Key Insights

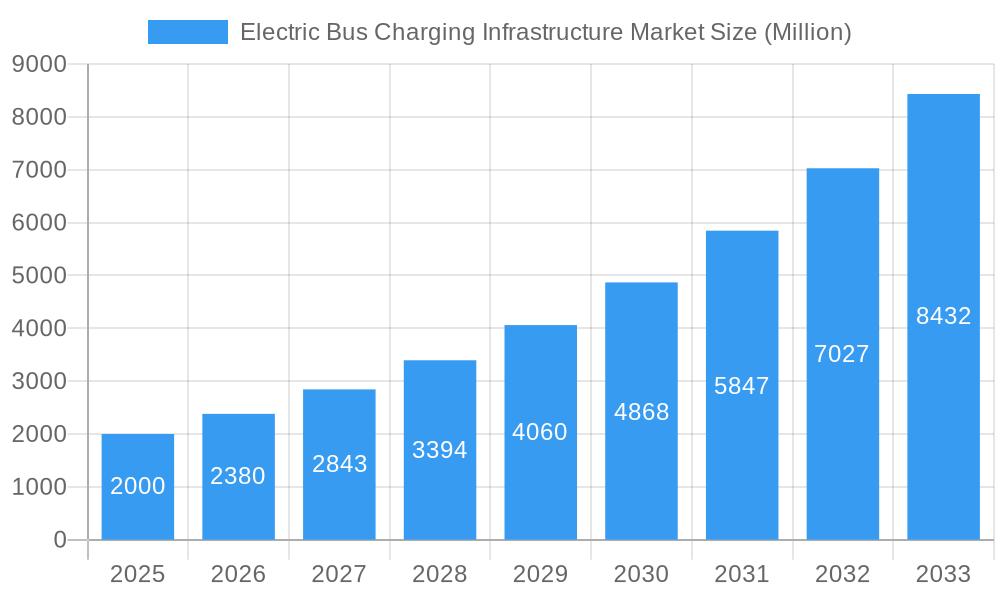

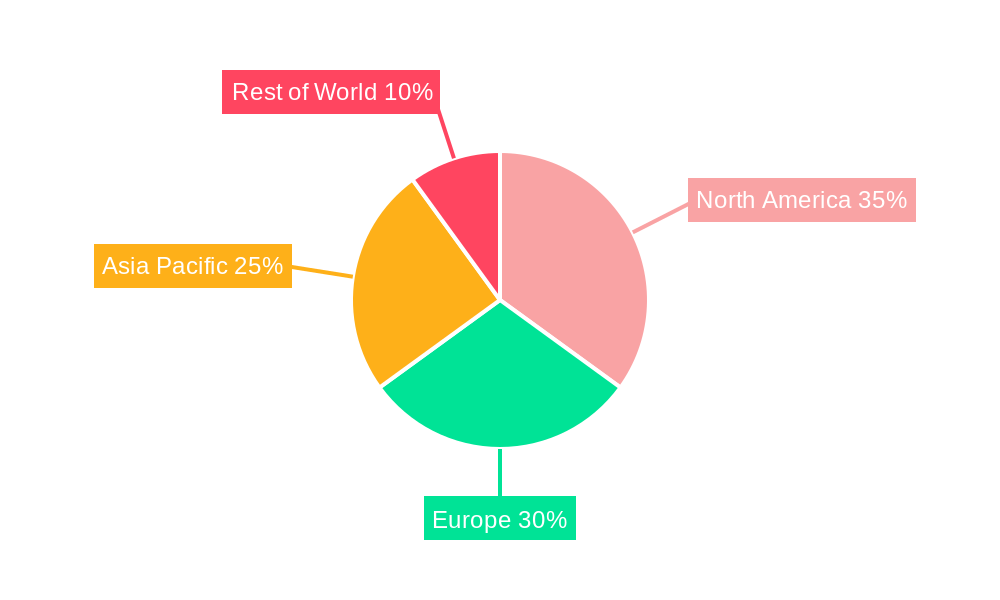

The Electric Bus Charging Infrastructure market is experiencing robust growth, projected to reach a substantial size driven by the increasing adoption of electric buses globally. The 19% Compound Annual Growth Rate (CAGR) from 2019 to 2025 indicates a significant upward trajectory, fueled by stringent emission regulations, government incentives promoting sustainable transportation, and the rising environmental awareness among urban planners and citizens. Key market drivers include the expanding electric bus fleet, the need for efficient and reliable charging solutions, and ongoing technological advancements in charging infrastructure, including faster charging speeds and improved grid integration. The market is segmented by charging type, with Plug-in Charging currently dominating due to its established infrastructure and lower initial investment costs. However, Overhead Charging is gaining traction, particularly in dedicated bus rapid transit (BRT) systems, due to its faster charging capabilities and suitability for high-frequency operations. Leading players in this market include established charging infrastructure providers, electric bus manufacturers, and energy management companies, reflecting the collaborative nature of this developing sector. Geographic variations exist, with North America and Europe currently holding larger market shares due to early adoption and robust regulatory frameworks. However, the Asia-Pacific region is poised for significant growth, driven by rapid urbanization and substantial government investments in public transportation infrastructure.

Electric Bus Charging Infrastructure Market Market Size (In Billion)

The forecast period (2025-2033) anticipates continued market expansion, with Plug-in Charging retaining its market share while Overhead Charging experiences accelerated adoption. Growth will be influenced by factors including the expansion of electric bus routes, improvements in battery technology allowing for longer ranges and reduced charging times, and the integration of smart charging technologies to optimize grid management and energy efficiency. Challenges remain, including the high initial investment costs for infrastructure deployment, the need for reliable grid capacity to support increased charging demands, and the requirement for standardized charging protocols to ensure interoperability. Nevertheless, the long-term outlook for the Electric Bus Charging Infrastructure market remains positive, reflecting a crucial component in the global transition towards sustainable urban mobility.

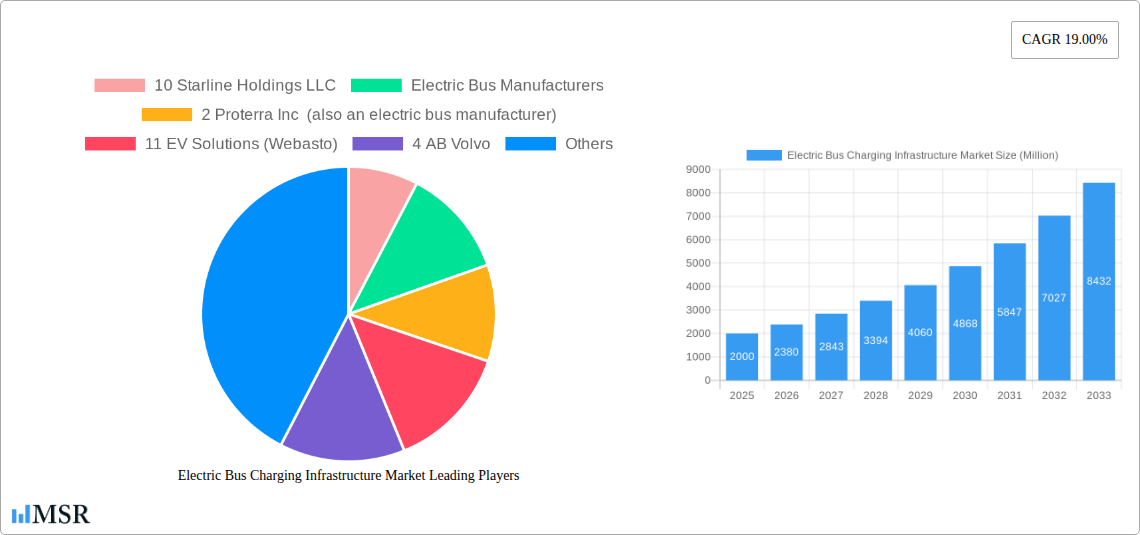

Electric Bus Charging Infrastructure Market Company Market Share

Electric Bus Charging Infrastructure Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Electric Bus Charging Infrastructure Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report delves into market dynamics, technological advancements, key players, and emerging opportunities. The market is experiencing significant growth driven by the global shift towards sustainable transportation and stringent emission regulations. This report forecasts a xx Million USD market value in 2025, showcasing a robust Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033).

Electric Bus Charging Infrastructure Market Market Concentration & Dynamics

The Electric Bus Charging Infrastructure Market exhibits a moderately concentrated landscape, with several key players holding significant market share. The market is characterized by intense competition, driven by both established charging infrastructure suppliers and electric bus manufacturers integrating charging solutions into their offerings. Innovation is a key differentiator, with ongoing developments in charging technologies (plug-in and overhead), power output, and smart charging management systems.

Regulatory frameworks, including government incentives and mandates for electric bus adoption, significantly influence market growth. Substitute products, such as diesel and CNG buses, still pose competition, but their market share is steadily declining due to environmental concerns and rising fuel costs. End-user trends, such as increasing demand for efficient and reliable charging infrastructure from public transportation agencies and private fleet operators, are strong growth drivers.

Mergers and acquisitions (M&A) are frequent, reflecting the consolidation efforts within the industry. The number of M&A deals in the past five years is estimated at xx, indicating a dynamic and evolving market structure. Key metrics like market share distribution (e.g., the top 5 players control approximately xx% of the market) are analyzed to provide a comprehensive understanding of the competitive landscape.

Electric Bus Charging Infrastructure Market Industry Insights & Trends

The Electric Bus Charging Infrastructure Market is experiencing exponential growth, driven by several key factors. The global push towards decarbonization and the increasing adoption of electric buses by urban transportation systems are significant contributors. Governments worldwide are implementing policies to reduce greenhouse gas emissions and improve air quality, creating a favorable regulatory environment for electric bus deployment and infrastructure development. This has resulted in a market size of xx Million USD in 2024, demonstrating a significant increase from the previous years. The market is projected to reach xx Million USD by 2033.

Technological advancements, including the development of faster charging technologies, improved battery technologies, and smart grid integration capabilities, are further accelerating market expansion. These innovations are enhancing charging efficiency, reducing charging times, and improving the overall operational efficiency of electric bus fleets. Evolving consumer behavior, with a growing preference for eco-friendly and sustainable transportation solutions, is also creating a positive market outlook. The CAGR for the market during the forecast period is expected to be xx%, a substantial increase from the historical period.

Key Markets & Segments Leading Electric Bus Charging Infrastructure Market

Geographically, [Dominant Region, e.g., North America] is currently the leading market for electric bus charging infrastructure, driven by strong government support, significant investments in public transportation, and a higher adoption rate of electric buses compared to other regions. [Dominant Country within the region, e.g., United States] plays a particularly crucial role due to its extensive public transportation network and substantial funding allocated for infrastructure development.

- Drivers in [Dominant Region/Country]:

- Strong government incentives and subsidies for electric bus adoption.

- Increasing investments in public transportation infrastructure.

- Growing awareness of environmental concerns and air quality issues.

- Expanding electric bus fleets in major cities.

By charging type, Plug-in Charging currently holds a larger market share than Overhead Charging. This is primarily due to its established infrastructure, lower initial investment cost, and wider availability. However, Overhead Charging is expected to witness significant growth in the future due to its advantages in terms of faster charging times and reduced downtime for buses.

Factors driving Plug-in Charging dominance:

- Lower initial investment compared to Overhead Charging.

- Wider availability and established infrastructure.

- Easier integration with existing charging networks.

- Suitability for various bus depot and charging locations.

Factors contributing to Overhead Charging growth potential:

- Faster charging speeds compared to Plug-in Charging.

- Reduced downtime for buses, maximizing operational efficiency.

- Potential for increased adoption in dedicated bus rapid transit systems.

- Long term cost effectiveness for high volume charging situations.

Electric Bus Charging Infrastructure Market Product Developments

Significant product innovations are transforming the electric bus charging infrastructure market. Advancements in power electronics, such as the adoption of silicon carbide (SiC) technology, are leading to higher efficiency and faster charging speeds. Smart charging management systems are being integrated to optimize energy consumption and improve grid stability. Wireless charging technologies are also emerging, offering the potential for seamless and convenient charging, although they are still at a relatively early stage of development. These innovations offer manufacturers a competitive edge by improving charging efficiency, reducing downtime, and lowering operational costs for end users.

Challenges in the Electric Bus Charging Infrastructure Market Market

The Electric Bus Charging Infrastructure Market faces several challenges, including high initial investment costs for infrastructure deployment, particularly for Overhead Charging systems. Supply chain disruptions and material shortages, especially for critical components like power electronics and batteries, can impact project timelines and increase costs. Furthermore, regulatory hurdles and standardization issues can slow down market growth. The lack of standardized charging protocols and interoperability challenges may hamper the widespread adoption of electric bus charging. The competitive landscape poses challenges with numerous players vying for market share.

Forces Driving Electric Bus Charging Infrastructure Market Growth

Several factors propel the market's growth. Stringent emission regulations and government mandates for electric bus adoption are key drivers. Increasing environmental awareness and the need for sustainable transportation solutions are shaping consumer preference. The availability of government subsidies and incentives further encourages the adoption of electric buses and charging infrastructure. Furthermore, technological advancements, such as faster charging solutions and improved battery technology, are lowering the total cost of ownership for electric bus operators, driving market adoption.

Long-Term Growth Catalysts in the Electric Bus Charging Infrastructure Market

Long-term growth will be fueled by continuous technological innovation, leading to more efficient and cost-effective charging solutions. Strategic partnerships between charging infrastructure providers, electric bus manufacturers, and grid operators will facilitate smoother integration and broader adoption. Expanding into new markets, particularly in developing countries with growing public transportation needs, will unlock significant growth potential. The establishment of robust charging infrastructure networks and the implementation of smart charging management systems are crucial for long-term market expansion.

Emerging Opportunities in Electric Bus Charging Infrastructure Market

Significant opportunities exist in integrating renewable energy sources, such as solar and wind power, into charging infrastructure to reduce reliance on the grid and lower carbon emissions. The development of advanced charging systems with functionalities beyond basic charging, such as energy storage, smart grid interaction, and fleet management features, presents compelling opportunities for value creation. Expanding into niche markets such as school buses, airport shuttles, and tourist buses will create specialized opportunities.

Leading Players in the Electric Bus Charging Infrastructure Market Sector

- 10 Starline Holdings LLC

- 2 Proterra Inc

- 11 EV Solutions (Webasto)

- 4 AB Volvo

- 3 ChargePoint Inc

- 1 BYD Auto Co Ltd

- 1 ABB Ltd

- 8 Heliox Energy

- 6 ALSTOM

- 5 Zhengzhou Yutong Bus Co Ltd

- 7 SemaConnect Inc

- 2 Mercedes-Benz AG

- 3 Traton SE

- 4 Siemens AG

- 7 NFI Group Inc

- 5 Schneider Electric SE

- 6 IVECO S p A

- 9 Vital EV Solutions

Key Milestones in Electric Bus Charging Infrastructure Market Industry

- November 2022: ABB E-Mobility secured USD 214 Million in pre-IPO funding, boosting its growth strategy through organic and inorganic expansion.

- September 2022: ABB E-Mobility commenced operations in South Carolina, creating over 100 jobs and boosting production capacity to 10,000 chargers annually.

- August 2022: Siemens and MAHLE Group partnered to develop advanced wireless charging systems for electric vehicles, driving standardization efforts.

Strategic Outlook for Electric Bus Charging Infrastructure Market Market

The Electric Bus Charging Infrastructure Market exhibits substantial long-term growth potential, driven by the global transition to sustainable transportation and the increasing adoption of electric buses. Strategic opportunities exist for companies focusing on innovation in charging technologies, integration with smart grids, and expansion into new geographic markets. Partnerships and collaborations will play a critical role in accelerating market penetration and creating efficient, reliable, and cost-effective charging solutions for electric bus fleets worldwide. The long-term outlook for the Electric Bus Charging Infrastructure Market is very positive, with continued growth anticipated throughout the forecast period.

Electric Bus Charging Infrastructure Market Segmentation

-

1. Charging Type

- 1.1. Plug-in Charging

- 1.2. Overhead Charging

Electric Bus Charging Infrastructure Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Electric Bus Charging Infrastructure Market Regional Market Share

Geographic Coverage of Electric Bus Charging Infrastructure Market

Electric Bus Charging Infrastructure Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 19.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Adoption of Electric Buses

- 3.3. Market Restrains

- 3.3.1. High Upfront Investment

- 3.4. Market Trends

- 3.4.1. Governmental Efforts to Increase in the Number of Electric Buses Will Boost Overhead Charging Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electric Bus Charging Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Charging Type

- 5.1.1. Plug-in Charging

- 5.1.2. Overhead Charging

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Charging Type

- 6. North America Electric Bus Charging Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Charging Type

- 6.1.1. Plug-in Charging

- 6.1.2. Overhead Charging

- 6.1. Market Analysis, Insights and Forecast - by Charging Type

- 7. Europe Electric Bus Charging Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Charging Type

- 7.1.1. Plug-in Charging

- 7.1.2. Overhead Charging

- 7.1. Market Analysis, Insights and Forecast - by Charging Type

- 8. Asia Pacific Electric Bus Charging Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Charging Type

- 8.1.1. Plug-in Charging

- 8.1.2. Overhead Charging

- 8.1. Market Analysis, Insights and Forecast - by Charging Type

- 9. Rest of the World Electric Bus Charging Infrastructure Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Charging Type

- 9.1.1. Plug-in Charging

- 9.1.2. Overhead Charging

- 9.1. Market Analysis, Insights and Forecast - by Charging Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 10 Starline Holdings LLC

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Electric Bus Manufacturers

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 2 Proterra Inc (also an electric bus manufacturer)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 11 EV Solutions (Webasto)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 4 AB Volvo

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 3 ChargePoint Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 1 BYD Auto Co Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 1 ABB Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 8 Heliox Energy

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 6 ALSTOM

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 5 Zhengzhou Yutong Bus Co Ltd

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 7 SemaConnect Inc

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 2 Mercedes-Benz AG

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 3 Traton SE

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 4 Siemens AG

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 7 NFI Group Inc

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 5 Schneider Electric SE

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.18 6 IVECO S p A

- 10.2.18.1. Overview

- 10.2.18.2. Products

- 10.2.18.3. SWOT Analysis

- 10.2.18.4. Recent Developments

- 10.2.18.5. Financials (Based on Availability)

- 10.2.19 9 Vital EV Solutions

- 10.2.19.1. Overview

- 10.2.19.2. Products

- 10.2.19.3. SWOT Analysis

- 10.2.19.4. Recent Developments

- 10.2.19.5. Financials (Based on Availability)

- 10.2.20 Electric Charging Infrastructure Suppliers

- 10.2.20.1. Overview

- 10.2.20.2. Products

- 10.2.20.3. SWOT Analysis

- 10.2.20.4. Recent Developments

- 10.2.20.5. Financials (Based on Availability)

- 10.2.1 10 Starline Holdings LLC

List of Figures

- Figure 1: Global Electric Bus Charging Infrastructure Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Electric Bus Charging Infrastructure Market Revenue (Million), by Charging Type 2025 & 2033

- Figure 3: North America Electric Bus Charging Infrastructure Market Revenue Share (%), by Charging Type 2025 & 2033

- Figure 4: North America Electric Bus Charging Infrastructure Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Electric Bus Charging Infrastructure Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Electric Bus Charging Infrastructure Market Revenue (Million), by Charging Type 2025 & 2033

- Figure 7: Europe Electric Bus Charging Infrastructure Market Revenue Share (%), by Charging Type 2025 & 2033

- Figure 8: Europe Electric Bus Charging Infrastructure Market Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Electric Bus Charging Infrastructure Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Electric Bus Charging Infrastructure Market Revenue (Million), by Charging Type 2025 & 2033

- Figure 11: Asia Pacific Electric Bus Charging Infrastructure Market Revenue Share (%), by Charging Type 2025 & 2033

- Figure 12: Asia Pacific Electric Bus Charging Infrastructure Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Electric Bus Charging Infrastructure Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Electric Bus Charging Infrastructure Market Revenue (Million), by Charging Type 2025 & 2033

- Figure 15: Rest of the World Electric Bus Charging Infrastructure Market Revenue Share (%), by Charging Type 2025 & 2033

- Figure 16: Rest of the World Electric Bus Charging Infrastructure Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Rest of the World Electric Bus Charging Infrastructure Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Electric Bus Charging Infrastructure Market Revenue Million Forecast, by Charging Type 2020 & 2033

- Table 2: Global Electric Bus Charging Infrastructure Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Electric Bus Charging Infrastructure Market Revenue Million Forecast, by Charging Type 2020 & 2033

- Table 4: Global Electric Bus Charging Infrastructure Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Rest of North America Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Electric Bus Charging Infrastructure Market Revenue Million Forecast, by Charging Type 2020 & 2033

- Table 9: Global Electric Bus Charging Infrastructure Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Germany Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: United Kingdom Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: France Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Italy Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Spain Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Electric Bus Charging Infrastructure Market Revenue Million Forecast, by Charging Type 2020 & 2033

- Table 17: Global Electric Bus Charging Infrastructure Market Revenue Million Forecast, by Country 2020 & 2033

- Table 18: China Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: India Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: South Korea Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Global Electric Bus Charging Infrastructure Market Revenue Million Forecast, by Charging Type 2020 & 2033

- Table 24: Global Electric Bus Charging Infrastructure Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: South America Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Middle East and Africa Electric Bus Charging Infrastructure Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electric Bus Charging Infrastructure Market?

The projected CAGR is approximately 19.00%.

2. Which companies are prominent players in the Electric Bus Charging Infrastructure Market?

Key companies in the market include 10 Starline Holdings LLC, Electric Bus Manufacturers, 2 Proterra Inc (also an electric bus manufacturer), 11 EV Solutions (Webasto), 4 AB Volvo, 3 ChargePoint Inc, 1 BYD Auto Co Ltd, 1 ABB Ltd, 8 Heliox Energy, 6 ALSTOM, 5 Zhengzhou Yutong Bus Co Ltd, 7 SemaConnect Inc, 2 Mercedes-Benz AG, 3 Traton SE, 4 Siemens AG, 7 NFI Group Inc, 5 Schneider Electric SE, 6 IVECO S p A, 9 Vital EV Solutions, Electric Charging Infrastructure Suppliers.

3. What are the main segments of the Electric Bus Charging Infrastructure Market?

The market segments include Charging Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Adoption of Electric Buses.

6. What are the notable trends driving market growth?

Governmental Efforts to Increase in the Number of Electric Buses Will Boost Overhead Charging Type.

7. Are there any restraints impacting market growth?

High Upfront Investment.

8. Can you provide examples of recent developments in the market?

November 2022: ABB E-Mobility, the electric vehicle charging solutions subsidiary of ABB Ltd., successfully raised CHF 200 million (USD 214 million) in a pre-IPO private placement led by a group of minority investors. The capital infusion will play a crucial role in supporting the company's growth strategy, which includes pursuing both organic and inorganic opportunities, such as potential mergers and acquisitions. The transaction is expected to be finalized in the fourth quarter of 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electric Bus Charging Infrastructure Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electric Bus Charging Infrastructure Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electric Bus Charging Infrastructure Market?

To stay informed about further developments, trends, and reports in the Electric Bus Charging Infrastructure Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence