Key Insights

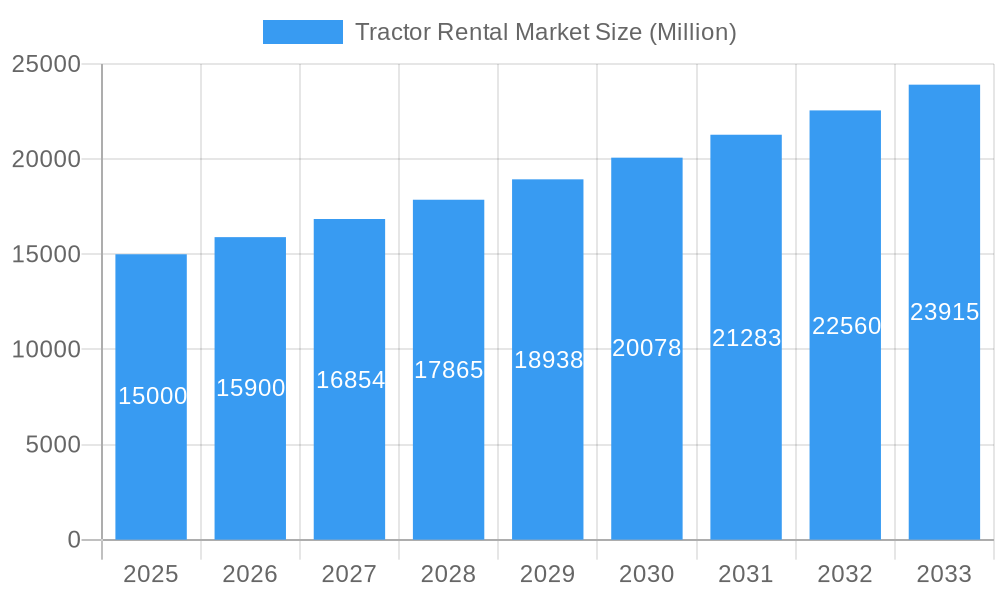

The global tractor rental market is experiencing robust growth, fueled by a CAGR exceeding 6% from 2019 to 2033. This expansion is driven by several key factors. Firstly, the increasing demand for efficient and cost-effective farming solutions, particularly among small and medium-sized farms, is a major catalyst. Renting tractors offers significant advantages over outright purchase, eliminating high upfront capital costs and reducing maintenance burdens. Secondly, the rising adoption of precision agriculture technologies is further boosting the market. Rental companies are increasingly incorporating advanced equipment into their fleets, providing farmers access to cutting-edge technology without the substantial investment required for ownership. Finally, favorable government policies promoting agricultural mechanization in various regions are also contributing to market growth. The market is segmented by equipment type (tractors, harvesters, haying equipment, and others), with tractors representing a significant portion of the rental revenue. Key players like The Papé Group Inc., Mahindra & Mahindra Limited, Kubota Corporation, and CNH Industrial are shaping the market landscape through strategic fleet expansions, technological advancements, and geographically targeted service expansion.

Tractor Rental Market Market Size (In Billion)

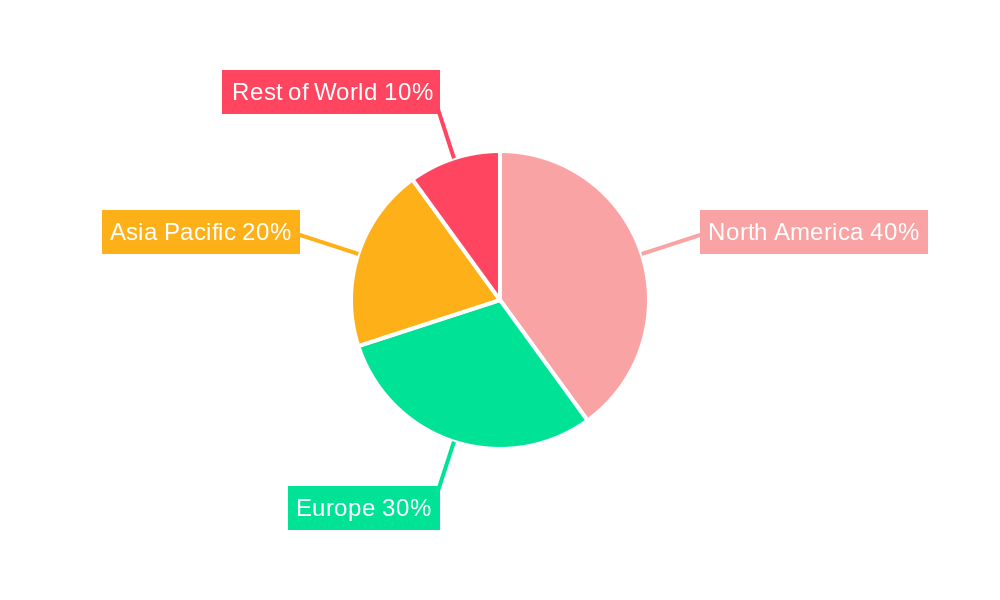

Geographical distribution shows a strong presence across North America (particularly the US and Canada), Europe (Germany, UK, and France being leading markets), and the Asia-Pacific region (India and China showing significant growth potential). While North America currently holds a larger market share, the Asia-Pacific region is projected to witness the fastest growth due to increasing agricultural activity and government initiatives supporting mechanization. However, market growth may face certain challenges, including potential fluctuations in agricultural commodity prices, economic downturns impacting farmer spending, and the need for consistent investment in fleet modernization and maintenance to meet evolving technological demands. The overall outlook, however, remains positive, indicating a continued expansion of the tractor rental market in the coming years, driven by the aforementioned factors and evolving farmer needs.

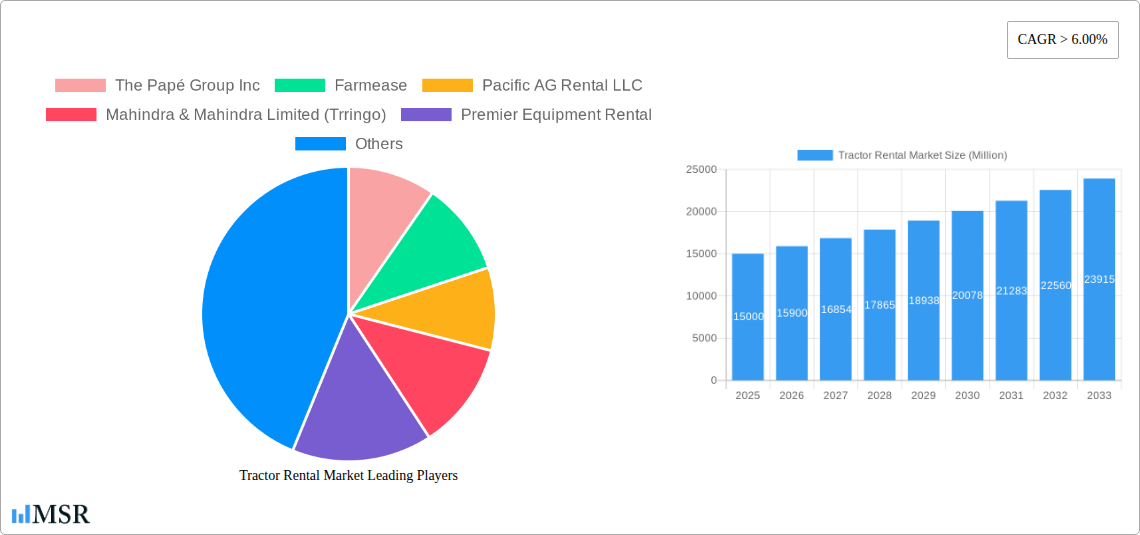

Tractor Rental Market Company Market Share

Tractor Rental Market Report: 2019-2033 Forecast

This comprehensive report provides an in-depth analysis of the global Tractor Rental Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a robust understanding of market dynamics, growth drivers, and future potential. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Tractor Rental Market Market Concentration & Dynamics

The Tractor Rental Market exhibits a moderately concentrated landscape, with key players holding significant market share. However, the market is witnessing increased competition from new entrants and technological disruptions. The market share of the top 5 players is estimated at xx%, indicating opportunities for both established and emerging players. Innovation is a key driver, with advancements in technology, such as precision farming tools and digital platforms for rental management, shaping market dynamics.

Regulatory frameworks, varying across different regions, significantly impact market operations and growth. Government initiatives promoting agricultural mechanization and supporting smallholder farmers through rental schemes are catalysts for market expansion. Substitute products, such as manual labor or shared ownership models, exert some influence, though the efficiency and scalability of tractor rentals provide a competitive advantage.

End-user trends, including increasing demand for efficient farming practices and cost-effective solutions, drive market growth. The number of M&A deals in the sector has increased in recent years. There were approximately xx M&A deals in the historical period (2019-2024), signifying consolidation and strategic expansion among key players.

Tractor Rental Market Industry Insights & Trends

The global Tractor Rental Market is experiencing robust growth, driven by several key factors. The increasing adoption of mechanization in agriculture, particularly in developing economies, fuels demand for tractor rental services. This trend is further propelled by rising labor costs and the need to enhance farm productivity. Technological advancements, such as GPS-guided tractors and automated farming technologies, are transforming the industry, boosting efficiency and reducing operational costs. Evolving consumer behaviors, including a preference for flexible and cost-effective solutions, are driving the shift towards rental models over outright ownership. The market size is projected to reach xx Million by 2033, indicating significant growth potential.

Key Markets & Segments Leading Tractor Rental Market

The North American and European markets currently dominate the Tractor Rental Market, driven by high agricultural output and advanced farming techniques. However, developing economies in Asia and Africa exhibit significant growth potential due to increasing agricultural activities and government initiatives promoting mechanization.

- By Equipment Type:

- Tractors: This segment holds the largest market share, owing to the widespread use of tractors in various farming operations.

- Harvestors: The harvesters segment is experiencing steady growth, driven by the need for efficient crop harvesting.

- Haying Equipment: The haying equipment rental segment is experiencing moderate growth due to its specialized nature.

- Others: This segment includes other agricultural machinery, such as tillers and planters, contributing to overall market expansion.

Drivers for Dominant Regions:

- North America: High agricultural output, advanced farming technologies, and established rental infrastructure contribute to market dominance.

- Europe: Similar to North America, advanced farming practices and government support for agricultural mechanization drive market growth.

- Asia-Pacific: Rapid economic growth, increasing agricultural production, and government initiatives aimed at boosting agricultural productivity contribute to considerable growth potential.

Tractor Rental Market Product Developments

Significant technological advancements are transforming the Tractor Rental Market. The integration of precision farming technologies, such as GPS guidance and automated steering systems, enhances efficiency and accuracy. The development of user-friendly mobile applications and online platforms streamlines the rental process, improving customer experience. These innovations provide a significant competitive edge, enabling rental providers to offer superior services and attract more customers. Furthermore, the adoption of telematics allows for remote monitoring and diagnostics, optimizing equipment utilization and reducing downtime.

Challenges in the Tractor Rental Market Market

The Tractor Rental Market faces several challenges. Regulatory hurdles, including licensing requirements and environmental regulations, can hinder market expansion. Supply chain disruptions, especially concerning the availability of spare parts and equipment, impact operational efficiency. Furthermore, intense competition among rental providers necessitates strategic pricing and service differentiation to maintain market share. The unpredictable nature of weather conditions and their effect on agricultural operations also impacts market stability.

Forces Driving Tractor Rental Market Growth

Several factors are driving the growth of the Tractor Rental Market. Technological advancements, such as GPS-guided tractors and automated systems, improve efficiency and reduce operational costs. Economic factors, such as rising labor costs and the need to enhance farm productivity, encourage farmers to opt for rental services. Government initiatives promoting agricultural mechanization and supporting smallholder farmers through rental programs further accelerate market growth. The increasing adoption of precision agriculture techniques further drives demand for specialized equipment rental.

Long-Term Growth Catalysts in the Tractor Rental Market

The long-term growth of the Tractor Rental Market will be fueled by continuous technological innovation, strategic partnerships among rental providers and equipment manufacturers, and expansion into new markets. The development of advanced telematics and data analytics capabilities will enable optimized equipment management and improved service offerings. Strategic alliances will facilitate wider market reach and access to specialized equipment. Expansion into underserved regions with high agricultural potential will unlock significant growth opportunities.

Emerging Opportunities in Tractor Rental Market

Emerging opportunities in the Tractor Rental Market include the expansion of rental services to include a wider range of agricultural equipment, the integration of data analytics for predictive maintenance and optimized equipment utilization, and the penetration of underserved markets in developing economies. The increasing adoption of precision agriculture technologies presents opportunities for specialized equipment rental, while the development of sustainable and environmentally friendly equipment will attract environmentally conscious customers. Finally, the utilization of blockchain technology for secure and transparent transaction management can improve the rental process.

Leading Players in the Tractor Rental Market Sector

- The Papé Group Inc

- Farmease

- Pacific AG Rental LLC

- Mahindra & Mahindra Limited (Trringo)

- Premier Equipment Rental

- KUBOTA Corporation

- Friesen Sales & Rentals

- CNH Industrial

- AGCO Corporation

- Messick's

- Flaman Group of Companies

- Titan Machinery

- JFarm Services

Key Milestones in Tractor Rental Market Industry

- September 2021: Sonalika Group launched its Sonalika Agro Solutions App, offering high-tech agro machinery rentals in India, expanding market access and digitalization.

- March 2022: eThekwini Municipality in South Africa provided free tractor rentals to farmers, highlighting government support and its impact on smallholder farmers.

- May 2022: KhetiGaadi, an Indian startup, launched agro-advisory services alongside rentals, adding value and supporting farmers beyond equipment.

- July 2022: Bihar, India, launched a mobile app-based farm equipment rental service, improving accessibility and reach for small farmers.

- August 2022: Deere & Co.'s investment in Hello Tractor broadened the reach of technology-enabled rental platforms in Africa, showcasing a significant strategic move in the market.

Strategic Outlook for Tractor Rental Market Market

The Tractor Rental Market holds significant potential for future growth. Continuous technological innovation, strategic partnerships, and expansion into emerging markets will be key drivers of market expansion. The focus on data-driven decision-making, efficient fleet management, and customer-centric service offerings will be crucial for success. Companies that effectively leverage technology and adapt to evolving customer needs are poised to capture significant market share in the years to come.

Tractor Rental Market Segmentation

-

1. Equipment Type

- 1.1. Tractors

- 1.2. Harvestors

- 1.3. Haying Equipment

- 1.4. Others

Tractor Rental Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

Tractor Rental Market Regional Market Share

Geographic Coverage of Tractor Rental Market

Tractor Rental Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Metals and Minerals to Fuel the Market

- 3.3. Market Restrains

- 3.3.1. Stringent Environmental Regulations and Community Concerns may Hinder the Market

- 3.4. Market Trends

- 3.4.1. Rising Developments in Tractor Rental Service Likely to Drive Demand in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Tractor Rental Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Equipment Type

- 5.1.1. Tractors

- 5.1.2. Harvestors

- 5.1.3. Haying Equipment

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Equipment Type

- 6. North America Tractor Rental Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Equipment Type

- 6.1.1. Tractors

- 6.1.2. Harvestors

- 6.1.3. Haying Equipment

- 6.1.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Equipment Type

- 7. Europe Tractor Rental Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Equipment Type

- 7.1.1. Tractors

- 7.1.2. Harvestors

- 7.1.3. Haying Equipment

- 7.1.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Equipment Type

- 8. Asia Pacific Tractor Rental Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Equipment Type

- 8.1.1. Tractors

- 8.1.2. Harvestors

- 8.1.3. Haying Equipment

- 8.1.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Equipment Type

- 9. Rest of the World Tractor Rental Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Equipment Type

- 9.1.1. Tractors

- 9.1.2. Harvestors

- 9.1.3. Haying Equipment

- 9.1.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Equipment Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 The Papé Group Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Farmease

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Pacific AG Rental LLC

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Mahindra & Mahindra Limited (Trringo)

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Premier Equipment Rental

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 KUBOTA Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Friesen Sales & Rentals*List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 CNH Industrial

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 AGCO Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Messick's

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Flaman Group of Companies

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Titan Machinery

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 JFarm Services

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 The Papé Group Inc

List of Figures

- Figure 1: Global Tractor Rental Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Tractor Rental Market Revenue (undefined), by Equipment Type 2025 & 2033

- Figure 3: North America Tractor Rental Market Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 4: North America Tractor Rental Market Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America Tractor Rental Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Tractor Rental Market Revenue (undefined), by Equipment Type 2025 & 2033

- Figure 7: Europe Tractor Rental Market Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 8: Europe Tractor Rental Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: Europe Tractor Rental Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Tractor Rental Market Revenue (undefined), by Equipment Type 2025 & 2033

- Figure 11: Asia Pacific Tractor Rental Market Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 12: Asia Pacific Tractor Rental Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Asia Pacific Tractor Rental Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Tractor Rental Market Revenue (undefined), by Equipment Type 2025 & 2033

- Figure 15: Rest of the World Tractor Rental Market Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 16: Rest of the World Tractor Rental Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Rest of the World Tractor Rental Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Tractor Rental Market Revenue undefined Forecast, by Equipment Type 2020 & 2033

- Table 2: Global Tractor Rental Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global Tractor Rental Market Revenue undefined Forecast, by Equipment Type 2020 & 2033

- Table 4: Global Tractor Rental Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: United States Tractor Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: Canada Tractor Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Rest of North America Tractor Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Global Tractor Rental Market Revenue undefined Forecast, by Equipment Type 2020 & 2033

- Table 9: Global Tractor Rental Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Germany Tractor Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: United Kingdom Tractor Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: France Tractor Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Italy Tractor Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Rest of Europe Tractor Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Global Tractor Rental Market Revenue undefined Forecast, by Equipment Type 2020 & 2033

- Table 16: Global Tractor Rental Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: India Tractor Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: China Tractor Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Japan Tractor Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: South Korea Tractor Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Rest of Asia Pacific Tractor Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Global Tractor Rental Market Revenue undefined Forecast, by Equipment Type 2020 & 2033

- Table 23: Global Tractor Rental Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: South America Tractor Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Middle East and Africa Tractor Rental Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Tractor Rental Market?

The projected CAGR is approximately 8.1%.

2. Which companies are prominent players in the Tractor Rental Market?

Key companies in the market include The Papé Group Inc, Farmease, Pacific AG Rental LLC, Mahindra & Mahindra Limited (Trringo), Premier Equipment Rental, KUBOTA Corporation, Friesen Sales & Rentals*List Not Exhaustive, CNH Industrial, AGCO Corporation, Messick's, Flaman Group of Companies, Titan Machinery, JFarm Services.

3. What are the main segments of the Tractor Rental Market?

The market segments include Equipment Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Metals and Minerals to Fuel the Market.

6. What are the notable trends driving market growth?

Rising Developments in Tractor Rental Service Likely to Drive Demand in the Market.

7. Are there any restraints impacting market growth?

Stringent Environmental Regulations and Community Concerns may Hinder the Market.

8. Can you provide examples of recent developments in the market?

August 2022- Deere and Co. invested in Hello Tractor, a Nigerian startup that offers marketplace and fleet management technology for African farmers to rent tractors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Tractor Rental Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Tractor Rental Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Tractor Rental Market?

To stay informed about further developments, trends, and reports in the Tractor Rental Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence