Key Insights

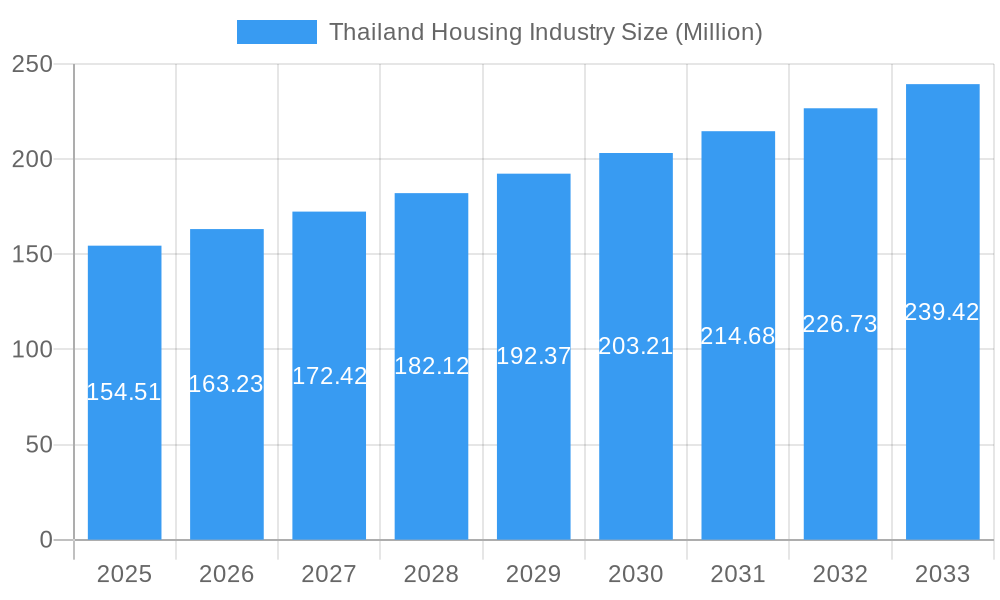

The Thailand housing market, valued at $154.51 million in 2025, is projected to experience robust growth, driven by a consistent Compound Annual Growth Rate (CAGR) of 5.54% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, a growing population, particularly in urban centers like Bangkok, Chiang Mai, Nonthaburi, and Samut Prakan, fuels increasing demand for residential properties. Secondly, rising disposable incomes and a burgeoning middle class are enabling more Thais to afford homeownership, bolstering the market. Furthermore, government initiatives aimed at improving infrastructure and attracting foreign investment contribute to the positive outlook. The market is segmented into Apartments and Condominiums, and Landed Houses and Villas, each catering to different segments of the population and varying budgetary requirements. Leading developers such as LPN Development PCL, Pruksa Real Estate, and Sansiri Public Co Ltd are key players, shaping the market's competitive landscape and driving innovation in design and construction.

Thailand Housing Industry Market Size (In Million)

However, the market isn't without challenges. Potential restraints include fluctuating interest rates impacting mortgage affordability and economic uncertainties that could affect consumer confidence. Furthermore, land scarcity in prime locations, particularly in Bangkok, can restrict supply and push prices upward. Despite these challenges, the long-term outlook for the Thai housing market remains positive, driven by sustained economic growth and the ongoing urbanization trend. The diverse range of housing options, combined with the active involvement of prominent developers, indicates a resilient and adaptable market poised for continued expansion throughout the forecast period. Strategic investments in infrastructure and targeted government policies will play a crucial role in maintaining this trajectory of growth.

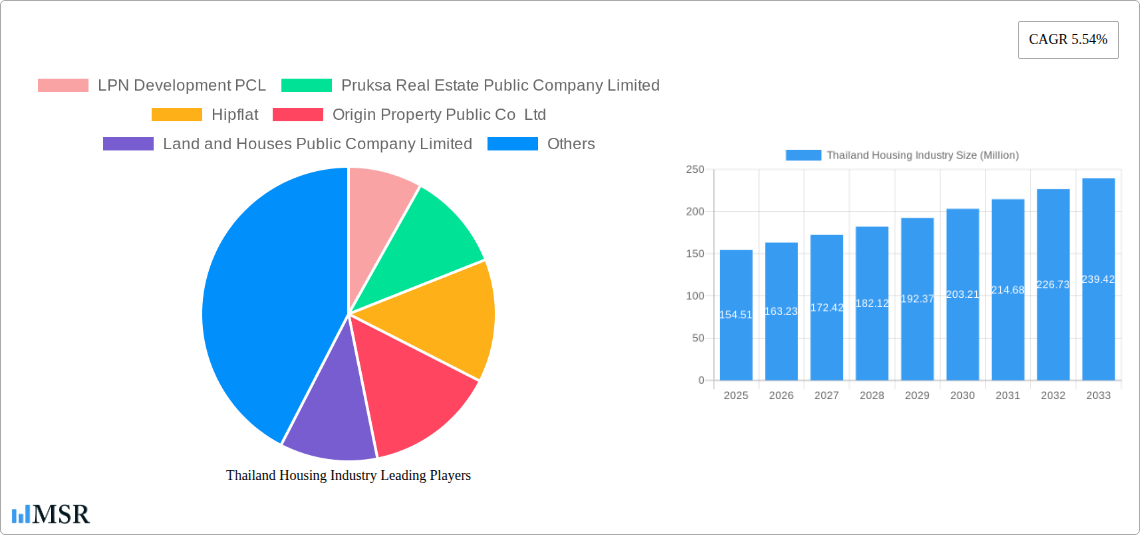

Thailand Housing Industry Company Market Share

Thailand Housing Industry Report: 2019-2033 Forecast

Dive deep into the dynamic Thailand housing market with this comprehensive report, providing invaluable insights for investors, developers, and industry stakeholders. This in-depth analysis covers the period 2019-2033, with a focus on 2025, offering a robust understanding of market trends, key players, and future growth potential.

This report meticulously analyzes the Thailand housing market, encompassing:

- Market Size & Growth: Detailed analysis of the market's size (in Millions of Baht), Compound Annual Growth Rate (CAGR), and future projections for apartments, condominiums, landed houses, and villas across key cities.

- Competitive Landscape: In-depth examination of market concentration, key players' market share, and recent M&A activities.

- Segment Analysis: Specific analysis of market segments by property type (apartments, condominiums, landed houses, villas) and key cities (Bangkok, Chiang Mai, Nonthaburi, Samut Prakan).

- Growth Drivers & Challenges: Identification of key factors driving market growth, along with an assessment of potential barriers and risks.

- Technological Advancements: Examination of how technological innovations are shaping the housing market, including smart home technologies and construction techniques.

- Consumer Behavior: Analysis of evolving consumer preferences and their impact on the demand for various housing types.

- Regulatory Landscape: Review of government policies and regulations impacting the sector.

Key Highlights:

- Study Period: 2019–2033

- Base Year: 2025

- Estimated Year: 2025

- Forecast Period: 2025–2033

- Historical Period: 2019–2024

Thailand Housing Industry Market Concentration & Dynamics

The Thailand housing market exhibits a moderately concentrated structure, with several large players holding significant market share. LPN Development PCL, Pruksa Real Estate Public Company Limited, and Sansiri Public Co Ltd are among the leading companies, collectively accounting for an estimated xx% of the market in 2025. However, a considerable number of smaller developers also contribute significantly to the overall market. The market is characterized by a dynamic innovation ecosystem, with ongoing development of sustainable building materials and smart home technologies. Regulatory frameworks, including building codes and land-use regulations, play a significant role in shaping market dynamics. Substitute products, such as renting, pose a competitive challenge, influencing pricing and demand. End-user trends show a preference for properties in prime locations with improved amenities and smart features. M&A activity has been moderate in recent years, with an estimated xx merger and acquisition deals in the period 2019-2024. This reflects a strategic consolidation within the industry and the ongoing quest for economies of scale.

Thailand Housing Industry Industry Insights & Trends

The Thailand housing market is experiencing significant growth, driven by several factors. The market size, estimated at xx Million Baht in 2025, is projected to reach xx Million Baht by 2033, representing a CAGR of xx%. Strong economic growth, increasing urbanization, and a burgeoning middle class fuel the demand for housing. Technological disruptions, such as the adoption of Building Information Modeling (BIM) and prefabricated construction techniques, are improving efficiency and reducing construction times. Evolving consumer behaviors, characterized by a preference for sustainable and technologically advanced housing, are reshaping the market. Demand for green building certifications and smart home features is rising, with consumers prioritizing energy efficiency and convenience. The increasing adoption of online platforms for property searches and transactions further enhances market transparency and access. The growth is however punctuated by cyclical fluctuations in the economy and interest rates.

Key Markets & Segments Leading Thailand Housing Industry

Dominant Segments:

- By Type: Condominiums and apartments dominate the market, driven by higher affordability and location advantages in urban centers. Landed houses and villas, while constituting a significant segment, demonstrate slower growth compared to high-rise developments. The preference for condos and apartments is heightened by the convenience of amenities and central locations.

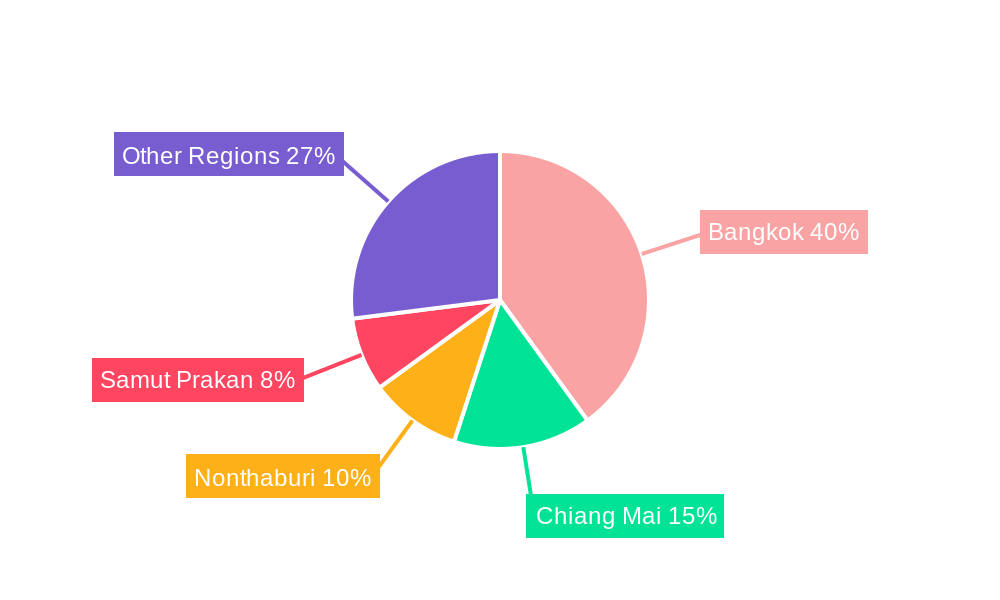

- By Key Cities: Bangkok remains the dominant market, driven by robust economic activity, employment opportunities, and superior infrastructure. Chiang Mai experiences steady growth due to its tourism appeal and increasing foreign investment. Nonthaburi and Samut Prakan benefit from their proximity to Bangkok and robust industrial activity.

Growth Drivers:

- Economic Growth: Sustained economic expansion and increasing disposable incomes bolster demand for housing across all segments.

- Urbanization: Ongoing migration from rural areas to cities fuels the demand for urban housing, particularly apartments and condominiums.

- Infrastructure Development: Government investments in infrastructure projects enhance connectivity and improve the desirability of certain locations.

- Tourism: Growth in the tourism sector drives demand for short-term rentals and second homes, especially in popular tourist destinations.

Thailand Housing Industry Product Developments

The Thailand housing industry witnesses continuous product innovations, with a focus on enhancing sustainability, incorporating smart technologies, and improving energy efficiency. Developers are actively integrating smart home features, such as automated lighting and security systems, while implementing green building practices to reduce environmental impact. The introduction of prefabricated construction methods aims to shorten construction times and lower costs. These advancements contribute to a more competitive and consumer-centric market.

Challenges in the Thailand Housing Industry Market

The Thailand housing market faces several challenges, including regulatory hurdles that can increase development times and costs, leading to delays in project completion. Supply chain disruptions, particularly in the availability of construction materials, impact project timelines and profitability, contributing to an estimated xx% increase in construction costs in 2025. Intense competition among developers also puts downward pressure on pricing, while land scarcity in prime locations limits development potential.

Forces Driving Thailand Housing Industry Growth

Key growth drivers for the Thailand housing industry include sustained economic growth boosting consumer confidence and purchasing power, increased urbanization creating a higher demand for housing, and government initiatives promoting affordable housing. Technological advancements, such as smart home technologies, and sustainable building practices enhance market appeal.

Long-Term Growth Catalysts in Thailand Housing Industry

Long-term growth catalysts include ongoing innovation in building materials and technologies, strategic partnerships between developers and technology companies leading to enhanced efficiency and creating new housing models, and expansion into emerging markets like secondary cities outside Bangkok.

Emerging Opportunities in Thailand Housing Industry

Emerging opportunities include catering to the increasing demand for affordable housing solutions, leveraging technology for innovative financing options, and targeting the growing segment of eco-conscious consumers through sustainable housing projects.

Leading Players in the Thailand Housing Industry Sector

- LPN Development PCL

- Pruksa Real Estate Public Company Limited

- Hipflat

- Origin Property Public Co Ltd

- Land and Houses Public Company Limited

- Supalai Company Limited

- Property Perfect Public Company Limited

- Sansiri Public Co Ltd

- AP (THAILAND) PUBLIC COMPANY LIMITED

- Ananda Development Public Company Limited

- Quality Houses Public Company Limited

- Magnolia Quality Development Corp Co Ltd

Key Milestones in Thailand Housing Industry Industry

- 2020: Introduction of new building codes emphasizing energy efficiency.

- 2022: Launch of several large-scale affordable housing projects by the government.

- 2023: Significant increase in adoption of smart home technologies in new developments.

- 2024: Merger between two mid-sized developers, leading to increased market consolidation.

Strategic Outlook for Thailand Housing Industry Market

The Thailand housing market is poised for continued growth, driven by robust economic fundamentals and increasing urbanization. Strategic opportunities lie in focusing on sustainable and technologically advanced housing solutions, expanding into new markets, and forming strategic partnerships to enhance market reach and efficiency. The focus on affordable housing and leveraging technology for improved construction methods will play a key role in shaping the future of the sector.

Thailand Housing Industry Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Landed Houses and Villas

-

2. Key Cities

- 2.1. Bangkok

- 2.2. Chiang Mais

- 2.3. Nontha Buri

- 2.4. Samut Prakan

Thailand Housing Industry Segmentation By Geography

- 1. Thailand

Thailand Housing Industry Regional Market Share

Geographic Coverage of Thailand Housing Industry

Thailand Housing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Government initiatives and huge investments driving the market4.; Vision 2030 and allied projects driving the market

- 3.3. Market Restrains

- 3.3.1. 4.; High construction costs affecting the market4.; Limited land availability affecting the growth of the market

- 3.4. Market Trends

- 3.4.1. Bangkok and Vicinities Witnessing Growth in the Residential Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Housing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Landed Houses and Villas

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Bangkok

- 5.2.2. Chiang Mais

- 5.2.3. Nontha Buri

- 5.2.4. Samut Prakan

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 LPN Development PCL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Pruksa Real Estate Public Company Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hipflat

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Origin Property Public Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Land and Houses Public Company Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Supalai Company Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Property Perfect Public Company Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sansiri Public Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AP (THAILAND) PUBLIC COMPANY LIMITED

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ananda Development Public Company Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Quality Houses Public Company Limited*List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Magnolia Quality Development Corp Co Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 LPN Development PCL

List of Figures

- Figure 1: Thailand Housing Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Thailand Housing Industry Share (%) by Company 2025

List of Tables

- Table 1: Thailand Housing Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Thailand Housing Industry Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 3: Thailand Housing Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Thailand Housing Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Thailand Housing Industry Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 6: Thailand Housing Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Housing Industry?

The projected CAGR is approximately 5.54%.

2. Which companies are prominent players in the Thailand Housing Industry?

Key companies in the market include LPN Development PCL, Pruksa Real Estate Public Company Limited, Hipflat, Origin Property Public Co Ltd, Land and Houses Public Company Limited, Supalai Company Limited, Property Perfect Public Company Limited, Sansiri Public Co Ltd, AP (THAILAND) PUBLIC COMPANY LIMITED, Ananda Development Public Company Limited, Quality Houses Public Company Limited*List Not Exhaustive, Magnolia Quality Development Corp Co Ltd.

3. What are the main segments of the Thailand Housing Industry?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 154.51 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Government initiatives and huge investments driving the market4.; Vision 2030 and allied projects driving the market.

6. What are the notable trends driving market growth?

Bangkok and Vicinities Witnessing Growth in the Residential Sector.

7. Are there any restraints impacting market growth?

4.; High construction costs affecting the market4.; Limited land availability affecting the growth of the market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Housing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Housing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Housing Industry?

To stay informed about further developments, trends, and reports in the Thailand Housing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence