Key Insights

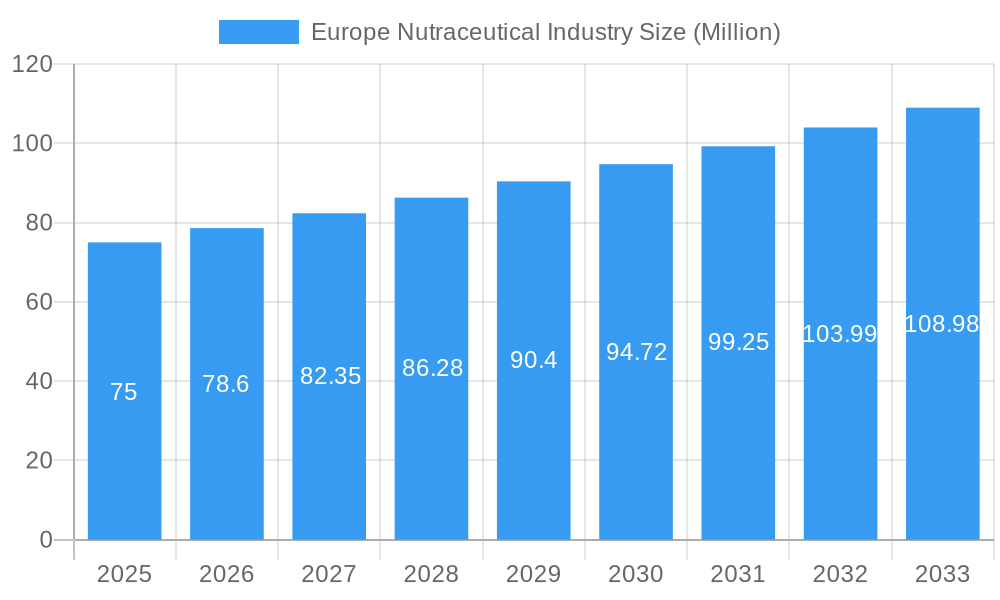

The European nutraceutical market is poised for robust expansion, projected to reach a substantial market size of €83.88 million with a Compound Annual Growth Rate (CAGR) of 4.91% from 2019 to 2033. This growth trajectory is underpinned by escalating consumer awareness regarding preventative healthcare and the role of nutrition in overall well-being. A significant driver for this market is the increasing demand for functional foods and beverages, which are increasingly being incorporated into daily diets for their specific health benefits beyond basic nutrition. Dietary supplements also continue to be a cornerstone, catering to a wide range of health concerns from immune support to cognitive function and athletic performance. The distribution landscape is rapidly evolving, with online retail stores emerging as a dominant force, offering unparalleled convenience and accessibility to a broad consumer base. Supermarkets and hypermarkets, alongside specialty stores, also maintain a strong presence, catering to diverse shopping preferences. Key players like Nestlé, PepsiCo, and The Coca-Cola Company are actively innovating and expanding their portfolios to capture market share in this dynamic sector.

Europe Nutraceutical Industry Market Size (In Million)

The European nutraceutical industry is characterized by a strong emphasis on innovation and product development, driven by a growing preference for natural and scientifically backed health solutions. Trends such as personalized nutrition, plant-based ingredients, and the integration of probiotics and prebiotics are gaining significant traction. Consumers are actively seeking products that offer tangible health benefits, leading to a surge in demand for functional ingredients that address specific health needs like gut health, immune boosting, and stress management. While the market exhibits strong growth potential, certain restraints, such as stringent regulatory frameworks for health claims and intense competition, necessitate strategic approaches from market participants. However, the overarching consumer shift towards proactive health management and the continued scientific validation of nutraceutical benefits are expected to propel the market forward, ensuring its sustained and impressive growth over the forecast period.

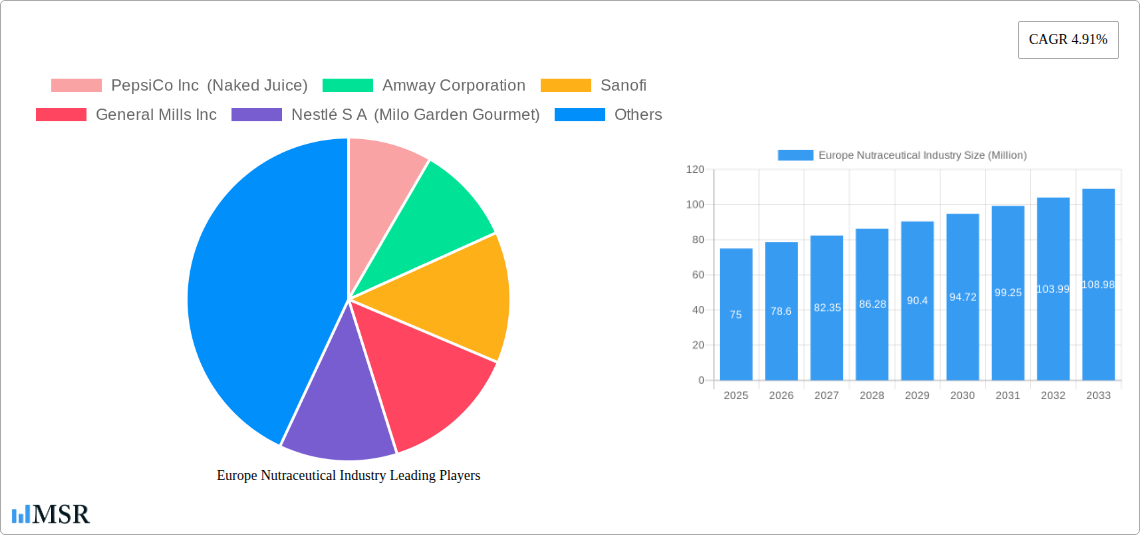

Europe Nutraceutical Industry Company Market Share

Europe Nutraceutical Industry Market: In-depth Analysis and Future Forecast (2019-2033)

Unlock unparalleled insights into the dynamic European nutraceutical market with this comprehensive report. Covering the study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period from 2025 to 2033, this report provides critical data and actionable intelligence for stakeholders seeking to capitalize on this high-growth sector. Dive deep into market size, CAGR, segmentation, competitive landscape, and emerging trends shaping the future of functional foods, beverages, and dietary supplements across Europe.

Europe Nutraceutical Industry Market Concentration & Dynamics

The European nutraceutical industry, projected to reach xx Million by 2025, is characterized by a moderate to high level of market concentration, with several key players holding significant market share. Innovation ecosystems are thriving, driven by increasing R&D investments and a growing demand for science-backed health solutions. Regulatory frameworks, while evolving, are generally supportive of product development, focusing on consumer safety and efficacy. Substitute products, primarily traditional pharmaceuticals and less fortified foods, pose a constant challenge, necessitating continuous innovation and clear value proposition from nutraceutical manufacturers. End-user trends are heavily influenced by growing health consciousness, an aging population, and a desire for preventive healthcare, driving demand for products targeting specific health concerns like immunity, cognitive function, and gut health. Mergers and acquisition (M&A) activities are notable, with an estimated xx M&A deals in the historical period, indicating a trend towards consolidation and strategic partnerships aimed at expanding product portfolios and market reach. For instance, the partnership between Bioiberica and Apsen for mobility products exemplifies strategic collaboration to tap into specific market needs.

Europe Nutraceutical Industry Industry Insights & Trends

The European nutraceutical industry is poised for robust expansion, driven by an escalating demand for health and wellness products across the continent. The market size was valued at approximately xx Million in 2024 and is anticipated to grow at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025–2033. This growth is fueled by a confluence of factors, including a growing aging population seeking to maintain vitality and prevent age-related ailments, heightened consumer awareness regarding the link between diet and health, and a proactive approach to disease prevention. Technological disruptions are playing a pivotal role, with advancements in ingredient science, bioavailability enhancement, and personalized nutrition paving the way for more effective and targeted nutraceutical solutions. For example, the launch of DFE Pharma's Nutrofeli starch portfolio highlights innovation in excipients for improved supplement formulation. Evolving consumer behaviors, such as the increasing preference for natural and plant-based ingredients, sustainable sourcing, and transparent labeling, are compelling manufacturers to reformulate and innovate. The rise of e-commerce and direct-to-consumer models further empowers consumers, providing them with greater access to a wider range of nutraceutical products and personalized recommendations. The COVID-19 pandemic significantly accelerated the focus on immunity-boosting ingredients and overall well-being, creating a sustained demand for immune support products. Furthermore, the growing prevalence of chronic diseases is pushing individuals towards dietary interventions, positioning nutraceuticals as a crucial component of a holistic health strategy. The development of novel delivery systems, such as gummies and chewables, is also catering to specific consumer preferences for convenience and palatability.

Key Markets & Segments Leading Europe Nutraceutical Industry

The Functional Beverage segment is emerging as a dominant force within the European nutraceutical industry, exhibiting significant growth and market penetration. Within this segment, the Online Retail Stores distribution channel is experiencing rapid expansion, driven by convenience and the increasing digital adoption by consumers across all age groups.

Functional Beverage Dominance: Functional beverages, encompassing everything from fortified juices and smoothies to enhanced water and sports drinks, are captivating European consumers due to their dual benefit of hydration and targeted health advantages. The increasing consumer desire for convenient ways to consume essential nutrients and active compounds without altering their daily routines is a primary driver. The market size for functional beverages in Europe is projected to reach xx Million by 2025.

- Drivers:

- Growing demand for convenient health solutions.

- Innovations in flavor profiles and ingredient combinations.

- Targeted marketing towards specific health needs (e.g., energy, relaxation, immunity).

- Increasing availability in mainstream retail and hospitality sectors.

- Drivers:

Online Retail Stores as a Key Channel: The digital transformation of retail has significantly impacted the nutraceutical sector. Online retail stores offer unparalleled accessibility, a vast product selection, competitive pricing, and personalized shopping experiences, making them a preferred channel for many European consumers. This channel is particularly instrumental in reaching niche markets and consumers seeking specialized nutraceutical products. The market share for online retail in the nutraceuticals is estimated to reach xx% by 2025.

- Drivers:

- Widespread internet and smartphone penetration.

- User-friendly e-commerce platforms and mobile apps.

- Efficient logistics and home delivery networks.

- Personalized recommendations and subscription models.

- Increased consumer trust in online purchasing.

- Drivers:

While Functional Beverages and Online Retail Stores are leading, other segments and channels are also contributing to the overall growth:

Product Type:

- Dietary Supplements: Remain a cornerstone of the nutraceutical market, offering concentrated doses of vitamins, minerals, herbs, and other beneficial compounds. Growth is sustained by a focus on specific health needs and preventative care.

- Functional Food: Includes products fortified with beneficial ingredients like probiotics, omega-3 fatty acids, and fiber, integrated into everyday foods such as cereals, dairy products, and baked goods.

Distribution Channel:

- Supermarkets/Hypermarkets: Continue to be a major distribution point, offering convenience and accessibility for a broad consumer base.

- Speciality Stores: Cater to consumers seeking niche or premium nutraceutical products, often providing expert advice and a curated selection.

- Convenience Stores: Emerging as a channel for on-the-go healthy options, including functional beverages and small-format supplements.

- Other Distribution Channels: Include direct sales, pharmacies, and health clinics, which cater to specific consumer needs and professional recommendations.

Europe Nutraceutical Industry Product Developments

Product innovation is a key differentiator in the competitive European nutraceutical landscape. Recent developments highlight a strong focus on leveraging natural, scientifically-backed ingredients for enhanced health benefits. For example, Bioiberica’s partnership with Apsen for mobility products underscores the trend towards targeted solutions for joint health, utilizing innovative ingredients like b-2 Cool native type II collagen and Mobilee. Simultaneously, DFE Pharma's expansion into nutraceutical excipients with the Nutrofeli starch portfolio indicates an industry-wide effort to improve the efficacy and delivery of supplements. Nexira's launch of Heptura, an ingredient for hepatoprotection and detoxification derived from natural sources, further exemplifies the commitment to natural solutions for vitality and immune system support. These developments reflect a market driven by technological advancements in ingredient sourcing, formulation, and a growing consumer demand for effective and natural health aids.

Challenges in the Europe Nutraceutical Industry Market

The European nutraceutical market faces several significant challenges that can impact growth and market penetration. Regulatory hurdles, including varying approval processes across different EU member states and stringent labeling requirements, can slow down product launches and increase compliance costs, estimated to impact xx% of new product introductions. Supply chain disruptions, as evidenced by global events, can lead to ingredient shortages and price volatility, affecting production timelines and profitability. Competitive pressures from both established pharmaceutical companies venturing into the wellness space and a multitude of smaller, agile players can fragment the market and necessitate aggressive marketing strategies. Furthermore, consumer skepticism due to unsubstantiated health claims or past product recalls can hinder market adoption, with an estimated xx% of consumers expressing concerns about product authenticity.

Forces Driving Europe Nutraceutical Industry Growth

The growth of the European nutraceutical industry is propelled by a powerful combination of technological, economic, and regulatory forces. Technological advancements in food science and biotechnology are enabling the development of novel ingredients with enhanced bioavailability and efficacy, such as advanced probiotic strains and personalized nutrient formulations. Economically, rising disposable incomes and a growing middle class across Europe translate to increased consumer spending on health and wellness products. The regulatory environment, while presenting challenges, also fosters growth by providing clear guidelines for product development and safety, thereby building consumer trust. Government initiatives promoting healthy lifestyles and disease prevention further support the market. The increasing prevalence of lifestyle-related diseases also creates a sustained demand for preventative and supportive health solutions.

Challenges in the Europe Nutraceutical Industry Market

Long-term growth catalysts for the European nutraceutical market are rooted in sustained innovation and strategic market expansions. The continuous exploration of new bioactive compounds from natural sources, coupled with rigorous scientific validation, will foster the development of next-generation health solutions. Strategic partnerships between ingredient suppliers, manufacturers, and research institutions are crucial for accelerating R&D and ensuring the scientific credibility of products. Furthermore, the increasing penetration of e-commerce and direct-to-consumer channels presents significant opportunities for market expansion, allowing companies to reach underserved demographics and offer personalized experiences. The growing global focus on preventative healthcare and the aging population worldwide will continue to drive demand for effective nutraceuticals.

Emerging Opportunities in Europe Nutraceutical Industry

Emerging opportunities in the European nutraceutical industry are abundant, driven by evolving consumer preferences and technological advancements. The growing demand for personalized nutrition, leveraging genetic testing and AI-driven insights, offers a significant avenue for growth. Furthermore, the increasing consumer interest in sustainable and ethically sourced ingredients presents an opportunity for brands to differentiate themselves. The expansion of nutraceutical applications into new areas such as mental well-being, sleep support, and sports recovery is creating untapped market potential. The integration of blockchain technology for enhanced supply chain transparency and traceability is also an emerging trend that can build greater consumer trust. Finally, the growing awareness of the gut-brain axis and its impact on overall health is opening new frontiers for probiotic and prebiotic innovations.

Leading Players in the Europe Nutraceutical Industry Sector

- PepsiCo Inc (Naked Juice)

- Amway Corporation

- Sanofi

- General Mills Inc

- Nestlé S A (Milo Garden Gourmet)

- Nutraceuticals Group*List Not Exhaustive

- The Coca-Cola Company (Aquarius)

- The Kraft Heinz Company

- The Kellogg's Company (Morningstar)

- Herbalife Nutrition U S

- Nature's Bounty Inc (Sundown Ester-C Solgar)

- Bioiberica

Key Milestones in Europe Nutraceutical Industry Industry

- April 2022: Bioiberica, a global life science company based in Spain, partnered with multinational health and pharmaceutical expert Apsen to develop innovative mobility products for the Brazilian market. Apsen's Motilex HA combines two of Bioiberica's leading joint health ingredients, b-2 Cool native type II collagen and Mobilee.

- January 2022: DFE Pharma, a German company, expanded its nutraceutical excipient offering with the launch of the Nutrofeli starch portfolio, comprising Nutrofeli ST100 (native starch), Nutrofeli ST200 (partially pregelatinized starch) and Nutrofeli ST300 (fully gelatinized starch).

- October 2021: Nexira launched Heptura, a new ingredient for hepatoprotection and detoxification. Heptura is an organic combination of Immortelle and Clove from the rocky and sunny lands of the Corsican maquis in France. A detox can help maintain energy and vitality and strengthen the immune system.

Strategic Outlook for Europe Nutraceutical Industry Market

The strategic outlook for the Europe nutraceutical industry remains exceptionally positive, with key growth accelerators anticipated to drive significant expansion. The increasing consumer demand for personalized nutrition solutions, coupled with advancements in scientific research, will empower companies to offer highly tailored products addressing specific health needs. Strategic collaborations between ingredient innovators, manufacturers, and technology providers will be crucial in developing and scaling novel formulations and delivery systems. Furthermore, the continued growth of online retail channels presents a significant opportunity for direct-to-consumer engagement, allowing for data-driven insights and customized marketing strategies. The focus on sustainability and ethical sourcing will also become a pivotal differentiator, appealing to a growing segment of environmentally conscious consumers. Proactive engagement with regulatory bodies to ensure clear pathways for innovation and product approval will be essential for sustained market access and growth.

Europe Nutraceutical Industry Segmentation

-

1. Product Type

- 1.1. Functional Food

- 1.2. Functional Beverage

- 1.3. Dietary Supplement

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Speciality Stores

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

Europe Nutraceutical Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

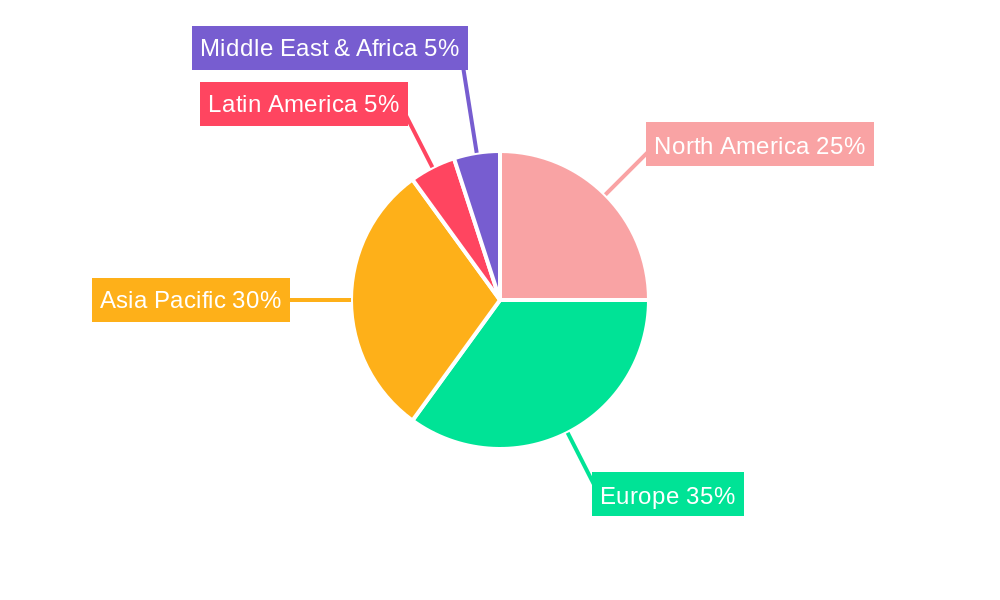

Europe Nutraceutical Industry Regional Market Share

Geographic Coverage of Europe Nutraceutical Industry

Europe Nutraceutical Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.91% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Consumption of Convenience Food in the Region; Increasing Demand for Gluten-free Pasta and Noodles

- 3.3. Market Restrains

- 3.3.1. Growing Competition from Other Convenience Foods

- 3.4. Market Trends

- 3.4.1. Germany Dominates the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Nutraceutical Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Functional Food

- 5.1.2. Functional Beverage

- 5.1.3. Dietary Supplement

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Speciality Stores

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PepsiCo Inc (Naked Juice)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Amway Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sanofi

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 General Mills Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nestlé S A (Milo Garden Gourmet)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nutraceuticals Group*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 The Coca-Cola Company (Aquarius)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 The Kraft Heinz Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 The Kellogg's Company (Morningstar)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Herbalife Nutrition U S

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Nature's Bounty Inc (Sundown Ester-C Solgar)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Bioiberica

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 PepsiCo Inc (Naked Juice)

List of Figures

- Figure 1: Europe Nutraceutical Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Nutraceutical Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Nutraceutical Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Europe Nutraceutical Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Europe Nutraceutical Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Nutraceutical Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Europe Nutraceutical Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Europe Nutraceutical Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Nutraceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Nutraceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: France Europe Nutraceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Nutraceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Nutraceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Nutraceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Nutraceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Nutraceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Nutraceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Nutraceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Nutraceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Nutraceutical Industry?

The projected CAGR is approximately 4.91%.

2. Which companies are prominent players in the Europe Nutraceutical Industry?

Key companies in the market include PepsiCo Inc (Naked Juice), Amway Corporation, Sanofi, General Mills Inc, Nestlé S A (Milo Garden Gourmet), Nutraceuticals Group*List Not Exhaustive, The Coca-Cola Company (Aquarius), The Kraft Heinz Company, The Kellogg's Company (Morningstar), Herbalife Nutrition U S, Nature's Bounty Inc (Sundown Ester-C Solgar), Bioiberica.

3. What are the main segments of the Europe Nutraceutical Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 83.88 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Consumption of Convenience Food in the Region; Increasing Demand for Gluten-free Pasta and Noodles.

6. What are the notable trends driving market growth?

Germany Dominates the Market.

7. Are there any restraints impacting market growth?

Growing Competition from Other Convenience Foods.

8. Can you provide examples of recent developments in the market?

April 2022: Bioiberica, a global life science company based in Spain, partnered with multinational health and pharmaceutical expert Apsen to develop innovative mobility products for the Brazilian market. Apsen's Motilex HA combines two of Bioiberica's leading joint health ingredients, b-2 Cool native type II collagen and Mobilee.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Nutraceutical Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Nutraceutical Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Nutraceutical Industry?

To stay informed about further developments, trends, and reports in the Europe Nutraceutical Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence