Key Insights

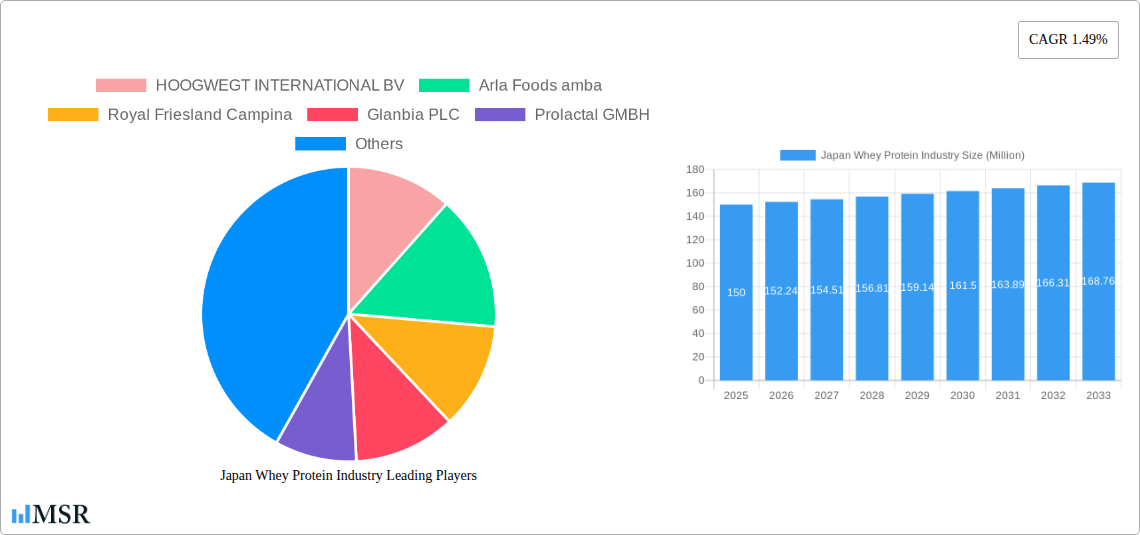

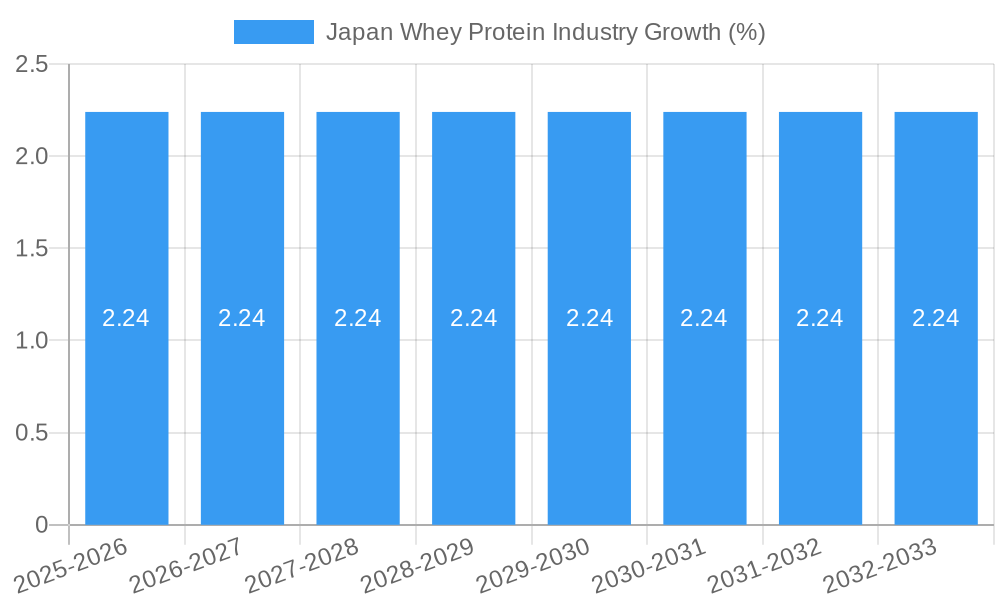

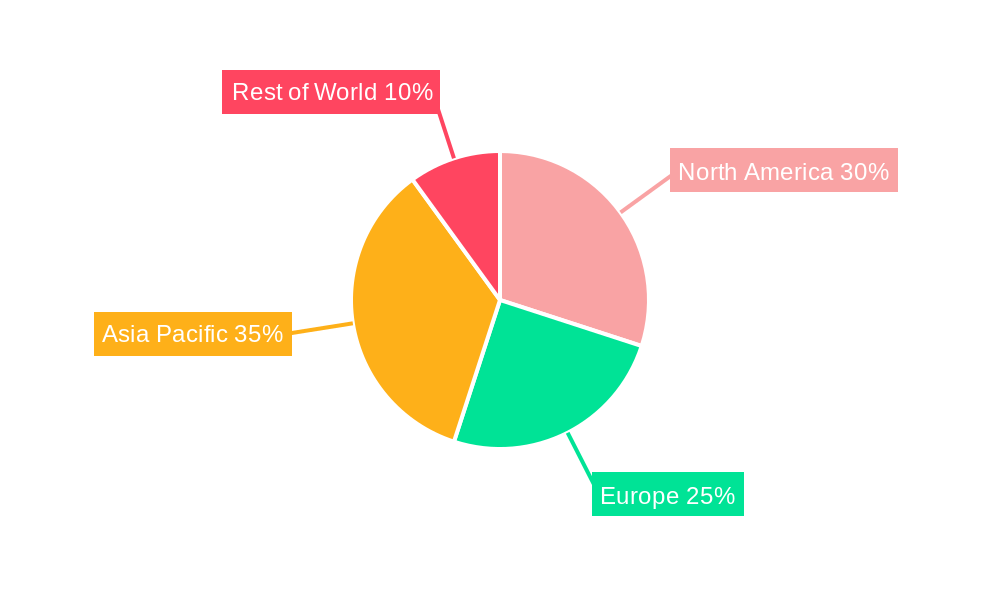

The Japan whey protein market, a segment of the broader Asia-Pacific region, exhibits promising growth potential driven by increasing health consciousness and a rising demand for sports nutrition products. While precise market size data for Japan specifically is unavailable, we can extrapolate from the provided Asia-Pacific CAGR of 1.49% and the overall market trends. Considering Japan's established fitness culture and high disposable incomes, we can reasonably assume a faster growth rate than the regional average. Factors such as the increasing prevalence of chronic diseases and the growing popularity of fitness activities, including strength training and endurance sports, are fueling demand for high-quality protein supplements. The whey protein market in Japan is segmented by product type (whey protein concentrates, isolates, and hydrolysates) and application (sports nutrition, infant formula, and functional foods). The sports and performance nutrition segment is likely the largest, reflecting the country's active lifestyle and growing awareness of the role of protein in muscle building and recovery. Major players like Morinaga Milk Industry Co Ltd, and potentially others operating in the broader Asia-Pacific region, hold significant market share, indicating a competitive landscape with established brands. However, opportunities exist for new entrants offering specialized products catering to niche consumer segments or focusing on innovative formulations and delivery systems. Future growth will likely depend on factors like increasing consumer awareness of the benefits of whey protein, innovative product development, and effective marketing strategies that resonate with the Japanese consumer.

The relatively high cost of whey protein compared to other protein sources could pose a challenge. However, this is likely to be offset by the increasing purchasing power and preference for premium, high-quality products among health-conscious consumers. Government regulations related to food safety and labeling also play a crucial role in shaping the market. The market’s future trajectory will be influenced by shifts in consumer preferences, technological advancements, and broader economic conditions within Japan.

Japan Whey Protein Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Japan whey protein industry, covering market dynamics, key players, emerging trends, and future growth prospects. The report utilizes data from the historical period (2019-2024), base year (2025), and forecast period (2025-2033) to deliver actionable insights for industry stakeholders. The study period spans 2019-2033, with a focus on the estimated year 2025. This report is essential for businesses involved in the production, distribution, and consumption of whey protein in Japan.

Japan Whey Protein Industry Market Concentration & Dynamics

The Japan whey protein market exhibits a moderately concentrated structure, with several multinational and domestic players holding significant market share. The top five players—including HOOGWEGT INTERNATIONAL BV, Arla Foods amba, Royal Friesland Campina, Glanbia PLC, and Morinaga Milk Industry Co Ltd—account for an estimated xx% of the total market in 2025. However, the market also features numerous smaller players, contributing to a dynamic competitive landscape.

- Market Share: The market share of the top five players is estimated at xx% in 2025, with individual player market shares varying.

- Innovation Ecosystems: Significant investments in R&D by key players are driving innovation in whey protein formulations and processing technologies, leading to products with enhanced functionalities and consumer appeal.

- Regulatory Frameworks: The Japanese regulatory framework for food and beverage products, including whey protein, is stringent, necessitating compliance with rigorous quality and safety standards. This impacts market entry and product development strategies.

- Substitute Products: Soy protein, casein protein, and other plant-based protein sources serve as substitutes for whey protein. However, whey protein's superior nutritional profile and functional properties maintain its dominance.

- End-User Trends: Growing health consciousness, rising disposable incomes, and the increasing popularity of sports and fitness activities are key drivers of demand for whey protein. Consumer preference is shifting toward high-quality, specialized whey protein products.

- M&A Activities: The number of M&A deals in the Japan whey protein market was xx in the period 2019-2024. Consolidation is expected to continue, driven by growth opportunities and the need for increased scale and efficiency.

Japan Whey Protein Industry Industry Insights & Trends

The Japan whey protein market is experiencing robust growth, driven by several factors. The market size was valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. This growth is attributed to the increasing adoption of whey protein in diverse applications, including sports nutrition, infant formula, and functional foods.

Technological advancements are transforming the whey protein market, with companies focusing on developing new products with enhanced functionalities, improved taste profiles, and greater convenience. Changing consumer preferences towards healthier and more functional foods also significantly influence the market. The increasing awareness of the health benefits of protein-rich diets, coupled with rising disposable incomes, fuels the demand for whey protein products, particularly among health-conscious consumers and athletes. This trend fuels innovation in product formats, flavor profiles, and marketing strategies targeting specific demographics. The market is seeing significant advancements in processing technologies leading to more efficient production and higher-quality whey proteins.

Key Markets & Segments Leading Japan Whey Protein Industry

The Japanese market for whey protein is segmented by type (Whey Protein Concentrates, Whey Protein Isolates, Hydrolyzed Whey Proteins) and application (Sports and Performance Nutrition, Infant Formula, Functional/Fortified Food). While all segments contribute significantly, the Sports and Performance Nutrition segment currently holds the largest market share due to the rising popularity of fitness and athletic activities in Japan.

- Dominant Segment: Sports and Performance Nutrition

- Drivers: Rising health awareness, increased participation in sports and fitness activities, growing demand for high-quality protein supplements.

- Whey Protein Isolates: This segment is experiencing rapid growth due to its high protein content and purity, making it appealing for athletes and health-conscious consumers.

- Whey Protein Concentrates: This segment remains significant due to its cost-effectiveness and widespread use in various food applications.

- Hydrolyzed Whey Proteins: This segment is characterized by high bioavailability and rapid absorption, gaining popularity among athletes and those seeking improved digestion.

- Infant Formula: The demand for whey protein in infant formula is driven by the nutritional requirements of infants, providing essential amino acids for growth and development.

- Functional/Fortified Food: The inclusion of whey protein in functional foods such as yogurt, dairy beverages, and bars is increasing as consumers seek convenient ways to increase their protein intake.

Japan Whey Protein Industry Product Developments

Recent product innovations showcase significant advancements in whey protein technology. For example, Arla Foods Ingredients' introduction of Nutrilac and ProteinBoost, utilizing patented microparticulate technology, highlights the focus on improving product functionalities and addressing the growing demand for high-quality protein. Glanbia's rebranding of its whey protein line as "Tirlan" emphasizes the adaptation of products to the specific needs of the Japanese market. These developments emphasize a focus on improved solubility, enhanced taste, and specialized functionalities. This competitive landscape is characterized by a continuous stream of innovations aiming to improve the digestibility, bioavailability, and overall consumer experience of whey protein products.

Challenges in the Japan Whey Protein Industry Market

The Japan whey protein market faces several challenges, including stringent regulatory requirements which can increase the cost and time required for product approvals. Supply chain disruptions due to global events can lead to price volatility and shortages. Furthermore, intense competition from both domestic and international players creates pressure on pricing and margins. Fluctuations in raw material costs (e.g., milk prices) also pose a significant challenge to profitability.

Forces Driving Japan Whey Protein Industry Growth

Several factors are driving the growth of the Japan whey protein market. Increasing health awareness and a rising trend towards fitness and wellness are boosting demand. Technological advancements, leading to the development of novel whey protein products with enhanced functionalities and improved taste, also contribute. Supportive government policies and rising disposable incomes further fuel the market expansion.

Long-Term Growth Catalysts in the Japan Whey Protein Industry

Long-term growth will be driven by continuous innovation in product formulations and processing technologies, leading to products tailored to specific consumer needs and preferences. Strategic partnerships between industry players will foster growth, enabling access to new markets and technologies. Expansion into new applications, such as plant-based protein blends, is likely to further contribute to sustained growth.

Emerging Opportunities in Japan Whey Protein Industry

Emerging opportunities include the development of specialized whey protein products tailored to specific dietary needs (e.g., low-lactose, organic). Growth potential lies in leveraging technology for personalized nutrition recommendations and exploring new distribution channels, such as e-commerce. The increasing popularity of functional foods and beverages presents a significant opportunity for growth.

Leading Players in the Japan Whey Protein Industry Sector

- HOOGWEGT INTERNATIONAL BV

- Arla Foods amba

- Royal Friesland Campina

- Glanbia PLC

- Prolactal GMBH

- Saputo Inc

- Fonterra Co-operative Group Limited

- Morinaga Milk Industry Co Ltd

- Groupe Lactalis

- Sodiaal Co-operative Group

Key Milestones in Japan Whey Protein Industry Industry

- July 2021: MILEI GmbH, a Morinaga subsidiary, inaugurated a new facility for commercial production.

- September 2022: Glanbia rebranded its whey protein line as "Tirlan" for the Japanese market.

- April 2023: Arla Foods Ingredients launched Nutrilac and ProteinBoost whey protein products.

Strategic Outlook for Japan Whey Protein Industry Market

The Japan whey protein market exhibits strong growth potential due to sustained demand driven by health-conscious consumers and expanding applications. Strategic opportunities involve capitalizing on innovation, focusing on niche segments, and developing products with enhanced functionalities to maintain a competitive edge. Expanding distribution channels and strategic alliances will further enhance market penetration and profitability.

Japan Whey Protein Industry Segmentation

-

1. Type

- 1.1. Whey Protein Concentrates

- 1.2. Whey Protein Isolates

- 1.3. Hydrolyzed Whey Proteins

-

2. Application

- 2.1. Sports and Performance Nutrition

- 2.2. Infant Formula

- 2.3. Functional/Fortified Food

Japan Whey Protein Industry Segmentation By Geography

- 1. Japan

Japan Whey Protein Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.49% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing inclination towards fitness and sports participation; Increasing demand for fortified processed food products

- 3.3. Market Restrains

- 3.3.1. Extensive presence of alternative protein products sourced from plant based ingredients

- 3.4. Market Trends

- 3.4.1. Sports and Performance Nutrition Dominates the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Whey Protein Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Whey Protein Concentrates

- 5.1.2. Whey Protein Isolates

- 5.1.3. Hydrolyzed Whey Proteins

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Sports and Performance Nutrition

- 5.2.2. Infant Formula

- 5.2.3. Functional/Fortified Food

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China Japan Whey Protein Industry Analysis, Insights and Forecast, 2019-2031

- 7. Japan Japan Whey Protein Industry Analysis, Insights and Forecast, 2019-2031

- 8. India Japan Whey Protein Industry Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Japan Whey Protein Industry Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Japan Whey Protein Industry Analysis, Insights and Forecast, 2019-2031

- 11. Australia Japan Whey Protein Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Japan Whey Protein Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 HOOGWEGT INTERNATIONAL BV

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Arla Foods amba

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Royal Friesland Campina

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Glanbia PLC

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Prolactal GMBH

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Saputo Inc *List Not Exhaustive

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Fonterra Co-operative Group Limited

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Morinaga Milk Industry Co Ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Groupe Lactalis

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Sodiaal Co-operative Group

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 HOOGWEGT INTERNATIONAL BV

List of Figures

- Figure 1: Japan Whey Protein Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Japan Whey Protein Industry Share (%) by Company 2024

List of Tables

- Table 1: Japan Whey Protein Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Japan Whey Protein Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Japan Whey Protein Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Japan Whey Protein Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Japan Whey Protein Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Japan Whey Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Japan Whey Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Japan Whey Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Japan Whey Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Japan Whey Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Japan Whey Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Japan Whey Protein Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Japan Whey Protein Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Japan Whey Protein Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Japan Whey Protein Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Whey Protein Industry?

The projected CAGR is approximately 1.49%.

2. Which companies are prominent players in the Japan Whey Protein Industry?

Key companies in the market include HOOGWEGT INTERNATIONAL BV, Arla Foods amba, Royal Friesland Campina, Glanbia PLC, Prolactal GMBH, Saputo Inc *List Not Exhaustive, Fonterra Co-operative Group Limited, Morinaga Milk Industry Co Ltd, Groupe Lactalis, Sodiaal Co-operative Group.

3. What are the main segments of the Japan Whey Protein Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing inclination towards fitness and sports participation; Increasing demand for fortified processed food products.

6. What are the notable trends driving market growth?

Sports and Performance Nutrition Dominates the Market.

7. Are there any restraints impacting market growth?

Extensive presence of alternative protein products sourced from plant based ingredients.

8. Can you provide examples of recent developments in the market?

April 2023: Arla Foods Ingredients, headquartered in Denmark, introduced Nutrilac and ProteinBoost, two cutting-edge whey protein products leveraging patented microparticulate technology. This innovative launch addresses the surging global demand for high-quality protein, particularly in the Japanese market. These versatile products find application in a wide range of dairy and sports nutrition products, including yogurt, desserts, and dairy beverages.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Whey Protein Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Whey Protein Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Whey Protein Industry?

To stay informed about further developments, trends, and reports in the Japan Whey Protein Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence