Key Insights

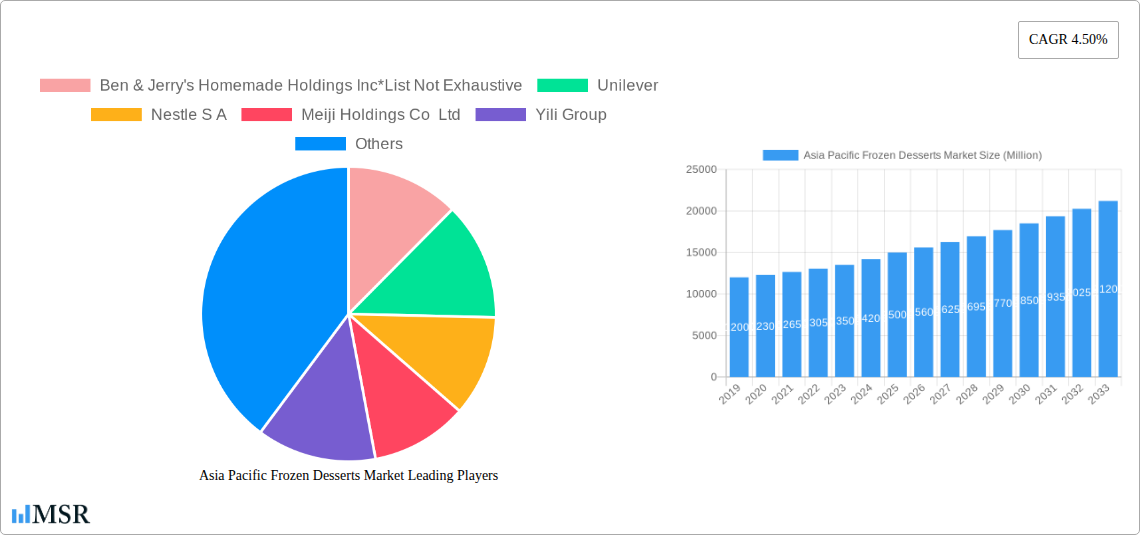

The Asia Pacific frozen desserts market is projected for significant expansion, expected to reach $128.56 billion by 2025, driven by a CAGR of 4.5% through 2033. Growth is attributed to rising disposable incomes, an expanding middle class seeking premium products, and a preference for convenient frozen treats. Increased urbanization and the growth of modern retail and online grocery platforms are enhancing product accessibility, from artisanal ice cream to diverse frozen confections.

Asia Pacific Frozen Desserts Market Market Size (In Billion)

Key trends include the rise of artisanal and premium ice cream, catering to demand for unique flavors and quality ingredients. Health-conscious consumers are driving innovation in lower-sugar, reduced-fat, and plant-based options. Major players and emerging local brands are intensifying competition and product development. Navigating fluctuating raw material costs, complex logistics, and varying food safety regulations will be crucial for market leaders. Significant growth is anticipated across the region, with China and India leading market expansion.

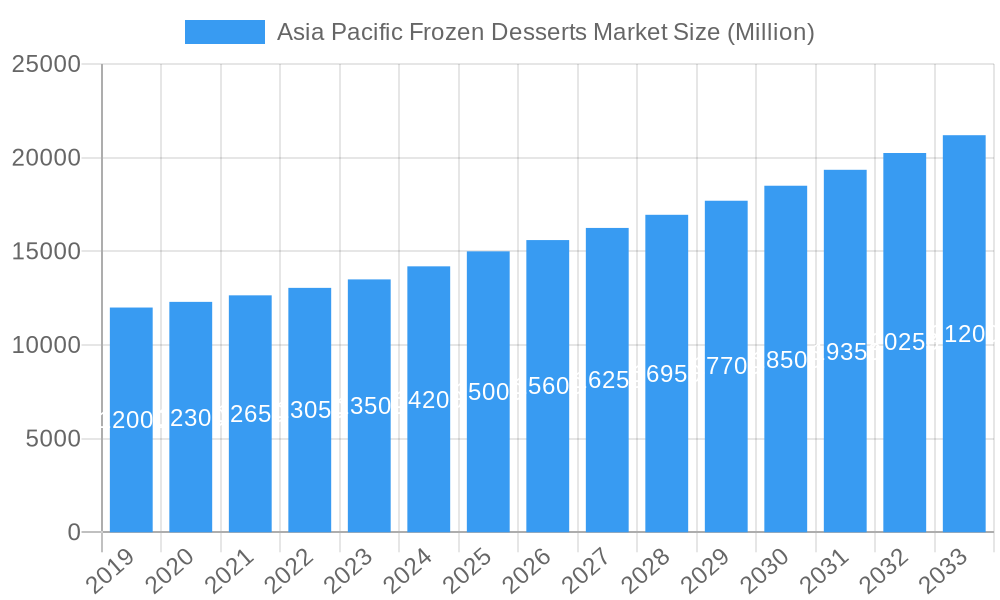

Asia Pacific Frozen Desserts Market Company Market Share

Unveiling the Asia Pacific Frozen Desserts Market: A Comprehensive Report

This in-depth report provides an essential roadmap for navigating the dynamic Asia Pacific frozen desserts market. Delving into market concentration, industry insights, key segments, product innovations, challenges, growth drivers, emerging opportunities, leading players, and pivotal milestones, this analysis offers actionable intelligence for stakeholders seeking to capitalize on this rapidly expanding sector. The study meticulously analyzes the market from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, drawing upon historical data from 2019–2024.

Asia Pacific Frozen Desserts Market Market Concentration & Dynamics

The Asia Pacific frozen desserts market exhibits a moderate to high level of concentration, with key players like Unilever, Nestle S.A., and Yili Group holding significant market share. Innovation ecosystems are thriving, driven by a growing demand for premiumization, healthier options, and novel flavor profiles. Regulatory frameworks across different countries, while evolving, generally support market growth, though specific import/export regulations and food safety standards require careful consideration. Substitute products, such as fresh fruit and other chilled desserts, pose a competitive threat but are increasingly being integrated into frozen dessert offerings. End-user trends are characterized by a burgeoning middle class with increasing disposable income, a heightened focus on health and wellness, and a growing appreciation for diverse culinary experiences. Mergers and acquisitions (M&A) activities are moderate, with strategic partnerships and smaller acquisitions aimed at expanding product portfolios and geographical reach. For instance, the market has witnessed X number of M&A deals in the historical period, reflecting a strategic consolidation and expansion drive. Market share distribution indicates that major multinational corporations dominate, yet regional and local players are carving out significant niches through specialized offerings and localized marketing strategies. The continuous influx of new product launches and the adoption of advanced manufacturing technologies are key indicators of a dynamic and competitive landscape.

Asia Pacific Frozen Desserts Market Industry Insights & Trends

The Asia Pacific frozen desserts market is poised for significant expansion, projected to reach approximately $XX Billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of XX% during the forecast period. This impressive growth is underpinned by several interconnected factors. A primary driver is the escalating disposable income across the region, particularly in emerging economies, which has fueled consumer spending on discretionary items like premium frozen desserts. The increasing urbanization and a growing middle-class population are further augmenting demand, with consumers seeking convenient and indulgent treat options. Technological disruptions are playing a crucial role in shaping the market. Advances in cold chain logistics and packaging technologies are enhancing product shelf life and expanding distribution networks, enabling wider product availability. Furthermore, the integration of e-commerce platforms for online frozen dessert retail has revolutionized accessibility, allowing consumers to purchase their favorite treats with unprecedented ease. Evolving consumer behaviors are also a significant trend. There is a discernible shift towards healthier alternatives, leading to a rising demand for frozen yogurt, low-sugar ice cream, and plant-based frozen dessert options. Consumers are increasingly health-conscious, seeking products with natural ingredients, reduced artificial additives, and functional benefits. This trend is driving innovation in product formulation, with manufacturers actively developing artisanal ice cream and dairy-free frozen desserts to cater to specific dietary needs and preferences. The influence of social media and celebrity endorsements is also noteworthy, shaping consumer choices and driving the popularity of innovative and visually appealing frozen desserts. The introduction of exotic flavors and fusion dessert concepts is another trend gaining traction, appealing to a younger demographic and adventurous palates. The overall market trajectory is characterized by continuous product evolution, strategic market penetration, and a keen understanding of shifting consumer demands.

Key Markets & Segments Leading Asia Pacific Frozen Desserts Market

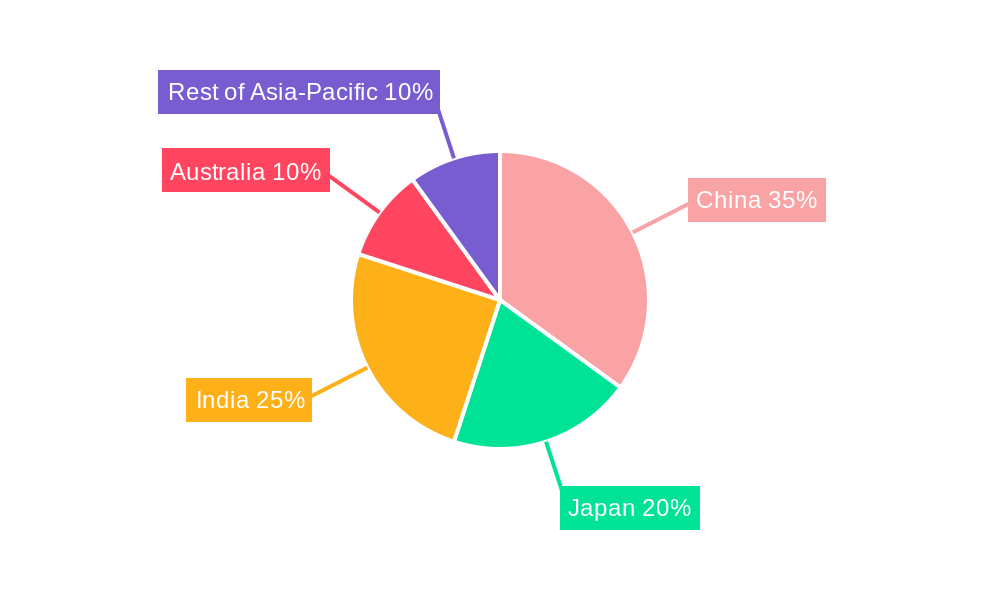

Dominance within the Asia Pacific frozen desserts market is multifaceted, with China emerging as the largest and fastest-growing regional market, driven by its massive population, rapid economic development, and a burgeoning middle class with a penchant for indulgence. Within product types, Ice Cream reigns supreme, accounting for a substantial market share. This segment itself is further broken down, with Dairy-based Ice Cream holding the largest portion due to its traditional appeal and wide availability. However, Artisanal Ice Cream is experiencing rapid growth, fueled by consumer demand for premium, unique flavors, and high-quality ingredients. Water-based Ice Cream, including sorbets and popsicles, is also gaining traction, particularly among health-conscious consumers and in warmer climates.

- Dominant Geography: China

- Drivers:

- High disposable income and increasing consumer spending power.

- Rapid urbanization and a growing middle-class population seeking convenient treats.

- Strong retail infrastructure and expanding distribution networks, including robust online retail channels for frozen desserts.

- Increasing preference for Western-style desserts and a growing appetite for novel flavors and premium offerings.

- Government initiatives promoting food industry development and consumer welfare.

- Drivers:

- Dominant Product Type: Ice Cream

- Dairy-based Ice Cream:

- Drivers: Established consumer preference, wide variety of flavors, and widespread availability in supermarkets/hypermarkets and convenience stores.

- Dominance Analysis: Traditional flavors and mainstream brands continue to drive sales, supported by extensive marketing campaigns and promotional activities.

- Artisanal Ice Cream:

- Drivers: Growing demand for premium, unique, and locally sourced ingredients; experiential consumption; and the influence of social media showcasing creative flavors.

- Dominance Analysis: This sub-segment is characterized by smaller, independent producers and niche brands, often found in speciality stores and increasingly online, catering to a discerning consumer base.

- Dairy-based Ice Cream:

- Dominant Distribution Channel: Supermarkets/Hypermarkets

- Drivers:

- Convenience and one-stop shopping experience for consumers.

- Wide product assortment and competitive pricing.

- Effective in-store promotions and visual merchandising.

- Dominance Analysis: These outlets provide the broadest reach for frozen desserts, ensuring accessibility to a vast consumer base across urban and semi-urban areas.

- Online Retailer:

- Drivers: Growing internet penetration and smartphone usage, increasing demand for home delivery services, and the convenience of online browsing and purchasing.

- Dominance Analysis: This channel is experiencing exponential growth, especially post-pandemic, with specialized frozen dessert delivery services and e-commerce giants expanding their offerings.

- Drivers:

The Rest of Asia-Pacific, encompassing countries like South Korea, Thailand, and Vietnam, is also showing significant growth potential due to similar economic and demographic trends. While Japan has a mature market with a strong preference for traditional and unique ice cream flavors, India presents a vast untapped market with immense growth opportunities driven by its young population and evolving consumption patterns. Australia, with its established westernized palate, also contributes significantly to the market, particularly in the premium and artisanal segments.

Asia Pacific Frozen Desserts Market Product Developments

Product innovation in the Asia Pacific frozen desserts market is characterized by a strong focus on health and wellness, premiumization, and novel flavor experiences. Manufacturers are increasingly incorporating natural ingredients, reducing sugar content, and offering plant-based alternatives to cater to evolving consumer preferences. The development of functional frozen desserts, enriched with probiotics or vitamins, is also gaining traction. Artisanal ice cream brands are pushing boundaries with unique flavor fusions, incorporating local ingredients and exotic fruits, appealing to adventurous consumers. Innovations in texture, such as the introduction of mochi-covered ice cream and layered frozen desserts, are also enhancing product appeal. Packaging advancements, including eco-friendly materials and convenient single-serve options, further contribute to market relevance and competitive edge.

Challenges in the Asia Pacific Frozen Desserts Market Market

The Asia Pacific frozen desserts market faces several challenges that can impact growth. Maintaining consistent product quality and integrity across vast and varied geographies, particularly concerning cold chain logistics, remains a significant hurdle. Fluctuating raw material prices, such as dairy and sugar, can affect profit margins and necessitate strategic sourcing and pricing adjustments. Intense competition from both global giants and agile local players leads to price wars and requires continuous product differentiation. Evolving and sometimes stringent food safety regulations across different countries can add complexity to product development and market entry strategies. Furthermore, the growing consumer awareness regarding sugar content and artificial ingredients necessitates constant reformulation and a shift towards healthier options, which can be costly and time-consuming.

Forces Driving Asia Pacific Frozen Desserts Market Growth

Several potent forces are propelling the Asia Pacific frozen desserts market. The rising disposable incomes across the region are a fundamental economic driver, empowering consumers to spend more on premium and indulgent frozen treats. Urbanization and the expansion of the middle class are creating larger consumer bases with greater access to diverse retail channels. Technological advancements in manufacturing, particularly in process efficiency and quality control, are enabling higher production volumes and cost optimization. The burgeoning e-commerce sector and sophisticated online delivery networks are significantly enhancing product accessibility and convenience. Furthermore, a growing awareness of health and wellness is driving demand for innovative, healthier frozen dessert options, such as low-sugar and plant-based alternatives, fostering market expansion through product diversification.

Challenges in the Asia Pacific Frozen Desserts Market Market

Long-term growth catalysts for the Asia Pacific frozen desserts market are deeply intertwined with ongoing consumer and technological evolution. The increasing demand for premium and gourmet frozen desserts, driven by a desire for unique flavors and high-quality ingredients, presents a significant opportunity for market expansion. Continued advancements in food technology, enabling the development of novel textures, functionalities, and healthier formulations without compromising taste, will be crucial. Strategic partnerships between established brands and local producers can facilitate market entry and expansion into diverse cultural landscapes. Furthermore, the growing focus on sustainability in production and packaging will resonate with environmentally conscious consumers, offering a competitive advantage. As emerging economies mature, their expanding middle class will continue to be a primary engine for sustained growth in the frozen desserts sector.

Emerging Opportunities in Asia Pacific Frozen Desserts Market

Emerging opportunities in the Asia Pacific frozen desserts market are ripe for exploration. The burgeoning demand for plant-based and vegan frozen desserts, catering to a growing segment of health-conscious and ethically-minded consumers, represents a significant untapped market. Innovations in frozen yogurt and other probiotic-rich frozen treats offer avenues for health and wellness product development. The penetration of specialized online retailers and the adoption of advanced delivery solutions present a significant opportunity to reach a wider consumer base and offer personalized ordering experiences. Exploring unique flavor profiles inspired by local cuisines and incorporating exotic ingredients can create niche markets and capture consumer interest. Furthermore, the development of functional frozen desserts that offer specific health benefits, such as immune support or digestive health, could unlock new consumer segments.

Leading Players in the Asia Pacific Frozen Desserts Market Sector

- Ben & Jerry's Homemade Holdings Inc

- Unilever

- Nestle S A

- Meiji Holdings Co Ltd

- Yili Group

- Dunkin' Brands Group Inc

- Mother Dairy Fruit & Vegetable Pvt Ltd

- Blue Bell Creameries LP

Key Milestones in Asia Pacific Frozen Desserts Market Industry

- 2020: Increased adoption of online ordering and home delivery services for frozen desserts due to global health concerns, significantly boosting the online retail segment.

- 2021: Launch of several plant-based and vegan frozen dessert lines by major manufacturers to cater to rising consumer demand for healthier ice cream options.

- 2022: Significant investment in R&D for novel flavor development and premiumization strategies, leading to the introduction of unique artisanal ice cream offerings.

- 2023: Expansion of frozen yogurt offerings with a focus on low-sugar and functional variants in key markets like China and India.

- 2024: Increased focus on sustainable packaging solutions and ethical sourcing of ingredients across various product categories, including dairy-based ice cream and water-based ice cream.

Strategic Outlook for Asia Pacific Frozen Desserts Market Market

The strategic outlook for the Asia Pacific frozen desserts market is exceptionally positive, driven by continued economic growth, evolving consumer preferences, and technological advancements. Key growth accelerators include the relentless pursuit of product innovation, focusing on healthier ingredients, novel flavors, and plant-based alternatives. Expanding distribution networks, particularly through the robust growth of online retail and specialty stores, will be critical for market penetration. Strategic collaborations and targeted marketing campaigns aimed at diverse demographic segments, especially the younger generation, will foster brand loyalty and market share. Furthermore, a strong emphasis on sustainability in sourcing, production, and packaging will resonate with an increasingly eco-conscious consumer base, positioning companies for long-term success in this dynamic and expanding market.

Asia Pacific Frozen Desserts Market Segmentation

-

1. Product Type

- 1.1. Frozen Yogurt

-

1.2. Ice Cream

- 1.2.1. Artisanal Ice Cream

- 1.2.2. Dairy-based Ice Cream

- 1.2.3. Water-based Ice Cream

- 1.3. Frozen Cakes

- 1.4. Others

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Speciality Stores

- 2.4. Online Retailer

- 2.5. Others

-

3. Geography

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia-Pacific

Asia Pacific Frozen Desserts Market Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Australia

- 5. Rest of Asia Pacific

Asia Pacific Frozen Desserts Market Regional Market Share

Geographic Coverage of Asia Pacific Frozen Desserts Market

Asia Pacific Frozen Desserts Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Applications of Animal Protein in Personal Care and Cosmetics; Increasing demand for Whey protein

- 3.3. Market Restrains

- 3.3.1. Increasing demand for plant-based proteins

- 3.4. Market Trends

- 3.4.1. Increasing Preference Toward Ice-cream Parlors in the Developing Countries

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Frozen Desserts Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Frozen Yogurt

- 5.1.2. Ice Cream

- 5.1.2.1. Artisanal Ice Cream

- 5.1.2.2. Dairy-based Ice Cream

- 5.1.2.3. Water-based Ice Cream

- 5.1.3. Frozen Cakes

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Speciality Stores

- 5.2.4. Online Retailer

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. Japan

- 5.3.3. India

- 5.3.4. Australia

- 5.3.5. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. Australia

- 5.4.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China Asia Pacific Frozen Desserts Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Frozen Yogurt

- 6.1.2. Ice Cream

- 6.1.2.1. Artisanal Ice Cream

- 6.1.2.2. Dairy-based Ice Cream

- 6.1.2.3. Water-based Ice Cream

- 6.1.3. Frozen Cakes

- 6.1.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Speciality Stores

- 6.2.4. Online Retailer

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. Japan

- 6.3.3. India

- 6.3.4. Australia

- 6.3.5. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Japan Asia Pacific Frozen Desserts Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Frozen Yogurt

- 7.1.2. Ice Cream

- 7.1.2.1. Artisanal Ice Cream

- 7.1.2.2. Dairy-based Ice Cream

- 7.1.2.3. Water-based Ice Cream

- 7.1.3. Frozen Cakes

- 7.1.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Speciality Stores

- 7.2.4. Online Retailer

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. Japan

- 7.3.3. India

- 7.3.4. Australia

- 7.3.5. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. India Asia Pacific Frozen Desserts Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Frozen Yogurt

- 8.1.2. Ice Cream

- 8.1.2.1. Artisanal Ice Cream

- 8.1.2.2. Dairy-based Ice Cream

- 8.1.2.3. Water-based Ice Cream

- 8.1.3. Frozen Cakes

- 8.1.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Speciality Stores

- 8.2.4. Online Retailer

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. Japan

- 8.3.3. India

- 8.3.4. Australia

- 8.3.5. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Australia Asia Pacific Frozen Desserts Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Frozen Yogurt

- 9.1.2. Ice Cream

- 9.1.2.1. Artisanal Ice Cream

- 9.1.2.2. Dairy-based Ice Cream

- 9.1.2.3. Water-based Ice Cream

- 9.1.3. Frozen Cakes

- 9.1.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Speciality Stores

- 9.2.4. Online Retailer

- 9.2.5. Others

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. Japan

- 9.3.3. India

- 9.3.4. Australia

- 9.3.5. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Rest of Asia Pacific Asia Pacific Frozen Desserts Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Frozen Yogurt

- 10.1.2. Ice Cream

- 10.1.2.1. Artisanal Ice Cream

- 10.1.2.2. Dairy-based Ice Cream

- 10.1.2.3. Water-based Ice Cream

- 10.1.3. Frozen Cakes

- 10.1.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Convenience Stores

- 10.2.3. Speciality Stores

- 10.2.4. Online Retailer

- 10.2.5. Others

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. Japan

- 10.3.3. India

- 10.3.4. Australia

- 10.3.5. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ben & Jerry's Homemade Holdings Inc*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Unilever

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nestle S A

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Meiji Holdings Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Yili Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dunkin' Brands Group Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Mother Dairy Fruit & Vegetable Pvt Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Blue Bell Creameries LP

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Ben & Jerry's Homemade Holdings Inc*List Not Exhaustive

List of Figures

- Figure 1: Asia Pacific Frozen Desserts Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Frozen Desserts Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Frozen Desserts Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Asia Pacific Frozen Desserts Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Asia Pacific Frozen Desserts Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Asia Pacific Frozen Desserts Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Asia Pacific Frozen Desserts Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Asia Pacific Frozen Desserts Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Asia Pacific Frozen Desserts Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Asia Pacific Frozen Desserts Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Asia Pacific Frozen Desserts Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: Asia Pacific Frozen Desserts Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Asia Pacific Frozen Desserts Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Asia Pacific Frozen Desserts Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Asia Pacific Frozen Desserts Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Asia Pacific Frozen Desserts Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: Asia Pacific Frozen Desserts Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Asia Pacific Frozen Desserts Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Asia Pacific Frozen Desserts Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: Asia Pacific Frozen Desserts Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 19: Asia Pacific Frozen Desserts Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Asia Pacific Frozen Desserts Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Asia Pacific Frozen Desserts Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Asia Pacific Frozen Desserts Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 23: Asia Pacific Frozen Desserts Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Asia Pacific Frozen Desserts Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Frozen Desserts Market?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the Asia Pacific Frozen Desserts Market?

Key companies in the market include Ben & Jerry's Homemade Holdings Inc*List Not Exhaustive, Unilever, Nestle S A, Meiji Holdings Co Ltd, Yili Group, Dunkin' Brands Group Inc, Mother Dairy Fruit & Vegetable Pvt Ltd, Blue Bell Creameries LP.

3. What are the main segments of the Asia Pacific Frozen Desserts Market?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 128.56 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Applications of Animal Protein in Personal Care and Cosmetics; Increasing demand for Whey protein.

6. What are the notable trends driving market growth?

Increasing Preference Toward Ice-cream Parlors in the Developing Countries.

7. Are there any restraints impacting market growth?

Increasing demand for plant-based proteins.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Frozen Desserts Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Frozen Desserts Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Frozen Desserts Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Frozen Desserts Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence