Key Insights

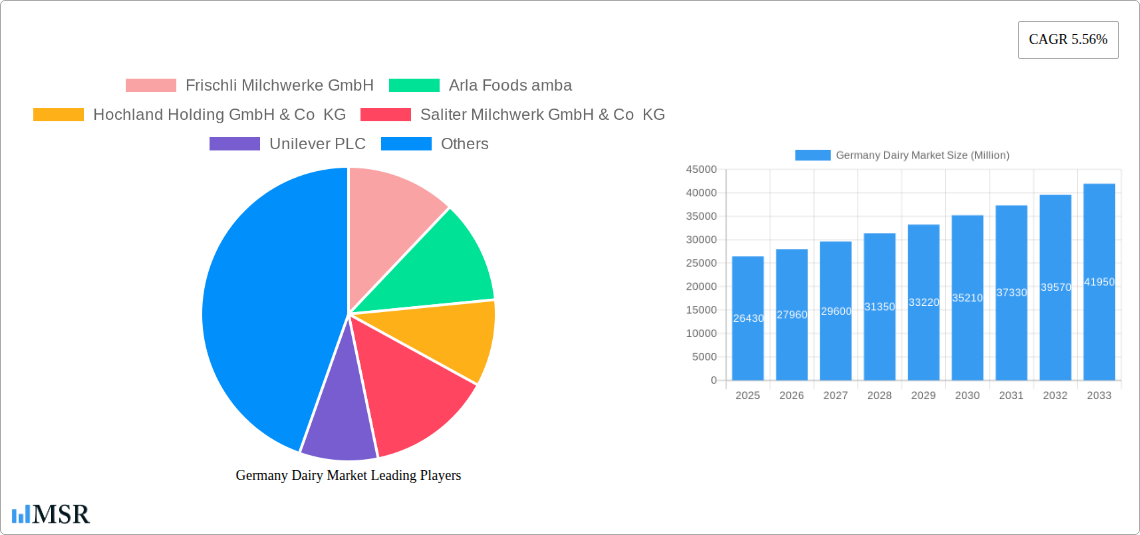

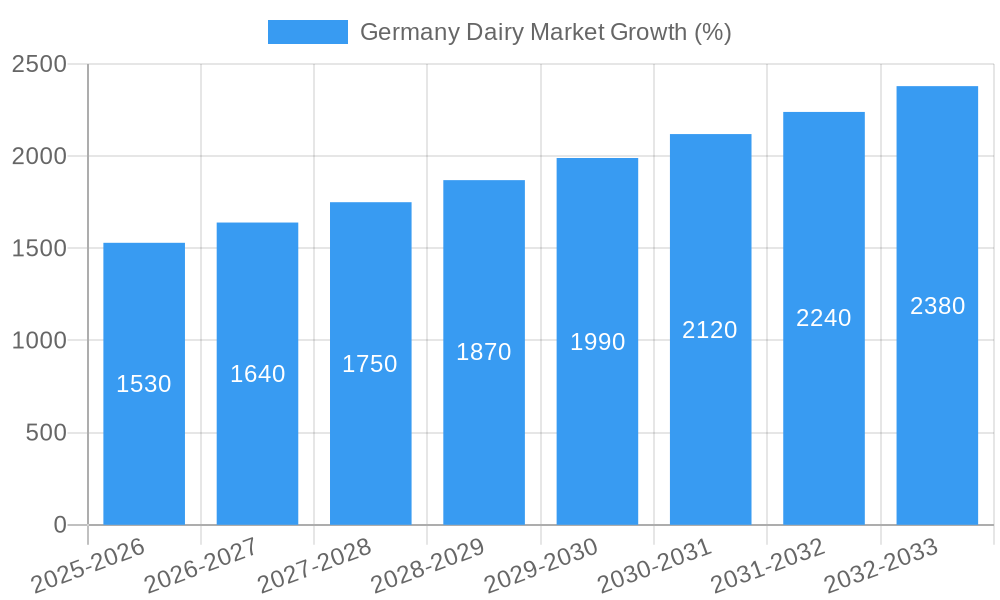

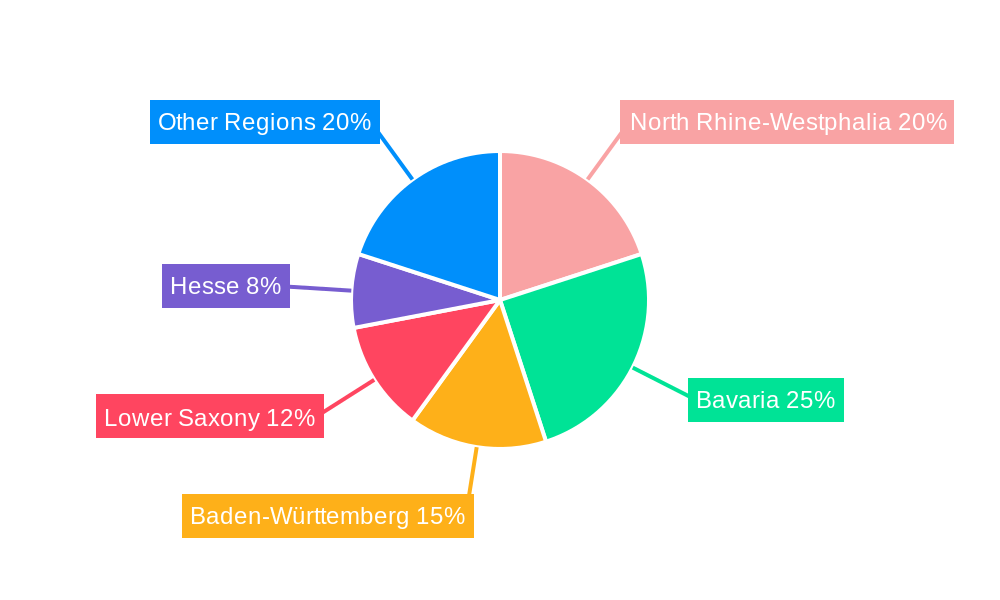

The German dairy market, valued at €26,430 million in 2025, is projected to experience robust growth, driven by increasing consumer demand for dairy products and a rising health-conscious population seeking nutritious options. The market's Compound Annual Growth Rate (CAGR) of 5.56% from 2025 to 2033 indicates significant expansion opportunities. Key drivers include the growing popularity of functional dairy products, such as yogurt with added probiotics, and the increasing consumption of cheese and butter across diverse demographics. Trends like the rise of organic and sustainably sourced dairy, alongside premiumization with innovative product formats, further fuel market growth. While potential restraints could include fluctuating milk prices and increased competition from plant-based alternatives, the market's inherent strength and consumer preference for traditional dairy products are expected to mitigate these challenges. Strong regional demand, particularly in populous states like North Rhine-Westphalia, Bavaria, and Baden-Württemberg, contribute significantly to overall market value. The segmentation reveals a balanced distribution between on-trade (restaurants, cafes) and off-trade (supermarkets, retail) channels, with notable contributions from various product categories including butter, highlighting market diversity. Leading players, including Frischli, Arla Foods, and Hochland, are well-positioned to capitalize on this growth through strategic product innovation, distribution expansion, and targeted marketing campaigns.

The forecast period (2025-2033) presents substantial potential for market expansion, with specific opportunities arising from further penetration in niche markets such as lactose-free and specialized dairy products catering to specific dietary needs. Growth will likely be influenced by government policies promoting sustainable agricultural practices and consumer awareness campaigns focused on the nutritional benefits of dairy consumption. The competitive landscape, characterized by both established giants and smaller regional players, suggests a dynamic market with continuous innovation and strategic maneuvering for market share. Successful strategies will revolve around understanding evolving consumer preferences, adapting to market trends, and effectively managing supply chain challenges. The German dairy market presents a strong investment opportunity, offering long-term growth prospects for both established and emerging players.

Germany Dairy Market: A Comprehensive Report (2019-2033)

This insightful report provides a detailed analysis of the Germany dairy market, covering market dynamics, key players, emerging trends, and future growth prospects. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is crucial for industry stakeholders, investors, and anyone seeking a comprehensive understanding of this dynamic market.

Germany Dairy Market Market Concentration & Dynamics

The German dairy market exhibits a moderately concentrated structure, with several large players holding significant market share. The top five companies – Arla Foods amba, Unilever PLC, Danone SA, DMK Deutsches Milchkontor GmbH, and Groupe Lactalis – collectively account for an estimated xx% of the total market. However, a considerable number of smaller regional players and private labels also contribute significantly to the market's overall volume.

- Market Share: Top 5 players: xx%, Top 10 players: xx%, Others: xx%.

- M&A Activity: The market has witnessed several notable mergers and acquisitions in recent years, indicating increased consolidation. The number of M&A deals in the period 2019-2024 totaled xx.

- Innovation Ecosystem: Innovation is primarily driven by product diversification (e.g., organic, functional dairy products), sustainable packaging solutions, and process optimization within existing facilities.

- Regulatory Framework: Strict regulations regarding food safety, labeling, and environmental sustainability significantly influence market operations.

- Substitute Products: Plant-based alternatives (e.g., almond, soy milk) pose a growing competitive threat, particularly within certain consumer segments.

- End-User Trends: Growing consumer awareness of health and wellness is driving demand for low-fat, organic, and functional dairy products. Furthermore, increasing preference for convenience and ready-to-consume products continues to reshape the market.

Germany Dairy Market Industry Insights & Trends

The German dairy market is characterized by steady growth, driven by a combination of factors. The market size in 2024 was estimated at €xx Billion, exhibiting a CAGR of xx% during the historical period (2019-2024). This growth is expected to continue during the forecast period (2025-2033), albeit at a slightly moderated pace, with a projected CAGR of xx%. Key growth drivers include rising disposable incomes, increasing urbanization, and shifting consumer preferences towards premium and specialized dairy products. Technological advancements, particularly in production efficiency and packaging, further contribute to market expansion. However, fluctuating milk prices and growing competition from plant-based alternatives present significant challenges. Consumer behavior is evolving towards greater focus on sustainability, ethical sourcing, and health benefits associated with dairy consumption.

Key Markets & Segments Leading Germany Dairy Market

The German dairy market is geographically diverse, with no single region exhibiting overwhelming dominance. However, urban areas and high-population density regions show higher per capita consumption.

Dominant Segment Analysis:

- Others (Warehouse clubs, gas stations, etc.): On-Trade: This segment is experiencing moderate growth, driven by the increasing popularity of foodservice outlets and convenience stores.

- Category: Butter: Butter remains a staple in German households, exhibiting relatively stable demand.

- Distribution Channel: Off-Trade: This segment represents the largest share of the market, driven by extensive supermarket and retail networks.

Drivers:

- Economic Growth: Strong economic growth fuels higher disposable incomes, increasing spending on dairy products.

- Infrastructure: A robust and well-developed distribution network facilitates efficient product delivery across the country.

Germany Dairy Market Product Developments

Recent product innovations focus on value-added offerings such as organic dairy, functional dairy products with added health benefits (e.g., probiotics), and convenient formats (e.g., single-serve yogurt cups, ready-to-drink milk). Technological advancements in processing and packaging enhance shelf life and product quality. These innovations cater to evolving consumer preferences and allow companies to differentiate themselves in a competitive market.

Challenges in the Germany Dairy Market Market

The German dairy market faces several challenges, including volatile milk prices, increasing competition from plant-based alternatives, and stringent regulatory requirements concerning food safety and labeling. Supply chain disruptions, exacerbated by geopolitical events, also pose a significant risk to market stability. These challenges can impact profitability and necessitate strategic adjustments within the industry.

Forces Driving Germany Dairy Market Growth

Key growth drivers include increasing health consciousness (demand for organic and functional dairy), technological advancements improving production efficiency and extending shelf life, and strong retail infrastructure facilitating wide product distribution. Government support for the domestic dairy industry and favorable consumer spending patterns also contribute positively to market expansion.

Challenges in the Germany Dairy Market Market

Long-term growth hinges on adapting to consumer preferences for sustainable and ethical sourcing practices, incorporating innovative packaging technologies, and expanding into emerging markets for premium dairy products. Strategic collaborations and partnerships across the value chain will be crucial for sustained growth.

Emerging Opportunities in Germany Dairy Market

Emerging opportunities lie in specialized dairy products (e.g., lactose-free, high-protein), sustainable and eco-friendly packaging solutions, and expanding into online sales channels. Catering to health-conscious consumers with innovative functional dairy products and promoting transparency regarding sourcing and production practices present further growth avenues.

Leading Players in the Germany Dairy Market Sector

- Frischli Milchwerke GmbH

- Arla Foods amba

- Hochland Holding GmbH & Co KG

- Saliter Milchwerk GmbH & Co KG

- Unilever PLC

- Danone SA

- Zott SE & Co K

- Muller Group

- Bayernland eG

- Kruger Group

- DMK Deutsches Milchkontor GmbH

- Groupe Lactalis

Key Milestones in Germany Dairy Market Industry

- March 2022: Lactalis Group's acquisition of Bayerische Milchindustrie eG's Fresh division significantly strengthens Lactalis' position and expands its regional product portfolio.

- February 2022: Hochland Holding GmbH & Co. KG's substantial investments in its dairy plants demonstrate a commitment to enhancing production capacity and efficiency.

- March 2021: Siggi's launch of its reduced-sugar yogurt line highlights the growing consumer demand for healthier dairy options.

Strategic Outlook for Germany Dairy Market Market

The German dairy market presents significant growth potential, driven by consumer demand for premium and specialized dairy products and a strong emphasis on sustainability. Companies that successfully adapt to changing consumer preferences, invest in innovation, and embrace sustainable practices are poised to benefit significantly from this market's continued expansion. Focus on value-added products, efficient supply chains, and strong brand building will be key strategic factors for success in the coming years.

Germany Dairy Market Segmentation

-

1. Category

-

1.1. Butter

-

1.1.1. By Product Type

- 1.1.1.1. Cultured Butter

- 1.1.1.2. Uncultured Butter

-

1.1.1. By Product Type

-

1.2. Cheese

- 1.2.1. Natural Cheese

- 1.2.2. Processed Cheese

-

1.3. Cream

- 1.3.1. Double Cream

- 1.3.2. Single Cream

- 1.3.3. Whipping Cream

- 1.3.4. Others

-

1.4. Dairy Desserts

- 1.4.1. Cheesecakes

- 1.4.2. Frozen Desserts

- 1.4.3. Ice Cream

- 1.4.4. Mousses

-

1.5. Milk

- 1.5.1. Condensed milk

- 1.5.2. Flavored Milk

- 1.5.3. Fresh Milk

- 1.5.4. Powdered Milk

- 1.5.5. UHT Milk

- 1.6. Sour Milk Drinks

-

1.7. Yogurt

- 1.7.1. Flavored Yogurt

- 1.7.2. Unflavored Yogurt

-

1.1. Butter

-

2. Distribution Channel

-

2.1. Off-Trade

- 2.1.1. Convenience Stores

- 2.1.2. Online Retail

- 2.1.3. Specialist Retailers

- 2.1.4. Supermarkets and Hypermarkets

- 2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 2.2. On-Trade

-

2.1. Off-Trade

Germany Dairy Market Segmentation By Geography

- 1. Germany

Germany Dairy Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.56% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Surge in Participation of Sports Activities; Functional and Processing Bnefits of Whey Protein

- 3.3. Market Restrains

- 3.3.1. High Manufacturing Costs and Fluctuations in Raw Material Prices

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Dairy Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Category

- 5.1.1. Butter

- 5.1.1.1. By Product Type

- 5.1.1.1.1. Cultured Butter

- 5.1.1.1.2. Uncultured Butter

- 5.1.1.1. By Product Type

- 5.1.2. Cheese

- 5.1.2.1. Natural Cheese

- 5.1.2.2. Processed Cheese

- 5.1.3. Cream

- 5.1.3.1. Double Cream

- 5.1.3.2. Single Cream

- 5.1.3.3. Whipping Cream

- 5.1.3.4. Others

- 5.1.4. Dairy Desserts

- 5.1.4.1. Cheesecakes

- 5.1.4.2. Frozen Desserts

- 5.1.4.3. Ice Cream

- 5.1.4.4. Mousses

- 5.1.5. Milk

- 5.1.5.1. Condensed milk

- 5.1.5.2. Flavored Milk

- 5.1.5.3. Fresh Milk

- 5.1.5.4. Powdered Milk

- 5.1.5.5. UHT Milk

- 5.1.6. Sour Milk Drinks

- 5.1.7. Yogurt

- 5.1.7.1. Flavored Yogurt

- 5.1.7.2. Unflavored Yogurt

- 5.1.1. Butter

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Off-Trade

- 5.2.1.1. Convenience Stores

- 5.2.1.2. Online Retail

- 5.2.1.3. Specialist Retailers

- 5.2.1.4. Supermarkets and Hypermarkets

- 5.2.1.5. Others (Warehouse clubs, gas stations, etc.)

- 5.2.2. On-Trade

- 5.2.1. Off-Trade

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Category

- 6. North Rhine-Westphalia Germany Dairy Market Analysis, Insights and Forecast, 2019-2031

- 7. Bavaria Germany Dairy Market Analysis, Insights and Forecast, 2019-2031

- 8. Baden-Württemberg Germany Dairy Market Analysis, Insights and Forecast, 2019-2031

- 9. Lower Saxony Germany Dairy Market Analysis, Insights and Forecast, 2019-2031

- 10. Hesse Germany Dairy Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Frischli Milchwerke GmbH

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Arla Foods amba

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hochland Holding GmbH & Co KG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Saliter Milchwerk GmbH & Co KG

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Unilever PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Danone SA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Zott SE & Co K

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Muller Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bayernland eG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Kruger Group

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 DMK Deutsches Milchkontor GmbH

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Groupe Lactalis

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Frischli Milchwerke GmbH

List of Figures

- Figure 1: Germany Dairy Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Germany Dairy Market Share (%) by Company 2024

List of Tables

- Table 1: Germany Dairy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Germany Dairy Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Germany Dairy Market Revenue Million Forecast, by Category 2019 & 2032

- Table 4: Germany Dairy Market Volume K Tons Forecast, by Category 2019 & 2032

- Table 5: Germany Dairy Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: Germany Dairy Market Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 7: Germany Dairy Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Germany Dairy Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: Germany Dairy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Dairy Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: North Rhine-Westphalia Germany Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: North Rhine-Westphalia Germany Dairy Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: Bavaria Germany Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Bavaria Germany Dairy Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Baden-Württemberg Germany Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Baden-Württemberg Germany Dairy Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: Lower Saxony Germany Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Lower Saxony Germany Dairy Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: Hesse Germany Dairy Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Hesse Germany Dairy Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: Germany Dairy Market Revenue Million Forecast, by Category 2019 & 2032

- Table 22: Germany Dairy Market Volume K Tons Forecast, by Category 2019 & 2032

- Table 23: Germany Dairy Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 24: Germany Dairy Market Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 25: Germany Dairy Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Germany Dairy Market Volume K Tons Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Dairy Market?

The projected CAGR is approximately 5.56%.

2. Which companies are prominent players in the Germany Dairy Market?

Key companies in the market include Frischli Milchwerke GmbH, Arla Foods amba, Hochland Holding GmbH & Co KG, Saliter Milchwerk GmbH & Co KG, Unilever PLC, Danone SA, Zott SE & Co K, Muller Group, Bayernland eG, Kruger Group, DMK Deutsches Milchkontor GmbH, Groupe Lactalis.

3. What are the main segments of the Germany Dairy Market?

The market segments include Category, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 26430 Million as of 2022.

5. What are some drivers contributing to market growth?

Surge in Participation of Sports Activities; Functional and Processing Bnefits of Whey Protein.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High Manufacturing Costs and Fluctuations in Raw Material Prices.

8. Can you provide examples of recent developments in the market?

March 2022: Lactalis Group and Bayerische Milchindustrie eG (BMI) signed a contract for the sale of BMI’s Fresh division with the product groups: Fresh Milk, Yoghurt, and other products. Through this acquisition, Lactalis intends to build a close and long-term partnership with the southern German milk producers to further develop the market for regional products in food retail, national foodservice, and ethnic trade.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 580026430 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Dairy Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Dairy Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Dairy Market?

To stay informed about further developments, trends, and reports in the Germany Dairy Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence