million), by Country 2025 & 2033

- Figure 48: Asia Pacific Organic Soy Protein Concentrate Industry Volume (K Tons), by Country 2025 & 2033

- Figure 49: Asia Pacific Organic Soy Protein Concentrate Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Organic Soy Protein Concentrate Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: Rest of the World Organic Soy Protein Concentrate Industry Revenue (million), by Application 2025 & 2033

- Figure 52: Rest of the World Organic Soy Protein Concentrate Industry Volume (K Tons), by Application 2025 & 2033

- Figure 53: Rest of the World Organic Soy Protein Concentrate Industry Revenue Share (%), by Application 2025 & 2033

- Figure 54: Rest of the World Organic Soy Protein Concentrate Industry Volume Share (%), by Application 2025 & 2033

- Figure 55: Rest of the World Organic Soy Protein Concentrate Industry Revenue (million), by Country 2025 & 2033

- Figure 56: Rest of the World Organic Soy Protein Concentrate Industry Volume (K Tons), by Country 2025 & 2033

- Figure 57: Rest of the World Organic Soy Protein Concentrate Industry Revenue Share (%), by Country 2025 & 2033

- Figure 58: Rest of the World Organic Soy Protein Concentrate Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Organic Soy Protein Concentrate Industry Revenue million Forecast, by Region 2020 & 2033

- Table 2: Global Organic Soy Protein Concentrate Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 3: Global Organic Soy Protein Concentrate Industry Revenue million Forecast, by Application 2020 & 2033

- Table 4: Global Organic Soy Protein Concentrate Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: Global Organic Soy Protein Concentrate Industry Revenue million Forecast, by Region 2020 & 2033

- Table 6: Global Organic Soy Protein Concentrate Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Global Organic Soy Protein Concentrate Industry Revenue million Forecast, by Country 2020 & 2033

- Table 8: Global Organic Soy Protein Concentrate Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 9: United States Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: United States Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 11: Canada Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Canada Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 13: Mexico Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Mexico Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 15: Global Organic Soy Protein Concentrate Industry Revenue million Forecast, by Country 2020 & 2033

- Table 16: Global Organic Soy Protein Concentrate Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: Germany Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Germany Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: United Kingdom Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: United Kingdom Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: France Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: France Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: Spain Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Spain Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: Italy Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Italy Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 27: Spain Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Spain Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 29: Belgium Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Belgium Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 31: Netherland Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Netherland Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 33: Nordics Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: Nordics Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 37: Global Organic Soy Protein Concentrate Industry Revenue million Forecast, by Country 2020 & 2033

- Table 38: Global Organic Soy Protein Concentrate Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 39: China Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: China Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 41: Japan Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Japan Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 43: India Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: India Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 45: South Korea Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: South Korea Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 47: Southeast Asia Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 48: Southeast Asia Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 49: Australia Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 50: Australia Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 51: Indonesia Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 52: Indonesia Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 53: Phillipes Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 54: Phillipes Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 55: Singapore Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 56: Singapore Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 57: Thailandc Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 58: Thailandc Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 59: Rest of Asia Pacific Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 60: Rest of Asia Pacific Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 61: Global Organic Soy Protein Concentrate Industry Revenue million Forecast, by Country 2020 & 2033

- Table 62: Global Organic Soy Protein Concentrate Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 63: Brazil Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 64: Brazil Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 65: Argentina Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 66: Argentina Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 67: Peru Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 68: Peru Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 69: Chile Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 70: Chile Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 71: Colombia Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 72: Colombia Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 73: Ecuador Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 74: Ecuador Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 75: Venezuela Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 76: Venezuela Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 77: Rest of South America Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 78: Rest of South America Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 79: Global Organic Soy Protein Concentrate Industry Revenue million Forecast, by Country 2020 & 2033

- Table 80: Global Organic Soy Protein Concentrate Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 81: United States Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 82: United States Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 83: Canada Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 84: Canada Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 85: Mexico Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 86: Mexico Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 87: Global Organic Soy Protein Concentrate Industry Revenue million Forecast, by Country 2020 & 2033

- Table 88: Global Organic Soy Protein Concentrate Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 89: United Arab Emirates Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 90: United Arab Emirates Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 91: Saudi Arabia Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 92: Saudi Arabia Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 93: South Africa Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 94: South Africa Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 95: Rest of Middle East and Africa Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 96: Rest of Middle East and Africa Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 97: Global Organic Soy Protein Concentrate Industry Revenue million Forecast, by Application 2020 & 2033

- Table 98: Global Organic Soy Protein Concentrate Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 99: Global Organic Soy Protein Concentrate Industry Revenue million Forecast, by Country 2020 & 2033

- Table 100: Global Organic Soy Protein Concentrate Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 101: United States Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 102: United States Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 103: Canada Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 104: Canada Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 105: Mexico Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 106: Mexico Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 107: Rest of North America Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 108: Rest of North America Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 109: Global Organic Soy Protein Concentrate Industry Revenue million Forecast, by Application 2020 & 2033

- Table 110: Global Organic Soy Protein Concentrate Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 111: Global Organic Soy Protein Concentrate Industry Revenue million Forecast, by Country 2020 & 2033

- Table 112: Global Organic Soy Protein Concentrate Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 113: Spain Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 114: Spain Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 115: United Kingdom Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 116: United Kingdom Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 117: Germany Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 118: Germany Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 119: France Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 120: France Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 121: Italy Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 122: Italy Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 123: Russia Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 124: Russia Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 125: Rest of Europe Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 126: Rest of Europe Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 127: Global Organic Soy Protein Concentrate Industry Revenue million Forecast, by Application 2020 & 2033

- Table 128: Global Organic Soy Protein Concentrate Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 129: Global Organic Soy Protein Concentrate Industry Revenue million Forecast, by Country 2020 & 2033

- Table 130: Global Organic Soy Protein Concentrate Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 131: China Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 132: China Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 133: Japan Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 134: Japan Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 135: India Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 136: India Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 137: Australia Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 138: Australia Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 139: Rest of Asia Pacific Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 140: Rest of Asia Pacific Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 141: Global Organic Soy Protein Concentrate Industry Revenue million Forecast, by Application 2020 & 2033

- Table 142: Global Organic Soy Protein Concentrate Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 143: Global Organic Soy Protein Concentrate Industry Revenue million Forecast, by Country 2020 & 2033

- Table 144: Global Organic Soy Protein Concentrate Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 145: South America Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 146: South America Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 147: Middle East and Africa Organic Soy Protein Concentrate Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 148: Middle East and Africa Organic Soy Protein Concentrate Industry Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Organic Soy Protein Concentrate Industry?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the Organic Soy Protein Concentrate Industry?

Key companies in the market include REJOICE LIFE INGREDIENTS*List Not Exhaustive, Archer Daniels Midland Company, The Scoular Company, Foodchem International Corporation, Chaitanya Agro Biotech Pvt Ltd, Nature Republic Inc, Cargill, Inc. , DuPont de Nemours, Inc., Solae LLC (a subsidiary of SOYMEAL) , The Green Labs LLC.

3. What are the main segments of the Organic Soy Protein Concentrate Industry?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 236.5 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand For Convenience & Processed Food.

6. What are the notable trends driving market growth?

Inclination Towards Meat-substitute and Dairy Free Foods.

7. Are there any restraints impacting market growth?

Increased Consumer Awareness On Side-Effects Of Chemical Additives.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Organic Soy Protein Concentrate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Organic Soy Protein Concentrate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Organic Soy Protein Concentrate Industry?

To stay informed about further developments, trends, and reports in the Organic Soy Protein Concentrate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence