Key Insights

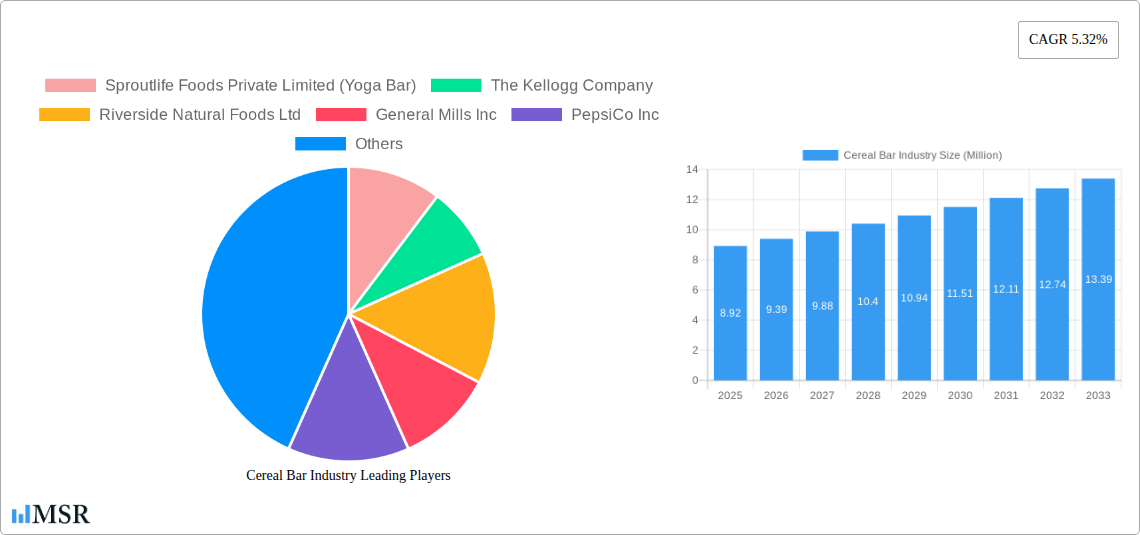

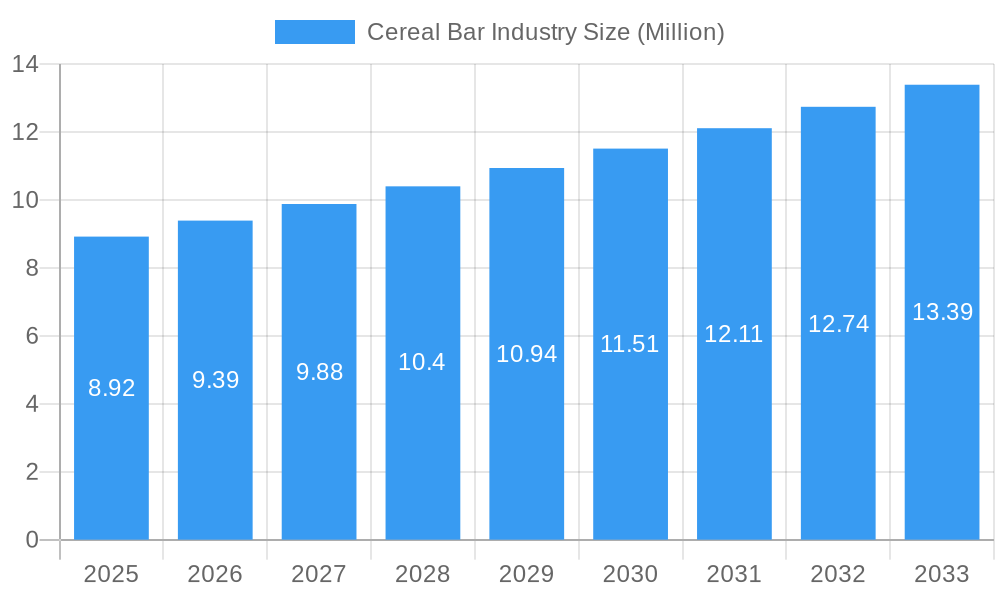

The global Cereal Bar market is poised for robust growth, projected to reach approximately USD 8.92 million by 2025, with a compound annual growth rate (CAGR) of 5.32% anticipated throughout the forecast period of 2025-2033. This expansion is primarily driven by a confluence of evolving consumer lifestyles, a growing emphasis on health and wellness, and the increasing demand for convenient, on-the-go nutrition. Consumers are actively seeking healthier snack alternatives to traditional confectionery, and cereal bars, with their perceived nutritional benefits and customizable ingredient profiles, are perfectly positioned to capitalize on this trend. The "on-the-go" consumption pattern, fueled by busy schedules and an active lifestyle, further solidifies the market's upward trajectory. Innovations in product formulations, incorporating superfoods, plant-based proteins, and allergen-free options, are also attracting a wider consumer base, including health-conscious individuals and those with specific dietary needs. The burgeoning online retail sector is playing a pivotal role in enhancing accessibility and expanding the market reach of various cereal bar brands, making it easier for consumers to discover and purchase their preferred products.

Cereal Bar Industry Market Size (In Million)

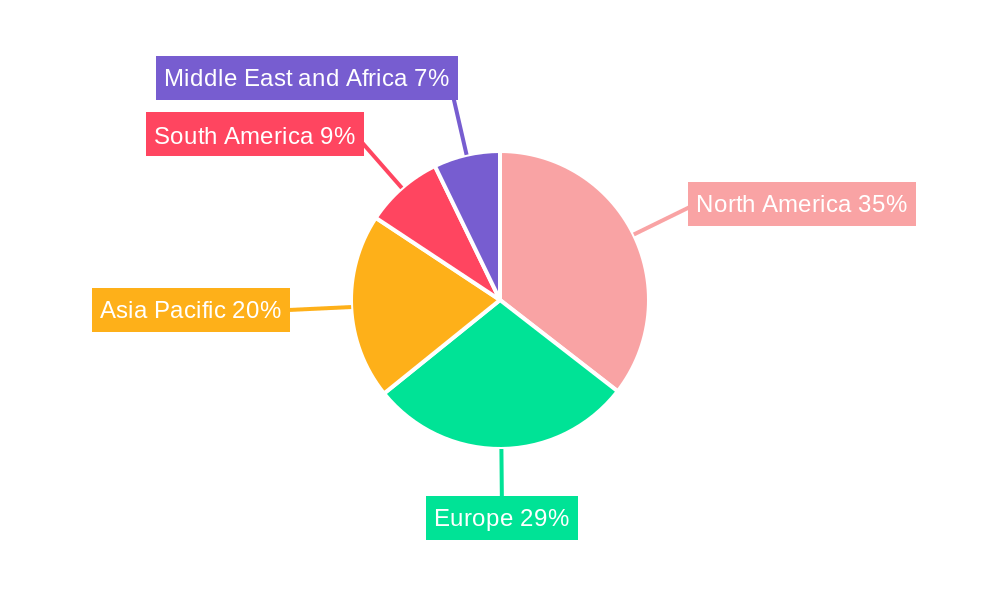

While the market exhibits strong growth potential, certain factors can influence its pace. The "other bars" segment, encompassing a diverse range of extruded cereal, protein, and energy bars, is expected to witness significant traction as manufacturers increasingly focus on specialized formulations catering to specific performance or dietary goals. This diversification within the product landscape is a key trend. However, the competitive intensity within the market, coupled with potential fluctuations in raw material costs, could present some restraints. Major players like Sproutlife Foods Private Limited (Yoga Bar), The Kellogg Company, General Mills Inc., and PepsiCo Inc. are actively engaged in product innovation, strategic partnerships, and market expansion to capture a larger share. The Asia Pacific region, with its rapidly growing middle class and increasing disposable incomes, is emerging as a particularly lucrative market, alongside established regions like North America and Europe. The shift towards healthier snacking habits is a pervasive global trend that underpins the sustained growth of the cereal bar industry.

Cereal Bar Industry Company Market Share

Here is the SEO-optimized, engaging report description for the Cereal Bar Industry, incorporating your requirements:

Uncover the Future of Snacking: In-Depth Cereal Bar Industry Market Report (2019-2033)

Dive into a comprehensive analysis of the global Cereal Bar Industry with our definitive market report. Spanning a critical study period from 2019 to 2033, with a base and estimated year of 2025, this report provides unparalleled insights into market dynamics, growth catalysts, and future opportunities. Essential for food manufacturers, ingredient suppliers, retailers, investors, and market analysts, this report offers actionable intelligence to navigate the competitive landscape of convenient and healthy snacking. Explore market share valuations in the hundreds of millions, understand evolving consumer preferences for granola bars, muesli bars, and healthy snack options, and identify key players driving innovation.

Cereal Bar Industry Market Concentration & Dynamics

The Cereal Bar Industry exhibits a moderate to high level of market concentration, with several global giants and specialized manufacturers vying for dominance. Innovation remains a critical differentiator, driving the development of healthier formulations, novel flavor profiles, and sustainable packaging solutions. Regulatory frameworks primarily focus on food safety, labeling accuracy, and nutritional claims, influencing product development and marketing strategies. Substitute products, including other convenient snacks like energy bars, protein bars, and fruit snacks, continuously challenge the market share of traditional cereal bars. End-user trends are increasingly shifting towards health-conscious choices, demanding low-sugar, high-fiber, and plant-based options. Merger and acquisition (M&A) activities are strategic, often aimed at expanding product portfolios, gaining market access in new regions, or acquiring innovative technologies. For instance, recent M&A activities indicate a trend towards consolidation and strategic partnerships, with an estimated xx M&A deals in the historical period, underscoring the industry's dynamic nature.

Cereal Bar Industry Industry Insights & Trends

The Cereal Bar Industry is poised for significant expansion, driven by a confluence of factors including rising health and wellness consciousness globally, increasing demand for convenient and on-the-go food options, and a growing preference for natural and minimally processed ingredients. The global market size for cereal bars is projected to reach an impressive $XX Billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. Technological disruptions are playing a pivotal role, from advanced processing techniques that enhance texture and shelf-life to the integration of smart packaging solutions that communicate nutritional information. Evolving consumer behaviors are a cornerstone of this growth; consumers are actively seeking dietary-specific bars such as gluten-free, vegan, and keto-friendly options, alongside those offering functional benefits like added protein, probiotics, or cognitive enhancers. The rise of the “flexitarian” diet and a general move away from processed sugars are further fueling innovation in sugar-free and naturally sweetened cereal bars. Furthermore, the proliferation of e-commerce channels has democratized access, enabling smaller brands to reach wider audiences and increasing the availability of niche and specialized products. This dynamic landscape presents substantial opportunities for companies that can adapt to these shifting consumer paradigms and leverage technological advancements.

Key Markets & Segments Leading Cereal Bar Industry

The Supermarkets/Hypermarkets distribution channel currently dominates the Cereal Bar Industry, capturing an estimated XX% of the market share. This dominance is attributed to their broad reach, ability to cater to diverse consumer demographics, and prime shelf placement for impulse purchases. However, the Online Retail Stores segment is experiencing robust growth, with an anticipated CAGR of XX% during the forecast period, driven by convenience and an expanding selection of specialized and international brands.

- Dominant Product Type:

- Granola/Muesli Bars: This segment leads due to their established reputation for wholesome ingredients and perceived health benefits. Growth is fueled by increasing consumer demand for fiber-rich and naturally sweetened options. Key drivers include:

- Growing awareness of digestive health.

- Perception as a healthier alternative to traditional confectionery.

- Versatility in flavor combinations and ingredient inclusions.

- Granola/Muesli Bars: This segment leads due to their established reputation for wholesome ingredients and perceived health benefits. Growth is fueled by increasing consumer demand for fiber-rich and naturally sweetened options. Key drivers include:

- Leading Distribution Channels:

- Supermarkets/Hypermarkets:

- Drivers: Wide accessibility, bulk purchase options, promotional strategies, and established customer loyalty.

- Dominance Analysis: These channels offer a one-stop shopping experience, making them the primary destination for household grocery needs, including breakfast and snack items like cereal bars. Retailer partnerships and strategic product placement significantly influence sales volumes.

- Online Retail Stores:

- Drivers: Convenience, wider product assortment, personalized recommendations, and competitive pricing.

- Dominance Analysis: The surge in e-commerce adoption, particularly post-pandemic, has accelerated the growth of online sales. Subscription models and direct-to-consumer (DTC) strategies are further bolstering this segment.

- Supermarkets/Hypermarkets:

Cereal Bar Industry Product Developments

Product innovation in the Cereal Bar Industry is characterized by a strong emphasis on health-conscious formulations and diverse flavor experiences. Companies are actively developing bars with reduced sugar content, incorporating natural sweeteners like stevia and monk fruit, and increasing fiber and protein inclusion to cater to the wellness trend. The launch of bars with functional ingredients, such as adaptogens, probiotics, and omega-3 fatty acids, signifies a move towards personalized nutrition. Furthermore, advancements in texture technology are creating more appealing and satisfying bar options, differentiating them from competitors and offering a competitive edge in a crowded market.

Challenges in the Cereal Bar Industry Market

The Cereal Bar Industry faces several significant challenges. Intense competition from a multitude of brands, including both established players and emerging startups, can lead to price wars and squeezed profit margins. Fluctuations in the cost of key raw materials, such as oats, nuts, and fruits, can impact production costs and necessitate price adjustments. Evolving consumer perceptions and scrutiny regarding sugar content and the “health halo” effect of some cereal bars can lead to market shifts. Additionally, stringent regulatory requirements for food labeling and nutritional claims, particularly across different international markets, add complexity. Quantifiable impacts include potential revenue loss due to negative publicity surrounding specific ingredients or health claims.

Forces Driving Cereal Bar Industry Growth

The primary forces driving Cereal Bar Industry growth include the escalating global health and wellness trend, leading consumers to seek convenient and nutritious snack alternatives. The increasing demand for on-the-go food solutions, driven by busy lifestyles and urbanisation, plays a crucial role. Technological advancements in food processing and ingredient innovation allow for the creation of more appealing and functional cereal bars. Economic growth in emerging markets is also contributing by increasing disposable incomes and consumer spending on packaged foods. Furthermore, strategic marketing campaigns highlighting the health benefits and convenience of cereal bars are effectively stimulating demand.

Challenges in the Cereal Bar Industry Market

Long-term growth catalysts for the Cereal Bar Industry lie in continuous product innovation that aligns with evolving consumer preferences for natural ingredients, reduced sugar, and functional benefits. Strategic partnerships and collaborations, such as the recent alliance between World of Sweets and Mondelez International for the Clif brand, are crucial for market expansion and brand visibility. Market expansions into underserved regions and the development of niche product lines catering to specific dietary needs (e.g., allergen-free, plant-based) will be key to sustained growth. Furthermore, investing in sustainable sourcing and packaging initiatives can enhance brand reputation and appeal to environmentally conscious consumers.

Emerging Opportunities in Cereal Bar Industry

Emerging opportunities in the Cereal Bar Industry are abundant, particularly in the realm of personalized nutrition and specialized functional ingredients. The growing popularity of plant-based and vegan diets presents a significant opening for innovative vegan cereal bars. The demand for bars with added health benefits, such as cognitive support, immune boosting, and stress reduction, is expanding rapidly. Furthermore, tapping into emerging markets with tailored product offerings and localized flavors can unlock substantial growth potential. The rise of subscription boxes and direct-to-consumer models offers a direct channel to engage with consumers and build brand loyalty.

Leading Players in the Cereal Bar Industry Sector

- Sproutlife Foods Private Limited (Yoga Bar)

- The Kellogg Company

- Riverside Natural Foods Ltd

- General Mills Inc

- PepsiCo Inc

- Associated British Foods PLC

- Mars Incorporated

- Mondelēz International Inc

- NuGo Nutrition

- McKee Foods Corporation

Key Milestones in Cereal Bar Industry Industry

- March 2024: World of Sweets partnered and collaborated with Mondelez International to grow the American-born Clif brand, supplying retailers with their products.

- January 2024: McKee Foods added Sunbelt Bakery chewy granola bars with a sell-by date code to the vending industry. The company launched its granola bars in three flavors, including classic chocolate chip, tasty oats & honey, and delicious fudge dipped chocolate chip. Additionally, McKee Foods claims that these products are self-stable and are individually wrapped.

- January 2024: Mars China announced another significant step toward sustainable packaging with the launch of its SNICKERS bar with dark chocolate cereal. The new product not only offers a low-sugar and low-glycemic index (GI) option for consumers but also features individual packaging made from a mono-PP material, meaning it can be more easily recycled in designated channels.

Strategic Outlook for Cereal Bar Industry Market

The strategic outlook for the Cereal Bar Industry is highly positive, fueled by continuous innovation and evolving consumer demand for healthier, convenient, and functional food options. Key growth accelerators include the expansion of product lines to cater to specific dietary needs, such as keto, paleo, and plant-based diets, and the integration of novel ingredients offering enhanced nutritional and health benefits. Strategic focus on sustainable sourcing and eco-friendly packaging will be critical for brand differentiation and consumer loyalty. Furthermore, leveraging digital channels for direct-to-consumer sales and personalized marketing campaigns will be essential for capturing market share and fostering long-term growth.

Cereal Bar Industry Segmentation

-

1. Product Type

- 1.1. Granola/Muesli Bars

- 1.2. Other Bars

-

2. Distribution Channel

- 2.1. Convenience Stores

- 2.2. Supermarkets/Hypermarkets

- 2.3. Specialty Stores

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

Cereal Bar Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Netherlands

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. United Arab Emirates

- 5.3. Rest of Middle East and Africa

Cereal Bar Industry Regional Market Share

Geographic Coverage of Cereal Bar Industry

Cereal Bar Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.32% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Popularity of On-the-Go Snacking Options; Trend Of Clean Label and Plant-Based Bars

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Rising Demand for On-the-go and Small-portion Snacking

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cereal Bar Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Granola/Muesli Bars

- 5.1.2. Other Bars

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Convenience Stores

- 5.2.2. Supermarkets/Hypermarkets

- 5.2.3. Specialty Stores

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Cereal Bar Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Granola/Muesli Bars

- 6.1.2. Other Bars

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Convenience Stores

- 6.2.2. Supermarkets/Hypermarkets

- 6.2.3. Specialty Stores

- 6.2.4. Online Retail Stores

- 6.2.5. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Cereal Bar Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Granola/Muesli Bars

- 7.1.2. Other Bars

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Convenience Stores

- 7.2.2. Supermarkets/Hypermarkets

- 7.2.3. Specialty Stores

- 7.2.4. Online Retail Stores

- 7.2.5. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Cereal Bar Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Granola/Muesli Bars

- 8.1.2. Other Bars

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Convenience Stores

- 8.2.2. Supermarkets/Hypermarkets

- 8.2.3. Specialty Stores

- 8.2.4. Online Retail Stores

- 8.2.5. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Cereal Bar Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Granola/Muesli Bars

- 9.1.2. Other Bars

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Convenience Stores

- 9.2.2. Supermarkets/Hypermarkets

- 9.2.3. Specialty Stores

- 9.2.4. Online Retail Stores

- 9.2.5. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Cereal Bar Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Granola/Muesli Bars

- 10.1.2. Other Bars

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Convenience Stores

- 10.2.2. Supermarkets/Hypermarkets

- 10.2.3. Specialty Stores

- 10.2.4. Online Retail Stores

- 10.2.5. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. North America Cereal Bar Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 11.1.4 Rest of North America

- 12. Europe Cereal Bar Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Spain

- 12.1.2 United Kingdom

- 12.1.3 Germany

- 12.1.4 France

- 12.1.5 Italy

- 12.1.6 Netherlands

- 12.1.7 Rest of Europe

- 13. Asia Pacific Cereal Bar Industry Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 Rest of Asia Pacific

- 14. South America Cereal Bar Industry Analysis, Insights and Forecast, 2020-2032

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Rest of South America

- 15. Middle East and Africa Cereal Bar Industry Analysis, Insights and Forecast, 2020-2032

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 South Africa

- 15.1.2 United Arab Emirates

- 15.1.3 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2025

- 16.2. Company Profiles

- 16.2.1 Sproutlife Foods Private Limited (Yoga Bar)

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 The Kellogg Company

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Riverside Natural Foods Ltd

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 General Mills Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 PepsiCo Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Associated British Foods PLC*List Not Exhaustive

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Mars Incorporated

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Mondelēz International Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 NuGo Nutrition

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 McKee Foods Corporation

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Sproutlife Foods Private Limited (Yoga Bar)

List of Figures

- Figure 1: Global Cereal Bar Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Cereal Bar Industry Revenue (Million), by Country 2025 & 2033

- Figure 3: North America Cereal Bar Industry Revenue Share (%), by Country 2025 & 2033

- Figure 4: Europe Cereal Bar Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: Europe Cereal Bar Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Asia Pacific Cereal Bar Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Cereal Bar Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Cereal Bar Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: South America Cereal Bar Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Middle East and Africa Cereal Bar Industry Revenue (Million), by Country 2025 & 2033

- Figure 11: Middle East and Africa Cereal Bar Industry Revenue Share (%), by Country 2025 & 2033

- Figure 12: North America Cereal Bar Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 13: North America Cereal Bar Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 14: North America Cereal Bar Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 15: North America Cereal Bar Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: North America Cereal Bar Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: North America Cereal Bar Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Cereal Bar Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 19: Europe Cereal Bar Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Europe Cereal Bar Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 21: Europe Cereal Bar Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: Europe Cereal Bar Industry Revenue (Million), by Country 2025 & 2033

- Figure 23: Europe Cereal Bar Industry Revenue Share (%), by Country 2025 & 2033

- Figure 24: Asia Pacific Cereal Bar Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 25: Asia Pacific Cereal Bar Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 26: Asia Pacific Cereal Bar Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 27: Asia Pacific Cereal Bar Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 28: Asia Pacific Cereal Bar Industry Revenue (Million), by Country 2025 & 2033

- Figure 29: Asia Pacific Cereal Bar Industry Revenue Share (%), by Country 2025 & 2033

- Figure 30: South America Cereal Bar Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 31: South America Cereal Bar Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 32: South America Cereal Bar Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 33: South America Cereal Bar Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 34: South America Cereal Bar Industry Revenue (Million), by Country 2025 & 2033

- Figure 35: South America Cereal Bar Industry Revenue Share (%), by Country 2025 & 2033

- Figure 36: Middle East and Africa Cereal Bar Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 37: Middle East and Africa Cereal Bar Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 38: Middle East and Africa Cereal Bar Industry Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 39: Middle East and Africa Cereal Bar Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Middle East and Africa Cereal Bar Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Cereal Bar Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cereal Bar Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Global Cereal Bar Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: Global Cereal Bar Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Cereal Bar Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Cereal Bar Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 6: United States Cereal Bar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Canada Cereal Bar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Mexico Cereal Bar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Cereal Bar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Cereal Bar Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Spain Cereal Bar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: United Kingdom Cereal Bar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany Cereal Bar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Cereal Bar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Italy Cereal Bar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Netherlands Cereal Bar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Cereal Bar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Cereal Bar Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: China Cereal Bar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan Cereal Bar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: India Cereal Bar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Australia Cereal Bar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Cereal Bar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Cereal Bar Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Brazil Cereal Bar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Argentina Cereal Bar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of South America Cereal Bar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Cereal Bar Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 29: South Africa Cereal Bar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: United Arab Emirates Cereal Bar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East and Africa Cereal Bar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Cereal Bar Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 33: Global Cereal Bar Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 34: Global Cereal Bar Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 35: United States Cereal Bar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Canada Cereal Bar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Mexico Cereal Bar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of North America Cereal Bar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Global Cereal Bar Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 40: Global Cereal Bar Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 41: Global Cereal Bar Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Spain Cereal Bar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: United Kingdom Cereal Bar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Germany Cereal Bar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: France Cereal Bar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Italy Cereal Bar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Netherlands Cereal Bar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Rest of Europe Cereal Bar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: Global Cereal Bar Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 50: Global Cereal Bar Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 51: Global Cereal Bar Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 52: China Cereal Bar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 53: Japan Cereal Bar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: India Cereal Bar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 55: Australia Cereal Bar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Rest of Asia Pacific Cereal Bar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 57: Global Cereal Bar Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 58: Global Cereal Bar Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 59: Global Cereal Bar Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Brazil Cereal Bar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 61: Argentina Cereal Bar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of South America Cereal Bar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 63: Global Cereal Bar Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 64: Global Cereal Bar Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 65: Global Cereal Bar Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 66: South Africa Cereal Bar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 67: United Arab Emirates Cereal Bar Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: Rest of Middle East and Africa Cereal Bar Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cereal Bar Industry?

The projected CAGR is approximately 5.32%.

2. Which companies are prominent players in the Cereal Bar Industry?

Key companies in the market include Sproutlife Foods Private Limited (Yoga Bar), The Kellogg Company, Riverside Natural Foods Ltd, General Mills Inc, PepsiCo Inc, Associated British Foods PLC*List Not Exhaustive, Mars Incorporated, Mondelēz International Inc, NuGo Nutrition, McKee Foods Corporation.

3. What are the main segments of the Cereal Bar Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.92 Million as of 2022.

5. What are some drivers contributing to market growth?

Popularity of On-the-Go Snacking Options; Trend Of Clean Label and Plant-Based Bars.

6. What are the notable trends driving market growth?

Rising Demand for On-the-go and Small-portion Snacking.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

March 2024: World of Sweets partnered and collaborated with Mondelez International to grow the American-born Clif brand, supplying retailers with their products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cereal Bar Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cereal Bar Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cereal Bar Industry?

To stay informed about further developments, trends, and reports in the Cereal Bar Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence