Key Insights

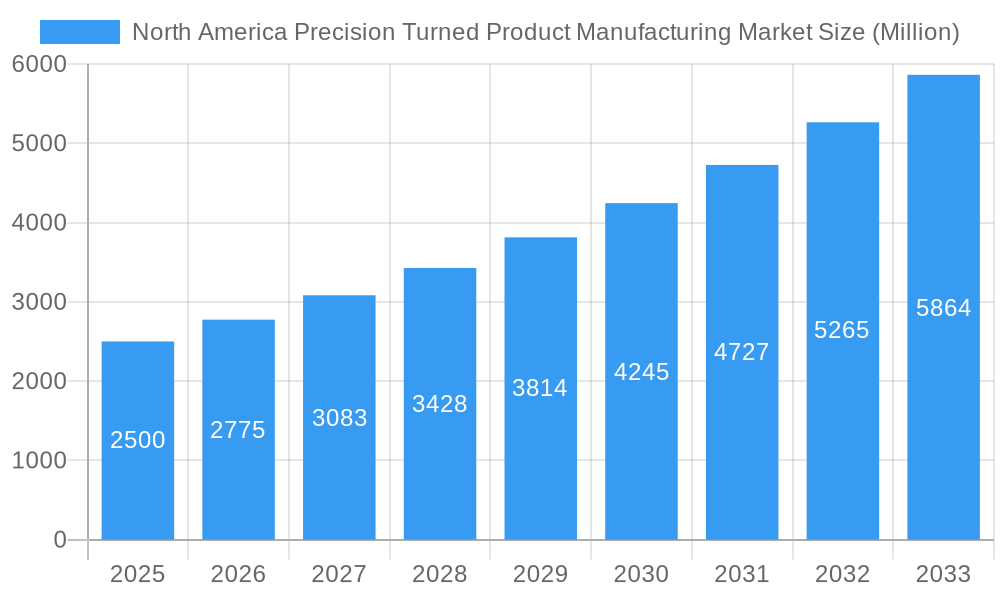

The North America precision turned product manufacturing market is experiencing substantial growth, fueled by increasing demand from the automotive, aerospace, medical devices, and electronics sectors. The market is projected for robust expansion, with a Compound Annual Growth Rate (CAGR) of 6.7%. The market size is estimated at $110.33 billion in the base year 2025, indicating significant current value. Key growth drivers include the widespread adoption of automation and advanced manufacturing technologies like CNC machining, a rising demand for precision components in high-tech applications, and the continuous need for lightweighting and enhanced material efficiency across industries. Ongoing product innovation and the development of specialized materials further support market expansion.

North America Precision Turned Product Manufacturing Market Market Size (In Billion)

The market is segmented by product type, material, and end-use industry. While specific segmental data is proprietary, the automotive and medical device manufacturing sectors are anticipated to represent significant market shares due to their high reliance on precision components. Despite its strong growth trajectory, the market confronts challenges such as volatile raw material prices, global supply chain disruptions, and rising labor costs. However, technological advancements and the implementation of lean manufacturing principles by key industry players are effectively mitigating these restraints, fostering sustained market growth. The competitive environment features a blend of large multinational corporations and specialized niche manufacturers, fostering both innovation and competitive pricing. The forecast period from 2025 to 2033 presents considerable opportunities for established companies and new entrants within the North American precision turned product manufacturing sector.

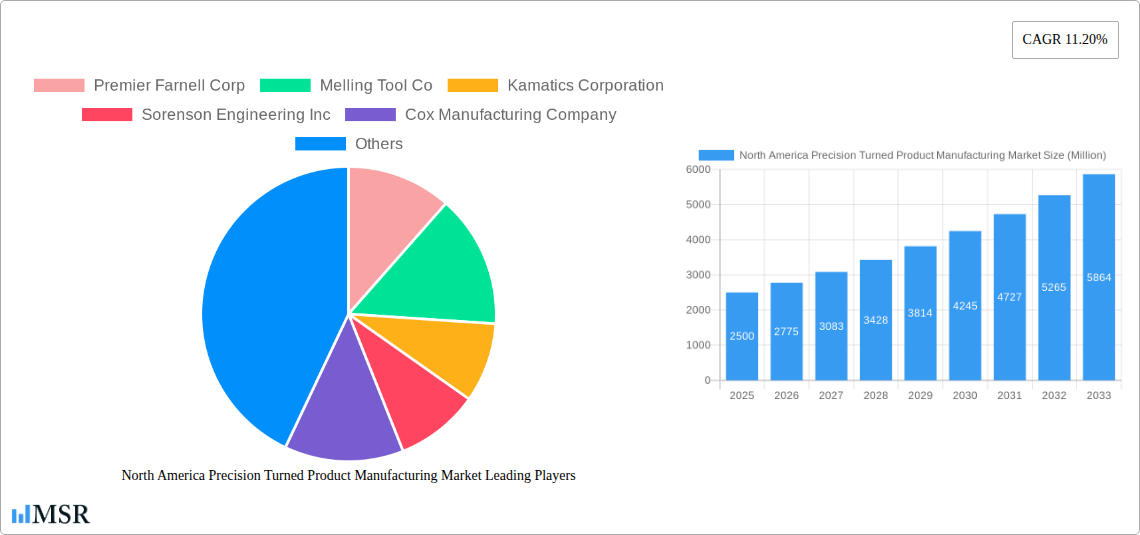

North America Precision Turned Product Manufacturing Market Company Market Share

North America Precision Turned Product Manufacturing Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America precision turned product manufacturing market, offering invaluable insights for stakeholders, investors, and industry professionals. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, key players, emerging trends, and future growth potential. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

North America Precision Turned Product Manufacturing Market Concentration & Dynamics

This section analyzes the competitive landscape of the North American precision turned product manufacturing market. We assess market concentration, identifying key players and their respective market shares. The report also delves into the innovation ecosystems driving technological advancements, the regulatory frameworks shaping industry practices, the presence of substitute products, evolving end-user trends, and the impact of mergers and acquisitions (M&A) activities.

- Market Concentration: The market exhibits a moderately concentrated structure, with the top 10 players holding an estimated xx% market share in 2025. Further analysis of market share distribution across different segments will be provided.

- M&A Activity: The report documents significant M&A activity, including the acquisition of Evans Industries Inc. and Little Enterprises LLC by Momentum Manufacturing Group in November 2022, and the Plansee Group's acquisition of Mi-Tech Tungsten Metals in December 2021. These deals highlight consolidation trends and expansion strategies within the market. The total number of M&A deals recorded during the historical period (2019-2024) was xx.

- Innovation Ecosystems: Several factors contribute to innovation, including advancements in CNC machining, automation technologies, and the adoption of Industry 4.0 principles.

- Regulatory Landscape: The report assesses the impact of relevant regulations on production, safety, and environmental compliance.

- Substitute Products: The market faces competition from alternative manufacturing processes, such as 3D printing and injection molding. The report analyzes the competitive pressures from these substitutes.

- End-User Trends: The report analyzes end-user demand across various sectors including automotive, aerospace, medical, and electronics.

North America Precision Turned Product Manufacturing Market Industry Insights & Trends

This section provides a detailed analysis of the market's growth trajectory, identifying key drivers, technological disruptions, and shifts in consumer behavior. The North American precision turned product manufacturing market is experiencing significant growth, driven by increasing demand across various end-use sectors. The market size is estimated at xx Million in 2025, expected to reach xx Million by 2033. Several factors contribute to this growth, including advancements in manufacturing technology and the increasing demand for precision-engineered components in diverse industries. Technological disruptions, particularly the adoption of automation and advanced manufacturing processes, are transforming the market landscape, enhancing efficiency and productivity. Evolving consumer preferences for higher-quality, more durable products further fuel market growth.

Key Markets & Segments Leading North America Precision Turned Product Manufacturing Market

This section identifies the dominant regions, countries, and market segments within North America. The report will highlight the leading regions and sub-segments based on market size, growth rate, and specific drivers.

- Dominant Region/Segment: Analysis suggests that [Specific Region/Segment - e.g., the automotive sector in the Midwest] is currently the leading segment, with xx% market share in 2025.

- Drivers for Dominance:

- Strong economic growth in target regions.

- Robust infrastructure supporting manufacturing activities.

- High concentration of key end-user industries.

- Government incentives and policies supporting the manufacturing sector.

North America Precision Turned Product Manufacturing Market Product Developments

Recent product developments focus on enhancing precision, efficiency, and material capabilities. Advancements in CNC machining, automation, and the use of advanced materials have led to more sophisticated and high-performance turned products. This enhances competitiveness and allows manufacturers to meet the increasingly stringent requirements of various industries.

Challenges in the North America Precision Turned Product Manufacturing Market Market

The North American precision turned product manufacturing market faces several challenges, including increasing raw material costs, supply chain disruptions, intense competition, and stringent regulatory compliance requirements. These factors can impact production costs and market profitability. The total impact on market growth is estimated to be a reduction of xx% by 2033.

Forces Driving North America Precision Turned Product Manufacturing Market Growth

Key growth drivers include technological advancements (automation, precision machining), strong demand from key industries (automotive, aerospace), government initiatives to support domestic manufacturing, and increasing focus on product quality and customization.

Long-Term Growth Catalysts in the North America Precision Turned Product Manufacturing Market

Long-term growth will be driven by continuous innovation in materials and manufacturing processes, strategic partnerships and collaborations between companies, and expansion into new markets. Focus on sustainability and environmentally friendly practices also present significant opportunities.

Emerging Opportunities in North America Precision Turned Product Manufacturing Market

Emerging opportunities lie in the adoption of additive manufacturing technologies, the development of specialized materials for high-performance applications, and the expansion into niche markets with high growth potential (e.g., medical devices, renewable energy).

Leading Players in the North America Precision Turned Product Manufacturing Market Sector

- Premier Farnell Corp

- Melling Tool Co

- Kamatics Corporation

- Sorenson Engineering Inc

- Cox Manufacturing Company

- Nook Industries LLC

- Creed-Monarch Inc

- Camcraft Inc

- M & W Industries Inc

- Greystone of Lincoln Inc

- Swagelok Hy-Level Company

- Herker Industries Inc

- Supreme Screw Products Inc

- List Not Exhaustive

Key Milestones in North America Precision Turned Product Manufacturing Market Industry

- November 2022: Momentum Manufacturing Group's acquisition of Evans Industries Inc. and Little Enterprises LLC significantly expands its capabilities and market reach.

- December 2021: Plansee Group's acquisition of Mi-Tech Tungsten Metals strengthens its position in the North American tungsten market.

Strategic Outlook for North America Precision Turned Product Manufacturing Market Market

The North American precision turned product manufacturing market presents significant long-term growth potential. Strategic investments in advanced technologies, expansion into new markets, and a focus on sustainability will be key to success. Companies that can adapt to evolving market demands and effectively manage supply chain complexities are poised for significant growth.

North America Precision Turned Product Manufacturing Market Segmentation

-

1. Operation

- 1.1. Manual Operation

- 1.2. CNC Operation

-

2. Machine Types

- 2.1. Automatic Screw Machines

- 2.2. Rotary Transfer Machines

- 2.3. Computer Numerically Controlled (CNC)

- 2.4. Lathes or Turning Centers

-

3. Material Type

- 3.1. Plastic

- 3.2. Steel

- 3.3. Other Material Types

-

4. End Use

- 4.1. Automobile

- 4.2. Electronics

- 4.3. Defense

- 4.4. Healthcare

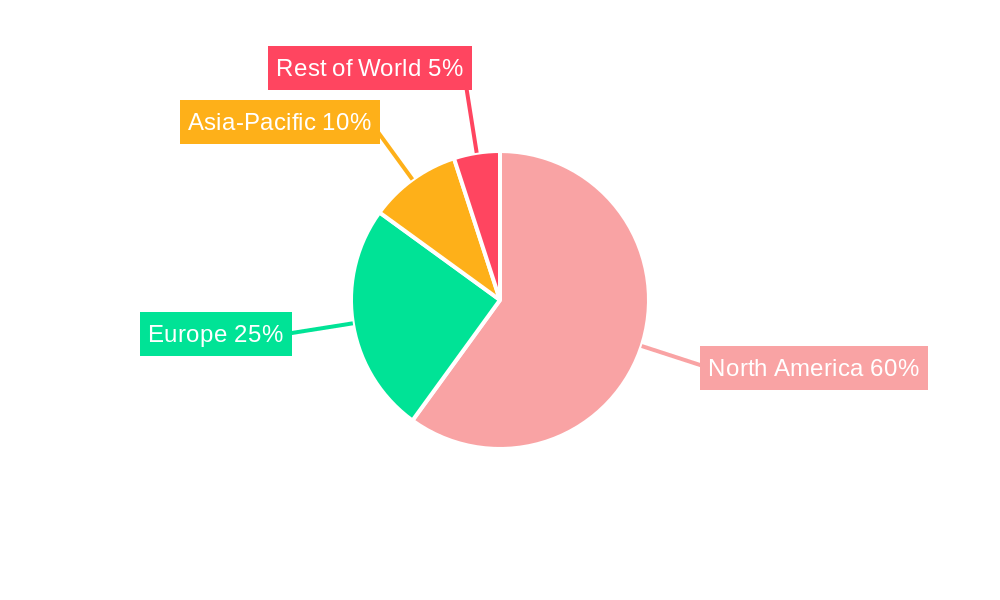

North America Precision Turned Product Manufacturing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Precision Turned Product Manufacturing Market Regional Market Share

Geographic Coverage of North America Precision Turned Product Manufacturing Market

North America Precision Turned Product Manufacturing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Manufacturing Sector is Being Transformed by the Internet Of Things (IoT)

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Precision Turned Product Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Operation

- 5.1.1. Manual Operation

- 5.1.2. CNC Operation

- 5.2. Market Analysis, Insights and Forecast - by Machine Types

- 5.2.1. Automatic Screw Machines

- 5.2.2. Rotary Transfer Machines

- 5.2.3. Computer Numerically Controlled (CNC)

- 5.2.4. Lathes or Turning Centers

- 5.3. Market Analysis, Insights and Forecast - by Material Type

- 5.3.1. Plastic

- 5.3.2. Steel

- 5.3.3. Other Material Types

- 5.4. Market Analysis, Insights and Forecast - by End Use

- 5.4.1. Automobile

- 5.4.2. Electronics

- 5.4.3. Defense

- 5.4.4. Healthcare

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Operation

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Premier Farnell Corp

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Melling Tool Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kamatics Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sorenson Engineering Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cox Manufacturing Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nook Industries LLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Creed-Monarch Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Camcraft Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 M & W Industries Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Greystone of Lincoln Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Swagelok Hy-Level Company

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Herker Industries Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Supreme Screw Products Inc **List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Premier Farnell Corp

List of Figures

- Figure 1: North America Precision Turned Product Manufacturing Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Precision Turned Product Manufacturing Market Share (%) by Company 2025

List of Tables

- Table 1: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by Operation 2020 & 2033

- Table 2: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by Machine Types 2020 & 2033

- Table 3: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 4: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by End Use 2020 & 2033

- Table 5: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by Operation 2020 & 2033

- Table 7: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by Machine Types 2020 & 2033

- Table 8: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 9: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by End Use 2020 & 2033

- Table 10: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States North America Precision Turned Product Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada North America Precision Turned Product Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico North America Precision Turned Product Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Precision Turned Product Manufacturing Market?

The projected CAGR is approximately 6.7%.

2. Which companies are prominent players in the North America Precision Turned Product Manufacturing Market?

Key companies in the market include Premier Farnell Corp, Melling Tool Co, Kamatics Corporation, Sorenson Engineering Inc, Cox Manufacturing Company, Nook Industries LLC, Creed-Monarch Inc, Camcraft Inc, M & W Industries Inc, Greystone of Lincoln Inc, Swagelok Hy-Level Company, Herker Industries Inc, Supreme Screw Products Inc **List Not Exhaustive.

3. What are the main segments of the North America Precision Turned Product Manufacturing Market?

The market segments include Operation, Machine Types, Material Type, End Use .

4. Can you provide details about the market size?

The market size is estimated to be USD 110.33 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Manufacturing Sector is Being Transformed by the Internet Of Things (IoT).

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

November 2022: Middle market private equity firm One Equity Partners announced the acquisition of precision machining service providers Evans Industries Inc. and Little Enterprises LLC by Momentum Manufacturing Group, a leading North American metal manufacturing services provider. The purchases will extend Momentum's capabilities, increase the company's exposure to mission-critical end markets, and add close to 160 qualified team members.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Precision Turned Product Manufacturing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Precision Turned Product Manufacturing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Precision Turned Product Manufacturing Market?

To stay informed about further developments, trends, and reports in the North America Precision Turned Product Manufacturing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence