Key Insights

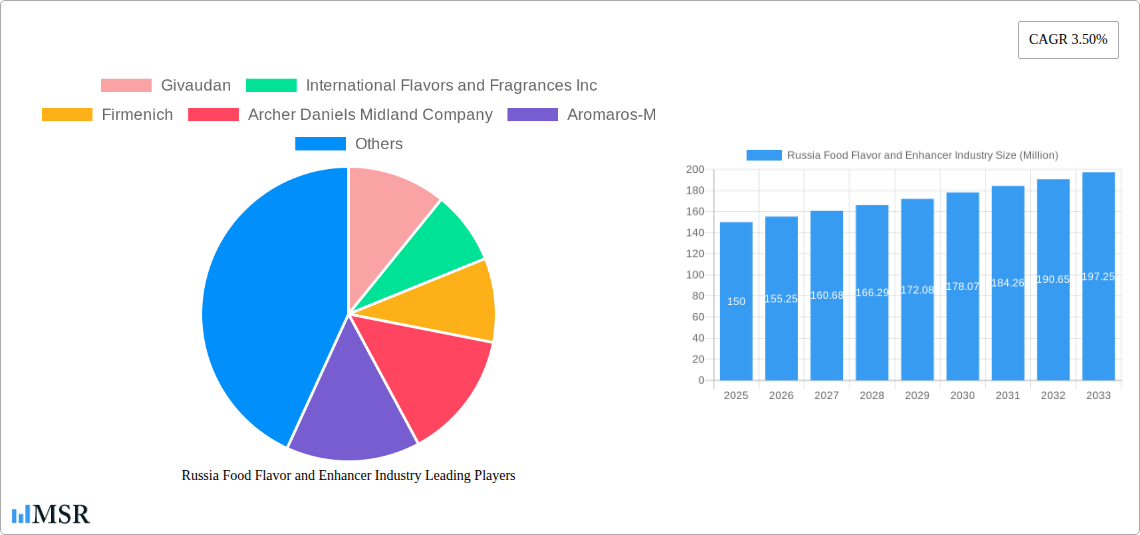

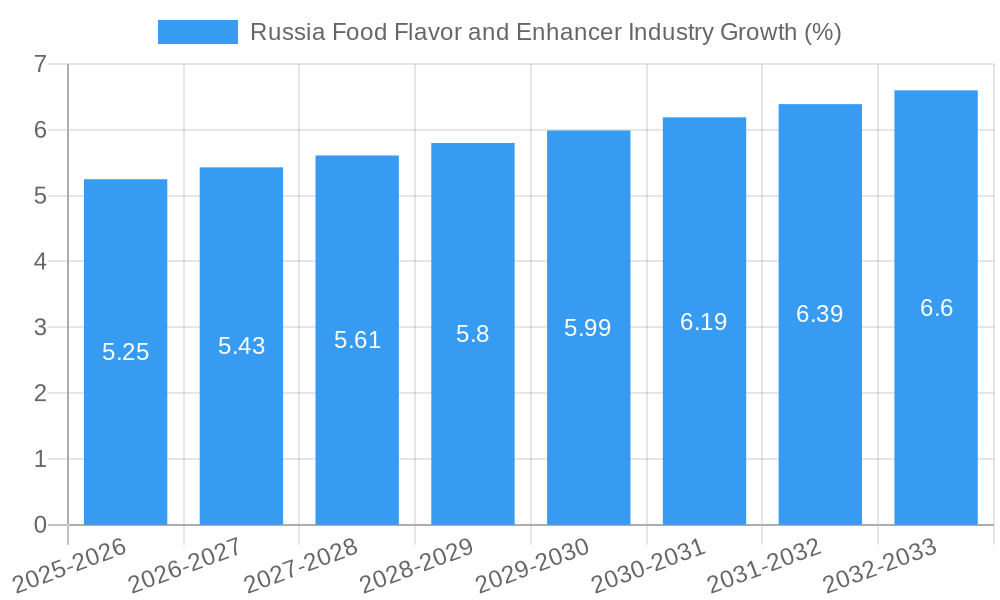

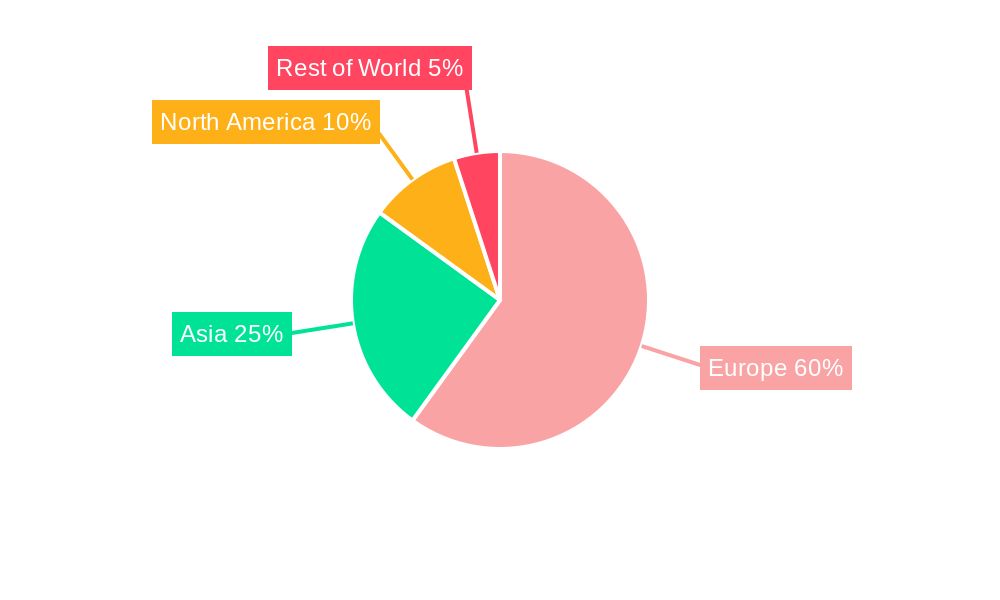

The Russia food flavor and enhancer market, while facing geopolitical challenges, demonstrates resilience and potential for growth. The market, estimated at $XX million in 2025 (a figure that needs to be sourced or reasonably estimated based on comparable markets and considering the provided CAGR), is projected to exhibit a Compound Annual Growth Rate (CAGR) of 3.50% from 2025 to 2033. This growth is driven by several key factors. Increasing consumer demand for processed foods, convenience foods, and diverse flavor profiles fuels this expansion. The rise of the food service industry and the growing popularity of bakery, confectionery, and beverage products contribute significantly. Furthermore, innovation in flavor technology, particularly the development of natural and clean-label options, is attracting health-conscious consumers. However, the market faces restraints like fluctuating raw material prices and economic instability within the region. Despite these challenges, the presence of established international players like Givaudan, International Flavors and Fragrances Inc., and Firmenich, alongside domestic companies like Aromaros-M, indicates a competitive landscape capable of adapting to market fluctuations. The segmentation by application (Bakery, Confectionery, Dairy, Beverages, Processed Food, Other Applications) and type (Flavors, Nature Identical Flavors, Flavor Enhancers) offers insights into specific growth areas and consumer preferences, allowing companies to tailor their offerings and strategies accordingly. The European market, particularly Germany, France, Italy, and the UK, are significant export destinations, influencing the overall market dynamics.

The forecast period of 2025-2033 presents opportunities for expansion, particularly through strategic partnerships and product diversification. Companies focusing on developing sustainable and ethically sourced ingredients will likely gain a competitive advantage. While economic uncertainties remain, the long-term growth prospects remain positive, driven by evolving consumer preferences and innovation within the food and beverage sector. Specific growth segments such as health-conscious natural flavors and innovative applications in the burgeoning convenience food sector promise strong returns in the coming years. A detailed regional analysis encompassing specific market penetration strategies in relation to various applications would further enhance market understanding and strategic planning.

Russia Food Flavor and Enhancer Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Russia food flavor and enhancer industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period 2019-2033, with a focus on 2025, this study delves into market dynamics, key segments, leading players, and future growth prospects. The report utilizes extensive data analysis and forecasts to present a clear picture of this dynamic market. The total market size is estimated at xx Million in 2025, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033).

Russia Food Flavor and Enhancer Industry Market Concentration & Dynamics

The Russian food flavor and enhancer market exhibits a moderately concentrated structure, with key players such as Givaudan, International Flavors and Fragrances Inc. (IFF), Firmenich, and Symrise AG holding significant market share. Aromaros-M and Kerry Group represent prominent local and international players, respectively, while Archer Daniels Midland Company and Takasago International Corporation also contribute to the market. Market share fluctuations are influenced by product innovation, pricing strategies, and M&A activities. The number of M&A deals in the sector has shown an upward trend in recent years (xx deals in 2024). This is driven by companies' pursuit of enhanced market reach and access to cutting-edge technologies. The regulatory landscape plays a crucial role, with evolving food safety regulations impacting ingredient sourcing and product development. Consumer preferences towards natural and clean-label products are driving innovation, while the rise of substitute products, such as natural herbs and spices, presents a competitive challenge. End-user trends, particularly in the bakery and confectionery sectors, are strongly influencing market demand, fueling the demand for specialized flavors and enhancers.

Russia Food Flavor and Enhancer Industry Industry Insights & Trends

The Russian food flavor and enhancer market experienced significant growth in the historical period (2019-2024), reaching an estimated value of xx Million in 2024. This growth is primarily attributed to factors such as rising disposable incomes, increasing urbanization, and the growing popularity of processed foods and convenience foods. Technological advancements in flavor creation and delivery systems are also contributing to market expansion. Consumer preferences for healthier and more diverse food options are driving demand for natural flavors and functional ingredients. The market is witnessing a notable shift towards clean-label products and the reduction of artificial additives. This trend is pushing manufacturers to innovate and develop natural flavor solutions that meet consumer expectations while maintaining product quality and taste. The ongoing economic shifts and fluctuations in the Russian market create both opportunities and challenges for industry players. The market’s evolution is influenced by a dynamic interplay of consumer behavior, technological innovation, and changing regulatory landscapes.

Key Markets & Segments Leading Russia Food Flavor and Enhancer Industry

Within the Russian food flavor and enhancer market, the processed food segment holds the largest market share, driven by the continuous growth of the convenience food industry. The beverage sector is also a significant contributor, with the rising popularity of ready-to-drink beverages fueling demand for flavorings.

Segment Drivers:

- Processed Food: Rising consumer demand for convenient and ready-to-eat options.

- Beverages: Growth of the ready-to-drink beverage sector, including carbonated soft drinks and functional beverages.

- Confectionery: Increasing demand for novel flavor profiles and innovative confectionery products.

- Dairy: Growing consumption of dairy products and the need for flavor enhancements.

- Bakery: Expansion of the bakery industry and demand for enhanced taste and texture in baked goods.

The Flavors segment commands a higher market share compared to the Flavor Enhancers segment. This reflects a broader consumer preference for nuanced taste profiles over intensified flavors. Geographically, major urban centers, including Moscow and St. Petersburg, drive significant market demand due to higher population density and purchasing power.

Russia Food Flavor and Enhancer Industry Product Developments

Recent product innovations focus on natural and clean-label ingredients, addressing the growing consumer preference for healthier food options. Companies are investing heavily in developing unique flavor profiles and customized solutions to meet the specific demands of different food and beverage applications. Technological advancements in flavor encapsulation and delivery systems enhance product stability, shelf-life, and overall quality. This constant drive for innovation is crucial for maintaining a competitive edge in this dynamic market.

Challenges in the Russia Food Flavor and Enhancer Industry Market

The Russian food flavor and enhancer market faces several challenges. Regulatory hurdles and fluctuating import/export policies create uncertainty and impact supply chain stability. Economic sanctions and geopolitical factors contribute to volatility in raw material prices and overall market conditions. Furthermore, intense competition among both domestic and international players necessitates continuous innovation and cost optimization to secure market share.

Forces Driving Russia Food Flavor and Enhancer Industry Growth

Technological advancements in flavor creation and delivery systems are significantly boosting market growth. Increasing consumer disposable incomes are supporting higher spending on food products, which directly impacts flavor and enhancer demand. Government initiatives promoting food processing and innovation further stimulate market expansion.

Challenges in the Russia Food Flavor and Enhancer Industry Market

Long-term growth catalysts for this market include strategic partnerships fostering innovation and expanding market access. Continuous research and development in natural and sustainable flavoring solutions will play a pivotal role in future market expansion. Investment in new technologies that streamline production processes and enhance efficiency will be crucial for long-term success.

Emerging Opportunities in Russia Food Flavor and Enhancer Industry

Growing consumer demand for unique and authentic flavor profiles presents significant opportunities for manufacturers who can offer innovative and high-quality products. The expansion of e-commerce and online grocery shopping creates new avenues for market penetration.

Leading Players in the Russia Food Flavor and Enhancer Industry Sector

- Givaudan

- International Flavors and Fragrances Inc.

- Firmenich

- Archer Daniels Midland Company

- Aromaros-M

- Kerry Group

- Symrise AG

- Takasago International Corporation

Key Milestones in Russia Food Flavor and Enhancer Industry Industry

- 2022 Q4: Givaudan launches a new line of natural flavors targeting the confectionery market.

- 2023 Q1: IFF acquires a local Russian flavor producer, expanding its market reach.

- 2024 Q2: Symrise introduces a range of sustainable and ethically sourced flavoring ingredients.

Strategic Outlook for Russia Food Flavor and Enhancer Industry Market

The Russian food flavor and enhancer market is poised for continued growth, driven by strong consumer demand, technological advancements, and strategic investments by leading players. Opportunities exist for businesses focusing on natural, sustainable, and customized flavor solutions. By navigating the regulatory landscape and adapting to evolving consumer preferences, companies can unlock substantial market potential in the coming years.

Russia Food Flavor and Enhancer Industry Segmentation

-

1. Type

-

1.1. Flavors

- 1.1.1. Natural Flavors

- 1.1.2. Synthetic Flavors

- 1.1.3. Nature Identical Flavors

- 1.2. Flavor Enhancers

-

1.1. Flavors

-

2. Application

- 2.1. Bakery

- 2.2. Confectionery

- 2.3. Dairy

- 2.4. Beverages

- 2.5. Processed Food

- 2.6. Other Applications

Russia Food Flavor and Enhancer Industry Segmentation By Geography

- 1. Russia

Russia Food Flavor and Enhancer Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Convenient Ready-to-Eat Food Products; Growing Affinity Toward Ethnic and Organic Frozen Ready Meals

- 3.3. Market Restrains

- 3.3.1. Rising Concerns Over Food Safety and Quality

- 3.4. Market Trends

- 3.4.1. Rising Demand for Clean Label Ingredients

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Food Flavor and Enhancer Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Flavors

- 5.1.1.1. Natural Flavors

- 5.1.1.2. Synthetic Flavors

- 5.1.1.3. Nature Identical Flavors

- 5.1.2. Flavor Enhancers

- 5.1.1. Flavors

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery

- 5.2.2. Confectionery

- 5.2.3. Dairy

- 5.2.4. Beverages

- 5.2.5. Processed Food

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Russia Food Flavor and Enhancer Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Russia Food Flavor and Enhancer Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Russia Food Flavor and Enhancer Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Russia Food Flavor and Enhancer Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Russia Food Flavor and Enhancer Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Europe Russia Food Flavor and Enhancer Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Givaudan

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 International Flavors and Fragrances Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Firmenich

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Archer Daniels Midland Company

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Aromaros-M

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Kerry Group

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Symrise AG

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Takasago International Corporatio

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 Givaudan

List of Figures

- Figure 1: Russia Food Flavor and Enhancer Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Russia Food Flavor and Enhancer Industry Share (%) by Company 2024

List of Tables

- Table 1: Russia Food Flavor and Enhancer Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Russia Food Flavor and Enhancer Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Russia Food Flavor and Enhancer Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Russia Food Flavor and Enhancer Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Russia Food Flavor and Enhancer Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Russia Food Flavor and Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Russia Food Flavor and Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Russia Food Flavor and Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Russia Food Flavor and Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Russia Food Flavor and Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Russia Food Flavor and Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Russia Food Flavor and Enhancer Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 13: Russia Food Flavor and Enhancer Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 14: Russia Food Flavor and Enhancer Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Food Flavor and Enhancer Industry?

The projected CAGR is approximately 3.50%.

2. Which companies are prominent players in the Russia Food Flavor and Enhancer Industry?

Key companies in the market include Givaudan, International Flavors and Fragrances Inc, Firmenich, Archer Daniels Midland Company, Aromaros-M, Kerry Group, Symrise AG, Takasago International Corporatio.

3. What are the main segments of the Russia Food Flavor and Enhancer Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for Convenient Ready-to-Eat Food Products; Growing Affinity Toward Ethnic and Organic Frozen Ready Meals.

6. What are the notable trends driving market growth?

Rising Demand for Clean Label Ingredients.

7. Are there any restraints impacting market growth?

Rising Concerns Over Food Safety and Quality.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Food Flavor and Enhancer Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Food Flavor and Enhancer Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Food Flavor and Enhancer Industry?

To stay informed about further developments, trends, and reports in the Russia Food Flavor and Enhancer Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence