Key Insights

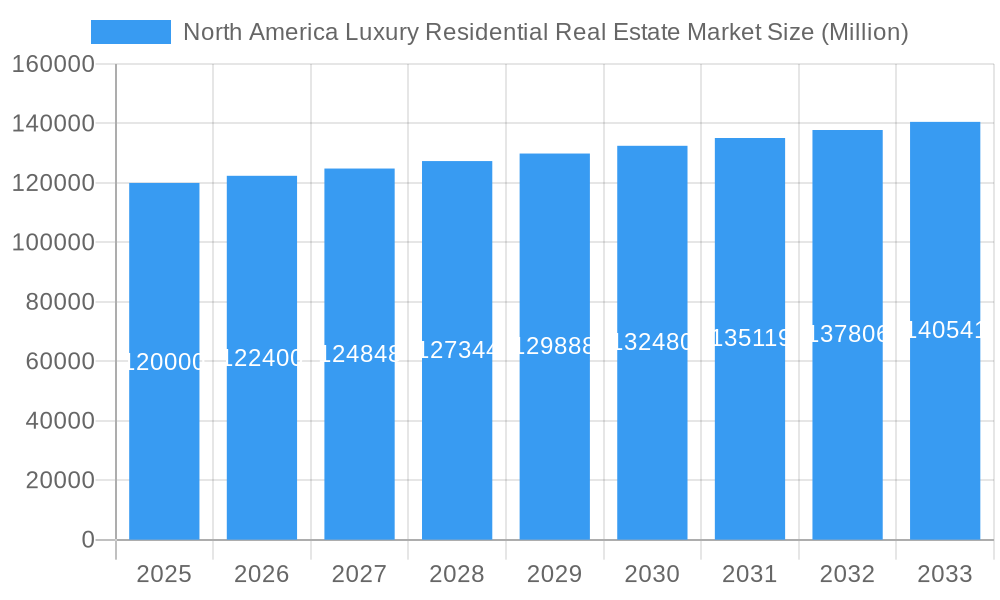

The North American luxury residential real estate market, encompassing villas, landed houses, apartments, and condominiums, demonstrates significant growth potential. With a current market size of $600 billion and a projected Compound Annual Growth Rate (CAGR) of 6% from 2024 to 2033, the sector is poised for expansion. Key drivers include a rising number of high-net-worth individuals, a strong preference for upscale living, and robust demand in prime urban and resort locations. Urbanization and the increasing view of luxury properties as investments further fuel this growth. The villas and landed houses segment is anticipated to lead market share, driven by a desire for spaciousness and privacy. While construction costs and interest rates present potential challenges, the market outlook remains positive. Major developers like Wood Partners, PulteGroup, Lennar Corporation, and Toll Brothers are well-positioned to capitalize on this expansion. The United States is expected to retain a dominant market share within North America due to its strong economy and established luxury real estate landscape.

North America Luxury Residential Real Estate Market Market Size (In Billion)

Market segmentation by property type highlights distinct trends. The villas and landed houses segment appeals to buyers prioritizing spaciousness and privacy. Conversely, apartments and condominiums offer an urban lifestyle with convenient access to amenities. Intense competition among developers is spurring innovation in design, amenities, and sustainability to attract discerning buyers. Future growth will be shaped by economic conditions, housing policies, and evolving consumer preferences for luxury living. Geographical expansion into secondary markets with growth potential is a key developer strategy. The North American luxury residential real estate market forecasts sustained growth and innovation throughout the projection period.

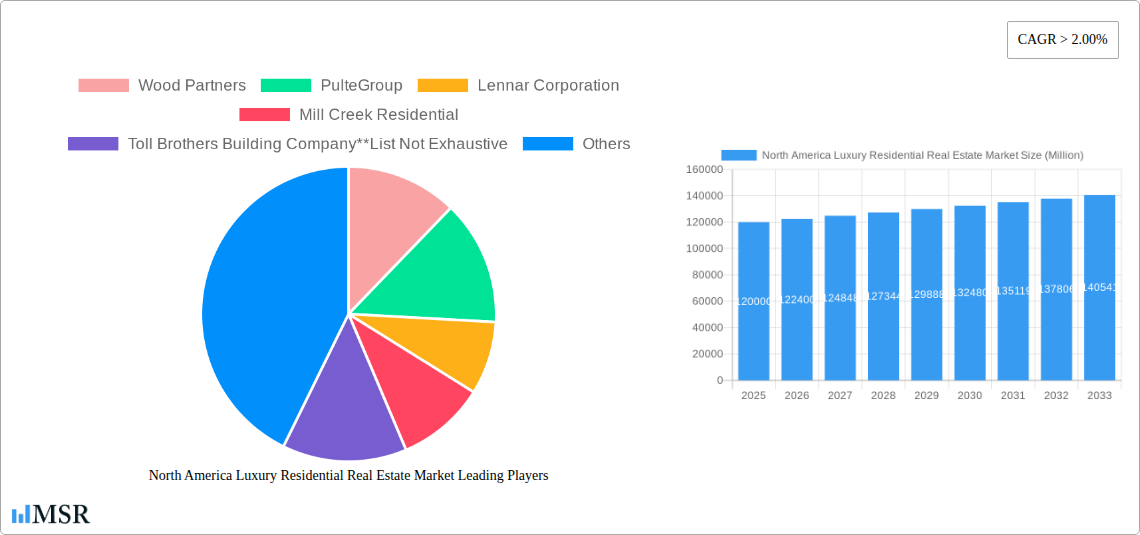

North America Luxury Residential Real Estate Market Company Market Share

North America Luxury Residential Real Estate Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North American luxury residential real estate market, offering invaluable insights for investors, developers, and industry stakeholders. Covering the period from 2019 to 2033, with a focus on 2025, this report delivers a detailed forecast and identifies key trends shaping this lucrative sector. The report meticulously examines market dynamics, key players, and emerging opportunities, empowering informed decision-making and strategic planning.

North America Luxury Residential Real Estate Market Concentration & Dynamics

The North American luxury residential real estate market exhibits a moderately concentrated landscape, with a few dominant players commanding significant market share. Based on 2024 data, the top five companies—Toll Brothers Building Company, PulteGroup, Lennar Corporation, D R Horton Home Construction, and Wood Partners—hold an estimated xx% collective market share. This concentration is influenced by factors such as brand recognition, extensive land holdings, and robust financial resources. However, a vibrant ecosystem of smaller, specialized developers and boutique firms also contributes significantly to niche segments within the luxury market.

The market's dynamics are shaped by several factors:

- Innovation Ecosystems: Technological advancements in construction materials, design software, and marketing strategies are driving innovation and enhancing the luxury residential experience. The use of sustainable building materials and smart home technologies is becoming increasingly prevalent.

- Regulatory Frameworks: Local zoning regulations, building codes, and environmental protection laws significantly impact development costs and project timelines. Variations across different states and municipalities create complexities for national developers.

- Substitute Products: While true substitutes for luxury homes are limited, alternative investment options like high-end condominiums or private club memberships exert some competitive pressure.

- End-User Trends: A rising affluent population, combined with shifting preferences towards sustainable and technologically advanced living spaces, are key demand drivers. Demand is particularly strong for properties with high-end amenities, smart home features, and convenient locations.

- M&A Activities: The number of M&A deals in the luxury residential sector has remained relatively stable in recent years, averaging xx deals annually between 2019 and 2024. Larger companies are strategically acquiring smaller firms to expand their geographic reach and product portfolios.

North America Luxury Residential Real Estate Market Industry Insights & Trends

The North American luxury residential real estate market is experiencing robust growth, driven by several key factors. The market size reached approximately $XX Million in 2024 and is projected to reach $XX Million by 2033, exhibiting a compound annual growth rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by a combination of factors:

- Strong Economic Growth: Sustained economic expansion in major North American cities has boosted disposable incomes, fueling demand for luxury properties.

- Favorable Demographics: An expanding population of high-net-worth individuals continues to drive demand for upscale residential options.

- Technological Disruptions: The integration of smart home technology, sustainable building materials, and innovative design concepts is reshaping the luxury residential landscape.

- Evolving Consumer Behaviors: The increasing preference for personalized living spaces, high-end amenities, and prime locations has pushed luxury home developers to innovate and adapt.

- Urbanization Trends: The concentration of wealth in major metropolitan areas is driving demand for luxury properties in urban centers.

Key Markets & Segments Leading North America Luxury Residential Real Estate Market

While the luxury residential market spans across North America, key regions like California, Florida, and the Northeast corridor consistently demonstrate robust performance. Within these areas, certain segments are particularly dominant:

- Dominant Segment: Villas and Landed Houses: Villas and landed houses represent the largest segment in the luxury market, commanding approximately xx% of the total market value in 2024.

Drivers of Villa and Landed House Dominance:

Larger Property Sizes: Offer more space and privacy than apartments or condominiums.

Customization Options: Allow for greater personalization and design flexibility.

Outdoor Spaces: Typically include significant outdoor areas, such as gardens, pools, and patios.

Prestige and Status: Are often associated with a higher level of prestige and status.

Strong Investment Potential: Historically have shown strong appreciation in value.

Apartments and Condominiums: This segment caters to a growing population seeking luxury living in urban centers with convenient amenities and lower maintenance requirements.

Detailed Dominance Analysis: The dominance of villas and landed houses stems from consumer preferences for larger living spaces, privacy, and outdoor amenities. The prestige associated with owning a large, custom-built home also plays a role. However, the apartment and condominium segment is experiencing steady growth, driven by a growing number of high-net-worth individuals preferring urban living and the desire for low-maintenance lifestyles. This trend is especially pronounced in major metropolitan areas with strong economies and established luxury residential developments.

North America Luxury Residential Real Estate Market Product Developments

Recent product innovations in the luxury residential market focus on incorporating smart home technology, sustainable building materials, and enhanced security features. This includes the integration of smart thermostats, lighting systems, and security cameras, as well as the use of energy-efficient appliances and materials. These advancements offer increased convenience, enhanced energy efficiency, and a competitive edge for developers. The growing demand for sustainable luxury properties has also spurred the adoption of eco-friendly materials and design strategies.

Challenges in the North America Luxury Residential Real Estate Market Market

The North American luxury residential real estate market faces several challenges, including:

- Regulatory Hurdles: Complex zoning regulations and permitting processes can delay project timelines and increase development costs.

- Supply Chain Issues: Disruptions in the global supply chain have impacted the availability and cost of building materials, leading to project delays and increased expenses.

- Competitive Pressures: Intense competition among established developers and new entrants is placing downward pressure on profit margins. This is particularly true in highly saturated markets.

- Economic Uncertainty: Fluctuations in the economy and interest rates can impact consumer demand.

Forces Driving North America Luxury Residential Real Estate Market Growth

Several factors are driving the growth of the North American luxury residential real estate market, including:

- Technological Advancements: Smart home integration, sustainable building materials, and innovative design concepts are enhancing the luxury living experience and driving demand.

- Economic Expansion: Continued economic growth in key markets is increasing disposable incomes, fueling demand for luxury properties.

- Favorable Regulatory Environment: In some regions, supportive government policies encourage investment in luxury residential development.

Long-Term Growth Catalysts in the North America Luxury Residential Real Estate Market

Long-term growth in this sector will be fueled by continued innovation in sustainable building practices and smart home technologies, strategic partnerships between developers and technology companies, and expansion into new markets with high growth potential.

Emerging Opportunities in North America Luxury Residential Real Estate Market

Emerging opportunities include the growing demand for luxury rental properties, the rise of co-living spaces, and the increasing focus on wellness and sustainability in luxury home design. The expansion into secondary markets with growing affluent populations also presents significant opportunities.

Leading Players in the North America Luxury Residential Real Estate Market Sector

- Wood Partners

- PulteGroup

- Lennar Corporation

- Mill Creek Residential

- Toll Brothers Building Company

- Alliance Residential

- D R Horton Home Construction

- Century Communities

- The Michaels Organization

- LMC Residential

Key Milestones in North America Luxury Residential Real Estate Market Industry

- 2020: Increased adoption of virtual tours and online platforms for property showcasing.

- 2021: Significant rise in demand for properties with home offices and outdoor spaces due to pandemic-related work-from-home trends.

- 2022: Several major luxury residential developments launched featuring smart home technology and sustainable design features.

- 2023: Increased focus on ESG (environmental, social, and governance) factors influencing investment decisions in the sector.

- 2024: Several mergers and acquisitions among leading developers aiming to consolidate market share and expand geographic reach.

Strategic Outlook for North America Luxury Residential Real Estate Market Market

The North American luxury residential real estate market is poised for sustained growth, driven by strong economic fundamentals, evolving consumer preferences, and technological advancements. Strategic opportunities exist for developers who focus on sustainable and technologically advanced designs, cater to the evolving needs of affluent buyers, and successfully navigate regulatory complexities. The long-term outlook remains positive, with significant potential for expansion in key markets and emerging opportunities in new segments.

North America Luxury Residential Real Estate Market Segmentation

-

1. Type

- 1.1. Villas and Landed Houses

- 1.2. Apartments and Condominiums

-

2. Geography

- 2.1. United States

- 2.2. Mexico

- 2.3. Canada

North America Luxury Residential Real Estate Market Segmentation By Geography

- 1. United States

- 2. Mexico

- 3. Canada

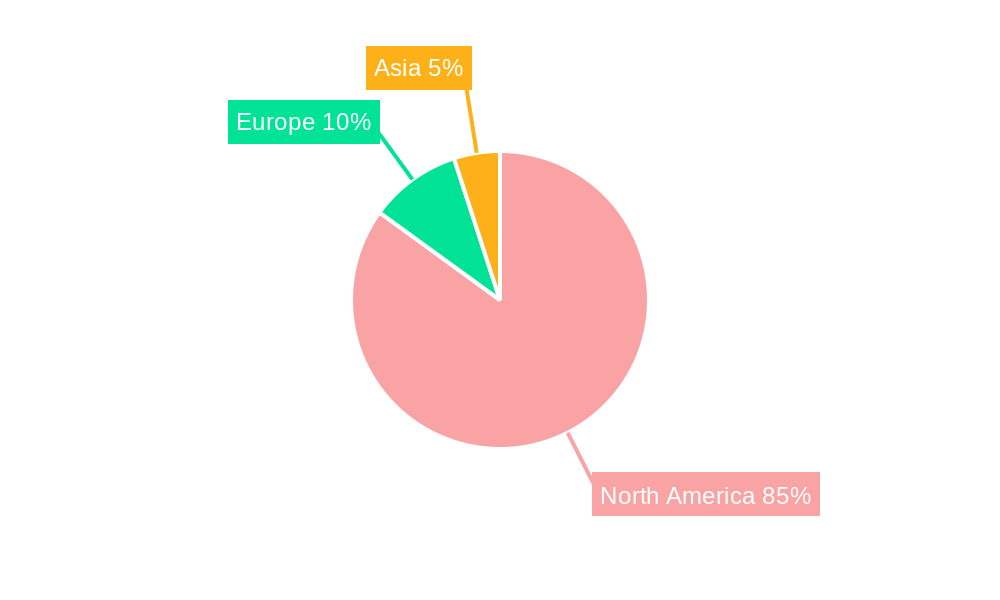

North America Luxury Residential Real Estate Market Regional Market Share

Geographic Coverage of North America Luxury Residential Real Estate Market

North America Luxury Residential Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in GDP contribution from Construction Industry; Increase in Number of Building Permits

- 3.3. Market Restrains

- 3.3.1. High Initial Investments

- 3.4. Market Trends

- 3.4.1. Emergence of the Millennial Generation in USA

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Luxury Residential Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Villas and Landed Houses

- 5.1.2. Apartments and Condominiums

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United States

- 5.2.2. Mexico

- 5.2.3. Canada

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Mexico

- 5.3.3. Canada

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Luxury Residential Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Villas and Landed Houses

- 6.1.2. Apartments and Condominiums

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United States

- 6.2.2. Mexico

- 6.2.3. Canada

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Mexico North America Luxury Residential Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Villas and Landed Houses

- 7.1.2. Apartments and Condominiums

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United States

- 7.2.2. Mexico

- 7.2.3. Canada

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Canada North America Luxury Residential Real Estate Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Villas and Landed Houses

- 8.1.2. Apartments and Condominiums

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United States

- 8.2.2. Mexico

- 8.2.3. Canada

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Wood Partners

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 PulteGroup

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Lennar Corporation

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Mill Creek Residential

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Toll Brothers Building Company**List Not Exhaustive

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Alliance Residential

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 D R Horton Home Construction

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Century Communities

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 The Michaels Organization

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 LMC Residential

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Wood Partners

List of Figures

- Figure 1: North America Luxury Residential Real Estate Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Luxury Residential Real Estate Market Share (%) by Company 2025

List of Tables

- Table 1: North America Luxury Residential Real Estate Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: North America Luxury Residential Real Estate Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 3: North America Luxury Residential Real Estate Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: North America Luxury Residential Real Estate Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: North America Luxury Residential Real Estate Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: North America Luxury Residential Real Estate Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: North America Luxury Residential Real Estate Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: North America Luxury Residential Real Estate Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 9: North America Luxury Residential Real Estate Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: North America Luxury Residential Real Estate Market Revenue billion Forecast, by Type 2020 & 2033

- Table 11: North America Luxury Residential Real Estate Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: North America Luxury Residential Real Estate Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Luxury Residential Real Estate Market?

The projected CAGR is approximately 6%.

2. Which companies are prominent players in the North America Luxury Residential Real Estate Market?

Key companies in the market include Wood Partners, PulteGroup, Lennar Corporation, Mill Creek Residential, Toll Brothers Building Company**List Not Exhaustive, Alliance Residential, D R Horton Home Construction, Century Communities, The Michaels Organization, LMC Residential.

3. What are the main segments of the North America Luxury Residential Real Estate Market?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 600 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in GDP contribution from Construction Industry; Increase in Number of Building Permits.

6. What are the notable trends driving market growth?

Emergence of the Millennial Generation in USA.

7. Are there any restraints impacting market growth?

High Initial Investments.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Luxury Residential Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Luxury Residential Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Luxury Residential Real Estate Market?

To stay informed about further developments, trends, and reports in the North America Luxury Residential Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence