Key Insights

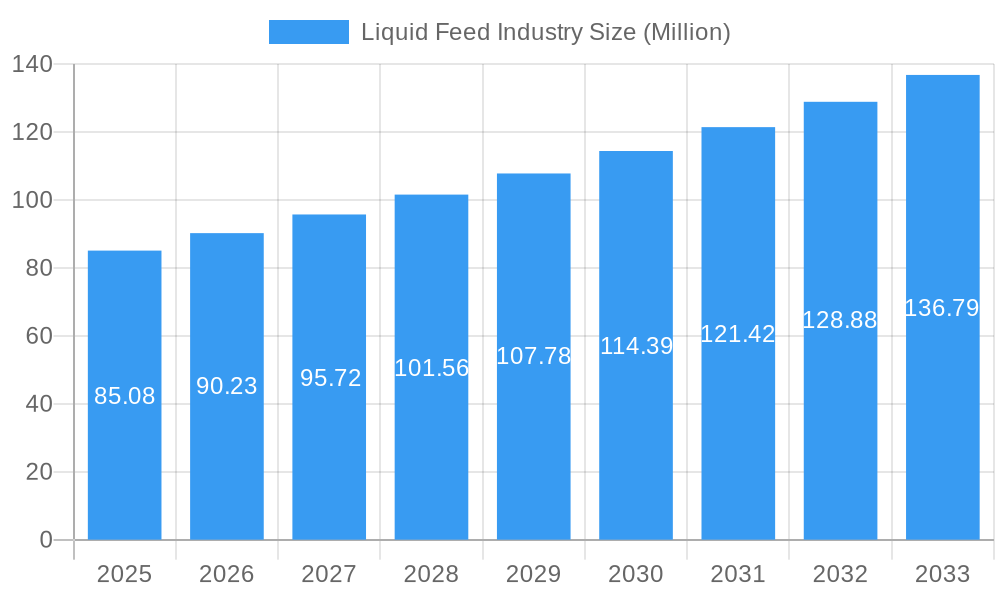

The global liquid feed industry, valued at $85.08 million in 2025, is poised for significant growth, exhibiting a Compound Annual Growth Rate (CAGR) of 6.02% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the increasing demand for efficient and cost-effective animal feed solutions is fueling market growth. Liquid feeds offer superior nutrient absorption compared to traditional dry feeds, leading to improved animal health and productivity. Furthermore, the growing global population and rising meat consumption are creating a surge in demand for animal protein, indirectly boosting the liquid feed market. Technological advancements in feed formulation and delivery systems are also contributing to market expansion, allowing for precise nutrient delivery and reduced feed waste. Finally, the increasing adoption of sustainable farming practices, with a focus on minimizing environmental impact, is further bolstering the demand for nutrient-rich and efficient liquid feed solutions.

Liquid Feed Industry Market Size (In Million)

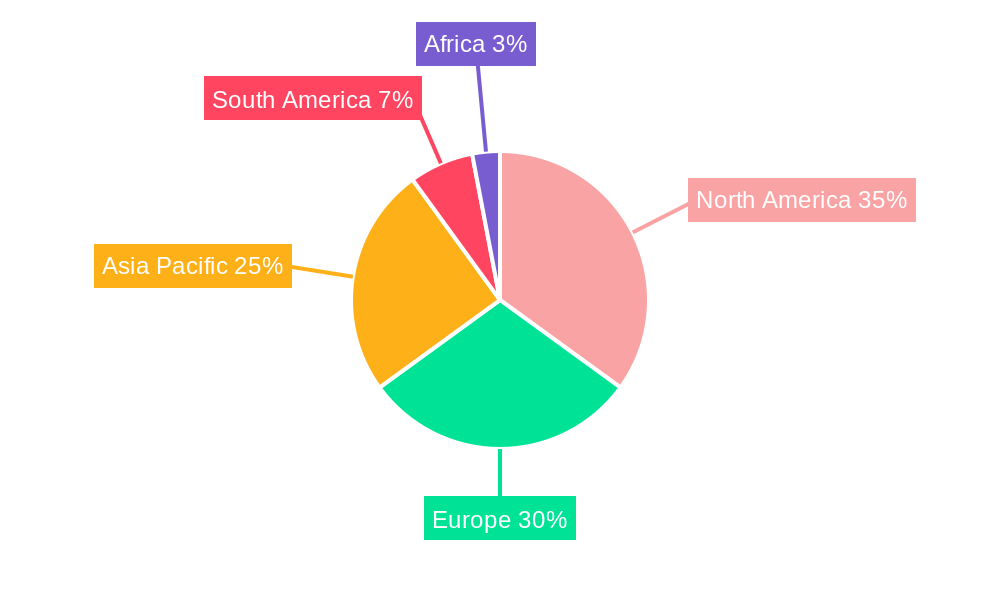

The market segmentation reveals diverse opportunities within the industry. The protein, mineral, and vitamin segments are major contributors, reflecting the crucial role of these nutrients in animal nutrition. Similarly, molasses, corn, and urea stand out as key ingredients, indicating prevalent raw material sourcing trends. The ruminant, poultry, and swine segments dominate the animal type categorization, reflecting the scale of these industries. Geographically, North America and Europe are currently leading markets, though the Asia-Pacific region is anticipated to experience substantial growth driven by expanding livestock farming and rising disposable incomes. Major players like Cargill Incorporated, Archer Daniels Midland Company, and BASF SE are actively shaping the industry landscape through innovation and strategic partnerships. However, challenges remain, such as fluctuating raw material prices and potential regulatory hurdles related to feed safety and environmental sustainability. Addressing these challenges will be crucial for sustained market growth.

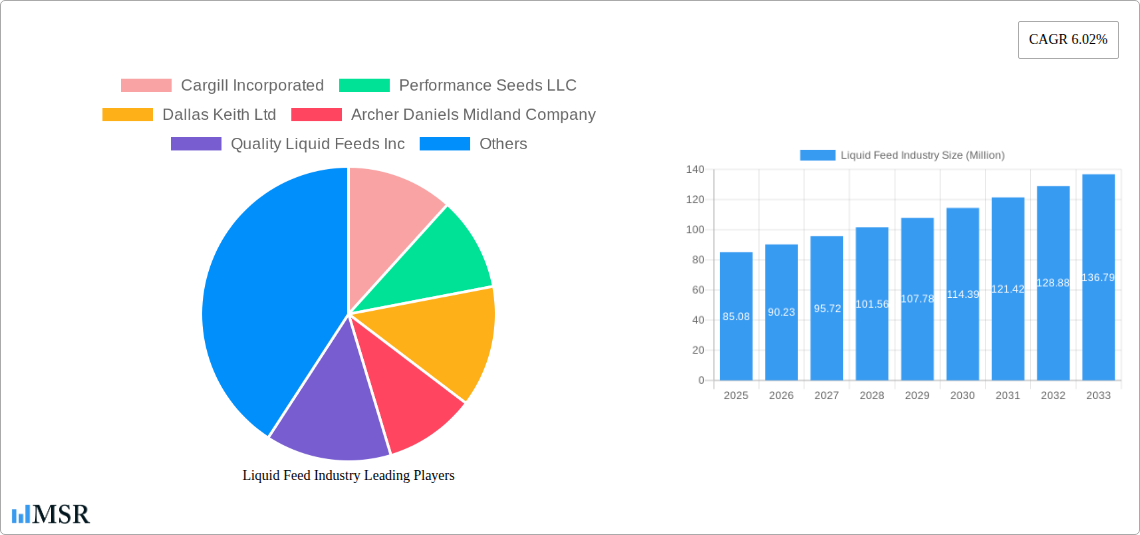

Liquid Feed Industry Company Market Share

Liquid Feed Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the global liquid feed industry, offering invaluable insights for stakeholders, investors, and industry professionals. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delves into market dynamics, key segments, leading players, and future growth opportunities. The global liquid feed market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Liquid Feed Industry Market Concentration & Dynamics

The liquid feed industry exhibits a moderately concentrated market structure, with several large multinational corporations commanding significant market share. Key players like Cargill Incorporated, Archer Daniels Midland Company, and BASF SE, hold substantial positions, influencing pricing and innovation. However, a number of smaller, specialized companies also contribute significantly, particularly within regional markets. Market share fluctuates based on M&A activity and product innovation.

Market Concentration Metrics:

- Top 5 Players Market Share: xx% (2024)

- M&A Deal Count (2019-2024): xx deals

Industry Dynamics:

- Innovation Ecosystems: Significant investment in R&D focuses on improving feed efficiency, nutrient delivery, and sustainability. The development of novel enzymes and additives is driving innovation.

- Regulatory Frameworks: Varying regulations across geographies impact the production and distribution of liquid feed, posing both challenges and opportunities. Compliance costs and changing regulations influence market dynamics.

- Substitute Products: While liquid feed offers advantages in terms of nutrient delivery and homogeneity, competition from dry feed remains a factor. The choice between liquid and dry feed often depends on animal type and farm infrastructure.

- End-User Trends: Increasing demand for high-quality protein sources and growing consumer awareness of animal welfare are key drivers for industry growth. This necessitates a focus on sustainable and efficient production practices.

- M&A Activities: Consolidation through mergers and acquisitions is a noticeable trend, allowing companies to expand their product portfolios and geographical reach. The acquisition of 3F Feed & Food by Eastman Chemical Company illustrates this trend.

Liquid Feed Industry Industry Insights & Trends

The global liquid feed market is experiencing robust growth driven by multiple factors. The rising global population and increasing demand for animal protein are key drivers. Technological advancements in feed formulation and manufacturing processes are enhancing efficiency and sustainability. Furthermore, evolving consumer preferences towards ethically sourced and sustainably produced animal products are influencing market demand. The market size is estimated to be xx Million in 2025.

Market Growth Drivers:

- Growing Global Demand for Animal Protein: Increased per capita meat consumption, especially in developing economies, fuels the demand for efficient animal feed.

- Technological Disruptions: Innovations in feed formulation, such as the use of advanced enzymes and additives, are improving feed efficiency and reducing environmental impact.

- Evolving Consumer Behavior: Growing awareness of animal welfare and sustainability is driving demand for high-quality, responsibly produced feed.

Key Markets & Segments Leading Liquid Feed Industry

The liquid feed market exhibits diverse segmentation across animal type, feed ingredients, and feed type.

Dominant Segments:

- Animal Type: Poultry and swine segments currently dominate, driven by high production volumes and efficient incorporation of liquid feed. Ruminant feed also holds a substantial market share. Aquaculture is a rapidly growing segment.

- Ingredients: Molasses and corn are primary ingredients, however, the utilization of alternative ingredients is growing due to sustainability concerns and price volatility.

- Type: Protein-rich liquid feeds are essential for optimal animal growth, maintaining their leading position. However, other types like mineral and vitamin supplements are gaining importance due to growing focus on animal health.

Regional Dominance: [Insert analysis of regional dominance, specifying leading regions and countries based on market size and growth rate. Include detailed reasons for regional dominance focusing on economic growth, infrastructure, and government policies. For example, regions with strong livestock industries and supportive government policies tend to exhibit higher demand and market share. Approximately 600 words should be dedicated to this section.]

Drivers for Dominant Segments:

- Poultry: High demand for poultry products, efficient feed conversion rates, and suitability of liquid feed systems.

- Swine: Similar to poultry, high demand and efficient liquid feed integration into swine production systems.

- Molasses: Cost-effectiveness, availability, and palatability to animals.

- Corn: Widely available, relatively inexpensive, and a key source of energy in animal feed.

- Proteins: Essential for animal growth and development, hence, high demand.

Liquid Feed Industry Product Developments

Recent innovations include the launch of novel enzyme products, such as BASF SE's Natupulse TS, enhancing feed digestibility and promoting sustainable production. The acquisition of 3F Feed & Food further signifies a shift towards advanced feed additives. These advancements provide improved feed efficiency and enhanced animal health, offering competitive advantages to manufacturers.

Challenges in the Liquid Feed Industry Market

Significant challenges include fluctuating raw material prices, which impact production costs and profitability. Regulatory hurdles, varying across different regions, pose compliance and operational costs. Intense competition and the need for continuous innovation necessitate significant R&D investments. Furthermore, supply chain disruptions can negatively impact production and market access. These factors collectively impact the overall market stability and growth trajectory. Estimated annual losses due to supply chain disruptions: xx Million.

Forces Driving Liquid Feed Industry Growth

Key growth drivers include rising global meat consumption, coupled with technological advancements in feed formulation and delivery systems. Government initiatives supporting sustainable agriculture and animal welfare also contribute positively. Growing consumer awareness of the link between animal feed and product quality further strengthens the demand for high-quality liquid feed.

Challenges in the Liquid Feed Industry Market (Long-Term Growth Catalysts)

Long-term growth hinges on strategic partnerships, technological innovation, and expansion into emerging markets. Focus on developing sustainable and efficient production processes, along with tailored solutions for specific animal types and regions, will remain critical for long-term success. Collaborations between feed producers and technology providers are also crucial for developing innovative solutions.

Emerging Opportunities in Liquid Feed Industry

Emerging opportunities lie in the development of specialized liquid feeds addressing specific nutritional needs of animals and promoting sustainability. Expansion into emerging markets with growing livestock populations presents significant growth potential. Further innovations in precision feeding technologies, allowing for optimized nutrient delivery and reduced waste, offer considerable opportunities.

Leading Players in the Liquid Feed Industry Sector

- Cargill Incorporated

- Performance Seeds LLC

- Dallas Keith Ltd

- Archer Daniels Midland Company

- Quality Liquid Feeds Inc

- Bundaberg Molasses

- BASF SE

- Land O'lakes Inc

- Alliance Liquid Feeds Inc

- Masterfeeds LP

- Midwest Liquid Feeds LLC

- GrainCorp Limited

- Westway Feed Products LLC

- Ridley Corporation

Key Milestones in Liquid Feed Industry Industry

- December 2021: BASF SE launched Natupulse TS, a novel enzyme for animal feed, enhancing digestibility and sustainability.

- April 2021: Eastman Chemical Company acquired 3F Feed & Food, expanding its presence in animal feed additives.

- December 2020: Archer Daniels Midland Company transitioned from dry to liquid lysine production, catering to changing market demand.

Strategic Outlook for Liquid Feed Industry Market

The liquid feed industry is poised for continued growth, driven by increasing global demand for animal protein and ongoing innovations in feed technology. Strategic partnerships, expansion into new markets, and a focus on sustainability will be critical for success. The market's future hinges on the ability of companies to meet the evolving demands of consumers and regulatory bodies.

Liquid Feed Industry Segmentation

-

1. Type

- 1.1. Proteins

- 1.2. Minerals

- 1.3. Vitamins

- 1.4. Other Types

-

2. Ingredients

- 2.1. Molasses

- 2.2. Corn

- 2.3. Urea

- 2.4. Other Ingredients

-

3. Animal Type

- 3.1. Ruminant

- 3.2. Poultry

- 3.3. Swine

- 3.4. Aquaculture

- 3.5. Other Animal Types

Liquid Feed Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Africa

- 5.1. South Africa

- 5.2. Rest of Africa

Liquid Feed Industry Regional Market Share

Geographic Coverage of Liquid Feed Industry

Liquid Feed Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.02% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health

- 3.3. Market Restrains

- 3.3.1. Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth

- 3.4. Market Trends

- 3.4.1. Increase in the Production of Meat and Aquaculture Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Liquid Feed Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Proteins

- 5.1.2. Minerals

- 5.1.3. Vitamins

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Ingredients

- 5.2.1. Molasses

- 5.2.2. Corn

- 5.2.3. Urea

- 5.2.4. Other Ingredients

- 5.3. Market Analysis, Insights and Forecast - by Animal Type

- 5.3.1. Ruminant

- 5.3.2. Poultry

- 5.3.3. Swine

- 5.3.4. Aquaculture

- 5.3.5. Other Animal Types

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Liquid Feed Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Proteins

- 6.1.2. Minerals

- 6.1.3. Vitamins

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Ingredients

- 6.2.1. Molasses

- 6.2.2. Corn

- 6.2.3. Urea

- 6.2.4. Other Ingredients

- 6.3. Market Analysis, Insights and Forecast - by Animal Type

- 6.3.1. Ruminant

- 6.3.2. Poultry

- 6.3.3. Swine

- 6.3.4. Aquaculture

- 6.3.5. Other Animal Types

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Liquid Feed Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Proteins

- 7.1.2. Minerals

- 7.1.3. Vitamins

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Ingredients

- 7.2.1. Molasses

- 7.2.2. Corn

- 7.2.3. Urea

- 7.2.4. Other Ingredients

- 7.3. Market Analysis, Insights and Forecast - by Animal Type

- 7.3.1. Ruminant

- 7.3.2. Poultry

- 7.3.3. Swine

- 7.3.4. Aquaculture

- 7.3.5. Other Animal Types

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Liquid Feed Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Proteins

- 8.1.2. Minerals

- 8.1.3. Vitamins

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Ingredients

- 8.2.1. Molasses

- 8.2.2. Corn

- 8.2.3. Urea

- 8.2.4. Other Ingredients

- 8.3. Market Analysis, Insights and Forecast - by Animal Type

- 8.3.1. Ruminant

- 8.3.2. Poultry

- 8.3.3. Swine

- 8.3.4. Aquaculture

- 8.3.5. Other Animal Types

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Liquid Feed Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Proteins

- 9.1.2. Minerals

- 9.1.3. Vitamins

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Ingredients

- 9.2.1. Molasses

- 9.2.2. Corn

- 9.2.3. Urea

- 9.2.4. Other Ingredients

- 9.3. Market Analysis, Insights and Forecast - by Animal Type

- 9.3.1. Ruminant

- 9.3.2. Poultry

- 9.3.3. Swine

- 9.3.4. Aquaculture

- 9.3.5. Other Animal Types

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Africa Liquid Feed Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Proteins

- 10.1.2. Minerals

- 10.1.3. Vitamins

- 10.1.4. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Ingredients

- 10.2.1. Molasses

- 10.2.2. Corn

- 10.2.3. Urea

- 10.2.4. Other Ingredients

- 10.3. Market Analysis, Insights and Forecast - by Animal Type

- 10.3.1. Ruminant

- 10.3.2. Poultry

- 10.3.3. Swine

- 10.3.4. Aquaculture

- 10.3.5. Other Animal Types

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Cargill Incorporated

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Performance Seeds LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Dallas Keith Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Archer Daniels Midland Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Quality Liquid Feeds Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Bundaberg Molasses

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BASF SE

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Land O'lakes Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Alliance Liquid Feeds Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Masterfeeds LP

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Midwest Liquid Feeds LLC*List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 GrainCorp Limited

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Westway Feed Products LLC

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Ridley Corporation

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Cargill Incorporated

List of Figures

- Figure 1: Global Liquid Feed Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Liquid Feed Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Liquid Feed Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Liquid Feed Industry Revenue (Million), by Ingredients 2025 & 2033

- Figure 5: North America Liquid Feed Industry Revenue Share (%), by Ingredients 2025 & 2033

- Figure 6: North America Liquid Feed Industry Revenue (Million), by Animal Type 2025 & 2033

- Figure 7: North America Liquid Feed Industry Revenue Share (%), by Animal Type 2025 & 2033

- Figure 8: North America Liquid Feed Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Liquid Feed Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Liquid Feed Industry Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe Liquid Feed Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Liquid Feed Industry Revenue (Million), by Ingredients 2025 & 2033

- Figure 13: Europe Liquid Feed Industry Revenue Share (%), by Ingredients 2025 & 2033

- Figure 14: Europe Liquid Feed Industry Revenue (Million), by Animal Type 2025 & 2033

- Figure 15: Europe Liquid Feed Industry Revenue Share (%), by Animal Type 2025 & 2033

- Figure 16: Europe Liquid Feed Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Liquid Feed Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Liquid Feed Industry Revenue (Million), by Type 2025 & 2033

- Figure 19: Asia Pacific Liquid Feed Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Pacific Liquid Feed Industry Revenue (Million), by Ingredients 2025 & 2033

- Figure 21: Asia Pacific Liquid Feed Industry Revenue Share (%), by Ingredients 2025 & 2033

- Figure 22: Asia Pacific Liquid Feed Industry Revenue (Million), by Animal Type 2025 & 2033

- Figure 23: Asia Pacific Liquid Feed Industry Revenue Share (%), by Animal Type 2025 & 2033

- Figure 24: Asia Pacific Liquid Feed Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Liquid Feed Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Liquid Feed Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: South America Liquid Feed Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: South America Liquid Feed Industry Revenue (Million), by Ingredients 2025 & 2033

- Figure 29: South America Liquid Feed Industry Revenue Share (%), by Ingredients 2025 & 2033

- Figure 30: South America Liquid Feed Industry Revenue (Million), by Animal Type 2025 & 2033

- Figure 31: South America Liquid Feed Industry Revenue Share (%), by Animal Type 2025 & 2033

- Figure 32: South America Liquid Feed Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Liquid Feed Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Africa Liquid Feed Industry Revenue (Million), by Type 2025 & 2033

- Figure 35: Africa Liquid Feed Industry Revenue Share (%), by Type 2025 & 2033

- Figure 36: Africa Liquid Feed Industry Revenue (Million), by Ingredients 2025 & 2033

- Figure 37: Africa Liquid Feed Industry Revenue Share (%), by Ingredients 2025 & 2033

- Figure 38: Africa Liquid Feed Industry Revenue (Million), by Animal Type 2025 & 2033

- Figure 39: Africa Liquid Feed Industry Revenue Share (%), by Animal Type 2025 & 2033

- Figure 40: Africa Liquid Feed Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Africa Liquid Feed Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Liquid Feed Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Liquid Feed Industry Revenue Million Forecast, by Ingredients 2020 & 2033

- Table 3: Global Liquid Feed Industry Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 4: Global Liquid Feed Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Liquid Feed Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Liquid Feed Industry Revenue Million Forecast, by Ingredients 2020 & 2033

- Table 7: Global Liquid Feed Industry Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 8: Global Liquid Feed Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Liquid Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Liquid Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Liquid Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of North America Liquid Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Liquid Feed Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Liquid Feed Industry Revenue Million Forecast, by Ingredients 2020 & 2033

- Table 15: Global Liquid Feed Industry Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 16: Global Liquid Feed Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Germany Liquid Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Liquid Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: France Liquid Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Liquid Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Liquid Feed Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global Liquid Feed Industry Revenue Million Forecast, by Ingredients 2020 & 2033

- Table 23: Global Liquid Feed Industry Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 24: Global Liquid Feed Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 25: China Liquid Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Japan Liquid Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: India Liquid Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Australia Liquid Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Asia Pacific Liquid Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Global Liquid Feed Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 31: Global Liquid Feed Industry Revenue Million Forecast, by Ingredients 2020 & 2033

- Table 32: Global Liquid Feed Industry Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 33: Global Liquid Feed Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 34: Brazil Liquid Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Argentina Liquid Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America Liquid Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Liquid Feed Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global Liquid Feed Industry Revenue Million Forecast, by Ingredients 2020 & 2033

- Table 39: Global Liquid Feed Industry Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 40: Global Liquid Feed Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 41: South Africa Liquid Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Rest of Africa Liquid Feed Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Liquid Feed Industry?

The projected CAGR is approximately 6.02%.

2. Which companies are prominent players in the Liquid Feed Industry?

Key companies in the market include Cargill Incorporated, Performance Seeds LLC, Dallas Keith Ltd, Archer Daniels Midland Company, Quality Liquid Feeds Inc, Bundaberg Molasses, BASF SE, Land O'lakes Inc, Alliance Liquid Feeds Inc, Masterfeeds LP, Midwest Liquid Feeds LLC*List Not Exhaustive, GrainCorp Limited, Westway Feed Products LLC, Ridley Corporation.

3. What are the main segments of the Liquid Feed Industry?

The market segments include Type, Ingredients, Animal Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 85.08 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Meat; Initiatives By the Key Players; Focus on Animal nutrition and Health.

6. What are the notable trends driving market growth?

Increase in the Production of Meat and Aquaculture Products.

7. Are there any restraints impacting market growth?

Shift Toward Vegan- Based Diet; Changing Raw Material Prices and Strict Government Rules to Restrict Market Growth.

8. Can you provide examples of recent developments in the market?

December 2021: BASF SE launched the new enzyme product Natupulse TS for animal feed. Natupulse TS is a non-starch polysaccharide (NSP) enzyme. The addition of ß-mannanase to the feed decreases digesta viscosity, increases the digestibility of the feed, and ensures a more sustainable production. Natupulse TS is available in powder and liquid form. Both formulations deliver very good overall stability during storage, in premix, and under challenging conditions in the pelleting process.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Liquid Feed Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Liquid Feed Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Liquid Feed Industry?

To stay informed about further developments, trends, and reports in the Liquid Feed Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence