Key Insights

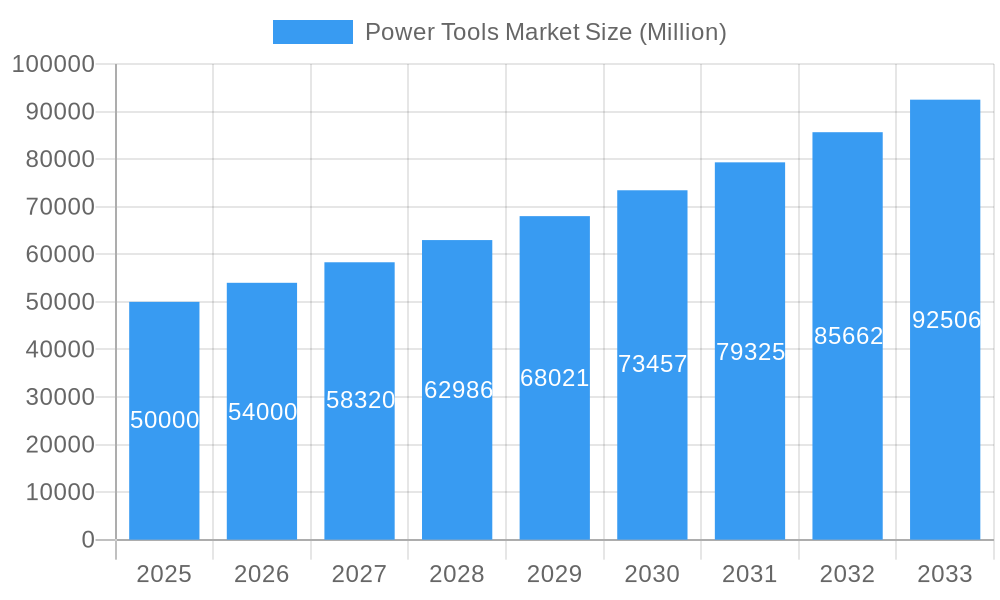

The global power tools market, valued at approximately $50 billion in 2025, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 8% from 2025 to 2033. This expansion is driven by several key factors. The increasing adoption of cordless power tools, offering greater portability and convenience, is a significant contributor. Furthermore, the growth of the construction and renovation sectors, particularly in developing economies experiencing rapid urbanization, fuels substantial demand. Technological advancements, such as the incorporation of brushless motors enhancing efficiency and battery life, are also driving market growth. Finally, rising professionalization in DIY and home improvement projects, coupled with increasing disposable incomes in many regions, further contributes to market expansion.

Power Tools Market Market Size (In Billion)

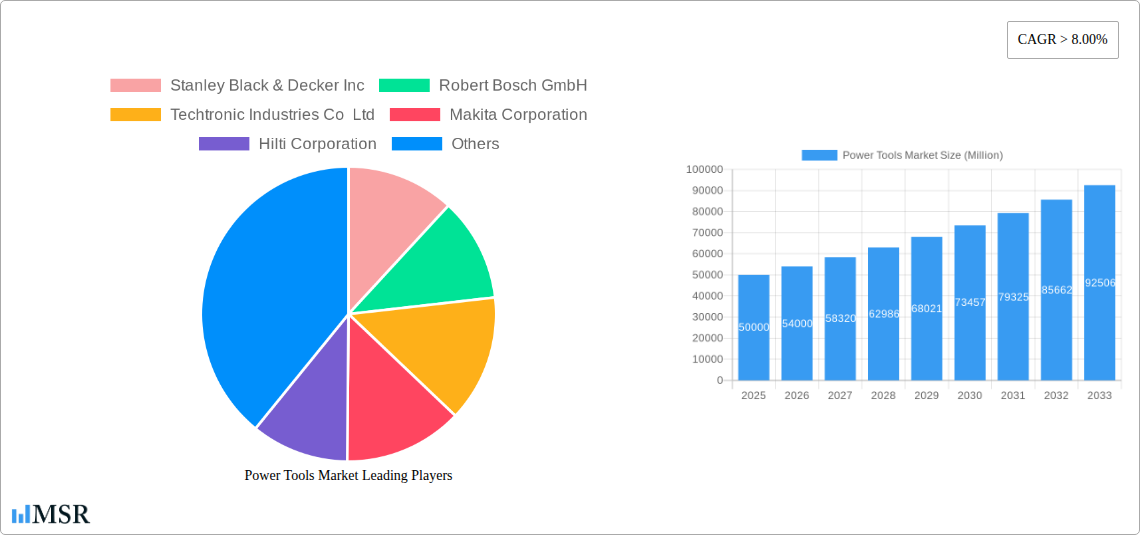

However, certain restraints temper the market's growth trajectory. Fluctuations in raw material prices, particularly those of metals and plastics used in manufacturing, pose challenges to profitability and pricing stability. Stringent environmental regulations regarding emissions and waste disposal also necessitate costly compliance measures for manufacturers. Additionally, increased competition, particularly from emerging players offering lower-priced alternatives, necessitates continuous innovation and competitive pricing strategies to maintain market share. Despite these challenges, the long-term outlook for the power tools market remains positive, fueled by consistent technological advancements and the ever-growing need for efficient and versatile tools across various industries and consumer segments. Major players like Stanley Black & Decker, Bosch, and Makita, alongside several other significant manufacturers, continue to innovate and invest heavily in research and development to maintain a competitive edge in this dynamic market.

Power Tools Market Company Market Share

Power Tools Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the global Power Tools Market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report delves into market dynamics, key trends, leading players, and future growth opportunities. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Power Tools Market Market Concentration & Dynamics

The Power Tools market exhibits a moderately concentrated landscape, with key players like Stanley Black & Decker Inc, Robert Bosch GmbH, Techtronic Industries Co Ltd, and Makita Corporation holding significant market share. However, the presence of numerous smaller players and regional manufacturers contributes to a dynamic competitive environment.

Market Concentration Metrics (2025 Estimates):

- Top 5 players' combined market share: xx%

- Top 10 players' combined market share: xx%

Innovation Ecosystems and Regulatory Frameworks:

The market is characterized by continuous innovation in cordless technology, brushless motors, smart tools, and connected solutions. Regulatory frameworks concerning safety, emissions, and energy efficiency vary across regions, impacting product design and market access.

Substitute Products and End-User Trends:

While traditional power tools remain dominant, the rise of robotic tools and alternative construction methods presents a subtle competitive pressure. End-user trends reflect a growing demand for lightweight, ergonomic, and digitally enabled tools.

M&A Activities:

The past five years have witnessed xx M&A deals in the power tools sector, primarily driven by efforts to expand product portfolios, gain access to new technologies, and enhance geographic reach.

Power Tools Market Industry Insights & Trends

The Power Tools market is experiencing robust growth, fueled by several key factors. The global construction boom, particularly in emerging economies, is a primary driver. Technological advancements, such as the adoption of brushless motors and lithium-ion batteries, are enhancing tool performance and efficiency, boosting market demand. Furthermore, the increasing adoption of cordless tools, driven by improved battery technology and user preference for convenience, is significantly contributing to market expansion. Evolving consumer behavior, marked by a preference for premium, feature-rich tools, further supports market growth. The market's value is estimated at xx Million in 2025, exhibiting a steady growth trajectory.

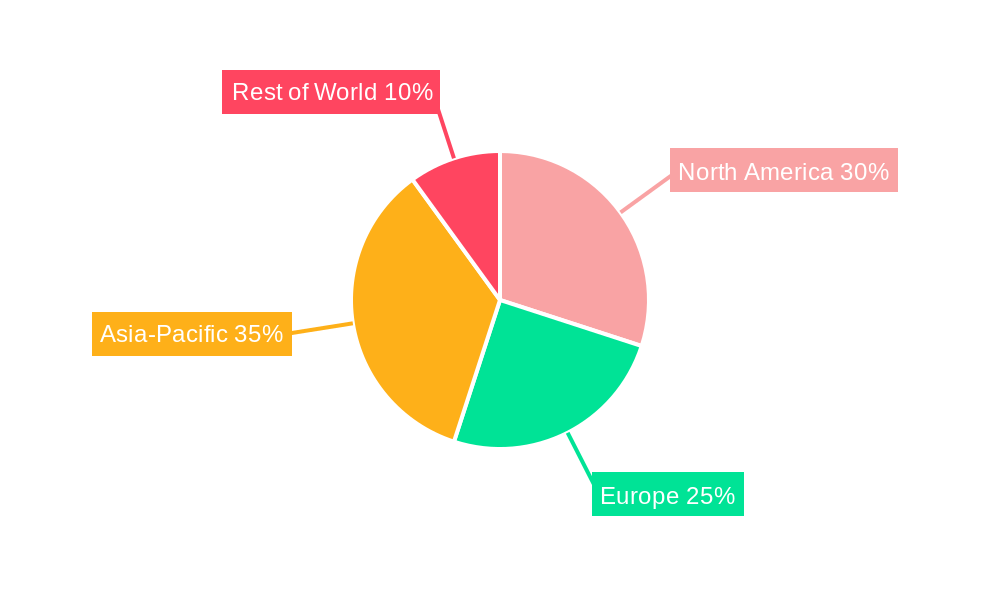

Key Markets & Segments Leading Power Tools Market

The global power tools market is a dynamic landscape shaped by regional economic strengths and evolving industry demands. Currently, North America stands as a dominant force, propelled by a vibrant construction sector, substantial consumer purchasing power, and a keen receptiveness to cutting-edge tool technology. Simultaneously, the Asia-Pacific region is exhibiting remarkable growth, largely attributable to extensive infrastructure development, rapid urbanization, and a burgeoning industrial base across several nations.

Geographic Market Dynamics:

- North America: Characterized by significant infrastructure investment, a robust construction industry, and a proven track record of early adoption for new power tool technologies.

- Asia-Pacific: Experiencing accelerated expansion driven by rapid urbanization, a growing industrial footprint, and increasing disposable incomes within emerging economies.

- Europe: Demonstrating steady growth, primarily fueled by ongoing renovation projects and strategic infrastructure development initiatives.

Within the end-user landscape, the construction segment continues to be the largest consumer of power tools. The industrial sector follows, with its growth closely tied to advancements in automation and the pursuit of enhanced manufacturing efficiency. The Do-It-Yourself (DIY) segment also contributes significantly, reflecting a growing interest in home improvement and personal projects.

Power Tools Market Product Developments

Innovation in the power tools market is intensely focused on elevating tool performance, maximizing operational efficiency, and refining the user experience. Key advancements include the widespread adoption of brushless motor technology, which significantly extends battery life and improves tool longevity. Ergonomic designs are being meticulously refined to minimize user fatigue during prolonged use. Furthermore, the integration of smart features, such as advanced connectivity and real-time monitoring capabilities, is enhancing user control and providing valuable operational insights. Notable examples of this innovative drive include DEWALT's strategic expansion of its TOUGHSYSTEM® 2.0 modular storage solutions, Hilti's pioneering collaboration with Canvas for robotic drywalling applications, and Bosch Power Tools' introduction of the compact yet powerful GWS12V-30 angle grinder, underscoring a consistent commitment to pushing the boundaries of power tool technology.

Challenges in the Power Tools Market Market

The power tools market navigates a complex terrain of challenges that can impact its trajectory. Rising raw material costs, coupled with persistent supply chain disruptions, can lead to increased production timelines and elevated manufacturing expenses. Intense competition, both from established industry giants and agile new entrants, further intensifies market pressures. Additionally, stringent safety and environmental regulations in various key regions present compliance hurdles that require careful management. The cumulative impact of these challenges is estimated to influence market growth by approximately [Insert Specific Percentage Here] in 2025, necessitating strategic adaptations and forward-thinking solutions from market participants.

Forces Driving Power Tools Market Growth

Key growth drivers include technological advancements (e.g., cordless tools, brushless motors, smart technology), infrastructure development globally, and increasing demand in emerging markets. Favorable economic conditions in several regions further contribute to market growth. Government initiatives promoting construction and industrial development also play a role.

Challenges in the Power Tools Market Market (Long-Term Growth Catalysts)

Looking beyond immediate hurdles, the long-term growth trajectory of the power tools market is poised to be significantly influenced by several key catalysts. Continued advancements in battery technology, promising increased power density and extended operational times, will be pivotal. The burgeoning development and integration of robotic and automated tool systems are expected to revolutionize efficiency and precision in various applications. Furthermore, the expansion of interconnected "smart tool" ecosystems, facilitating seamless data exchange and enhanced operational management, will unlock new levels of productivity. Strategic partnerships, mergers, and acquisitions among industry players will also play a critical role in consolidating expertise, expanding market reach, and shaping the future competitive landscape.

Emerging Opportunities in Power Tools Market

The power tools market is ripe with emerging opportunities, particularly in catering to specialized applications and expanding into underserved markets. The development of highly specialized tools for niche professional tasks presents a significant growth avenue. The power tool rental market, especially for high-value professional equipment, is also poised for expansion as businesses seek flexible and cost-effective solutions. Furthermore, the ongoing economic development and increasing disposable incomes in emerging markets, particularly in developing countries, offer substantial untapped potential. The strategic integration of advanced technologies such as Artificial Intelligence (AI) and the Internet of Things (IoT) into power tools promises to unlock innovative functionalities, enhance predictive maintenance, and create entirely new market segments.

Leading Players in the Power Tools Market Sector

Key Milestones in Power Tools Market Industry

- March 2023: DEWALT enhances its user-centric approach by expanding its TOUGHSYSTEM® 2.0 storage portfolio. This strategic move prioritizes modularity and improved user convenience, reinforcing the brand's commitment to a holistic product ecosystem.

- March 2023: Hilti signals a significant shift towards automation in construction through its partnership with Canvas for robotic drywalling. This collaboration highlights the transformative potential of robotics in increasing productivity and redefining traditional construction methods.

- June 2022: Bosch Power Tools continues its innovation streak with the launch of the GWS12V-30 angle grinder. This release underscores the company's ongoing dedication to developing powerful, efficient, and user-friendly cordless grinding solutions.

Strategic Outlook for Power Tools Market Market

The Power Tools market is poised for continued growth, driven by technological advancements, infrastructure development, and increasing demand from emerging markets. Strategic opportunities exist for companies to focus on developing innovative, sustainable, and user-friendly products, expand into new markets, and leverage strategic partnerships to enhance market reach and competitiveness. The future of the market lies in the adoption of smart technology and automation in construction and manufacturing.

Power Tools Market Segmentation

-

1. Mode Of Operation

-

1.1. Electric

- 1.1.1. Cordless

- 1.1.2. Corded

- 1.2. Pneumatic

- 1.3. Other Modes of Operations

-

1.1. Electric

-

2. Product

- 2.1. Wrenches

- 2.2. Grinders

- 2.3. Drills

- 2.4. Saws

- 2.5. Other Products

-

3. Application

- 3.1. Industrial

- 3.2. Residential

Power Tools Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Power Tools Market Regional Market Share

Geographic Coverage of Power Tools Market

Power Tools Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Rise in Global Construction and Infrastructure Development Activities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Power Tools Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Mode Of Operation

- 5.1.1. Electric

- 5.1.1.1. Cordless

- 5.1.1.2. Corded

- 5.1.2. Pneumatic

- 5.1.3. Other Modes of Operations

- 5.1.1. Electric

- 5.2. Market Analysis, Insights and Forecast - by Product

- 5.2.1. Wrenches

- 5.2.2. Grinders

- 5.2.3. Drills

- 5.2.4. Saws

- 5.2.5. Other Products

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Industrial

- 5.3.2. Residential

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Mode Of Operation

- 6. North America Power Tools Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Mode Of Operation

- 6.1.1. Electric

- 6.1.1.1. Cordless

- 6.1.1.2. Corded

- 6.1.2. Pneumatic

- 6.1.3. Other Modes of Operations

- 6.1.1. Electric

- 6.2. Market Analysis, Insights and Forecast - by Product

- 6.2.1. Wrenches

- 6.2.2. Grinders

- 6.2.3. Drills

- 6.2.4. Saws

- 6.2.5. Other Products

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Industrial

- 6.3.2. Residential

- 6.1. Market Analysis, Insights and Forecast - by Mode Of Operation

- 7. South America Power Tools Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Mode Of Operation

- 7.1.1. Electric

- 7.1.1.1. Cordless

- 7.1.1.2. Corded

- 7.1.2. Pneumatic

- 7.1.3. Other Modes of Operations

- 7.1.1. Electric

- 7.2. Market Analysis, Insights and Forecast - by Product

- 7.2.1. Wrenches

- 7.2.2. Grinders

- 7.2.3. Drills

- 7.2.4. Saws

- 7.2.5. Other Products

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Industrial

- 7.3.2. Residential

- 7.1. Market Analysis, Insights and Forecast - by Mode Of Operation

- 8. Europe Power Tools Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Mode Of Operation

- 8.1.1. Electric

- 8.1.1.1. Cordless

- 8.1.1.2. Corded

- 8.1.2. Pneumatic

- 8.1.3. Other Modes of Operations

- 8.1.1. Electric

- 8.2. Market Analysis, Insights and Forecast - by Product

- 8.2.1. Wrenches

- 8.2.2. Grinders

- 8.2.3. Drills

- 8.2.4. Saws

- 8.2.5. Other Products

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Industrial

- 8.3.2. Residential

- 8.1. Market Analysis, Insights and Forecast - by Mode Of Operation

- 9. Middle East & Africa Power Tools Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Mode Of Operation

- 9.1.1. Electric

- 9.1.1.1. Cordless

- 9.1.1.2. Corded

- 9.1.2. Pneumatic

- 9.1.3. Other Modes of Operations

- 9.1.1. Electric

- 9.2. Market Analysis, Insights and Forecast - by Product

- 9.2.1. Wrenches

- 9.2.2. Grinders

- 9.2.3. Drills

- 9.2.4. Saws

- 9.2.5. Other Products

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Industrial

- 9.3.2. Residential

- 9.1. Market Analysis, Insights and Forecast - by Mode Of Operation

- 10. Asia Pacific Power Tools Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Mode Of Operation

- 10.1.1. Electric

- 10.1.1.1. Cordless

- 10.1.1.2. Corded

- 10.1.2. Pneumatic

- 10.1.3. Other Modes of Operations

- 10.1.1. Electric

- 10.2. Market Analysis, Insights and Forecast - by Product

- 10.2.1. Wrenches

- 10.2.2. Grinders

- 10.2.3. Drills

- 10.2.4. Saws

- 10.2.5. Other Products

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Industrial

- 10.3.2. Residential

- 10.1. Market Analysis, Insights and Forecast - by Mode Of Operation

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Stanley Black & Decker Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Robert Bosch GmbH

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Techtronic Industries Co Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Makita Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hilti Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Atlas Copco AB

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ingersoll Rand

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Snap-on Incorporated

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Apex Tool Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Honeywell International Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Emerson Electric Co

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Husqvarna AB

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 KYOCERA Corporation**List Not Exhaustive

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Stanley Black & Decker Inc

List of Figures

- Figure 1: Global Power Tools Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Power Tools Market Revenue (undefined), by Mode Of Operation 2025 & 2033

- Figure 3: North America Power Tools Market Revenue Share (%), by Mode Of Operation 2025 & 2033

- Figure 4: North America Power Tools Market Revenue (undefined), by Product 2025 & 2033

- Figure 5: North America Power Tools Market Revenue Share (%), by Product 2025 & 2033

- Figure 6: North America Power Tools Market Revenue (undefined), by Application 2025 & 2033

- Figure 7: North America Power Tools Market Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America Power Tools Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Power Tools Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Power Tools Market Revenue (undefined), by Mode Of Operation 2025 & 2033

- Figure 11: South America Power Tools Market Revenue Share (%), by Mode Of Operation 2025 & 2033

- Figure 12: South America Power Tools Market Revenue (undefined), by Product 2025 & 2033

- Figure 13: South America Power Tools Market Revenue Share (%), by Product 2025 & 2033

- Figure 14: South America Power Tools Market Revenue (undefined), by Application 2025 & 2033

- Figure 15: South America Power Tools Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: South America Power Tools Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: South America Power Tools Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Power Tools Market Revenue (undefined), by Mode Of Operation 2025 & 2033

- Figure 19: Europe Power Tools Market Revenue Share (%), by Mode Of Operation 2025 & 2033

- Figure 20: Europe Power Tools Market Revenue (undefined), by Product 2025 & 2033

- Figure 21: Europe Power Tools Market Revenue Share (%), by Product 2025 & 2033

- Figure 22: Europe Power Tools Market Revenue (undefined), by Application 2025 & 2033

- Figure 23: Europe Power Tools Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: Europe Power Tools Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Europe Power Tools Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Power Tools Market Revenue (undefined), by Mode Of Operation 2025 & 2033

- Figure 27: Middle East & Africa Power Tools Market Revenue Share (%), by Mode Of Operation 2025 & 2033

- Figure 28: Middle East & Africa Power Tools Market Revenue (undefined), by Product 2025 & 2033

- Figure 29: Middle East & Africa Power Tools Market Revenue Share (%), by Product 2025 & 2033

- Figure 30: Middle East & Africa Power Tools Market Revenue (undefined), by Application 2025 & 2033

- Figure 31: Middle East & Africa Power Tools Market Revenue Share (%), by Application 2025 & 2033

- Figure 32: Middle East & Africa Power Tools Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Middle East & Africa Power Tools Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Power Tools Market Revenue (undefined), by Mode Of Operation 2025 & 2033

- Figure 35: Asia Pacific Power Tools Market Revenue Share (%), by Mode Of Operation 2025 & 2033

- Figure 36: Asia Pacific Power Tools Market Revenue (undefined), by Product 2025 & 2033

- Figure 37: Asia Pacific Power Tools Market Revenue Share (%), by Product 2025 & 2033

- Figure 38: Asia Pacific Power Tools Market Revenue (undefined), by Application 2025 & 2033

- Figure 39: Asia Pacific Power Tools Market Revenue Share (%), by Application 2025 & 2033

- Figure 40: Asia Pacific Power Tools Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Asia Pacific Power Tools Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Power Tools Market Revenue undefined Forecast, by Mode Of Operation 2020 & 2033

- Table 2: Global Power Tools Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 3: Global Power Tools Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Global Power Tools Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Power Tools Market Revenue undefined Forecast, by Mode Of Operation 2020 & 2033

- Table 6: Global Power Tools Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 7: Global Power Tools Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 8: Global Power Tools Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States Power Tools Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Power Tools Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Mexico Power Tools Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Global Power Tools Market Revenue undefined Forecast, by Mode Of Operation 2020 & 2033

- Table 13: Global Power Tools Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 14: Global Power Tools Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 15: Global Power Tools Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Brazil Power Tools Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Argentina Power Tools Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Power Tools Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global Power Tools Market Revenue undefined Forecast, by Mode Of Operation 2020 & 2033

- Table 20: Global Power Tools Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 21: Global Power Tools Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 22: Global Power Tools Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Power Tools Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Germany Power Tools Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: France Power Tools Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Italy Power Tools Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Spain Power Tools Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Russia Power Tools Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Benelux Power Tools Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Nordics Power Tools Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Power Tools Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Power Tools Market Revenue undefined Forecast, by Mode Of Operation 2020 & 2033

- Table 33: Global Power Tools Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 34: Global Power Tools Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 35: Global Power Tools Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 36: Turkey Power Tools Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Israel Power Tools Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: GCC Power Tools Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: North Africa Power Tools Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: South Africa Power Tools Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Power Tools Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Global Power Tools Market Revenue undefined Forecast, by Mode Of Operation 2020 & 2033

- Table 43: Global Power Tools Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 44: Global Power Tools Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 45: Global Power Tools Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 46: China Power Tools Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: India Power Tools Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Japan Power Tools Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 49: South Korea Power Tools Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Power Tools Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 51: Oceania Power Tools Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Power Tools Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Power Tools Market?

The projected CAGR is approximately 9.9%.

2. Which companies are prominent players in the Power Tools Market?

Key companies in the market include Stanley Black & Decker Inc, Robert Bosch GmbH, Techtronic Industries Co Ltd, Makita Corporation, Hilti Corporation, Atlas Copco AB, Ingersoll Rand, Snap-on Incorporated, Apex Tool Group, Honeywell International Inc, Emerson Electric Co, Husqvarna AB, KYOCERA Corporation**List Not Exhaustive.

3. What are the main segments of the Power Tools Market?

The market segments include Mode Of Operation, Product, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Rise in Global Construction and Infrastructure Development Activities.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

March 2023: DEWALT, a Stanley Black & Decker brand, announced the expansion of its TOUGHSYSTEM® 2.0 storage portfolio with the introduction of three new products - an Adaptor, Deep Compact Toolbox, and 3-Drawer Toolbox - providing users with greater connectivity to other storage modules and convenient access to tools. The new TOUGHSYSTEM® 2.0 Adaptor (DWST08017) allows users to build a versatile and customized storage solution through expanded compatibility.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Power Tools Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Power Tools Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Power Tools Market?

To stay informed about further developments, trends, and reports in the Power Tools Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence