Key Insights

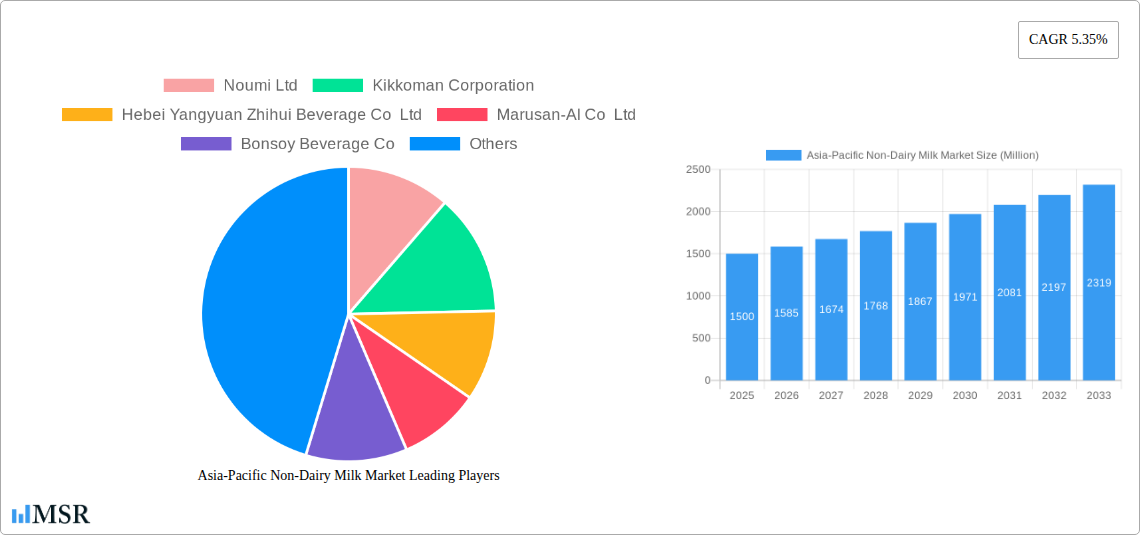

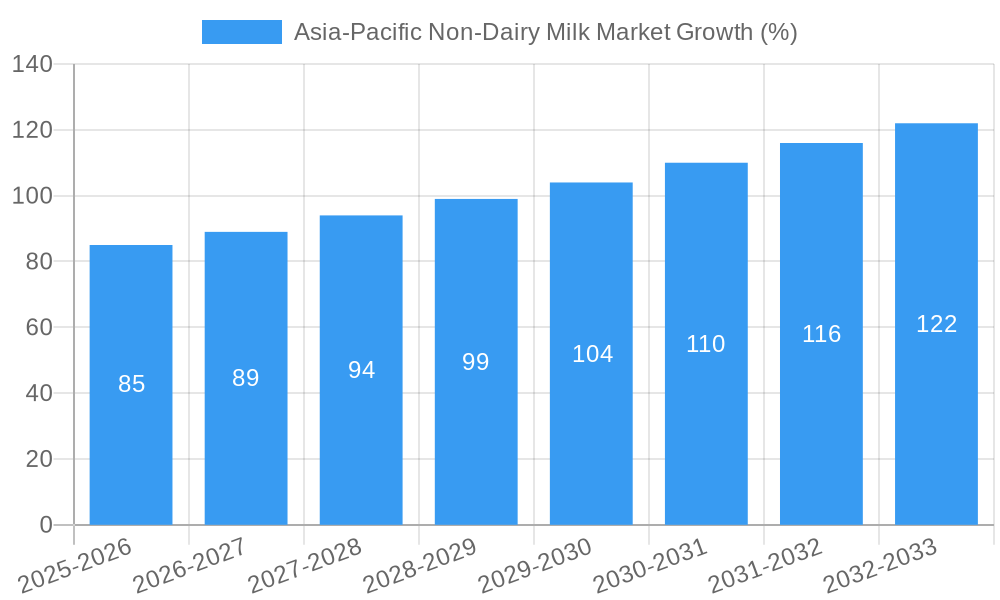

The Asia-Pacific non-dairy milk market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by a CAGR of 5.35% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing awareness of health benefits associated with plant-based diets, particularly among health-conscious consumers, is significantly boosting demand. Secondly, the rising prevalence of lactose intolerance and dairy allergies is creating a substantial consumer base actively seeking alternative milk options. Furthermore, the growing vegan and vegetarian population within the region is acting as a significant catalyst for market growth. The increasing availability of diverse non-dairy milk options, ranging from almond and soy milk to newer entrants like oat and hemp milk, caters to a wider range of consumer preferences and dietary needs. Finally, innovative product development focusing on improved taste and texture, along with functional benefits like added vitamins and proteins, is enhancing the appeal of non-dairy milk alternatives.

However, challenges persist. Price fluctuations in raw materials, particularly for certain nuts and seeds, can impact production costs and market prices. Additionally, consumer perception regarding the taste and nutritional value of certain non-dairy milk types compared to traditional dairy milk may pose a restraint to wider adoption. Nevertheless, the market's growth trajectory is positive, largely driven by the increasing demand for healthier and more sustainable food options. Significant growth is expected across various segments, including oat milk and almond milk, with strong distribution across both on-trade and off-trade channels. Key players such as Oatly Group AB, Vitasoy International Holdings Ltd., and Blue Diamond Growers are actively shaping the market landscape through innovation and strategic expansion. The increasing investment in research and development, focusing on improving the taste, texture, and nutritional profile of non-dairy milk, is further solidifying the market's positive outlook.

Asia-Pacific Non-Dairy Milk Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Asia-Pacific non-dairy milk market, offering valuable insights for industry stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report unveils the market's dynamics, trends, and future potential. The market is segmented by product type (almond milk, cashew milk, coconut milk, hazelnut milk, hemp milk, oat milk, soy milk), distribution channel (on-trade, off-trade, others), and key countries across the Asia-Pacific region (Australia, China, India, Indonesia, Japan, Malaysia, New Zealand, Pakistan, South Korea, and Rest of Asia Pacific). Key players analyzed include Noumi Ltd, Kikkoman Corporation, Hebei Yangyuan Zhihui Beverage Co Ltd, Marusan-AI Co Ltd, Bonsoy Beverage Co, Blue Diamond Growers, Oatly Group AB, Coconut Palm Group Co Ltd, Vitasoy International Holdings Ltd, and The Hershey Company. The report projects a market valued at xx Million in 2025, exhibiting a CAGR of xx% during the forecast period.

Asia-Pacific Non-Dairy Milk Market Market Concentration & Dynamics

The Asia-Pacific non-dairy milk market is characterized by a moderately concentrated landscape, with a few major players holding significant market share. However, the market exhibits high dynamism due to increasing consumer demand, technological advancements, and a surge in new entrants. Innovation is a key driver, with companies continually developing new product formulations and exploring sustainable sourcing practices. Regulatory frameworks, while varying across countries, are increasingly focusing on labeling and food safety standards. Substitute products, such as traditional dairy milk and other plant-based beverages, present competition. End-user trends, driven by health consciousness and ethical concerns, favor plant-based alternatives. M&A activity within the sector remains significant, with several notable acquisitions and partnerships aiming to expand market reach and product portfolios. In 2024, the estimated number of M&A deals in the market was xx. Market share is highly competitive, with the top 5 players estimated to hold approximately xx% in 2024.

- Market Concentration: Moderately concentrated, with increasing competition.

- Innovation: High levels of innovation in product development and sustainability.

- Regulatory Framework: Varies across countries, emphasizing food safety and labeling.

- Substitute Products: Competition from traditional dairy and other plant-based drinks.

- End-User Trends: Growing health and ethical consciousness driving demand.

- M&A Activity: Significant, aiming for expansion and portfolio diversification.

Asia-Pacific Non-Dairy Milk Market Industry Insights & Trends

The Asia-Pacific non-dairy milk market is experiencing robust growth, driven by several key factors. Rising health awareness, increasing preference for plant-based diets, and growing lactose intolerance among consumers are significantly fueling market expansion. Technological advancements in production processes, leading to cost reductions and improved product quality, are also contributing to the market's growth. Consumer behavior is evolving toward healthier and more sustainable choices, further supporting the demand for non-dairy milk alternatives. The market size was estimated at xx Million in 2024, with a projected CAGR of xx% from 2025 to 2033. Several technological disruptions, such as the development of novel processing techniques and the adoption of innovative packaging materials, are shaping the market landscape. Evolving consumer behaviors, driven by increased awareness of health benefits and environmental concerns, are significantly impacting product preferences and purchase patterns.

Key Markets & Segments Leading Asia-Pacific Non-Dairy Milk Market

The Asia-Pacific non-dairy milk market is dominated by several key regions and segments.

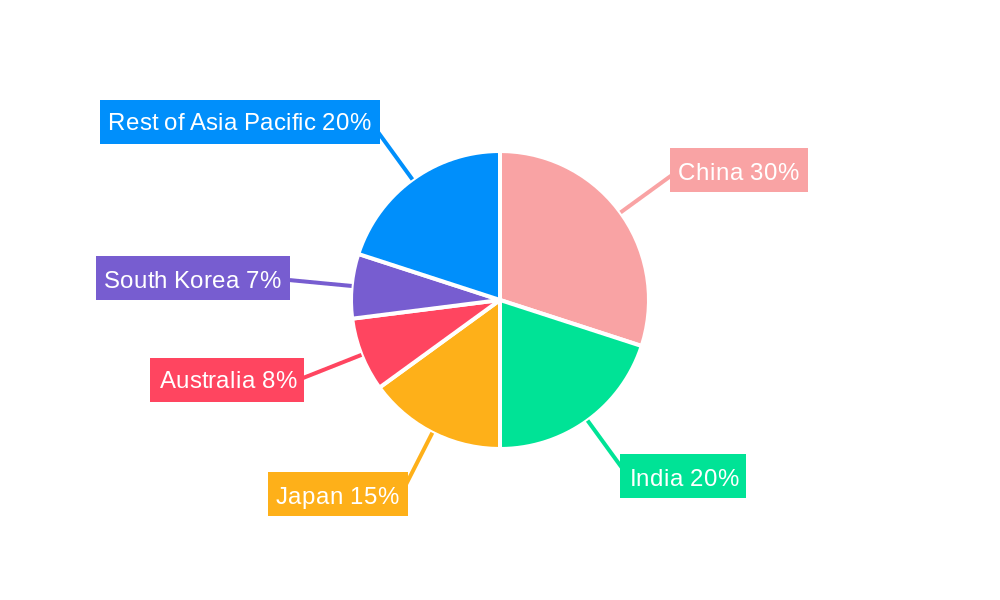

Dominant Countries: China and India represent significant market opportunities due to their vast populations and rising disposable incomes. Japan and Australia also demonstrate strong market growth.

Dominant Product Types: Soy milk and coconut milk currently hold the largest market share, owing to established consumer preferences and readily available production capabilities. Oat milk is emerging as a fast-growing segment, driven by its health halo and creamy texture.

Dominant Distribution Channels: The off-trade channel (supermarkets, hypermarkets) dominates the distribution landscape. However, the on-trade channel (restaurants, cafes) is witnessing increasing demand due to the rising popularity of plant-based beverages in food service establishments.

Growth Drivers:

- Economic Growth: Rising disposable incomes in several Asian countries.

- Health Consciousness: Growing awareness of health benefits associated with plant-based diets.

- Environmental Concerns: Increasing preference for sustainable and environmentally friendly products.

- Technological Advancements: Improved production processes and innovative packaging solutions.

- Infrastructure Development: Enhanced cold chain infrastructure to support perishable goods.

Asia-Pacific Non-Dairy Milk Market Product Developments

Recent years have witnessed significant product innovations within the Asia-Pacific non-dairy milk market. Companies are focusing on developing products with enhanced nutritional profiles, such as those fortified with vitamins and minerals. Innovative packaging solutions, emphasizing extended shelf life and sustainability, are also gaining traction. Technological advancements are driving improvements in taste, texture, and overall quality, enhancing consumer acceptance. These developments are creating competitive edges, enabling companies to differentiate their offerings and capture larger market shares. The focus is shifting towards organic, ethically sourced, and low-sugar products to cater to the growing health-conscious consumer base.

Challenges in the Asia-Pacific Non-Dairy Milk Market Market

The Asia-Pacific non-dairy milk market faces several challenges, including inconsistent regulatory frameworks across different countries, which can increase compliance costs. Supply chain disruptions, particularly concerning raw material sourcing and packaging, can impact production and pricing. Intense competition from established players and new entrants necessitates continuous innovation and strategic partnerships to maintain a competitive edge. The overall impact of these challenges on market growth is estimated to be a reduction of approximately xx% in the overall market size.

Forces Driving Asia-Pacific Non-Dairy Milk Market Growth

Several key factors are driving the growth of the Asia-Pacific non-dairy milk market. Technological advancements in production and processing are lowering costs and improving product quality, making the products more accessible and affordable. Favorable government policies and regulations are encouraging the adoption of plant-based alternatives. Rising health and environmental concerns are driving consumer preferences towards healthier and sustainable food choices, resulting in a significant increase in demand for non-dairy milk. Examples include government subsidies for sustainable agriculture and initiatives promoting plant-based diets.

Long-Term Growth Catalysts in the Asia-Pacific Non-Dairy Milk Market

Long-term growth in the Asia-Pacific non-dairy milk market will be fueled by continued innovation in product development, such as the introduction of novel flavors and functional ingredients. Strategic partnerships between established players and smaller companies will expand market reach and introduce new technologies. Market expansion into newer and developing countries will open up new revenue streams and further increase overall market size.

Emerging Opportunities in Asia-Pacific Non-Dairy Milk Market

Emerging opportunities include the development of new product variants tailored to specific consumer needs and preferences, such as lactose-free, low-sugar, and organic options. The growing interest in sustainable packaging solutions presents opportunities for eco-conscious brands. Expansion into untapped markets within the Asia-Pacific region offers significant growth potential. Moreover, strategic alliances and collaborations with food service providers can drive increased market penetration.

Leading Players in the Asia-Pacific Non-Dairy Milk Market Sector

- Noumi Ltd

- Kikkoman Corporation

- Hebei Yangyuan Zhihui Beverage Co Ltd

- Marusan-AI Co Ltd

- Bonsoy Beverage Co

- Blue Diamond Growers

- Oatly Group AB

- Coconut Palm Group Co Ltd

- Vitasoy International Holdings Ltd

- The Hershey Company

Key Milestones in Asia-Pacific Non-Dairy Milk Market Industry

September 2022: Hershey India launched Sofit Plus, a plant protein-fortified drink, aimed at addressing nutritional deficiencies in underprivileged children. This highlights the increasing focus on functional and socially responsible products.

September 2022: Vitasoy launched its Plant+ range of plant-based milk, featuring oat and almond milk varieties. This demonstrates the market's innovation in offering diverse product options.

September 2022: Vitasoy expanded its Plant+ range into the Singaporean market, further emphasizing the regional expansion strategies of key players.

Strategic Outlook for Asia-Pacific Non-Dairy Milk Market Market

The Asia-Pacific non-dairy milk market holds immense future potential. Continued innovation, strategic partnerships, and expansion into new markets will drive substantial growth. Companies that adapt to evolving consumer preferences and invest in sustainable practices will be well-positioned to capitalize on emerging opportunities. The market is expected to experience consistent growth, driven by health and sustainability trends, offering significant returns for early adopters and innovative players.

Asia-Pacific Non-Dairy Milk Market Segmentation

-

1. Product Type

- 1.1. Almond Milk

- 1.2. Cashew Milk

- 1.3. Coconut Milk

- 1.4. Hazelnut Milk

- 1.5. Hemp Milk

- 1.6. Oat Milk

- 1.7. Soy Milk

-

2. Distribution Channel

-

2.1. Off-Trade

-

2.1.1. By Sub Distribution Channels

- 2.1.1.1. Convenience Stores

- 2.1.1.2. Online Retail

- 2.1.1.3. Specialist Retailers

- 2.1.1.4. Supermarkets and Hypermarkets

- 2.1.1.5. Others (Warehouse clubs, gas stations, etc.)

-

2.1.1. By Sub Distribution Channels

- 2.2. On-Trade

-

2.1. Off-Trade

Asia-Pacific Non-Dairy Milk Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Non-Dairy Milk Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.35% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Inclination Towards Vegan/Plant-based Protein Sources; Increasing Demand for Functional Protein Beverages

- 3.3. Market Restrains

- 3.3.1. Competition from Substitute Products

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Non-Dairy Milk Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Almond Milk

- 5.1.2. Cashew Milk

- 5.1.3. Coconut Milk

- 5.1.4. Hazelnut Milk

- 5.1.5. Hemp Milk

- 5.1.6. Oat Milk

- 5.1.7. Soy Milk

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. By Sub Distribution Channels

- 5.2.1.1.1. Convenience Stores

- 5.2.1.1.2. Online Retail

- 5.2.1.1.3. Specialist Retailers

- 5.2.1.1.4. Supermarkets and Hypermarkets

- 5.2.1.1.5. Others (Warehouse clubs, gas stations, etc.)

- 5.2.1.1. By Sub Distribution Channels

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China Asia-Pacific Non-Dairy Milk Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific Non-Dairy Milk Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific Non-Dairy Milk Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific Non-Dairy Milk Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific Non-Dairy Milk Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific Non-Dairy Milk Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific Non-Dairy Milk Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Noumi Ltd

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Kikkoman Corporation

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Hebei Yangyuan Zhihui Beverage Co Ltd

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Marusan-AI Co Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Bonsoy Beverage Co

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Blue Diamond Growers

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Oatly Group AB

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Coconut Palm Group Co Ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Vitasoy International Holdings Lt

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 The Hershey Company

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Noumi Ltd

List of Figures

- Figure 1: Asia-Pacific Non-Dairy Milk Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Non-Dairy Milk Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Non-Dairy Milk Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Non-Dairy Milk Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Asia-Pacific Non-Dairy Milk Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Asia-Pacific Non-Dairy Milk Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia-Pacific Non-Dairy Milk Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Asia-Pacific Non-Dairy Milk Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Asia-Pacific Non-Dairy Milk Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Asia-Pacific Non-Dairy Milk Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Asia-Pacific Non-Dairy Milk Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Asia-Pacific Non-Dairy Milk Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Asia-Pacific Non-Dairy Milk Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Asia-Pacific Non-Dairy Milk Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Asia-Pacific Non-Dairy Milk Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 14: Asia-Pacific Non-Dairy Milk Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: Asia-Pacific Non-Dairy Milk Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Asia-Pacific Non-Dairy Milk Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Asia-Pacific Non-Dairy Milk Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Asia-Pacific Non-Dairy Milk Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Asia-Pacific Non-Dairy Milk Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Asia-Pacific Non-Dairy Milk Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: New Zealand Asia-Pacific Non-Dairy Milk Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Indonesia Asia-Pacific Non-Dairy Milk Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Malaysia Asia-Pacific Non-Dairy Milk Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Singapore Asia-Pacific Non-Dairy Milk Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Thailand Asia-Pacific Non-Dairy Milk Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Vietnam Asia-Pacific Non-Dairy Milk Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Philippines Asia-Pacific Non-Dairy Milk Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Non-Dairy Milk Market?

The projected CAGR is approximately 5.35%.

2. Which companies are prominent players in the Asia-Pacific Non-Dairy Milk Market?

Key companies in the market include Noumi Ltd, Kikkoman Corporation, Hebei Yangyuan Zhihui Beverage Co Ltd, Marusan-AI Co Ltd, Bonsoy Beverage Co, Blue Diamond Growers, Oatly Group AB, Coconut Palm Group Co Ltd, Vitasoy International Holdings Lt, The Hershey Company.

3. What are the main segments of the Asia-Pacific Non-Dairy Milk Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Inclination Towards Vegan/Plant-based Protein Sources; Increasing Demand for Functional Protein Beverages.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Competition from Substitute Products.

8. Can you provide examples of recent developments in the market?

September 2022: Hershey India launched Sofit Plus, a plant protein-fortified drink. The product is developed as a part of its ‘Nourishing Minds’ social initiative in collaboration with IIT-Bombay, Sion Hospital, to meet the nutritional needs of underprivileged kids.September 2022: Vitasoy launched a plant-based milk range Plant+, which includes oat and almond milk varieties with zero cholesterol, low sugar, and high calcium.September 2022: Vitasoy launched the Vitasoy Plant+ range of plant milk in the Singaporean market. These plant-based milk products are available in almond, oat, and soy varieties and are high in calcium and low in sugar with zero cholesterol.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Non-Dairy Milk Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Non-Dairy Milk Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Non-Dairy Milk Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Non-Dairy Milk Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence