Key Insights

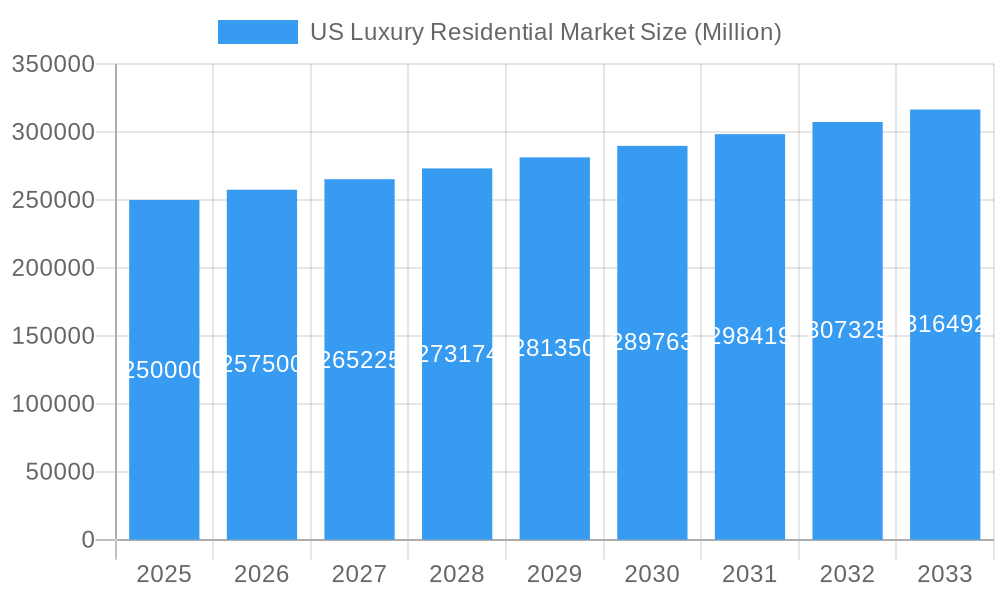

The US luxury residential market, valued at approximately $250 billion in 2025, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 3% through 2033. This expansion is driven by several key factors. Firstly, a persistent increase in high-net-worth individuals fuels demand for upscale properties in prime locations. Secondly, historically low interest rates in recent years (though this is a fluctuating factor) have incentivized luxury home purchases. Furthermore, a preference for larger, more amenity-rich homes, coupled with a desire for privacy and exclusivity, further strengthens this market segment. The market is segmented by property type (apartments/condominiums, villas/landed houses) and geographically, with major cities like New York, Los Angeles, San Francisco, Miami, and Washington D.C. dominating market share due to their concentration of affluent residents and desirable lifestyles. Competition is fierce, with established national builders like Toll Brothers and D.R. Horton vying for market dominance alongside a multitude of regional and custom home builders catering to specific design preferences and luxury demands.

US Luxury Residential Market Market Size (In Billion)

Despite the positive outlook, several factors could restrain growth. Rising construction costs and material shortages, particularly impacting the availability of skilled labor, may lead to price increases and potentially slow down project completion rates. Furthermore, economic downturns or shifts in interest rate policies could dampen buyer demand. The market's vulnerability to economic fluctuations necessitates ongoing monitoring of macroeconomic indicators to accurately predict future trends. Nevertheless, the long-term forecast remains positive, anticipating continued growth spurred by the enduring appeal of luxury real estate as a desirable asset class in the US. This growth will be largely driven by continued demand in key metropolitan areas and a preference for high-end features and customized living spaces.

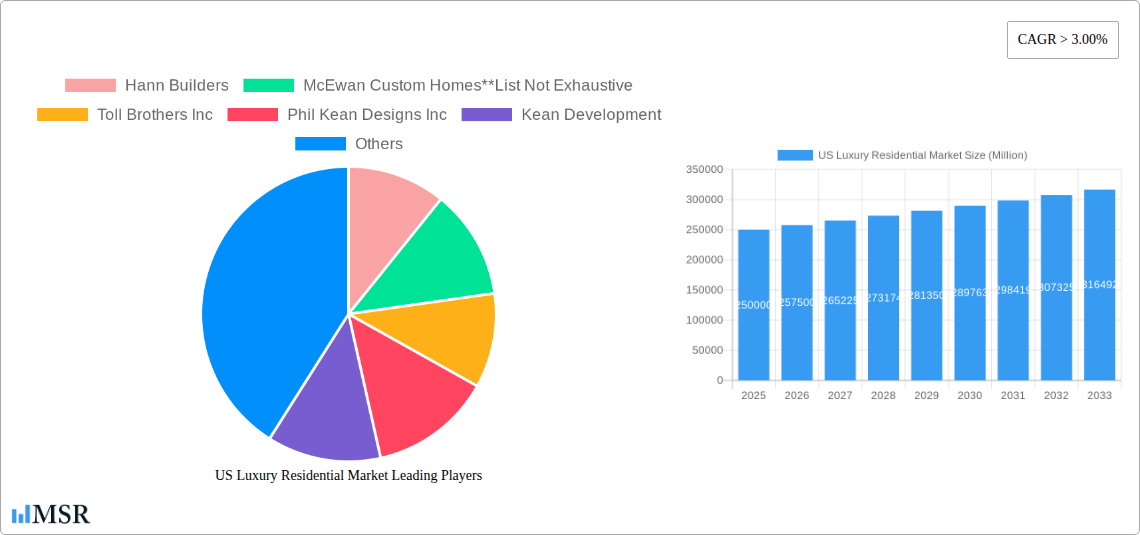

US Luxury Residential Market Company Market Share

US Luxury Residential Market Report: 2019-2033 Forecast

Uncover lucrative investment opportunities and navigate the complexities of the high-end US residential real estate sector with our comprehensive market analysis. This in-depth report provides a detailed examination of the US luxury residential market, projecting growth trends from 2019 to 2033, with a focus on 2025. We analyze market dynamics, key players, emerging opportunities, and challenges to provide actionable insights for investors, developers, and industry stakeholders.

US Luxury Residential Market Market Concentration & Dynamics

This section analyzes the competitive landscape of the US luxury residential market, assessing market concentration, innovation ecosystems, regulatory frameworks, substitute products, end-user trends, and M&A activities. The market is characterized by a moderate level of concentration, with a few large players like Toll Brothers Inc. holding significant market share, while numerous smaller, specialized firms like Hann Builders and McEwan Custom Homes cater to niche segments. The market share of the top 5 players is estimated at 35% in 2025.

- Innovation Ecosystems: Significant innovation is seen in sustainable building materials, smart home technology integration, and architectural design.

- Regulatory Frameworks: Zoning regulations, building codes, and environmental protection laws significantly impact development and construction.

- Substitute Products: While limited, alternative investment options such as commercial real estate or high-yield bonds exert some competitive pressure.

- End-User Trends: Growing demand for luxury amenities, sustainable features, and unique architectural designs drives market growth. Demand for larger properties in suburban areas is increasing due to changes in remote work preferences.

- M&A Activities: The number of M&A deals in the luxury residential sector averaged 25 annually during the historical period (2019-2024), with a projected increase to 30 deals annually during the forecast period (2025-2033).

US Luxury Residential Market Industry Insights & Trends

The US luxury residential market experienced significant growth during the historical period (2019-2024), with market size reaching $xx Million in 2024. The market is projected to continue its upward trajectory, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching an estimated market size of $xx Million by 2033. Several factors contribute to this growth. High-net-worth individuals continue to invest in luxury real estate as a safe haven asset and for lifestyle reasons. Technological advancements in smart home technology and sustainable building practices are driving demand. Evolving consumer preferences are reflected in the increasing demand for larger properties with luxurious amenities in desirable locations. Furthermore, low interest rates in the early part of the study period stimulated the market. However, interest rate increases in the recent past have had a moderating effect. Nevertheless, the long-term outlook remains strong.

Key Markets & Segments Leading US Luxury Residential Market

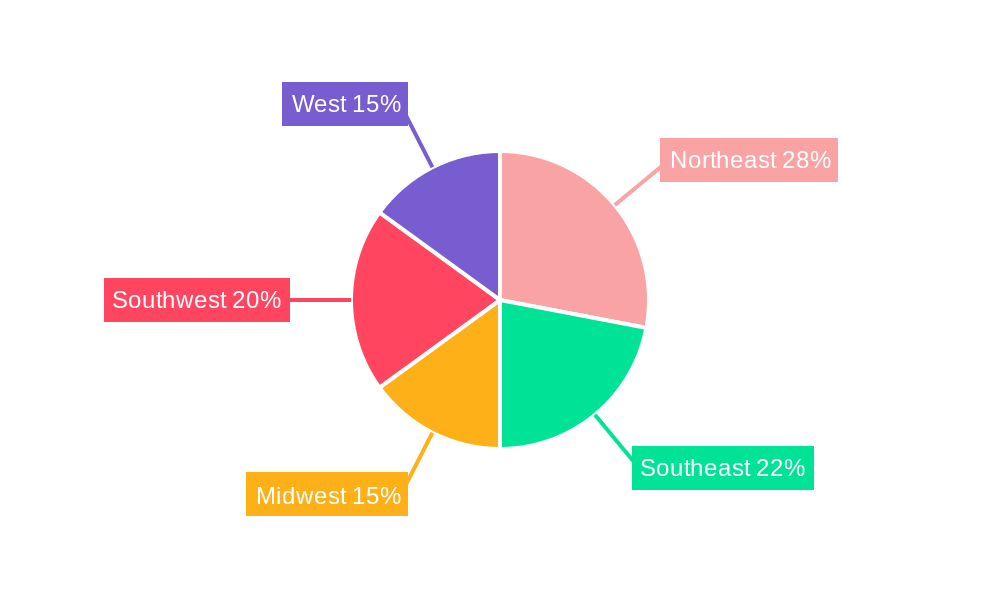

The New York, Los Angeles, and San Francisco metropolitan areas dominate the US luxury residential market, representing approximately 60% of the total market value in 2025. Miami and Washington D.C. also contribute significantly to the overall market.

By Type: Villas and landed houses constitute the largest segment within the luxury housing market, reflecting a preference for spaciousness and privacy.

By City:

- New York: Strong economic activity, high concentration of high-net-worth individuals, and limited land availability drive high prices and strong demand.

- Los Angeles: Desirable climate, celebrity culture, and a large entertainment industry contribute to the high demand.

- San Francisco: Technological innovation and a high concentration of tech professionals fuel the luxury housing market.

- Miami: International appeal, warm climate, and beach lifestyle attract wealthy buyers.

- Washington D.C.: Political influence, high salaries, and a desirable location draw buyers.

Drivers:

- Strong economic growth in key metropolitan areas.

- Robust infrastructure development and improvements.

- High concentration of high-net-worth individuals.

- Increasing demand for luxury amenities and unique architectural designs.

US Luxury Residential Market Product Developments

Technological advancements are transforming luxury residential construction. Smart home technology integration, including automated lighting, security systems, and energy management, is becoming increasingly common. The use of sustainable building materials and energy-efficient designs is gaining traction, driven by both environmental concerns and cost savings. These innovations provide a competitive edge for builders and appeal to environmentally conscious buyers. Furthermore, customized designs that cater to the unique needs and preferences of high-net-worth individuals are in high demand.

Challenges in the US Luxury Residential Market Market

The luxury residential market faces several challenges. Supply chain disruptions continue to impact construction timelines and costs. Increasing material costs, particularly lumber and steel, contribute to higher construction expenses, which in turn puts pressure on profitability and pricing. Regulatory hurdles, including zoning restrictions and environmental approvals, can delay projects and increase costs. Finally, increased interest rates have impacted the overall cost of financing luxury properties, causing a slowdown in demand.

Forces Driving US Luxury Residential Market Growth

Key growth drivers include increasing disposable income among high-net-worth individuals, a preference for luxury amenities and upscale living, and technological advancements enhancing the functionality and sustainability of luxury homes. Government incentives and policies that promote sustainable building practices further drive market expansion. These factors create opportunities for both established players and newcomers in the luxury residential market.

Long-Term Growth Catalysts in the US Luxury Residential Market

Long-term growth in the US luxury residential market is fueled by continued innovation in building technologies, including sustainable designs and smart home integration. Strategic partnerships between developers, architects, and technology companies will further enhance product offerings and attract discerning buyers. Expansion into new markets, particularly in high-growth regions, and increased emphasis on personalized luxury experiences will sustain growth over the long term.

Emerging Opportunities in US Luxury Residential Market

Emerging opportunities lie in sustainable and energy-efficient construction, smart home technology integration, and customized designs catering to the individual preferences of luxury homebuyers. The increasing demand for wellness features in homes presents another significant opportunity for developers. Furthermore, exploring new markets and strategic partnerships can help established players expand and maintain a competitive edge.

Leading Players in the US Luxury Residential Market Sector

- Toll Brothers Inc

- Hann Builders

- McEwan Custom Homes

- Phil Kean Designs Inc

- Kean Development

- Calvis Wyant

- Wardell Builders

- D R Horton

- Haley Custom Homes

- Bob Thompson Homes

Key Milestones in US Luxury Residential Market Industry

- 2020: Increased demand for suburban luxury homes due to the COVID-19 pandemic and shift to remote work.

- 2021: Significant increase in material costs and supply chain disruptions impacting construction projects.

- 2022: Rising interest rates began to slow luxury home sales.

- 2023: Continued focus on sustainable and energy-efficient luxury home construction.

- 2024: Emerging trend of incorporating wellness features into luxury homes.

Strategic Outlook for US Luxury Residential Market Market

The US luxury residential market is poised for continued growth, driven by sustained demand for high-end properties and technological advancements. Strategic partnerships, focusing on innovation and sustainable practices, will be crucial for success. Companies that can effectively navigate supply chain challenges and adapt to evolving consumer preferences will be best positioned for long-term growth and profitability. The market will see continued innovation in sustainable design and smart home technology, further solidifying the long-term outlook.

US Luxury Residential Market Segmentation

-

1. Type

- 1.1. Apartments and Condominiums

- 1.2. Villas and Landed Houses

-

2. City

- 2.1. New York

- 2.2. Los Angeles

- 2.3. San Francisco

- 2.4. Miami

- 2.5. Washington DC

- 2.6. Other Cities

US Luxury Residential Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Luxury Residential Market Regional Market Share

Geographic Coverage of US Luxury Residential Market

US Luxury Residential Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Energy efficiency in construction; Flexibility and customization options

- 3.3. Market Restrains

- 3.3.1. Limited availability of suitable land for construction; Lower quality compared to traditional construction

- 3.4. Market Trends

- 3.4.1. Home Automation Becoming a Pre-requisite for Luxury Real Estate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Luxury Residential Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Apartments and Condominiums

- 5.1.2. Villas and Landed Houses

- 5.2. Market Analysis, Insights and Forecast - by City

- 5.2.1. New York

- 5.2.2. Los Angeles

- 5.2.3. San Francisco

- 5.2.4. Miami

- 5.2.5. Washington DC

- 5.2.6. Other Cities

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America US Luxury Residential Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Apartments and Condominiums

- 6.1.2. Villas and Landed Houses

- 6.2. Market Analysis, Insights and Forecast - by City

- 6.2.1. New York

- 6.2.2. Los Angeles

- 6.2.3. San Francisco

- 6.2.4. Miami

- 6.2.5. Washington DC

- 6.2.6. Other Cities

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America US Luxury Residential Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Apartments and Condominiums

- 7.1.2. Villas and Landed Houses

- 7.2. Market Analysis, Insights and Forecast - by City

- 7.2.1. New York

- 7.2.2. Los Angeles

- 7.2.3. San Francisco

- 7.2.4. Miami

- 7.2.5. Washington DC

- 7.2.6. Other Cities

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe US Luxury Residential Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Apartments and Condominiums

- 8.1.2. Villas and Landed Houses

- 8.2. Market Analysis, Insights and Forecast - by City

- 8.2.1. New York

- 8.2.2. Los Angeles

- 8.2.3. San Francisco

- 8.2.4. Miami

- 8.2.5. Washington DC

- 8.2.6. Other Cities

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa US Luxury Residential Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Apartments and Condominiums

- 9.1.2. Villas and Landed Houses

- 9.2. Market Analysis, Insights and Forecast - by City

- 9.2.1. New York

- 9.2.2. Los Angeles

- 9.2.3. San Francisco

- 9.2.4. Miami

- 9.2.5. Washington DC

- 9.2.6. Other Cities

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific US Luxury Residential Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Apartments and Condominiums

- 10.1.2. Villas and Landed Houses

- 10.2. Market Analysis, Insights and Forecast - by City

- 10.2.1. New York

- 10.2.2. Los Angeles

- 10.2.3. San Francisco

- 10.2.4. Miami

- 10.2.5. Washington DC

- 10.2.6. Other Cities

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Hann Builders

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 McEwan Custom Homes**List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Toll Brothers Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Phil Kean Designs Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kean Development

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Calvis Wyant

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Wardell Builders

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 D R Horton

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Haley Custom Homes

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Bob Thompson Homes

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Hann Builders

List of Figures

- Figure 1: Global US Luxury Residential Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America US Luxury Residential Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America US Luxury Residential Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America US Luxury Residential Market Revenue (Million), by City 2025 & 2033

- Figure 5: North America US Luxury Residential Market Revenue Share (%), by City 2025 & 2033

- Figure 6: North America US Luxury Residential Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America US Luxury Residential Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America US Luxury Residential Market Revenue (Million), by Type 2025 & 2033

- Figure 9: South America US Luxury Residential Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: South America US Luxury Residential Market Revenue (Million), by City 2025 & 2033

- Figure 11: South America US Luxury Residential Market Revenue Share (%), by City 2025 & 2033

- Figure 12: South America US Luxury Residential Market Revenue (Million), by Country 2025 & 2033

- Figure 13: South America US Luxury Residential Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe US Luxury Residential Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Europe US Luxury Residential Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Europe US Luxury Residential Market Revenue (Million), by City 2025 & 2033

- Figure 17: Europe US Luxury Residential Market Revenue Share (%), by City 2025 & 2033

- Figure 18: Europe US Luxury Residential Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe US Luxury Residential Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa US Luxury Residential Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Middle East & Africa US Luxury Residential Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East & Africa US Luxury Residential Market Revenue (Million), by City 2025 & 2033

- Figure 23: Middle East & Africa US Luxury Residential Market Revenue Share (%), by City 2025 & 2033

- Figure 24: Middle East & Africa US Luxury Residential Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa US Luxury Residential Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific US Luxury Residential Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Asia Pacific US Luxury Residential Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Asia Pacific US Luxury Residential Market Revenue (Million), by City 2025 & 2033

- Figure 29: Asia Pacific US Luxury Residential Market Revenue Share (%), by City 2025 & 2033

- Figure 30: Asia Pacific US Luxury Residential Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific US Luxury Residential Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global US Luxury Residential Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global US Luxury Residential Market Revenue Million Forecast, by City 2020 & 2033

- Table 3: Global US Luxury Residential Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global US Luxury Residential Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global US Luxury Residential Market Revenue Million Forecast, by City 2020 & 2033

- Table 6: Global US Luxury Residential Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States US Luxury Residential Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada US Luxury Residential Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico US Luxury Residential Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global US Luxury Residential Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global US Luxury Residential Market Revenue Million Forecast, by City 2020 & 2033

- Table 12: Global US Luxury Residential Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil US Luxury Residential Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina US Luxury Residential Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America US Luxury Residential Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global US Luxury Residential Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global US Luxury Residential Market Revenue Million Forecast, by City 2020 & 2033

- Table 18: Global US Luxury Residential Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom US Luxury Residential Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany US Luxury Residential Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France US Luxury Residential Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy US Luxury Residential Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain US Luxury Residential Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia US Luxury Residential Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux US Luxury Residential Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics US Luxury Residential Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe US Luxury Residential Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global US Luxury Residential Market Revenue Million Forecast, by Type 2020 & 2033

- Table 29: Global US Luxury Residential Market Revenue Million Forecast, by City 2020 & 2033

- Table 30: Global US Luxury Residential Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey US Luxury Residential Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel US Luxury Residential Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC US Luxury Residential Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa US Luxury Residential Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa US Luxury Residential Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa US Luxury Residential Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global US Luxury Residential Market Revenue Million Forecast, by Type 2020 & 2033

- Table 38: Global US Luxury Residential Market Revenue Million Forecast, by City 2020 & 2033

- Table 39: Global US Luxury Residential Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China US Luxury Residential Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India US Luxury Residential Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan US Luxury Residential Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea US Luxury Residential Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN US Luxury Residential Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania US Luxury Residential Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific US Luxury Residential Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Luxury Residential Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the US Luxury Residential Market?

Key companies in the market include Hann Builders, McEwan Custom Homes**List Not Exhaustive, Toll Brothers Inc, Phil Kean Designs Inc, Kean Development, Calvis Wyant, Wardell Builders, D R Horton, Haley Custom Homes, Bob Thompson Homes.

3. What are the main segments of the US Luxury Residential Market?

The market segments include Type, City.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Energy efficiency in construction; Flexibility and customization options.

6. What are the notable trends driving market growth?

Home Automation Becoming a Pre-requisite for Luxury Real Estate.

7. Are there any restraints impacting market growth?

Limited availability of suitable land for construction; Lower quality compared to traditional construction.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Luxury Residential Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Luxury Residential Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Luxury Residential Market?

To stay informed about further developments, trends, and reports in the US Luxury Residential Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence