Key Insights

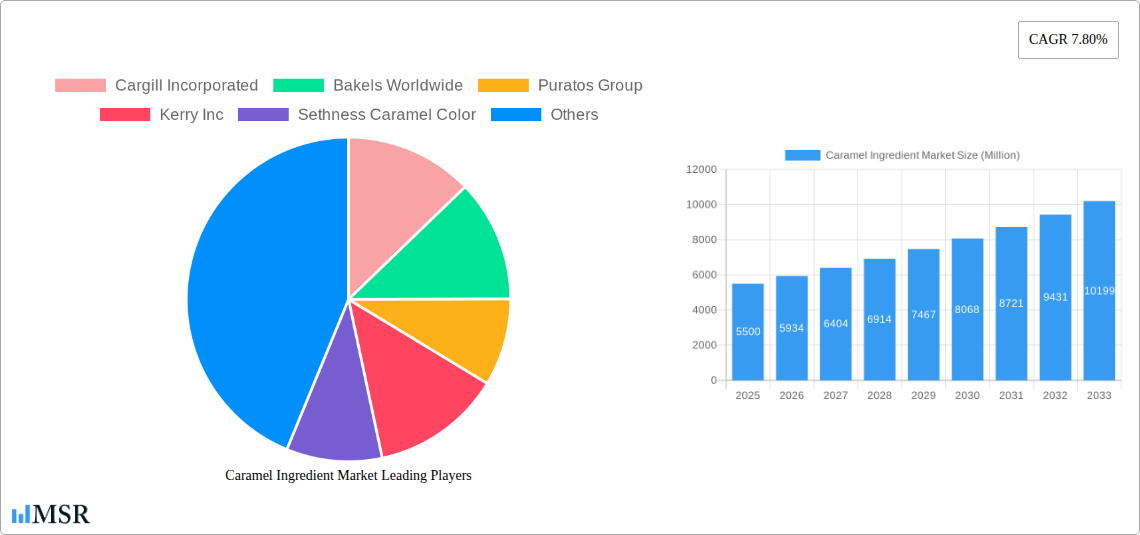

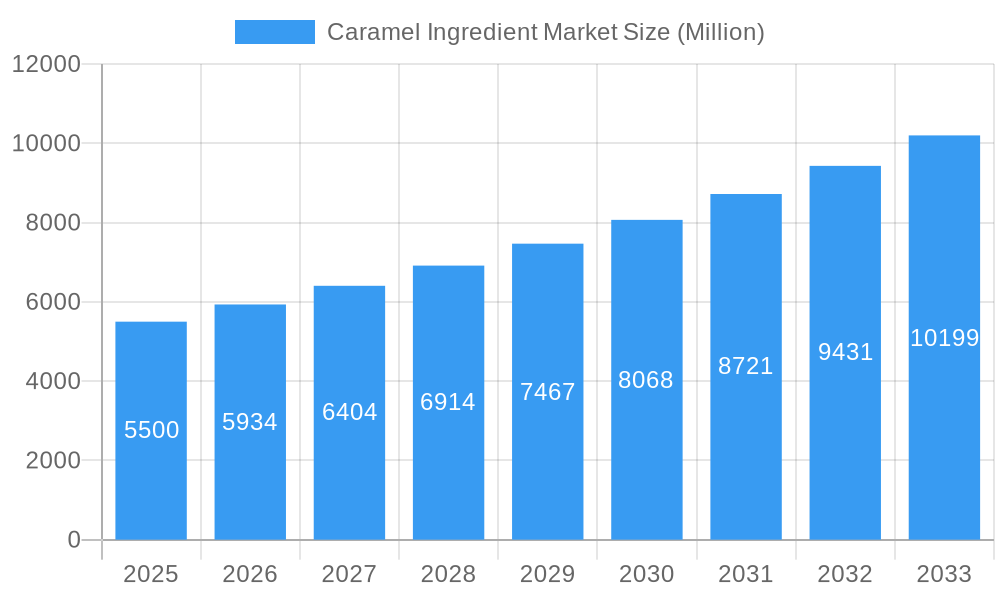

The global Caramel Ingredient Market is poised for significant expansion, with an estimated market size of approximately $5.5 billion in 2025. This growth is fueled by a robust Compound Annual Growth Rate (CAGR) of 7.80%, projecting the market to reach substantial valuations by 2033. The increasing consumer preference for natural and visually appealing food and beverage products is a primary driver, leading to a higher demand for caramel ingredients across various applications. Innovations in caramel production, including the development of liquid and syrup forms for easier incorporation, are also contributing to market momentum. The confectionery and bakery sectors, in particular, are leveraging caramel ingredients to enhance flavor profiles and create visually attractive products, catering to evolving consumer tastes and a desire for indulgent experiences.

Caramel Ingredient Market Market Size (In Billion)

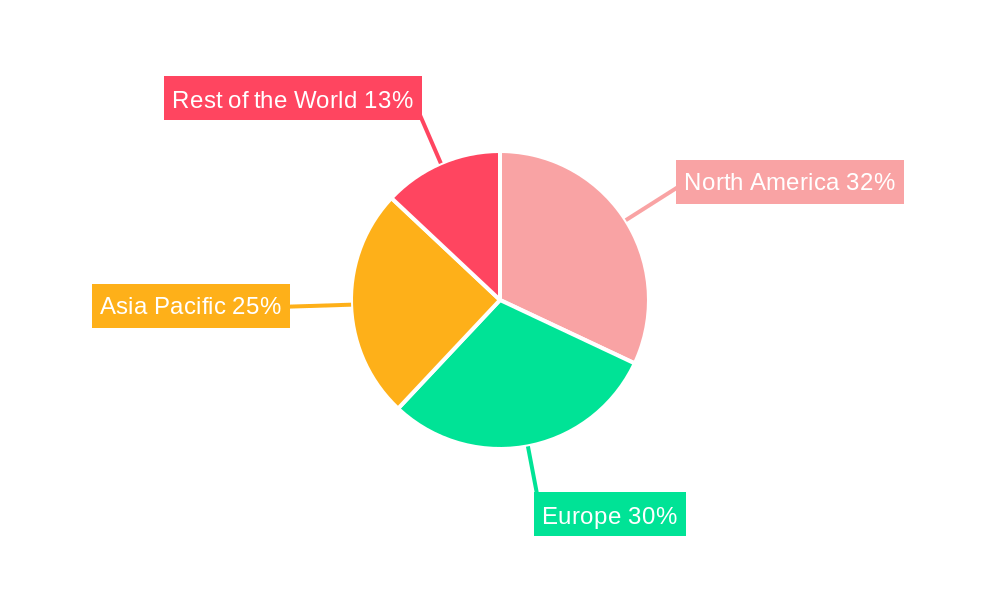

Restrains such as fluctuating raw material prices, particularly for sugar and dairy, could pose challenges to market growth. However, the rising demand for clean-label products and the development of caramel ingredients derived from alternative sources are expected to mitigate these concerns. The market is segmented into powder and liquid/syrup types, with liquid/syrup dominating due to its ease of use and versatility in applications like beverages and dairy. Geographically, North America and Europe currently hold significant market shares, driven by established food processing industries and high consumer spending on processed foods. However, the Asia Pacific region, propelled by rapid urbanization, a growing middle class, and increasing adoption of Western food trends, is anticipated to witness the fastest growth in the coming years, presenting substantial opportunities for market players.

Caramel Ingredient Market Company Market Share

Unlock the sweet potential of the global caramel ingredient market with our in-depth analysis. This report provides critical insights into market dynamics, industry trends, key player strategies, and future growth trajectories for the period 2019–2033, with a base year of 2025 and a forecast period of 2025–2033.

This authoritative report delves deep into the multifaceted caramel ingredient market, offering strategic intelligence for stakeholders across the food and beverage industry. We meticulously examine market concentration, emerging trends, key segments, product innovations, challenges, and growth drivers, providing a 360-degree view of this dynamic sector. Essential for manufacturers, suppliers, investors, and R&D professionals seeking to capitalize on the evolving demand for caramel flavors and functionalities.

Caramel Ingredient Market Market Concentration & Dynamics

The caramel ingredient market is characterized by a moderate level of concentration, with a mix of large multinational corporations and specialized regional players. Innovation ecosystems are thriving, driven by the continuous demand for novel flavor profiles, clean-label ingredients, and enhanced functionalities in food and beverage applications. Regulatory frameworks, primarily focused on food safety and labeling, are generally well-established but can vary by region, impacting ingredient sourcing and product development. Substitute products, such as other flavor enhancers and natural sweeteners, pose a competitive challenge, but the unique sensory appeal of caramel continues to maintain its dominance. End-user trends, including a growing preference for indulgent yet healthier options, are shaping product development strategies. Merger and acquisition (M&A) activities are observed as key players seek to expand their product portfolios, geographical reach, and technological capabilities. Estimated M&A deal counts in the historical period (2019-2024) are projected to be in the range of 15-25, indicating strategic consolidation. Market share distribution sees major players holding significant portions, but with room for niche specialists to thrive.

Caramel Ingredient Market Industry Insights & Trends

The caramel ingredient market is poised for robust growth, driven by a confluence of factors including an escalating global demand for processed foods and beverages, the inherent appeal of caramel's rich flavor and aroma, and ongoing innovation in product development. The market size is estimated to be around $4,500 Million in the base year 2025, with a projected Compound Annual Growth Rate (CAGR) of approximately 5.5% during the forecast period 2025–2033. Technological disruptions are playing a pivotal role, with advancements in caramelization processes leading to more stable, consistent, and customizable caramel ingredients. These innovations allow for the creation of caramel with varying flavor profiles, colors, and functional properties, catering to specific application needs. Evolving consumer behaviors are also a significant catalyst; a growing consumer preference for natural and clean-label products is pushing manufacturers to develop caramel ingredients derived from natural sources and processed with minimal additives. Furthermore, the increasing popularity of dessert-inspired beverages and the rising demand for premium confectionery products are directly contributing to the expansion of the caramel ingredient market. The convenience food sector, too, is a substantial contributor, with caramel often used to enhance the palatability of ready-to-eat meals and snacks. The growing health consciousness among consumers has also spurred demand for reduced-sugar and sugar-free caramel variants, presenting a significant avenue for product innovation and market penetration. The bakery segment, in particular, consistently demonstrates strong performance due to the widespread use of caramel in cakes, cookies, and pastries. Similarly, the confectionery sector's insatiable appetite for chocolates, caramels, and other sweet treats ensures sustained demand. The beverage industry's adoption of caramel flavors in coffee, teas, and alcoholic drinks further bolsters market growth.

Key Markets & Segments Leading Caramel Ingredient Market

The global caramel ingredient market exhibits significant regional and segmental dominance. North America and Europe currently lead the market, driven by mature food processing industries and high consumer spending on confectionery and bakery products. Asia Pacific, however, is emerging as the fastest-growing region, fueled by rapid economic development, increasing disposable incomes, and a burgeoning middle class with a growing appetite for processed foods and indulgence.

Dominant Segments by Type:

- Liquid/Syrup: This segment holds the largest market share due to its versatility and ease of incorporation into a wide array of food and beverage formulations, including sauces, toppings, and beverage flavorings. Its superior texture and consistency make it a preferred choice for many applications.

- Powder: While currently holding a smaller share, the powder segment is experiencing rapid growth, driven by demand for longer shelf-life ingredients, convenient handling, and applications where a dry ingredient is preferred, such as in instant mixes and baked goods.

Dominant Segments by Application:

- Confectionery: This remains the largest application segment, as caramel is a quintessential ingredient in chocolates, candies, and other sweet treats. The demand for premium and artisanal confectionery further amplifies this dominance.

- Bakery: A close second, the bakery segment extensively utilizes caramel ingredients in cakes, pastries, cookies, and fillings, contributing significantly to market demand. The versatility of caramel allows for diverse applications from simple glazes to complex dessert components.

- Beverages: The beverage industry is a rapidly expanding application, with caramel flavors being a popular choice for coffee, tea, dairy drinks, and alcoholic beverages. The growth of flavored lattes and specialty drinks is a key driver.

- Dairy and Frozen Desserts: Caramel is a staple in ice cream, yogurt, and other dairy-based desserts, providing a rich and satisfying flavor profile.

- Other Applications: This includes a range of niche uses in sauces, dressings, and savory applications where caramel can add a subtle sweetness and depth of flavor.

Drivers for dominance in these segments include economic growth, increasing urbanization leading to higher consumption of convenience foods, strong brand presence of key players, and consistent consumer demand for familiar and comforting flavors.

Caramel Ingredient Market Product Developments

Product innovation in the caramel ingredient market is characterized by a focus on enhanced functionality, natural sourcing, and unique flavor profiles. Companies are developing caramel ingredients with improved heat stability for baking applications, reduced sugar options to cater to health-conscious consumers, and natural coloring agents derived from caramel for clean-label products. Novel flavor variations, such as salted caramel and spiced caramel, are gaining traction, expanding their appeal beyond traditional applications. Technological advancements in caramelization processes allow for precise control over color, flavor, and texture, enabling manufacturers to create bespoke caramel solutions tailored to specific product requirements. The market relevance of these developments is significant, as they directly address evolving consumer preferences and regulatory demands, providing competitive advantages to companies at the forefront of innovation.

Challenges in the Caramel Ingredient Market Market

The caramel ingredient market, while promising, faces several hurdles. Regulatory compliance, particularly concerning food labeling and ingredient sourcing transparency, can be complex and costly. Supply chain disruptions, stemming from fluctuating raw material prices (sugar, dairy) and geopolitical events, can impact ingredient availability and cost-effectiveness. Intense competition among existing players and the emergence of new entrants exert continuous price pressures. Furthermore, the ongoing consumer trend towards sugar reduction necessitates the development of cost-effective and palatable sugar-free or low-sugar caramel alternatives, which remains a significant R&D challenge. The projected impact of these challenges could lead to a marginal slowdown in growth for specific segments if not adequately addressed, potentially by 0.5-1% annually in affected areas.

Forces Driving Caramel Ingredient Market Growth

Several powerful forces are propelling the caramel ingredient market forward. Technological advancements in caramelization processes are leading to more efficient production, improved quality control, and the creation of novel caramel variants with enhanced functionalities. Economic factors, such as rising disposable incomes in emerging economies and a growing global population, are increasing the demand for processed foods and beverages that frequently incorporate caramel. Regulatory frameworks, while sometimes challenging, are also driving innovation towards cleaner labels and more sustainable sourcing practices. The increasing consumer preference for indulgent and premium food and beverage experiences, coupled with the versatile appeal of caramel flavors across numerous applications, remains a fundamental growth catalyst.

Challenges in the Caramel Ingredient Market Market

Long-term growth catalysts for the caramel ingredient market are deeply intertwined with innovation and strategic market expansion. The continuous pursuit of cleaner label solutions, including naturally derived caramel colors and flavors, will be crucial in meeting evolving consumer demands and regulatory scrutiny. Strategic partnerships and collaborations between ingredient manufacturers and food and beverage companies will foster co-creation and the development of bespoke caramel solutions for niche markets. Exploring and penetrating untapped or underserved geographical markets, particularly in developing economies, presents significant opportunities for sustained expansion. Investments in advanced manufacturing technologies to improve efficiency and reduce environmental impact will also be key differentiators.

Emerging Opportunities in Caramel Ingredient Market

Emerging opportunities in the caramel ingredient market are abundant and diverse. The rising global interest in plant-based diets is creating a demand for vegan caramel ingredients, particularly for dairy-free applications in confectionery, beverages, and desserts. The "better-for-you" trend is driving innovation in reduced-sugar, low-calorie, and functional caramel ingredients fortified with prebiotics or other health-promoting additives. The premiumization of food and beverage products presents an opportunity for high-end, artisanal caramel ingredients with complex flavor profiles and unique textures. Furthermore, the expanding use of caramel in savory applications, such as glazes for meats and marinades, offers a new avenue for market penetration. Technological advancements in fermentation and enzyme-based processing also hold promise for novel caramel ingredient development.

Leading Players in the Caramel Ingredient Market Sector

- Cargill Incorporated

- Bakels Worldwide

- Puratos Group

- Kerry Inc

- Sethness Caramel Color

- DDW the Color House

- Alvin Caramel Colours (India) Private Ltd

- Nigay

- Sensient Technologies Corporation

- Martin Braun KG

Key Milestones in Caramel Ingredient Market Industry

- 2021: Big Train, a brand of Kerry Group, released new dairy-free caramel latte flavors in its Big Train product family of hot and cold beverage mixes with 'GanedenBC30' probiotic, used by foodservice operators. This innovation aims to meet the consumer demand for healthy products.

- 2021: British Bakels launched a new Chocolate Millionaires Caramel PF, the latest addition to the True Caramel range. This new product provides all the versatile qualities of traditional Millionaires Caramel with a chocolatey twist. The company launched the product to expand its True Caramel range and boost the growth of caramel ingredients globally.

- 2019: Barry Callebaut announced the launch of its latest chocolate innovation, Caramel Aura. This newest addition to Barry Callebaut's caramel collection offers a premium and decadent flavor experience with the inclusion of specialized ingredients in combination with the fine-tuned processing, which delivers a creamy, warm, memorable, and flavor-forward caramel experience.

Strategic Outlook for Caramel Ingredient Market Market

The strategic outlook for the caramel ingredient market remains exceptionally positive, driven by sustained consumer demand for its appealing flavor and versatility. Future market potential will be significantly shaped by ongoing innovation in clean-label solutions, particularly natural caramel colors and flavors, and sugar-free variants. Strategic opportunities lie in expanding the application range into savory products and leveraging advancements in plant-based and functional ingredients. Companies that can effectively navigate regulatory landscapes, ensure supply chain resilience, and invest in advanced processing technologies will be well-positioned for leadership. The growing disposable income in emerging markets represents a substantial avenue for geographic expansion and increased market penetration.

Caramel Ingredient Market Segmentation

-

1. Type

- 1.1. Powder

- 1.2. Liquid/Syrup

-

2. Application

- 2.1. Bakery

- 2.2. Confectionery

- 2.3. Beverages

- 2.4. Dairy and Frozen Desserts

- 2.5. Other Applications

Caramel Ingredient Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Caramel Ingredient Market Regional Market Share

Geographic Coverage of Caramel Ingredient Market

Caramel Ingredient Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Wide Applications and Functionality; Demand For Gluten-Free Products

- 3.3. Market Restrains

- 3.3.1. Easy Availability of Economically Feasible Alternatives

- 3.4. Market Trends

- 3.4.1. Increased Application of Bakery Ingredients in Developing Regions

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Caramel Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Powder

- 5.1.2. Liquid/Syrup

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery

- 5.2.2. Confectionery

- 5.2.3. Beverages

- 5.2.4. Dairy and Frozen Desserts

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Caramel Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Powder

- 6.1.2. Liquid/Syrup

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Bakery

- 6.2.2. Confectionery

- 6.2.3. Beverages

- 6.2.4. Dairy and Frozen Desserts

- 6.2.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Caramel Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Powder

- 7.1.2. Liquid/Syrup

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Bakery

- 7.2.2. Confectionery

- 7.2.3. Beverages

- 7.2.4. Dairy and Frozen Desserts

- 7.2.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Caramel Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Powder

- 8.1.2. Liquid/Syrup

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Bakery

- 8.2.2. Confectionery

- 8.2.3. Beverages

- 8.2.4. Dairy and Frozen Desserts

- 8.2.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Caramel Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Powder

- 9.1.2. Liquid/Syrup

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Bakery

- 9.2.2. Confectionery

- 9.2.3. Beverages

- 9.2.4. Dairy and Frozen Desserts

- 9.2.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. North America Caramel Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 10.1.3 Mexico

- 11. Europe Caramel Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 United Kingdom

- 11.1.3 France

- 11.1.4 Spain

- 11.1.5 Italy

- 11.1.6 Spain

- 11.1.7 Belgium

- 11.1.8 Netherland

- 11.1.9 Nordics

- 11.1.10 Rest of Europe

- 12. Asia Pacific Caramel Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 China

- 12.1.2 Japan

- 12.1.3 India

- 12.1.4 South Korea

- 12.1.5 Southeast Asia

- 12.1.6 Australia

- 12.1.7 Indonesia

- 12.1.8 Phillipes

- 12.1.9 Singapore

- 12.1.10 Thailandc

- 12.1.11 Rest of Asia Pacific

- 13. South America Caramel Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Brazil

- 13.1.2 Argentina

- 13.1.3 Peru

- 13.1.4 Chile

- 13.1.5 Colombia

- 13.1.6 Ecuador

- 13.1.7 Venezuela

- 13.1.8 Rest of South America

- 14. North America Caramel Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 United States

- 14.1.2 Canada

- 14.1.3 Mexico

- 15. MEA Caramel Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United Arab Emirates

- 15.1.2 Saudi Arabia

- 15.1.3 South Africa

- 15.1.4 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2025

- 16.2. Company Profiles

- 16.2.1 Cargill Incorporated

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Bakels Worldwide

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Puratos Group

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Kerry Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Sethness Caramel Color

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 DDW the Color House

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Alvin Caramel Colours (India) Private Ltd*List Not Exhaustive

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Nigay

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Sensient Technologies Corporation

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Martin Braun KG

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Cargill Incorporated

List of Figures

- Figure 1: Global Caramel Ingredient Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Caramel Ingredient Market Revenue (Million), by Country 2025 & 2033

- Figure 3: North America Caramel Ingredient Market Revenue Share (%), by Country 2025 & 2033

- Figure 4: Europe Caramel Ingredient Market Revenue (Million), by Country 2025 & 2033

- Figure 5: Europe Caramel Ingredient Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Asia Pacific Caramel Ingredient Market Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific Caramel Ingredient Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Caramel Ingredient Market Revenue (Million), by Country 2025 & 2033

- Figure 9: South America Caramel Ingredient Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Caramel Ingredient Market Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Caramel Ingredient Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: MEA Caramel Ingredient Market Revenue (Million), by Country 2025 & 2033

- Figure 13: MEA Caramel Ingredient Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Caramel Ingredient Market Revenue (Million), by Type 2025 & 2033

- Figure 15: North America Caramel Ingredient Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: North America Caramel Ingredient Market Revenue (Million), by Application 2025 & 2033

- Figure 17: North America Caramel Ingredient Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: North America Caramel Ingredient Market Revenue (Million), by Country 2025 & 2033

- Figure 19: North America Caramel Ingredient Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Europe Caramel Ingredient Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Europe Caramel Ingredient Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Europe Caramel Ingredient Market Revenue (Million), by Application 2025 & 2033

- Figure 23: Europe Caramel Ingredient Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Europe Caramel Ingredient Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Caramel Ingredient Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Caramel Ingredient Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Asia Pacific Caramel Ingredient Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific Caramel Ingredient Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Asia Pacific Caramel Ingredient Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Asia Pacific Caramel Ingredient Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Caramel Ingredient Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Rest of the World Caramel Ingredient Market Revenue (Million), by Type 2025 & 2033

- Figure 33: Rest of the World Caramel Ingredient Market Revenue Share (%), by Type 2025 & 2033

- Figure 34: Rest of the World Caramel Ingredient Market Revenue (Million), by Application 2025 & 2033

- Figure 35: Rest of the World Caramel Ingredient Market Revenue Share (%), by Application 2025 & 2033

- Figure 36: Rest of the World Caramel Ingredient Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Rest of the World Caramel Ingredient Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Caramel Ingredient Market Revenue Million Forecast, by Region 2020 & 2033

- Table 2: Global Caramel Ingredient Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global Caramel Ingredient Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global Caramel Ingredient Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Caramel Ingredient Market Revenue Million Forecast, by Country 2020 & 2033

- Table 6: United States Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Canada Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Mexico Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Caramel Ingredient Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Germany Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: United Kingdom Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: France Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Italy Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Spain Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Belgium Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Netherland Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Nordics Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Global Caramel Ingredient Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: China Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Japan Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: India Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: South Korea Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Southeast Asia Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Australia Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Indonesia Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Phillipes Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Singapore Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Thailandc Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Caramel Ingredient Market Revenue Million Forecast, by Country 2020 & 2033

- Table 33: Brazil Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Argentina Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Peru Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Chile Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Colombia Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Ecuador Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Venezuela Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of South America Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Global Caramel Ingredient Market Revenue Million Forecast, by Country 2020 & 2033

- Table 42: United States Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: Canada Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Mexico Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Global Caramel Ingredient Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: United Arab Emirates Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Saudi Arabia Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: South Africa Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: Rest of Middle East and Africa Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Global Caramel Ingredient Market Revenue Million Forecast, by Type 2020 & 2033

- Table 51: Global Caramel Ingredient Market Revenue Million Forecast, by Application 2020 & 2033

- Table 52: Global Caramel Ingredient Market Revenue Million Forecast, by Country 2020 & 2033

- Table 53: United States Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Canada Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 55: Mexico Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Rest of North America Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 57: Global Caramel Ingredient Market Revenue Million Forecast, by Type 2020 & 2033

- Table 58: Global Caramel Ingredient Market Revenue Million Forecast, by Application 2020 & 2033

- Table 59: Global Caramel Ingredient Market Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Spain Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 61: United Kingdom Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Germany Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 63: France Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Italy Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 65: Russia Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Rest of Europe Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 67: Global Caramel Ingredient Market Revenue Million Forecast, by Type 2020 & 2033

- Table 68: Global Caramel Ingredient Market Revenue Million Forecast, by Application 2020 & 2033

- Table 69: Global Caramel Ingredient Market Revenue Million Forecast, by Country 2020 & 2033

- Table 70: China Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 71: Japan Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: India Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 73: Australia Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 74: Rest of Asia Pacific Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 75: Global Caramel Ingredient Market Revenue Million Forecast, by Type 2020 & 2033

- Table 76: Global Caramel Ingredient Market Revenue Million Forecast, by Application 2020 & 2033

- Table 77: Global Caramel Ingredient Market Revenue Million Forecast, by Country 2020 & 2033

- Table 78: South America Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 79: Middle East and Africa Caramel Ingredient Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Caramel Ingredient Market?

The projected CAGR is approximately 7.80%.

2. Which companies are prominent players in the Caramel Ingredient Market?

Key companies in the market include Cargill Incorporated, Bakels Worldwide, Puratos Group, Kerry Inc, Sethness Caramel Color, DDW the Color House, Alvin Caramel Colours (India) Private Ltd*List Not Exhaustive, Nigay, Sensient Technologies Corporation, Martin Braun KG.

3. What are the main segments of the Caramel Ingredient Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Wide Applications and Functionality; Demand For Gluten-Free Products.

6. What are the notable trends driving market growth?

Increased Application of Bakery Ingredients in Developing Regions.

7. Are there any restraints impacting market growth?

Easy Availability of Economically Feasible Alternatives.

8. Can you provide examples of recent developments in the market?

In 2021, Big Train, a brand of Kerry Group, released new dairy-free caramel latte flavors in its Big Train product family of hot and cold beverage mixes with 'GanedenBC30' probiotic, used by foodservice operators. This innovation aims to meet the consumer demand for healthy products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Caramel Ingredient Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Caramel Ingredient Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Caramel Ingredient Market?

To stay informed about further developments, trends, and reports in the Caramel Ingredient Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence