Key Insights

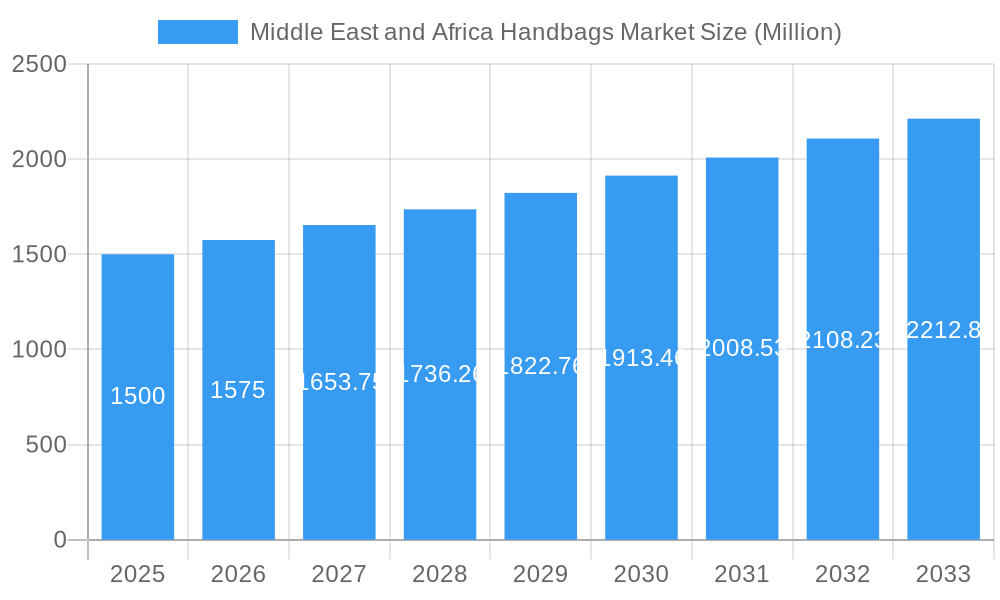

The Middle East and Africa (MEA) handbags market is poised for significant expansion, projected to reach $67.94 billion by 2025. This growth is propelled by rising disposable incomes, a fashion-conscious youth demographic, and the proliferation of e-commerce. The market is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 6.2% from 2025 to 2033. Key drivers include the increasing demand for luxury and designer handbags, amplified by social media and celebrity influence, alongside the convenience of online shopping. While economic volatility and counterfeit products pose challenges, robust growth factors are expected to outweigh these concerns. The market segmentation highlights consumer preferences across various handbag types, with satchels, bucket bags, and totes dominating. The expanding online retail landscape is a pivotal trend, enhancing accessibility to diverse brands and styles across the MEA region. Major luxury brands like Hermès, Gucci, Prada, and LVMH currently hold significant market share, yet emerging brands have opportunities to address niche demands and regional preferences. Geographic variations in consumer preferences and purchasing power will shape market dynamics, with stronger economic regions likely experiencing accelerated growth.

Middle East and Africa Handbags Market Market Size (In Billion)

The forecast period (2025-2033) anticipates sustained market expansion, driven by increasing urbanization, evolving fashion trends, and a growing middle class with enhanced spending power. Luxury brands are expected to maintain their stronghold in the premium segment, while mid-range and budget categories will witness intense competition from both international and local contenders. The escalating adoption of online channels presents substantial growth opportunities region-wide. Brands must strategically adapt to cater to specific regional tastes and the complexities of diverse online marketplaces. Success will hinge on effective digital marketing, streamlined delivery, and product offerings tailored to the unique cultural contexts and preferences prevalent across the Middle East and Africa.

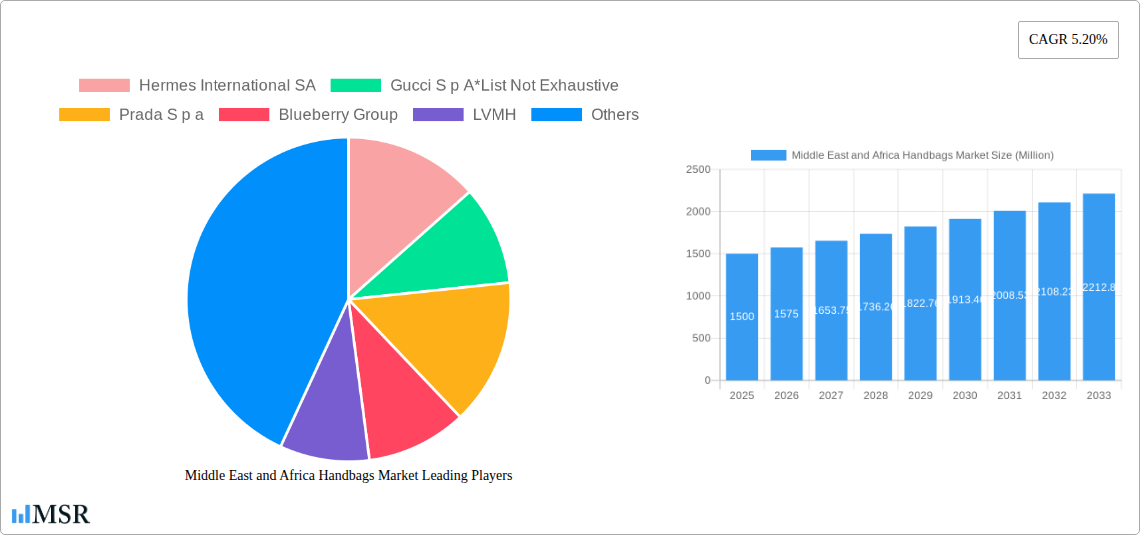

Middle East and Africa Handbags Market Company Market Share

Middle East & Africa Handbags Market: A Comprehensive Report 2019-2033

This comprehensive report offers an in-depth analysis of the Middle East and Africa handbags market, providing crucial insights for industry stakeholders. Spanning the period 2019-2033 (Study Period), with a base year of 2025 and forecast period 2025-2033, this report meticulously examines market dynamics, growth drivers, key players, and emerging trends. The report leverages data from the historical period (2019-2024) to provide robust projections for the future. The market is segmented by type (Satchel, Bucket Bag, Clutch, Tote Bag, Others) and distribution channel (Offline Retail Stores, Online Retail Stores). Key players analyzed include Hermes International SA, Gucci S p A, Prada S p a, Blueberry Group, LVMH, Capri Holdings Limited, Fossil Group, Chanel SA, Kering Group, and Kate Spade & Company (list not exhaustive). Expect detailed analysis of market size, CAGR, market share, and M&A activity, presented with actionable insights to help you navigate this dynamic market. The estimated market size in 2025 is xx Million.

Middle East and Africa Handbags Market Market Concentration & Dynamics

The Middle East and Africa handbags market exhibits a moderately concentrated structure, with a few major players commanding significant market share. However, the presence of numerous smaller players and the rise of e-commerce are fostering increased competition. The market's innovation ecosystem is vibrant, fueled by the demand for unique designs and sustainable practices. Regulatory frameworks, particularly concerning product safety and labeling, influence market dynamics. Substitute products, including locally produced bags and imitation goods, present a challenge. End-user trends, focusing on luxury, personalization, and ethically sourced products, are driving market evolution. M&A activity has been moderate, with xx deals recorded between 2019 and 2024, primarily focusing on expanding market reach and product portfolios. Market share for the top 5 players in 2024 was estimated at approximately xx%.

- Market Concentration: Moderately concentrated, with top players holding xx% market share in 2024.

- Innovation: Strong focus on design innovation, sustainable materials, and technological integration.

- Regulatory Landscape: Varying regulations across countries affecting product labeling and safety.

- Substitute Products: Presence of locally made bags and imitation products impacting market share.

- End-User Trends: Demand for luxury, personalized, and ethically sourced handbags is increasing.

- M&A Activity: xx deals recorded between 2019 and 2024, primarily for market expansion and product diversification.

Middle East and Africa Handbags Market Industry Insights & Trends

The Middle East and Africa handbags market is experiencing robust growth, driven by rising disposable incomes, increasing fashion consciousness, and a growing preference for luxury goods. The market size was valued at xx Million in 2024 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. Technological disruptions, such as the rise of e-commerce and personalized marketing, are reshaping the industry landscape. Evolving consumer behaviors, including a preference for online shopping and sustainable products, are further influencing market dynamics. The increasing adoption of social media and influencer marketing is also playing a crucial role in shaping consumer preferences and driving sales. The market is expected to witness further growth propelled by increasing tourism, rising middle-class population, and the adoption of online shopping.

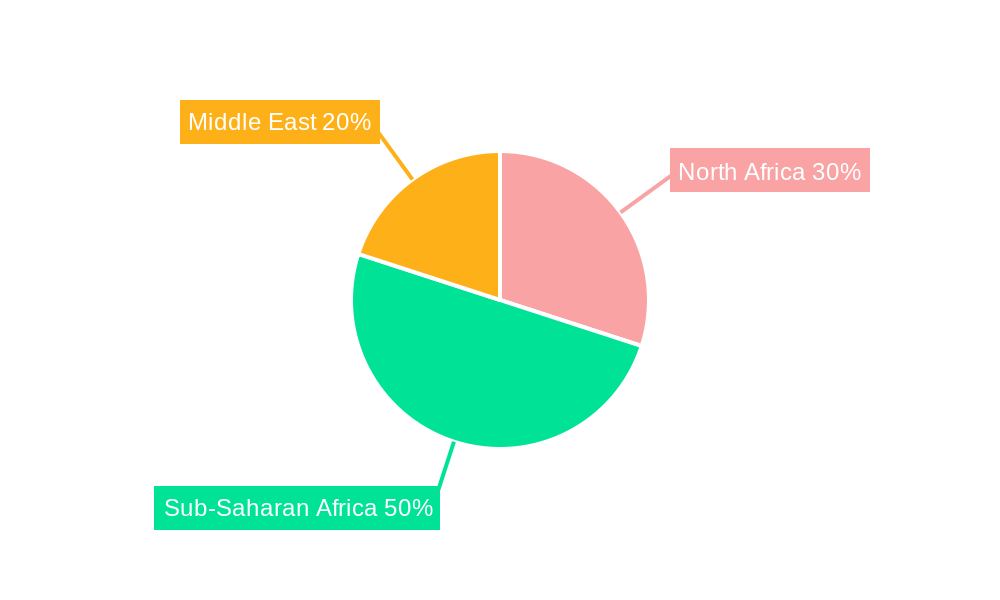

Key Markets & Segments Leading Middle East and Africa Handbags Market

The UAE and Saudi Arabia are the dominant markets in the Middle East and Africa region, owing to high disposable incomes and a strong fashion-conscious population. Within the product segments, the Tote Bag segment holds the largest market share, followed by Satchel and Clutch bags. Offline retail stores still dominate the distribution channel, but the online retail segment is experiencing rapid growth, fueled by increasing internet penetration and e-commerce adoption.

- Dominant Regions: UAE and Saudi Arabia.

- Dominant Segments (By Type): Tote Bag, followed by Satchel and Clutch bags.

- Dominant Distribution Channel: Offline retail stores, with significant growth in online retail.

- Growth Drivers:

- Rising disposable incomes and increased spending power.

- Growing fashion consciousness and preference for luxury goods.

- Increasing adoption of e-commerce and online shopping.

- Expanding tourism sector.

- Improving infrastructure and logistics.

Middle East and Africa Handbags Market Product Developments

The Middle East and Africa handbags market is witnessing a surge in product innovations, with a focus on sustainable materials, unique designs, and personalized customization options. Technological advancements, such as 3D printing and smart materials, are being incorporated to enhance product functionality and aesthetics. These developments are creating competitive advantages for companies that prioritize innovation and respond effectively to evolving consumer preferences. The introduction of new materials, such as recycled fabrics and vegan leather, is also gaining traction, responding to the growing demand for eco-friendly products.

Challenges in the Middle East and Africa Handbags Market Market

The Middle East and Africa handbags market faces challenges such as fluctuating currency exchange rates, impacting import costs. Supply chain disruptions and logistical hurdles can also hinder growth. Counterfeit products pose a significant threat, eroding the market share of authentic brands. Stringent import regulations and customs procedures in some countries further increase costs and complexity. These factors collectively impact overall market growth and profitability.

Forces Driving Middle East and Africa Handbags Market Growth

The market's growth is propelled by several key factors: a rising middle class with increased purchasing power; evolving fashion trends and a growing preference for luxury goods; technological advancements such as e-commerce and personalized marketing; and government initiatives promoting local manufacturing and sustainable practices. Increased tourism and a vibrant social media influence also boost market expansion.

Long-Term Growth Catalysts in Middle East and Africa Handbags Market

Long-term growth in the Middle East and Africa handbags market will be driven by continuous product innovation focusing on sustainability and personalization. Strategic partnerships between brands and retailers, along with expansion into new markets within the region, will be crucial for sustained growth. Government policies supporting local manufacturers and promoting responsible consumption will also play a significant role in shaping the industry's future.

Emerging Opportunities in Middle East and Africa Handbags Market

Emerging opportunities lie in tapping into the growing demand for sustainable and ethically sourced handbags. Utilizing innovative technologies such as augmented reality for personalized shopping experiences will attract tech-savvy consumers. Expansion into untapped markets within the region, particularly those with burgeoning middle classes, presents further growth potential. Focus on smaller, niche markets with specific style preferences can also yield considerable returns.

Leading Players in the Middle East and Africa Handbags Market Sector

- Hermes International SA

- Gucci S p A

- Prada S p a

- Blueberry Group

- LVMH

- Capri Holdings Limited

- Fossil Group

- Chanel SA

- Kering Group

- Kate Spade & Company

Key Milestones in Middle East and Africa Handbags Market Industry

- September 2020: Louis Vuitton launched its e-commerce site in Saudi Arabia, expanding its reach to Arabian customers.

- 2022: Chanel launched Heart Shaped bags in two sizes (mini and large), adding to its product portfolio.

- June 2022: Kering launched the 'Fashion Our Future' initiative, focusing on women and responsible fashion, impacting the market's sustainability focus.

Strategic Outlook for Middle East and Africa Handbags Market Market

The Middle East and Africa handbags market presents substantial long-term growth potential, driven by a combination of factors. Strategic partnerships, particularly with local retailers and e-commerce platforms, are key to expanding market reach. Investing in sustainable and ethically sourced materials aligns with growing consumer preferences and enhances brand image. Continuous product innovation, focusing on personalized designs and incorporating technological advancements, will be crucial for maintaining a competitive edge. The market is poised for continued expansion, offering significant opportunities for established and emerging players alike.

Middle East and Africa Handbags Market Segmentation

-

1. Type

- 1.1. Satchel

- 1.2. Bucket Bag

- 1.3. Clutch

- 1.4. Tote Bag

- 1.5. Others

-

2. Distribution Channel

- 2.1. Offline Retail Stores

- 2.2. Online Retail Stores

-

3. Geography

- 3.1. United Arab Emirates

- 3.2. Saudi Arabia

- 3.3. South Africa

- 3.4. Qatar

- 3.5. Rest of Middle East and Africa

Middle East and Africa Handbags Market Segmentation By Geography

- 1. United Arab Emirates

- 2. Saudi Arabia

- 3. South Africa

- 4. Qatar

- 5. Rest of Middle East and Africa

Middle East and Africa Handbags Market Regional Market Share

Geographic Coverage of Middle East and Africa Handbags Market

Middle East and Africa Handbags Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Product Innovations to Drive Demand for Watches; Rising Demand for Premium Fashion Items

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Strategic Developments by Major players

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Handbags Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Satchel

- 5.1.2. Bucket Bag

- 5.1.3. Clutch

- 5.1.4. Tote Bag

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Offline Retail Stores

- 5.2.2. Online Retail Stores

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United Arab Emirates

- 5.3.2. Saudi Arabia

- 5.3.3. South Africa

- 5.3.4. Qatar

- 5.3.5. Rest of Middle East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Arab Emirates

- 5.4.2. Saudi Arabia

- 5.4.3. South Africa

- 5.4.4. Qatar

- 5.4.5. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United Arab Emirates Middle East and Africa Handbags Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Satchel

- 6.1.2. Bucket Bag

- 6.1.3. Clutch

- 6.1.4. Tote Bag

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Offline Retail Stores

- 6.2.2. Online Retail Stores

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United Arab Emirates

- 6.3.2. Saudi Arabia

- 6.3.3. South Africa

- 6.3.4. Qatar

- 6.3.5. Rest of Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Saudi Arabia Middle East and Africa Handbags Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Satchel

- 7.1.2. Bucket Bag

- 7.1.3. Clutch

- 7.1.4. Tote Bag

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Offline Retail Stores

- 7.2.2. Online Retail Stores

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United Arab Emirates

- 7.3.2. Saudi Arabia

- 7.3.3. South Africa

- 7.3.4. Qatar

- 7.3.5. Rest of Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. South Africa Middle East and Africa Handbags Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Satchel

- 8.1.2. Bucket Bag

- 8.1.3. Clutch

- 8.1.4. Tote Bag

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Offline Retail Stores

- 8.2.2. Online Retail Stores

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United Arab Emirates

- 8.3.2. Saudi Arabia

- 8.3.3. South Africa

- 8.3.4. Qatar

- 8.3.5. Rest of Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Qatar Middle East and Africa Handbags Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Satchel

- 9.1.2. Bucket Bag

- 9.1.3. Clutch

- 9.1.4. Tote Bag

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Offline Retail Stores

- 9.2.2. Online Retail Stores

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United Arab Emirates

- 9.3.2. Saudi Arabia

- 9.3.3. South Africa

- 9.3.4. Qatar

- 9.3.5. Rest of Middle East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Middle East and Africa Middle East and Africa Handbags Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Satchel

- 10.1.2. Bucket Bag

- 10.1.3. Clutch

- 10.1.4. Tote Bag

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Offline Retail Stores

- 10.2.2. Online Retail Stores

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. United Arab Emirates

- 10.3.2. Saudi Arabia

- 10.3.3. South Africa

- 10.3.4. Qatar

- 10.3.5. Rest of Middle East and Africa

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Hermes International SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Gucci S p A*List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Prada S p a

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Blueberry Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 LVMH

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Capri Holdings Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Fossil Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Chanel SA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kering Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Kate Spade & Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Hermes International SA

List of Figures

- Figure 1: Middle East and Africa Handbags Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Handbags Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Handbags Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Middle East and Africa Handbags Market Volume K Units Forecast, by Type 2020 & 2033

- Table 3: Middle East and Africa Handbags Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Middle East and Africa Handbags Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 5: Middle East and Africa Handbags Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: Middle East and Africa Handbags Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 7: Middle East and Africa Handbags Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Middle East and Africa Handbags Market Volume K Units Forecast, by Region 2020 & 2033

- Table 9: Middle East and Africa Handbags Market Revenue billion Forecast, by Type 2020 & 2033

- Table 10: Middle East and Africa Handbags Market Volume K Units Forecast, by Type 2020 & 2033

- Table 11: Middle East and Africa Handbags Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 12: Middle East and Africa Handbags Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 13: Middle East and Africa Handbags Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 14: Middle East and Africa Handbags Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 15: Middle East and Africa Handbags Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Middle East and Africa Handbags Market Volume K Units Forecast, by Country 2020 & 2033

- Table 17: Middle East and Africa Handbags Market Revenue billion Forecast, by Type 2020 & 2033

- Table 18: Middle East and Africa Handbags Market Volume K Units Forecast, by Type 2020 & 2033

- Table 19: Middle East and Africa Handbags Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 20: Middle East and Africa Handbags Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 21: Middle East and Africa Handbags Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: Middle East and Africa Handbags Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 23: Middle East and Africa Handbags Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Middle East and Africa Handbags Market Volume K Units Forecast, by Country 2020 & 2033

- Table 25: Middle East and Africa Handbags Market Revenue billion Forecast, by Type 2020 & 2033

- Table 26: Middle East and Africa Handbags Market Volume K Units Forecast, by Type 2020 & 2033

- Table 27: Middle East and Africa Handbags Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 28: Middle East and Africa Handbags Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 29: Middle East and Africa Handbags Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: Middle East and Africa Handbags Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 31: Middle East and Africa Handbags Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Middle East and Africa Handbags Market Volume K Units Forecast, by Country 2020 & 2033

- Table 33: Middle East and Africa Handbags Market Revenue billion Forecast, by Type 2020 & 2033

- Table 34: Middle East and Africa Handbags Market Volume K Units Forecast, by Type 2020 & 2033

- Table 35: Middle East and Africa Handbags Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 36: Middle East and Africa Handbags Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 37: Middle East and Africa Handbags Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 38: Middle East and Africa Handbags Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 39: Middle East and Africa Handbags Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Middle East and Africa Handbags Market Volume K Units Forecast, by Country 2020 & 2033

- Table 41: Middle East and Africa Handbags Market Revenue billion Forecast, by Type 2020 & 2033

- Table 42: Middle East and Africa Handbags Market Volume K Units Forecast, by Type 2020 & 2033

- Table 43: Middle East and Africa Handbags Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 44: Middle East and Africa Handbags Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 45: Middle East and Africa Handbags Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 46: Middle East and Africa Handbags Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 47: Middle East and Africa Handbags Market Revenue billion Forecast, by Country 2020 & 2033

- Table 48: Middle East and Africa Handbags Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Handbags Market?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the Middle East and Africa Handbags Market?

Key companies in the market include Hermes International SA, Gucci S p A*List Not Exhaustive, Prada S p a, Blueberry Group, LVMH, Capri Holdings Limited, Fossil Group, Chanel SA, Kering Group, Kate Spade & Company.

3. What are the main segments of the Middle East and Africa Handbags Market?

The market segments include Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 67.94 billion as of 2022.

5. What are some drivers contributing to market growth?

Product Innovations to Drive Demand for Watches; Rising Demand for Premium Fashion Items.

6. What are the notable trends driving market growth?

Strategic Developments by Major players.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

In June 2022, Kering launched the global initiative on women and responsible fashion called 'Fashion Our Future' in collaboration with Marie Claire.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Handbags Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Handbags Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Handbags Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Handbags Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence