Key Insights

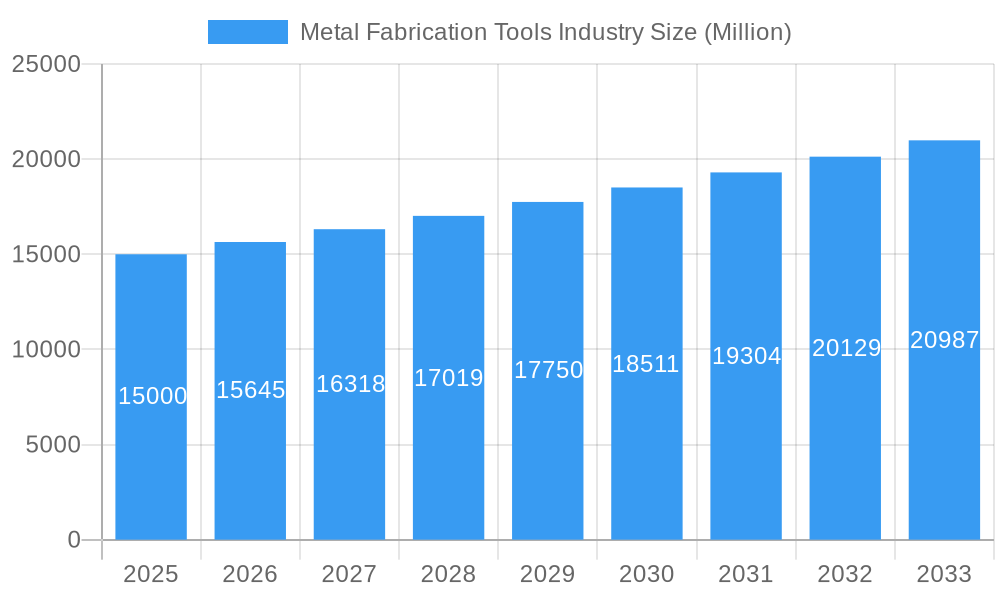

The Metal Fabrication Tools industry, currently valued at approximately $XX million (assuming a reasonable market size based on industry reports and company revenues), is experiencing robust growth. A compound annual growth rate (CAGR) exceeding 4.30% from 2019 to 2024 indicates a healthy trajectory, fueled by several key drivers. Increased automation in manufacturing, particularly within automotive, aerospace, and construction sectors, is a significant factor. The rising demand for lightweight yet high-strength materials, such as advanced alloys and composites, necessitates specialized fabrication tools, further bolstering market expansion. Emerging trends like additive manufacturing (3D printing of metal parts) and the adoption of Industry 4.0 technologies (smart factories and connected tools) are also contributing to the industry's growth. However, the market faces certain restraints, including fluctuating raw material prices, supply chain disruptions, and the need for skilled labor to operate advanced machinery. Market segmentation encompasses various tool types (e.g., laser cutting systems, press brakes, bending machines, and welding equipment), which cater to diverse fabrication needs across different industries. Key players like Trumpf, Amada, DMG MORI, and FANUC Corp dominate the landscape, constantly innovating to maintain their competitive edge. Regional variations exist, with developed economies exhibiting higher adoption rates of advanced technologies compared to emerging markets. The forecast period (2025-2033) projects continued growth, driven by ongoing technological advancements and expanding industrialization globally.

Metal Fabrication Tools Industry Market Size (In Billion)

The industry's future hinges on several factors. Continued investment in research and development (R&D) is crucial for enhancing tool precision, efficiency, and automation capabilities. Addressing the skills gap through workforce training initiatives will be essential to maximizing the potential of advanced technologies. Furthermore, companies must navigate supply chain volatility and effectively manage raw material costs to ensure sustained profitability. Sustainable practices, focusing on energy efficiency and reduced environmental impact, are becoming increasingly important for market competitiveness. Strategic partnerships and mergers and acquisitions are also likely to shape the competitive landscape, leading to greater consolidation within the industry. This robust and dynamic industry presents significant opportunities for existing players and potential new entrants, provided they can adapt to the evolving technological and economic environment.

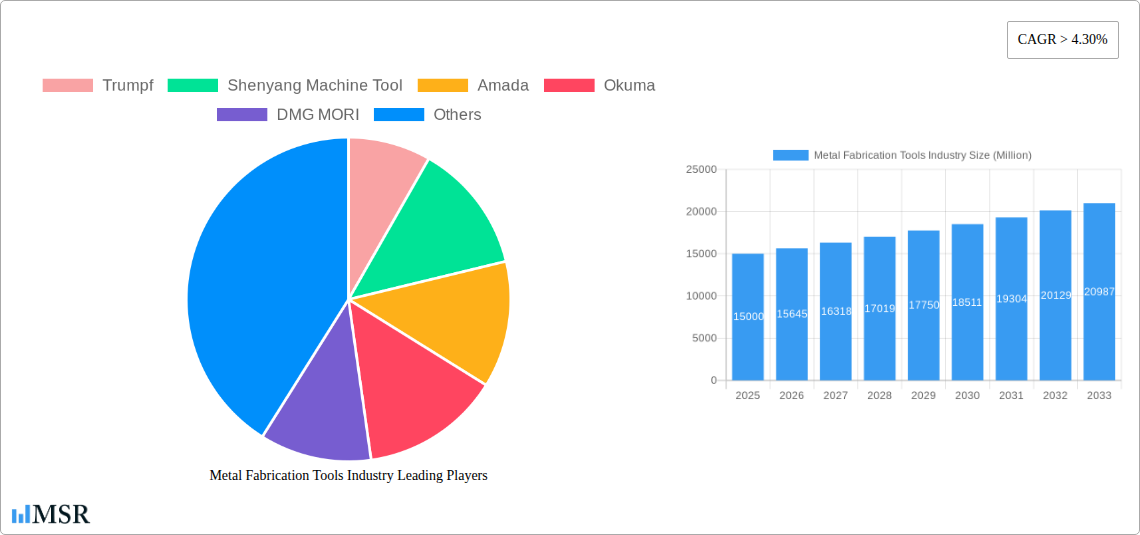

Metal Fabrication Tools Industry Company Market Share

Metal Fabrication Tools Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Metal Fabrication Tools industry, offering crucial insights for stakeholders, investors, and industry professionals. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers actionable intelligence on market dynamics, growth drivers, and future trends. The global market size is projected to reach xx Million by 2033, showcasing significant growth potential.

Metal Fabrication Tools Industry Market Concentration & Dynamics

The Metal Fabrication Tools industry exhibits a moderately concentrated market structure, with key players like Trumpf, Shenyang Machine Tool, Amada, Okuma, DMG MORI, FANUC Corp, Colfax, Atlas Copco, and BTD Manufacturing holding significant market share. However, the presence of numerous smaller players and regional specialists creates a dynamic competitive landscape.

Innovation ecosystems are crucial, with ongoing R&D efforts focused on automation, precision, and smart manufacturing technologies. Regulatory frameworks, particularly those concerning safety and environmental compliance, influence manufacturing processes and product development. Substitute products, such as 3D printing technologies, pose a growing challenge, while end-user trends towards automation and customized solutions drive demand for advanced fabrication tools.

Mergers and acquisitions (M&A) activities are a significant feature. Recent examples include:

- November 2022: Momentum Manufacturing Group's acquisition of Evans Industries and Little Enterprises significantly expanded its manufacturing capacity and expertise in precision metal machining for semiconductor production.

- March 2022: Ryerson Holding Corporation's acquisition of Apogee Steel Fabrication Incorporated strengthened its Canadian operations and value-added services.

The number of M&A deals in the period 2019-2024 totaled xx, indicating a strong consolidation trend within the industry. Market share data for the leading players is currently estimated at xx% for Trumpf, xx% for Amada and so on. The industry's dynamic nature is fueled by continuous technological advancements, evolving consumer demands, and strategic acquisitions.

Metal Fabrication Tools Industry Industry Insights & Trends

The global Metal Fabrication Tools market experienced substantial growth during the historical period (2019-2024), reaching xx Million in 2024. This growth is primarily attributed to increasing demand from key end-use sectors like automotive, construction, and aerospace. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by several factors.

Technological disruptions, such as the increasing adoption of automation, robotics, and AI-powered systems in metal fabrication, are transforming industry practices. This leads to improved efficiency, precision, and reduced labor costs. Evolving consumer behaviors, including a preference for customized products and shorter lead times, necessitate flexible and adaptable fabrication tools.

The rise of Industry 4.0 principles is driving demand for smart manufacturing technologies, enabling real-time data analysis, predictive maintenance, and improved overall equipment effectiveness (OEE). These trends will continue to shape the industry's landscape, leading to further market expansion in the coming years.

Key Markets & Segments Leading Metal Fabrication Tools Industry

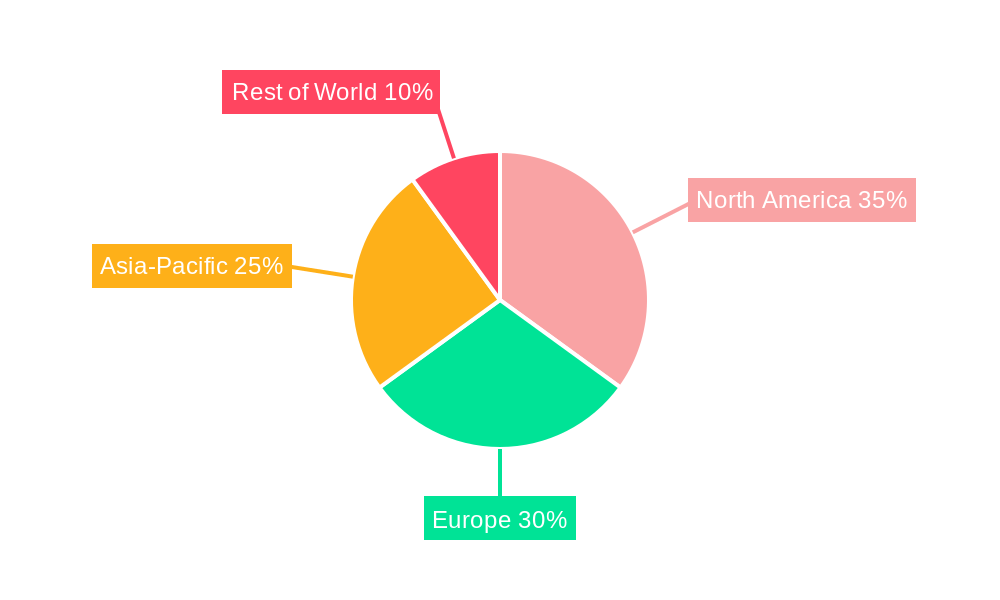

While data for regional market share is unavailable at this time (xx), the North American market is currently predicted to be dominant in the Metal Fabrication Tools industry, followed by Asia and Europe. This dominance stems from several factors:

- Strong Manufacturing Base: North America possesses a robust manufacturing sector, particularly in industries like automotive and aerospace, which are major consumers of metal fabrication tools.

- Technological Advancements: The region is at the forefront of technological innovation, with significant investments in R&D and the adoption of advanced manufacturing technologies.

- Economic Growth: Stable economic growth in several North American countries supports increased investment in capital equipment, including metal fabrication tools.

The automotive segment is expected to retain its dominant position throughout the forecast period, driven by the ongoing growth of the global automotive industry and the increasing complexity of vehicle designs. Infrastructure development projects in various regions also represent a significant growth driver, creating substantial demand for metal fabrication tools in construction. Additional drivers are expected to emerge from rising demand in the renewable energy sector as well as the defense and aerospace industries.

Metal Fabrication Tools Industry Product Developments

Recent product innovations focus on enhancing precision, automation, and efficiency. Laser cutting systems with increased cutting speeds and improved accuracy are becoming increasingly prevalent, while robotic automation solutions improve production throughput and reduce labor costs. Smart manufacturing capabilities, incorporating data analytics and predictive maintenance, are also being integrated into many new products. These advancements provide manufacturers with a competitive edge in terms of productivity, quality, and cost reduction.

Challenges in the Metal Fabrication Tools Industry Market

The industry faces several challenges, including:

- Supply Chain Disruptions: Global supply chain disruptions have led to increased lead times and material costs, impacting production schedules and profitability.

- Regulatory Hurdles: Compliance with stringent environmental and safety regulations increases manufacturing costs and complexities.

- Intense Competition: The market is characterized by intense competition among established players and emerging competitors, necessitating continuous innovation and cost optimization. These factors may reduce overall profit margins by approximately xx% annually.

Forces Driving Metal Fabrication Tools Industry Growth

Key growth drivers include:

- Technological Advancements: The ongoing development and adoption of advanced technologies like AI, robotics, and automation enhance productivity and efficiency.

- Economic Growth in Emerging Markets: Rapid economic growth in countries like China and India drives increased demand for metal fabrication tools across various sectors.

- Government Initiatives: Government initiatives promoting infrastructure development and industrialization create favorable conditions for market expansion.

Long-Term Growth Catalysts in the Metal Fabrication Tools Industry

Long-term growth will be driven by strategic partnerships and collaborations within the industry, leading to innovation in areas like additive manufacturing and smart factories. Expanding into new markets, especially in developing economies, coupled with continuous R&D investments in advanced materials and processes, will unlock significant growth opportunities.

Emerging Opportunities in Metal Fabrication Tools Industry

Emerging opportunities lie in the development and adoption of sustainable manufacturing practices, reducing environmental impact, and utilizing recycled materials. The growing demand for lightweight materials in industries like aerospace and automotive creates opportunities for specialized fabrication tools. Expansion into niche markets, such as medical devices and personalized manufacturing, also present significant potential.

Leading Players in the Metal Fabrication Tools Industry Sector

- Trumpf

- Shenyang Machine Tool

- Amada

- Okuma

- DMG MORI

- FANUC Corp

- Colfax

- Atlas Copco

- BTD Manufacturing

Key Milestones in Metal Fabrication Tools Industry Industry

- November 2022: Momentum Manufacturing Group's acquisition of Evans Industries and Little Enterprises expands its capacity and expertise in precision metal machining for semiconductors. This signals a diversification trend within the industry.

- March 2022: Ryerson Holding Corporation's acquisition of Apogee Steel Fabrication Incorporated strengthens its market position and expands its service offerings in Canada. This reflects the ongoing consolidation within the industry.

Strategic Outlook for Metal Fabrication Tools Industry Market

The Metal Fabrication Tools industry is poised for continued growth, driven by technological advancements, expanding applications, and increasing demand from various end-use sectors. Strategic investments in R&D, automation, and sustainable manufacturing practices will be crucial for companies seeking to maintain a competitive edge. Focusing on emerging markets and addressing supply chain challenges will be key factors influencing future market dynamics and unlocking significant growth opportunities.

Metal Fabrication Tools Industry Segmentation

-

1. Service Type

-

1.1. Machining and Cutting

- 1.1.1. Machining Centres

- 1.1.2. Lathe Machines

- 1.1.3. Drilling, Grinding, Horning, and Lapping Machines

- 1.1.4. Laser, Ion Beam, and Ultrasonic Machines

- 1.1.5. Gear Cutting Machines

- 1.1.6. Sawing and Cutting-off Machines

- 1.1.7. Other Handling and Cutting Equipment

-

1.2. Welding

- 1.2.1. ARC Welding

- 1.2.2. Oxy-fuel Welding

- 1.2.3. Laser Beam Welding

- 1.2.4. Other Types of Welding

-

1.3. Forming

- 1.3.1. Forging Machines and Hammers

- 1.3.2. Bending, Folding, and Straightening Machines

- 1.3.3. Shearing, Punching, and Notching Machines

- 1.3.4. Wire Forming Machines

- 1.3.5. Other Presses and Metal Forming Machines

- 1.4. Other Service Types

-

1.1. Machining and Cutting

-

2. End-user Industries

- 2.1. Automotive

- 2.2. Construction

- 2.3. Aerospace

- 2.4. Electrical and Electronics

- 2.5. Other End-user Industries

Metal Fabrication Tools Industry Segmentation By Geography

- 1. North America

- 2. Latin America

- 3. Asia Pacific

- 4. Europe

- 5. Middle East and Africa

Metal Fabrication Tools Industry Regional Market Share

Geographic Coverage of Metal Fabrication Tools Industry

Metal Fabrication Tools Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Focus on the Implementation of Industry 4.0

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Metal Fabrication Tools Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Machining and Cutting

- 5.1.1.1. Machining Centres

- 5.1.1.2. Lathe Machines

- 5.1.1.3. Drilling, Grinding, Horning, and Lapping Machines

- 5.1.1.4. Laser, Ion Beam, and Ultrasonic Machines

- 5.1.1.5. Gear Cutting Machines

- 5.1.1.6. Sawing and Cutting-off Machines

- 5.1.1.7. Other Handling and Cutting Equipment

- 5.1.2. Welding

- 5.1.2.1. ARC Welding

- 5.1.2.2. Oxy-fuel Welding

- 5.1.2.3. Laser Beam Welding

- 5.1.2.4. Other Types of Welding

- 5.1.3. Forming

- 5.1.3.1. Forging Machines and Hammers

- 5.1.3.2. Bending, Folding, and Straightening Machines

- 5.1.3.3. Shearing, Punching, and Notching Machines

- 5.1.3.4. Wire Forming Machines

- 5.1.3.5. Other Presses and Metal Forming Machines

- 5.1.4. Other Service Types

- 5.1.1. Machining and Cutting

- 5.2. Market Analysis, Insights and Forecast - by End-user Industries

- 5.2.1. Automotive

- 5.2.2. Construction

- 5.2.3. Aerospace

- 5.2.4. Electrical and Electronics

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Latin America

- 5.3.3. Asia Pacific

- 5.3.4. Europe

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America Metal Fabrication Tools Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. Machining and Cutting

- 6.1.1.1. Machining Centres

- 6.1.1.2. Lathe Machines

- 6.1.1.3. Drilling, Grinding, Horning, and Lapping Machines

- 6.1.1.4. Laser, Ion Beam, and Ultrasonic Machines

- 6.1.1.5. Gear Cutting Machines

- 6.1.1.6. Sawing and Cutting-off Machines

- 6.1.1.7. Other Handling and Cutting Equipment

- 6.1.2. Welding

- 6.1.2.1. ARC Welding

- 6.1.2.2. Oxy-fuel Welding

- 6.1.2.3. Laser Beam Welding

- 6.1.2.4. Other Types of Welding

- 6.1.3. Forming

- 6.1.3.1. Forging Machines and Hammers

- 6.1.3.2. Bending, Folding, and Straightening Machines

- 6.1.3.3. Shearing, Punching, and Notching Machines

- 6.1.3.4. Wire Forming Machines

- 6.1.3.5. Other Presses and Metal Forming Machines

- 6.1.4. Other Service Types

- 6.1.1. Machining and Cutting

- 6.2. Market Analysis, Insights and Forecast - by End-user Industries

- 6.2.1. Automotive

- 6.2.2. Construction

- 6.2.3. Aerospace

- 6.2.4. Electrical and Electronics

- 6.2.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Latin America Metal Fabrication Tools Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. Machining and Cutting

- 7.1.1.1. Machining Centres

- 7.1.1.2. Lathe Machines

- 7.1.1.3. Drilling, Grinding, Horning, and Lapping Machines

- 7.1.1.4. Laser, Ion Beam, and Ultrasonic Machines

- 7.1.1.5. Gear Cutting Machines

- 7.1.1.6. Sawing and Cutting-off Machines

- 7.1.1.7. Other Handling and Cutting Equipment

- 7.1.2. Welding

- 7.1.2.1. ARC Welding

- 7.1.2.2. Oxy-fuel Welding

- 7.1.2.3. Laser Beam Welding

- 7.1.2.4. Other Types of Welding

- 7.1.3. Forming

- 7.1.3.1. Forging Machines and Hammers

- 7.1.3.2. Bending, Folding, and Straightening Machines

- 7.1.3.3. Shearing, Punching, and Notching Machines

- 7.1.3.4. Wire Forming Machines

- 7.1.3.5. Other Presses and Metal Forming Machines

- 7.1.4. Other Service Types

- 7.1.1. Machining and Cutting

- 7.2. Market Analysis, Insights and Forecast - by End-user Industries

- 7.2.1. Automotive

- 7.2.2. Construction

- 7.2.3. Aerospace

- 7.2.4. Electrical and Electronics

- 7.2.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Asia Pacific Metal Fabrication Tools Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. Machining and Cutting

- 8.1.1.1. Machining Centres

- 8.1.1.2. Lathe Machines

- 8.1.1.3. Drilling, Grinding, Horning, and Lapping Machines

- 8.1.1.4. Laser, Ion Beam, and Ultrasonic Machines

- 8.1.1.5. Gear Cutting Machines

- 8.1.1.6. Sawing and Cutting-off Machines

- 8.1.1.7. Other Handling and Cutting Equipment

- 8.1.2. Welding

- 8.1.2.1. ARC Welding

- 8.1.2.2. Oxy-fuel Welding

- 8.1.2.3. Laser Beam Welding

- 8.1.2.4. Other Types of Welding

- 8.1.3. Forming

- 8.1.3.1. Forging Machines and Hammers

- 8.1.3.2. Bending, Folding, and Straightening Machines

- 8.1.3.3. Shearing, Punching, and Notching Machines

- 8.1.3.4. Wire Forming Machines

- 8.1.3.5. Other Presses and Metal Forming Machines

- 8.1.4. Other Service Types

- 8.1.1. Machining and Cutting

- 8.2. Market Analysis, Insights and Forecast - by End-user Industries

- 8.2.1. Automotive

- 8.2.2. Construction

- 8.2.3. Aerospace

- 8.2.4. Electrical and Electronics

- 8.2.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Europe Metal Fabrication Tools Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. Machining and Cutting

- 9.1.1.1. Machining Centres

- 9.1.1.2. Lathe Machines

- 9.1.1.3. Drilling, Grinding, Horning, and Lapping Machines

- 9.1.1.4. Laser, Ion Beam, and Ultrasonic Machines

- 9.1.1.5. Gear Cutting Machines

- 9.1.1.6. Sawing and Cutting-off Machines

- 9.1.1.7. Other Handling and Cutting Equipment

- 9.1.2. Welding

- 9.1.2.1. ARC Welding

- 9.1.2.2. Oxy-fuel Welding

- 9.1.2.3. Laser Beam Welding

- 9.1.2.4. Other Types of Welding

- 9.1.3. Forming

- 9.1.3.1. Forging Machines and Hammers

- 9.1.3.2. Bending, Folding, and Straightening Machines

- 9.1.3.3. Shearing, Punching, and Notching Machines

- 9.1.3.4. Wire Forming Machines

- 9.1.3.5. Other Presses and Metal Forming Machines

- 9.1.4. Other Service Types

- 9.1.1. Machining and Cutting

- 9.2. Market Analysis, Insights and Forecast - by End-user Industries

- 9.2.1. Automotive

- 9.2.2. Construction

- 9.2.3. Aerospace

- 9.2.4. Electrical and Electronics

- 9.2.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Middle East and Africa Metal Fabrication Tools Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. Machining and Cutting

- 10.1.1.1. Machining Centres

- 10.1.1.2. Lathe Machines

- 10.1.1.3. Drilling, Grinding, Horning, and Lapping Machines

- 10.1.1.4. Laser, Ion Beam, and Ultrasonic Machines

- 10.1.1.5. Gear Cutting Machines

- 10.1.1.6. Sawing and Cutting-off Machines

- 10.1.1.7. Other Handling and Cutting Equipment

- 10.1.2. Welding

- 10.1.2.1. ARC Welding

- 10.1.2.2. Oxy-fuel Welding

- 10.1.2.3. Laser Beam Welding

- 10.1.2.4. Other Types of Welding

- 10.1.3. Forming

- 10.1.3.1. Forging Machines and Hammers

- 10.1.3.2. Bending, Folding, and Straightening Machines

- 10.1.3.3. Shearing, Punching, and Notching Machines

- 10.1.3.4. Wire Forming Machines

- 10.1.3.5. Other Presses and Metal Forming Machines

- 10.1.4. Other Service Types

- 10.1.1. Machining and Cutting

- 10.2. Market Analysis, Insights and Forecast - by End-user Industries

- 10.2.1. Automotive

- 10.2.2. Construction

- 10.2.3. Aerospace

- 10.2.4. Electrical and Electronics

- 10.2.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Trumpf

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Shenyang Machine Tool

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Amada

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Okuma

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 DMG MORI

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 FANUC Corp

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Colfax

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Atlas Copco

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 BTD Manufacturing**List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Trumpf

List of Figures

- Figure 1: Global Metal Fabrication Tools Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Metal Fabrication Tools Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 3: North America Metal Fabrication Tools Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 4: North America Metal Fabrication Tools Industry Revenue (Million), by End-user Industries 2025 & 2033

- Figure 5: North America Metal Fabrication Tools Industry Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 6: North America Metal Fabrication Tools Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Metal Fabrication Tools Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Latin America Metal Fabrication Tools Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 9: Latin America Metal Fabrication Tools Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 10: Latin America Metal Fabrication Tools Industry Revenue (Million), by End-user Industries 2025 & 2033

- Figure 11: Latin America Metal Fabrication Tools Industry Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 12: Latin America Metal Fabrication Tools Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Latin America Metal Fabrication Tools Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Metal Fabrication Tools Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 15: Asia Pacific Metal Fabrication Tools Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 16: Asia Pacific Metal Fabrication Tools Industry Revenue (Million), by End-user Industries 2025 & 2033

- Figure 17: Asia Pacific Metal Fabrication Tools Industry Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 18: Asia Pacific Metal Fabrication Tools Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Metal Fabrication Tools Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Europe Metal Fabrication Tools Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 21: Europe Metal Fabrication Tools Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 22: Europe Metal Fabrication Tools Industry Revenue (Million), by End-user Industries 2025 & 2033

- Figure 23: Europe Metal Fabrication Tools Industry Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 24: Europe Metal Fabrication Tools Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Metal Fabrication Tools Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Metal Fabrication Tools Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 27: Middle East and Africa Metal Fabrication Tools Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 28: Middle East and Africa Metal Fabrication Tools Industry Revenue (Million), by End-user Industries 2025 & 2033

- Figure 29: Middle East and Africa Metal Fabrication Tools Industry Revenue Share (%), by End-user Industries 2025 & 2033

- Figure 30: Middle East and Africa Metal Fabrication Tools Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Metal Fabrication Tools Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Metal Fabrication Tools Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Global Metal Fabrication Tools Industry Revenue Million Forecast, by End-user Industries 2020 & 2033

- Table 3: Global Metal Fabrication Tools Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Metal Fabrication Tools Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 5: Global Metal Fabrication Tools Industry Revenue Million Forecast, by End-user Industries 2020 & 2033

- Table 6: Global Metal Fabrication Tools Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Metal Fabrication Tools Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 8: Global Metal Fabrication Tools Industry Revenue Million Forecast, by End-user Industries 2020 & 2033

- Table 9: Global Metal Fabrication Tools Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Metal Fabrication Tools Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 11: Global Metal Fabrication Tools Industry Revenue Million Forecast, by End-user Industries 2020 & 2033

- Table 12: Global Metal Fabrication Tools Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Metal Fabrication Tools Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 14: Global Metal Fabrication Tools Industry Revenue Million Forecast, by End-user Industries 2020 & 2033

- Table 15: Global Metal Fabrication Tools Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Metal Fabrication Tools Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 17: Global Metal Fabrication Tools Industry Revenue Million Forecast, by End-user Industries 2020 & 2033

- Table 18: Global Metal Fabrication Tools Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Metal Fabrication Tools Industry?

The projected CAGR is approximately > 4.30%.

2. Which companies are prominent players in the Metal Fabrication Tools Industry?

Key companies in the market include Trumpf, Shenyang Machine Tool, Amada, Okuma, DMG MORI, FANUC Corp, Colfax, Atlas Copco, BTD Manufacturing**List Not Exhaustive.

3. What are the main segments of the Metal Fabrication Tools Industry?

The market segments include Service Type, End-user Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Focus on the Implementation of Industry 4.0.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

November 2022: Momentum Manufacturing Group (MMG), a metal producer, recently acquired two companies that enable the production of semiconductors in order to enter the semiconductor sector. Evans Industries in Topsfield, Massachusetts, and Little Enterprises in Ipswich, Massachusetts, have joined MMG, giving the Georgetown, Massachusetts-based company 86,000 square feet of additional manufacturing space and almost 160 highly qualified team members. Both businesses provide wafer fabrication equipment support components and offer precision metal machining. The purchases will improve MMG's current manufacturing business, which consists of 10 facilities spread throughout New England.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Metal Fabrication Tools Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Metal Fabrication Tools Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Metal Fabrication Tools Industry?

To stay informed about further developments, trends, and reports in the Metal Fabrication Tools Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence