Key Insights

The Spanish food colorants market is projected for robust growth, expected to reach 4.22 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6.4% through 2033. This expansion is driven by a strong consumer preference for visually appealing food products and a significant demand for natural colorants derived from botanical sources. The prevailing "clean label" trend in Spain is compelling manufacturers to adopt natural alternatives to synthetic options, aligning with consumer expectations for healthier and transparent ingredients. This trend is particularly influential in the beverage, dairy, and confectionery sectors, where vibrant colors enhance product appeal and differentiation. The growing processed food industry and increasing food product exports from Spain further bolster demand for food colorants.

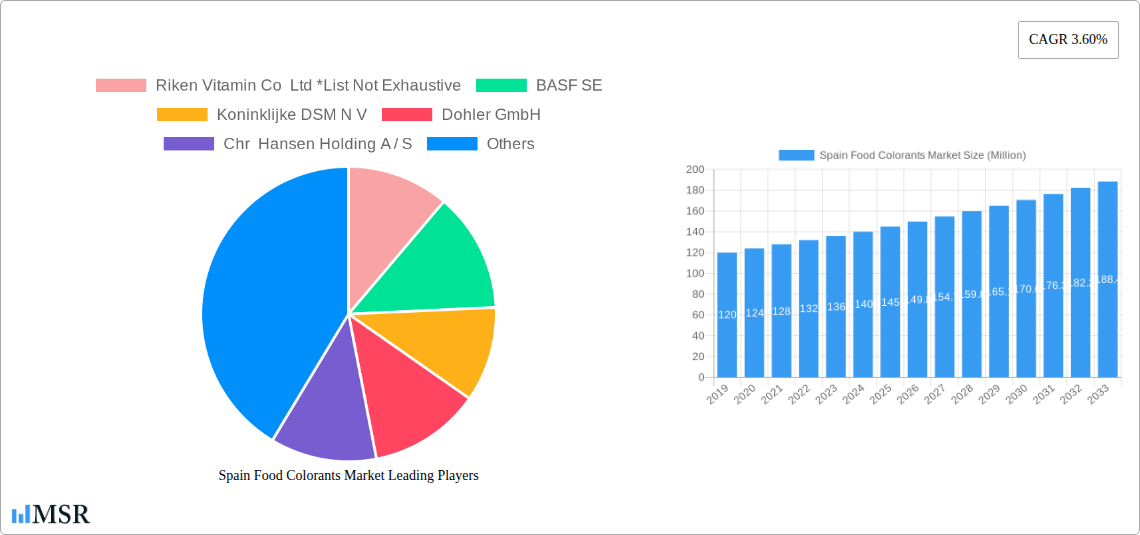

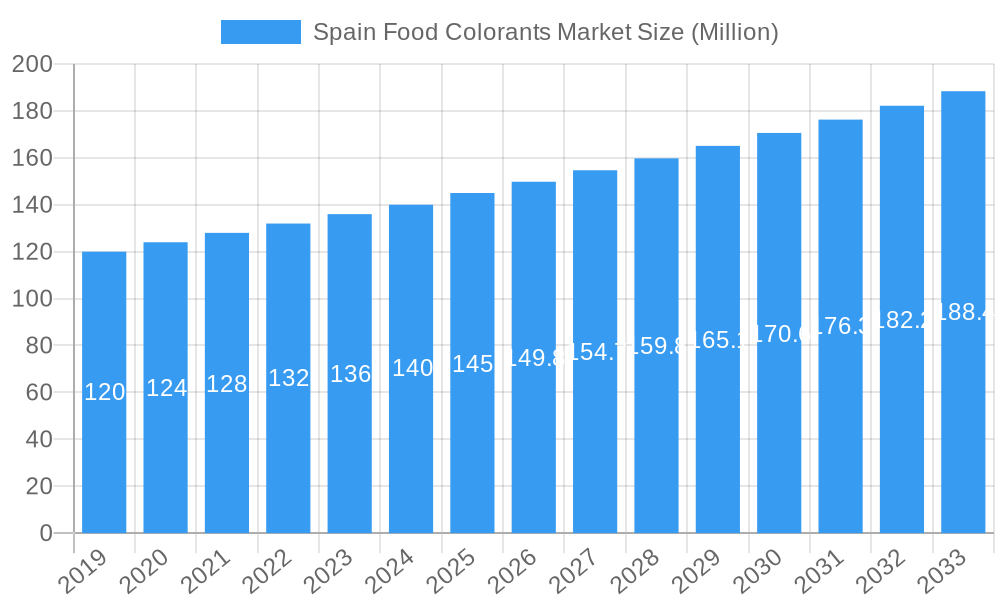

Spain Food Colorants Market Market Size (In Billion)

Market challenges include fluctuating raw material costs for natural colorants, stringent regulatory approvals, and potential variations in color intensity and stability. However, ongoing advancements in extraction and stabilization technologies are actively addressing these concerns. The market is segmented by colorant type (Natural vs. Synthetic) and key applications including Beverages, Dairy & Frozen Products, Bakery, Confectionery, and Meat, Poultry & Seafood. Natural colorants are experiencing higher growth due to sustained consumer demand. Leading international players such as BASF SE, Chr Hansen Holding A/S, and Sensient Technologies Corporation, alongside Riken Vitamin Co Ltd and Givaudan (Naturex), are key participants in the competitive Spanish market, fostering innovation and strategic partnerships.

Spain Food Colorants Market Company Market Share

This comprehensive report offers in-depth analysis of the Spain food colorants market, a dynamic sector shaped by evolving consumer preferences and regulatory frameworks. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this report provides crucial insights for stakeholders aiming to identify and capitalize on growth opportunities. Explore the intricacies of the natural food colorants market, synthetic food colorants market, and their diverse applications across beverages, dairy & frozen products, bakery, confectionery, meat, poultry & seafood, and other food segments. Utilize our expert analysis on food colorant innovations, market drivers, and challenges to inform strategic decision-making.

Spain Food Colorants Market Market Concentration & Dynamics

The Spain food colorants market exhibits a moderate to high level of concentration, characterized by the presence of both established global players and specialized regional manufacturers. Key companies such as BASF SE, Koninklijke DSM N.V., Chr Hansen Holding A/S, Sensient Technologies Corporation, and Givaudan (Naturex) dominate the landscape, driving innovation and shaping market trends. Riken Vitamin Co Ltd and Dohler GmbH also play significant roles, contributing to the diverse product offerings. The innovation ecosystem is robust, with continuous research and development focused on enhancing the stability, vibrancy, and health profiles of food colorants, particularly in the natural color segment. Regulatory frameworks, primarily governed by the European Union's Food Additives Regulation, exert a significant influence, promoting safety and transparency while sometimes posing challenges for novel ingredient introductions. Substitute products, such as alternative coloring techniques or ingredient reformulation to achieve desired visual appeal, present a constant competitive pressure. End-user trends are increasingly shifting towards clean label solutions, demanding natural, plant-based colorants with perceived health benefits, driving demand for natural color options over synthetic color. Mergers and acquisitions (M&A) activities are strategically employed by leading players to expand their product portfolios, gain market share, and enhance their technological capabilities. In recent years, the market has witnessed several notable M&A deals, underscoring a trend towards consolidation and strategic partnerships aimed at capturing a larger share of the growing food colorants market in Spain.

Spain Food Colorants Market Industry Insights & Trends

The Spain food colorants market is poised for substantial growth, driven by a confluence of factors that are reshaping the food and beverage industry. The estimated market size for food colorants in Spain is projected to reach approximately $XXX Million in 2025, with a compelling Compound Annual Growth Rate (CAGR) of xx% anticipated during the forecast period (2025-2033). This robust growth trajectory is largely attributable to the increasing consumer demand for visually appealing food products, coupled with a growing awareness and preference for natural food colorants. The shift away from artificial ingredients, often perceived as less healthy, is a significant market driver, propelling the natural color segment to the forefront. Technological advancements in extraction, stabilization, and formulation techniques are enabling the development of more vibrant, stable, and cost-effective natural color solutions, bridging the gap previously occupied by synthetic color alternatives. For instance, advancements in microencapsulation technology are improving the shelf-life and performance of natural pigments in various food applications. Evolving consumer behaviors, influenced by social media trends and growing health consciousness, are further amplifying the demand for products that not only taste good but also look appealing and are perceived as healthier. The bakery, confectionery, and beverage sectors, in particular, are experiencing a surge in demand for vibrant and diverse color palettes derived from natural sources. The Spanish food industry's commitment to innovation and premium product offerings also contributes to market expansion, as manufacturers seek to differentiate their products through enhanced visual appeal. Furthermore, the growing popularity of processed and convenience foods, which often rely on colorants to maintain visual consistency and consumer appeal, also provides a steady demand stream. The regulatory landscape, while stringent, is also a catalyst for innovation, encouraging the development of safer and more sustainable food colorant solutions. The increasing focus on sustainability and ethical sourcing by consumers and manufacturers alike is also influencing the development and adoption of natural food colorants.

Key Markets & Segments Leading Spain Food Colorants Market

The Spain food colorants market is characterized by distinct segment dominance, with natural color emerging as the undisputed leader, driven by profound shifts in consumer preference and regulatory landscapes. The estimated market share for natural color in Spain is projected to be significantly higher than synthetic color in 2025, reflecting the widespread adoption of clean label principles. Within the application segments, the beverage industry stands out as a primary consumer of food colorants. The vibrant hues demanded by soft drinks, juices, and alcoholic beverages, coupled with the increasing popularity of plant-based and functional beverages, fuel consistent demand. The dairy & frozen product segment also represents a substantial market, with colorants essential for creating visually appealing yogurts, ice creams, and desserts. The bakery and confectionery sectors are perennial strongholds, where color plays a crucial role in product differentiation and consumer appeal. From the rich browns of chocolate to the bright colors of candies and pastries, colorants are integral to the sensory experience. The meat, poultry & seafood segment, while historically reliant on natural color for appearance, is also witnessing innovation in colorant applications for processed products. The "Others" segment, encompassing a wide array of processed foods, convenience meals, and specialty items, contributes a steady demand for diverse colorant solutions.

- Natural Color Dominance:

- Consumer Demand for Clean Labels: Growing health consciousness and a preference for transparent ingredient lists are driving consumers towards naturally sourced colorants.

- Perceived Health Benefits: Natural pigments are often associated with additional health benefits (e.g., antioxidants from anthocyanins), further boosting their appeal.

- Technological Advancements: Improved extraction and stabilization technologies are making natural colorants more viable and cost-effective for a wider range of applications.

- Regulatory Support: Favorable regulatory environments in Spain and the EU encourage the use of natural colorants, often with less stringent labeling requirements compared to synthetic alternatives.

- Beverage Sector Leadership:

- Diverse Product Portfolio: The sheer variety of beverages, from juices and teas to sports drinks and alcoholic beverages, necessitates a wide spectrum of colors.

- Visual Appeal: Color is a key factor in initial product choice for consumers in the beverage market.

- Growth of Functional & Plant-Based Beverages: These segments often leverage natural colors to align with their healthier and more natural positioning.

- Bakery & Confectionery Strength:

- Intrinsic Product Appeal: Color is fundamental to the visual allure of baked goods and confectionery, directly impacting purchase decisions.

- Innovation in Design: From intricate cake decorations to vibrant candy assortments, colorants enable creative product differentiation.

- Seasonal & Festive Demand: These sectors experience surges in demand tied to holidays and special occasions, where colorful products are highly sought after.

Spain Food Colorants Market Product Developments

Product innovation in the Spain food colorants market is intensely focused on expanding the palette of natural color options and enhancing their performance. Manufacturers are actively developing novel colorants derived from sustainable sources, such as algae, fungi, and upcycled agricultural byproducts. Advancements in encapsulation technologies are improving the stability and usability of sensitive natural pigments, enabling their application in challenging food matrices and processing conditions. The market is witnessing a rise in colorants with multi-functional properties, offering not only visual appeal but also potential health benefits like antioxidant activity. For example, the development of more heat-stable and pH-resistant natural reds and blues continues to be a key area of research, addressing limitations of early natural colorants.

Challenges in the Spain Food Colorants Market Market

Despite robust growth, the Spain food colorants market faces several significant challenges. The natural color segment, while in high demand, grapples with issues of variability in raw material supply, fluctuating prices, and sometimes limited shade intensity compared to synthetic counterparts. Regulatory hurdles remain a concern, with evolving EU and national regulations requiring continuous adaptation and compliance, particularly regarding novel ingredients and labeling. Supply chain disruptions, exacerbated by global events, can impact the availability and cost of both natural and synthetic raw materials. Furthermore, competitive pressures from both established players and emerging companies, as well as the ongoing development of alternative coloring technologies, necessitate constant innovation and cost optimization.

Forces Driving Spain Food Colorants Market Growth

Several powerful forces are propelling the Spain food colorants market forward. The most significant is the ever-increasing consumer demand for natural and clean label products, driven by health consciousness and a desire for transparency. Technological advancements in the extraction, purification, and stabilization of natural pigments are making them more viable and cost-effective for a wider range of applications, effectively narrowing the performance gap with synthetic alternatives. Favorable regulatory frameworks that encourage the use of safe and natural ingredients also act as a catalyst. Furthermore, the growth of the food processing industry in Spain, coupled with the continuous introduction of new and innovative food and beverage products that require enhanced visual appeal, consistently fuels demand. Economic growth and rising disposable incomes also support the consumption of premium and visually attractive food items.

Challenges in the Spain Food Colorants Market Market

The Spain food colorants market faces long-term growth catalysts primarily in continued innovation and strategic market expansion. The persistent drive for novel natural food colorants derived from underutilized sources or offering unique color profiles will be crucial. Partnerships and collaborations between ingredient suppliers, food manufacturers, and research institutions will foster the development and adoption of these advanced solutions. Furthermore, exploring and penetrating emerging markets within Spain and potentially expanding export opportunities for Spanish food colorant manufacturers will provide significant growth avenues. The development of colorants with enhanced functional properties, beyond just aesthetics, and the adoption of sustainable manufacturing practices will also contribute to sustained market leadership.

Emerging Opportunities in Spain Food Colorants Market

Emerging opportunities in the Spain food colorants market are centered around evolving consumer preferences and technological breakthroughs. The growing demand for plant-based food colorants derived from sources like microalgae and insects presents a novel and sustainable avenue. Innovations in color-changing or reactive food colorants that respond to temperature or pH changes could unlock unique product experiences. Furthermore, the increasing focus on personalized nutrition may lead to opportunities for custom-colored food products tailored to individual needs. The expanding market for functional foods and beverages offers a platform for colorants that can impart health benefits, such as antioxidants, alongside visual appeal.

Leading Players in the Spain Food Colorants Market Sector

- BASF SE

- Koninklijke DSM N.V.

- Chr Hansen Holding A/S

- Sensient Technologies Corporation

- Givaudan (Naturex)

- Riken Vitamin Co Ltd

- Dohler GmbH

Key Milestones in Spain Food Colorants Market Industry

- 2019: Increased consumer awareness and demand for clean label products gain significant traction, boosting the natural food colorants market.

- 2020: Advancements in microencapsulation technology for natural colorants are highlighted, improving stability and application range.

- 2021: European Union implements revised regulations on food additives, impacting the labeling and usage of certain colorants.

- 2022: Key players in the market announce strategic investments in R&D for sustainable sourcing of natural colorants.

- 2023: Growth in the plant-based food sector fuels demand for vibrant and natural color solutions for vegan and vegetarian products.

- 2024: Focus on upcycled ingredients for colorant production intensifies, driven by sustainability initiatives.

Strategic Outlook for Spain Food Colorants Market Market

The strategic outlook for the Spain food colorants market is overwhelmingly positive, driven by sustained consumer demand for natural ingredients and continuous innovation. The market is set to witness a strong emphasis on the development of novel, high-performance natural food colorants that offer greater stability, vibrant shades, and cost-effectiveness. Strategic partnerships and acquisitions will likely continue as companies aim to consolidate their market positions and expand their technological capabilities. The increasing integration of colorants with functional benefits, catering to the growing health and wellness trend, presents a significant growth accelerator. Moreover, a focus on sustainable sourcing and production practices will be paramount for long-term success, aligning with both regulatory expectations and consumer values.

Spain Food Colorants Market Segmentation

-

1. Type

- 1.1. Natural Color

- 1.2. Synthetic Color

-

2. Application

- 2.1. Beverage

- 2.2. Dairy & Frozen Product

- 2.3. Bakery

- 2.4. Confectionery

- 2.5. Meat, Poultry & Seafood

- 2.6. Others

Spain Food Colorants Market Segmentation By Geography

- 1. Spain

Spain Food Colorants Market Regional Market Share

Geographic Coverage of Spain Food Colorants Market

Spain Food Colorants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Rising Awareness of the Health Benefits Associated with Collagen Consumption; Rising Sport and Fitness Trends Drives the Market Growth

- 3.3. Market Restrains

- 3.3.1. Concerns over the Source and Animal Welfare in Collagen Extraction Limit the Market Growth

- 3.4. Market Trends

- 3.4.1. Rising Demand for Natural Food Colorants

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Food Colorants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Natural Color

- 5.1.2. Synthetic Color

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Beverage

- 5.2.2. Dairy & Frozen Product

- 5.2.3. Bakery

- 5.2.4. Confectionery

- 5.2.5. Meat, Poultry & Seafood

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Riken Vitamin Co Ltd *List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BASF SE

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Koninklijke DSM N V

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dohler GmbH

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Chr Hansen Holding A / S

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sensient Technologies Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Givaudan (Naturex)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Riken Vitamin Co Ltd *List Not Exhaustive

List of Figures

- Figure 1: Spain Food Colorants Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Spain Food Colorants Market Share (%) by Company 2025

List of Tables

- Table 1: Spain Food Colorants Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Spain Food Colorants Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Spain Food Colorants Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Spain Food Colorants Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Spain Food Colorants Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Spain Food Colorants Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Food Colorants Market?

The projected CAGR is approximately 6.4%.

2. Which companies are prominent players in the Spain Food Colorants Market?

Key companies in the market include Riken Vitamin Co Ltd *List Not Exhaustive, BASF SE, Koninklijke DSM N V, Dohler GmbH, Chr Hansen Holding A / S, Sensient Technologies Corporation, Givaudan (Naturex).

3. What are the main segments of the Spain Food Colorants Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.22 billion as of 2022.

5. What are some drivers contributing to market growth?

The Rising Awareness of the Health Benefits Associated with Collagen Consumption; Rising Sport and Fitness Trends Drives the Market Growth.

6. What are the notable trends driving market growth?

Rising Demand for Natural Food Colorants.

7. Are there any restraints impacting market growth?

Concerns over the Source and Animal Welfare in Collagen Extraction Limit the Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Food Colorants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Food Colorants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Food Colorants Market?

To stay informed about further developments, trends, and reports in the Spain Food Colorants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence