Key Insights

The China Sports Drink Market is projected for substantial growth, anticipating a significant market size by 2025. This expansion is fueled by rising health consciousness, particularly among urban populations, an increased focus on fitness and athletic performance, and growing disposable incomes. The market is expected to achieve a Compound Annual Growth Rate (CAGR) of 6.6% through 2033. Evolving consumer preferences for healthier beverage options and the widespread adoption of sports and fitness activities across all age demographics are key drivers. Innovation in product development, including natural ingredients, functional benefits like enhanced hydration and energy replenishment, and diverse flavor options, further stimulates market growth. Strategic marketing by leading brands, emphasizing the health benefits of sports drinks for active lifestyles, is also crucial for consumer adoption and market penetration.

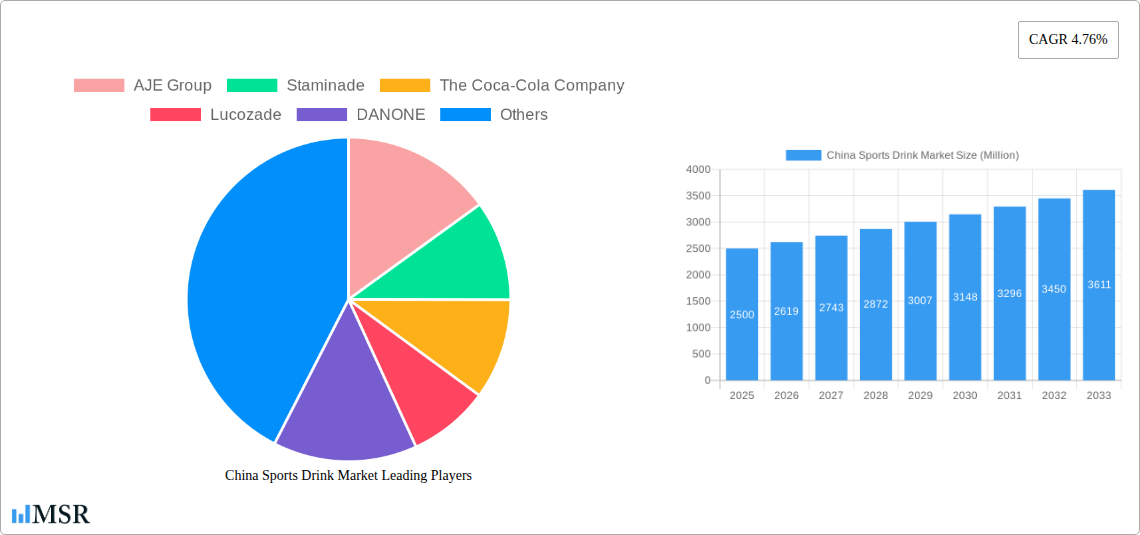

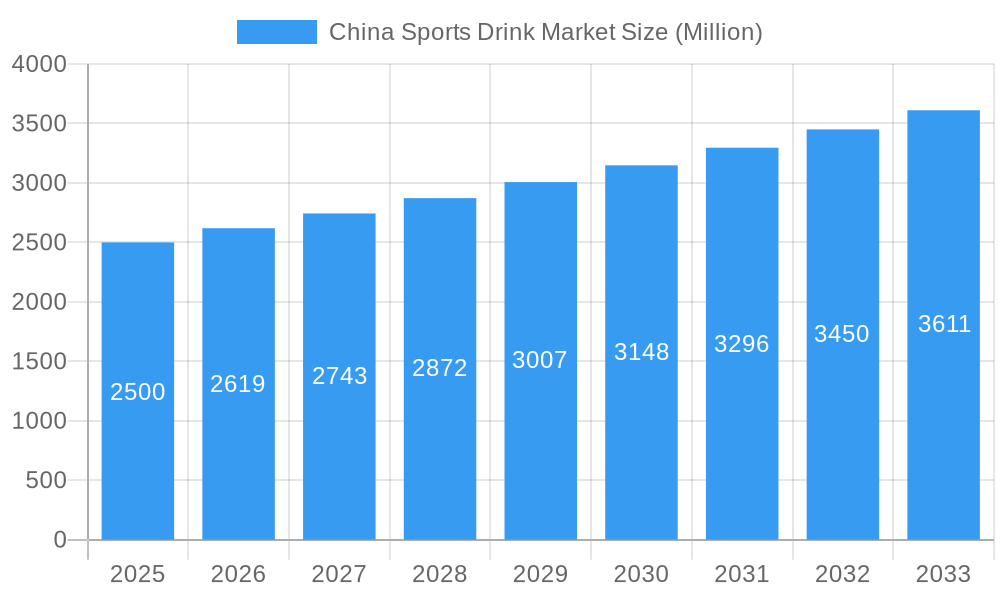

China Sports Drink Market Market Size (In Billion)

Distribution channels are evolving, with online retail emerging as a significant avenue alongside established supermarkets and hypermarkets. Convenience stores remain vital for immediate consumer access. Major players such as AJE Group, The Coca-Cola Company, PepsiCo Inc., and DANONE are actively investing in product innovation, expanding distribution, and forming strategic partnerships. Potential challenges include competition from other functional beverages and a growing demand for natural hydration alternatives. However, the prevailing trend towards healthier, active lifestyles in China creates a highly favorable environment for sustained growth in the sports drink sector.

China Sports Drink Market Company Market Share

Explore the dynamic China Sports Drink Market with our comprehensive research report. This analysis offers deep insights into market dynamics, key trends, and future prospects within this rapidly expanding beverage sector. Driven by heightened health awareness, increasing consumer spending power, and a growing fitness culture, the market is set for considerable expansion.

This report provides essential insights for stakeholders including sports drink manufacturers, beverage companies, retailers, investors, and industry analysts aiming to leverage opportunities in this evolving market. We meticulously analyze market segmentation, competitive landscapes, product innovations, and strategic recommendations.

Market Size: 1.82 billion Base Year: 2021 CAGR: 6.6% Forecast Period: 2022–2033

China Sports Drink Market Market Concentration & Dynamics

The China sports drink market exhibits a moderate to high concentration, with a few key global and domestic players holding significant market share. Innovation ecosystems are rapidly developing, fueled by R&D investments aimed at creating healthier, functional, and specialized sports nutrition beverages. Regulatory frameworks, while evolving, prioritize product safety and labeling accuracy, influencing formulation and marketing strategies. Substitute products, such as functional waters and energy drinks, present a competitive challenge, necessitating continuous product differentiation. End-user trends are strongly influenced by rising disposable incomes, urbanization, and a growing emphasis on healthy lifestyles and athletic performance. Mergers & Acquisitions (M&A) activities are present, though less frequent than in more mature markets, primarily focused on acquiring innovative brands or expanding distribution networks.

- Market Share: Dominated by key players, with a gradual increase in the market share of niche and emerging brands.

- M&A Activities: Sporadic but strategic, focusing on market consolidation and capability enhancement.

- Innovation Ecosystems: Growing, with a focus on natural ingredients, low-sugar options, and personalized nutrition.

- Regulatory Frameworks: Increasingly stringent, emphasizing food safety and health claims.

- Substitute Products: Functional beverages, energy drinks, and traditional beverages pose competitive threats.

- End-User Trends: Driven by fitness, wellness, and recovery needs.

China Sports Drink Market Industry Insights & Trends

The China sports drink market is experiencing robust growth, projected to reach an estimated XXX Million by 2025. This expansion is propelled by a confluence of factors. The increasing adoption of Western lifestyles and a heightened awareness of health and wellness among the Chinese population are primary drivers. As more individuals engage in sports and fitness activities, the demand for specialized beverages that aid in hydration, electrolyte replenishment, and muscle recovery is surging. The e-commerce boom in China has also significantly impacted the distribution and accessibility of sports drinks, with online retail stores becoming a crucial channel for both established brands and new entrants. Technological advancements in product formulation, including the incorporation of natural ingredients, novel electrolytes, and performance-enhancing compounds like BCAAs and L-Carnitine, are further stimulating market growth. Consumer preferences are evolving, with a growing demand for low-sugar, natural, and functional sports drinks that cater to specific athletic needs, from endurance to rapid recovery. The government's emphasis on public health and sports development initiatives also contributes to a favorable market environment.

The CAGR (Compound Annual Growth Rate) for the China sports drink market is estimated to be XX.X% during the forecast period of 2025-2033. This sustained growth trajectory reflects the enduring appeal of sports and active lifestyles, coupled with the industry's ability to innovate and adapt to consumer demands. The market size is expected to expand from approximately XXX Million in 2019 to XXX Million by 2033. Key trends include the rise of personalized sports nutrition, the integration of smart packaging solutions, and the growing appeal of plant-based and vegan sports drink options. The competitive landscape is characterized by a mix of global giants and ambitious domestic players, all vying for market share through aggressive marketing campaigns, product diversification, and strategic partnerships.

Key Markets & Segments Leading China Sports Drink Market

The China sports drink market is segmented by Packaging Type and Distribution Channel, with specific segments exhibiting exceptional growth and dominance.

Packaging Type Dominance:

Bottle (PET/Glass): This segment holds a commanding position in the China sports drink market.

- Drivers:

- Convenience and Portability: PET bottles, in particular, offer unparalleled convenience for on-the-go consumption, aligning with the active lifestyles of consumers.

- Durability and Safety: Glass bottles are perceived as premium and safer for certain formulations, appealing to health-conscious consumers.

- Brand Visibility: Bottles provide ample surface area for branding and product information, crucial in a competitive retail environment.

- Recyclability: Increasing consumer awareness and government initiatives promoting recycling favor PET bottles.

- Market Size: This segment is estimated to constitute over XX% of the total market value in 2025.

- Market Dynamics: Dominated by leading brands offering a wide range of flavors and formulations in various bottle sizes.

- Drivers:

Can: While a smaller segment, the aluminum can is gaining traction, especially for single-serving options and premium offerings.

- Drivers:

- Perceived Premiumness: Cans are often associated with higher-end products and rapid cooling.

- Lightweight and Recyclability: Aluminum cans are lightweight and highly recyclable, appealing to environmentally conscious consumers.

- Market Dynamics: Emerging brands and specific product lines are leveraging cans to differentiate themselves.

- Drivers:

Distribution Channel Dominance:

Supermarkets/Hypermarkets: These remain the primary distribution channels for sports drinks in China.

- Drivers:

- Wide Reach and Accessibility: Supermarkets and hypermarkets have extensive networks across urban and suburban areas, providing broad consumer access.

- Impulse Purchases: Strategic placement of sports drinks near sporting goods or checkout counters encourages impulse buying.

- Promotional Activities: These channels offer ample space for in-store promotions, discounts, and sampling, driving sales.

- Market Size: Expected to account for over XX% of the distribution channel revenue in 2025.

- Market Dynamics: Dominated by high sales volumes and strong brand presence.

- Drivers:

Convenience Stores: Their proliferation and 24/7 accessibility make them a significant channel for immediate consumption needs.

- Drivers:

- On-the-Go Consumption: Ideal for consumers seeking immediate hydration during or after physical activity.

- Prime Locations: Often situated in high-traffic areas, including gyms, parks, and public transportation hubs.

- Market Dynamics: Growing importance for grab-and-go options and impulse purchases.

- Drivers:

Online Retail Stores: This channel is experiencing rapid growth and is crucial for reaching a wider demographic.

- Drivers:

- Convenience and Variety: Consumers can browse and purchase a vast array of products from the comfort of their homes.

- Targeted Marketing: Online platforms allow for personalized marketing and promotions to specific consumer segments.

- Emerging Brands: Provides an accessible platform for smaller brands to enter the market and build a customer base.

- Market Dynamics: Rapidly increasing market share, fueled by e-commerce giants like Tmall and JD.com.

- Drivers:

Other Distribution Channels: This includes specialized sports retailers, gyms, fitness centers, and direct-to-consumer (DTC) models.

- Drivers:

- Niche Targeting: Allows brands to reach specific fitness communities and athletes.

- Expert Recommendations: Association with fitness professionals can build credibility.

- Market Dynamics: Growing in importance for premium and specialized sports nutrition products.

- Drivers:

China Sports Drink Market Product Developments

Product innovation in the China sports drink market is characterized by a focus on functionality and health. Companies are actively developing formulations that go beyond basic hydration, incorporating ingredients like electrolytes for enhanced fluid balance, carbohydrates for sustained energy, and amino acids for muscle repair. Advancements in flavor profiles, including natural fruit extracts and exotic blends, are appealing to evolving consumer palates. Low-sugar and sugar-free options are gaining significant traction, reflecting a broader health consciousness. Furthermore, the integration of vitamins and minerals for overall wellness, and specialized ingredients for specific athletic disciplines, are key areas of development. The market relevance of these innovations lies in their ability to address unmet consumer needs and create a competitive edge in a rapidly expanding market.

Challenges in the China Sports Drink Market Market

Despite its promising growth, the China sports drink market faces several challenges. Regulatory hurdles regarding health claims and ingredient approvals can slow down product launches and market entry. Intense competition from both global giants and agile domestic players necessitates continuous investment in marketing and product differentiation. Supply chain complexities, including logistics and raw material sourcing, can impact cost-effectiveness and product availability. Furthermore, evolving consumer preferences and the increasing demand for healthier alternatives, such as natural juices and functional waters, present a constant challenge to maintain market share.

Forces Driving China Sports Drink Market Growth

Several forces are propelling the China sports drink market forward. The escalating participation in sports and fitness activities, driven by increasing disposable incomes and a growing health-conscious population, is a primary driver. Government initiatives promoting sports and public health create a supportive environment for the industry. Technological advancements in product formulation, leading to the development of more functional and appealing sports drinks, are attracting new consumers. The expanding e-commerce infrastructure in China ensures wider accessibility and convenient purchasing options, further boosting sales.

Challenges in the China Sports Drink Market Market

Long-term growth catalysts for the China sports drink market include continuous innovation in product development, focusing on personalization and targeted nutrition for different athletic needs. Strategic partnerships between sports drink brands and fitness influencers, gyms, and sporting events will enhance brand visibility and credibility. Market expansion into tier-2 and tier-3 cities, which are experiencing rapid urbanization and income growth, presents significant untapped potential. The development of sustainable packaging solutions and ethical sourcing practices will also resonate with an increasingly environmentally aware consumer base.

Emerging Opportunities in China Sports Drink Market

Emerging opportunities in the China sports drink market lie in the growing demand for plant-based and vegan sports drink options, catering to a rising segment of health-conscious and ethically-minded consumers. The integration of functional ingredients beyond hydration and energy, such as adaptogens for stress relief and prebiotics for gut health, offers avenues for product diversification. The expansion of direct-to-consumer (DTC) channels, coupled with personalized subscription services, can foster stronger customer loyalty. Furthermore, exploring niche sports and fitness communities, such as yoga, tai chi, and extreme sports, can unlock new market segments.

Leading Players in the China Sports Drink Market Sector

- AJE Group

- Staminade

- The Coca-Cola Company

- Lucozade

- DANONE

- PepSico Inc

- Otsuka Pharmaceutical Co Ltd

Key Milestones in China Sports Drink Market Industry

- 2019: Increased focus on functional ingredients and low-sugar options by leading players.

- 2020: Surge in online sales and direct-to-consumer (DTC) strategies due to the pandemic.

- 2021: Expansion of product portfolios to include specialized recovery drinks and electrolyte-rich beverages.

- 2022: Growing consumer interest in natural ingredients and plant-based sports drinks.

- 2023: Increased marketing campaigns targeting younger demographics and fitness enthusiasts.

- 2024: Introduction of innovative packaging solutions focusing on sustainability and convenience.

Strategic Outlook for China Sports Drink Market Market

The strategic outlook for the China sports drink market is highly optimistic, driven by sustained growth in active lifestyles and evolving consumer demand for health-conscious products. Key growth accelerators include continued product innovation in functional ingredients and flavor profiles, alongside strategic expansion into emerging urban centers and online retail platforms. Building strong brand loyalty through targeted marketing, influencer collaborations, and robust distribution networks will be paramount. Embracing sustainability in packaging and sourcing will further enhance brand appeal. The market is ripe for investment and strategic partnerships, offering significant opportunities for both established and emerging players.

China Sports Drink Market Segmentation

-

1. Packaging Type

- 1.1. Bottle (Pet/Glass)

- 1.2. Can

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

China Sports Drink Market Segmentation By Geography

- 1. China

China Sports Drink Market Regional Market Share

Geographic Coverage of China Sports Drink Market

China Sports Drink Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Health and Wellness Trends Drives the Market; Rising Demand for functional Food Drives the Market

- 3.3. Market Restrains

- 3.3.1. High Competition from Other Protein Sources

- 3.4. Market Trends

- 3.4.1. Growing Popularity of Fitness Management Programs

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Sports Drink Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 5.1.1. Bottle (Pet/Glass)

- 5.1.2. Can

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 AJE Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Staminade

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 The Coca-Cola Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lucozade

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DANONE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PepSico Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Otsuka Pharmaceutical Co Ltd*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 AJE Group

List of Figures

- Figure 1: China Sports Drink Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Sports Drink Market Share (%) by Company 2025

List of Tables

- Table 1: China Sports Drink Market Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 2: China Sports Drink Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: China Sports Drink Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: China Sports Drink Market Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 5: China Sports Drink Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: China Sports Drink Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Sports Drink Market?

The projected CAGR is approximately 6.6%.

2. Which companies are prominent players in the China Sports Drink Market?

Key companies in the market include AJE Group, Staminade, The Coca-Cola Company, Lucozade, DANONE, PepSico Inc, Otsuka Pharmaceutical Co Ltd*List Not Exhaustive.

3. What are the main segments of the China Sports Drink Market?

The market segments include Packaging Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.82 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Health and Wellness Trends Drives the Market; Rising Demand for functional Food Drives the Market.

6. What are the notable trends driving market growth?

Growing Popularity of Fitness Management Programs.

7. Are there any restraints impacting market growth?

High Competition from Other Protein Sources.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Sports Drink Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Sports Drink Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Sports Drink Market?

To stay informed about further developments, trends, and reports in the China Sports Drink Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence