Key Insights

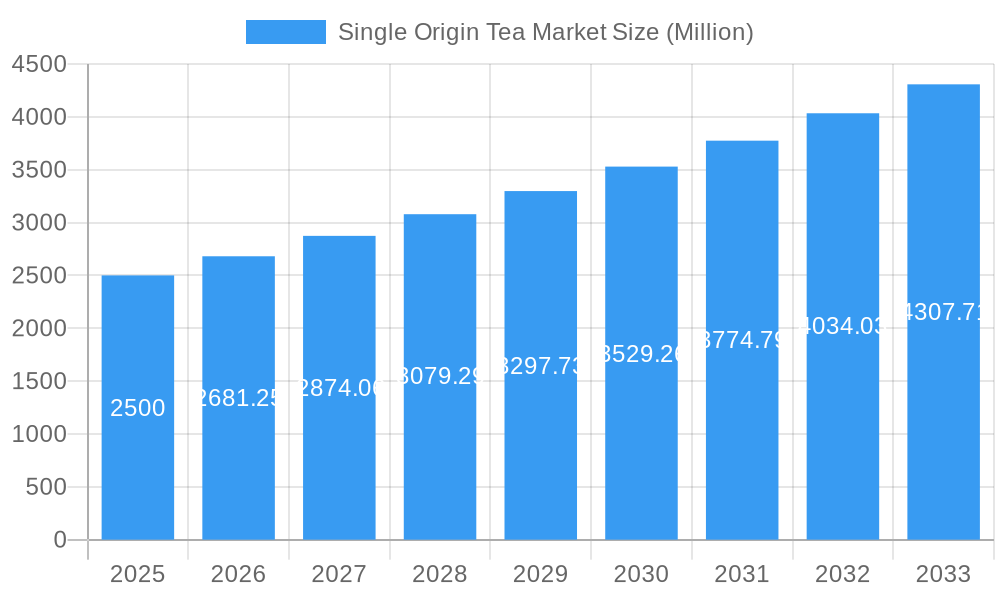

The global Single Origin Tea Market is set for substantial growth, projected to reach $2,500 billion by 2025. The market is expected to witness a robust CAGR of 11.5% through 2033. This expansion is driven by increasing consumer preference for premium, traceable, and high-quality tea experiences over conventional blends. Growing consumer demand for unique flavor profiles and the distinct terroir of specific tea-growing regions are key catalysts. The wellness trend, emphasizing natural ingredients and the health benefits of teas like green tea and artisanal black teas, further fuels market penetration. Direct-to-consumer models and the increasing availability through online and specialty retail channels are enhancing accessibility, contributing to the market's upward trajectory.

Single Origin Tea Market Market Size (In Billion)

Key market drivers include the meticulous craftsmanship and storytelling associated with single origin teas, appealing to consumers seeking authenticity. The exploration of diverse tea varietals, including unique Oolongs, Pu-erh, and rare white teas, is gaining momentum. Ethical sourcing and sustainability are also critical factors, as consumers increasingly consider the social and environmental impact of their purchases. Potential restraints include the higher price point of single origin teas compared to mass-produced blends. Maintaining consistent quality and supply chain integrity for these specialized products presents challenges. The competitive landscape features established players and new entrants focusing on niche markets and unique offerings, fostering innovation.

Single Origin Tea Market Company Market Share

This report offers a comprehensive analysis of the Single Origin Tea Market from 2019 to 2033. It examines market concentration, industry insights, key segments, product developments, challenges, and emerging opportunities, providing actionable intelligence for stakeholders in the premium tea industry. The analysis covers Black Tea, Green Tea, and Other Tea varieties, along with Tea Bags, Loose Tea packaging, and distribution channels including Supermarkets/Hypermarkets, Specialty Stores, Online Retail Stores, and Other Distribution Channels.

Single Origin Tea Market Market Concentration & Dynamics

The Single Origin Tea Market exhibits a moderate to high concentration, with a few dominant players holding significant market share. Key companies like Dilmah Ceylon Tea Company PLC, Akbar Brothers Ltd, and Origin Tea are at the forefront, driving innovation and shaping consumer preferences for high-quality, traceable teas. The innovation ecosystem is characterized by continuous product development, focusing on unique flavor profiles, sustainable sourcing, and premium packaging. Regulatory frameworks, while generally supportive of food and beverage industries, can vary across regions, impacting import/export dynamics and labeling requirements. Substitute products, primarily blended teas and other premium beverages like coffee and artisanal hot chocolates, pose a competitive challenge. End-user trends lean towards health-consciousness, ethical sourcing, and a desire for authentic, high-quality experiences, fueling demand for single-origin offerings. Merger and Acquisition (M&A) activities are observed, though not extensively, primarily involving smaller artisanal brands being acquired by larger entities seeking to expand their premium portfolio. The Single Origin Tea Market is estimated to have a market share of approximately $7,500 Million in the base year of 2025, with an estimated M&A deal count of 3-5 significant transactions within the historical period.

Single Origin Tea Market Industry Insights & Trends

The Single Origin Tea Market is poised for robust growth, driven by a confluence of factors. The global premium tea market is expanding at a Compound Annual Growth Rate (CAGR) of approximately 6.5% from 2019 to 2033, with the single origin segment significantly outperforming the overall tea market. This surge is fueled by an increasing consumer awareness and appreciation for the nuanced flavors and unique terroirs associated with teas from specific geographic origins. Technological disruptions are playing a crucial role, particularly in enhancing traceability and transparency throughout the supply chain. Innovations in blockchain technology allow consumers to virtually trace their tea from farm to cup, building trust and brand loyalty. Furthermore, advancements in sustainable farming practices and eco-friendly packaging solutions are resonating with environmentally conscious consumers. Evolving consumer behaviors are a cornerstone of this market's expansion. There is a discernible shift towards a more discerning palate, with consumers actively seeking out premium experiences and willing to pay a premium for authenticity, quality, and ethical production. The health and wellness trend continues to be a significant driver, as single-origin teas are often perceived as being richer in antioxidants and natural beneficial compounds. The overall Single Origin Tea Market Size is projected to reach $15,000 Million by 2033, growing from an estimated $8,000 Million in 2025. This growth is underpinned by a strong desire for unique and artisanal products, moving away from mass-produced blends. The COVID-19 pandemic also contributed to a rise in at-home consumption of premium beverages, a trend that is expected to persist.

Key Markets & Segments Leading Single Origin Tea Market

The Single Origin Tea Market is experiencing significant leadership from specific regions and segments, driven by distinct economic and consumer factors.

Dominant Segments:

Type: Black Tea: Black tea remains a dominant force in the single origin market.

- Drivers: Established consumer familiarity, diverse flavor profiles (from robust Assams to delicate Darjeelings), and historical significance in major tea-consuming nations contribute to its widespread appeal. Economic growth in developed and emerging markets directly correlates with increased demand for premium black teas.

- Dominance Analysis: The sheer volume of black tea consumption globally, coupled with a strong tradition of appreciating regional nuances, positions it as a primary driver of single-origin sales. Countries with a long history of tea cultivation and consumption, such as India, Sri Lanka, and Kenya, are major contributors to the black tea segment's dominance.

Packaging: Loose Tea: While tea bags are convenient, loose leaf tea continues to dominate the premium single-origin space.

- Drivers: Perceived higher quality of whole leaves, superior flavor infusion, and a ritualistic consumption experience attract discerning consumers. The desire for a more authentic and engaging tea-drinking ritual is a key factor.

- Dominance Analysis: Specialty tea stores and online retail channels heavily promote loose leaf single-origin teas, catering to connoisseurs who value the control over brewing and the uncompromised quality of whole leaves. This segment often commands higher price points.

Distribution Channel: Specialty Stores & Online Retail Stores: These channels are paramount for premium single-origin tea.

- Drivers: Specialty stores offer curated selections, expert advice, and a tactile experience, while online retail provides unparalleled accessibility and a vast array of options. The ability to connect directly with consumers and tell the story behind each tea is crucial.

- Dominance Analysis: These channels allow brands to effectively communicate the unique narrative of single-origin teas, emphasizing terroir, cultivation methods, and ethical practices. They cater to a consumer base willing to research and invest in high-quality products. For instance, the proliferation of direct-to-consumer e-commerce platforms has democratized access to rare single-origin teas globally.

Emerging and Significant Segments:

Type: Green Tea: Green tea is experiencing substantial growth in the single-origin market.

- Drivers: Rising health consciousness, its perceived wellness benefits, and the availability of diverse regional varietals (e.g., Japanese Sencha, Chinese Dragon Well) are fueling demand. Growing awareness of its antioxidant properties and metabolism-boosting effects attracts health-conscious consumers.

- Dominance Analysis: The increasing popularity of Asian cuisines and wellness trends, coupled with a growing appreciation for the subtle, vegetal notes of single-origin green teas, is driving its expansion. Markets in North America and Europe are showing a strong appetite for these varieties.

Distribution Channel: Supermarkets/Hypermarkets: While historically less dominant for premium single-origin, these channels are gaining traction.

- Drivers: Increased shelf space allocated to premium and artisanal products, coupled with private label innovations, are expanding reach. As consumer education grows, even mainstream retailers are stocking higher-quality single-origin options.

- Dominance Analysis: Supermarkets are adapting by creating dedicated sections for premium teas, allowing for greater visibility and accessibility to a broader consumer base. This channel is becoming increasingly important for brands looking to scale their single-origin offerings beyond niche markets.

Single Origin Tea Market Product Developments

Product developments in the Single Origin Tea Market are centered on enhancing traceability, promoting sustainability, and innovating flavor profiles. Companies are investing in advanced packaging technologies that preserve freshness and offer a premium unboxing experience. There's a growing emphasis on highlighting the unique terroir and varietal characteristics of each tea, with detailed origin stories and tasting notes becoming standard. Certifications such as Organic, Fair Trade, and Rainforest Alliance are increasingly sought after by consumers and integrated into product marketing. Furthermore, brands are experimenting with limited-edition releases and artisanal blends that showcase exceptional single-origin harvests, creating exclusivity and driving consumer engagement. The market is also seeing a rise in cold-brew friendly single-origin teas, catering to evolving consumption habits.

Challenges in the Single Origin Tea Market Market

The Single Origin Tea Market faces several significant challenges that can impede its growth and market penetration.

- Supply Chain Volatility: Extreme weather events, geopolitical instability, and pest infestations can disrupt the production and supply of high-quality single-origin teas, leading to price fluctuations and availability issues.

- Premium Pricing and Consumer Perception: The inherent cost of producing single-origin teas, coupled with the need for specialized cultivation and processing, results in higher retail prices. Educating consumers about the value proposition and justifying these premiums remains a constant challenge.

- Counterfeiting and Adulteration: The high demand and premium pricing for single-origin teas make them targets for counterfeiting and adulteration, which can damage brand reputation and consumer trust.

- Competition from Blended Teas: While single-origin teas offer unique characteristics, they face stiff competition from established blended tea brands that offer consistency, affordability, and wide availability.

Forces Driving Single Origin Tea Market Growth

The Single Origin Tea Market is propelled by several potent growth forces.

- Growing Consumer Demand for Authenticity and Traceability: Consumers are increasingly seeking transparent supply chains and authentic products, driving demand for teas with a traceable origin story.

- Rising Health and Wellness Consciousness: The perceived health benefits of tea, particularly single-origin varieties rich in antioxidants, are attracting health-conscious consumers.

- Emergence of E-commerce and Direct-to-Consumer (DTC) Channels: Online platforms have made premium and niche single-origin teas more accessible to a global audience, bypassing traditional retail gatekeepers.

- Influence of Social Media and Influencer Marketing: The visual appeal and unique narratives of single-origin teas are highly conducive to social media marketing, creating awareness and desire among a wider demographic.

Challenges in the Single Origin Tea Market Market

Long-term growth catalysts for the Single Origin Tea Market are deeply intertwined with innovation and market expansion. The continuous pursuit of unique and exotic single-origin varietals from underrepresented regions presents significant opportunities. Investments in sustainable farming practices and ethical sourcing not only appeal to conscious consumers but also ensure long-term viability of supply. Furthermore, strategic partnerships between tea producers and gourmet food retailers, as well as collaborations with chefs and mixologists, can introduce single-origin teas to new consumption occasions and audiences. The development of innovative brewing technologies and educational platforms that demystify the complexities of single-origin teas will also foster a more engaged and loyal customer base, securing sustained market growth.

Emerging Opportunities in Single Origin Tea Market

The Single Origin Tea Market is brimming with emerging opportunities.

- Expansion into Emerging Markets: Untapped potential exists in regions with growing disposable incomes and an increasing appreciation for premium beverages, such as Southeast Asia and parts of Latin America.

- Innovations in Cold Brew and Ready-to-Drink (RTD) Segments: The growing popularity of cold beverages presents an opportunity for single-origin teas in RTD formats and specialized cold-brew blends.

- Focus on Sustainable and Regenerative Agriculture: Brands that champion and can effectively communicate their commitment to eco-friendly and regenerative farming practices will attract a growing segment of environmentally conscious consumers.

- Development of Artisanal Tea Blends with Single-Origin Bases: While the focus is on single origins, there is an opportunity to create premium blended teas using high-quality single-origin teas as the foundation, offering unique flavor profiles.

Leading Players in the Single Origin Tea Market Sector

- Akbar Brothers Ltd

- Dilmah Ceylon Tea Company PLC

- Origin Tea

- Debonair Tea Company

- Single Estate Teas

- Art of Tea

- Alveus GmbH

- Organic India

- Premier's Tea Limited

Key Milestones in Single Origin Tea Market Industry

- July 2022: Akbar Tea launched an exclusive premium tea outlet at the Boulevard Boutique Mall in Muscat, Oman, offering a diverse range of Ceylon teas. This expansion into a premium retail space signifies a strategic move to enhance brand visibility and direct consumer engagement.

- 2021: Increased focus on direct-to-consumer (DTC) sales channels by various single-origin tea brands, driven by the pandemic's impact on retail and a growing consumer preference for online shopping.

- 2020: Significant rise in demand for single-origin teas with proven health benefits, particularly those rich in antioxidants like certain green and white teas.

- 2019: Growing emphasis on sustainable sourcing and eco-friendly packaging across the single-origin tea industry, driven by increasing consumer environmental awareness.

Strategic Outlook for Single Origin Tea Market Market

The strategic outlook for the Single Origin Tea Market is highly promising, characterized by sustained growth driven by evolving consumer preferences and innovative market strategies. Future growth accelerators will likely involve deeper integration of technology for enhanced supply chain transparency and consumer engagement, such as blockchain for traceability. Strategic partnerships with hospitality sectors, high-end food retailers, and international distribution networks will be crucial for market penetration and brand expansion. Continued investment in product innovation, focusing on unique varietals, limited editions, and health-centric formulations, will further solidify market positioning. The report forecasts significant opportunities for companies that can effectively communicate their brand's story, commitment to quality, and ethical sourcing practices, thereby capturing a larger share of the premium beverage market.

Single Origin Tea Market Segmentation

-

1. Type

- 1.1. Black Tea

- 1.2. Green Tea

- 1.3. Others

-

2. Packaging

- 2.1. Tea Bags

- 2.2. Loose Tea

-

3. Distribution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Specialty Stores

- 3.3. Online Retail Stores

- 3.4. Other Distribution Channels

Single Origin Tea Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. Italy

- 2.4. France

- 2.5. Spain

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. South Africa

- 6.1. Saudi Arabia

- 6.2. Rest of Middle East

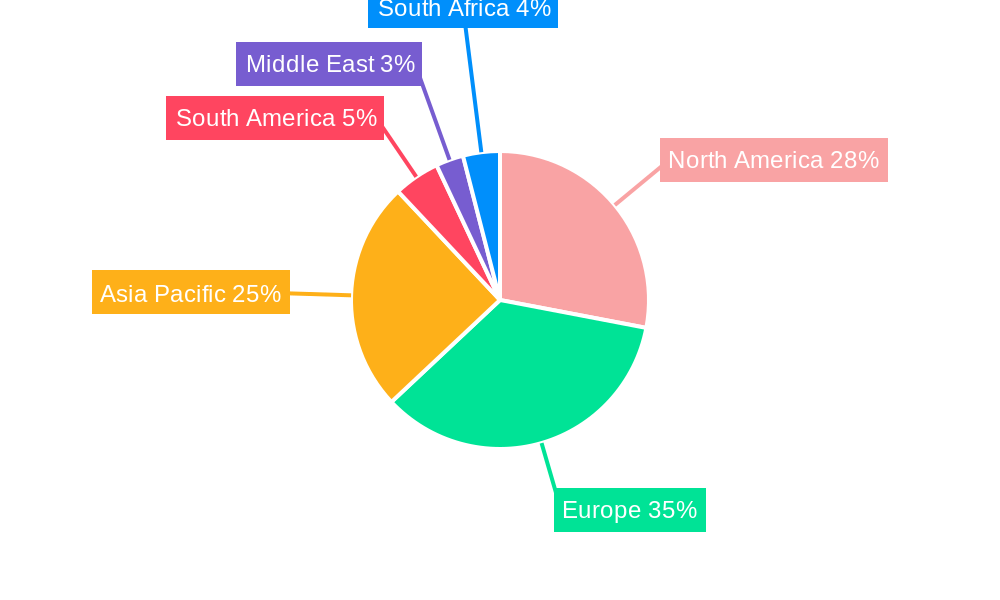

Single Origin Tea Market Regional Market Share

Geographic Coverage of Single Origin Tea Market

Single Origin Tea Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Flavored Spirits; Growing Consumption of Premium Alcoholic Beverages

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations Pertaining to Spirits

- 3.4. Market Trends

- 3.4.1. Rising Popularity of Organic Tea Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Single Origin Tea Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Black Tea

- 5.1.2. Green Tea

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Packaging

- 5.2.1. Tea Bags

- 5.2.2. Loose Tea

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Specialty Stores

- 5.3.3. Online Retail Stores

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East

- 5.4.6. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Single Origin Tea Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Black Tea

- 6.1.2. Green Tea

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Packaging

- 6.2.1. Tea Bags

- 6.2.2. Loose Tea

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Supermarkets/Hypermarkets

- 6.3.2. Specialty Stores

- 6.3.3. Online Retail Stores

- 6.3.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Single Origin Tea Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Black Tea

- 7.1.2. Green Tea

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Packaging

- 7.2.1. Tea Bags

- 7.2.2. Loose Tea

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Supermarkets/Hypermarkets

- 7.3.2. Specialty Stores

- 7.3.3. Online Retail Stores

- 7.3.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Single Origin Tea Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Black Tea

- 8.1.2. Green Tea

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Packaging

- 8.2.1. Tea Bags

- 8.2.2. Loose Tea

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Supermarkets/Hypermarkets

- 8.3.2. Specialty Stores

- 8.3.3. Online Retail Stores

- 8.3.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Single Origin Tea Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Black Tea

- 9.1.2. Green Tea

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Packaging

- 9.2.1. Tea Bags

- 9.2.2. Loose Tea

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Supermarkets/Hypermarkets

- 9.3.2. Specialty Stores

- 9.3.3. Online Retail Stores

- 9.3.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Single Origin Tea Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Black Tea

- 10.1.2. Green Tea

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Packaging

- 10.2.1. Tea Bags

- 10.2.2. Loose Tea

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Supermarkets/Hypermarkets

- 10.3.2. Specialty Stores

- 10.3.3. Online Retail Stores

- 10.3.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. South Africa Single Origin Tea Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Black Tea

- 11.1.2. Green Tea

- 11.1.3. Others

- 11.2. Market Analysis, Insights and Forecast - by Packaging

- 11.2.1. Tea Bags

- 11.2.2. Loose Tea

- 11.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.3.1. Supermarkets/Hypermarkets

- 11.3.2. Specialty Stores

- 11.3.3. Online Retail Stores

- 11.3.4. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Akbar Brothers Ltd

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Kahawa*List Not Exhaustive

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Dilmah Ceylon Tea Company PLC

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Origin Tea

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Debonair Tea Company

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Single Estate Teas

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Art of Tea

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Alveus GmbH

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Organic India

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Premier's Tea Limited

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Akbar Brothers Ltd

List of Figures

- Figure 1: Global Single Origin Tea Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Single Origin Tea Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Single Origin Tea Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Single Origin Tea Market Revenue (billion), by Packaging 2025 & 2033

- Figure 5: North America Single Origin Tea Market Revenue Share (%), by Packaging 2025 & 2033

- Figure 6: North America Single Origin Tea Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 7: North America Single Origin Tea Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America Single Origin Tea Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Single Origin Tea Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Single Origin Tea Market Revenue (billion), by Type 2025 & 2033

- Figure 11: Europe Single Origin Tea Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Single Origin Tea Market Revenue (billion), by Packaging 2025 & 2033

- Figure 13: Europe Single Origin Tea Market Revenue Share (%), by Packaging 2025 & 2033

- Figure 14: Europe Single Origin Tea Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 15: Europe Single Origin Tea Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: Europe Single Origin Tea Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Single Origin Tea Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Single Origin Tea Market Revenue (billion), by Type 2025 & 2033

- Figure 19: Asia Pacific Single Origin Tea Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Single Origin Tea Market Revenue (billion), by Packaging 2025 & 2033

- Figure 21: Asia Pacific Single Origin Tea Market Revenue Share (%), by Packaging 2025 & 2033

- Figure 22: Asia Pacific Single Origin Tea Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 23: Asia Pacific Single Origin Tea Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Asia Pacific Single Origin Tea Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Single Origin Tea Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Single Origin Tea Market Revenue (billion), by Type 2025 & 2033

- Figure 27: South America Single Origin Tea Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: South America Single Origin Tea Market Revenue (billion), by Packaging 2025 & 2033

- Figure 29: South America Single Origin Tea Market Revenue Share (%), by Packaging 2025 & 2033

- Figure 30: South America Single Origin Tea Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 31: South America Single Origin Tea Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: South America Single Origin Tea Market Revenue (billion), by Country 2025 & 2033

- Figure 33: South America Single Origin Tea Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East Single Origin Tea Market Revenue (billion), by Type 2025 & 2033

- Figure 35: Middle East Single Origin Tea Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East Single Origin Tea Market Revenue (billion), by Packaging 2025 & 2033

- Figure 37: Middle East Single Origin Tea Market Revenue Share (%), by Packaging 2025 & 2033

- Figure 38: Middle East Single Origin Tea Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 39: Middle East Single Origin Tea Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Middle East Single Origin Tea Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East Single Origin Tea Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: South Africa Single Origin Tea Market Revenue (billion), by Type 2025 & 2033

- Figure 43: South Africa Single Origin Tea Market Revenue Share (%), by Type 2025 & 2033

- Figure 44: South Africa Single Origin Tea Market Revenue (billion), by Packaging 2025 & 2033

- Figure 45: South Africa Single Origin Tea Market Revenue Share (%), by Packaging 2025 & 2033

- Figure 46: South Africa Single Origin Tea Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 47: South Africa Single Origin Tea Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 48: South Africa Single Origin Tea Market Revenue (billion), by Country 2025 & 2033

- Figure 49: South Africa Single Origin Tea Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Single Origin Tea Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Single Origin Tea Market Revenue billion Forecast, by Packaging 2020 & 2033

- Table 3: Global Single Origin Tea Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Single Origin Tea Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Single Origin Tea Market Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Global Single Origin Tea Market Revenue billion Forecast, by Packaging 2020 & 2033

- Table 7: Global Single Origin Tea Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Single Origin Tea Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Single Origin Tea Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Single Origin Tea Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Single Origin Tea Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of North America Single Origin Tea Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global Single Origin Tea Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global Single Origin Tea Market Revenue billion Forecast, by Packaging 2020 & 2033

- Table 15: Global Single Origin Tea Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 16: Global Single Origin Tea Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: United Kingdom Single Origin Tea Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Germany Single Origin Tea Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Single Origin Tea Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: France Single Origin Tea Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Spain Single Origin Tea Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Russia Single Origin Tea Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Single Origin Tea Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global Single Origin Tea Market Revenue billion Forecast, by Type 2020 & 2033

- Table 25: Global Single Origin Tea Market Revenue billion Forecast, by Packaging 2020 & 2033

- Table 26: Global Single Origin Tea Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 27: Global Single Origin Tea Market Revenue billion Forecast, by Country 2020 & 2033

- Table 28: India Single Origin Tea Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: China Single Origin Tea Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Japan Single Origin Tea Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Australia Single Origin Tea Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Rest of Asia Pacific Single Origin Tea Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Global Single Origin Tea Market Revenue billion Forecast, by Type 2020 & 2033

- Table 34: Global Single Origin Tea Market Revenue billion Forecast, by Packaging 2020 & 2033

- Table 35: Global Single Origin Tea Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 36: Global Single Origin Tea Market Revenue billion Forecast, by Country 2020 & 2033

- Table 37: Brazil Single Origin Tea Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Argentina Single Origin Tea Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Single Origin Tea Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Global Single Origin Tea Market Revenue billion Forecast, by Type 2020 & 2033

- Table 41: Global Single Origin Tea Market Revenue billion Forecast, by Packaging 2020 & 2033

- Table 42: Global Single Origin Tea Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 43: Global Single Origin Tea Market Revenue billion Forecast, by Country 2020 & 2033

- Table 44: Global Single Origin Tea Market Revenue billion Forecast, by Type 2020 & 2033

- Table 45: Global Single Origin Tea Market Revenue billion Forecast, by Packaging 2020 & 2033

- Table 46: Global Single Origin Tea Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 47: Global Single Origin Tea Market Revenue billion Forecast, by Country 2020 & 2033

- Table 48: Saudi Arabia Single Origin Tea Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: Rest of Middle East Single Origin Tea Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Single Origin Tea Market?

The projected CAGR is approximately 11.5%.

2. Which companies are prominent players in the Single Origin Tea Market?

Key companies in the market include Akbar Brothers Ltd, Kahawa*List Not Exhaustive, Dilmah Ceylon Tea Company PLC, Origin Tea, Debonair Tea Company, Single Estate Teas, Art of Tea, Alveus GmbH, Organic India, Premier's Tea Limited.

3. What are the main segments of the Single Origin Tea Market?

The market segments include Type, Packaging, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.5 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Flavored Spirits; Growing Consumption of Premium Alcoholic Beverages.

6. What are the notable trends driving market growth?

Rising Popularity of Organic Tea Products.

7. Are there any restraints impacting market growth?

Stringent Government Regulations Pertaining to Spirits.

8. Can you provide examples of recent developments in the market?

In July 2022, Akbar Tea launched an exclusive premium tea outlet at the Boulevard Boutique Mall, located in Muscat, Oman. The company offered its Ceylon tea of different varieties through this outlet in Sultanate.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Single Origin Tea Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Single Origin Tea Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Single Origin Tea Market?

To stay informed about further developments, trends, and reports in the Single Origin Tea Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence