Key Insights

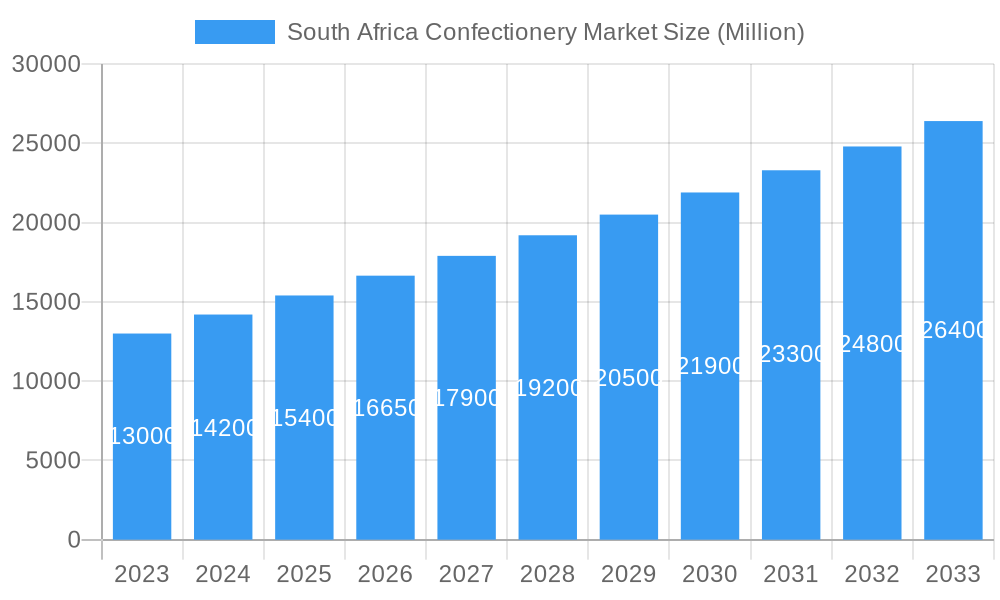

The South African confectionery market is projected for significant growth, with an estimated market size of 5.09 billion in 2025, expected to expand at a Compound Annual Growth Rate (CAGR) of 6.96% through 2033. Key growth drivers include a rising middle class with increased disposable income, strong impulse purchase behavior, and a growing demand for premium and artisanal confectionery. The increasing preference for dark chocolate aligns with evolving health consciousness. The expansion of online retail and the convenience of small-format stores are enhancing market accessibility. Continuous product innovation, including novel flavors, textures, and healthier options, is further stimulating market dynamics.

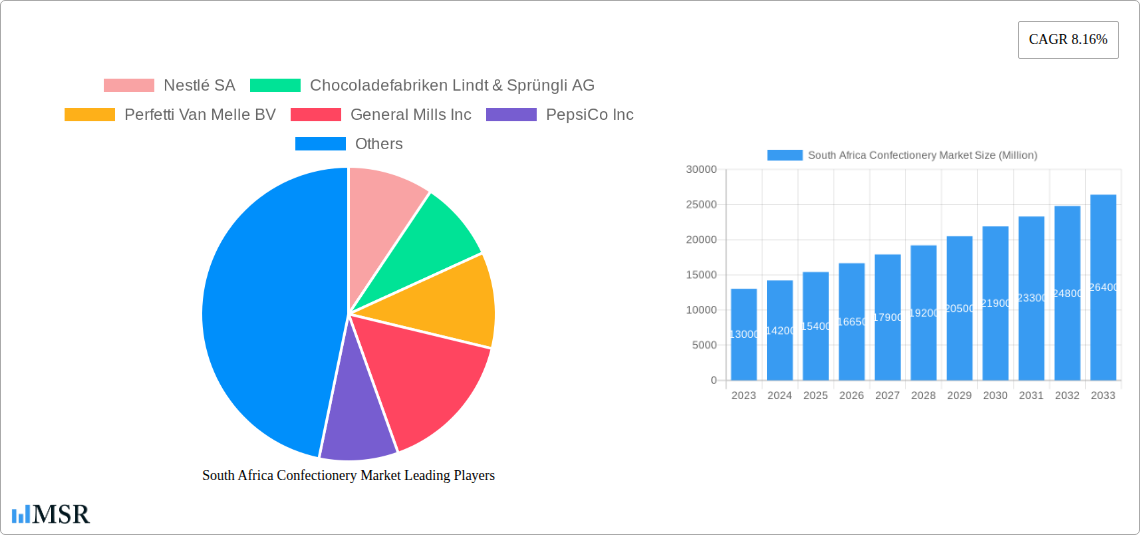

South Africa Confectionery Market Market Size (In Billion)

Challenges include economic volatility and escalating raw material costs impacting profitability. Intense competition from domestic and international players requires ongoing product development and strategic marketing. However, the confectionery sector's resilience as an affordable indulgence suggests these challenges are surmountable. Market segmentation highlights strong performance in Confections, particularly Chocolate, Sugar Confectionery, and Snack Bars. Convenience stores and supermarkets are anticipated to remain primary distribution channels, alongside the notable growth of e-commerce. Major market participants such as Nestlé SA, Mondelēz International Inc., and The Hershey Company are actively influencing market trends through innovation and strategic investments.

South Africa Confectionery Market Company Market Share

South Africa Confectionery Market: In-Depth Analysis & Forecast 2019-2033

Unlock actionable insights into the dynamic South African confectionery market with this comprehensive report. Analyzing the period from 2019 to 2033, with a detailed focus on the base year 2025 and the forecast period 2025-2033, this report provides critical data and strategic guidance for industry stakeholders. Explore market size, growth drivers, segment dominance, product innovations, challenges, and opportunities within the rapidly evolving South African confectionery industry. Discover key trends in chocolate, gums, snack bars, and sugar confectionery, understand consumer behavior shifts, and identify lucrative distribution channels like online retail stores and supermarkets/hypermarkets. Featuring in-depth analysis of major players including Nestlé SA, Mars Incorporated, Mondelēz International Inc., and The Hershey Company, this report is an essential tool for confectionery manufacturers, distributors, and investors seeking to capitalize on growth in this vibrant market.

South Africa Confectionery Market Market Concentration & Dynamics

The South African confectionery market exhibits a moderate to high level of concentration, with a few major global and local players dominating market share. Companies such as Nestlé SA, Mars Incorporated, Mondelēz International Inc., and Tiger Brands hold significant sway, influencing innovation and pricing strategies. The innovation ecosystem is characterized by a focus on premiumization, health-conscious options, and indulgence. Regulatory frameworks, particularly concerning food safety and labeling, play a crucial role in shaping market entry and product development. Substitute products, including savory snacks and healthier alternatives, present a growing challenge. End-user trends indicate a rising demand for convenient, on-the-go treats, as well as a growing preference for ethically sourced and sustainable confectionery. Mergers and acquisitions (M&A) activities, though not always widely publicized, are strategic moves to consolidate market presence, acquire new technologies, or expand product portfolios. M&A deal counts in this sector, while fluctuating, signal a continuous effort by key players to strengthen their competitive positions. Analyzing these dynamics is crucial for understanding market evolution and identifying strategic growth avenues.

South Africa Confectionery Market Industry Insights & Trends

The South African confectionery market is experiencing robust growth, driven by a confluence of economic factors, evolving consumer preferences, and technological advancements. The projected market size for the base year 2025 is estimated to be approximately RXX Billion, with a Compound Annual Growth Rate (CAGR) of around X.X% expected during the forecast period 2025–2033. Key growth drivers include the expanding middle class, increasing disposable incomes, and a youthful demographic with a high propensity for impulse purchases of confectionery. Technological disruptions are primarily seen in advanced manufacturing processes, leading to greater efficiency and novel product formulations. Evolving consumer behaviors are a significant trend, with a growing demand for healthier options, including sugar-free, low-calorie, and plant-based confectionery. Consumers are also increasingly seeking unique flavor experiences and premium products that offer a sense of indulgence. The rise of online retail channels has further broadened accessibility and introduced new avenues for direct-to-consumer sales, while traditional channels like supermarkets and convenience stores continue to hold substantial market share. The increasing awareness around health and wellness is also prompting manufacturers to innovate with functional confectionery, incorporating ingredients like probiotics and vitamins.

Key Markets & Segments Leading South Africa Confectionery Market

The South African confectionery market is broadly segmented across various confection types and distribution channels, each contributing significantly to overall market value.

Dominant Confectionery Segments:

- Chocolate: This remains a cornerstone of the confectionery market, driven by consistent demand for dark, milk, and white chocolate variants.

- Dark Chocolate: Growing consumer interest in health benefits associated with dark chocolate, coupled with its richer flavor profile, fuels its demand.

- Milk Chocolate: Continues to be the most popular due to its creamy texture and widely appealing taste, favored by all age groups.

- White Chocolate: Holds a niche but growing segment, often used in premium and artisanal products.

- Sugar Confectionery: This broad category encompasses a wide array of products, offering diverse taste experiences and price points.

- Gummies and Jellies: Highly popular among children and young adults, offering a chewy and fruity indulgence.

- Hard Candy and Lollipops: Classic, affordable treats that remain consistent sellers, especially in impulse purchase scenarios.

- Mints and Pastilles: Cater to the adult demographic seeking breath freshening and subtle sweetness.

- Toffees and Nougats: Offer a richer, chewier texture appealing to a broader age range.

- Snack Bars: A rapidly growing segment, driven by health-conscious consumers and the demand for convenient meal replacements or energy boosters.

- Protein Bars: Experiencing significant growth due to the fitness and wellness trend, offering satiety and muscle-building benefits.

- Cereal Bars and Fruit & Nut Bars: Positioned as healthier, on-the-go options, appealing to busy lifestyles.

Leading Distribution Channels:

- Supermarket/Hypermarket: This remains the primary distribution channel, benefiting from high foot traffic, product variety, and competitive pricing. Economic growth and increasing urbanization contribute to the dominance of this channel.

- Convenience Store: Crucial for impulse purchases and immediate gratification, convenience stores play a vital role in reaching consumers in urban and peri-urban areas. The proliferation of these stores enhances accessibility.

- Online Retail Store: Experiencing substantial growth, online platforms offer convenience, wider product selection, and personalized offers, catering to the tech-savvy consumer base. The increasing internet penetration and e-commerce infrastructure support this trend.

The dominance of these segments is propelled by factors such as sustained economic growth, improving infrastructure that facilitates distribution, and the ability of manufacturers to adapt to evolving consumer palates and dietary preferences. The sheer variety and accessibility of chocolate and sugar confectionery, coupled with the rising popularity of health-oriented snack bars, ensures continued market leadership.

South Africa Confectionery Market Product Developments

Product innovation in the South African confectionery market is a key driver of growth and competitiveness. Recent developments showcase a strong focus on catering to evolving consumer demands for healthier, plant-based, and indulgence-driven options. For instance, the launch of vegan chocolate ranges by global players demonstrates a strategic move to capture a growing ethical consumer base. Similarly, the introduction of special edition flavors and limited-edition bars by major manufacturers like Mondelēz International Inc. and The Hershey Company highlights the industry's emphasis on novelty and exciting taste experiences. The introduction of protein-enriched bars with appealing flavor profiles, such as peanut butter and jelly, signifies the convergence of confectionery and functional food trends, appealing to health-conscious individuals seeking both taste and nutritional benefits. These product developments are crucial for maintaining market relevance, attracting new consumers, and staying ahead of competitors by offering unique value propositions.

Challenges in the South Africa Confectionery Market Market

The South African confectionery market faces several hurdles that can impact growth and profitability. Regulatory compliance, particularly concerning sugar taxes and stricter labeling requirements for nutritional information, poses an ongoing challenge for manufacturers. Supply chain disruptions, exacerbated by logistical complexities and potential raw material price volatility, can affect production costs and product availability. Intensifying competitive pressures from both local and international players, coupled with the emergence of private label brands, requires continuous innovation and efficient operational strategies. Furthermore, economic downturns and currency fluctuations can impact consumer purchasing power, leading to reduced demand for discretionary items like confectionery. Addressing these challenges effectively is paramount for sustainable market success.

Forces Driving South Africa Confectionery Market Growth

Several powerful forces are propelling the growth of the South African confectionery market. A burgeoning young population with a high consumption rate of treats and snacks represents a significant demographic advantage. Increasing disposable incomes within segments of the population are leading to greater spending on impulse purchases and premium confectionery. The expanding retail landscape, including the proliferation of modern trade outlets and the rapid growth of e-commerce, enhances product accessibility. Furthermore, innovative product development, with a focus on healthier options, unique flavors, and indulgent experiences, is consistently stimulating consumer demand. The growing trend of gifting confectionery for various occasions also contributes to sustained market expansion.

Challenges in the South Africa Confectionery Market Market

While growth opportunities abound, the South African confectionery market navigates several long-term challenges. The persistent issue of sugar dependency in many popular confectionery products necessitates ongoing research and development into sugar reduction strategies and the adoption of healthier alternatives. Volatile commodity prices, particularly for cocoa and sugar, can significantly impact manufacturing costs and profit margins, requiring robust hedging strategies. Ethical sourcing and sustainability concerns are gaining prominence, compelling companies to invest in transparent and responsible supply chains, which can increase operational complexity and costs. Additionally, the socio-economic disparities within the country can lead to fragmented demand patterns, requiring tailored product offerings and pricing strategies for different consumer segments.

Emerging Opportunities in South Africa Confectionery Market

The South African confectionery market is ripe with emerging opportunities that forward-thinking businesses can leverage. The significant rise of the health and wellness trend presents a substantial opportunity for the growth of sugar-free, low-calorie, and plant-based confectionery products. Premiumization is another key trend, with consumers willing to pay more for high-quality, artisanal, and uniquely flavored confectionery. The rapid expansion of online retail and direct-to-consumer (DTC) channels offers new avenues for market penetration and personalized customer engagement. Furthermore, there is a growing demand for functional confectionery, incorporating ingredients that offer added health benefits, such as vitamins, minerals, or probiotics. Exploring these niche segments and adapting product portfolios to meet these evolving consumer preferences will be crucial for future success.

Leading Players in the South Africa Confectionery Market Sector

- Nestlé SA

- Chocoladefabriken Lindt & Sprüngli AG

- Perfetti Van Melle BV

- General Mills Inc

- PepsiCo Inc

- Tiger Brands

- Premier Foods Pty

- Abbott Laboratories

- August Storck KG

- Ferrero International SA

- Mars Incorporated

- Yıldız Holding A

- Arcor S A I C

- HARIBO Holding GmbH & Co KG

- Mondelēz International Inc

- The Hershey Company

- Kellogg Company

Key Milestones in South Africa Confectionery Market Industry

- July 2023: Chocoladefabriken Lindt & Sprüngli AG launched a vegan chocolate range in South Africa, featuring Lindt Vegan Smooth Chocolate and Lindt Vegan Hazelnut Chocolate, catering to the growing demand for plant-based options.

- May 2023: Mondelēz International Inc., under its brand, introduced three new special edition flavors: Dairy Milk Fudge Cookie Crumble, Fudge Mint Crisp, and Dream Coconut & Hazelnut Bliss, adding indulgence and novelty to its chocolate offerings.

- April 2023: The Hershey Company, through its ONE brand, launched the Limited Edition Peanut Butter & Jelly Flavored Protein Bar, combining high protein content with a popular flavor profile to appeal to health-conscious consumers.

Strategic Outlook for South Africa Confectionery Market Market

The strategic outlook for the South African confectionery market is optimistic, driven by sustained consumer demand and continuous innovation. Key growth accelerators include a deeper penetration of the health and wellness segment, with an emphasis on reduced sugar and plant-based alternatives, and the premiumization trend, offering consumers unique and indulgent experiences. Further development in online retail channels and direct-to-consumer strategies will unlock new avenues for market reach and customer engagement. Investment in sustainable sourcing and production practices will also be critical for long-term brand loyalty and regulatory compliance. By focusing on these strategic opportunities, companies can ensure robust growth and maintain a competitive edge in this dynamic market.

South Africa Confectionery Market Segmentation

-

1. Confections

-

1.1. Chocolate

-

1.1.1. By Confectionery Variant

- 1.1.1.1. Dark Chocolate

- 1.1.1.2. Milk and White Chocolate

-

1.1.1. By Confectionery Variant

-

1.2. Gums

- 1.2.1. Bubble Gum

-

1.2.2. Chewing Gum

-

1.2.2.1. By Sugar Content

- 1.2.2.1.1. Sugar Chewing Gum

- 1.2.2.1.2. Sugar-free Chewing Gum

-

1.2.2.1. By Sugar Content

-

1.3. Snack Bar

- 1.3.1. Cereal Bar

- 1.3.2. Fruit & Nut Bar

- 1.3.3. Protein Bar

-

1.4. Sugar Confectionery

- 1.4.1. Hard Candy

- 1.4.2. Lollipops

- 1.4.3. Mints

- 1.4.4. Pastilles, Gummies, and Jellies

- 1.4.5. Toffees and Nougats

- 1.4.6. Others

-

1.1. Chocolate

-

2. Distribution Channel

- 2.1. Convenience Store

- 2.2. Online Retail Store

- 2.3. Supermarket/Hypermarket

- 2.4. Others

South Africa Confectionery Market Segmentation By Geography

- 1. South Africa

South Africa Confectionery Market Regional Market Share

Geographic Coverage of South Africa Confectionery Market

South Africa Confectionery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.96% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Focus on Maintaining Health and Well-Being; Launching Supplements For Specific Purposes and Targeted Population

- 3.3. Market Restrains

- 3.3.1. Supplement Consumption and Their Side-effects; Inclination Towards Substitute Products

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Confectionery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Confections

- 5.1.1. Chocolate

- 5.1.1.1. By Confectionery Variant

- 5.1.1.1.1. Dark Chocolate

- 5.1.1.1.2. Milk and White Chocolate

- 5.1.1.1. By Confectionery Variant

- 5.1.2. Gums

- 5.1.2.1. Bubble Gum

- 5.1.2.2. Chewing Gum

- 5.1.2.2.1. By Sugar Content

- 5.1.2.2.1.1. Sugar Chewing Gum

- 5.1.2.2.1.2. Sugar-free Chewing Gum

- 5.1.2.2.1. By Sugar Content

- 5.1.3. Snack Bar

- 5.1.3.1. Cereal Bar

- 5.1.3.2. Fruit & Nut Bar

- 5.1.3.3. Protein Bar

- 5.1.4. Sugar Confectionery

- 5.1.4.1. Hard Candy

- 5.1.4.2. Lollipops

- 5.1.4.3. Mints

- 5.1.4.4. Pastilles, Gummies, and Jellies

- 5.1.4.5. Toffees and Nougats

- 5.1.4.6. Others

- 5.1.1. Chocolate

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Convenience Store

- 5.2.2. Online Retail Store

- 5.2.3. Supermarket/Hypermarket

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Confections

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nestlé SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Chocoladefabriken Lindt & Sprüngli AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Perfetti Van Melle BV

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 General Mills Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PepsiCo Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Tiger Brands

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Premier Foods Pty

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Abbott Laboratories

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 August Storck KG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ferrero International SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Mars Incorporated

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Yıldız Holding A

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Arcor S A I C

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 HARIBO Holding GmbH & Co KG

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Mondelēz International Inc

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 The Hershey Company

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Kellogg Company

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 Nestlé SA

List of Figures

- Figure 1: South Africa Confectionery Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South Africa Confectionery Market Share (%) by Company 2025

List of Tables

- Table 1: South Africa Confectionery Market Revenue billion Forecast, by Confections 2020 & 2033

- Table 2: South Africa Confectionery Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: South Africa Confectionery Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: South Africa Confectionery Market Revenue billion Forecast, by Confections 2020 & 2033

- Table 5: South Africa Confectionery Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: South Africa Confectionery Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Confectionery Market?

The projected CAGR is approximately 6.96%.

2. Which companies are prominent players in the South Africa Confectionery Market?

Key companies in the market include Nestlé SA, Chocoladefabriken Lindt & Sprüngli AG, Perfetti Van Melle BV, General Mills Inc, PepsiCo Inc, Tiger Brands, Premier Foods Pty, Abbott Laboratories, August Storck KG, Ferrero International SA, Mars Incorporated, Yıldız Holding A, Arcor S A I C, HARIBO Holding GmbH & Co KG, Mondelēz International Inc, The Hershey Company, Kellogg Company.

3. What are the main segments of the South Africa Confectionery Market?

The market segments include Confections, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.09 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Focus on Maintaining Health and Well-Being; Launching Supplements For Specific Purposes and Targeted Population.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Supplement Consumption and Their Side-effects; Inclination Towards Substitute Products.

8. Can you provide examples of recent developments in the market?

July 2023: Chocoladefabriken Lindt & Sprüngli AG launched a vegan chocolate range in South Africa. The products are available in two vegan flavors – Lindt Vegan Smooth Chocolate (made with oats and almonds to deliver a smooth, creamy texture) and Lindt Vegan Hazelnut Chocolate (made with roasted hazelnuts and premium vegan chocolate for a nutty flavor).May 2023: Under its brand, Mondelēz International Inc. launched three new special edition flavors that deliver indulgence with much-loved flavor combinations. The 150 g slabs include Dairy Milk Fudge Cookie Crumble, Fudge Mint Crisp, and Dream Coconut & Hazelnut Bliss.April 2023: Under the ONE brand, The Hershey Company launched the Peanut Butter & Jelly Flavored Protein Bar. The ONE Limited Edition Peanut Butter & Jelly flavored bars are packed with 20 g of protein, 1 g of sugar, and the familiar taste of peanut butter and strawberry jelly flavors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Confectionery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Confectionery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Confectionery Market?

To stay informed about further developments, trends, and reports in the South Africa Confectionery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence