Key Insights

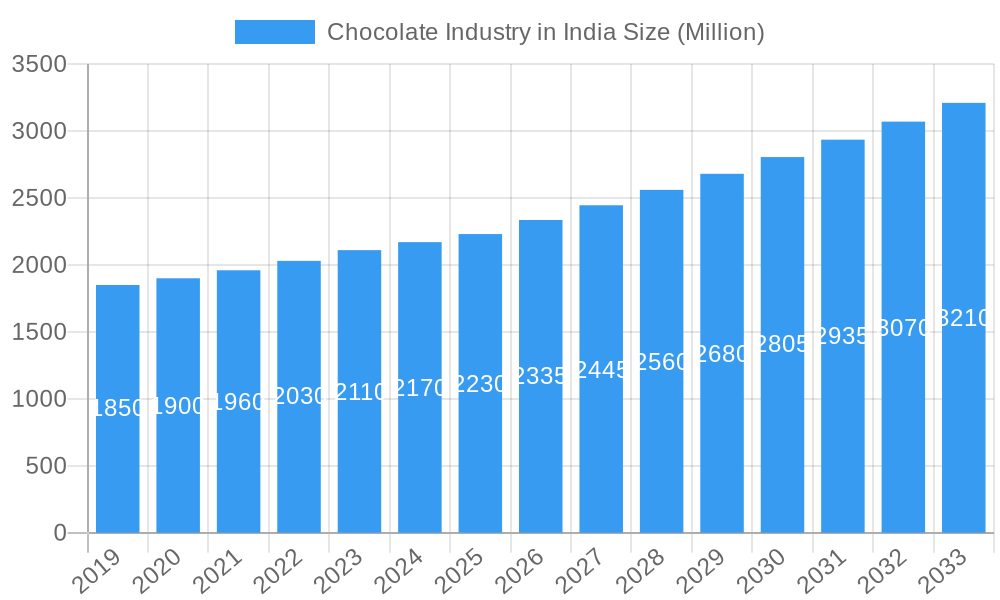

The Indian chocolate market is poised for significant expansion, driven by evolving consumer preferences, rising disposable incomes, and a growing demand for premium and artisanal chocolate. With a current market size of 2.48 billion, the industry is projected to witness a Compound Annual Growth Rate (CAGR) of 7.63% over the forecast period, with the base year set at 2025. Growth is fueled by the increasing popularity of dark chocolate, appreciated for its perceived health benefits and sophisticated taste, alongside the continued dominance of milk and white chocolate variants catering to broader palates. The distribution landscape is dynamic, with online retail channels gaining prominence alongside traditional supermarkets, hypermarkets, and convenience stores, mirroring the digital shift in Indian purchasing habits. Key players such as Nestlé SA, Mondelez International Inc., and Ferrero International SA are actively investing in product innovation and market reach to capitalize on this burgeoning demand.

Chocolate Industry in India Market Size (In Billion)

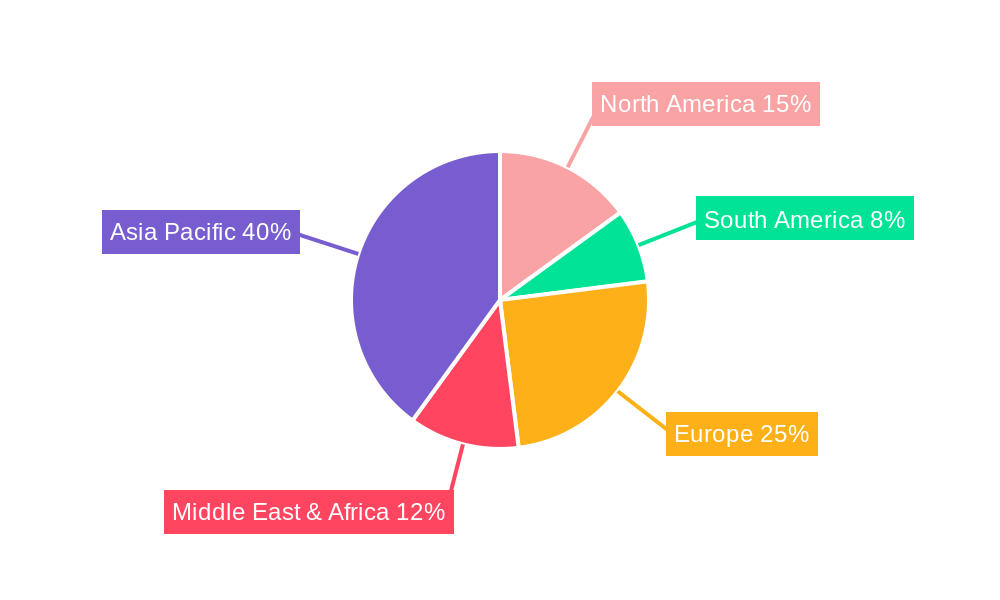

While the Indian chocolate industry is experiencing substantial growth, certain factors present potential challenges. Price sensitivity among a significant portion of the Indian population and the availability of affordable local confectionery alternatives can restrain faster market penetration in the mass market segment. However, the increasing demand for chocolate as gifts, especially during festivals and special occasions, coupled with the growing trend of health-conscious indulgence, is creating new avenues for premium product development. Companies are strategically addressing these challenges through product diversification, targeted marketing, and optimized supply chains for wider accessibility. The Asia Pacific region, with India at its forefront, is expected to be a major contributor to the global chocolate market's expansion, propelled by its young demographic and increasing urbanization.

Chocolate Industry in India Company Market Share

Indian Chocolate Market Analysis: Growth, Trends, and Forecast (2025-2033)

Explore the dynamic Indian chocolate market, your essential guide to growth, innovation, and opportunity. This in-depth report analyzes India's rapidly expanding chocolate sector, projected to reach a significant market size by 2025. Gain actionable insights into market concentration, consumer trends, product development, and key players shaping the future of chocolate in India.

Focusing on high-growth segments like Dark Chocolate, Milk and White Chocolate, and dominant distribution channels including Convenience Stores, Online Retail Stores, and Supermarkets/Hypermarkets, this report offers a granular understanding of market opportunities. Essential for capitalizing on the burgeoning Indian confectionery landscape, this analysis is meticulously crafted to inform strategic decision-making.

Chocolate Industry in India Market Concentration & Dynamics

The Indian chocolate industry, while experiencing significant growth, exhibits a moderate level of market concentration. Key players like Nestlé SA, Mondelēz International Inc., and ITC Limited hold substantial market share, but the increasing presence of domestic brands and international entrants such as Ferrero International SA, Mars Incorporated, and The Hershey Company fuels dynamic competition. Innovation ecosystems are thriving, with companies actively investing in new product development, particularly in premium and healthier chocolate variants. The regulatory framework, though evolving, generally supports industry growth, but compliance with food safety standards and labeling requirements remains crucial. Substitute products, primarily traditional Indian sweets, continue to pose a competitive challenge, especially in rural and semi-urban markets. End-user trends are shifting towards health-conscious choices, premiumization, and artisanal offerings. M&A activities are on the rise, signaling consolidation and strategic expansion. For instance, the acquisition of LuvIt by DS Group and Reliance Consumer Products' stake in Lotus Chocolate Company Ltd. highlight this trend. The market share is distributed, with leading players capturing a significant portion, while a growing number of smaller and regional players contribute to market diversity. M&A deal counts are projected to increase as companies seek to strengthen their portfolios and market reach.

Chocolate Industry in India Industry Insights & Trends

The Indian chocolate industry is poised for substantial growth, driven by a confluence of economic, social, and demographic factors. The market size is estimated to be in the billions, with a robust Compound Annual Growth Rate (CAGR) projected over the forecast period. Key growth drivers include rising disposable incomes, a burgeoning young population with a penchant for indulgence, and increasing urbanization, leading to greater access to organized retail channels. Technological disruptions are playing a pivotal role, with advancements in manufacturing processes improving efficiency and product quality. E-commerce platforms have revolutionized distribution, making a wider array of chocolates accessible to consumers across the nation. Evolving consumer behaviors are characterized by a growing demand for premium, dark, and ethically sourced chocolates, alongside an increasing awareness of health benefits associated with cocoa content. The penetration of global brands, coupled with the innovation of local players, is reshaping consumer preferences. The market is witnessing a surge in demand for gifting chocolates, especially during festive seasons, further boosting sales volumes. The influence of digital marketing and social media is also instrumental in creating brand awareness and driving impulse purchases. The industry's ability to adapt to these evolving trends will be critical for sustained success.

Key Markets & Segments Leading Chocolate Industry in India

The Indian chocolate industry's dominance is intricately linked to its burgeoning urban centers and a rapidly expanding middle class. The Confectionery segment, encompassing a wide array of chocolate products, leads the market. Within this, Milk and White Chocolate variants currently hold the largest market share due to their broad appeal and mass-market accessibility. However, Dark Chocolate is witnessing an accelerated growth trajectory, driven by increasing health consciousness and a discerning consumer base seeking richer, more complex flavors.

The Distribution Channel landscape is increasingly diversified. Supermarkets/Hypermarkets remain a significant channel, offering convenience and a wide product selection. Online Retail Stores are rapidly gaining prominence, providing unparalleled reach and catering to the digital-savvy Indian consumer, especially in metropolitan areas. Convenience Stores play a crucial role in driving impulse purchases and ensuring product availability in smaller towns and residential areas. Others, including impulse vending machines and specialty chocolate boutiques, are emerging as niche but growing segments.

Drivers for the dominance of these segments include:

- Economic Growth: Rising disposable incomes in urban and semi-urban areas directly correlate with increased spending on premium and indulgence products like chocolate.

- Urbanization: The migration of populations to cities expands the reach of organized retail and introduces consumers to a wider variety of chocolate products and brands.

- Demographic Dividend: A large youth population with a high propensity for snacking and indulgence is a primary consumer base for chocolates.

- Evolving Lifestyles: Increased snacking occasions and a growing culture of gifting during festivals and celebrations further propel chocolate consumption.

- Digital Penetration: The widespread adoption of smartphones and internet access has democratized access to online retail, making chocolates available to a broader audience.

The analysis of these segments and channels reveals a market that is both consolidating in its mass-market appeal and fragmenting into premium and niche offerings, presenting a complex yet promising landscape for stakeholders.

Chocolate Industry in India Product Developments

Product innovation in the Indian chocolate industry is a key differentiator. Companies are actively developing novel formulations, including sugar-free, low-calorie, and vegan chocolate options to cater to evolving health trends. The introduction of unique flavor infusions, such as local Indian spices and fruits, is creating distinct product identities and appealing to regional palates. Technological advancements in processing are enabling the creation of chocolates with improved texture and shelf-life, while sustainable sourcing and ethical production practices are gaining traction, enhancing market relevance. These advancements, coupled with attractive packaging and marketing strategies, are crucial for gaining a competitive edge in this dynamic market.

Challenges in the Chocolate Industry in India Market

Despite its growth, the Indian chocolate market faces several challenges. Regulatory hurdles, including stringent food safety standards and import duties on cocoa beans, can impact operational costs and product availability. Supply chain complexities, particularly in sourcing quality cocoa and ensuring efficient distribution across diverse geographical terrains, pose significant logistical challenges. Intense competitive pressures from both established international brands and a growing number of domestic players, along with the enduring popularity of traditional Indian sweets, can limit market penetration and price flexibility. Fluctuations in raw material prices, especially cocoa, also present an economic constraint. The overall impact of these challenges can lead to increased production costs and potentially slower growth in certain market segments.

Forces Driving Chocolate Industry in India Growth

Several forces are propelling the Indian chocolate industry forward. Technological advancements in manufacturing and packaging are enhancing product quality and shelf life, while also improving production efficiency. Economic factors, such as rising per capita income and a growing middle class with increased purchasing power, are creating a larger consumer base for chocolate products. Favorable demographic trends, including a substantial youth population and increasing urbanization, contribute to sustained demand. Regulatory support and the government's focus on boosting the food processing industry further incentivize growth. The increasing adoption of digital platforms for marketing and distribution is expanding market reach and accessibility.

Challenges in the Chocolate Industry in India Market

Long-term growth catalysts for the Indian chocolate industry are rooted in sustained innovation and strategic market expansion. Continued investment in product development, focusing on health and wellness trends like sugar reduction and fortification with functional ingredients, will be critical. Partnerships and collaborations, including joint ventures and licensing agreements with international players, can accelerate market entry and technology transfer. Market expansion into Tier 2 and Tier 3 cities, coupled with the development of affordable yet quality chocolate offerings for these demographics, presents significant untapped potential. Furthermore, a focus on sustainable sourcing and ethical practices can enhance brand loyalty and appeal to an increasingly conscious consumer base.

Emerging Opportunities in Chocolate Industry in India

Emerging opportunities in the Indian chocolate industry are abundant. The rising demand for premium and artisanal chocolates offers a lucrative niche for specialized brands. The burgeoning e-commerce sector continues to provide unprecedented access to consumers across the country, facilitating direct-to-consumer sales. Growing awareness about the health benefits of dark chocolate is driving demand for higher cocoa content products. Furthermore, innovative packaging solutions and the development of unique flavor combinations that cater to local tastes present avenues for differentiation. The expansion of chocolate into value-added segments, such as chocolate-based beverages and desserts, also offers significant growth potential.

Leading Players in the Chocolate Industry in India Sector

- Nestlé SA

- Chocoladefabriken Lindt & Sprüngli AG

- Reliance Industries Ltd

- Surya Food & Agro Ltd

- Ferrero International SA

- DS Group

- Mars Incorporated

- Yıldız Holding A

- Mondelēz International Inc

- Gujarat Co-operative Milk Marketing Federation Ltd

- ITC Limited

- The Hershey Company

Key Milestones in Chocolate Industry in India Industry

- June 2023: Dharampal Satyapal Group (DS Group) announced the acquisition of The Good Stuff Pvt. Ltd, formerly known as Global CP Pvt. Ltd. (LuvIt brand). This strategic move strengthens DS Group’s Confectionary portfolio, indicating a focus on consolidating and expanding market presence.

- May 2023: Reliance Consumer Products (RCPL), the FMCG arm of Reliance Retail Ventures (RRVL), completed the acquisition of a controlling stake in Lotus Chocolate Company Ltd. This signifies a major consolidation play and an aggressive expansion strategy by a key retail conglomerate into the chocolate manufacturing sector.

- February 2023: Ferrero International SA expanded its business by introducing a new chocolate variant, Kinder® Chocolate Mini Friends. This product launch underscores Ferrero's strategic move to increase its consumer base by offering unique flavored products, highlighting product diversification and market penetration efforts.

Strategic Outlook for Chocolate Industry in India Market

The strategic outlook for the Indian chocolate industry is exceptionally promising, characterized by sustained growth and evolving market dynamics. Key growth accelerators include continued investment in product innovation, particularly in health-conscious and premium segments, and the leveraging of digital channels for enhanced distribution and consumer engagement. Companies that can effectively navigate supply chain complexities and adapt to changing consumer preferences for ethical and sustainable products will be well-positioned for success. Strategic partnerships and acquisitions are expected to play a pivotal role in consolidating market share and expanding product portfolios. The industry's future potential is further enhanced by the untapped rural markets and the increasing demand for chocolate as a gifting item, presenting a robust roadmap for future expansion and profitability.

Chocolate Industry in India Segmentation

-

1. Confectionery Variant

- 1.1. Dark Chocolate

- 1.2. Milk and White Chocolate

-

2. Distribution Channel

- 2.1. Convenience Store

- 2.2. Online Retail Store

- 2.3. Supermarket/Hypermarket

- 2.4. Others

Chocolate Industry in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Chocolate Industry in India Regional Market Share

Geographic Coverage of Chocolate Industry in India

Chocolate Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.63% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Influence of Endorsements

- 3.2.2 Aggressive Marketing

- 3.2.3 and Strategic Investments; Demand for Sustainable Chocolates and Single Origin Certified Chocolates

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Products; Fluctuating Price of Raw Materials

- 3.4. Market Trends

- 3.4.1. Convenience stores accounted for major share of sales chocolate across the country due to easy accessibility

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Chocolate Industry in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 5.1.1. Dark Chocolate

- 5.1.2. Milk and White Chocolate

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Convenience Store

- 5.2.2. Online Retail Store

- 5.2.3. Supermarket/Hypermarket

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 6. North America Chocolate Industry in India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 6.1.1. Dark Chocolate

- 6.1.2. Milk and White Chocolate

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Convenience Store

- 6.2.2. Online Retail Store

- 6.2.3. Supermarket/Hypermarket

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 7. South America Chocolate Industry in India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 7.1.1. Dark Chocolate

- 7.1.2. Milk and White Chocolate

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Convenience Store

- 7.2.2. Online Retail Store

- 7.2.3. Supermarket/Hypermarket

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 8. Europe Chocolate Industry in India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 8.1.1. Dark Chocolate

- 8.1.2. Milk and White Chocolate

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Convenience Store

- 8.2.2. Online Retail Store

- 8.2.3. Supermarket/Hypermarket

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 9. Middle East & Africa Chocolate Industry in India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 9.1.1. Dark Chocolate

- 9.1.2. Milk and White Chocolate

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Convenience Store

- 9.2.2. Online Retail Store

- 9.2.3. Supermarket/Hypermarket

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 10. Asia Pacific Chocolate Industry in India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 10.1.1. Dark Chocolate

- 10.1.2. Milk and White Chocolate

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Convenience Store

- 10.2.2. Online Retail Store

- 10.2.3. Supermarket/Hypermarket

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 11. North India Chocolate Industry in India Analysis, Insights and Forecast, 2020-2032

- 12. South India Chocolate Industry in India Analysis, Insights and Forecast, 2020-2032

- 13. East India Chocolate Industry in India Analysis, Insights and Forecast, 2020-2032

- 14. West India Chocolate Industry in India Analysis, Insights and Forecast, 2020-2032

- 15. Competitive Analysis

- 15.1. Global Market Share Analysis 2025

- 15.2. Company Profiles

- 15.2.1 Nestlé SA

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Chocoladefabriken Lindt & Sprüngli AG

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 Reliance Industries Ltd

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Surya Food & Agro Ltd

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Ferrero International SA

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 DS Group

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Mars Incorporated

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 Yıldız Holding A

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 Mondelēz International Inc

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 Gujarat Co-operative Milk Marketing Federation Ltd

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.11 ITC Limited

- 15.2.11.1. Overview

- 15.2.11.2. Products

- 15.2.11.3. SWOT Analysis

- 15.2.11.4. Recent Developments

- 15.2.11.5. Financials (Based on Availability)

- 15.2.12 The Hershey Company

- 15.2.12.1. Overview

- 15.2.12.2. Products

- 15.2.12.3. SWOT Analysis

- 15.2.12.4. Recent Developments

- 15.2.12.5. Financials (Based on Availability)

- 15.2.1 Nestlé SA

List of Figures

- Figure 1: Global Chocolate Industry in India Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: India Chocolate Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 3: India Chocolate Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 4: North America Chocolate Industry in India Revenue (billion), by Confectionery Variant 2025 & 2033

- Figure 5: North America Chocolate Industry in India Revenue Share (%), by Confectionery Variant 2025 & 2033

- Figure 6: North America Chocolate Industry in India Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 7: North America Chocolate Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America Chocolate Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Chocolate Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Chocolate Industry in India Revenue (billion), by Confectionery Variant 2025 & 2033

- Figure 11: South America Chocolate Industry in India Revenue Share (%), by Confectionery Variant 2025 & 2033

- Figure 12: South America Chocolate Industry in India Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 13: South America Chocolate Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: South America Chocolate Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 15: South America Chocolate Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 16: Europe Chocolate Industry in India Revenue (billion), by Confectionery Variant 2025 & 2033

- Figure 17: Europe Chocolate Industry in India Revenue Share (%), by Confectionery Variant 2025 & 2033

- Figure 18: Europe Chocolate Industry in India Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 19: Europe Chocolate Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 20: Europe Chocolate Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 21: Europe Chocolate Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 22: Middle East & Africa Chocolate Industry in India Revenue (billion), by Confectionery Variant 2025 & 2033

- Figure 23: Middle East & Africa Chocolate Industry in India Revenue Share (%), by Confectionery Variant 2025 & 2033

- Figure 24: Middle East & Africa Chocolate Industry in India Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 25: Middle East & Africa Chocolate Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 26: Middle East & Africa Chocolate Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 27: Middle East & Africa Chocolate Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 28: Asia Pacific Chocolate Industry in India Revenue (billion), by Confectionery Variant 2025 & 2033

- Figure 29: Asia Pacific Chocolate Industry in India Revenue Share (%), by Confectionery Variant 2025 & 2033

- Figure 30: Asia Pacific Chocolate Industry in India Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 31: Asia Pacific Chocolate Industry in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: Asia Pacific Chocolate Industry in India Revenue (billion), by Country 2025 & 2033

- Figure 33: Asia Pacific Chocolate Industry in India Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Chocolate Industry in India Revenue billion Forecast, by Region 2020 & 2033

- Table 2: Global Chocolate Industry in India Revenue billion Forecast, by Confectionery Variant 2020 & 2033

- Table 3: Global Chocolate Industry in India Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Chocolate Industry in India Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Chocolate Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 6: North India Chocolate Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: South India Chocolate Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: East India Chocolate Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: West India Chocolate Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Chocolate Industry in India Revenue billion Forecast, by Confectionery Variant 2020 & 2033

- Table 11: Global Chocolate Industry in India Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global Chocolate Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 13: United States Chocolate Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Canada Chocolate Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Mexico Chocolate Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global Chocolate Industry in India Revenue billion Forecast, by Confectionery Variant 2020 & 2033

- Table 17: Global Chocolate Industry in India Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 18: Global Chocolate Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Brazil Chocolate Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Argentina Chocolate Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America Chocolate Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Chocolate Industry in India Revenue billion Forecast, by Confectionery Variant 2020 & 2033

- Table 23: Global Chocolate Industry in India Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 24: Global Chocolate Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 25: United Kingdom Chocolate Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Germany Chocolate Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: France Chocolate Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Italy Chocolate Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Spain Chocolate Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Russia Chocolate Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Benelux Chocolate Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Nordics Chocolate Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Rest of Europe Chocolate Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Global Chocolate Industry in India Revenue billion Forecast, by Confectionery Variant 2020 & 2033

- Table 35: Global Chocolate Industry in India Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 36: Global Chocolate Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 37: Turkey Chocolate Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Israel Chocolate Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: GCC Chocolate Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: North Africa Chocolate Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: South Africa Chocolate Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Rest of Middle East & Africa Chocolate Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: Global Chocolate Industry in India Revenue billion Forecast, by Confectionery Variant 2020 & 2033

- Table 44: Global Chocolate Industry in India Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 45: Global Chocolate Industry in India Revenue billion Forecast, by Country 2020 & 2033

- Table 46: China Chocolate Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: India Chocolate Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Japan Chocolate Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: South Korea Chocolate Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Chocolate Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 51: Oceania Chocolate Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Chocolate Industry in India Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chocolate Industry in India?

The projected CAGR is approximately 7.63%.

2. Which companies are prominent players in the Chocolate Industry in India?

Key companies in the market include Nestlé SA, Chocoladefabriken Lindt & Sprüngli AG, Reliance Industries Ltd, Surya Food & Agro Ltd, Ferrero International SA, DS Group, Mars Incorporated, Yıldız Holding A, Mondelēz International Inc, Gujarat Co-operative Milk Marketing Federation Ltd, ITC Limited, The Hershey Company.

3. What are the main segments of the Chocolate Industry in India?

The market segments include Confectionery Variant, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.48 billion as of 2022.

5. What are some drivers contributing to market growth?

Influence of Endorsements. Aggressive Marketing. and Strategic Investments; Demand for Sustainable Chocolates and Single Origin Certified Chocolates.

6. What are the notable trends driving market growth?

Convenience stores accounted for major share of sales chocolate across the country due to easy accessibility.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Products; Fluctuating Price of Raw Materials.

8. Can you provide examples of recent developments in the market?

June 2023: Dharampal Satyapal Group (DS Group) announced the acquisition of The Good Stuff Pvt. Ltd, formerly known as Global CP Pvt. Ltd., which sells chocolates and confectioneries under the LuvIt brand. This acquisition can prove a strategic move to grow and strengthen the group’s Confectionary portfolio.May 2023: Reliance Consumer Products (RCPL), the FMCG arm of Reliance Retail Ventures (RRVL), completed the acquisition of a controlling stake in Lotus Chocolate Company Ltd.February 2023: Ferrero International SA expanded its business by introducing a new chocolate variant under its brand, Kinder® Chocolate Mini Friends. The expansion is based on its strategic move to increase its consumer base by offering unique flavored products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chocolate Industry in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chocolate Industry in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chocolate Industry in India?

To stay informed about further developments, trends, and reports in the Chocolate Industry in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence