Key Insights

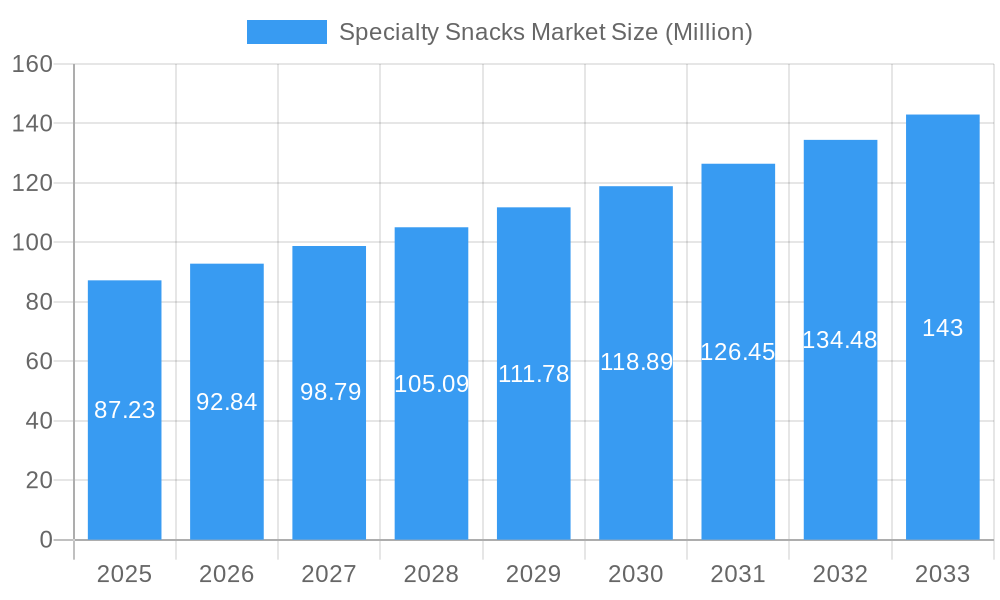

The global Specialty Snacks Market is poised for robust expansion, with a current market size of approximately USD 87.23 million. This dynamic sector is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.45% from 2025 to 2033, indicating significant investment and consumer interest. The market's growth is propelled by evolving consumer preferences towards healthier, innovative, and convenient snacking options. Driven by a desire for functional ingredients, unique flavor profiles, and ethically sourced products, consumers are actively seeking out specialty snacks that cater to specific dietary needs and lifestyle choices. The rising awareness of the impact of diet on overall well-being is a key factor, leading to a surge in demand for snacks enriched with protein, fiber, and natural ingredients, while sugar and artificial additive content is increasingly scrutinized.

Specialty Snacks Market Market Size (In Million)

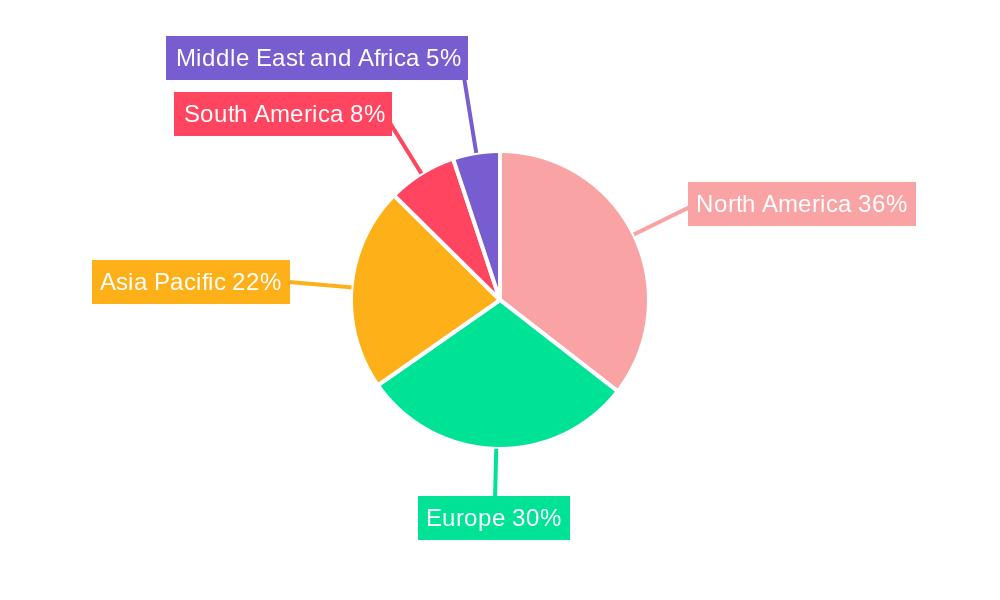

The market landscape is characterized by a diverse range of product types, including Snack Bars, Bakery-based Snacks, Nuts and Seeds Snacks, and Popped Snacks, each capturing distinct consumer segments. Distribution channels are also diversifying, with Online Retailer Stores witnessing substantial growth alongside traditional Supermarkets/Hypermarkets and Convenience/Grocery Stores. This omnichannel approach is crucial for reaching a wider consumer base. Geographically, North America and Europe currently lead the market, driven by high disposable incomes and a mature health-conscious consumer base. However, the Asia Pacific region, fueled by rapid urbanization, a growing middle class, and increasing adoption of Western dietary habits, is expected to emerge as a significant growth engine in the coming years. Key industry players are actively engaged in product innovation and strategic expansions to capitalize on these burgeoning opportunities.

Specialty Snacks Market Company Market Share

This comprehensive Specialty Snacks Market report delivers deep insights into the dynamic premium snack market, exploring growth trajectories, key industry players, and emerging trends. Spanning the historical period (2019–2024), base year (2025), and forecast period (2025–2033), this analysis provides actionable intelligence for stakeholders seeking to capitalize on the burgeoning demand for healthier, convenient, and niche snack options. The report covers product types including Snack Bars, Bakery-based Snacks, Nuts and Seeds Snacks, Popped Snacks, and Other Product Types, alongside crucial distribution channels such as Supermarkets/Hypermarkets, Convenience/Grocery Stores, Online Retailer Stores, and Other Distribution Channels. With an estimated market size of over $100 Million in 2025 and projected to reach over $200 Million by 2033, at a CAGR of over 8%, this report is an indispensable guide.

Specialty Snacks Market Market Concentration & Dynamics

The specialty snacks market exhibits a moderate to high concentration, with key global players like Nestle SA, The Kellogg Company, General Mills Inc., PepsiCo Inc., and Mars Incorporated holding significant market shares. Innovation ecosystems are robust, fueled by consumer demand for healthier ingredients, functional benefits, and unique flavor profiles. Regulatory frameworks, particularly concerning labeling for allergens, nutritional content, and health claims, are evolving and influencing product development. Substitute products, ranging from traditional snacks to fresh produce, present a constant challenge, requiring specialty snack manufacturers to differentiate through premiumization and added value. End-user trends are strongly shifting towards health-conscious consumption, convenience, and personalized nutrition. Merger and acquisition (M&A) activities are prevalent, with approximately 10-15 significant M&A deals observed annually in the broader snack industry, indicating consolidation and strategic expansion by leading companies. For instance, the acquisition of Chipita Global SA by Mondelez International underscores the pursuit of high-growth segments.

Specialty Snacks Market Industry Insights & Trends

The specialty snacks market is experiencing robust expansion, driven by an increasing consumer preference for healthier, functional, and indulgent snack options. Market growth drivers include a growing awareness of the impact of diet on overall well-being, a desire for convenient yet nutritious food solutions, and the rising disposable income in emerging economies. Technological disruptions, such as advancements in food processing and ingredient innovation, are enabling the creation of novel textures, flavors, and health benefits within snacks. Evolving consumer behaviors, characterized by a demand for transparency in ingredients, sustainable sourcing, and personalized dietary needs (e.g., keto, vegan, gluten-free), are reshaping product development strategies. The market size, estimated at over $100 Million in 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of over 8% through 2033, reaching over $200 Million. This sustained growth is fueled by an increasing demand for products that offer more than just satiety, such as those providing energy, protein, or stress relief. The proliferation of online retail channels has also made specialty snacks more accessible to a wider consumer base, further propelling market growth.

Key Markets & Segments Leading Specialty Snacks Market

- Dominant Region: North America currently leads the specialty snacks market, driven by high consumer awareness regarding health and wellness, a strong presence of key manufacturers, and a mature distribution network. Economic growth and a high disposable income per capita are significant drivers in this region.

- Dominant Product Type: Snack Bars represent a leading segment within the specialty snacks market. Their portability, convenience, and wide variety of formulations catering to different dietary needs (e.g., protein bars, energy bars, meal replacement bars) make them highly popular. The Nuts and Seeds Snacks segment is also experiencing substantial growth due to the perceived health benefits of nuts and seeds.

- Dominant Distribution Channel: Supermarkets/Hypermarkets remain the primary distribution channel for specialty snacks, offering wide product visibility and accessibility to a broad consumer base. However, Online Retailer Stores are rapidly gaining traction, providing consumers with unparalleled convenience and access to a wider array of niche and specialized products. The ease of comparison and doorstep delivery further fuels this channel's growth.

The dominance of these segments is further supported by evolving consumer lifestyles, where on-the-go consumption and health-conscious purchasing decisions are paramount. For example, the increasing prevalence of busy schedules drives the demand for convenient snack bars, while growing awareness of the benefits of plant-based diets fuels the growth of nuts and seeds snacks.

Specialty Snacks Market Product Developments

Product innovation in the specialty snacks market is characterized by a focus on health-conscious formulations and novel ingredients. Companies are actively developing Snack Bars with specific functional benefits, such as low sugar, high protein, or enhanced energy. Innovations in Bakery-based Snacks include the introduction of gluten-free and plant-based options. The Nuts and Seeds Snacks segment sees advancements in flavored and functional varieties, incorporating ingredients like adaptogens or probiotics. Popped Snacks are evolving beyond traditional corn with the use of ancient grains and unique seasoning blends. The market relevance of these developments lies in their ability to cater to a diverse range of consumer needs and preferences, offering competitive advantages through unique selling propositions and superior nutritional profiles.

Challenges in the Specialty Snacks Market Market

- Regulatory Hurdles: Navigating complex and evolving food labeling regulations, especially concerning health claims and ingredient transparency, can be a significant challenge for specialty snacks market players.

- Supply Chain Volatility: Sourcing of premium and niche ingredients can be susceptible to fluctuations in availability and price, impacting production costs and consistency.

- Intense Competition: The growing popularity of specialty snacks has led to an influx of new entrants and the expansion of product portfolios by established players, intensifying competitive pressures.

- Consumer Price Sensitivity: While consumers seek premium products, price remains a factor, especially in economically sensitive periods, potentially limiting the adoption of higher-priced specialty snacks.

Forces Driving Specialty Snacks Market Growth

The specialty snacks market is propelled by several potent forces. Technologically, advancements in food science allow for the creation of snacks with enhanced nutritional profiles and unique textures. Economically, rising disposable incomes and a growing middle class in both developed and developing nations translate to increased spending on premium and health-oriented food products. Regulatory factors, such as favorable policies supporting healthy food choices and clear labeling, can also stimulate market growth. Furthermore, the increasing global urbanization and fast-paced lifestyles contribute to the demand for convenient, on-the-go snacking solutions.

Challenges in the Specialty Snacks Market Market

The long-term growth catalysts for the specialty snacks market are deeply rooted in innovation and strategic market expansion. Continued investment in research and development to create snacks with demonstrable health benefits, such as improved gut health or cognitive function, will sustain consumer interest. Strategic partnerships with health and wellness influencers, as well as collaborations with other food and beverage companies, can broaden market reach and credibility. Expanding into underserved geographical regions with tailored product offerings can unlock new revenue streams. The ongoing trend of personalization in food consumption also presents an opportunity for brands to offer customizable snack options.

Emerging Opportunities in Specialty Snacks Market

Emerging opportunities in the specialty snacks market are abundant and diverse. The growing demand for plant-based and vegan snacks presents a significant avenue for product development and market penetration. The increasing awareness of mental wellness is creating a niche for snacks infused with ingredients like adaptogens and nootropics. Furthermore, the rise of personalized nutrition platforms offers opportunities for direct-to-consumer (DTC) models and customized snack boxes tailored to individual dietary requirements and preferences. Sustainable sourcing and eco-friendly packaging are also becoming critical purchasing factors, opening doors for brands that prioritize environmental responsibility.

Leading Players in the Specialty Snacks Market Sector

- Nestle SA

- The Kellogg Company

- General Mills Inc.

- PepsiCo Inc.

- Intersnack Group GmbH

- Conagra Brands Inc (SlimJim)

- Blue Diamond Growers

- Mars Incorporated

- The Kraft Heinz Company

- Mondelez International

Key Milestones in Specialty Snacks Market Industry

- May 2022: Mondelez International acquired Chipita Global SA, a high-growth leader in the Central and Eastern European croissants and baked snacks market. This acquisition significantly expanded Mondelez's presence in the baked snacks category and in key European markets.

- September 2021: General Mills Inc. introduced Good Measure, a new brand of snacks for consumers concerned with how food interacts with their blood sugar, including those with diabetes and pre-diabetes. Good Measure launched Creamy Nut Butter Bars and Crunchy Almond Crisps, sweetened with allulose, addressing a growing health-conscious consumer segment.

- June 2021: The Kellogg Company launched Kellogg's Special K Keto-Friendly Snack Bars, which are available in two flavors, namely, chocolate almond fudge and peanut butter fudge. This launch catered to the growing keto diet trend and expanded Kellogg's offering in the functional snack bar segment.

Strategic Outlook for Specialty Snacks Market Market

The specialty snacks market is poised for continued robust growth, driven by an enduring consumer shift towards healthier and more functional food choices. Future market potential lies in further innovation within plant-based, protein-rich, and gut-health-focused snack categories. Strategic opportunities include expanding into emerging markets with tailored product offerings, leveraging digital channels for direct-to-consumer sales, and embracing sustainable practices in sourcing and packaging to align with consumer values. Collaborations and partnerships will be crucial for accelerating product development and market penetration, ensuring sustained competitive advantage in this dynamic sector.

Specialty Snacks Market Segmentation

-

1. Product Type

- 1.1. Snack Bars

- 1.2. Bakery-based Snacks

- 1.3. Nuts and Seeds Snacks

- 1.4. Popped Snacks

- 1.5. Other Product Types

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience/Grocery Stores

- 2.3. Online Retailer Stores

- 2.4. Other Distribution Channels

Specialty Snacks Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Specialty Snacks Market Regional Market Share

Geographic Coverage of Specialty Snacks Market

Specialty Snacks Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Sports Participation; Increasing Awareness about Health and Fitness

- 3.3. Market Restrains

- 3.3.1. Adverse Effects of Overconsumption of Products

- 3.4. Market Trends

- 3.4.1. Growing Demand for Convenient and Healthy Snacking

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Specialty Snacks Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Snack Bars

- 5.1.2. Bakery-based Snacks

- 5.1.3. Nuts and Seeds Snacks

- 5.1.4. Popped Snacks

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience/Grocery Stores

- 5.2.3. Online Retailer Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Specialty Snacks Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Snack Bars

- 6.1.2. Bakery-based Snacks

- 6.1.3. Nuts and Seeds Snacks

- 6.1.4. Popped Snacks

- 6.1.5. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience/Grocery Stores

- 6.2.3. Online Retailer Stores

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Specialty Snacks Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Snack Bars

- 7.1.2. Bakery-based Snacks

- 7.1.3. Nuts and Seeds Snacks

- 7.1.4. Popped Snacks

- 7.1.5. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience/Grocery Stores

- 7.2.3. Online Retailer Stores

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Specialty Snacks Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Snack Bars

- 8.1.2. Bakery-based Snacks

- 8.1.3. Nuts and Seeds Snacks

- 8.1.4. Popped Snacks

- 8.1.5. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience/Grocery Stores

- 8.2.3. Online Retailer Stores

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Specialty Snacks Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Snack Bars

- 9.1.2. Bakery-based Snacks

- 9.1.3. Nuts and Seeds Snacks

- 9.1.4. Popped Snacks

- 9.1.5. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience/Grocery Stores

- 9.2.3. Online Retailer Stores

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Specialty Snacks Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Snack Bars

- 10.1.2. Bakery-based Snacks

- 10.1.3. Nuts and Seeds Snacks

- 10.1.4. Popped Snacks

- 10.1.5. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Convenience/Grocery Stores

- 10.2.3. Online Retailer Stores

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Nestle SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 The Kellogg Company

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 General Mills Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 PepsiCo Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Intersnack Group GmbH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Conagra Brands Inc (SlimJim)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Blue Diamond Growers

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Mars Incorporated

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 The Kraft Heinz Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Mondelez International

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Nestle SA

List of Figures

- Figure 1: Global Specialty Snacks Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Specialty Snacks Market Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Specialty Snacks Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Specialty Snacks Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 5: North America Specialty Snacks Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Specialty Snacks Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Specialty Snacks Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Specialty Snacks Market Revenue (Million), by Product Type 2025 & 2033

- Figure 9: Europe Specialty Snacks Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Specialty Snacks Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 11: Europe Specialty Snacks Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Specialty Snacks Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Specialty Snacks Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Specialty Snacks Market Revenue (Million), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Specialty Snacks Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Specialty Snacks Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 17: Asia Pacific Specialty Snacks Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Asia Pacific Specialty Snacks Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Specialty Snacks Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Specialty Snacks Market Revenue (Million), by Product Type 2025 & 2033

- Figure 21: South America Specialty Snacks Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Specialty Snacks Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: South America Specialty Snacks Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America Specialty Snacks Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Specialty Snacks Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Specialty Snacks Market Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Specialty Snacks Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Specialty Snacks Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: Middle East and Africa Specialty Snacks Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East and Africa Specialty Snacks Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Specialty Snacks Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Specialty Snacks Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Specialty Snacks Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Specialty Snacks Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Specialty Snacks Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Global Specialty Snacks Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Specialty Snacks Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Specialty Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Specialty Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Specialty Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Specialty Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Specialty Snacks Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: Global Specialty Snacks Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Specialty Snacks Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Spain Specialty Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Specialty Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Specialty Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Specialty Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Specialty Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Russia Specialty Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Specialty Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Specialty Snacks Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 22: Global Specialty Snacks Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Specialty Snacks Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: China Specialty Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Specialty Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: India Specialty Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Australia Specialty Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Specialty Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Specialty Snacks Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 30: Global Specialty Snacks Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 31: Global Specialty Snacks Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Brazil Specialty Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Specialty Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Specialty Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Specialty Snacks Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 36: Global Specialty Snacks Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global Specialty Snacks Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: South Africa Specialty Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Saudi Arabia Specialty Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Specialty Snacks Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Specialty Snacks Market?

The projected CAGR is approximately 6.45%.

2. Which companies are prominent players in the Specialty Snacks Market?

Key companies in the market include Nestle SA, The Kellogg Company, General Mills Inc, PepsiCo Inc, Intersnack Group GmbH, Conagra Brands Inc (SlimJim), Blue Diamond Growers, Mars Incorporated, The Kraft Heinz Company, Mondelez International.

3. What are the main segments of the Specialty Snacks Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 87.23 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Sports Participation; Increasing Awareness about Health and Fitness.

6. What are the notable trends driving market growth?

Growing Demand for Convenient and Healthy Snacking.

7. Are there any restraints impacting market growth?

Adverse Effects of Overconsumption of Products.

8. Can you provide examples of recent developments in the market?

May 2022: Mondelez International acquired Chipita Global SA, a high-growth leader in the Central and Eastern European croissants and baked snacks market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Specialty Snacks Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Specialty Snacks Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Specialty Snacks Market?

To stay informed about further developments, trends, and reports in the Specialty Snacks Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence