Key Insights

The Canadian metal fabrication equipment market, currently valued at approximately $6.5 billion (base year 2025), is poised for significant expansion, with a projected Compound Annual Growth Rate (CAGR) of 1.6% through 2033. This growth is propelled by substantial investments in Canadian infrastructure, particularly within the energy and construction sectors, driving demand for advanced fabrication machinery. The increasing integration of automation and Industry 4.0 technologies within manufacturing operations further fuels the need for high-precision equipment, including robotic welding systems, laser cutting machines, and automated bending solutions. Additionally, a reinforced focus on domestic manufacturing and supply chain resilience is elevating the requirement for efficient and dependable metal fabrication capabilities nationwide. Key industry players like BTD Manufacturing, Colfax, and Atlas Copco are strategically positioned to capitalize on this market trajectory, leveraging their established market presence and technological proficiency. While potential challenges such as raw material price volatility and skilled labor scarcity exist, ongoing industry innovation and investment in workforce development are expected to effectively address these concerns.

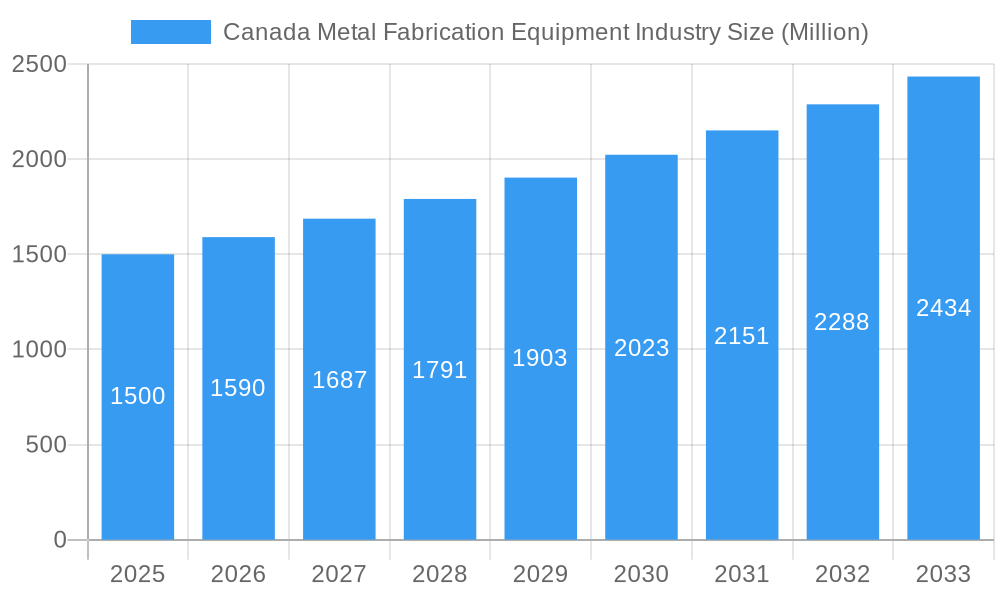

Canada Metal Fabrication Equipment Industry Market Size (In Billion)

Canada's metal fabrication equipment market exhibits diverse segmentation across equipment types, including sheet metal machinery, tube and pipe bending equipment, and welding systems, serving critical end-use industries such as construction, automotive, aerospace, and energy. Anticipated regional demand variations are tied to provinces undertaking vigorous infrastructure development. The forecast period (2025-2033) indicates a sustained upward market trend, supported by continued investment and technological innovation. The industry's future success hinges on its adaptability to technological advancements, strategic supply chain collaborations, and dedicated investment in human capital to cultivate the skilled technicians and engineers essential for operating and maintaining sophisticated equipment.

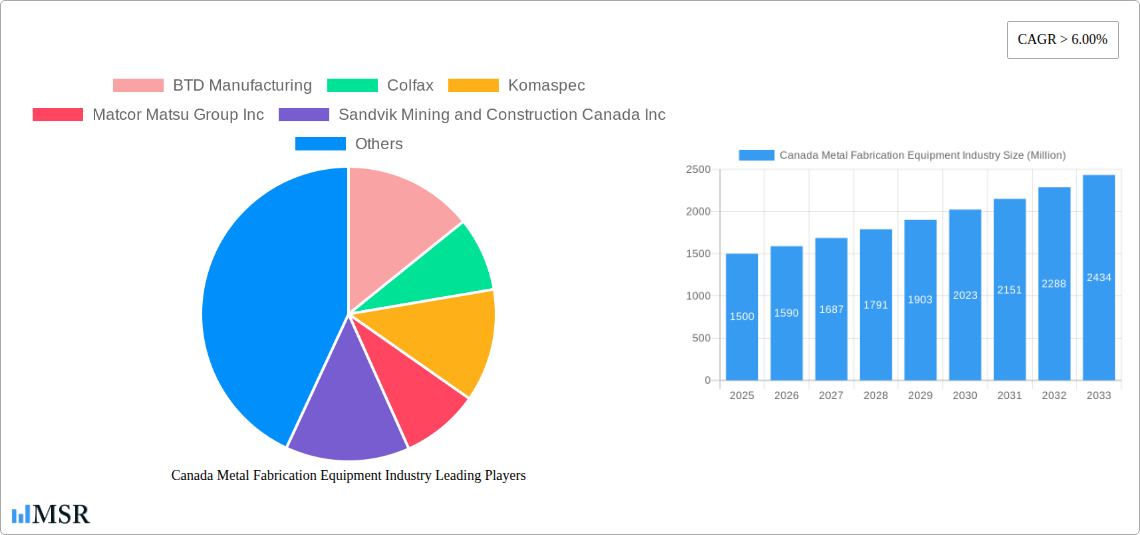

Canada Metal Fabrication Equipment Industry Company Market Share

Canada Metal Fabrication Equipment Industry Report: 2019-2033

This comprehensive report provides a detailed analysis of the Canadian metal fabrication equipment industry, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market dynamics, growth drivers, challenges, and emerging opportunities within this crucial sector. The study delves into market concentration, technological advancements, key players like BTD Manufacturing, Colfax, Komaspec, Matcor Matsu Group Inc, Sandvik Mining and Construction Canada Inc, STANDARD IRON & WIRE WORKS INC, TRUMPF Canada Inc, Atlas Copco, AMADA Canada, and DMG MORI Canada (list not exhaustive), and significant industry milestones. Expect actionable insights and data-driven forecasts to help navigate the complexities of this evolving market.

Canada Metal Fabrication Equipment Industry Market Concentration & Dynamics

The Canadian metal fabrication equipment industry exhibits a moderately concentrated market structure, with a few large players holding significant market share. However, a vibrant ecosystem of smaller, specialized firms also contributes significantly. Innovation is driven by both established players investing in R&D and agile startups focusing on niche applications. The regulatory landscape, while generally supportive of manufacturing, presents certain compliance challenges related to safety and environmental standards. Substitute products, such as 3D-printed metal components, are emerging but haven't yet significantly disrupted the traditional fabrication equipment market. End-user trends reveal a growing demand for automation, precision, and sustainable manufacturing practices.

- Market Share (Estimated 2025): Top 5 players hold approximately xx% of the market.

- M&A Activity (2019-2024): xx major mergers and acquisitions were recorded, indicating a consolidating market.

Canada Metal Fabrication Equipment Industry Industry Insights & Trends

The Canadian metal fabrication equipment market is projected to experience a CAGR of xx% during the forecast period (2025-2033), reaching a market size of $xx Million by 2033 from $xx Million in 2025. This growth is primarily fuelled by increasing investments in infrastructure projects, particularly in the energy and construction sectors. Technological disruptions, such as the adoption of Industry 4.0 technologies (e.g., AI, IoT, robotics), are transforming manufacturing processes, driving demand for advanced fabrication equipment. Consumer behavior shifts towards sustainable and efficient manufacturing practices are also impacting the market. This growing preference for eco-friendly solutions is prompting manufacturers to develop energy-efficient and environmentally responsible equipment.

Key Markets & Segments Leading Canada Metal Fabrication Equipment Industry

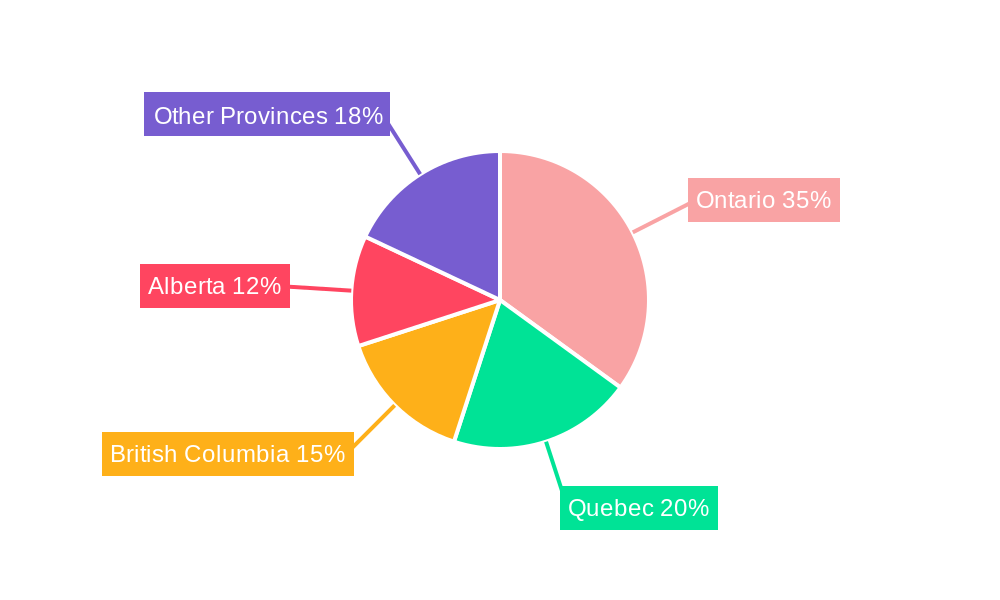

The Ontario province dominates the Canadian metal fabrication equipment market, driven by a strong manufacturing base, extensive infrastructure development, and a large concentration of end-user industries. Quebec and British Columbia also represent significant markets.

- Key Growth Drivers:

- Robust economic growth in key sectors (construction, energy, automotive).

- Significant investments in infrastructure modernization and expansion.

- Increasing adoption of advanced manufacturing technologies.

- Government initiatives promoting industrial growth and innovation.

The dominance of Ontario is attributed to its well-established industrial base, highly skilled workforce, and proximity to major transportation networks. This strategic location provides easy access to both domestic and international markets. This concentration creates a self-reinforcing ecosystem fostering innovation and growth.

Canada Metal Fabrication Equipment Industry Product Developments

Recent product innovations focus on enhanced precision, automation, and integration with smart manufacturing systems. The market is witnessing the introduction of digitally controlled machines, robotic welding systems, and advanced laser cutting technologies. These advancements enhance productivity, reduce waste, and improve overall efficiency, providing a significant competitive edge for manufacturers. The integration of AI and machine learning is also becoming increasingly prevalent.

Challenges in the Canada Metal Fabrication Equipment Industry Market

The Canadian metal fabrication equipment industry faces challenges such as fluctuating commodity prices, supply chain disruptions (impacting component availability and lead times), and intense competition from international manufacturers. Regulatory compliance requirements can also present significant hurdles, particularly for smaller firms. These factors contribute to cost pressures and can affect profitability. Furthermore, skills shortages in specialized areas, such as robotics programming and advanced manufacturing techniques, pose a significant challenge for industry growth.

Forces Driving Canada Metal Fabrication Equipment Industry Growth

Several factors contribute to the long-term growth of the Canadian metal fabrication equipment industry. Technological advancements, such as the adoption of Industry 4.0 technologies and automation, are driving increased productivity and efficiency. Government support for innovation and infrastructure development, coupled with rising demand across various sectors, fuels further expansion. Furthermore, the growing emphasis on sustainable manufacturing practices presents an opportunity for manufacturers to offer environmentally friendly solutions.

Challenges in the Canada Metal Fabrication Equipment Industry Market

Long-term growth hinges on addressing skills gaps through training initiatives, fostering collaboration within the industry ecosystem, and expanding into new international markets. Investment in R&D is crucial for staying competitive, requiring strong partnerships between academia and industry. Successful navigation of supply chain complexities and proactive adaptation to evolving technological landscapes will be paramount to long-term success.

Emerging Opportunities in Canada Metal Fabrication Equipment Industry

Emerging opportunities lie in the development and adoption of sustainable manufacturing technologies, the integration of AI and machine learning into fabrication processes, and expanding into niche market segments with specialized needs. The growing demand for customized solutions opens avenues for smaller firms to compete by focusing on specialized applications. Furthermore, opportunities exist for expanding into new global markets, leveraging Canada's reputation for high-quality manufacturing.

Leading Players in the Canada Metal Fabrication Equipment Industry Sector

- BTD Manufacturing

- Colfax

- Komaspec

- Matcor Matsu Group Inc

- Sandvik Mining and Construction Canada Inc

- STANDARD IRON & WIRE WORKS INC

- TRUMPF Canada Inc

- Atlas Copco

- AMADA Canada

- DMG MORI Canada

- (List Not Exhaustive)

Key Milestones in Canada Metal Fabrication Equipment Industry Industry

- February 2022: Arrow Machine and Fabrication Group acquired Steelcraft, expanding its customer base and manufacturing footprint.

- January 2022: Ag Growth International Inc. (AGI) acquired Eastern Fabricators, strengthening its presence in stainless-steel equipment for food processing.

Strategic Outlook for Canada Metal Fabrication Equipment Industry Market

The Canadian metal fabrication equipment industry holds significant long-term growth potential, driven by ongoing infrastructure investments, technological advancements, and a growing emphasis on sustainable manufacturing. Strategic opportunities lie in focusing on innovation, building strong partnerships, and leveraging Canada's reputation for high-quality manufacturing to expand into new markets both domestically and internationally. Companies that successfully adapt to technological disruptions and prioritize sustainable practices are well-positioned for considerable growth in the coming decade.

Canada Metal Fabrication Equipment Industry Segmentation

-

1. Service Type

- 1.1. Machining and Cutting

- 1.2. Forming

- 1.3. Welding

- 1.4. Other Service Type

-

2. Product Type

- 2.1. Automatic

- 2.2. Semi-automatic

- 2.3. Manual

-

3. End User Industry

- 3.1. Manufacturing

- 3.2. Power and Utilities

- 3.3. Construction

- 3.4. Oil and Gas

- 3.5. Other End-user Industries

Canada Metal Fabrication Equipment Industry Segmentation By Geography

- 1. Canada

Canada Metal Fabrication Equipment Industry Regional Market Share

Geographic Coverage of Canada Metal Fabrication Equipment Industry

Canada Metal Fabrication Equipment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Construction Industry Offers Immense Demand for the Metal Fabrication Equipment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Metal Fabrication Equipment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Machining and Cutting

- 5.1.2. Forming

- 5.1.3. Welding

- 5.1.4. Other Service Type

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Automatic

- 5.2.2. Semi-automatic

- 5.2.3. Manual

- 5.3. Market Analysis, Insights and Forecast - by End User Industry

- 5.3.1. Manufacturing

- 5.3.2. Power and Utilities

- 5.3.3. Construction

- 5.3.4. Oil and Gas

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BTD Manufacturing

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Colfax

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Komaspec

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Matcor Matsu Group Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sandvik Mining and Construction Canada Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 STANDARD IRON & WIRE WORKS INC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TRUMPF Canada Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Atlas Copco

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AMADA Canada

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 DMG MORI Canada**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 BTD Manufacturing

List of Figures

- Figure 1: Canada Metal Fabrication Equipment Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Canada Metal Fabrication Equipment Industry Share (%) by Company 2025

List of Tables

- Table 1: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 2: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 4: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by Service Type 2020 & 2033

- Table 6: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by End User Industry 2020 & 2033

- Table 8: Canada Metal Fabrication Equipment Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Metal Fabrication Equipment Industry?

The projected CAGR is approximately 1.6%.

2. Which companies are prominent players in the Canada Metal Fabrication Equipment Industry?

Key companies in the market include BTD Manufacturing, Colfax, Komaspec, Matcor Matsu Group Inc, Sandvik Mining and Construction Canada Inc, STANDARD IRON & WIRE WORKS INC, TRUMPF Canada Inc, Atlas Copco, AMADA Canada, DMG MORI Canada**List Not Exhaustive.

3. What are the main segments of the Canada Metal Fabrication Equipment Industry?

The market segments include Service Type, Product Type, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.5 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Construction Industry Offers Immense Demand for the Metal Fabrication Equipment.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2022: Arrow Machine and Fabrication Group of Guelph, Ontario, announced the acquisition of Steelcraft, a Kitchener, Ontario, steel design, engineering, and fabrication firm. This acquisition expands Arrow's global customer base and manufacturing footprint. It also further promotes the company's strategy of partnering with leading operator-run machining and fabrication organizations to leverage their collective capabilities, solve customer problems, and develop deeper supply chain interactions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Metal Fabrication Equipment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Metal Fabrication Equipment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Metal Fabrication Equipment Industry?

To stay informed about further developments, trends, and reports in the Canada Metal Fabrication Equipment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence