Key Insights

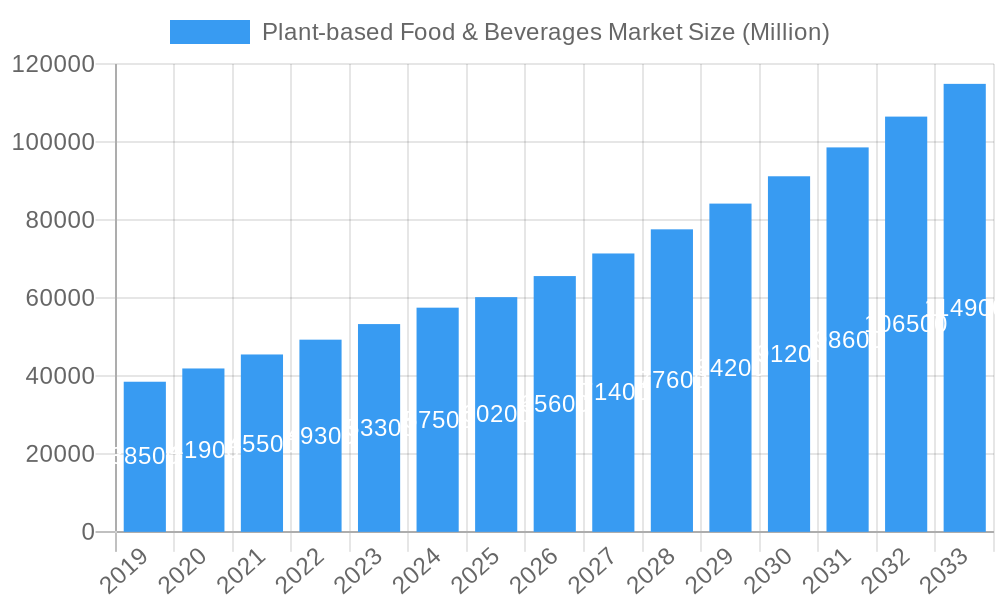

The global plant-based food and beverages market is poised for significant expansion, projected to reach approximately $60.2 billion in 2025. This robust growth is fueled by an estimated compound annual growth rate (CAGR) of 9.28% through 2033, indicating a sustained upward trajectory. Key drivers propelling this market include a growing consumer awareness of health benefits associated with plant-based diets, increasing concerns about environmental sustainability and climate change, and ethical considerations regarding animal welfare. Consumers are actively seeking alternatives to traditional animal-derived products, driven by a desire for healthier lifestyles and a reduced ecological footprint. Furthermore, advancements in food technology are leading to more diverse, palatable, and accessible plant-based options across various food categories.

Plant-based Food & Beverages Market Market Size (In Billion)

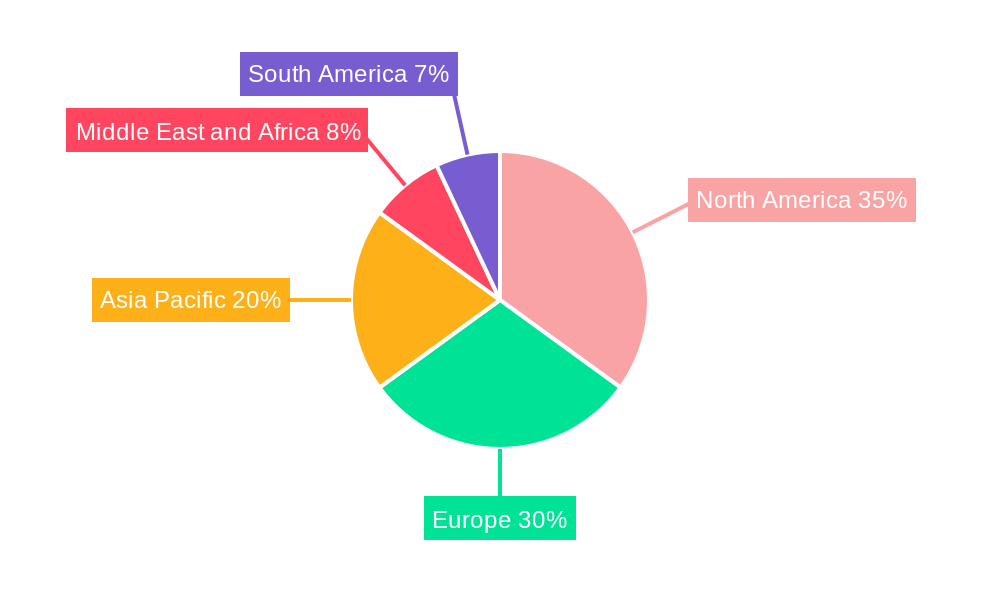

The market is characterized by a dynamic segmentation landscape, with Plant-based Dairy leading the charge, encompassing popular items like yogurts, cheeses, and frozen desserts. Meat substitutes, including tofu, tempeh, and textured vegetable protein, also hold a substantial share. Plant-based beverages, such as packaged milk and smoothies, are witnessing considerable adoption. Distribution channels are evolving, with a notable shift towards off-trade, particularly supermarkets/hypermarkets and increasingly, online stores, catering to consumer convenience and accessibility. Geographically, North America and Europe currently dominate the market, owing to established consumer trends and strong regulatory support. However, the Asia Pacific region is emerging as a significant growth frontier, driven by increasing disposable incomes and a burgeoning interest in health-conscious and sustainable food choices.

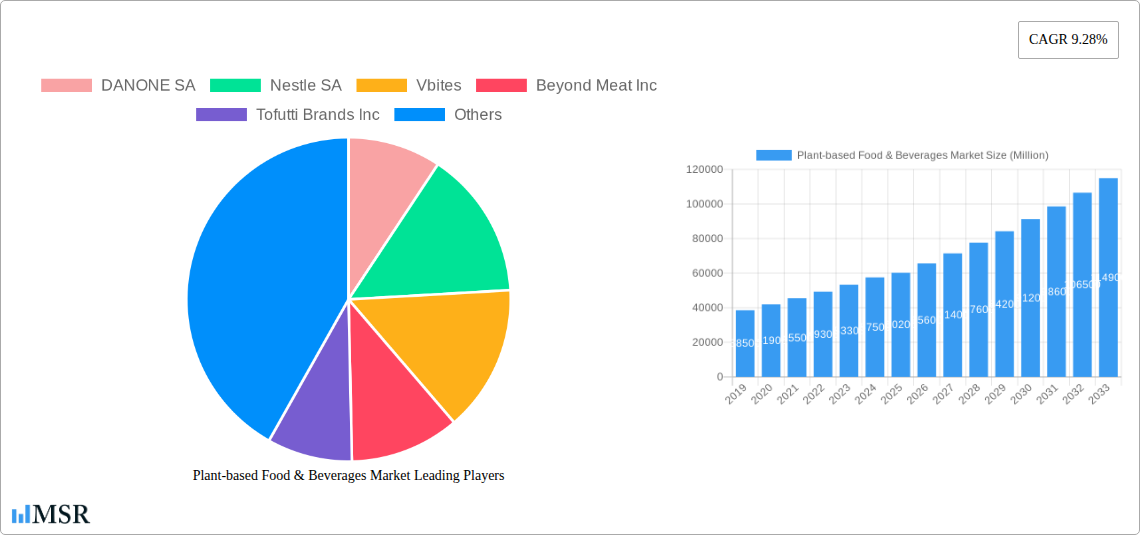

Plant-based Food & Beverages Market Company Market Share

Plant-based Food & Beverages Market: Comprehensive Growth Analysis & Forecast 2019–2033

Dive into the burgeoning plant-based food and beverages market with this in-depth report. Discover critical insights into market dynamics, key growth drivers, emerging opportunities, and the competitive landscape from 2019 to 2033. This report is an indispensable resource for food manufacturers, beverage companies, ingredient suppliers, retailers, investors, and industry analysts seeking to capitalize on the accelerating global shift towards sustainable and health-conscious food choices. Featuring detailed segment analysis, regional spotlights, and actionable strategies, this report empowers stakeholders to navigate this dynamic market.

Plant-based Food & Beverages Market Market Concentration & Dynamics

The plant-based food and beverages market exhibits a moderate level of concentration, with a mix of large multinational corporations and agile, specialized brands vying for market share. Innovation remains a key differentiator, fostering dynamic competition. The report assesses various innovation ecosystems, from novel ingredient development to advanced processing technologies that enhance taste, texture, and nutritional profiles of plant-based alternatives. Regulatory frameworks are evolving globally, with an increasing focus on labeling accuracy, nutritional equivalency claims, and sustainability certifications, impacting product development and market access. The threat of substitute products, while present, is diminishing as plant-based options mature in taste and affordability. End-user trends are overwhelmingly positive, driven by health consciousness, environmental concerns, and ethical considerations. Merger and acquisition (M&A) activities are a significant indicator of market maturity, with strategic investments and consolidations aimed at expanding product portfolios and market reach. We anticipate approximately 15-20 significant M&A deals annually within the forecast period.

Plant-based Food & Beverages Market Industry Insights & Trends

The global plant-based food and beverages market is experiencing robust expansion, projected to reach an estimated market size of $105.8 Billion in 2025, with a compelling Compound Annual Growth Rate (CAGR) of 12.5% during the forecast period of 2025–2033. This significant growth is propelled by a confluence of powerful factors. A primary driver is the escalating consumer awareness regarding the health benefits associated with plant-centric diets, including reduced risks of chronic diseases like heart disease and certain cancers. Furthermore, a growing segment of consumers is actively seeking ethical and sustainable food choices, motivated by concerns over animal welfare and the environmental impact of conventional animal agriculture, such as greenhouse gas emissions and land/water usage. Technological advancements in food science are playing a pivotal role, enabling the development of plant-based alternatives that closely mimic the taste, texture, and nutritional value of their animal-derived counterparts. Innovations in fermentation, precision agriculture, and novel protein extraction are continuously enhancing the appeal and accessibility of plant-based products. The rise of e-commerce and direct-to-consumer (DTC) models has also expanded market reach, making plant-based products more convenient to purchase for a wider audience. The increasing availability of plant-based dairy, meat substitutes, plant-based beverages, and plant-based nutrition/snack bars across various retail channels further fuels market penetration.

Key Markets & Segments Leading Plant-based Food & Beverages Market

North America currently leads the plant-based food and beverages market, driven by high consumer adoption rates, strong innovation ecosystems, and well-established retail infrastructures. The United States, in particular, remains a dominant force due to its large consumer base and proactive approach to embracing plant-based diets.

Dominant Segments:

Plant-based Beverages: This segment, encompassing packaged milk, packaged smoothies, coffee, and tea, holds a significant market share.

- Drivers: Consumer preference for dairy alternatives due to lactose intolerance and perceived health benefits; increasing popularity of plant-based coffee and tea additives; convenient and portable options for on-the-go consumption.

- Dominance Analysis: The widespread availability and versatility of plant-based milks (almond, soy, oat, coconut) in various applications, from direct consumption to culinary use, solidifies their leading position. The growth in ready-to-drink plant-based beverages further bolsters this segment.

Meat Substitutes: This rapidly expanding segment includes tofu, tempeh, textured vegetable protein, and other meat substitutes.

- Drivers: Growing demand for protein sources that align with health and ethical concerns; innovative product development mimicking the taste and texture of traditional meat; increasing adoption by flexitarian consumers.

- Dominance Analysis: The introduction of sophisticated and palatable plant-based burgers, sausages, and chicken alternatives has significantly driven market penetration. Continued advancements in flavor profiles and cooking methods are expanding consumer acceptance beyond vegetarian and vegan demographics.

Plant-based Dairy: This encompasses yogurt, cheese, frozen desserts and ice-cream, and other plant-based dairy products.

- Drivers: Consumer desire for dairy-free options without compromising on taste and texture; innovation in plant-based cheese formulations; growing demand for dairy-free ice cream and frozen desserts.

- Dominance Analysis: The plant-based dairy segment is witnessing impressive growth, with brands consistently launching improved formulations that address taste and meltability challenges. The expansion of product ranges within yogurt and cheese categories caters to diverse culinary needs.

Distribution Channel Dominance:

- Off-Trade: This channel, particularly supermarkets/hypermarkets and online stores, dominates the market.

- Drivers: Wide product availability and competitive pricing in supermarkets; increasing convenience and accessibility offered by online retailers; growth in specialized plant-based sections within mainstream grocery stores.

- Dominance Analysis: Supermarkets and hypermarkets serve as primary access points for consumers seeking a broad range of plant-based options. The surge in online grocery shopping further amplifies the reach of these products, offering consumers greater choice and convenience.

Plant-based Food & Beverages Market Product Developments

Product development in the plant-based food and beverages market is characterized by relentless innovation focused on enhancing taste, texture, and nutritional profiles. Companies are leveraging advanced ingredient technologies and processing techniques to create plant-based alternatives that closely replicate the sensory experiences of traditional animal products. Key advancements include the development of novel protein sources, improved binding agents, and sophisticated flavor encapsulation technologies. Applications are expanding beyond direct consumption to include versatile ingredients for culinary use. This ongoing commitment to product enhancement is crucial for attracting a broader consumer base and fostering sustained market growth.

Challenges in the Plant-based Food & Beverages Market Market

Despite its strong growth trajectory, the plant-based food and beverages market faces several challenges. These include:

- Price Premium: Plant-based products often command a higher price point compared to their conventional counterparts, posing a barrier for price-sensitive consumers.

- Taste and Texture Perceptions: While rapidly improving, some consumers still perceive taste and texture limitations in certain plant-based alternatives.

- Regulatory Scrutiny: Evolving labeling regulations and debates surrounding the terminology used for plant-based products can create market uncertainty.

- Supply Chain Volatility: Sourcing specialized plant-based ingredients can be subject to agricultural yields and global supply chain disruptions, impacting availability and cost.

- Nutritional Completeness: Ensuring complete nutritional profiles, particularly regarding essential vitamins and minerals often found in animal products, remains an area of focus and development.

Forces Driving Plant-based Food & Beverages Market Growth

The plant-based food and beverages market is propelled by a powerful combination of forces. Rising global health consciousness, fueled by increasing awareness of diet-related diseases, drives consumers towards healthier food choices. Growing environmental concerns regarding climate change and sustainable resource management are significantly influencing purchasing decisions, as consumers seek to reduce their ecological footprint. Ethical considerations surrounding animal welfare are also a major catalyst, with a significant portion of the population actively choosing vegan and vegetarian diets. Furthermore, technological advancements in food science are continuously improving the taste, texture, and nutritional value of plant-based products, making them more appealing and accessible to a broader consumer base. Government initiatives promoting sustainable agriculture and healthier eating habits further contribute to market expansion.

Challenges in the Plant-based Food & Beverages Market Market

Long-term growth in the plant-based food and beverages market will hinge on overcoming persistent challenges and capitalizing on evolving market dynamics. Continued investment in research and development is crucial to further enhance the sensory appeal and nutritional completeness of plant-based products, addressing lingering consumer perceptions. Innovations in ingredient sourcing and processing technologies will be vital to mitigate supply chain vulnerabilities and achieve greater cost parity with conventional products. Strategic partnerships between ingredient suppliers, food manufacturers, and retailers will streamline distribution and expand market reach. Moreover, educational initiatives that clearly communicate the health, environmental, and ethical benefits of plant-based diets will be instrumental in fostering sustained consumer demand and expanding market penetration into new demographics and regions.

Emerging Opportunities in Plant-based Food & Beverages Market

The plant-based food and beverages market is ripe with emerging opportunities. The burgeoning interest in personalized nutrition is creating a demand for specialized plant-based products tailored to specific dietary needs and health goals. Further innovation in plant-based protein sources, such as precision fermentation and cultivated ingredients, promises to unlock new taste profiles and functionalities. Expansion into developing economies, where plant-based diets are traditionally common and health consciousness is rising, presents a significant untapped market. The integration of AI and data analytics in product development and consumer engagement can optimize offerings and personalize marketing efforts. Furthermore, the growing trend of flexitarianism – consumers reducing but not eliminating animal products – represents a massive opportunity for products that offer accessible and enjoyable plant-based alternatives.

Leading Players in the Plant-based Food & Beverages Market Sector

- DANONE SA

- Nestle SA

- Vbites

- Beyond Meat Inc

- Tofutti Brands Inc

- The Hain Celestial Group Inc

- Conagra Brands Inc

- Eden Foods Inc

- Blue Diamond Growers

- Campbell Soup Company

Key Milestones in Plant-based Food & Beverages Market Industry

- May 2022: Danone launched the new Dairy & Plants Blend baby formula, addressing the growing demand for feeding options suitable for vegetarian, flexitarian, and plant-based diets while ensuring infant nutritional needs are met.

- January 2022: Gaia's Farming Co., a new biotech company, launched its first two milk alternatives made with hemp and oats, catering to the expanding vegan population.

- May 2021: Conagra Brands expanded its Gardein meat alternatives in Canada with the introduction of a new Suprême Plant-Based Burger, bolstering its presence in the meat substitute market.

Strategic Outlook for Plant-based Food & Beverages Market Market

The strategic outlook for the plant-based food and beverages market is exceptionally promising, driven by an irreversible shift in consumer preferences and ongoing technological advancements. Growth accelerators will include a continued focus on product innovation to achieve parity with animal-based products in taste, texture, and nutrition, alongside efforts to reduce price premiums through economies of scale and efficient supply chains. Strategic partnerships across the value chain, from ingredient suppliers to retailers, will be crucial for expanding distribution and market penetration. Furthermore, targeted marketing campaigns that highlight the holistic benefits – health, environmental, and ethical – of plant-based consumption will broaden consumer appeal. Expansion into untapped geographic markets and the development of specialized product lines for diverse consumer needs will unlock new avenues for sustained growth and market leadership.

Plant-based Food & Beverages Market Segmentation

-

1. Type

-

1.1. Plant-based Dairy

- 1.1.1. Yogurt

- 1.1.2. Cheese

- 1.1.3. Frozen Desserts and Ice-Cream

- 1.1.4. Other Plant-based Dairy

-

1.2. Meat Substitutes

- 1.2.1. Tofu

- 1.2.2. Tempeh

- 1.2.3. Textured Vegetable Protein

- 1.2.4. Other Meat Substitutes

- 1.3. Plant-based Nutrition/Snack Bars

- 1.4. Plant-based Bakery Products

-

1.5. Plant-based Beverages

- 1.5.1. Packaged Milk

- 1.5.2. Packaged Smoothies

- 1.5.3. Coffee

- 1.5.4. Tea

- 1.5.5. Other Plant-based Beverages

- 1.6. Other Food and Beverages

-

1.1. Plant-based Dairy

-

2. Distribution Channel

- 2.1. On-Trade

-

2.2. Off-Trade

- 2.2.1. Supermarkets/Hypermarkets

- 2.2.2. Convenience Stores

- 2.2.3. Online Stores

- 2.2.4. Other Off-trade Distribution Channels

Plant-based Food & Beverages Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. Spain

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Plant-based Food & Beverages Market Regional Market Share

Geographic Coverage of Plant-based Food & Beverages Market

Plant-based Food & Beverages Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Health Concerns are Supporting the Market's Growth; Growing Consumer Preference for Convenience Seafood

- 3.3. Market Restrains

- 3.3.1. Rising Concern About Quality and Safety Standards of Canned Tuna

- 3.4. Market Trends

- 3.4.1. Growing Popularity of Vegan Culture

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Plant-based Food & Beverages Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Plant-based Dairy

- 5.1.1.1. Yogurt

- 5.1.1.2. Cheese

- 5.1.1.3. Frozen Desserts and Ice-Cream

- 5.1.1.4. Other Plant-based Dairy

- 5.1.2. Meat Substitutes

- 5.1.2.1. Tofu

- 5.1.2.2. Tempeh

- 5.1.2.3. Textured Vegetable Protein

- 5.1.2.4. Other Meat Substitutes

- 5.1.3. Plant-based Nutrition/Snack Bars

- 5.1.4. Plant-based Bakery Products

- 5.1.5. Plant-based Beverages

- 5.1.5.1. Packaged Milk

- 5.1.5.2. Packaged Smoothies

- 5.1.5.3. Coffee

- 5.1.5.4. Tea

- 5.1.5.5. Other Plant-based Beverages

- 5.1.6. Other Food and Beverages

- 5.1.1. Plant-based Dairy

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-Trade

- 5.2.2. Off-Trade

- 5.2.2.1. Supermarkets/Hypermarkets

- 5.2.2.2. Convenience Stores

- 5.2.2.3. Online Stores

- 5.2.2.4. Other Off-trade Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Plant-based Food & Beverages Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Plant-based Dairy

- 6.1.1.1. Yogurt

- 6.1.1.2. Cheese

- 6.1.1.3. Frozen Desserts and Ice-Cream

- 6.1.1.4. Other Plant-based Dairy

- 6.1.2. Meat Substitutes

- 6.1.2.1. Tofu

- 6.1.2.2. Tempeh

- 6.1.2.3. Textured Vegetable Protein

- 6.1.2.4. Other Meat Substitutes

- 6.1.3. Plant-based Nutrition/Snack Bars

- 6.1.4. Plant-based Bakery Products

- 6.1.5. Plant-based Beverages

- 6.1.5.1. Packaged Milk

- 6.1.5.2. Packaged Smoothies

- 6.1.5.3. Coffee

- 6.1.5.4. Tea

- 6.1.5.5. Other Plant-based Beverages

- 6.1.6. Other Food and Beverages

- 6.1.1. Plant-based Dairy

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. On-Trade

- 6.2.2. Off-Trade

- 6.2.2.1. Supermarkets/Hypermarkets

- 6.2.2.2. Convenience Stores

- 6.2.2.3. Online Stores

- 6.2.2.4. Other Off-trade Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Plant-based Food & Beverages Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Plant-based Dairy

- 7.1.1.1. Yogurt

- 7.1.1.2. Cheese

- 7.1.1.3. Frozen Desserts and Ice-Cream

- 7.1.1.4. Other Plant-based Dairy

- 7.1.2. Meat Substitutes

- 7.1.2.1. Tofu

- 7.1.2.2. Tempeh

- 7.1.2.3. Textured Vegetable Protein

- 7.1.2.4. Other Meat Substitutes

- 7.1.3. Plant-based Nutrition/Snack Bars

- 7.1.4. Plant-based Bakery Products

- 7.1.5. Plant-based Beverages

- 7.1.5.1. Packaged Milk

- 7.1.5.2. Packaged Smoothies

- 7.1.5.3. Coffee

- 7.1.5.4. Tea

- 7.1.5.5. Other Plant-based Beverages

- 7.1.6. Other Food and Beverages

- 7.1.1. Plant-based Dairy

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. On-Trade

- 7.2.2. Off-Trade

- 7.2.2.1. Supermarkets/Hypermarkets

- 7.2.2.2. Convenience Stores

- 7.2.2.3. Online Stores

- 7.2.2.4. Other Off-trade Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Plant-based Food & Beverages Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Plant-based Dairy

- 8.1.1.1. Yogurt

- 8.1.1.2. Cheese

- 8.1.1.3. Frozen Desserts and Ice-Cream

- 8.1.1.4. Other Plant-based Dairy

- 8.1.2. Meat Substitutes

- 8.1.2.1. Tofu

- 8.1.2.2. Tempeh

- 8.1.2.3. Textured Vegetable Protein

- 8.1.2.4. Other Meat Substitutes

- 8.1.3. Plant-based Nutrition/Snack Bars

- 8.1.4. Plant-based Bakery Products

- 8.1.5. Plant-based Beverages

- 8.1.5.1. Packaged Milk

- 8.1.5.2. Packaged Smoothies

- 8.1.5.3. Coffee

- 8.1.5.4. Tea

- 8.1.5.5. Other Plant-based Beverages

- 8.1.6. Other Food and Beverages

- 8.1.1. Plant-based Dairy

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. On-Trade

- 8.2.2. Off-Trade

- 8.2.2.1. Supermarkets/Hypermarkets

- 8.2.2.2. Convenience Stores

- 8.2.2.3. Online Stores

- 8.2.2.4. Other Off-trade Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Plant-based Food & Beverages Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Plant-based Dairy

- 9.1.1.1. Yogurt

- 9.1.1.2. Cheese

- 9.1.1.3. Frozen Desserts and Ice-Cream

- 9.1.1.4. Other Plant-based Dairy

- 9.1.2. Meat Substitutes

- 9.1.2.1. Tofu

- 9.1.2.2. Tempeh

- 9.1.2.3. Textured Vegetable Protein

- 9.1.2.4. Other Meat Substitutes

- 9.1.3. Plant-based Nutrition/Snack Bars

- 9.1.4. Plant-based Bakery Products

- 9.1.5. Plant-based Beverages

- 9.1.5.1. Packaged Milk

- 9.1.5.2. Packaged Smoothies

- 9.1.5.3. Coffee

- 9.1.5.4. Tea

- 9.1.5.5. Other Plant-based Beverages

- 9.1.6. Other Food and Beverages

- 9.1.1. Plant-based Dairy

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. On-Trade

- 9.2.2. Off-Trade

- 9.2.2.1. Supermarkets/Hypermarkets

- 9.2.2.2. Convenience Stores

- 9.2.2.3. Online Stores

- 9.2.2.4. Other Off-trade Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Plant-based Food & Beverages Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Plant-based Dairy

- 10.1.1.1. Yogurt

- 10.1.1.2. Cheese

- 10.1.1.3. Frozen Desserts and Ice-Cream

- 10.1.1.4. Other Plant-based Dairy

- 10.1.2. Meat Substitutes

- 10.1.2.1. Tofu

- 10.1.2.2. Tempeh

- 10.1.2.3. Textured Vegetable Protein

- 10.1.2.4. Other Meat Substitutes

- 10.1.3. Plant-based Nutrition/Snack Bars

- 10.1.4. Plant-based Bakery Products

- 10.1.5. Plant-based Beverages

- 10.1.5.1. Packaged Milk

- 10.1.5.2. Packaged Smoothies

- 10.1.5.3. Coffee

- 10.1.5.4. Tea

- 10.1.5.5. Other Plant-based Beverages

- 10.1.6. Other Food and Beverages

- 10.1.1. Plant-based Dairy

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. On-Trade

- 10.2.2. Off-Trade

- 10.2.2.1. Supermarkets/Hypermarkets

- 10.2.2.2. Convenience Stores

- 10.2.2.3. Online Stores

- 10.2.2.4. Other Off-trade Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Plant-based Food & Beverages Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 11.1.4 Rest of North America

- 12. Europe Plant-based Food & Beverages Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United Kingdom

- 12.1.2 Germany

- 12.1.3 Spain

- 12.1.4 France

- 12.1.5 Italy

- 12.1.6 Russia

- 12.1.7 Rest of Europe

- 13. Asia Pacific Plant-based Food & Beverages Market Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 Rest of Asia Pacific

- 14. South America Plant-based Food & Beverages Market Analysis, Insights and Forecast, 2020-2032

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Rest of South America

- 15. Middle East and Africa Plant-based Food & Beverages Market Analysis, Insights and Forecast, 2020-2032

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Saudi Arabia

- 15.1.2 South Africa

- 15.1.3 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2025

- 16.2. Company Profiles

- 16.2.1 DANONE SA

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Nestle SA

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Vbites

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Beyond Meat Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Tofutti Brands Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 The Hain Celestial Group Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Conagra Brands Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Eden Foods Inc *List Not Exhaustive

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Blue Diamond Growers

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Campbell Soup Company

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 DANONE SA

List of Figures

- Figure 1: Global Plant-based Food & Beverages Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Plant-based Food & Beverages Market Revenue (Million), by Country 2025 & 2033

- Figure 3: North America Plant-based Food & Beverages Market Revenue Share (%), by Country 2025 & 2033

- Figure 4: Europe Plant-based Food & Beverages Market Revenue (Million), by Country 2025 & 2033

- Figure 5: Europe Plant-based Food & Beverages Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Asia Pacific Plant-based Food & Beverages Market Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Plant-based Food & Beverages Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Plant-based Food & Beverages Market Revenue (Million), by Country 2025 & 2033

- Figure 9: South America Plant-based Food & Beverages Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Middle East and Africa Plant-based Food & Beverages Market Revenue (Million), by Country 2025 & 2033

- Figure 11: Middle East and Africa Plant-based Food & Beverages Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: North America Plant-based Food & Beverages Market Revenue (Million), by Type 2025 & 2033

- Figure 13: North America Plant-based Food & Beverages Market Revenue Share (%), by Type 2025 & 2033

- Figure 14: North America Plant-based Food & Beverages Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 15: North America Plant-based Food & Beverages Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: North America Plant-based Food & Beverages Market Revenue (Million), by Country 2025 & 2033

- Figure 17: North America Plant-based Food & Beverages Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Plant-based Food & Beverages Market Revenue (Million), by Type 2025 & 2033

- Figure 19: Europe Plant-based Food & Beverages Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Europe Plant-based Food & Beverages Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 21: Europe Plant-based Food & Beverages Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: Europe Plant-based Food & Beverages Market Revenue (Million), by Country 2025 & 2033

- Figure 23: Europe Plant-based Food & Beverages Market Revenue Share (%), by Country 2025 & 2033

- Figure 24: Asia Pacific Plant-based Food & Beverages Market Revenue (Million), by Type 2025 & 2033

- Figure 25: Asia Pacific Plant-based Food & Beverages Market Revenue Share (%), by Type 2025 & 2033

- Figure 26: Asia Pacific Plant-based Food & Beverages Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 27: Asia Pacific Plant-based Food & Beverages Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 28: Asia Pacific Plant-based Food & Beverages Market Revenue (Million), by Country 2025 & 2033

- Figure 29: Asia Pacific Plant-based Food & Beverages Market Revenue Share (%), by Country 2025 & 2033

- Figure 30: South America Plant-based Food & Beverages Market Revenue (Million), by Type 2025 & 2033

- Figure 31: South America Plant-based Food & Beverages Market Revenue Share (%), by Type 2025 & 2033

- Figure 32: South America Plant-based Food & Beverages Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 33: South America Plant-based Food & Beverages Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 34: South America Plant-based Food & Beverages Market Revenue (Million), by Country 2025 & 2033

- Figure 35: South America Plant-based Food & Beverages Market Revenue Share (%), by Country 2025 & 2033

- Figure 36: Middle East and Africa Plant-based Food & Beverages Market Revenue (Million), by Type 2025 & 2033

- Figure 37: Middle East and Africa Plant-based Food & Beverages Market Revenue Share (%), by Type 2025 & 2033

- Figure 38: Middle East and Africa Plant-based Food & Beverages Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 39: Middle East and Africa Plant-based Food & Beverages Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Middle East and Africa Plant-based Food & Beverages Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Plant-based Food & Beverages Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Plant-based Food & Beverages Market Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Global Plant-based Food & Beverages Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global Plant-based Food & Beverages Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Plant-based Food & Beverages Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Plant-based Food & Beverages Market Revenue Million Forecast, by Country 2020 & 2033

- Table 6: United States Plant-based Food & Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Canada Plant-based Food & Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Mexico Plant-based Food & Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Plant-based Food & Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Plant-based Food & Beverages Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United Kingdom Plant-based Food & Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Germany Plant-based Food & Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain Plant-based Food & Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France Plant-based Food & Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Italy Plant-based Food & Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Russia Plant-based Food & Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Plant-based Food & Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global Plant-based Food & Beverages Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: China Plant-based Food & Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan Plant-based Food & Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: India Plant-based Food & Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Australia Plant-based Food & Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Asia Pacific Plant-based Food & Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Plant-based Food & Beverages Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Brazil Plant-based Food & Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Argentina Plant-based Food & Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of South America Plant-based Food & Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Plant-based Food & Beverages Market Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Saudi Arabia Plant-based Food & Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa Plant-based Food & Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East and Africa Plant-based Food & Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Plant-based Food & Beverages Market Revenue Million Forecast, by Type 2020 & 2033

- Table 33: Global Plant-based Food & Beverages Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 34: Global Plant-based Food & Beverages Market Revenue Million Forecast, by Country 2020 & 2033

- Table 35: United States Plant-based Food & Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Canada Plant-based Food & Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Mexico Plant-based Food & Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Rest of North America Plant-based Food & Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Global Plant-based Food & Beverages Market Revenue Million Forecast, by Type 2020 & 2033

- Table 40: Global Plant-based Food & Beverages Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 41: Global Plant-based Food & Beverages Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: United Kingdom Plant-based Food & Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: Germany Plant-based Food & Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Spain Plant-based Food & Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: France Plant-based Food & Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Italy Plant-based Food & Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Russia Plant-based Food & Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Rest of Europe Plant-based Food & Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: Global Plant-based Food & Beverages Market Revenue Million Forecast, by Type 2020 & 2033

- Table 50: Global Plant-based Food & Beverages Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 51: Global Plant-based Food & Beverages Market Revenue Million Forecast, by Country 2020 & 2033

- Table 52: China Plant-based Food & Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 53: Japan Plant-based Food & Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: India Plant-based Food & Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 55: Australia Plant-based Food & Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Rest of Asia Pacific Plant-based Food & Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 57: Global Plant-based Food & Beverages Market Revenue Million Forecast, by Type 2020 & 2033

- Table 58: Global Plant-based Food & Beverages Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 59: Global Plant-based Food & Beverages Market Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Brazil Plant-based Food & Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 61: Argentina Plant-based Food & Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Rest of South America Plant-based Food & Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 63: Global Plant-based Food & Beverages Market Revenue Million Forecast, by Type 2020 & 2033

- Table 64: Global Plant-based Food & Beverages Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 65: Global Plant-based Food & Beverages Market Revenue Million Forecast, by Country 2020 & 2033

- Table 66: Saudi Arabia Plant-based Food & Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 67: South Africa Plant-based Food & Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: Rest of Middle East and Africa Plant-based Food & Beverages Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Plant-based Food & Beverages Market?

The projected CAGR is approximately 9.28%.

2. Which companies are prominent players in the Plant-based Food & Beverages Market?

Key companies in the market include DANONE SA, Nestle SA, Vbites, Beyond Meat Inc, Tofutti Brands Inc, The Hain Celestial Group Inc, Conagra Brands Inc, Eden Foods Inc *List Not Exhaustive, Blue Diamond Growers, Campbell Soup Company.

3. What are the main segments of the Plant-based Food & Beverages Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Health Concerns are Supporting the Market's Growth; Growing Consumer Preference for Convenience Seafood.

6. What are the notable trends driving market growth?

Growing Popularity of Vegan Culture.

7. Are there any restraints impacting market growth?

Rising Concern About Quality and Safety Standards of Canned Tuna.

8. Can you provide examples of recent developments in the market?

May 2022: Danone launched the new Dairy & Plants Blend baby formula to meet parents' demand for feeding options suitable for vegetarian, flexitarian, and plant-based diets, while still meeting their baby's specific nutritional requirements.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Plant-based Food & Beverages Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Plant-based Food & Beverages Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Plant-based Food & Beverages Market?

To stay informed about further developments, trends, and reports in the Plant-based Food & Beverages Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence