Key Insights

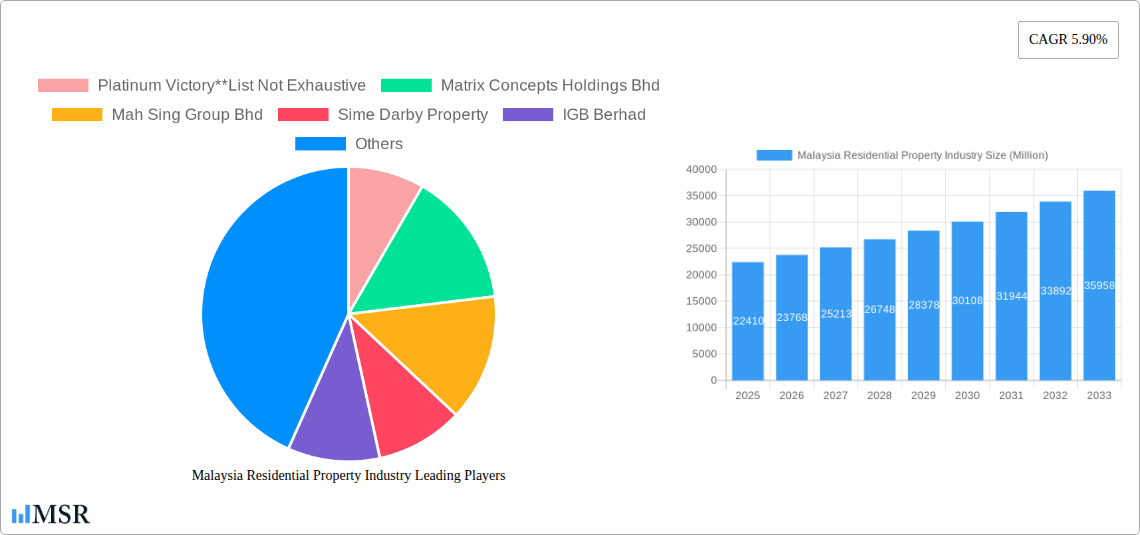

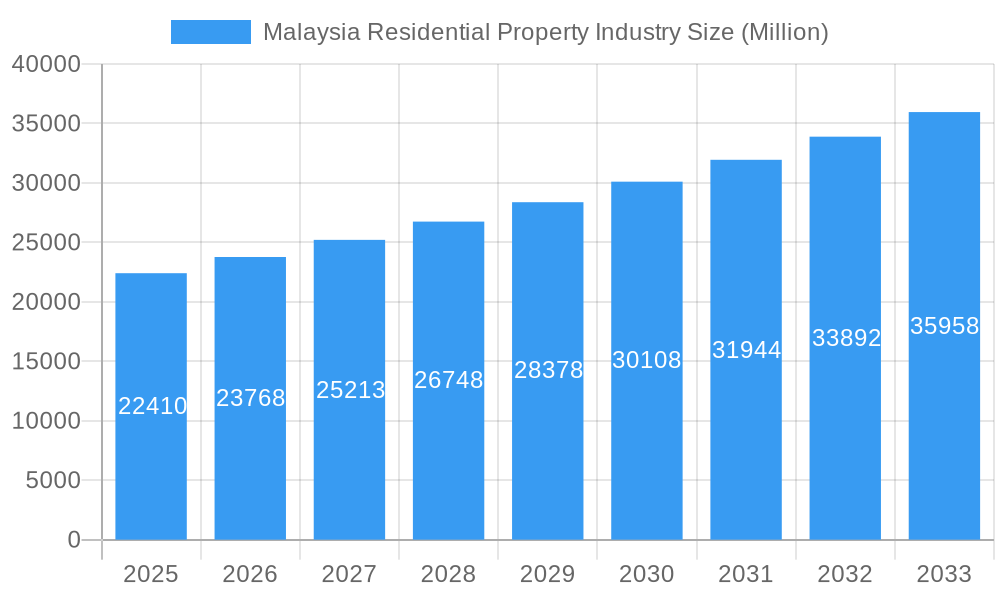

The Malaysian residential property market, valued at RM22.41 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.90% from 2025 to 2033. This growth is fueled by several key factors. Increasing urbanization, particularly in major cities like Kuala Lumpur, Johor Bahru, George Town, and Seberang Perai, drives demand for housing, especially apartments, condominiums, landed houses, and villas. Government initiatives aimed at affordable housing and infrastructure development further contribute to market expansion. The presence of established and reputable developers such as Platinum Victory, Matrix Concepts Holdings Bhd, Mah Sing Group Bhd, Sime Darby Property, IGB Berhad, IOI Properties, Glomac Bhd, S P Setia, UEM Sunrise, and Eco World Development Group Berhad, indicates a healthy and competitive landscape. However, challenges such as fluctuating interest rates, material cost increases, and potential economic uncertainties could moderate growth in certain periods. The market segmentation reveals a strong preference for apartments and condominiums in high-density urban areas, while landed properties remain popular in suburban and more spacious settings. The consistent growth trajectory indicates a promising outlook for investors and developers, although careful consideration of market fluctuations and economic trends is crucial for long-term success.

Malaysia Residential Property Industry Market Size (In Billion)

The forecast period (2025-2033) anticipates a steady increase in market value, reflecting the ongoing demand for residential properties in Malaysia. Strategic investments in infrastructure, combined with the country’s economic growth, will likely support this positive trend. The distribution across different property types (apartments/condominiums vs. landed houses/villas) and key cities reflects distinct market segments with varying growth potentials. Analyzing these segments allows developers and investors to make informed decisions regarding property development and investment strategies. Continued monitoring of macroeconomic indicators, government policies, and consumer preferences is essential for navigating the dynamic nature of the Malaysian residential property market effectively.

Malaysia Residential Property Industry Company Market Share

Malaysia Residential Property Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Malaysian residential property industry, covering market dynamics, key trends, leading players, and future growth prospects. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033. This report is crucial for investors, developers, real estate professionals, and anyone seeking to understand this dynamic market. The report utilizes data from 2019-2024 (Historical Period) to project the market to 2033. Market values are expressed in Millions.

Malaysia Residential Property Industry Market Concentration & Dynamics

This section assesses the concentration of the Malaysian residential property market, examining innovation, regulatory frameworks, substitute products, end-user trends, and mergers & acquisitions (M&A) activities. The market is characterized by a moderately concentrated landscape with several large players holding significant market share. However, a growing number of smaller developers are also emerging.

- Market Share: The top 5 players (Sime Darby Property, Mah Sing Group Bhd, IGB Berhad, IOI Properties, and SP Setia) collectively hold an estimated xx% market share in 2025. This is expected to slightly decrease to xx% by 2033 due to increased competition.

- M&A Activity: The period from 2019-2024 witnessed xx M&A deals in the Malaysian residential property sector. Key transactions include PropertyGuru's acquisition of iProperty Malaysia (Dec 2022) and Knight Frank's acquisition of Property Hub Sdn Bhd (Apr 2022). This trend is expected to continue, driven by consolidation and expansion strategies.

- Innovation Ecosystem: The Malaysian residential property market is witnessing increased adoption of PropTech, leading to innovative solutions in areas such as property management, online marketing, and virtual tours.

- Regulatory Framework: Government regulations, such as housing policies and building codes, significantly impact market dynamics. Changes in these regulations can influence investment decisions and development patterns.

- Substitute Products: The availability of rental properties and alternative housing solutions (e.g., serviced apartments) presents some level of competition to the residential property market. However, the demand for homeownership remains strong.

- End-User Trends: Increasing urbanization, evolving preferences for sustainable housing, and changing demographic patterns influence demand for different types of residential properties.

Malaysia Residential Property Industry Industry Insights & Trends

The Malaysian residential property market exhibits significant growth potential, driven by various factors. The market size in 2025 is estimated at RM xx Million, with a Compound Annual Growth Rate (CAGR) of xx% projected from 2025 to 2033. Key growth drivers include sustained economic growth, robust population increase, government initiatives promoting affordable housing, and rising urbanization.

Technological disruptions, such as the growing use of PropTech and big data analytics, are transforming the industry, enhancing efficiency and transparency. Furthermore, changing consumer preferences, including a growing preference for sustainable and smart homes, are reshaping product offerings and design strategies. The shift towards online property searches and transactions is also a noteworthy trend.

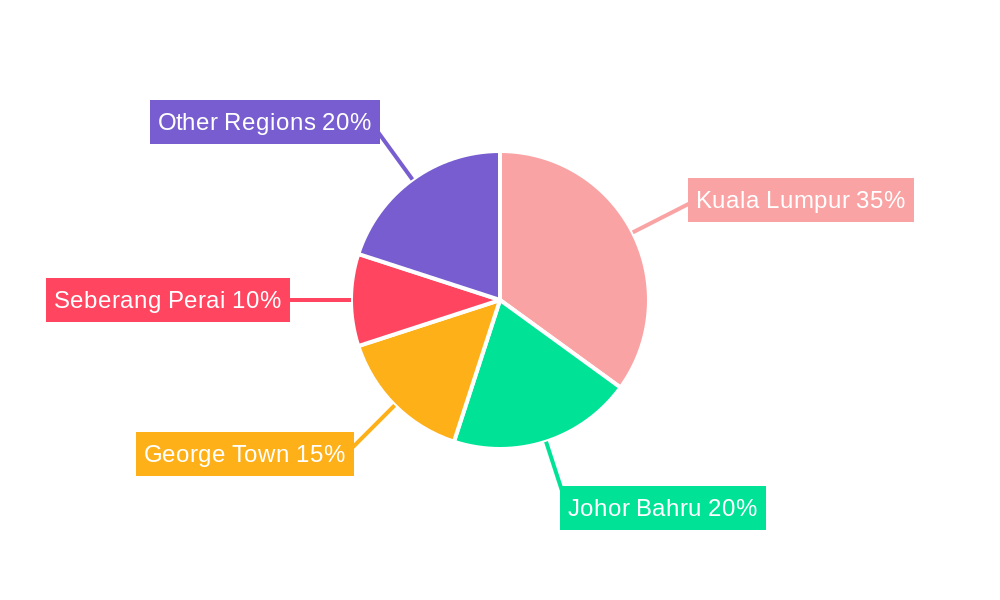

Key Markets & Segments Leading Malaysia Residential Property Industry

The Kuala Lumpur metropolitan area remains the dominant market segment, followed by Johor Bahru. Within property types, apartments and condominiums continue to experience strong demand, largely driven by affordability and location preferences.

Drivers for Kuala Lumpur: Strong economic activity, well-developed infrastructure, high employment rates, and a large concentration of multinational corporations drive demand for residential properties in Kuala Lumpur.

Drivers for Johor Bahru: Proximity to Singapore, rising affluence, and infrastructure developments (e.g., the Rapid Transit System) fuel the growth of the Johor Bahru residential property market.

Apartments and Condominiums: High demand driven by affordability and location in major urban centers.

Landed Houses and Villas: Continued demand, albeit with a more price-sensitive market. Growth is driven by higher disposable incomes and preferences for spacious living, particularly in suburban areas.

Seberang Perai & George Town: These markets exhibit a strong mix of both segments, largely driven by local demand and tourism related activities.

Malaysia Residential Property Industry Product Developments

The residential property sector is seeing notable product innovations, particularly in green building technologies, smart home features, and improved property management systems facilitated by PropTech. These innovations provide competitive advantages for developers, enhancing the value proposition for buyers and attracting environmentally conscious consumers. The integration of sustainable designs and smart technology is increasingly becoming a standard feature in new developments.

Challenges in the Malaysia Residential Property Industry Market

The industry faces challenges including regulatory complexities, particularly concerning land acquisition and approvals; fluctuating material prices and supply chain disruptions impacting construction costs; and intense competition from established and new players. These factors can result in project delays and margin pressures for developers.

Forces Driving Malaysia Residential Property Industry Growth

Technological advancements, including PropTech adoption, are driving efficiency and streamlining processes. Government initiatives aimed at improving affordability, such as affordable housing schemes and infrastructure development, bolster market growth. Economic growth and rising incomes further stimulate demand for residential properties.

Challenges in the Malaysia Residential Property Industry Market

Long-term growth catalysts are driven by continuous innovation, strategic partnerships that leverage technology and expertise, and expanding into new markets both domestically and potentially internationally for some larger developers. The focus on sustainable development practices and providing affordable housing solutions to a growing population remains essential for sustained success.

Emerging Opportunities in Malaysia Residential Property Industry

Opportunities lie in the development of eco-friendly and sustainable housing, catering to the growing demand for environmentally conscious homes. The integration of smart home technology and personalized property management solutions through PropTech offers another avenue for growth. Furthermore, exploring new markets and leveraging emerging technologies to enhance the customer experience remains crucial.

Leading Players in the Malaysia Residential Property Industry Sector

- Platinum Victory

- Matrix Concepts Holdings Bhd

- Mah Sing Group Bhd

- Sime Darby Property

- IGB Berhad

- IOI Properties

- Glomac Bhd

- S P Setia

- UEM Sunrise

- Eco World Development Group Berhad

Key Milestones in Malaysia Residential Property Industry Industry

- December 2022: PropertyGuru acquires iProperty Malaysia, leading to a significant consolidation in the online property portal market.

- April 2022: Knight Frank Malaysia expands its residential market presence through the acquisition of Property Hub Sdn Bhd.

Strategic Outlook for Malaysia Residential Property Industry Market

The Malaysian residential property market is poised for sustained growth, driven by a robust economy, growing population, and increasing urbanization. Strategic opportunities lie in focusing on sustainable and smart home technologies, catering to evolving consumer preferences, and proactively addressing regulatory hurdles. Companies adapting to technological advancements and embracing innovative approaches will be best positioned to capture significant market share in the coming years.

Malaysia Residential Property Industry Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Landed Houses and Villas

-

2. Key Cities

- 2.1. Kuala Lumpur

- 2.2. Seberang Perai

- 2.3. George Town

- 2.4. Johor Bahru

Malaysia Residential Property Industry Segmentation By Geography

- 1. Malaysia

Malaysia Residential Property Industry Regional Market Share

Geographic Coverage of Malaysia Residential Property Industry

Malaysia Residential Property Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Residential Real Estate Demand by Young People4.; Increase in Average Housing Price in Mexico

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of Affordable Housing Inhibiting the Growth of the Market4.; Economic Instability Affecting the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Increase in Urbanization Boosting Demand for Residential Real Estate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Malaysia Residential Property Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Landed Houses and Villas

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Kuala Lumpur

- 5.2.2. Seberang Perai

- 5.2.3. George Town

- 5.2.4. Johor Bahru

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Malaysia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Platinum Victory**List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Matrix Concepts Holdings Bhd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Mah Sing Group Bhd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sime Darby Property

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 IGB Berhad

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 IOI Properties

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Glomac Bhd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 S P Setia

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 UEM Sunrise

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Eco World Development Group Berhad

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Platinum Victory**List Not Exhaustive

List of Figures

- Figure 1: Malaysia Residential Property Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Malaysia Residential Property Industry Share (%) by Company 2025

List of Tables

- Table 1: Malaysia Residential Property Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Malaysia Residential Property Industry Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 3: Malaysia Residential Property Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Malaysia Residential Property Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Malaysia Residential Property Industry Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 6: Malaysia Residential Property Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Malaysia Residential Property Industry?

The projected CAGR is approximately 5.90%.

2. Which companies are prominent players in the Malaysia Residential Property Industry?

Key companies in the market include Platinum Victory**List Not Exhaustive, Matrix Concepts Holdings Bhd, Mah Sing Group Bhd, Sime Darby Property, IGB Berhad, IOI Properties, Glomac Bhd, S P Setia, UEM Sunrise, Eco World Development Group Berhad.

3. What are the main segments of the Malaysia Residential Property Industry?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 22.41 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Residential Real Estate Demand by Young People4.; Increase in Average Housing Price in Mexico.

6. What are the notable trends driving market growth?

Increase in Urbanization Boosting Demand for Residential Real Estate.

7. Are there any restraints impacting market growth?

4.; Lack of Affordable Housing Inhibiting the Growth of the Market4.; Economic Instability Affecting the Growth of the Market.

8. Can you provide examples of recent developments in the market?

December 2022: The south-east Asian real estate technology company, The PropertyGuru Group, has finalized the acquisition of iProperty Malaysia. Given that two brands (PropertyGuru and iProperty) are merging, they currently have a huge duty. The acquisition enables them to concentrate on what they believe is necessary to support their clients, and they aim to provide them with even more value.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Malaysia Residential Property Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Malaysia Residential Property Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Malaysia Residential Property Industry?

To stay informed about further developments, trends, and reports in the Malaysia Residential Property Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence