Key Insights

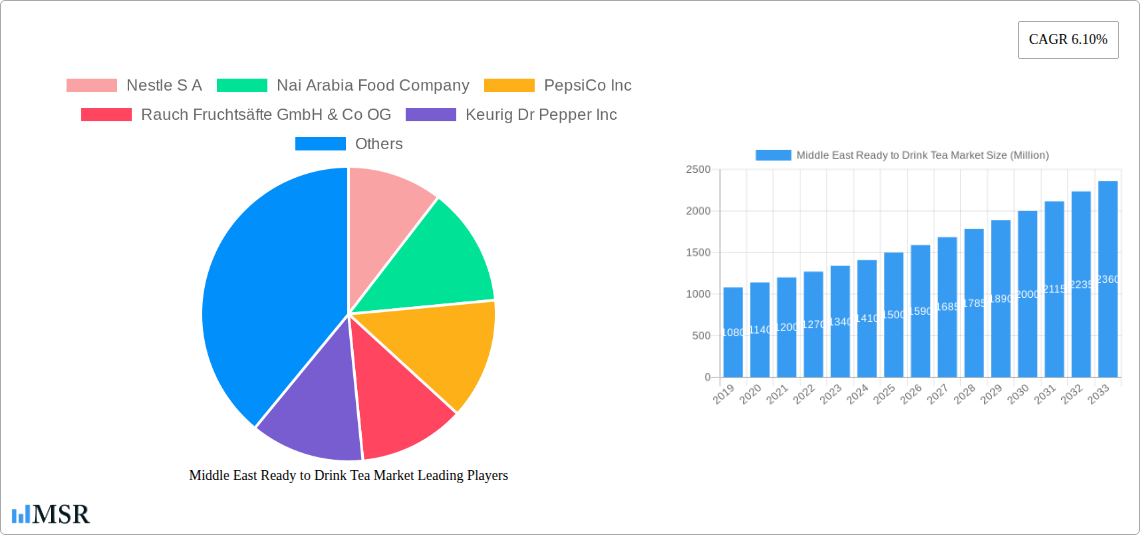

The Middle East Ready-to-Drink (RTD) Tea Market is poised for significant expansion, projected to reach a substantial market size of approximately $1,500 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.10% anticipated to continue through 2033. This upward trajectory is primarily fueled by evolving consumer preferences towards healthier beverage options, an increasing demand for convenient and ready-to-consume products, and the growing disposable incomes across key Middle Eastern nations. Consumers are increasingly seeking alternatives to traditional carbonated soft drinks, and RTD tea, with its perceived health benefits and diverse flavor profiles, is perfectly positioned to capitalize on this shift. The market's growth is further bolstered by aggressive marketing strategies from leading players, expanding distribution networks, and the introduction of innovative product formulations catering to local tastes and dietary preferences.

Middle East Ready to Drink Tea Market Market Size (In Billion)

The market segmentation reveals a dynamic landscape. Green Tea and Herbal Tea are emerging as dominant categories, driven by their association with wellness and natural ingredients. Iced Tea also holds a significant share due to its refreshing appeal, particularly in the region's warmer climate. In terms of packaging, PET Bottles and Aseptic packages are leading the charge, offering convenience and extended shelf life, aligning with the busy lifestyles of modern consumers. Distribution channels are witnessing a strong push towards Off-trade, with Online Retail and Supermarkets/Hypermarkets experiencing accelerated growth, reflecting the increasing digitalization of commerce and the preference for one-stop shopping. Key players like Nestle S.A., PepsiCo Inc., and The Coca-Cola Company are heavily investing in product innovation and market penetration, ensuring a competitive yet expanding market. While the market enjoys strong growth drivers, potential restraints could include fluctuating raw material prices, stringent regulatory landscapes for food and beverages, and intense competition among established and emerging brands.

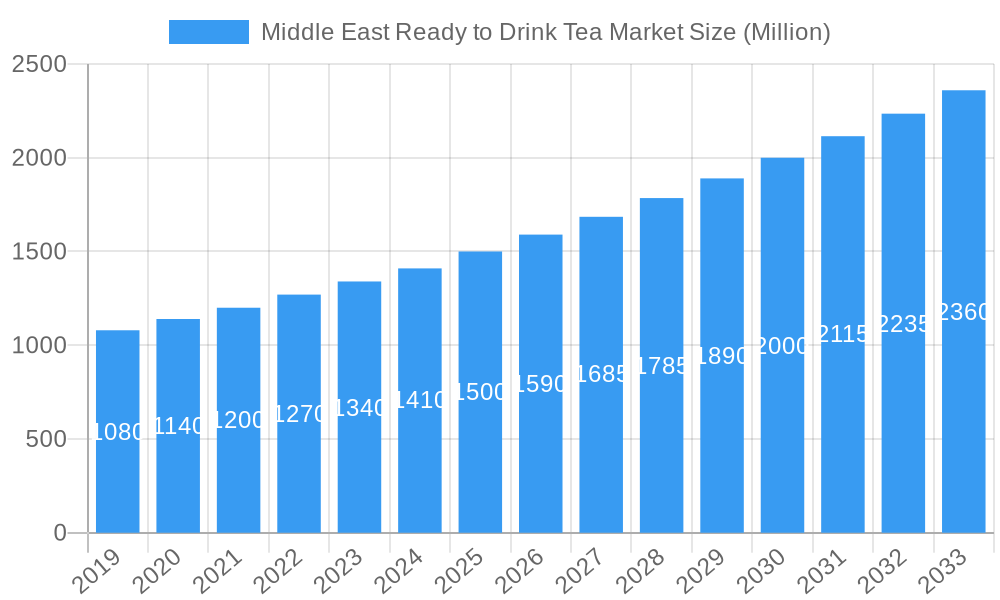

Middle East Ready to Drink Tea Market Company Market Share

This comprehensive report delves into the dynamic Middle East Ready to Drink (RTD) Tea market, offering deep insights into its growth trajectory, segmentation, key players, and future potential. Covering the period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025–2033, this report is an indispensable resource for industry stakeholders seeking to understand market concentration, innovation, consumer trends, and strategic opportunities within this rapidly evolving sector. We meticulously analyze market dynamics, explore leading segments, identify growth drivers and challenges, and spotlight key industry developments and emerging trends. The report's detailed analysis will equip businesses with actionable intelligence to navigate the competitive landscape and capitalize on lucrative opportunities in the Middle East RTD Tea market.

Middle East Ready to Drink Tea Market Market Concentration & Dynamics

The Middle East Ready to Drink (RTD) Tea market exhibits a moderate to high level of concentration, with a few major global players and several regional strongholds dominating significant market share. Nestle S.A., PepsiCo Inc., and The Coca-Cola Company are prominent multinational corporations with extensive product portfolios and robust distribution networks, contributing significantly to market share. Regional players like Nai Arabia Food Company and Barakat Group of Companies are also carving out substantial niches, driven by localized consumer preferences and agile market responsiveness. The innovation ecosystem is characterized by a growing emphasis on healthier formulations, natural ingredients, and unique flavor profiles to cater to an increasingly health-conscious consumer base. Regulatory frameworks are generally supportive, though local food and beverage standards and import regulations require careful adherence. Substitute products, primarily carbonated soft drinks and juices, present ongoing competition, necessitating continuous product differentiation and marketing efforts. End-user trends reveal a strong preference for convenience, with RTD teas aligning well with on-the-go lifestyles. Mergers and acquisitions (M&A) activities, such as Fine Hygienic Holding's investment in Nai Arabia valued at over USD 10 million in October 2019, underscore the strategic importance of consolidation and market access. M&A deal counts are expected to see a steady, albeit selective, increase as companies seek to expand their product offerings and geographical reach.

Middle East Ready to Drink Tea Market Industry Insights & Trends

The Middle East Ready to Drink (RTD) Tea market is poised for significant expansion, driven by a confluence of factors including a growing young population, increasing disposable incomes, and a rising awareness of health and wellness benefits associated with tea consumption. Market size in 2025 is estimated at over USD 1,500 Million, with a projected Compound Annual Growth Rate (CAGR) of approximately 6.5% from 2025 to 2033. Technological disruptions are evident in advanced processing and packaging techniques that enhance shelf life and maintain product quality. Innovations in ingredient sourcing, such as the incorporation of functional herbs and botanicals, are catering to evolving consumer demands for beverages that offer more than just hydration. Evolving consumer behaviors are central to market growth; a shift away from traditional sugary beverages towards healthier alternatives like RTD teas is a key trend. Consumers are increasingly seeking transparency in ingredients, demanding natural flavors, reduced sugar content, and functional benefits. The convenience factor of RTD formats perfectly aligns with the fast-paced lifestyles prevalent across the region. Furthermore, the growing influence of social media and online retail channels is shaping purchasing decisions and providing new avenues for brand engagement and product discovery. The market is witnessing a surge in demand for diverse flavor profiles, moving beyond traditional black tea to embrace green tea, herbal infusions, and innovative fruit-flavored blends. The perceived health benefits, such as antioxidant properties and stress-relief capabilities, are further augmenting the appeal of RTD teas.

Key Markets & Segments Leading Middle East Ready to Drink Tea Market

The United Arab Emirates (UAE) and Saudi Arabia are currently the leading markets within the Middle East RTD Tea sector, driven by their large, diverse populations, high disposable incomes, and well-developed retail infrastructures. Economic growth and significant investments in tourism and hospitality further bolster demand in these countries.

Soft Drink Type Dominance:

- Green Tea holds a substantial market share, appealing to health-conscious consumers seeking its perceived metabolic and antioxidant benefits.

- Herbal Tea is experiencing robust growth, driven by consumer interest in wellness, natural remedies, and caffeine-free options. Flavors like mint, chamomile, and ginger are particularly popular.

- Iced Tea remains a strong contender, especially in warmer climates, offering a refreshing and convenient beverage choice.

- Other RTD Tea segments, including functional teas with added vitamins or probiotics, are emerging as niche but rapidly growing categories.

Packaging Type Trends:

- PET Bottles dominate due to their convenience, portability, and cost-effectiveness, making them ideal for on-the-go consumption.

- Aseptic packages are gaining traction for their shelf-stability and eco-friendliness, catering to both large-scale distribution and consumer preference for sustainable options.

- Metal Cans are popular for their perceived premium quality and rapid cooling, often associated with iced tea and energy-boosting variants.

- Glass Bottles cater to a premium segment, often associated with artisanal or specialty RTD teas.

Distribution Channel Dynamics:

- Off-trade channels are paramount, with Supermarkets/Hypermarkets being the primary point of sale for a broad range of RTD teas.

- Convenience Stores are crucial for impulse purchases and on-the-go consumption.

- Online Retail is experiencing exponential growth, fueled by the convenience of e-commerce and the ability of brands to reach a wider audience.

- On-trade channels, including cafes and restaurants, contribute to trial and brand visibility, though their overall contribution to volume is generally lower than off-trade.

Middle East Ready to Drink Tea Market Product Developments

Product innovation in the Middle East RTD Tea market is intensely focused on health and wellness. Companies are launching RTD teas with reduced sugar content, natural sweeteners, and functional ingredients like antioxidants, vitamins, and herbal extracts. Examples include the introduction of Yerba Mate by Honest Tea (a subsidiary of The Coca-Cola Company) in Saudi Arabia in April 2021, offering a caffeinated option with a specific calorie and sugar profile. Furthermore, the development of energy-boosting RTD teas, such as PepsiCo's "Rockstar Focus™" unveiled in February 2024 and available in Saudi Arabia, UAE, and Qatar, highlights a trend towards beverages that offer mental clarity and energy, incorporating ingredients like Lion's Mane. These developments reflect a strategic effort to capture a broader consumer base by aligning product offerings with evolving lifestyle needs and health perceptions.

Challenges in the Middle East Ready to Drink Tea Market Market

Despite robust growth, the Middle East RTD Tea market faces several challenges. Intense competition from established beverage giants and an increasing number of new entrants necessitates continuous innovation and aggressive marketing. Fluctuations in raw material costs, particularly for tea leaves and packaging materials, can impact profit margins. Stringent regulatory requirements related to food safety, labeling, and ingredient standards across different GCC countries add complexity to market entry and product formulation. Consumer perception and brand loyalty shifts also pose a challenge, as consumers are increasingly discerning and influenced by health claims and marketing. Supply chain disruptions, though less frequent, can impact product availability.

Forces Driving Middle East Ready to Drink Tea Market Growth

Several key forces are propelling the growth of the Middle East RTD Tea market. A significant driver is the growing health and wellness trend, leading consumers to seek healthier alternatives to traditional sugary drinks. The increasing disposable income and a young demographic across the region foster higher consumption of convenience beverages. Product innovation, focusing on diverse flavors, natural ingredients, and functional benefits, caters to evolving consumer preferences. The expansion of distribution channels, particularly the burgeoning online retail sector, enhances accessibility. Government initiatives promoting healthy lifestyles and the growing tourism sector also contribute positively to market expansion.

Challenges in the Middle East Ready to Drink Tea Market Market

Long-term growth catalysts for the Middle East RTD Tea market are rooted in sustained innovation and strategic market penetration. The increasing demand for premium and functional RTD teas presents an opportunity for companies to develop specialized product lines catering to specific health benefits or unique flavor experiences. Expansion into emerging markets within the broader Middle East and North Africa (MENA) region offers untapped potential. Partnerships and collaborations with local distributors and retailers can strengthen market presence. Furthermore, investments in sustainable packaging and production methods will resonate with an environmentally conscious consumer base and align with regional sustainability goals, ensuring long-term market viability and appeal.

Emerging Opportunities in Middle East Ready to Drink Tea Market

Emerging opportunities in the Middle East RTD Tea market are abundant and varied. The growth of the functional beverage segment, incorporating ingredients like probiotics, adaptogens, and nootropics, presents a significant avenue for innovation. Plant-based and vegan RTD tea options are gaining traction as consumer awareness of ethical consumption rises. Personalized nutrition and customized RTD tea formulations tailored to individual dietary needs and preferences represent a future frontier. The increasing penetration of e-commerce and direct-to-consumer (DTC) models offers new avenues for market reach and customer engagement. Furthermore, exploring niche tea varieties and regional flavors can attract discerning consumers and create unique market differentiators.

Leading Players in the Middle East Ready to Drink Tea Market Sector

- Nestle S.A.

- Nai Arabia Food Company

- PepsiCo Inc.

- Rauch Fruchtsäfte GmbH & Co OG

- Keurig Dr Pepper Inc.

- Barakat Group of Companies

- The Coca-Cola Company

- The Savola Group

- Sapporo Holdings Limited

Key Milestones in Middle East Ready to Drink Tea Market Industry

- February 2024: Rockstar® Energy Drink, a subsidiary of PepsiCo, Inc, unveiled “Rockstar Focus™,” a new line of energy drinks delivering energy and mental boost made with innovative ingredients like Lion’s Mane. These products are available in retail channels in Saudi Arabia, UAE, and Qatar.

- April 2021: Honest Tea, a subsidiary of The Coca-Cola Company, expanded its bottled beverage portfolio with the launch of Honest Yerba Mate in the Saudi Arabian market.

- October 2019: Fine Hygienic Holding became the largest single shareholder with a 30% stake in Dubai's natural food and beverage company Nai Arabia in a deal valued at over USD 10 million.

Strategic Outlook for Middle East Ready to Drink Tea Market Market

The strategic outlook for the Middle East Ready to Drink (RTD) Tea market is exceptionally promising, fueled by a sustained shift towards healthier beverage choices and the region's dynamic consumer landscape. Key growth accelerators include intensified product innovation focused on functional ingredients and diverse flavor profiles, catering to evolving wellness trends. Expanding distribution networks, with a particular emphasis on e-commerce and modern retail formats, will be critical for enhancing accessibility. Strategic partnerships and targeted marketing campaigns aimed at young, urban populations will drive brand engagement and market penetration. Furthermore, companies that prioritize sustainable practices and transparent ingredient sourcing will likely gain a competitive edge and foster long-term consumer loyalty. The market's potential for continued growth is substantial, driven by increasing disposable incomes and a growing appreciation for convenient, high-quality beverage options.

Middle East Ready to Drink Tea Market Segmentation

-

1. Soft Drink Type

- 1.1. Green Tea

- 1.2. Herbal Tea

- 1.3. Iced Tea

- 1.4. Other RTD Tea

-

2. Packaging Type

- 2.1. Aseptic packages

- 2.2. Glass Bottles

- 2.3. Metal Can

- 2.4. PET Bottles

-

3. Distribution Channel

-

3.1. Off-trade

- 3.1.1. Convenience Stores

- 3.1.2. Online Retail

- 3.1.3. Supermarket/Hypermarket

- 3.1.4. Others

- 3.2. On-trade

-

3.1. Off-trade

Middle East Ready to Drink Tea Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Ready to Drink Tea Market Regional Market Share

Geographic Coverage of Middle East Ready to Drink Tea Market

Middle East Ready to Drink Tea Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin

- 3.3. Market Restrains

- 3.3.1. Low Stability of Riboflavin on Exposure to Light and Heat

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Ready to Drink Tea Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 5.1.1. Green Tea

- 5.1.2. Herbal Tea

- 5.1.3. Iced Tea

- 5.1.4. Other RTD Tea

- 5.2. Market Analysis, Insights and Forecast - by Packaging Type

- 5.2.1. Aseptic packages

- 5.2.2. Glass Bottles

- 5.2.3. Metal Can

- 5.2.4. PET Bottles

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Off-trade

- 5.3.1.1. Convenience Stores

- 5.3.1.2. Online Retail

- 5.3.1.3. Supermarket/Hypermarket

- 5.3.1.4. Others

- 5.3.2. On-trade

- 5.3.1. Off-trade

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nestle S A

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nai Arabia Food Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PepsiCo Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Rauch Fruchtsäfte GmbH & Co OG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Keurig Dr Pepper Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Barakat Group of Companies

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 The Coca-Cola Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 The Savola Grou

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sapporo Holdings Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Nestle S A

List of Figures

- Figure 1: Middle East Ready to Drink Tea Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East Ready to Drink Tea Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East Ready to Drink Tea Market Revenue Million Forecast, by Soft Drink Type 2020 & 2033

- Table 2: Middle East Ready to Drink Tea Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 3: Middle East Ready to Drink Tea Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Middle East Ready to Drink Tea Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Middle East Ready to Drink Tea Market Revenue Million Forecast, by Soft Drink Type 2020 & 2033

- Table 6: Middle East Ready to Drink Tea Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 7: Middle East Ready to Drink Tea Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Middle East Ready to Drink Tea Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Saudi Arabia Middle East Ready to Drink Tea Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United Arab Emirates Middle East Ready to Drink Tea Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Israel Middle East Ready to Drink Tea Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Qatar Middle East Ready to Drink Tea Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Kuwait Middle East Ready to Drink Tea Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Oman Middle East Ready to Drink Tea Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Bahrain Middle East Ready to Drink Tea Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Jordan Middle East Ready to Drink Tea Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Lebanon Middle East Ready to Drink Tea Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Ready to Drink Tea Market?

The projected CAGR is approximately 6.10%.

2. Which companies are prominent players in the Middle East Ready to Drink Tea Market?

Key companies in the market include Nestle S A, Nai Arabia Food Company, PepsiCo Inc, Rauch Fruchtsäfte GmbH & Co OG, Keurig Dr Pepper Inc, Barakat Group of Companies, The Coca-Cola Company, The Savola Grou, Sapporo Holdings Limited.

3. What are the main segments of the Middle East Ready to Drink Tea Market?

The market segments include Soft Drink Type, Packaging Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Low Stability of Riboflavin on Exposure to Light and Heat.

8. Can you provide examples of recent developments in the market?

February 2024: Rockstar® Energy Drink, a subsidiary of PepsiCo, Inc unveiled “Rockstar Focus™,” a new line of energy drinks delivering energy & mental boost made with innovative ingredients like Lion’s Mane, a mushroom used in traditional eastern cultures, and providing 200 mg of caffeine. These products are avilable in retail channels in Saudi Arabia, UAE and Qatar.April 2021: Honest Tea, a subsidiary of The Coca-Cola Company, has expanded its bottled beverage portfolio with the launch of Honest Yerba Mate in the Saudi Arabian market. The new caffeinated ready-to-drink (RTD) contains 13g of sugar and 60 calories per 16oz can.October 2019: Fine Hygienic Holding, a paper products manufacturer, became the largest single shareholder with 30% stake in Dubai's natural food and beverage company Nai Arabia in a deal valued at over USD 10 million.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Ready to Drink Tea Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Ready to Drink Tea Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Ready to Drink Tea Market?

To stay informed about further developments, trends, and reports in the Middle East Ready to Drink Tea Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence