Key Insights

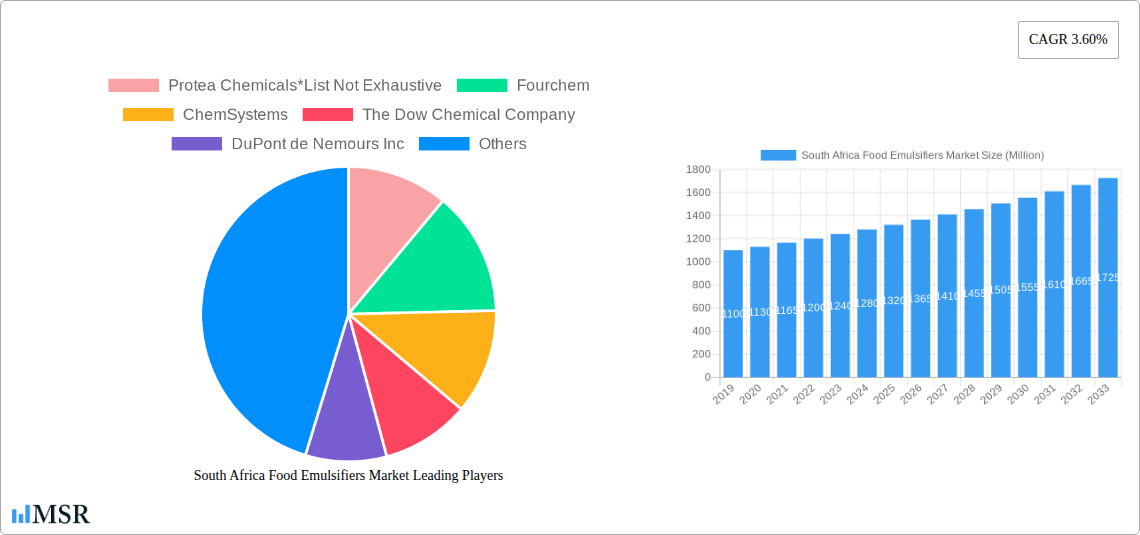

The South African food emulsifiers market is poised for steady growth, projected to reach approximately ZAR 1,500 million by 2025, with an estimated Compound Annual Growth Rate (CAGR) of 3.60% from 2019 to 2033. This expansion is primarily driven by the increasing demand for processed and convenience foods, a growing consumer preference for healthier food options with improved texture and shelf-life, and the burgeoning food and beverage industry in South Africa. Key segments contributing to this growth include Lecithin, Monoglyceride, and Diglyceride derivatives, which are widely used across various applications. The dairy and bakery sectors are significant consumers of food emulsifiers, benefiting from enhanced product quality and stability. Furthermore, the rising adoption of innovative food formulations and the increasing integration of emulsifiers in meat, poultry, and seafood processing are expected to fuel market momentum. The trend towards natural and clean-label emulsifiers is also gaining traction, presenting opportunities for manufacturers to develop and market sustainable solutions.

South Africa Food Emulsifiers Market Market Size (In Billion)

Despite the positive outlook, the market faces certain restraints, including fluctuating raw material prices, particularly for plant-derived emulsifiers like lecithin, and stringent regulatory compliances in food processing. However, the continuous innovation in product development, such as the creation of emulsifiers with multi-functional properties and improved cost-effectiveness, is expected to mitigate these challenges. The competitive landscape features key players like DuPont de Nemours Inc., The Dow Chemical Company, and Palsgaard, who are actively involved in research and development to introduce novel products and expand their market presence. Investments in expanding production capacities and strategic collaborations are also anticipated to shape the market's future trajectory. The forecast period, from 2025 to 2033, is expected to witness sustained demand, driven by evolving consumer tastes and the ongoing modernization of South Africa's food manufacturing infrastructure.

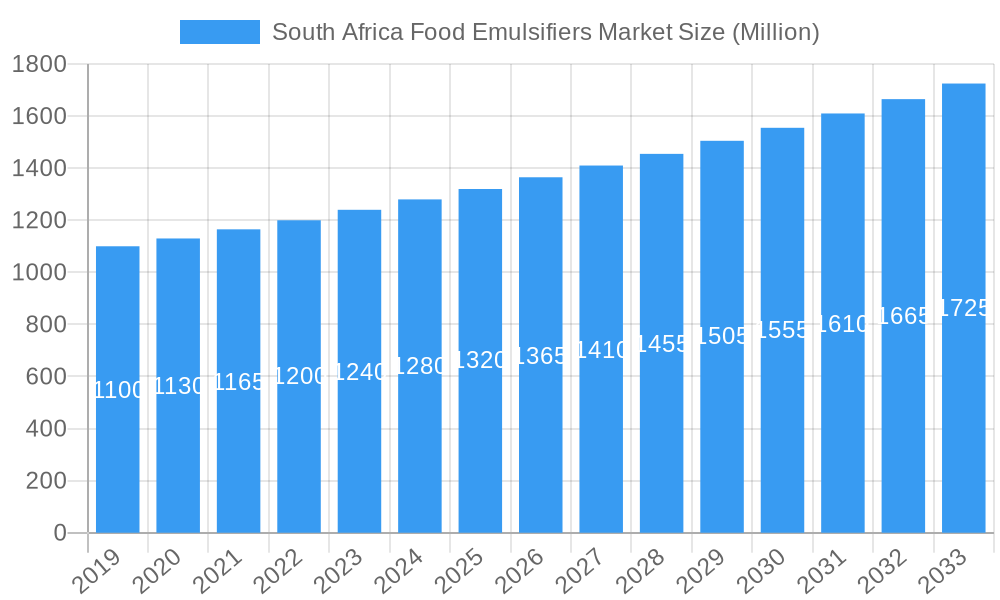

South Africa Food Emulsifiers Market Company Market Share

This in-depth report provides a detailed analysis of the South Africa food emulsifiers market, a critical sector for food manufacturers seeking to enhance product texture, stability, and shelf-life. Leveraging extensive research and industry expertise, this report offers actionable insights for stakeholders, including food ingredient suppliers, manufacturers, distributors, and investors. We forecast the market to reach USD 550.2 Million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of 6.8% from the base year 2025.

Historical data from 2019-2024 highlights a steady upward trajectory, driven by increasing demand for processed foods and evolving consumer preferences for convenience and premium food products. The base year 2025 is estimated to be valued at USD 330.1 Million. This comprehensive report covers the study period from 2019 to 2033, with a keen focus on the forecast period of 2025–2033.

South Africa Food Emulsifiers Market Market Concentration & Dynamics

The South Africa food emulsifiers market exhibits a moderate to high concentration, characterized by the presence of both global giants and local players. Innovation plays a pivotal role, with companies investing in R&D to develop novel emulsifier solutions that cater to specific functional and clean-label demands. The innovation ecosystem is bolstered by collaborations between ingredient manufacturers and food processing companies. Regulatory frameworks, primarily governed by the Food and Agriculture Organization of the United Nations (FAO) and local food safety authorities, ensure product quality and safety, influencing ingredient sourcing and formulation.

The threat of substitute products is relatively low, as emulsifiers offer unique functional benefits that are difficult to replicate. However, the growing trend towards “clean label” ingredients is prompting manufacturers to explore naturally derived emulsifiers. End-user trends are shifting towards healthier and more sustainable food options, directly impacting the demand for specific types of emulsifiers.

Key Market Dynamics:

- Market Share Distribution: Key players hold significant market share, with established brands dominating the lecithin and monoglyceride segments.

- M&A Activities: While the market has witnessed strategic partnerships and smaller acquisitions aimed at expanding product portfolios or market reach, large-scale M&A activities are relatively moderate, indicating a stable competitive landscape. The number of M&A deals in the historical period (2019-2024) was approximately 5-7.

- Technological Advancements: Continuous advancements in emulsifier production technology are enhancing efficiency and product quality.

South Africa Food Emulsifiers Market Industry Insights & Trends

The South Africa food emulsifiers market is on a sustained growth trajectory, fueled by a confluence of compelling factors. Market growth drivers are primarily attributed to the burgeoning processed food industry, the increasing demand for convenience foods, and the rising adoption of emulsifiers in bakery, dairy, and confectionery applications to improve texture, stability, and overall product appeal. The market size in 2025 is estimated at USD 330.1 Million, with a projected CAGR of 6.8% during the forecast period (2025-2033).

Technological disruptions in emulsifier manufacturing, including advancements in enzymatic modification and encapsulation technologies, are enabling the development of higher-performance and specialized emulsifiers. These innovations are crucial for meeting the evolving needs of food manufacturers, particularly in creating products with improved mouthfeel, extended shelf life, and enhanced nutritional profiles. The shift towards healthier and more natural food options is also influencing the market, driving demand for emulsifiers derived from natural sources like soy, sunflower, and rapeseed. This trend is particularly evident in the demand for lecithin and monoglycerides, which are widely perceived as more natural alternatives.

Evolving consumer behaviors are playing a significant role, with an increasing preference for visually appealing and texturally consistent food products. Emulsifiers are instrumental in achieving these desirable attributes, thereby supporting their continued integration into a wide array of food formulations. Furthermore, the growth of the quick-service restaurant (QSR) sector and the increasing consumption of ready-to-eat meals are indirectly boosting the demand for food emulsifiers, as these products often rely on emulsifiers for texture and stability. The expanding middle class and increasing disposable incomes in South Africa also contribute to a higher consumption of processed and convenience foods, further solidifying the market's growth prospects. The report delves deep into these dynamics, providing a granular understanding of the forces shaping the South Africa food emulsifiers market.

Key Markets & Segments Leading South Africa Food Emulsifiers Market

The South Africa food emulsifiers market is characterized by the strong performance of specific segments and applications, driven by robust consumer demand and the functional benefits offered by these ingredients. The Bakery segment consistently emerges as a dominant force, driven by the widespread consumption of bread, cakes, pastries, and biscuits across South Africa. Emulsifiers in bakery products play a crucial role in improving dough handling, crumb structure, volume, and shelf life, making them indispensable for bakers.

Dominant Type Segment: Lecithin & Monoglyceride, Diglyceride, and Derivatives:

- Economic Growth: The steady growth of the food processing industry, particularly in the bakery and dairy sectors, directly translates to higher demand for these foundational emulsifiers.

- Versatility: Lecithin, with its excellent emulsifying and wetting properties, finds extensive use in bakery goods, confectionery, and dairy products. Monoglycerides and diglycerides are vital for improving texture, aeration, and fat distribution in baked goods and dairy.

- Cost-Effectiveness: These types of emulsifiers often offer a favorable cost-to-performance ratio, making them attractive to a broad range of manufacturers.

- Consumer Perception: While consumer awareness regarding emulsifiers is growing, lecithin is generally perceived as a more natural ingredient, further bolstering its demand.

Dominant Application Segment: Bakery & Dairy:

- Bakery Dominance: South Africa has a deeply ingrained culture of baked goods consumption. The demand for bread, cakes, and pastries remains consistently high, driving the need for emulsifiers that enhance texture, volume, and shelf life. The bakery segment is estimated to account for over 30% of the total market share in 2025.

- Dairy Growth: The dairy sector, encompassing products like ice cream, yogurt, and cheese, also exhibits significant growth. Emulsifiers are essential in dairy applications for preventing ice crystal formation in frozen desserts, improving creaminess, and stabilizing emulsions in spreads and dressings.

- Confectionery Demand: The thriving confectionery market, driven by impulse purchases and gifting occasions, also contributes significantly to emulsifier demand, where they are used to control fat bloom, improve texture, and ensure smooth melting properties.

Regional Dynamics: While the entire South Africa market shows promise, the Western Cape and Gauteng provinces, being economic hubs with higher population densities and established food processing industries, represent the largest consumer bases for food emulsifiers. The increasing urbanization and adoption of modern retail formats in these regions further amplify the demand for processed foods.

South Africa Food Emulsifiers Market Product Developments

Recent product developments in the South Africa food emulsifiers market are centered on enhancing functionality, sustainability, and clean-label attributes. Manufacturers are focusing on creating emulsifiers with improved heat stability, cold emulsification capabilities, and reduced reliance on synthetic ingredients. Innovations in enzyme-modified emulsifiers and plant-based alternatives are gaining traction, catering to the growing consumer demand for natural and minimally processed food products. These advancements not only broaden the application scope for emulsifiers but also provide manufacturers with competitive advantages in a dynamic market.

Challenges in the South Africa Food Emulsifiers Market Market

Despite the positive outlook, the South Africa food emulsifiers market faces several challenges that could temper growth. Regulatory hurdles, particularly concerning the approval and labeling of novel emulsifiers, can slow down market penetration. Supply chain disruptions, exacerbated by global economic volatility and logistical complexities, can impact the availability and cost of raw materials, affecting pricing and production schedules. Intense competition among both global and local players can lead to price pressures and necessitate continuous innovation to maintain market share. The cost sensitivity of some food manufacturers, especially smaller enterprises, also presents a challenge in adopting premium or specialized emulsifier solutions.

Forces Driving South Africa Food Emulsifiers Market Growth

Several powerful forces are propelling the South Africa food emulsifiers market forward. The growing demand for convenience and processed foods, driven by busy lifestyles and urbanization, is a primary catalyst. Technological advancements in food manufacturing and the development of innovative emulsifier formulations that offer superior functionality are further stimulating growth. Increasing consumer awareness about the benefits of emulsifiers in enhancing food texture and shelf life, coupled with a growing preference for aesthetically pleasing and stable food products, also contributes significantly. Furthermore, the expansion of the food service industry and the increasing adoption of premium ingredients by food manufacturers are creating new avenues for market expansion.

Challenges in the South Africa Food Emulsifiers Market Market

The long-term growth of the South Africa food emulsifiers market hinges on addressing persistent challenges and capitalizing on emerging trends. While demand for processed foods is robust, manufacturers must navigate the increasing scrutiny and demand for healthier, "cleaner" ingredient lists. This necessitates a focus on naturally derived and minimally processed emulsifiers. Furthermore, economic fluctuations and currency volatility can impact the import costs of specialized emulsifier ingredients and raw materials, affecting affordability for some market segments. The need for continuous research and development to keep pace with evolving consumer preferences and regulatory changes also represents an ongoing investment requirement.

Emerging Opportunities in South Africa Food Emulsifiers Market

The South Africa food emulsifiers market is ripe with emerging opportunities. The rising demand for plant-based food alternatives presents a significant avenue for emulsifier suppliers offering solutions tailored for vegan and vegetarian products. Innovations in encapsulation technologies for emulsifiers can unlock new applications in functional foods and nutraceuticals, delivering enhanced bioavailability and targeted release. The growing focus on sustainable sourcing and production of food ingredients is also creating opportunities for manufacturers who can demonstrate eco-friendly practices. Furthermore, the untapped potential in smaller towns and rural areas, as economic development and food processing infrastructure expand, offers a promising frontier for market growth.

Leading Players in the South Africa Food Emulsifiers Market Sector

- Protea Chemicals

- Fourchem

- ChemSystems

- The Dow Chemical Company

- DuPont de Nemours Inc

- Palsgaard

- South Bakels Pty Ltd

Key Milestones in South Africa Food Emulsifiers Market Industry

- 2019: Increased investment in R&D for naturally derived emulsifiers by leading global ingredient suppliers.

- 2020: Growing consumer awareness around clean label trends, impacting demand for specific emulsifier types.

- 2021: Introduction of new enzyme-modified emulsifiers offering enhanced stability in baked goods.

- 2022: Strategic partnerships formed between local food manufacturers and international emulsifier suppliers to enhance product offerings.

- 2023: Increased focus on sustainable sourcing and production practices by key market players.

- 2024: Emerging interest in emulsifier applications within the plant-based food sector.

Strategic Outlook for South Africa Food Emulsifiers Market Market

The strategic outlook for the South Africa food emulsifiers market is exceptionally positive, driven by strong consumer demand for processed foods and ongoing innovation. Growth accelerators will include the continued expansion of the bakery, dairy, and confectionery sectors, coupled with the increasing adoption of emulsifiers in emerging food categories like plant-based alternatives. Companies that prioritize research and development to offer clean-label, high-performance, and sustainable emulsifier solutions will be best positioned for success. Strategic partnerships and collaborations with food manufacturers to co-develop customized solutions will further solidify market leadership and unlock untapped market potential in the coming years.

South Africa Food Emulsifiers Market Segmentation

-

1. Type

- 1.1. Lecithin

- 1.2. Monoglyceride, Diglyceride, and Derivatives

- 1.3. Sorbitan Ester

- 1.4. Polyglycerol Ester

- 1.5. Other Types

-

2. Application

- 2.1. Dairy

- 2.2. Bakery

- 2.3. Meat, Poltry, and Seafood

- 2.4. Beverage

- 2.5. Confectionery

- 2.6. Other Applications

South Africa Food Emulsifiers Market Segmentation By Geography

- 1. South Africa

South Africa Food Emulsifiers Market Regional Market Share

Geographic Coverage of South Africa Food Emulsifiers Market

South Africa Food Emulsifiers Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness of Functional Benefits of Carotenoids; Consumption of Health and Wellness Products

- 3.3. Market Restrains

- 3.3.1. High Processing Cost and Low Yield of Natural Food Colors

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Clean Label Ingredients

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Food Emulsifiers Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Lecithin

- 5.1.2. Monoglyceride, Diglyceride, and Derivatives

- 5.1.3. Sorbitan Ester

- 5.1.4. Polyglycerol Ester

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Dairy

- 5.2.2. Bakery

- 5.2.3. Meat, Poltry, and Seafood

- 5.2.4. Beverage

- 5.2.5. Confectionery

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. South Africa South Africa Food Emulsifiers Market Analysis, Insights and Forecast, 2020-2032

- 7. Sudan South Africa Food Emulsifiers Market Analysis, Insights and Forecast, 2020-2032

- 8. Uganda South Africa Food Emulsifiers Market Analysis, Insights and Forecast, 2020-2032

- 9. Tanzania South Africa Food Emulsifiers Market Analysis, Insights and Forecast, 2020-2032

- 10. Kenya South Africa Food Emulsifiers Market Analysis, Insights and Forecast, 2020-2032

- 11. Rest of Africa South Africa Food Emulsifiers Market Analysis, Insights and Forecast, 2020-2032

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Protea Chemicals*List Not Exhaustive

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Fourchem

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 ChemSystems

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 The Dow Chemical Company

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 DuPont de Nemours Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Palsgaard

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 South Bakels Pty Ltd

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.1 Protea Chemicals*List Not Exhaustive

List of Figures

- Figure 1: South Africa Food Emulsifiers Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South Africa Food Emulsifiers Market Share (%) by Company 2025

List of Tables

- Table 1: South Africa Food Emulsifiers Market Revenue Million Forecast, by Region 2020 & 2033

- Table 2: South Africa Food Emulsifiers Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: South Africa Food Emulsifiers Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: South Africa Food Emulsifiers Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: South Africa Food Emulsifiers Market Revenue Million Forecast, by Country 2020 & 2033

- Table 6: South Africa South Africa Food Emulsifiers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Sudan South Africa Food Emulsifiers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Uganda South Africa Food Emulsifiers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Tanzania South Africa Food Emulsifiers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Kenya South Africa Food Emulsifiers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of Africa South Africa Food Emulsifiers Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: South Africa Food Emulsifiers Market Revenue Million Forecast, by Type 2020 & 2033

- Table 13: South Africa Food Emulsifiers Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: South Africa Food Emulsifiers Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Food Emulsifiers Market?

The projected CAGR is approximately 3.60%.

2. Which companies are prominent players in the South Africa Food Emulsifiers Market?

Key companies in the market include Protea Chemicals*List Not Exhaustive, Fourchem, ChemSystems, The Dow Chemical Company, DuPont de Nemours Inc, Palsgaard, South Bakels Pty Ltd.

3. What are the main segments of the South Africa Food Emulsifiers Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness of Functional Benefits of Carotenoids; Consumption of Health and Wellness Products.

6. What are the notable trends driving market growth?

Increasing Demand for Clean Label Ingredients.

7. Are there any restraints impacting market growth?

High Processing Cost and Low Yield of Natural Food Colors.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Food Emulsifiers Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Food Emulsifiers Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Food Emulsifiers Market?

To stay informed about further developments, trends, and reports in the South Africa Food Emulsifiers Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence