Key Insights

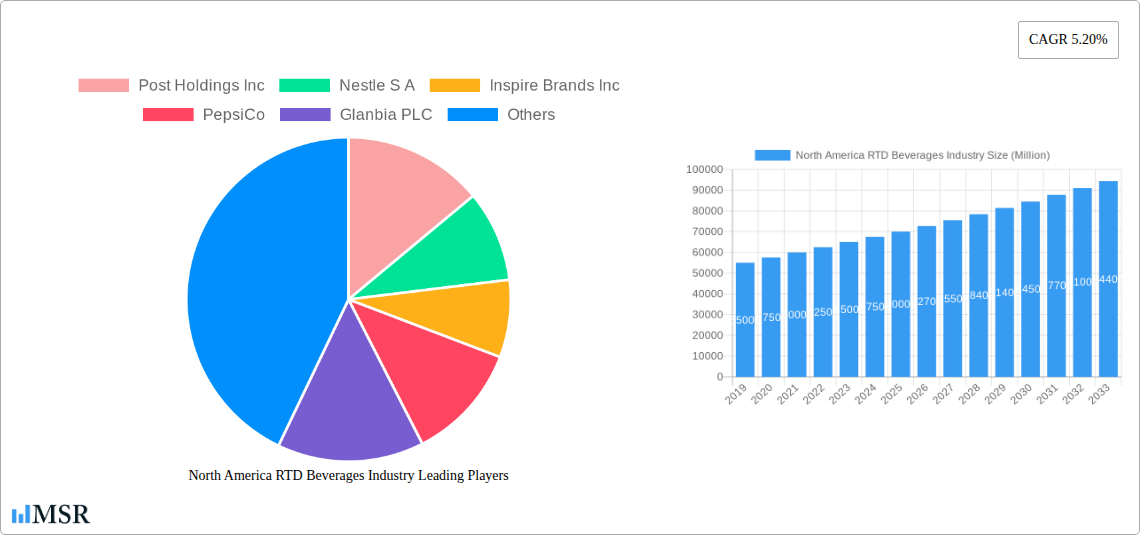

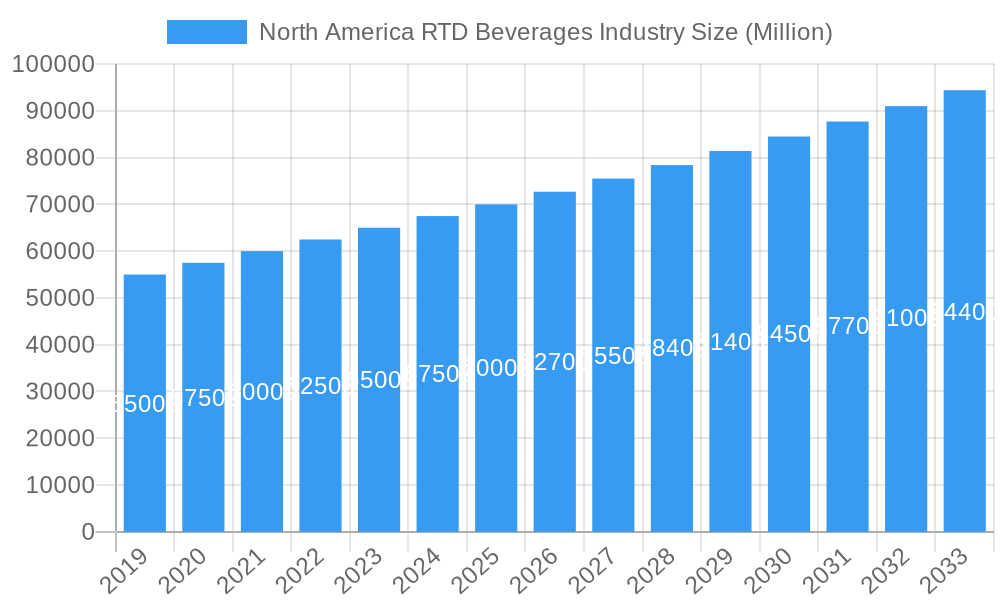

The North American Ready-to-Drink (RTD) beverage market is projected to reach approximately $8.9 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 2% through 2033. This growth is fueled by evolving consumer lifestyles, demand for convenience, and rising health consciousness. Key segments, including coffee, energy drinks, and juices, are experiencing significant demand for on-the-go refreshment and functional benefits. The expansion of online retail, alongside the continued strength of supermarkets and hypermarkets, enhances market accessibility. Leading companies are investing in innovation to capitalize on this dynamic market. The United States is the largest market, with Canada and Mexico also demonstrating strong growth potential.

North America RTD Beverages Industry Market Size (In Billion)

The North American RTD beverage sector is influenced by trends and challenges. The growing popularity of plant-based, low-sugar, and premium beverages is driving product innovation. Functional RTDs offering benefits such as enhanced energy and immune support are gaining consumer interest. However, rising ingredient costs and regulatory scrutiny around sugar content and health claims pose potential challenges. Despite these factors, the persistent trend towards convenience and mindful consumption, supported by strategic investments, indicates a continued positive outlook for the North American RTD beverage market. The market is expected to grow from an estimated $8.9 billion in 2025 to over $10 billion by 2033.

North America RTD Beverages Industry Company Market Share

Unveiling the North America RTD Beverages Industry: Market Dynamics, Growth Drivers, and Strategic Outlook (2019-2033)

This comprehensive report offers an in-depth analysis of the North America RTD Beverages Industry, providing critical insights into market concentration, growth trends, key segments, and strategic opportunities. Covering the study period from 2019 to 2033, with a base and estimated year of 2025, this report is an indispensable resource for industry stakeholders seeking to navigate this dynamic market. Discover market size projections reaching XX Million by 2033, CAGR estimations, and actionable intelligence on product innovations, challenges, and emerging trends.

North America RTD Beverages Industry Market Concentration & Dynamics

The North America RTD Beverages Industry exhibits a dynamic market concentration, with a blend of large multinational corporations and agile niche players vying for market share. Innovation ecosystems are rapidly evolving, driven by consumer demand for healthier, functional, and convenient beverage options. Regulatory frameworks continue to shape product development and marketing, with a growing emphasis on ingredient transparency and sustainable sourcing. Substitute products, including traditional brewed beverages and fresh juices, present a constant competitive pressure, necessitating continuous product differentiation and value proposition enhancement. End-user trends are overwhelmingly leaning towards on-the-go consumption, with a significant preference for RTD formats. Mergers and acquisitions (M&A) activities are expected to remain robust, with key players strategically acquiring innovative brands and technologies to expand their portfolios and market reach. The report quantifies M&A deal counts and analyzes market share shifts, providing a clear picture of the competitive landscape.

- Market Share Dominance: Analysis of leading players' market share provides insights into competitive positioning.

- M&A Activity: Tracking M&A deal counts and strategic rationale behind acquisitions.

- Innovation Ecosystems: Identifying key areas of product and packaging innovation.

- Regulatory Landscape: Examining the impact of current and future regulations.

- Substitute Product Analysis: Understanding the competitive threat from non-RTD alternatives.

- End-User Behavior Shifts: Quantifying the growing preference for RTD formats.

North America RTD Beverages Industry Industry Insights & Trends

The North America RTD Beverages Industry is poised for substantial growth, driven by an amalgamation of escalating consumer demand for convenience, a burgeoning health and wellness consciousness, and continuous product innovation. The market size is projected to reach XX Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. Technological disruptions are playing a pivotal role, from advanced processing techniques ensuring extended shelf life and nutrient retention to novel packaging solutions that enhance portability and sustainability. Evolving consumer behaviors, such as the increasing preference for plant-based options, lower sugar content, and functional ingredients like adaptogens and probiotics, are reshaping product development strategies. The shift towards online retail channels, driven by the convenience and wider selection offered, is another significant trend. Furthermore, the demand for unique flavor profiles and artisanal RTD beverages is on the rise, creating opportunities for smaller, specialized brands to capture niche markets. The report delves into these trends, providing quantitative data on market size and CAGR, and qualitative analysis of the underlying drivers.

- Market Size Projections: Detailed forecasts for the North American RTD beverages market up to 2033.

- CAGR Analysis: Robust estimation of the market's average annual growth rate.

- Key Growth Drivers: In-depth exploration of factors fueling market expansion.

- Technological Advancements: Analysis of innovations impacting production, packaging, and product formulation.

- Consumer Behavior Shifts: Understanding changing preferences in taste, health, and convenience.

- Evolving Retail Landscape: The impact of online and offline distribution channels.

Key Markets & Segments Leading North America RTD Beverages Industry

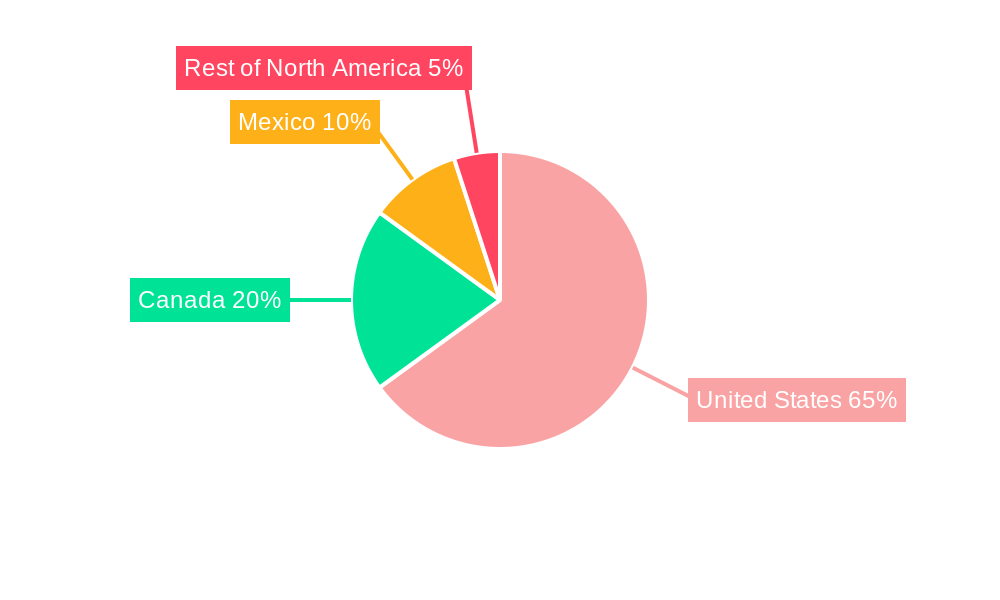

The United States stands as the dominant market within the North America RTD Beverages Industry, driven by a large, affluent consumer base with a high propensity for convenience-driven purchases and a strong appetite for novel beverage experiences. Within product types, Energy Drinks and Coffee segments are leading the charge, fueled by the on-the-go lifestyles of consumers and the growing demand for functional beverages that enhance performance and focus. The Supermarkets/Hypermarkets distribution channel continues to command the largest market share due to its extensive reach and diverse product offerings. However, Online Stores are experiencing rapid growth, reflecting the evolving shopping habits of consumers.

- Dominant Geography: United States

- Economic Growth: A strong economy underpins consumer spending on premium and convenience beverages.

- Urbanization: High population density in urban centers drives demand for RTD products.

- Consumer Sophistication: A discerning consumer base seeks variety, quality, and functional benefits.

- Leading Product Segments:

- Energy Drinks: Driven by demand for performance enhancement and combating fatigue.

- Driver: Busy lifestyles and academic/professional demands.

- Driver: Innovation in flavors and functional ingredients.

- Coffee: Capitalizing on the booming ready-to-drink coffee culture and demand for convenient caffeine solutions.

- Driver: Popularity of cold brew and specialty coffee variations.

- Driver: Growing acceptance of dairy and non-dairy alternatives.

- Energy Drinks: Driven by demand for performance enhancement and combating fatigue.

- Dominant Distribution Channel:

- Supermarkets/Hypermarkets: Unmatched reach and visibility for a wide array of RTD beverages.

- Driver: One-stop shopping convenience for households.

- Driver: Prominent shelf placement and promotional activities.

- Supermarkets/Hypermarkets: Unmatched reach and visibility for a wide array of RTD beverages.

- Emerging Segments & Channels:

- Online Stores: Experiencing significant growth due to convenience and personalization options.

- Driver: Direct-to-consumer (DTC) models and subscription services.

- Driver: Expanding product availability and competitive pricing.

- Fruit & Vegetable Juice: Growing interest in healthier beverage options with added nutritional benefits.

- Driver: Increased awareness of health and wellness trends.

- Driver: Demand for clean-label and natural ingredients.

- Online Stores: Experiencing significant growth due to convenience and personalization options.

North America RTD Beverages Industry Product Developments

Product innovation is a cornerstone of the North America RTD Beverages Industry, with a strong emphasis on health-conscious formulations and functional benefits. Companies are actively developing RTD beverages with reduced sugar, natural sweeteners, and added vitamins, minerals, and adaptogens. The market is witnessing a surge in plant-based RTD beverages, catering to a growing vegan and lactose-intolerant population. Advancements in packaging technology are also contributing to product differentiation, with a focus on sustainable materials and enhanced convenience features. The competitive edge is increasingly derived from unique flavor profiles, sophisticated branding, and the ability to tap into emerging consumer wellness trends.

Challenges in the North America RTD Beverages Industry Market

The North America RTD Beverages Industry faces several challenges, including intense competition, fluctuating raw material prices, and stringent regulatory requirements for product labeling and health claims. Supply chain disruptions, exacerbated by global events, can impact production and distribution efficiency. Furthermore, consumer perception regarding the health impact of certain RTD categories, particularly those high in sugar or artificial ingredients, poses a continuous hurdle.

- Intense Market Competition: High saturation in certain product categories.

- Raw Material Price Volatility: Fluctuations impacting cost of goods.

- Regulatory Compliance: Navigating evolving food and beverage regulations.

- Consumer Health Perceptions: Addressing concerns about sugar and artificial ingredients.

- Supply Chain Vulnerabilities: Managing risks in global logistics.

Forces Driving North America RTD Beverages Industry Growth

Several key forces are propelling the growth of the North America RTD Beverages Industry. The pervasive demand for convenience, driven by increasingly busy lifestyles, makes RTD beverages an attractive option for consumers seeking quick and easy refreshment. A growing awareness of health and wellness is spurring innovation in functional RTD beverages, incorporating ingredients like probiotics, vitamins, and natural energy boosters. The expansion of e-commerce and direct-to-consumer (DTC) channels is broadening accessibility and enhancing consumer reach.

- Consumer Demand for Convenience: On-the-go consumption driving preference for RTD formats.

- Health and Wellness Trends: Growing interest in functional ingredients and healthier formulations.

- E-commerce Expansion: Increased accessibility through online retail and DTC models.

- Product Innovation: Continuous introduction of new flavors and product categories.

- Demographic Shifts: Growing millennial and Gen Z populations with RTD preferences.

Challenges in the North America RTD Beverages Industry Market

Long-term growth in the North America RTD Beverages Industry will be sustained by continuous innovation, strategic partnerships, and market expansions. The industry's ability to adapt to evolving consumer preferences for sustainability and ethical sourcing will be crucial. Further development of functional RTD beverages targeting specific health benefits, such as immune support or cognitive enhancement, presents significant growth potential. Collaborative efforts between beverage manufacturers and technology providers can unlock new production efficiencies and packaging solutions, driving both cost savings and enhanced consumer appeal.

Emerging Opportunities in North America RTD Beverages Industry

Emerging opportunities within the North America RTD Beverages Industry lie in the expansion of plant-based and sustainable product lines, catering to environmentally conscious consumers. The growing demand for personalized nutrition opens avenues for RTD beverages tailored to specific dietary needs and health goals. Technological advancements in fermentation and ingredient encapsulation can lead to novel functional RTD offerings with improved bioavailability. Furthermore, exploring untapped demographic segments and geographical sub-regions within North America can unlock new growth avenues.

- Plant-Based & Sustainable Products: Catering to growing consumer demand for ethical and eco-friendly options.

- Personalized Nutrition RTDs: Developing beverages for specific dietary and health requirements.

- Functional Ingredient Innovations: Leveraging new technologies for enhanced health benefits.

- Untapped Niche Markets: Identifying and serving specific consumer groups and preferences.

- Emerging Flavor Profiles: Experimenting with unique and international taste sensations.

Leading Players in the North America RTD Beverages Industry Sector

- Post Holdings Inc

- Nestle S A

- Inspire Brands Inc

- PepsiCo

- Glanbia PLC

- Danone SA

- Keurig Dr Pepper

- The Coca-Cola Company

- Starbucks

- Kraft foods group

Key Milestones in North America RTD Beverages Industry Industry

- May 2022: Sunshine Beverage Company expanded its sparkling energy drink range with a new tropical pineapple flavor in the U.S.

- May 2022: FinLav S.p.A's subsidiary Lavazza launched a new range of ready-to-drink coffee in the U.S. market, available in four flavors and both dairy and non-dairy options, at select Lavazza cafés, Eataly, Amazon, and other key retailers.

- June 2022: Danone SA, under its Activia brand, introduced a drinkable yogurt in various flavors designed to promote improved immunity and gut health.

Strategic Outlook for North America RTD Beverages Industry Market

The strategic outlook for the North America RTD Beverages Industry remains exceptionally promising, driven by a confluence of sustained consumer demand for convenience, an escalating focus on health and wellness, and continuous product innovation. Future growth accelerators will likely stem from the deep integration of functional ingredients, the development of more sustainable packaging solutions, and the strategic expansion into underserved consumer segments. Companies that prioritize agility in product development, invest in robust supply chains, and leverage data analytics to understand evolving consumer preferences will be best positioned for long-term success and market leadership in this dynamic sector.

North America RTD Beverages Industry Segmentation

-

1. Product Type

- 1.1. Tea

- 1.2. Coffee

- 1.3. Energy Drinks

- 1.4. Fruit & Vegetable Juice

- 1.5. Dairy-based Beverages

- 1.6. Others

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Online Stores

- 2.4. Others

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America RTD Beverages Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America RTD Beverages Industry Regional Market Share

Geographic Coverage of North America RTD Beverages Industry

North America RTD Beverages Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for specialty and organic coffee pods and capsules; Innovations in packaging formats

- 3.3. Market Restrains

- 3.3.1. Availability of counterfeit products

- 3.4. Market Trends

- 3.4.1. Growing Preference for Plant-based and Clean-label RTD Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America RTD Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Tea

- 5.1.2. Coffee

- 5.1.3. Energy Drinks

- 5.1.4. Fruit & Vegetable Juice

- 5.1.5. Dairy-based Beverages

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Stores

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America RTD Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Tea

- 6.1.2. Coffee

- 6.1.3. Energy Drinks

- 6.1.4. Fruit & Vegetable Juice

- 6.1.5. Dairy-based Beverages

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Online Stores

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America RTD Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Tea

- 7.1.2. Coffee

- 7.1.3. Energy Drinks

- 7.1.4. Fruit & Vegetable Juice

- 7.1.5. Dairy-based Beverages

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Online Stores

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico North America RTD Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Tea

- 8.1.2. Coffee

- 8.1.3. Energy Drinks

- 8.1.4. Fruit & Vegetable Juice

- 8.1.5. Dairy-based Beverages

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Online Stores

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of North America North America RTD Beverages Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Tea

- 9.1.2. Coffee

- 9.1.3. Energy Drinks

- 9.1.4. Fruit & Vegetable Juice

- 9.1.5. Dairy-based Beverages

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Online Stores

- 9.2.4. Others

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Post Holdings Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Nestle S A

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Inspire Brands Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 PepsiCo

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Glanbia PLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Danone SA

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Keurig Dr Pepper*List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 The Coca-Cola Company

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Starbucks

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Kraft foods group

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Post Holdings Inc

List of Figures

- Figure 1: North America RTD Beverages Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America RTD Beverages Industry Share (%) by Company 2025

List of Tables

- Table 1: North America RTD Beverages Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: North America RTD Beverages Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: North America RTD Beverages Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: North America RTD Beverages Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: North America RTD Beverages Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: North America RTD Beverages Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: North America RTD Beverages Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: North America RTD Beverages Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: North America RTD Beverages Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: North America RTD Beverages Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: North America RTD Beverages Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: North America RTD Beverages Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: North America RTD Beverages Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: North America RTD Beverages Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: North America RTD Beverages Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: North America RTD Beverages Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: North America RTD Beverages Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: North America RTD Beverages Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 19: North America RTD Beverages Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: North America RTD Beverages Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America RTD Beverages Industry?

The projected CAGR is approximately 2%.

2. Which companies are prominent players in the North America RTD Beverages Industry?

Key companies in the market include Post Holdings Inc, Nestle S A, Inspire Brands Inc, PepsiCo, Glanbia PLC, Danone SA, Keurig Dr Pepper*List Not Exhaustive, The Coca-Cola Company, Starbucks, Kraft foods group.

3. What are the main segments of the North America RTD Beverages Industry?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.9 billion as of 2022.

5. What are some drivers contributing to market growth?

Demand for specialty and organic coffee pods and capsules; Innovations in packaging formats.

6. What are the notable trends driving market growth?

Growing Preference for Plant-based and Clean-label RTD Products.

7. Are there any restraints impacting market growth?

Availability of counterfeit products.

8. Can you provide examples of recent developments in the market?

In May 2022, Sunshine beverage company announced the expansion of their sparkling energy drink product range by launching the latest sparkling drink with tropical pineapple in the U.S.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America RTD Beverages Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America RTD Beverages Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America RTD Beverages Industry?

To stay informed about further developments, trends, and reports in the North America RTD Beverages Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence