Key Insights

The Electric Vehicle (EV) Test Equipment market is poised for significant expansion, driven by the accelerated global adoption of electric mobility. With a projected Compound Annual Growth Rate (CAGR) of 31.42%, the market is anticipated to reach 211.72 million by 2025. This robust growth underscores the critical need for advanced testing infrastructure to ensure the safety, performance, and reliability of EVs and their components. The market is segmented by application, including battery testing, powertrain testing (motors, inverters), EV component testing (sensors, controllers), and charging infrastructure testing. Escalating regulatory mandates for EV safety and performance are a primary growth catalyst, compelling manufacturers to invest in sophisticated testing solutions. Geographically, North America and Europe are leading markets, while the Asia-Pacific region, particularly China, is set for rapid expansion due to burgeoning EV production and supportive government policies. Key players in this competitive landscape include Intertek, Horiba, and National Instruments, alongside specialized EV testing equipment providers. Emerging EV technologies, such as advanced battery chemistries and autonomous driving systems, will continue to drive demand for cutting-edge test equipment.

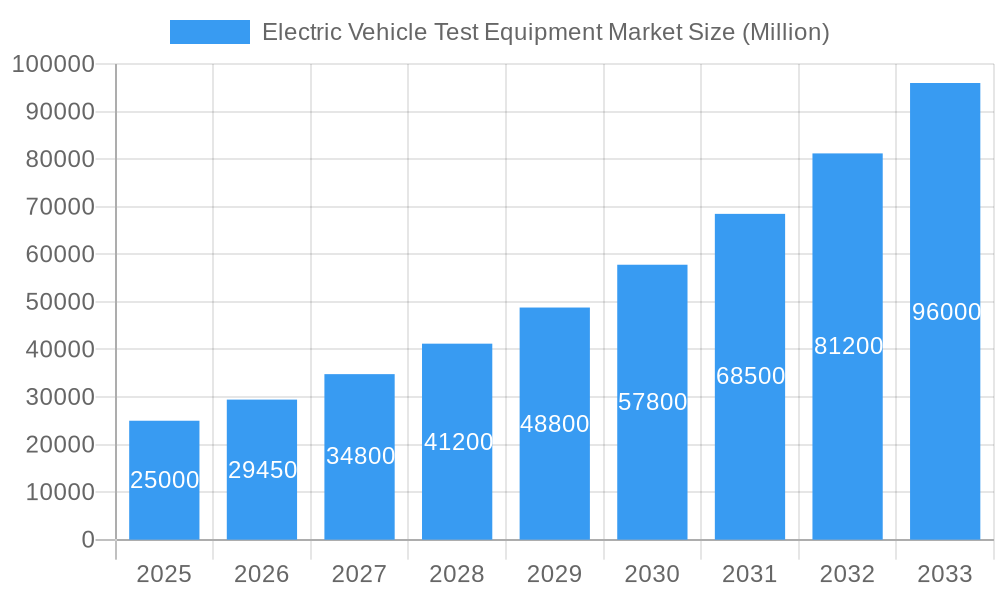

Electric Vehicle Test Equipment Market Market Size (In Million)

The forecast period (2025-2033) indicates sustained market growth, supported by the increasing prevalence of plug-in hybrid vehicles (PHEVs) and battery electric vehicles (BEVs) across passenger and commercial vehicle segments. While fuel cell electric vehicles (FCEVs) represent a smaller segment, their technological advancement and infrastructure development will contribute to overall market expansion. A key market trend is the continuous innovation in testing methodologies and equipment, focusing on enhanced speed, efficiency, and comprehensiveness. Despite potential restraints such as the high cost of specialized equipment and the requirement for skilled technicians, the market outlook remains highly positive, propelled by the irreversible global transition to electric transportation.

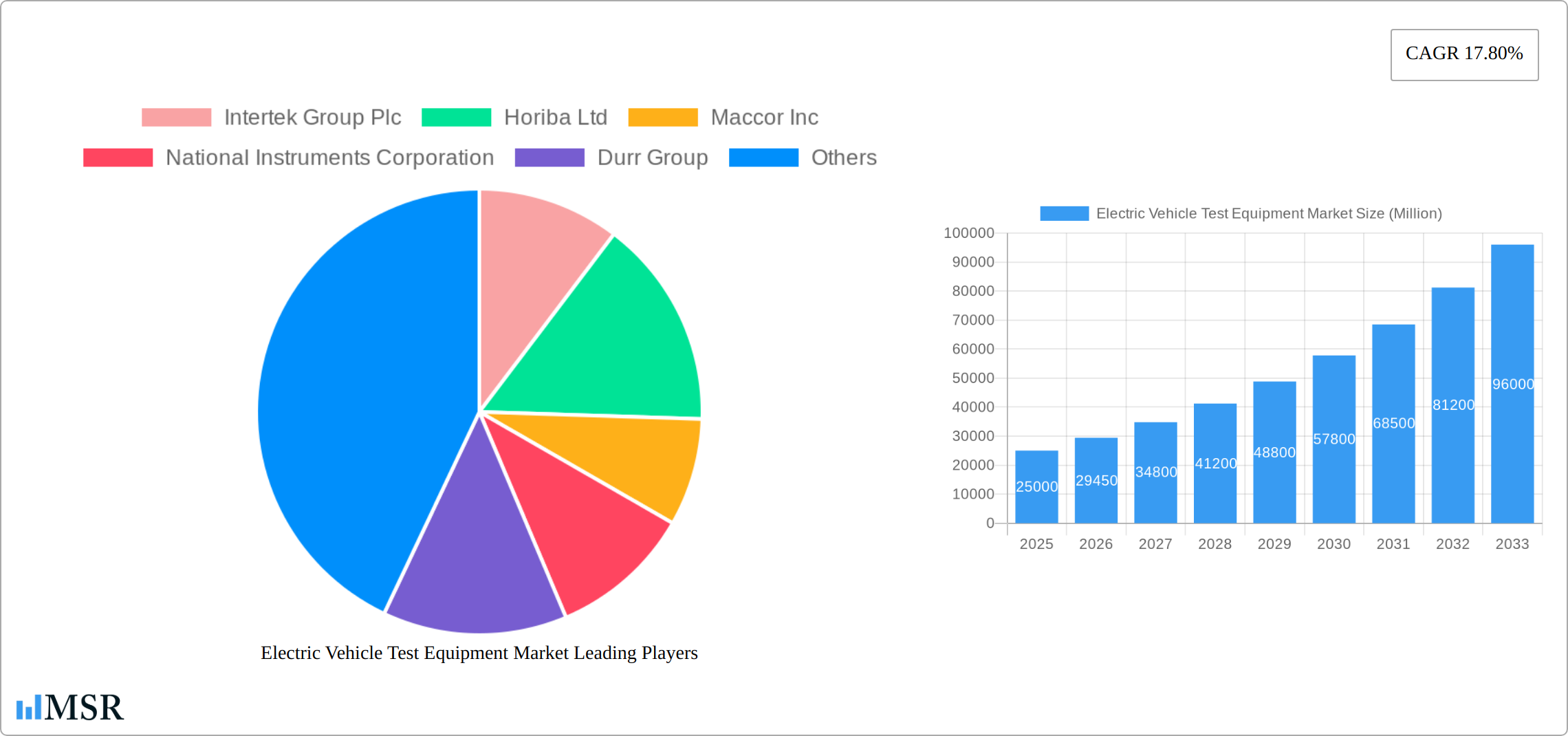

Electric Vehicle Test Equipment Market Company Market Share

Electric Vehicle Test Equipment Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Electric Vehicle (EV) Test Equipment market, offering invaluable insights for industry stakeholders, investors, and researchers. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. The report covers key market segments, leading players, and emerging trends, providing a complete picture of this dynamic market projected to reach xx Million by 2033.

Electric Vehicle Test Equipment Market Concentration & Dynamics

The EV test equipment market is characterized by a moderately concentrated landscape, with several major players holding significant market share. However, the market also exhibits a dynamic competitive environment fueled by continuous innovation, strategic mergers and acquisitions (M&A), and evolving regulatory frameworks. Market concentration is further influenced by regional variations in EV adoption rates and government policies.

- Market Share: The top five players collectively hold approximately xx% of the global market share in 2025, with Intertek Group Plc, Horiba Ltd, and National Instruments Corporation among the leading companies. Precise figures are detailed in the full report.

- M&A Activity: The past five years have witnessed xx M&A deals in the EV test equipment sector, demonstrating the ongoing consolidation and strategic expansion within the industry. These deals are driven by a need to enhance technological capabilities, expand geographic reach, and gain access to new customer bases.

- Innovation Ecosystems: Significant investments in research and development (R&D) by both established players and startups are fueling innovation in areas such as battery testing, powertrain simulation, and charging infrastructure testing. Collaboration between equipment manufacturers and EV makers is crucial in driving technological advancements.

- Regulatory Frameworks: Stringent safety and performance standards for EVs globally are driving demand for advanced testing equipment. Government regulations regarding emission standards and battery safety are significant factors shaping the market's growth trajectory.

- Substitute Products: While there are limited direct substitutes for specialized EV test equipment, the market faces indirect competition from general-purpose testing equipment and simulation software. This competition is likely to remain fairly constrained due to the unique requirements of EV testing.

- End-User Trends: The rising adoption of EVs globally and increasing demand for high-performance and safe vehicles are key factors propelling the demand for advanced EV test equipment. End-user preferences for specific features and capabilities drive innovation and product development within the industry.

Electric Vehicle Test Equipment Market Industry Insights & Trends

The global Electric Vehicle Test Equipment market is witnessing robust expansion, propelled by the accelerated adoption and development of electric vehicles worldwide. The market, valued at approximately XX Million in 2025, is forecast to reach a significant XX Million by 2033, signifying a compelling XX% Compound Annual Growth Rate (CAGR) over the projected forecast period. Several interconnected factors are fueling this upward trajectory:

The burgeoning global demand for electric vehicles stands as the foremost catalyst for market growth. This demand is further amplified by stringent government mandates and incentives aimed at promoting EV adoption across numerous nations, creating a favorable regulatory environment. Concurrently, continuous advancements in battery chemistry, electric powertrain efficiency, and the expansion of charging infrastructure are critical enablers of market expansion. The ongoing innovation in the development of more sophisticated, accurate, and efficient testing equipment directly contributes to this market dynamism. Consumer inclination towards sustainable and environmentally conscious transportation solutions continues to be a powerful driver of demand. The integration of cutting-edge features, such as autonomous driving capabilities, further necessitates the development and deployment of advanced testing solutions to ensure safety and performance. Significant investments in research and development within the automotive sector are spurring continuous innovation in EV technology, which in turn creates a strong and consistent demand for specialized testing equipment. The synergistic collaboration between automotive manufacturers and leading equipment providers is paramount in shaping and implementing state-of-the-art testing methodologies and solutions.

Key Markets & Segments Leading Electric Vehicle Test Equipment Market

The EV test equipment market is segmented by propulsion type (Plug-in Hybrid Vehicle, Battery Electric Vehicle, Fuel Cell Electric Vehicle), equipment type (Battery Test, Powertrain, EV Component, EV Charging, Other Equipment Types), and vehicle type (Passenger Cars, Commercial Vehicles). While the market shows strong growth across all segments, some areas demonstrate more significant dominance:

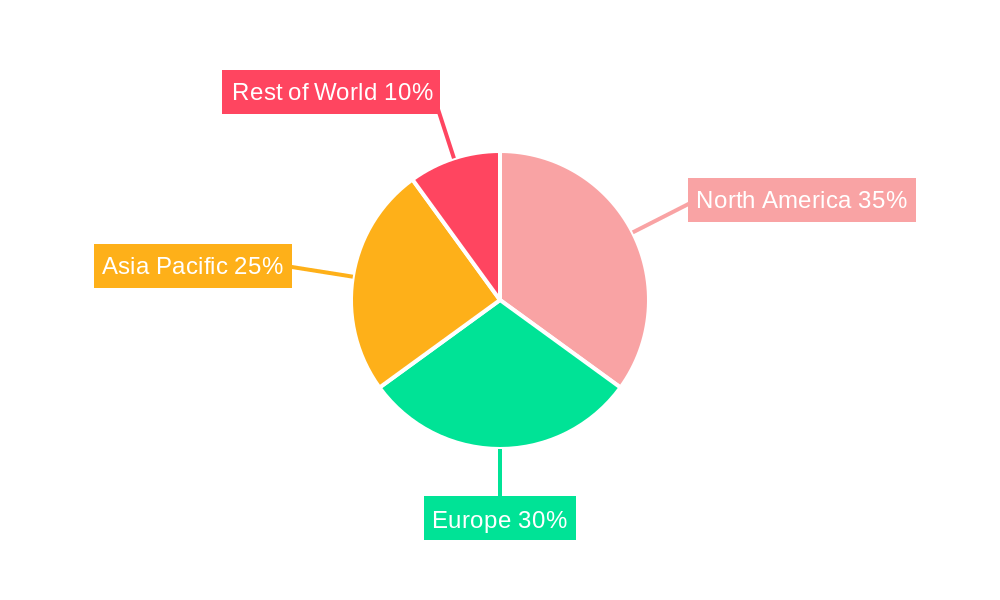

Dominant Region: The Asia-Pacific region is currently the leading market for EV test equipment, driven by high EV adoption rates, particularly in China and other rapidly developing economies. Europe and North America also hold significant market shares, with growth rates influenced by regional governmental policies and regulations.

Dominant Segment (By Propulsion Type): Battery Electric Vehicles (BEVs) currently hold the largest market share within the propulsion type segment due to their increasing popularity and widespread adoption.

Dominant Segment (By Equipment Type): The battery test equipment segment represents the largest share, reflecting the critical role of battery performance and safety in EV development.

Dominant Segment (By Vehicle Type): Passenger cars currently dominate the market, but the commercial vehicle segment is projected to experience significant growth in the coming years, fueled by increasing demand for electric commercial fleets.

Drivers for Key Segments:

- Economic Growth: Rising disposable incomes and increasing purchasing power are leading to higher demand for EVs, particularly in developing economies.

- Infrastructure Development: Government investments in charging infrastructure and related support networks are essential to accelerate EV adoption and consequently the demand for testing equipment.

- Technological Advancements: Continuous improvements in battery technology, charging systems, and other EV components are driving the need for more sophisticated testing methodologies and equipment.

- Stringent Regulations: Government regulations promoting EV adoption and enforcing safety standards are crucial factors driving market growth.

Electric Vehicle Test Equipment Market Product Developments

Recent product innovations focus on improving the accuracy, efficiency, and automation of EV testing. Advanced battery testing systems simulate real-world driving conditions, enabling more rigorous evaluations of battery performance, safety, and lifespan. Powertrain testing equipment is becoming increasingly sophisticated, integrating advanced simulation capabilities to optimize the performance of electric motors, inverters, and other powertrain components. New EV charging equipment tests compatibility and interoperability with various charging standards, ensuring safety and reliability. These advancements provide manufacturers with a competitive edge by enabling the production of higher-performing and more reliable electric vehicles.

Challenges in the Electric Vehicle Test Equipment Market

Despite the promising outlook, the EV test equipment market encounters several significant challenges that require strategic navigation:

- Evolving Regulatory Landscapes: The complex and rapidly changing regulatory standards across diverse geographical regions present a substantial hurdle for manufacturers. This necessitates continuous adaptation of testing protocols and equipment, leading to increased testing complexity, validation cycles, and associated costs.

- Supply Chain Volatility: Persistent disruptions within global supply chains can significantly impact the timely availability of essential raw materials and critical components required for the manufacturing of advanced testing equipment. This can result in production delays, increased lead times, and unpredictable price fluctuations, affecting market stability.

- Intense Competitive Environment: The market is characterized by fierce competition from established industry giants as well as agile new entrants. This dynamic landscape compels manufacturers to prioritize continuous innovation, enhance product performance, and optimize cost-effectiveness to sustain and expand their market share, thereby demanding substantial and sustained R&D investments.

Forces Driving Electric Vehicle Test Equipment Market Growth

Several factors are driving the growth of the EV test equipment market:

- Technological Advancements: Innovations in battery technology, powertrain systems, and charging infrastructure are leading to the development of more sophisticated testing requirements.

- Government Regulations: Stringent safety and emission standards are driving increased demand for advanced testing equipment, particularly for battery safety, vehicle range and emissions compliance.

- Economic Growth: The global economic growth is positively impacting the demand for electric vehicles, resulting in a parallel expansion of the testing equipment market.

Long-Term Growth Catalysts in Electric Vehicle Test Equipment Market

Long-term growth will be fueled by continued innovation in EV technology, strategic partnerships between equipment manufacturers and EV producers, and expansion into new geographic markets. The development of next-generation battery technologies and autonomous driving systems will drive demand for specialized testing solutions, further supporting market growth.

Emerging Opportunities in Electric Vehicle Test Equipment Market

The future of the EV test equipment market is brimming with exciting and transformative opportunities:

- Untapped Geographies and Emerging Markets: Significant growth potential lies in expanding into emerging economies that are demonstrating rapid adoption rates of electric vehicles. These markets present a greenfield opportunity for manufacturers to establish a strong foothold and cater to a burgeoning demand.

- Technological Convergence and Innovation: The development and integration of next-generation testing technologies, such as advanced AI-powered simulation platforms, sophisticated digital twin solutions, and highly automated testing systems, offer substantial avenues for market expansion and differentiation. These innovations promise enhanced efficiency, reduced testing times, and improved insights.

- Catering to Evolving Consumer Demands: As consumer expectations for advanced EV features, enhanced performance metrics, and improved user experience continue to rise, there is a corresponding demand for more sophisticated and comprehensive testing capabilities to validate these attributes. This creates opportunities for specialized testing solutions focused on areas like battery longevity, charging speed optimization, and integrated vehicle systems.

Leading Players in the Electric Vehicle Test Equipment Sector

- Intertek Group Plc

- Horiba Ltd

- Maccor Inc

- National Instruments Corporation

- Durr Group

- Tuv Rheinland

- Arbin Instruments

- Toyo System Co Ltd

- Wonik Pne Co Ltd

- Keysight Technologies Inc

- Froude Inc

- Dynomerk Controls

Key Milestones in Electric Vehicle Test Equipment Industry

- July 2022: TÜV SÜD Thailand opened a new Battery and Automotive Components Testing Centre, expanding its global testing capacity. This significantly strengthens the testing infrastructure within Asia and supports the increasing demand for EV testing.

- July 2022: National Instruments Japan Corporation established a new Co-engineering Lab for collaborative research with automakers on advanced technologies, including electrification. This highlights the importance of collaboration in driving technological innovation within the EV sector.

- April 2022: Tevva's partnership with HORIBA MIRA at MIRA Technologies Park provides access to advanced testing capabilities, further demonstrating the industry’s focus on cutting-edge testing solutions to improve vehicle performance and safety.

Strategic Outlook for Electric Vehicle Test Equipment Market

The future of the EV test equipment market is bright, with significant growth potential driven by the continued expansion of the electric vehicle industry. Strategic opportunities for manufacturers include investing in R&D to develop next-generation testing technologies, forging strategic partnerships with EV manufacturers, and expanding into new geographical markets. Focusing on automation, AI-driven testing solutions, and improved testing efficiency will enable companies to better address the evolving needs of the rapidly growing EV sector.

Electric Vehicle Test Equipment Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

-

2. Propulsion Type

- 2.1. Battery Electric Vehicles (BEVs)

- 2.2. Plug-In Hybrid Electric Vehicles (PHEVs)

- 2.3. Hybrid Electric Vehicles (HEVs)

- 2.4. Fuel Cell Electric Vehicles (FCEVs)

-

3. Equipment Type

- 3.1. Electric Vehicle (EV) Battery Test Systems

- 3.2. Powertrain Testing

- 3.3. Electric Vehicle (EV) Component

- 3.4. Electric Vehicle (EV) Charging

- 3.5. Others (EV Drivetrain Test)

Electric Vehicle Test Equipment Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Electric Vehicle Test Equipment Market Regional Market Share

Geographic Coverage of Electric Vehicle Test Equipment Market

Electric Vehicle Test Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 31.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Vehicle Sales to Fuel Market Growth

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increased Electric Vehicle Adoption Globally

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electric Vehicle Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.2.1. Battery Electric Vehicles (BEVs)

- 5.2.2. Plug-In Hybrid Electric Vehicles (PHEVs)

- 5.2.3. Hybrid Electric Vehicles (HEVs)

- 5.2.4. Fuel Cell Electric Vehicles (FCEVs)

- 5.3. Market Analysis, Insights and Forecast - by Equipment Type

- 5.3.1. Electric Vehicle (EV) Battery Test Systems

- 5.3.2. Powertrain Testing

- 5.3.3. Electric Vehicle (EV) Component

- 5.3.4. Electric Vehicle (EV) Charging

- 5.3.5. Others (EV Drivetrain Test)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Electric Vehicle Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Passenger Cars

- 6.1.2. Commercial Vehicles

- 6.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 6.2.1. Battery Electric Vehicles (BEVs)

- 6.2.2. Plug-In Hybrid Electric Vehicles (PHEVs)

- 6.2.3. Hybrid Electric Vehicles (HEVs)

- 6.2.4. Fuel Cell Electric Vehicles (FCEVs)

- 6.3. Market Analysis, Insights and Forecast - by Equipment Type

- 6.3.1. Electric Vehicle (EV) Battery Test Systems

- 6.3.2. Powertrain Testing

- 6.3.3. Electric Vehicle (EV) Component

- 6.3.4. Electric Vehicle (EV) Charging

- 6.3.5. Others (EV Drivetrain Test)

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Electric Vehicle Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Passenger Cars

- 7.1.2. Commercial Vehicles

- 7.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 7.2.1. Battery Electric Vehicles (BEVs)

- 7.2.2. Plug-In Hybrid Electric Vehicles (PHEVs)

- 7.2.3. Hybrid Electric Vehicles (HEVs)

- 7.2.4. Fuel Cell Electric Vehicles (FCEVs)

- 7.3. Market Analysis, Insights and Forecast - by Equipment Type

- 7.3.1. Electric Vehicle (EV) Battery Test Systems

- 7.3.2. Powertrain Testing

- 7.3.3. Electric Vehicle (EV) Component

- 7.3.4. Electric Vehicle (EV) Charging

- 7.3.5. Others (EV Drivetrain Test)

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Electric Vehicle Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Passenger Cars

- 8.1.2. Commercial Vehicles

- 8.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 8.2.1. Battery Electric Vehicles (BEVs)

- 8.2.2. Plug-In Hybrid Electric Vehicles (PHEVs)

- 8.2.3. Hybrid Electric Vehicles (HEVs)

- 8.2.4. Fuel Cell Electric Vehicles (FCEVs)

- 8.3. Market Analysis, Insights and Forecast - by Equipment Type

- 8.3.1. Electric Vehicle (EV) Battery Test Systems

- 8.3.2. Powertrain Testing

- 8.3.3. Electric Vehicle (EV) Component

- 8.3.4. Electric Vehicle (EV) Charging

- 8.3.5. Others (EV Drivetrain Test)

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Rest of the World Electric Vehicle Test Equipment Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Passenger Cars

- 9.1.2. Commercial Vehicles

- 9.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 9.2.1. Battery Electric Vehicles (BEVs)

- 9.2.2. Plug-In Hybrid Electric Vehicles (PHEVs)

- 9.2.3. Hybrid Electric Vehicles (HEVs)

- 9.2.4. Fuel Cell Electric Vehicles (FCEVs)

- 9.3. Market Analysis, Insights and Forecast - by Equipment Type

- 9.3.1. Electric Vehicle (EV) Battery Test Systems

- 9.3.2. Powertrain Testing

- 9.3.3. Electric Vehicle (EV) Component

- 9.3.4. Electric Vehicle (EV) Charging

- 9.3.5. Others (EV Drivetrain Test)

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Intertek Group Plc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Horiba Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Maccor Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 National Instruments Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Durr Group

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Tuv Rheinland

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Arbin Instruments

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Toyo System Co Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Wonik Pne Co Ltd*List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Keysight Technologies Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Froude Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Dynomerk Controls

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 Intertek Group Plc

List of Figures

- Figure 1: Global Electric Vehicle Test Equipment Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Electric Vehicle Test Equipment Market Revenue (million), by Vehicle Type 2025 & 2033

- Figure 3: North America Electric Vehicle Test Equipment Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Electric Vehicle Test Equipment Market Revenue (million), by Propulsion Type 2025 & 2033

- Figure 5: North America Electric Vehicle Test Equipment Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 6: North America Electric Vehicle Test Equipment Market Revenue (million), by Equipment Type 2025 & 2033

- Figure 7: North America Electric Vehicle Test Equipment Market Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 8: North America Electric Vehicle Test Equipment Market Revenue (million), by Country 2025 & 2033

- Figure 9: North America Electric Vehicle Test Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Electric Vehicle Test Equipment Market Revenue (million), by Vehicle Type 2025 & 2033

- Figure 11: Europe Electric Vehicle Test Equipment Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 12: Europe Electric Vehicle Test Equipment Market Revenue (million), by Propulsion Type 2025 & 2033

- Figure 13: Europe Electric Vehicle Test Equipment Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 14: Europe Electric Vehicle Test Equipment Market Revenue (million), by Equipment Type 2025 & 2033

- Figure 15: Europe Electric Vehicle Test Equipment Market Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 16: Europe Electric Vehicle Test Equipment Market Revenue (million), by Country 2025 & 2033

- Figure 17: Europe Electric Vehicle Test Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Electric Vehicle Test Equipment Market Revenue (million), by Vehicle Type 2025 & 2033

- Figure 19: Asia Pacific Electric Vehicle Test Equipment Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 20: Asia Pacific Electric Vehicle Test Equipment Market Revenue (million), by Propulsion Type 2025 & 2033

- Figure 21: Asia Pacific Electric Vehicle Test Equipment Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 22: Asia Pacific Electric Vehicle Test Equipment Market Revenue (million), by Equipment Type 2025 & 2033

- Figure 23: Asia Pacific Electric Vehicle Test Equipment Market Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 24: Asia Pacific Electric Vehicle Test Equipment Market Revenue (million), by Country 2025 & 2033

- Figure 25: Asia Pacific Electric Vehicle Test Equipment Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Electric Vehicle Test Equipment Market Revenue (million), by Vehicle Type 2025 & 2033

- Figure 27: Rest of the World Electric Vehicle Test Equipment Market Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 28: Rest of the World Electric Vehicle Test Equipment Market Revenue (million), by Propulsion Type 2025 & 2033

- Figure 29: Rest of the World Electric Vehicle Test Equipment Market Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 30: Rest of the World Electric Vehicle Test Equipment Market Revenue (million), by Equipment Type 2025 & 2033

- Figure 31: Rest of the World Electric Vehicle Test Equipment Market Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 32: Rest of the World Electric Vehicle Test Equipment Market Revenue (million), by Country 2025 & 2033

- Figure 33: Rest of the World Electric Vehicle Test Equipment Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Propulsion Type 2020 & 2033

- Table 3: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Equipment Type 2020 & 2033

- Table 4: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 6: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Propulsion Type 2020 & 2033

- Table 7: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Equipment Type 2020 & 2033

- Table 8: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 13: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Propulsion Type 2020 & 2033

- Table 14: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Equipment Type 2020 & 2033

- Table 15: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Country 2020 & 2033

- Table 16: Germany Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: United Kingdom Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: France Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Italy Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Spain Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 23: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Propulsion Type 2020 & 2033

- Table 24: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Equipment Type 2020 & 2033

- Table 25: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Country 2020 & 2033

- Table 26: China Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: India Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Japan Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: South Korea Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Rest of Asia Pacific Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Vehicle Type 2020 & 2033

- Table 32: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Propulsion Type 2020 & 2033

- Table 33: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Equipment Type 2020 & 2033

- Table 34: Global Electric Vehicle Test Equipment Market Revenue million Forecast, by Country 2020 & 2033

- Table 35: South America Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Middle East and Africa Electric Vehicle Test Equipment Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electric Vehicle Test Equipment Market?

The projected CAGR is approximately 31.42%.

2. Which companies are prominent players in the Electric Vehicle Test Equipment Market?

Key companies in the market include Intertek Group Plc, Horiba Ltd, Maccor Inc, National Instruments Corporation, Durr Group, Tuv Rheinland, Arbin Instruments, Toyo System Co Ltd, Wonik Pne Co Ltd*List Not Exhaustive, Keysight Technologies Inc, Froude Inc, Dynomerk Controls.

3. What are the main segments of the Electric Vehicle Test Equipment Market?

The market segments include Vehicle Type, Propulsion Type, Equipment Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 211.72 million as of 2022.

5. What are some drivers contributing to market growth?

Increased Vehicle Sales to Fuel Market Growth.

6. What are the notable trends driving market growth?

Increased Electric Vehicle Adoption Globally.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

July 2022: At the Amata City Chonburi Industrial Estate, TÜV SÜD Thailand officially opened its Battery and Automotive Components Testing Centre. This facility will add to TÜV SÜD's existing network of eight battery testing labs located in North America, Germany, and Asia. This integrated facility, which covers over 3,000 square meters, makes it simple to access global and local expertise to meet the quality and safety requirements necessary for e-Mobility to be adopted more quickly.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electric Vehicle Test Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electric Vehicle Test Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electric Vehicle Test Equipment Market?

To stay informed about further developments, trends, and reports in the Electric Vehicle Test Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence