Key Insights

The South American athletic footwear market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 5.25% from 2025 to 2033. This expansion is fueled by several key factors. Rising disposable incomes across major South American economies like Brazil and Argentina are driving increased consumer spending on athletic apparel and footwear. A burgeoning fitness culture, coupled with the increasing popularity of various sports and outdoor activities, further contributes to market growth. The growing preference for comfortable and stylish athletic footwear, transcending purely functional needs, is also a significant driver. Furthermore, the expansion of organized retail and e-commerce channels significantly enhances market accessibility and fuels sales. Segmentation reveals a strong demand across all product types, with running shoes, sports shoes, and trekking/hiking shoes leading the market. The men's segment currently dominates, though the women's and children's segments show promising growth potential.

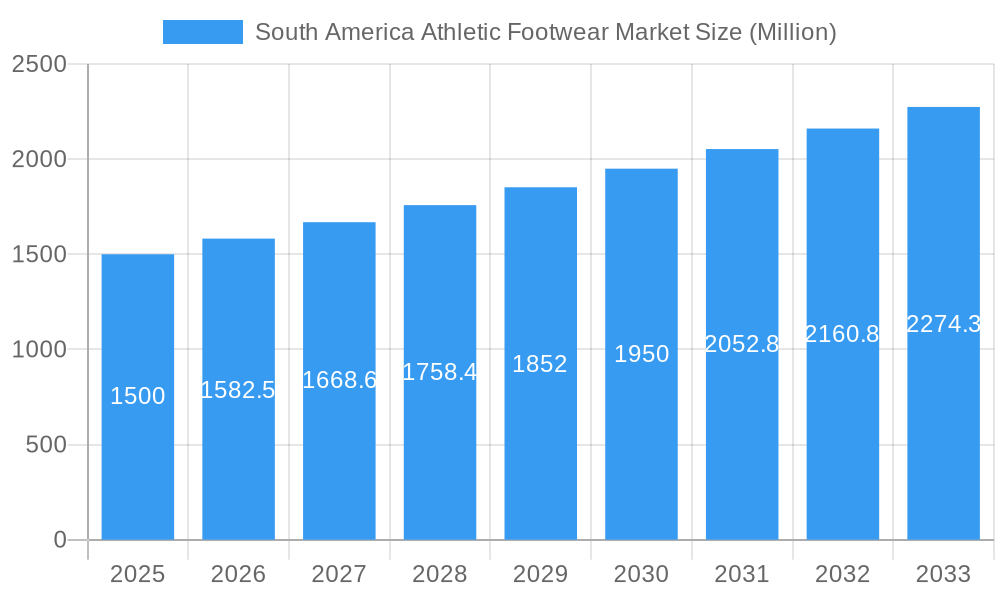

South America Athletic Footwear Market Market Size (In Billion)

However, market growth is not without challenges. Economic volatility in certain South American countries can impact consumer spending, posing a restraint. Fluctuating currency exchange rates and import tariffs can influence pricing and profitability for both international and domestic brands. Competition remains fierce, with established global players like Nike, Adidas, and Puma vying for market share alongside local brands like Vulcabras. Successfully navigating these challenges will be key for sustained market growth. The market's future hinges on continued economic stability, further penetration of e-commerce platforms, and the ability of brands to cater to evolving consumer preferences through innovation in design, technology, and marketing strategies. The increasing adoption of sustainable and ethically produced footwear will also be a crucial factor in shaping future market dynamics.

South America Athletic Footwear Market Company Market Share

South America Athletic Footwear Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the South America athletic footwear market, offering invaluable insights for industry stakeholders. With a detailed examination of market dynamics, leading players, and future trends, this report is an essential resource for strategic decision-making. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The historical period analyzed is 2019-2024. The report projects a market valued at xx Million in 2025, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period.

South America Athletic Footwear Market Concentration & Dynamics

The South American athletic footwear market exhibits a moderately concentrated landscape, dominated by global giants like Nike Inc, Adidas AG, and Puma SE, alongside regional players such as Vulcabras. These major players collectively hold approximately xx% of the market share in 2025. However, the market is dynamic, with increasing participation from smaller, specialized brands catering to niche segments.

Market Concentration Metrics (2025):

- Top 5 players' market share: xx%

- Top 10 players' market share: xx%

- Herfindahl-Hirschman Index (HHI): xx

Market Dynamics:

- Innovation Ecosystem: The market witnesses continuous innovation in materials, design, and technology, driven by consumer demand for enhanced performance and comfort. This leads to frequent product launches and upgrades.

- Regulatory Frameworks: Varying regulations across South American countries regarding product safety and labeling impact market operations. Compliance costs can significantly vary.

- Substitute Products: The market faces competition from other footwear categories, such as casual and formal shoes, impacting sales particularly in price-sensitive segments.

- End-User Trends: Growing health consciousness and increasing participation in sports and fitness activities are key drivers of market growth. Demand for specialized footwear is rising across demographics.

- M&A Activities: The market has seen a moderate number of mergers and acquisitions (M&A) deals in recent years (xx deals between 2019 and 2024), primarily involving smaller brands being acquired by larger players for market expansion and brand diversification.

South America Athletic Footwear Market Industry Insights & Trends

The South American athletic footwear market is currently on a trajectory of significant expansion, propelled by a confluence of dynamic factors. The market, estimated at XX Million USD in 2024, is anticipated to surge to XX Million USD by 2033, reflecting a robust compound annual growth rate (CAGR). This upward momentum is largely attributed to the burgeoning middle class, characterized by rising disposable incomes and increasing urbanization across key South American nations. Consequently, there's a pronounced shift in consumer lifestyles towards more active and athletic pursuits, driving a greater demand for specialized and performance-oriented footwear.

Innovation is a key differentiator, with manufacturers increasingly integrating cutting-edge technologies. This includes the incorporation of smart sensors for performance tracking and enhanced comfort, as well as a growing emphasis on sustainable materials and eco-friendly production processes in response to rising environmental consciousness among consumers. The digital transformation is also profoundly reshaping the market, with evolving consumer preferences leaning towards personalized product offerings and the convenience of e-commerce platforms for purchasing athletic gear.

The surge in popularity of fitness activities, ranging from marathon running and cross-training to a wide array of team sports, directly fuels the demand for a diverse range of specialized athletic footwear designed for optimal performance and injury prevention. Furthermore, supportive government initiatives aimed at promoting sports participation, public health, and active living across the continent are playing a crucial role in fostering a conducive environment for market growth. While economic volatility in certain regions and currency fluctuations can present temporary headwinds to consumer spending, the underlying long-term growth prospects remain exceptionally strong, underpinned by demographic trends and an enduring focus on health and wellness.

Key Markets & Segments Leading South America Athletic Market

Dominant Regions/Countries:

Brazil remains the largest market within South America, accounting for the majority of sales due to its large population and relatively high disposable incomes. Argentina and Colombia also represent significant markets.

Dominant Segments:

- By Distribution Channel: Online retail stores are experiencing rapid growth, driven by increasing internet penetration and consumer preference for e-commerce. However, supermarkets/hypermarkets still hold a significant share, primarily for mainstream brands.

- By Product Type: Running shoes and sport shoes constitute the largest segments, reflecting the popularity of running and team sports. The trekking/hiking shoe segment shows steady growth due to increased outdoor activities.

- By End-User: Men currently dominate the market, followed by women, with a growing children's segment.

Key Drivers for Dominant Segments:

- Brazil: Strong economy, large population, high sports participation rates.

- Online Retail: Convenience, wider selection, competitive pricing.

- Running Shoes: Rising popularity of running, marathons, and fitness activities.

South America Athletic Footwear Market Product Developments

Significant advancements in materials science have resulted in lighter, more durable, and more comfortable athletic footwear. The incorporation of innovative technologies, such as enhanced cushioning systems and breathable fabrics, provides athletes with superior performance and comfort. The growing demand for sustainable and eco-friendly products is driving the development of athletic shoes made from recycled materials and sustainable manufacturing processes. This focus on innovation creates a competitive advantage for brands that can deliver superior product features and sustainability.

Challenges in the South America Athletic Footwear Market

Despite its promising growth, the South American athletic footwear market navigates several significant challenges:

- Economic Volatility and Currency Fluctuations: Persistent economic instability and unpredictable currency exchange rates in several South American countries can significantly impact consumer purchasing power, leading to reduced spending on non-essential items like premium athletic footwear.

- Supply Chain Vulnerabilities: The reliance on global supply chains exposes the market to disruptions caused by geopolitical events, logistical bottlenecks, and material shortages, potentially leading to production delays, increased costs, and stockouts.

- Prevalence of Counterfeit Products: The pervasive issue of counterfeit athletic footwear not only erodes brand value and customer trust but also directly impacts sales volumes and profitability for legitimate manufacturers and retailers.

- Complex Import Tariffs and Regulatory Frameworks: The diverse and often fluctuating import duties, taxes, and regulatory landscapes across different South American countries add layers of complexity and operational costs for companies looking to import and distribute their products across the region.

- Infrastructure Limitations: In some areas, underdeveloped logistics and retail infrastructure can pose challenges for efficient distribution and market reach, particularly for smaller brands or in more remote regions.

Forces Driving South America Athletic Footwear Market Growth

Key growth drivers include:

- Rising Disposable Incomes: An expanding middle class with increased purchasing power fuels higher demand for athletic footwear.

- Growing Health Consciousness: Increasing focus on fitness and wellness encourages participation in sports and physical activities, leading to greater footwear demand.

- Technological Advancements: Innovations in materials and design create superior products that enhance performance and attract consumers.

- Government Initiatives: Initiatives promoting sports and healthy lifestyles further stimulate market expansion.

Long-Term Growth Catalysts in South America Athletic Footwear Market

Long-term growth will be fueled by strategic partnerships, collaborations, and market expansions into underserved areas. The focus on sustainable and technologically advanced products, along with effective marketing campaigns targeted at specific demographics, will further enhance growth. Continuous product innovation and adaptation to evolving consumer preferences will remain crucial for long-term success in this competitive market.

Emerging Opportunities in South America Athletic Footwear Market

Emerging opportunities include:

- Growth of E-commerce: Expansion of online retail channels presents significant growth potential, especially in less-developed areas with limited physical retail presence.

- Focus on Sustainability: Consumer demand for eco-friendly products opens up opportunities for brands adopting sustainable manufacturing processes.

- Niche Market Segmentation: Targeting specific demographics and sports with specialized products offers growth opportunities.

Leading Players in the South America Athletic Footwear Market Sector

Key Milestones in South America Athletic Footwear Market Industry

- 2019: Iconix Brand Group solidified its presence in the region by extending Umbro's licensing agreement with Grupo Dass across Brazil, Argentina, and Paraguay, strategically expanding the brand's reach and market penetration in these key South American territories.

- 2021: Nike Inc. undertook a significant strategic shift in its operational model within Brazil, Argentina, Chile, and Uruguay by transitioning its business operations to established strategic distributor partnerships. This move was aimed at enhancing operational efficiency, optimizing distribution networks, and bolstering overall profitability within these crucial markets.

- 2022: PUMA SE demonstrated a strong commitment to fostering athletic development in the region by entering into a pivotal partnership with the Brazilian Confederation of Athletics. This collaboration involved the sponsorship of national teams and a substantial commitment to supporting 24 youth teams, thereby significantly boosting PUMA's brand visibility, market presence, and dedication to grassroots sports development in South America.

- 2023: Increased investment in direct-to-consumer (DTC) channels and e-commerce platforms by major global players, recognizing the growing online shopping habits of South American consumers and seeking to gain greater control over customer experience and data.

- Ongoing: A continuous trend of local brands and smaller innovative companies emerging, focusing on niche sports, sustainable practices, and culturally relevant designs to capture specific market segments within the diverse South American landscape.

Strategic Outlook for South America Athletic Footwear Market

The South American athletic footwear market presents significant long-term growth potential. Continued investment in product innovation, expansion into e-commerce channels, and strategic partnerships will be key to capturing market share and driving revenue growth. Focusing on sustainable practices and catering to the evolving needs and preferences of consumers will be crucial for long-term success in this dynamic market.

South America Athletic Footwear Market Segmentation

-

1. Product Type

- 1.1. Running Shoes

- 1.2. Sport Shoes

- 1.3. Trekking/Hiking Shoes

- 1.4. Other Product Types

-

2. End user

- 2.1. Men

- 2.2. Women

- 2.3. Children

-

3. Distribution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Online Retail Stores

- 3.3. Others

-

4. Geography

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

South America Athletic Footwear Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

South America Athletic Footwear Market Regional Market Share

Geographic Coverage of South America Athletic Footwear Market

South America Athletic Footwear Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.43% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Social Media Influence and Aggressive Marketing Fueling Market Demand; Augmented Expenditure on Advertisement and Promotional Activities by Key players

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfiet Products

- 3.4. Market Trends

- 3.4.1. Expanding Sports Sector with Strong Support from Governing Bodies

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Athletic Footwear Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Running Shoes

- 5.1.2. Sport Shoes

- 5.1.3. Trekking/Hiking Shoes

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End user

- 5.2.1. Men

- 5.2.2. Women

- 5.2.3. Children

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Online Retail Stores

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Brazil

- 5.5.2. Argentina

- 5.5.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Brazil South America Athletic Footwear Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Running Shoes

- 6.1.2. Sport Shoes

- 6.1.3. Trekking/Hiking Shoes

- 6.1.4. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End user

- 6.2.1. Men

- 6.2.2. Women

- 6.2.3. Children

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Supermarkets/Hypermarkets

- 6.3.2. Online Retail Stores

- 6.3.3. Others

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. Brazil

- 6.4.2. Argentina

- 6.4.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Argentina South America Athletic Footwear Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Running Shoes

- 7.1.2. Sport Shoes

- 7.1.3. Trekking/Hiking Shoes

- 7.1.4. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End user

- 7.2.1. Men

- 7.2.2. Women

- 7.2.3. Children

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Supermarkets/Hypermarkets

- 7.3.2. Online Retail Stores

- 7.3.3. Others

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. Brazil

- 7.4.2. Argentina

- 7.4.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Rest of South America South America Athletic Footwear Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Running Shoes

- 8.1.2. Sport Shoes

- 8.1.3. Trekking/Hiking Shoes

- 8.1.4. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by End user

- 8.2.1. Men

- 8.2.2. Women

- 8.2.3. Children

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Supermarkets/Hypermarkets

- 8.3.2. Online Retail Stores

- 8.3.3. Others

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. Brazil

- 8.4.2. Argentina

- 8.4.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Brazil South America Athletic Footwear Market Analysis, Insights and Forecast, 2020-2032

- 10. Argentina South America Athletic Footwear Market Analysis, Insights and Forecast, 2020-2032

- 11. Rest of South America South America Athletic Footwear Market Analysis, Insights and Forecast, 2020-2032

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Adidas AG

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 New Balance Athletics Inc *List Not Exhaustive

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Vulcabras

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Decathlon SA

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Skechers USA Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Puma SE

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Under Armour Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Mizuno Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Nike Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 ASICS Corporation

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Adidas AG

List of Figures

- Figure 1: South America Athletic Footwear Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: South America Athletic Footwear Market Share (%) by Company 2025

List of Tables

- Table 1: South America Athletic Footwear Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 2: South America Athletic Footwear Market Volume K Units Forecast, by Region 2020 & 2033

- Table 3: South America Athletic Footwear Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 4: South America Athletic Footwear Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 5: South America Athletic Footwear Market Revenue undefined Forecast, by End user 2020 & 2033

- Table 6: South America Athletic Footwear Market Volume K Units Forecast, by End user 2020 & 2033

- Table 7: South America Athletic Footwear Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 8: South America Athletic Footwear Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 9: South America Athletic Footwear Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 10: South America Athletic Footwear Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 11: South America Athletic Footwear Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 12: South America Athletic Footwear Market Volume K Units Forecast, by Region 2020 & 2033

- Table 13: South America Athletic Footwear Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 14: South America Athletic Footwear Market Volume K Units Forecast, by Country 2020 & 2033

- Table 15: Brazil South America Athletic Footwear Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Brazil South America Athletic Footwear Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 17: Argentina South America Athletic Footwear Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Argentina South America Athletic Footwear Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 19: Rest of South America South America Athletic Footwear Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Rest of South America South America Athletic Footwear Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 21: South America Athletic Footwear Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 22: South America Athletic Footwear Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 23: South America Athletic Footwear Market Revenue undefined Forecast, by End user 2020 & 2033

- Table 24: South America Athletic Footwear Market Volume K Units Forecast, by End user 2020 & 2033

- Table 25: South America Athletic Footwear Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 26: South America Athletic Footwear Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 27: South America Athletic Footwear Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 28: South America Athletic Footwear Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 29: South America Athletic Footwear Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 30: South America Athletic Footwear Market Volume K Units Forecast, by Country 2020 & 2033

- Table 31: South America Athletic Footwear Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 32: South America Athletic Footwear Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 33: South America Athletic Footwear Market Revenue undefined Forecast, by End user 2020 & 2033

- Table 34: South America Athletic Footwear Market Volume K Units Forecast, by End user 2020 & 2033

- Table 35: South America Athletic Footwear Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 36: South America Athletic Footwear Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 37: South America Athletic Footwear Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 38: South America Athletic Footwear Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 39: South America Athletic Footwear Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: South America Athletic Footwear Market Volume K Units Forecast, by Country 2020 & 2033

- Table 41: South America Athletic Footwear Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 42: South America Athletic Footwear Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 43: South America Athletic Footwear Market Revenue undefined Forecast, by End user 2020 & 2033

- Table 44: South America Athletic Footwear Market Volume K Units Forecast, by End user 2020 & 2033

- Table 45: South America Athletic Footwear Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 46: South America Athletic Footwear Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 47: South America Athletic Footwear Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 48: South America Athletic Footwear Market Volume K Units Forecast, by Geography 2020 & 2033

- Table 49: South America Athletic Footwear Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 50: South America Athletic Footwear Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Athletic Footwear Market?

The projected CAGR is approximately 2.43%.

2. Which companies are prominent players in the South America Athletic Footwear Market?

Key companies in the market include Adidas AG, New Balance Athletics Inc *List Not Exhaustive, Vulcabras, Decathlon SA, Skechers USA Inc, Puma SE, Under Armour Inc, Mizuno Corporation, Nike Inc, ASICS Corporation.

3. What are the main segments of the South America Athletic Footwear Market?

The market segments include Product Type, End user, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Social Media Influence and Aggressive Marketing Fueling Market Demand; Augmented Expenditure on Advertisement and Promotional Activities by Key players.

6. What are the notable trends driving market growth?

Expanding Sports Sector with Strong Support from Governing Bodies.

7. Are there any restraints impacting market growth?

Availability of Counterfiet Products.

8. Can you provide examples of recent developments in the market?

In 2022, PUMA Se partnered up with the Brazilian Confederation of Athletics to sponsor their national teams. This partnership also includes sponsoring 24 adult and youth teams.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Athletic Footwear Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Athletic Footwear Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Athletic Footwear Market?

To stay informed about further developments, trends, and reports in the South America Athletic Footwear Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence