Key Insights

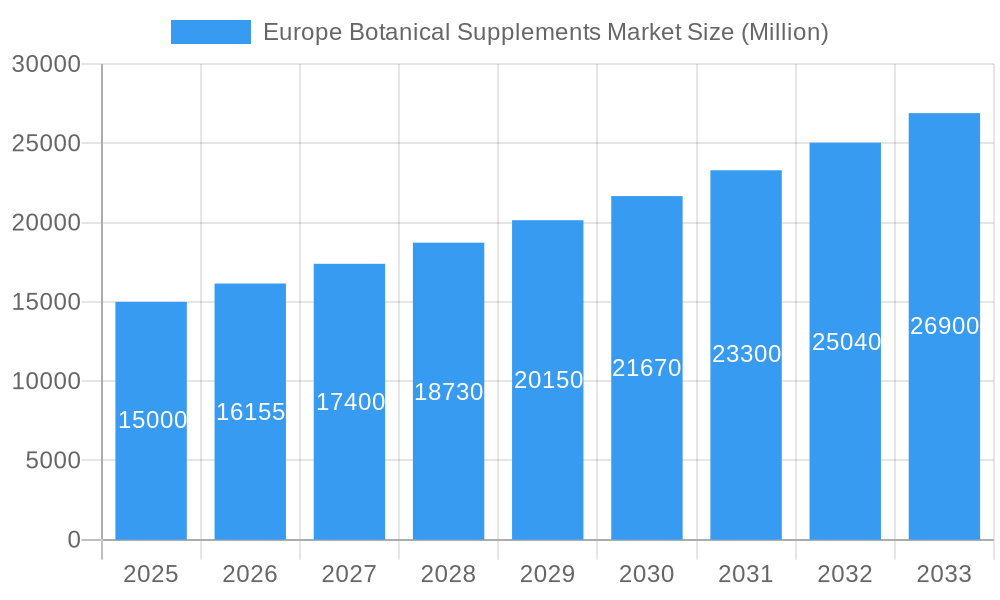

The European botanical supplements market, projected to reach 66.07 billion by 2025, is anticipated to experience significant expansion, growing at a compound annual growth rate (CAGR) of 9.3% from 2025 to 2033. This robust growth is driven by heightened consumer demand for natural health solutions, increasing awareness of the benefits of botanical ingredients, and a rising preference for preventative healthcare measures. The market is segmented by product form, including powders, capsules, and tablets, and by distribution channels such as supermarkets, pharmacies, and online retail. Online channels are demonstrating particularly strong growth, aligning with broader e-commerce trends. Key markets within Europe include Germany, France, the UK, and Italy, supported by high consumer spending on health and wellness products and established distribution networks. Potential challenges include navigating regulatory complexities and ensuring product quality and standardization. The competitive landscape features both multinational corporations and specialized niche players, catering to diverse consumer needs.

Europe Botanical Supplements Market Market Size (In Billion)

The European botanical supplements market is forecast to reach approximately 137.8 billion by 2033. Leading companies such as Whitewall GmbH, Himalaya Wellness, and NOW Foods are actively investing in research and development, product line expansion, and strategic alliances to leverage this market potential. The integration of botanical supplements into functional foods and beverages further indicates a growing trend towards incorporating natural health solutions into daily lifestyles. Understanding evolving consumer preferences across European countries will be vital for successful market entry and sustained growth.

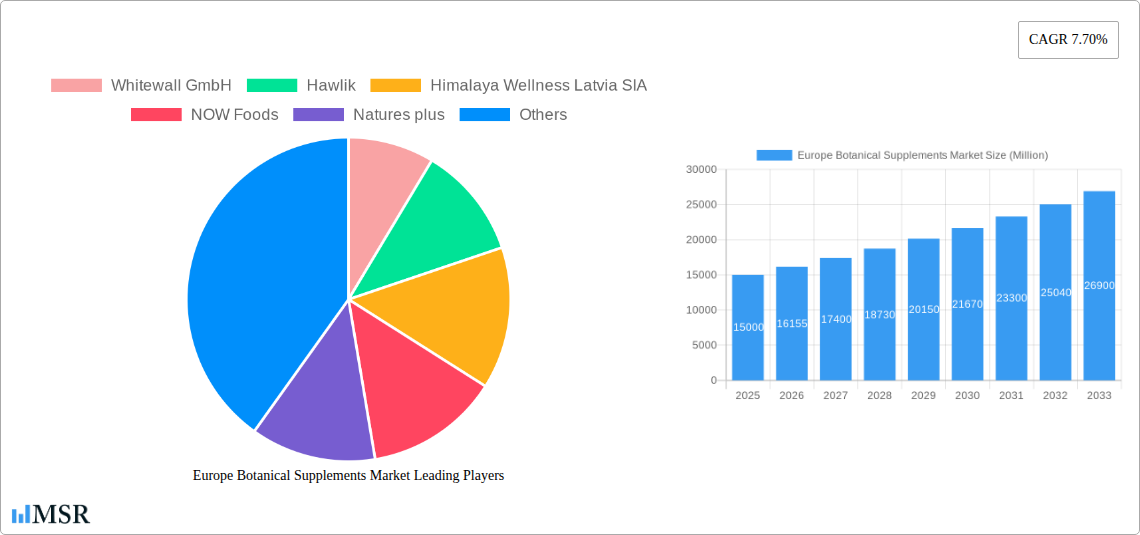

Europe Botanical Supplements Market Company Market Share

Europe Botanical Supplements Market Analysis: Size, Trends, and Forecast (2025-2033)

This comprehensive report offers an in-depth analysis of the European botanical supplements market, detailing market size, growth catalysts, key segments, prominent players, and future projections. The analysis covers the period from 2025 to 2033, with 2025 identified as the base year. This report is an essential resource for industry participants, investors, and businesses seeking to identify and capitalize on opportunities within this dynamic sector. The market is projected to reach an estimated value of 137.8 billion by 2033, with a CAGR of 9.3% during the forecast period (2025-2033).

Europe Botanical Supplements Market Market Concentration & Dynamics

The European botanical supplements market exhibits a moderately concentrated landscape, with several major players holding significant market share, alongside a multitude of smaller, specialized companies. While precise market share figures for individual companies remain proprietary, key players like Whitewall GmbH, Hawlik, Himalaya Wellness Latvia SIA, NOW Foods, and Nature's Plus exert considerable influence. The market's dynamics are shaped by several key factors:

- Innovation Ecosystems: Constant innovation in extraction techniques, formulation, and delivery systems fuels market growth. The development of novel botanical extracts with enhanced bioavailability and efficacy is a key driver.

- Regulatory Frameworks: Stringent European regulations regarding ingredient safety and labeling influence market structure and product development. Compliance costs can be a significant barrier for smaller players.

- Substitute Products: Competition arises from synthetic vitamin and mineral supplements, and other health and wellness products.

- End-User Trends: Increasing consumer awareness of natural health solutions and a preference for plant-based products drive market demand. This is particularly noticeable in segments targeting specific health concerns, such as joint health and immunity.

- M&A Activities: Consolidation through mergers and acquisitions is anticipated to increase as larger companies seek to expand their product portfolios and market reach. The number of M&A deals in the sector from 2019 to 2024 is estimated at xx, showcasing a significant level of consolidation activity.

Europe Botanical Supplements Market Industry Insights & Trends

The European botanical supplements market has witnessed robust growth over the historical period (2019-2024), driven by several factors: growing consumer interest in natural health solutions, increasing awareness of the potential health benefits of botanical ingredients, and the rising prevalence of chronic diseases. The market size in 2024 reached approximately xx Million and is expected to surpass xx Million by 2033. This translates to a robust CAGR of xx%.

Technological advancements, particularly in extraction and analytical techniques, are enhancing the quality and efficacy of botanical supplements, further stimulating growth. The adoption of advanced technologies also helps ensure product safety and quality. Evolving consumer behaviors, including a rising preference for personalized nutrition and online purchasing, are reshaping the market landscape. Growth is also driven by increasing health awareness, rising disposable incomes, and the availability of a wide variety of products in various forms. However, challenges remain, including the need to address consumer skepticism regarding product efficacy and safety.

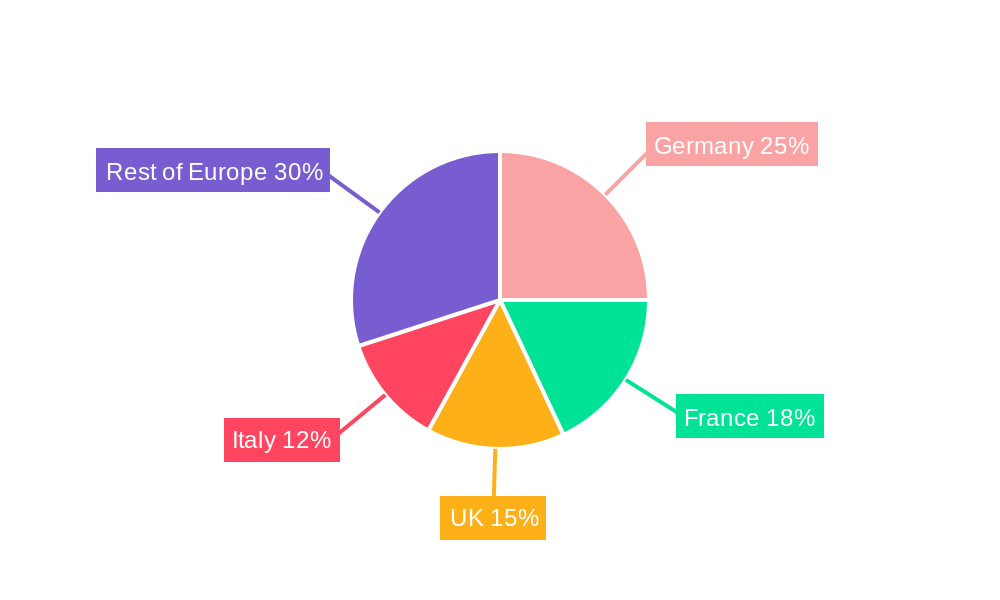

Key Markets & Segments Leading Europe Botanical Supplements Market

The European botanical supplements market is geographically diverse, with significant variations in consumption patterns and market dynamics across different countries. While precise regional dominance requires further analysis and might vary slightly, the UK, Germany, and France are likely leading markets based on their high population density, sophisticated healthcare systems, and robust e-commerce infrastructure.

By Form:

- Capsules: Capsules maintain the dominant market share due to their ease of consumption and convenient dosage.

- Tablets: Tablets are a strong second, offering similar benefits to capsules.

- Powders: Powders offer versatility but may be less popular due to inconvenience for some.

- Other Forms: This segment (including liquids, teas, etc.) holds a niche but growing share, with functional drinks and other novel formats gaining popularity.

By Distribution Channel:

- Online Stores: The rapid growth of e-commerce has made online stores a major distribution channel, offering convenience and access to a wider range of products.

- Pharmacies/Drug Stores: Pharmacies and drug stores remain important channels, benefiting from consumer trust and the professional advice offered by pharmacists.

- Supermarkets and Hypermarkets: The increasing availability of botanical supplements in supermarkets and hypermarkets is driving market accessibility and reach.

Drivers such as economic growth, expanding retail infrastructure, and increased healthcare spending contribute to overall market growth.

Europe Botanical Supplements Market Product Developments

Recent product developments highlight ongoing innovation within the European botanical supplements market. The emphasis lies on delivering products with enhanced bioavailability, targeted efficacy, and improved convenience. The use of novel extraction techniques, advanced encapsulation methods, and the incorporation of synergistic botanical blends is expanding product offerings and catering to specific health needs. Companies are also focusing on developing sustainable and ethically sourced ingredients to meet growing consumer demand for eco-friendly products.

Challenges in the Europe Botanical Supplements Market Market

The European botanical supplements market faces several challenges. Stringent regulatory frameworks requiring rigorous testing and compliance increase costs for manufacturers. Supply chain complexities, especially sourcing high-quality botanical ingredients, can impact product availability and prices. Intense competition amongst established brands and new entrants adds pressure on pricing and margins. Furthermore, inconsistent quality across brands remains a concern, potentially eroding consumer confidence.

Forces Driving Europe Botanical Supplements Market Growth

Several factors contribute to the market's growth. Technological advancements in extraction and analytical methods enhance product quality. Economic factors such as rising disposable incomes increase consumer spending on health and wellness. Government regulations promoting safe and effective supplements also support market expansion. Growing consumer awareness of health and wellness through media and education leads to increased demand for botanical supplements.

Long-Term Growth Catalysts in Europe Botanical Supplements Market

Long-term growth will be fueled by the ongoing development of novel botanical extracts with improved bioavailability and efficacy. Strategic partnerships between research institutions and supplement manufacturers are expected to drive further innovations. Expanding market penetration into underserved regions and the introduction of personalized supplement regimens based on individual genetic and health profiles will also create new growth opportunities.

Emerging Opportunities in Europe Botanical Supplements Market

Significant opportunities exist in developing personalized supplements tailored to individual needs. Leveraging advancements in nutrigenomics and precision medicine could lead to the development of innovative supplement formulations. The growing demand for organic and sustainably sourced botanical ingredients presents a significant opportunity for companies committed to ethical and environmentally responsible practices. Functional foods and beverages incorporating botanical extracts are also emerging as promising growth areas.

Leading Players in the Europe Botanical Supplements Market Sector

- Whitewall GmbH

- Hawlik

- Himalaya Wellness Latvia SIA

- NOW Foods

- Nature's Plus

- GNC Holdings

- Gaia Herbs Farm

- Zein Pharma

- Dr. Willmar Schwabe GmbH & Co. KG (Nature's Way Products LLC)

- KLAIRE LABS

Key Milestones in Europe Botanical Supplements Market Industry

- August 2022: Stada's Natures Aid subsidiary launched a children's supplement range in the UK, expanding the VMS market.

- May 2022: FutureCeuticals launched FruiteX-B, a mineral complex for joint health, expanding the available ingredients and products.

- March 2022: Cymbiotika launched an e-commerce store in the UK, increasing online supplement accessibility.

Strategic Outlook for Europe Botanical Supplements Market Market

The future of the European botanical supplements market appears bright, with continued growth driven by increasing consumer awareness, technological advancements, and evolving consumption patterns. Companies that focus on product innovation, sustainable sourcing, and personalized nutrition strategies will likely thrive in this competitive landscape. Expansion into new markets and the development of novel delivery systems and formulations will be key to achieving long-term success.

Europe Botanical Supplements Market Segmentation

-

1. Form

- 1.1. Powder

- 1.2. Capsules

- 1.3. Tablets

- 1.4. Other Forms

-

2. Distibution Channel

- 2.1. Supermarkets and Hypermarkets

- 2.2. Pharmacies/ Drug Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

Europe Botanical Supplements Market Segmentation By Geography

- 1. United Kingdom

- 2. Germany

- 3. Spain

- 4. France

- 5. Italy

- 6. Russia

- 7. Rest of Europe

Europe Botanical Supplements Market Regional Market Share

Geographic Coverage of Europe Botanical Supplements Market

Europe Botanical Supplements Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Obesity; Growing Number of Fitness Enthusiasts or Health-Conscious Consumers

- 3.3. Market Restrains

- 3.3.1. Penetration of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Escalating Consumer Investment In Preventive Healthcare Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Botanical Supplements Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Powder

- 5.1.2. Capsules

- 5.1.3. Tablets

- 5.1.4. Other Forms

- 5.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.2.1. Supermarkets and Hypermarkets

- 5.2.2. Pharmacies/ Drug Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.3.2. Germany

- 5.3.3. Spain

- 5.3.4. France

- 5.3.5. Italy

- 5.3.6. Russia

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. United Kingdom Europe Botanical Supplements Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Form

- 6.1.1. Powder

- 6.1.2. Capsules

- 6.1.3. Tablets

- 6.1.4. Other Forms

- 6.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 6.2.1. Supermarkets and Hypermarkets

- 6.2.2. Pharmacies/ Drug Stores

- 6.2.3. Online Stores

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Form

- 7. Germany Europe Botanical Supplements Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Form

- 7.1.1. Powder

- 7.1.2. Capsules

- 7.1.3. Tablets

- 7.1.4. Other Forms

- 7.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 7.2.1. Supermarkets and Hypermarkets

- 7.2.2. Pharmacies/ Drug Stores

- 7.2.3. Online Stores

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Form

- 8. Spain Europe Botanical Supplements Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Form

- 8.1.1. Powder

- 8.1.2. Capsules

- 8.1.3. Tablets

- 8.1.4. Other Forms

- 8.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 8.2.1. Supermarkets and Hypermarkets

- 8.2.2. Pharmacies/ Drug Stores

- 8.2.3. Online Stores

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Form

- 9. France Europe Botanical Supplements Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Form

- 9.1.1. Powder

- 9.1.2. Capsules

- 9.1.3. Tablets

- 9.1.4. Other Forms

- 9.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 9.2.1. Supermarkets and Hypermarkets

- 9.2.2. Pharmacies/ Drug Stores

- 9.2.3. Online Stores

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Form

- 10. Italy Europe Botanical Supplements Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Form

- 10.1.1. Powder

- 10.1.2. Capsules

- 10.1.3. Tablets

- 10.1.4. Other Forms

- 10.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 10.2.1. Supermarkets and Hypermarkets

- 10.2.2. Pharmacies/ Drug Stores

- 10.2.3. Online Stores

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Form

- 11. Russia Europe Botanical Supplements Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Form

- 11.1.1. Powder

- 11.1.2. Capsules

- 11.1.3. Tablets

- 11.1.4. Other Forms

- 11.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 11.2.1. Supermarkets and Hypermarkets

- 11.2.2. Pharmacies/ Drug Stores

- 11.2.3. Online Stores

- 11.2.4. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Form

- 12. Rest of Europe Europe Botanical Supplements Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Form

- 12.1.1. Powder

- 12.1.2. Capsules

- 12.1.3. Tablets

- 12.1.4. Other Forms

- 12.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 12.2.1. Supermarkets and Hypermarkets

- 12.2.2. Pharmacies/ Drug Stores

- 12.2.3. Online Stores

- 12.2.4. Other Distribution Channels

- 12.1. Market Analysis, Insights and Forecast - by Form

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Whitewall GmbH

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Hawlik

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Himalaya Wellness Latvia SIA

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 NOW Foods

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Natures plus

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 GNC Holdings

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Gaia Herbs Farm

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Zein Pharma

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Dr Willmar Schwabe GmbH & Co KG (Nature's Way Products LLC )*List Not Exhaustive

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 KLAIRE LABS

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Whitewall GmbH

List of Figures

- Figure 1: Europe Botanical Supplements Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Botanical Supplements Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Botanical Supplements Market Revenue billion Forecast, by Form 2020 & 2033

- Table 2: Europe Botanical Supplements Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 3: Europe Botanical Supplements Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Botanical Supplements Market Revenue billion Forecast, by Form 2020 & 2033

- Table 5: Europe Botanical Supplements Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 6: Europe Botanical Supplements Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Europe Botanical Supplements Market Revenue billion Forecast, by Form 2020 & 2033

- Table 8: Europe Botanical Supplements Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 9: Europe Botanical Supplements Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Europe Botanical Supplements Market Revenue billion Forecast, by Form 2020 & 2033

- Table 11: Europe Botanical Supplements Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 12: Europe Botanical Supplements Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe Botanical Supplements Market Revenue billion Forecast, by Form 2020 & 2033

- Table 14: Europe Botanical Supplements Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 15: Europe Botanical Supplements Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Europe Botanical Supplements Market Revenue billion Forecast, by Form 2020 & 2033

- Table 17: Europe Botanical Supplements Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 18: Europe Botanical Supplements Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: Europe Botanical Supplements Market Revenue billion Forecast, by Form 2020 & 2033

- Table 20: Europe Botanical Supplements Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 21: Europe Botanical Supplements Market Revenue billion Forecast, by Country 2020 & 2033

- Table 22: Europe Botanical Supplements Market Revenue billion Forecast, by Form 2020 & 2033

- Table 23: Europe Botanical Supplements Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 24: Europe Botanical Supplements Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Botanical Supplements Market?

The projected CAGR is approximately 9.3%.

2. Which companies are prominent players in the Europe Botanical Supplements Market?

Key companies in the market include Whitewall GmbH, Hawlik, Himalaya Wellness Latvia SIA, NOW Foods, Natures plus, GNC Holdings, Gaia Herbs Farm, Zein Pharma, Dr Willmar Schwabe GmbH & Co KG (Nature's Way Products LLC )*List Not Exhaustive, KLAIRE LABS.

3. What are the main segments of the Europe Botanical Supplements Market?

The market segments include Form, Distibution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 66.07 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Obesity; Growing Number of Fitness Enthusiasts or Health-Conscious Consumers.

6. What are the notable trends driving market growth?

Escalating Consumer Investment In Preventive Healthcare Products.

7. Are there any restraints impacting market growth?

Penetration of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

In August 2022, Stada's Natures Aid subsidiary launched the children's supplement range in the United Kingdom. It adds a new, fun line of children's vitamin/mineral supplement (VMS) products to its portfolio.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Botanical Supplements Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Botanical Supplements Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Botanical Supplements Market?

To stay informed about further developments, trends, and reports in the Europe Botanical Supplements Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence