Key Insights

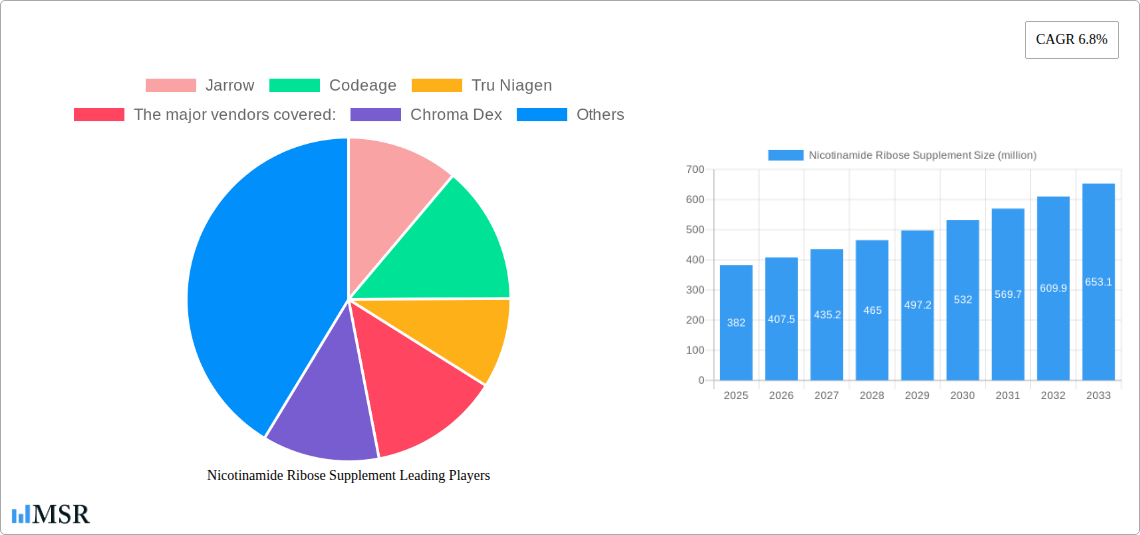

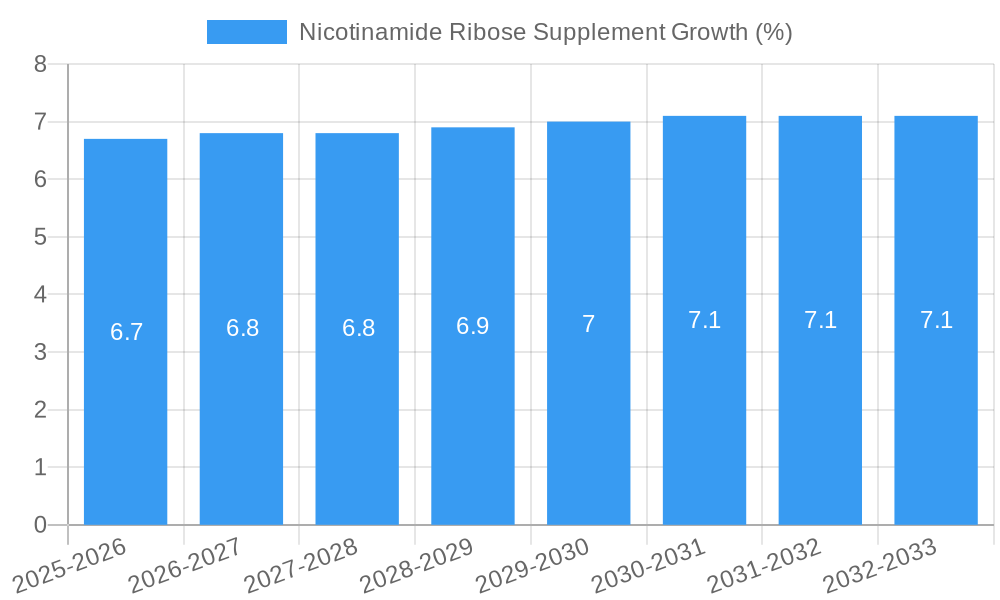

The global Nicotinamide Ribose Supplement market is projected for robust expansion, currently valued at approximately USD 382 million in 2025. The market is anticipated to grow at a Compound Annual Growth Rate (CAGR) of 6.8% during the forecast period of 2025-2033. This sustained growth is primarily driven by an increasing consumer awareness of NAD+ precursors and their role in cellular energy production, anti-aging benefits, and overall well-being. The rising prevalence of age-related chronic diseases and a proactive approach to health management among individuals are also significant contributors. Furthermore, advancements in research highlighting the therapeutic potential of Nicotinamide Ribose in various health conditions are fueling market demand. The pharmaceutical industry, a key application segment, is leveraging these supplements for their potential to support metabolic health and mitigate oxidative stress, while the food industry is exploring their integration into functional foods and beverages to enhance nutritional profiles.

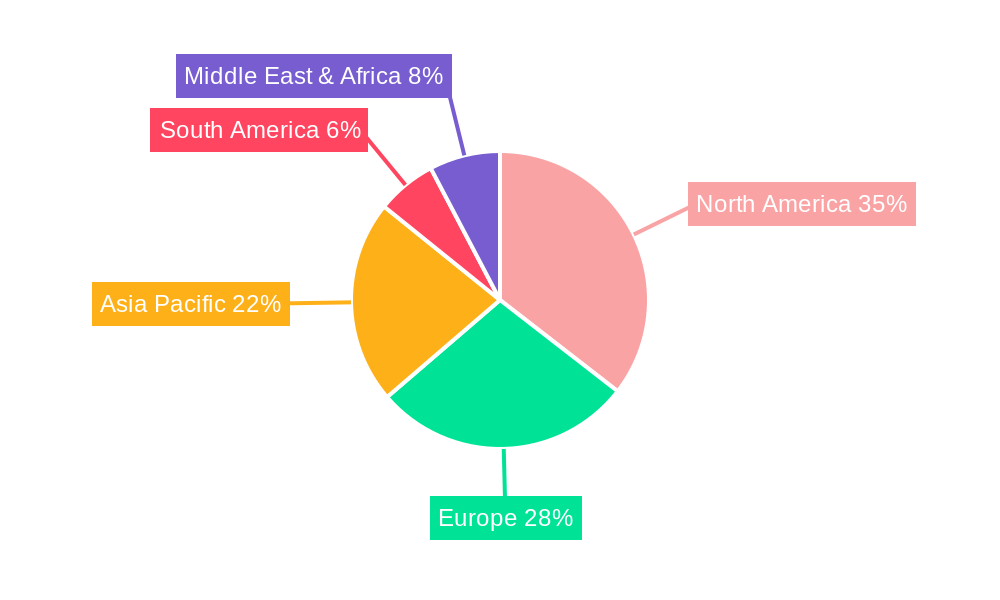

Key trends shaping the Nicotinamide Ribose Supplement market include the growing popularity of premium and scientifically backed supplement brands, along with an increasing demand for pharmaceutical-grade ingredients. While the market presents substantial opportunities, certain restraints, such as the high cost of production and the need for extensive clinical validation to support specific health claims, could influence the pace of growth. However, the expanding global reach of e-commerce platforms and direct-to-consumer sales channels are effectively bridging geographical gaps and making these supplements more accessible to a wider consumer base. North America and Europe are expected to remain dominant regions due to high disposable incomes and a strong emphasis on health and wellness. Asia Pacific, however, is anticipated to exhibit the fastest growth, driven by increasing health consciousness and a burgeoning middle class.

This comprehensive report offers an in-depth analysis of the global Nicotinamide Ribose Supplement market, covering the historical period from 2019 to 2024, the base year of 2025, and a forecast period extending to 2033. With an estimated market size of $XXX million in 2025, the Nicotinamide Ribose Supplement industry is poised for significant expansion, driven by increasing consumer awareness of NAD+ precursor benefits and growing demand across the Food and Pharmaceutical Industries.

Nicotinamide Ribose Supplement Market Concentration & Dynamics

The global Nicotinamide Ribose Supplement market exhibits a moderate to high concentration with several key players actively shaping its trajectory. Innovation ecosystems are thriving, evidenced by ongoing research into new formulations and delivery methods, pushing the boundaries of what is possible in cellular energy and aging research. Regulatory frameworks, while varied across regions, are largely focused on ensuring product safety and efficacy, influencing market entry strategies for both established and emerging companies. The threat of substitute products is relatively low, as Nicotinamide Ribose (NR) offers a distinct pathway to boosting NAD+ levels compared to other NAD+ precursors or general B3 vitamins. End-user trends highlight a growing demand from health-conscious consumers seeking to optimize cellular function and combat age-related decline. Mergers and acquisitions (M&A) activities are a crucial aspect of market dynamics, with an estimated XX M&A deals observed in the historical period, indicating a drive for consolidation and market expansion among leading vendors. The market share of the top five vendors is estimated to be around XX%, reflecting the competitive landscape.

Nicotinamide Ribose Supplement Industry Insights & Trends

The Nicotinamide Ribose Supplement industry is experiencing robust growth, projected to reach $XXX million by 2033 with a Compound Annual Growth Rate (CAGR) of XX% from the base year of 2025. This expansion is fueled by a confluence of factors, including escalating consumer interest in proactive health management and the burgeoning field of anti-aging research. Technological disruptions are playing a pivotal role, with advancements in manufacturing processes leading to higher purity and bioavailability of Nicotinamide Ribose, thereby enhancing product efficacy and consumer trust. Evolving consumer behaviors are characterized by a shift towards evidence-based supplements and a willingness to invest in products that offer tangible health benefits, such as improved energy levels, enhanced cognitive function, and cellular repair. The scientific community's deepening understanding of Nicotinamide Adenine Dinucleotide (NAD+) pathways and their critical role in metabolism and DNA repair is a significant market driver. The pharmaceutical industry's exploration of NR for therapeutic applications further solidifies its market position. Emerging research correlating NAD+ levels with various chronic conditions is also stimulating demand. The increasing availability of Nicotinamide Ribose supplements through online retail channels and specialized health stores has broadened accessibility and convenience for consumers worldwide. Furthermore, the development of novel delivery systems, such as extended-release formulations and synergistic combinations with other beneficial compounds, is enhancing the appeal and effectiveness of Nicotinamide Ribose supplements, thereby driving market growth.

Key Markets & Segments Leading Nicotinamide Ribose Supplement

The Pharmaceutical Industry is a dominant segment in the Nicotinamide Ribose Supplement market, driven by its extensive research into therapeutic applications and its capacity for large-scale production and distribution. This segment's dominance is further propelled by the increasing recognition of Nicotinamide Ribose as a potential intervention for age-related diseases and metabolic disorders.

- Pharmaceutical Industry Drivers:

- Intensive R&D investment in NAD+ precursor therapeutics.

- Clinical trials demonstrating efficacy for various health conditions.

- Established distribution networks for pharmaceutical-grade products.

- Growing demand for supplements supporting cellular health and longevity.

The Food Industry is another significant contributor, with Nicotinamide Ribose being increasingly incorporated into functional foods and beverages aimed at enhancing overall well-being. The appeal lies in its potential to boost energy levels and support metabolic health in a palatable format.

- Food Industry Drivers:

- Consumer demand for fortified foods with health benefits.

- Versatility of Nicotinamide Ribose in various food applications.

- Growing trend of preventative healthcare and wellness.

In terms of product types, Pharmaceutical Grade Nicotinamide Ribose currently leads due to stringent quality control and its primary application in clinical research and therapeutic formulations. However, Food Grade Nicotinamide Ribose is experiencing rapid growth as its use in the dietary supplement and functional food sectors expands.

Pharmaceutical Grade Drivers:

- High purity requirements for clinical and therapeutic use.

- Strict regulatory compliance for drug development.

- Established trust in its safety and efficacy for medical applications.

Food Grade Drivers:

- Cost-effectiveness for mass-market dietary supplements.

- Growing consumer preference for natural and science-backed ingredients.

- Broader accessibility and market penetration.

Geographically, North America and Europe represent the leading markets due to higher disposable incomes, advanced healthcare infrastructure, and a strong consumer focus on health and wellness. The Asia-Pacific region, however, is projected to witness the fastest growth, fueled by a rising middle class and increasing awareness of health supplements.

Nicotinamide Ribose Supplement Product Developments

Product developments in the Nicotinamide Ribose Supplement market are characterized by a focus on enhancing bioavailability and exploring novel applications. Innovations include advanced encapsulation techniques for sustained release, synergistic formulations with other beneficial compounds like pterostilbene and resveratrol, and increased product diversification across various dosage forms. Companies are also investing in research to understand and highlight specific health benefits, such as cognitive enhancement and muscle function support, leading to more targeted marketing and product differentiation.

Challenges in the Nicotinamide Ribose Supplement Market

The Nicotinamide Ribose Supplement market faces several challenges, including regulatory hurdles related to health claims and ingredient approvals in different regions, which can delay market entry and increase compliance costs, estimated to add XX% to product development timelines. Supply chain complexities, particularly for high-purity ingredients, can lead to price volatility and potential shortages, impacting product availability. Furthermore, intense competitive pressures from both established players and new entrants necessitate continuous innovation and aggressive marketing strategies, potentially leading to price wars that could impact profit margins, with an estimated XX% of market value at risk due to competitive pricing.

Forces Driving Nicotinamide Ribose Supplement Growth

The growth of the Nicotinamide Ribose Supplement market is primarily driven by an increasing global focus on health and wellness, leading to a surge in demand for products that support cellular health and longevity. Scientific advancements in understanding NAD+ metabolism and its role in aging and various physiological processes are providing a strong foundation for product development and consumer education. Technological innovations in synthesis and formulation are improving the efficacy and accessibility of Nicotinamide Ribose supplements. Additionally, supportive regulatory environments in key markets that recognize the benefits of NAD+ precursors are facilitating market expansion.

Challenges in the Nicotinamide Ribose Supplement Market

Long-term growth catalysts for the Nicotinamide Ribose Supplement market lie in the continued expansion of scientific research, uncovering new therapeutic applications and health benefits. Strategic partnerships between supplement manufacturers, research institutions, and pharmaceutical companies can accelerate product development and market penetration. Market expansion into emerging economies with growing health consciousness presents significant growth opportunities. Furthermore, advancements in personalized nutrition and the integration of Nicotinamide Ribose into tailored health regimens will likely be key drivers for sustained future growth.

Emerging Opportunities in Nicotinamide Ribose Supplement

Emerging opportunities in the Nicotinamide Ribose Supplement market are abundant. The aging global population presents a significant demographic opportunity, with a growing demand for anti-aging and vitality-enhancing products. The expansion of the nutraceutical industry and the increasing acceptance of dietary supplements as a part of a preventative healthcare strategy are creating new avenues for growth. Opportunities also exist in developing specialized formulations for athletes, cognitive support, and metabolic health management. Furthermore, the direct-to-consumer (DTC) e-commerce model offers a scalable platform for reaching a wider customer base and building brand loyalty.

Leading Players in the Nicotinamide Ribose Supplement Sector

- Jarrow

- Codeage

- Tru Niagen

- Chroma Dex

- Elysium Health

- Natural Nutra

- Thorne

- Zhejiang Jiahua Pharmchemical

- Shenzhen Longgesheng Technology

- Bontac Bio-engineering

- Springtide

- Solaray

- Life Extension

- ChromaDex Corporation

- Thorne Research

- Tesseract Medical Research

- Biotrend Chemikalien

- Vitacost.com

Key Milestones in Nicotinamide Ribose Supplement Industry

- 2019: Increased publication of research highlighting Nicotinamide Ribose's role in cellular energy and NAD+ synthesis.

- 2020: Expansion of Tru Niagen's product line and marketing efforts globally.

- 2021: Growing interest from pharmaceutical companies in exploring NR for therapeutic applications.

- 2022: Introduction of new formulations and delivery methods by various vendors aimed at improving bioavailability.

- 2023: Significant increase in consumer awareness and demand for NAD+ precursors driven by health and wellness trends.

- 2024: Continued investment in R&D for novel applications and clinical validation.

Strategic Outlook for Nicotinamide Ribose Supplement Market

The strategic outlook for the Nicotinamide Ribose Supplement market is highly promising, characterized by sustained growth and innovation. Key accelerators include the deepening scientific understanding of NAD+ pathways and their implications for health and aging, driving further research and development. Strategic emphasis on product differentiation through enhanced bioavailability and targeted health benefits will be crucial. Furthermore, expanding market reach into underserved geographies and forming collaborations with healthcare professionals and research institutions will be vital for long-term success. The market is expected to witness continued M&A activity as companies seek to consolidate their positions and leverage synergies.

Nicotinamide Ribose Supplement Segmentation

-

1. Application

- 1.1. Food Industry

- 1.2. Pharmaceutical Industry

- 1.3. Others

-

2. Types

- 2.1. Pharmaceutical Grade

- 2.2. Food Grade

- 2.3. Others

Nicotinamide Ribose Supplement Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Nicotinamide Ribose Supplement REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.8% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Nicotinamide Ribose Supplement Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Food Industry

- 5.1.2. Pharmaceutical Industry

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Pharmaceutical Grade

- 5.2.2. Food Grade

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Nicotinamide Ribose Supplement Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Food Industry

- 6.1.2. Pharmaceutical Industry

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Pharmaceutical Grade

- 6.2.2. Food Grade

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Nicotinamide Ribose Supplement Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Food Industry

- 7.1.2. Pharmaceutical Industry

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Pharmaceutical Grade

- 7.2.2. Food Grade

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Nicotinamide Ribose Supplement Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Food Industry

- 8.1.2. Pharmaceutical Industry

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Pharmaceutical Grade

- 8.2.2. Food Grade

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Nicotinamide Ribose Supplement Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Food Industry

- 9.1.2. Pharmaceutical Industry

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Pharmaceutical Grade

- 9.2.2. Food Grade

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Nicotinamide Ribose Supplement Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Food Industry

- 10.1.2. Pharmaceutical Industry

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Pharmaceutical Grade

- 10.2.2. Food Grade

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Jarrow

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Codeage

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Tru Niagen

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 The major vendors covered

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.1 Jarrow

List of Figures

- Figure 1: Global Nicotinamide Ribose Supplement Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Nicotinamide Ribose Supplement Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Nicotinamide Ribose Supplement Revenue (million), by Application 2024 & 2032

- Figure 4: North America Nicotinamide Ribose Supplement Volume (K), by Application 2024 & 2032

- Figure 5: North America Nicotinamide Ribose Supplement Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Nicotinamide Ribose Supplement Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Nicotinamide Ribose Supplement Revenue (million), by Types 2024 & 2032

- Figure 8: North America Nicotinamide Ribose Supplement Volume (K), by Types 2024 & 2032

- Figure 9: North America Nicotinamide Ribose Supplement Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Nicotinamide Ribose Supplement Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Nicotinamide Ribose Supplement Revenue (million), by Country 2024 & 2032

- Figure 12: North America Nicotinamide Ribose Supplement Volume (K), by Country 2024 & 2032

- Figure 13: North America Nicotinamide Ribose Supplement Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Nicotinamide Ribose Supplement Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Nicotinamide Ribose Supplement Revenue (million), by Application 2024 & 2032

- Figure 16: South America Nicotinamide Ribose Supplement Volume (K), by Application 2024 & 2032

- Figure 17: South America Nicotinamide Ribose Supplement Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Nicotinamide Ribose Supplement Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Nicotinamide Ribose Supplement Revenue (million), by Types 2024 & 2032

- Figure 20: South America Nicotinamide Ribose Supplement Volume (K), by Types 2024 & 2032

- Figure 21: South America Nicotinamide Ribose Supplement Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Nicotinamide Ribose Supplement Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Nicotinamide Ribose Supplement Revenue (million), by Country 2024 & 2032

- Figure 24: South America Nicotinamide Ribose Supplement Volume (K), by Country 2024 & 2032

- Figure 25: South America Nicotinamide Ribose Supplement Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Nicotinamide Ribose Supplement Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Nicotinamide Ribose Supplement Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Nicotinamide Ribose Supplement Volume (K), by Application 2024 & 2032

- Figure 29: Europe Nicotinamide Ribose Supplement Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Nicotinamide Ribose Supplement Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Nicotinamide Ribose Supplement Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Nicotinamide Ribose Supplement Volume (K), by Types 2024 & 2032

- Figure 33: Europe Nicotinamide Ribose Supplement Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Nicotinamide Ribose Supplement Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Nicotinamide Ribose Supplement Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Nicotinamide Ribose Supplement Volume (K), by Country 2024 & 2032

- Figure 37: Europe Nicotinamide Ribose Supplement Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Nicotinamide Ribose Supplement Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Nicotinamide Ribose Supplement Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Nicotinamide Ribose Supplement Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Nicotinamide Ribose Supplement Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Nicotinamide Ribose Supplement Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Nicotinamide Ribose Supplement Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Nicotinamide Ribose Supplement Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Nicotinamide Ribose Supplement Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Nicotinamide Ribose Supplement Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Nicotinamide Ribose Supplement Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Nicotinamide Ribose Supplement Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Nicotinamide Ribose Supplement Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Nicotinamide Ribose Supplement Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Nicotinamide Ribose Supplement Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Nicotinamide Ribose Supplement Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Nicotinamide Ribose Supplement Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Nicotinamide Ribose Supplement Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Nicotinamide Ribose Supplement Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Nicotinamide Ribose Supplement Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Nicotinamide Ribose Supplement Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Nicotinamide Ribose Supplement Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Nicotinamide Ribose Supplement Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Nicotinamide Ribose Supplement Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Nicotinamide Ribose Supplement Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Nicotinamide Ribose Supplement Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Nicotinamide Ribose Supplement Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Nicotinamide Ribose Supplement Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Nicotinamide Ribose Supplement Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Nicotinamide Ribose Supplement Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Nicotinamide Ribose Supplement Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Nicotinamide Ribose Supplement Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Nicotinamide Ribose Supplement Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Nicotinamide Ribose Supplement Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Nicotinamide Ribose Supplement Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Nicotinamide Ribose Supplement Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Nicotinamide Ribose Supplement Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Nicotinamide Ribose Supplement Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Nicotinamide Ribose Supplement Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Nicotinamide Ribose Supplement Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Nicotinamide Ribose Supplement Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Nicotinamide Ribose Supplement Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Nicotinamide Ribose Supplement Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Nicotinamide Ribose Supplement Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Nicotinamide Ribose Supplement Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Nicotinamide Ribose Supplement Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Nicotinamide Ribose Supplement Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Nicotinamide Ribose Supplement Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Nicotinamide Ribose Supplement Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Nicotinamide Ribose Supplement Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Nicotinamide Ribose Supplement Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Nicotinamide Ribose Supplement Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Nicotinamide Ribose Supplement Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Nicotinamide Ribose Supplement Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Nicotinamide Ribose Supplement Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Nicotinamide Ribose Supplement Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Nicotinamide Ribose Supplement Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Nicotinamide Ribose Supplement Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Nicotinamide Ribose Supplement Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Nicotinamide Ribose Supplement Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Nicotinamide Ribose Supplement Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Nicotinamide Ribose Supplement Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Nicotinamide Ribose Supplement Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Nicotinamide Ribose Supplement Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Nicotinamide Ribose Supplement Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Nicotinamide Ribose Supplement Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Nicotinamide Ribose Supplement Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Nicotinamide Ribose Supplement Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Nicotinamide Ribose Supplement Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Nicotinamide Ribose Supplement Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Nicotinamide Ribose Supplement Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Nicotinamide Ribose Supplement Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Nicotinamide Ribose Supplement Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Nicotinamide Ribose Supplement Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Nicotinamide Ribose Supplement Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Nicotinamide Ribose Supplement Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Nicotinamide Ribose Supplement Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Nicotinamide Ribose Supplement Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Nicotinamide Ribose Supplement Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Nicotinamide Ribose Supplement Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Nicotinamide Ribose Supplement Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Nicotinamide Ribose Supplement Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Nicotinamide Ribose Supplement Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Nicotinamide Ribose Supplement Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Nicotinamide Ribose Supplement Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Nicotinamide Ribose Supplement Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Nicotinamide Ribose Supplement Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Nicotinamide Ribose Supplement Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Nicotinamide Ribose Supplement Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Nicotinamide Ribose Supplement Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Nicotinamide Ribose Supplement Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Nicotinamide Ribose Supplement Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Nicotinamide Ribose Supplement Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Nicotinamide Ribose Supplement Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Nicotinamide Ribose Supplement Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Nicotinamide Ribose Supplement Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Nicotinamide Ribose Supplement Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Nicotinamide Ribose Supplement Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Nicotinamide Ribose Supplement Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Nicotinamide Ribose Supplement Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Nicotinamide Ribose Supplement Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Nicotinamide Ribose Supplement Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Nicotinamide Ribose Supplement Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Nicotinamide Ribose Supplement Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Nicotinamide Ribose Supplement Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Nicotinamide Ribose Supplement Volume K Forecast, by Country 2019 & 2032

- Table 81: China Nicotinamide Ribose Supplement Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Nicotinamide Ribose Supplement Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Nicotinamide Ribose Supplement Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Nicotinamide Ribose Supplement Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Nicotinamide Ribose Supplement Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Nicotinamide Ribose Supplement Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Nicotinamide Ribose Supplement Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Nicotinamide Ribose Supplement Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Nicotinamide Ribose Supplement Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Nicotinamide Ribose Supplement Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Nicotinamide Ribose Supplement Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Nicotinamide Ribose Supplement Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Nicotinamide Ribose Supplement Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Nicotinamide Ribose Supplement Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nicotinamide Ribose Supplement?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the Nicotinamide Ribose Supplement?

Key companies in the market include Jarrow, Codeage, Tru Niagen, The major vendors covered:, Chroma Dex, Elysium Health, Natural Nutra, Thorne, Zhejiang Jiahua Pharmchemical, Shenzhen Longgesheng Technology, Bontac Bio-engineering, Springtide, Solaray, Life Extension, ChromaDex Corporation, Thorne Research, Tesseract Medical Research, Biotrend Chemikalien, Vitacost.com.

3. What are the main segments of the Nicotinamide Ribose Supplement?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 382 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nicotinamide Ribose Supplement," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nicotinamide Ribose Supplement report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nicotinamide Ribose Supplement?

To stay informed about further developments, trends, and reports in the Nicotinamide Ribose Supplement, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence