Key Insights

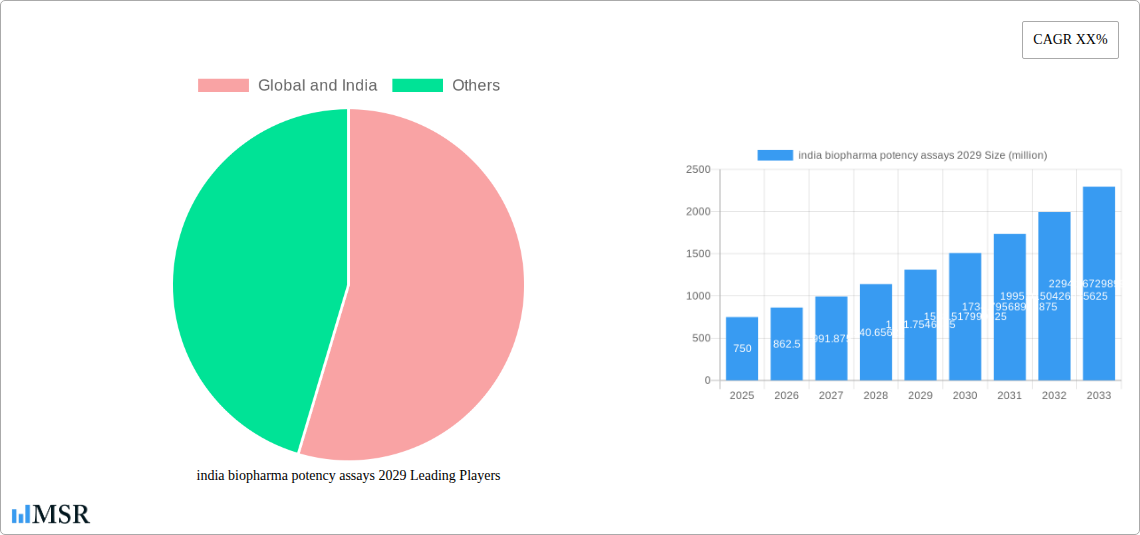

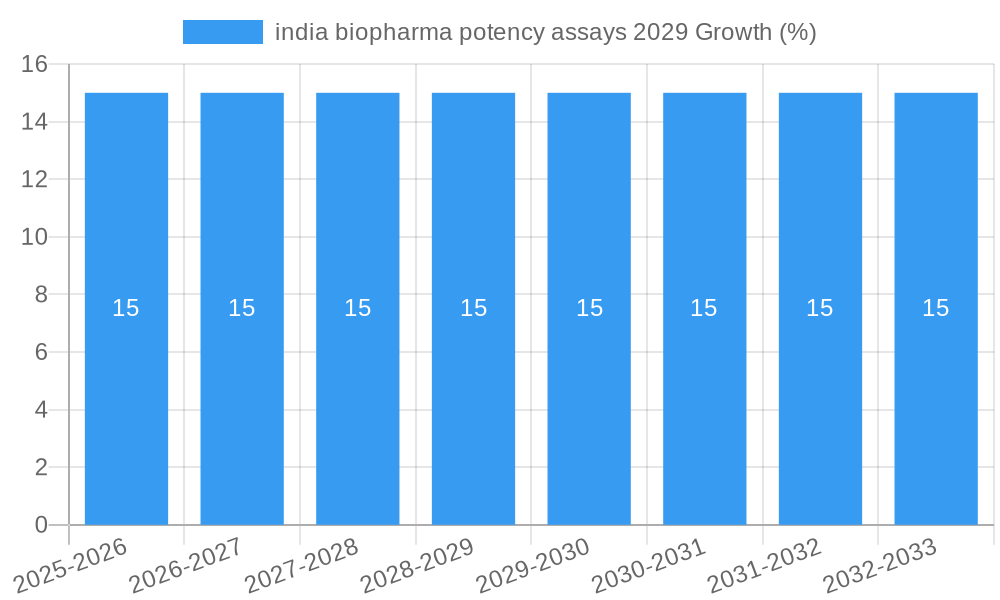

The Indian biopharma potency assays market is projected for robust growth, driven by an expanding biopharmaceutical sector and increasing investments in drug discovery and development. With an estimated market size of approximately USD 750 million in 2025, the market is anticipated to witness a Compound Annual Growth Rate (CAGR) of around 15% from 2025 to 2033, reaching a significant valuation by 2029. This surge is primarily fueled by the rising demand for biosimilars and novel biologics, necessitating rigorous potency testing to ensure product efficacy and safety. Furthermore, the Indian government's supportive policies, including initiatives like "Make in India" and Production Linked Incentive (PLI) schemes for pharmaceuticals and biotechnology, are fostering a conducive environment for domestic biopharmaceutical manufacturing and R&D, thereby amplifying the need for advanced potency assay solutions. The increasing complexity of biologic drug molecules also demands sophisticated and sensitive assay methodologies, pushing manufacturers to adopt cutting-edge technologies.

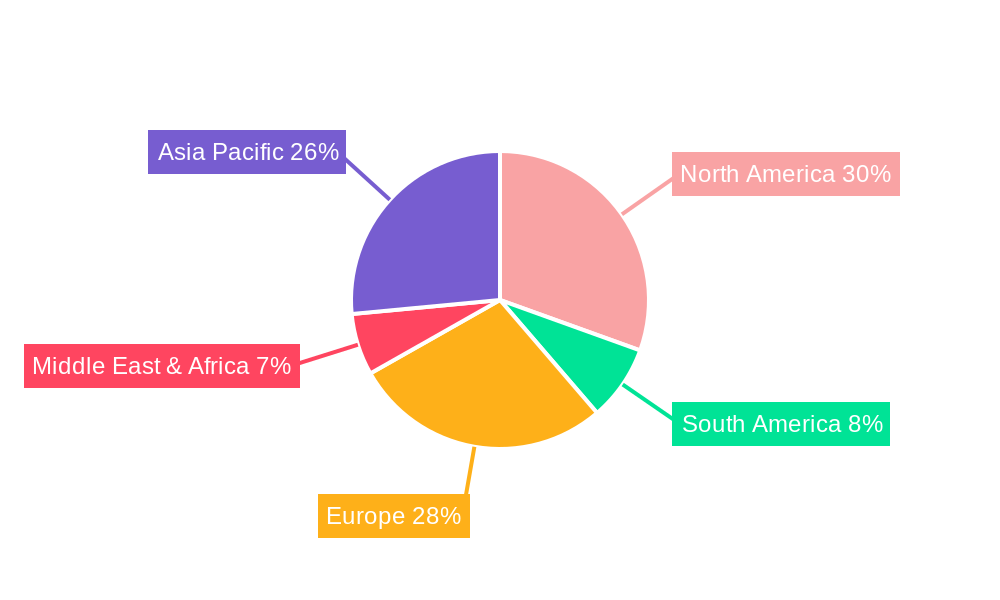

The market is segmented across various applications, including cell-based assays, biochemical assays, and enzyme-linked immunosorbent assays (ELISA), each catering to specific stages of drug development and quality control. Type-wise, the market is characterized by the adoption of both traditional and advanced methods, with a growing preference for automation and high-throughput screening solutions. Key restraints, such as the high cost of sophisticated assay development and the need for skilled personnel, are being addressed through technological advancements and increased training initiatives. Companies are actively investing in research and development to offer a comprehensive portfolio of potency assay kits and services, catering to the diverse needs of pharmaceutical and biotechnology companies in India and globally. The Asia Pacific region, with India as a prominent player, is expected to be a significant contributor to the global market's growth trajectory.

India Biopharma Potency Assays 2029: Unlocking the Future of Pharmaceutical Quality and Efficacy

Report Description:

Dive deep into the dynamic Indian biopharmaceutical potency assays market with this comprehensive report, India Biopharma Potency Assays 2029. Spanning a critical study period from 2019 to 2033, with a base year of 2025, this report offers unparalleled insights into market concentration, industry dynamics, key segments, and future growth trajectories. Analyze pivotal industry developments, understand the technological innovations shaping potency testing, and identify strategic opportunities and challenges for stakeholders. Featuring meticulous analysis of global and Indian companies, segmentation by application and type, and crucial market metrics, this report is an indispensable resource for pharmaceutical manufacturers, assay developers, regulatory bodies, investors, and research institutions aiming to capitalize on the burgeoning Indian biopharma landscape.

india biopharma potency assays 2029 Market Concentration & Dynamics

The Indian biopharma potency assays market is characterized by a moderate level of concentration, with a few prominent global and Indian players holding significant market shares, estimated at approximately 45% collectively. The innovation ecosystem is rapidly evolving, driven by increased investment in research and development and a growing emphasis on quality control and assurance. Regulatory frameworks, guided by bodies like the Central Drugs Standard Control Organisation (CDSCO) and adhering to international standards (e.g., ICH guidelines), are becoming more stringent, demanding robust and validated potency assays for a wide range of biopharmaceuticals. The threat of substitute products is minimal in the context of potency assays, as their specificity and accuracy are paramount for ensuring drug efficacy and patient safety. End-user trends highlight a clear shift towards adopting advanced analytical techniques, including cell-based assays and high-throughput screening methods, to meet the increasing complexity of biologics. Merger and acquisition (M&A) activities, while currently moderate, are anticipated to increase as larger companies seek to expand their portfolios and technological capabilities. An estimated 15 M&A deals were observed in the historical period (2019-2024), with projections indicating at least 25 such transactions by 2033.

india biopharma potency assays 2029 Industry Insights & Trends

The Indian biopharma potency assays market is poised for significant growth, projected to reach a market size of over USD 1,800 million by 2029, exhibiting a robust Compound Annual Growth Rate (CAGR) of approximately 12.5% from the base year 2025. This expansion is fundamentally driven by the escalating demand for biologics, including monoclonal antibodies, vaccines, and recombinant proteins, which necessitate highly specific and sensitive potency assays for quality control. Technological disruptions are at the forefront, with the adoption of advanced techniques such as automated systems, single-molecule detection, and digital pathology revolutionizing the speed, accuracy, and reproducibility of potency testing. The increasing complexity of novel biologics, such as cell and gene therapies, is further fueling the need for innovative and sophisticated assay development. Evolving consumer behaviors, particularly in the form of increased patient awareness regarding drug quality and efficacy, are compelling manufacturers to invest heavily in ensuring the potency and safety of their products. Furthermore, the Indian government's focus on 'Make in India' and strengthening the domestic pharmaceutical manufacturing sector, coupled with increased outsourcing of biopharmaceutical research and manufacturing by global companies to India, are significant catalysts for market expansion. The report forecasts continued integration of Artificial Intelligence (AI) and Machine Learning (ML) in assay development and data analysis, leading to predictive modeling for potency and improved lot-to-lot consistency. The growing prevalence of chronic diseases and the aging global population are also contributing to the rising demand for biologics, subsequently driving the need for a comprehensive range of potency assays.

Key Markets & Segments Leading india biopharma potency assays 2029

The monoclonal antibodies (mAbs) segment is projected to be the dominant force in the Indian biopharma potency assays market, accounting for over 35% of the total market share by 2029. This dominance is underpinned by the rapidly growing therapeutic applications of mAbs in oncology, autoimmune diseases, and infectious diseases.

- Drivers for mAbs Dominance:

- High Efficacy and Targeted Therapy: mAbs offer precise targeting of disease pathways, leading to improved patient outcomes.

- Expanding Therapeutic Pipeline: A substantial number of mAb candidates are progressing through clinical trials, promising future market growth.

- Increasing R&D Investment: Significant investments by both global and Indian biopharma companies in mAb research and development.

- Favorable Regulatory Support: Increasing regulatory approvals for mAb-based therapies in India.

In terms of Application, the Quality Control (QC) segment is expected to lead, driven by the critical need for lot release testing, stability testing, and raw material testing to ensure product safety and efficacy. The Research & Development (R&D) application segment also presents substantial growth opportunities, fueled by the continuous innovation in biologics.

- Dominance of Quality Control:

- Regulatory Mandates: Stringent regulatory requirements necessitate comprehensive QC testing at every stage of biopharmaceutical production.

- Product Safety and Efficacy: Potency assays are indispensable for confirming that each batch of a biopharmaceutical product consistently delivers the intended therapeutic effect.

- Brand Reputation and Trust: Ensuring product quality through rigorous QC builds trust among healthcare professionals and patients.

- Cost-Effectiveness: Proactive QC testing helps prevent costly product recalls and adverse events.

Geographically, the Western region of India, particularly states like Maharashtra and Gujarat, is anticipated to remain the largest market for biopharma potency assays, driven by the concentration of pharmaceutical manufacturing hubs, research institutions, and a robust healthcare infrastructure.

- Drivers for Western India's Dominance:

- Established Pharmaceutical Ecosystem: Presence of numerous multinational and domestic biopharmaceutical companies with advanced manufacturing facilities.

- Skilled Workforce Availability: Access to a highly skilled pool of scientists and technicians specialized in biopharmaceutical development and quality control.

- Government Incentives and Support: Favorable policies and incentives from state governments to promote the biopharmaceutical industry.

- Proximity to Key Markets and Infrastructure: Excellent connectivity and logistical support for raw material sourcing and product distribution.

india biopharma potency assays 2029 Product Developments

Product development in the Indian biopharma potency assays market is characterized by a surge in innovation focused on enhancing specificity, sensitivity, and speed. Companies are investing in the development of advanced cell-based assays that more accurately mimic in vivo biological responses. Furthermore, there's a growing emphasis on high-throughput screening assays and automated platforms to accelerate drug discovery and development pipelines, thereby reducing time-to-market. The integration of biosensors and microfluidic technologies is also gaining traction, promising more miniaturized, cost-effective, and rapid testing solutions.

Challenges in the india biopharma potency assays 2029 Market

The Indian biopharma potency assays market faces several significant challenges. High development costs associated with novel and complex assays can be a considerable barrier. The evolving and sometimes inconsistent regulatory landscape across different regions within India can lead to compliance complexities. Furthermore, a shortage of highly skilled personnel trained in advanced bioanalytical techniques poses a constraint on market growth. Supply chain disruptions for specialized reagents and equipment can also impact the timely availability of critical testing components, estimated to cause delays of up to 15% in assay development timelines in some instances. Intense competition from established global players also presents a challenge for domestic manufacturers.

Forces Driving india biopharma potency assays 2029 Growth

Several key forces are propelling the growth of the Indian biopharma potency assays market. The increasing prevalence of chronic diseases, such as cancer, diabetes, and autoimmune disorders, is driving the demand for biologics, which in turn fuels the need for robust potency testing. Government initiatives promoting domestic manufacturing and R&D, alongside favorable foreign direct investment policies, are creating a conducive environment for market expansion. Technological advancements, particularly in areas like cell-based assays and automation, are enabling more accurate and efficient potency determination. The growing focus on biosimilars, requiring rigorous comparative potency testing, also contributes significantly to market growth.

Challenges in the india biopharma potency assays 2029 Market

The long-term growth catalysts for the Indian biopharma potency assays market lie in continuous innovation and strategic market expansion. The development of standardized and harmonized assay protocols across different regulatory bodies will streamline market access and reduce compliance burdens. Further investment in automation and AI-driven analytics will enhance efficiency and reduce assay turnaround times. The increasing demand for personalized medicine and rare disease treatments will necessitate the development of highly specialized and sensitive potency assays. Partnerships between academic institutions, research organizations, and biopharmaceutical companies will foster collaborative innovation, leading to groundbreaking advancements in assay technology.

Emerging Opportunities in india biopharma potency assays 2029

Emerging opportunities in the Indian biopharma potency assays market are abundant. The burgeoning market for cell and gene therapies presents a significant, yet largely untapped, area for specialized potency assay development. The increasing demand for vaccines, both for infectious diseases and preventative care, will continue to drive the need for advanced potency testing solutions. Furthermore, the growing adoption of continuous manufacturing processes in biopharmaceutical production will create opportunities for real-time, in-process potency monitoring assays. The expansion of the biosimilar market also offers substantial growth potential as more complex biosimilars enter the pipeline, requiring sophisticated comparative potency assessments.

Leading Players in the india biopharma potency assays 2029 Sector

- Thermo Fisher Scientific

- Merck KGaA

- Danaher Corporation

- Charles River Laboratories

- Eurofins Scientific

- Lonza Group

- Bio-Rad Laboratories

- Agilent Technologies

- GenScript

- WuXi AppTec

Key Milestones in india biopharma potency assays 2029 Industry

- 2019: Increased regulatory emphasis on biosimilar characterization and potency, leading to a surge in demand for comparative assays.

- 2020: Accelerated development and validation of potency assays for novel biologics targeting infectious diseases, spurred by the COVID-19 pandemic.

- 2021: Significant investment in automation and high-throughput screening technologies by leading biopharmaceutical companies to expedite R&D timelines.

- 2022: Emergence of novel cell-based assay platforms offering improved physiological relevance and predictive power.

- 2023: Growing adoption of digital tools and AI in assay design, data analysis, and interpretation, enhancing efficiency and accuracy.

- 2024: Increased regulatory guidance on potency assays for advanced therapy medicinal products (ATMPs) like cell and gene therapies.

Strategic Outlook for india biopharma potency assays 2029 Market

The strategic outlook for the Indian biopharma potency assays market is exceptionally positive, driven by a confluence of factors including a rapidly expanding biopharmaceutical manufacturing base, increasing R&D investments, and supportive government policies. Growth accelerators will include the development of novel, highly specific potency assays for complex biologics such as cell and gene therapies and mRNA vaccines. Strategic partnerships between assay developers, biopharmaceutical manufacturers, and contract research organizations (CROs) will be crucial for market penetration and innovation. The adoption of advanced analytical technologies, including AI-powered data analysis and automation, will further enhance efficiency and reduce time-to-market for new drugs. The focus on quality and regulatory compliance will continue to be paramount, creating sustained demand for validated and reliable potency testing solutions, positioning India as a global hub for biopharmaceutical innovation and quality assurance.

india biopharma potency assays 2029 Segmentation

- 1. Application

- 2. Types

india biopharma potency assays 2029 Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

india biopharma potency assays 2029 REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global india biopharma potency assays 2029 Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America india biopharma potency assays 2029 Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America india biopharma potency assays 2029 Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe india biopharma potency assays 2029 Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa india biopharma potency assays 2029 Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific india biopharma potency assays 2029 Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1. Global and India

List of Figures

- Figure 1: Global india biopharma potency assays 2029 Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America india biopharma potency assays 2029 Revenue (million), by Application 2024 & 2032

- Figure 3: North America india biopharma potency assays 2029 Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America india biopharma potency assays 2029 Revenue (million), by Types 2024 & 2032

- Figure 5: North America india biopharma potency assays 2029 Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America india biopharma potency assays 2029 Revenue (million), by Country 2024 & 2032

- Figure 7: North America india biopharma potency assays 2029 Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America india biopharma potency assays 2029 Revenue (million), by Application 2024 & 2032

- Figure 9: South America india biopharma potency assays 2029 Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America india biopharma potency assays 2029 Revenue (million), by Types 2024 & 2032

- Figure 11: South America india biopharma potency assays 2029 Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America india biopharma potency assays 2029 Revenue (million), by Country 2024 & 2032

- Figure 13: South America india biopharma potency assays 2029 Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe india biopharma potency assays 2029 Revenue (million), by Application 2024 & 2032

- Figure 15: Europe india biopharma potency assays 2029 Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe india biopharma potency assays 2029 Revenue (million), by Types 2024 & 2032

- Figure 17: Europe india biopharma potency assays 2029 Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe india biopharma potency assays 2029 Revenue (million), by Country 2024 & 2032

- Figure 19: Europe india biopharma potency assays 2029 Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa india biopharma potency assays 2029 Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa india biopharma potency assays 2029 Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa india biopharma potency assays 2029 Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa india biopharma potency assays 2029 Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa india biopharma potency assays 2029 Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa india biopharma potency assays 2029 Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific india biopharma potency assays 2029 Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific india biopharma potency assays 2029 Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific india biopharma potency assays 2029 Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific india biopharma potency assays 2029 Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific india biopharma potency assays 2029 Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific india biopharma potency assays 2029 Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global india biopharma potency assays 2029 Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global india biopharma potency assays 2029 Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global india biopharma potency assays 2029 Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global india biopharma potency assays 2029 Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global india biopharma potency assays 2029 Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global india biopharma potency assays 2029 Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global india biopharma potency assays 2029 Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States india biopharma potency assays 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada india biopharma potency assays 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico india biopharma potency assays 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global india biopharma potency assays 2029 Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global india biopharma potency assays 2029 Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global india biopharma potency assays 2029 Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil india biopharma potency assays 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina india biopharma potency assays 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America india biopharma potency assays 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global india biopharma potency assays 2029 Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global india biopharma potency assays 2029 Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global india biopharma potency assays 2029 Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom india biopharma potency assays 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany india biopharma potency assays 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France india biopharma potency assays 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy india biopharma potency assays 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain india biopharma potency assays 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia india biopharma potency assays 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux india biopharma potency assays 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics india biopharma potency assays 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe india biopharma potency assays 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global india biopharma potency assays 2029 Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global india biopharma potency assays 2029 Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global india biopharma potency assays 2029 Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey india biopharma potency assays 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel india biopharma potency assays 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC india biopharma potency assays 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa india biopharma potency assays 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa india biopharma potency assays 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa india biopharma potency assays 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global india biopharma potency assays 2029 Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global india biopharma potency assays 2029 Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global india biopharma potency assays 2029 Revenue million Forecast, by Country 2019 & 2032

- Table 41: China india biopharma potency assays 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India india biopharma potency assays 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan india biopharma potency assays 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea india biopharma potency assays 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN india biopharma potency assays 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania india biopharma potency assays 2029 Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific india biopharma potency assays 2029 Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the india biopharma potency assays 2029?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the india biopharma potency assays 2029?

Key companies in the market include Global and India.

3. What are the main segments of the india biopharma potency assays 2029?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4350.00, USD 6525.00, and USD 8700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "india biopharma potency assays 2029," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the india biopharma potency assays 2029 report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the india biopharma potency assays 2029?

To stay informed about further developments, trends, and reports in the india biopharma potency assays 2029, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence