Key Insights

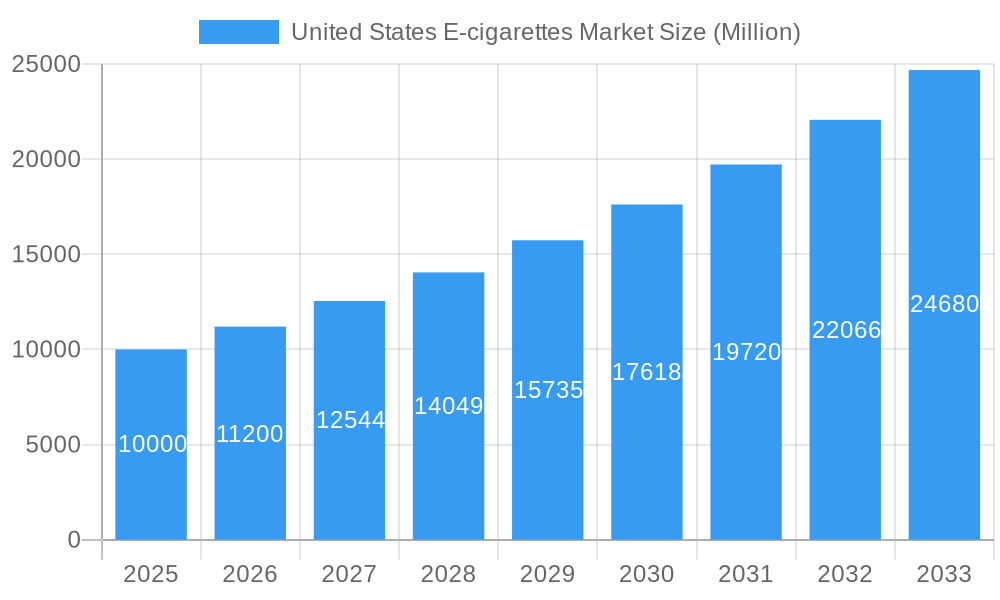

The United States e-cigarette market, a significant segment of the global market, is experiencing robust growth, driven by factors such as the increasing prevalence of vaping among young adults and the growing popularity of vaping as a smoking cessation tool. The market's substantial size, estimated at $X billion in 2025 (based on the global market size and considering the US's significant share of the global market), projects a Compound Annual Growth Rate (CAGR) of approximately 12% between 2025 and 2033. This growth is fueled by continuous innovation in product design, including the introduction of more sophisticated and appealing devices such as personalized vaporizers and the evolution of rechargeable, disposable cartomizer systems, catering to diverse consumer preferences and needs. Further expansion is expected from the increasing availability of online retail channels, supplementing the established offline retail networks. However, the market faces regulatory challenges and evolving public health concerns regarding nicotine addiction and the potential long-term health consequences of vaping, which might partially restrain market growth in the coming years.

United States E-cigarettes Market Market Size (In Billion)

The dominance of key players like Juul Labs Inc., NJOY Inc., and British American Tobacco PLC in the US market shapes competition. These established players leverage their extensive marketing reach and strong distribution networks to maintain a significant market share. However, the market is also witnessing the rise of smaller, innovative companies, introducing novel product features and appealing to niche segments within the vaping population. The US market demonstrates significant regional variations, with higher adoption rates likely in urban areas compared to rural regions. The ongoing regulatory landscape, encompassing taxation, age restrictions, and flavor restrictions, significantly impacts market trends. Future growth will depend on navigating these regulations, fostering responsible innovation, and addressing public health concerns to ensure sustainable growth. Future market forecasts will depend on a careful analysis of the regulatory environment.

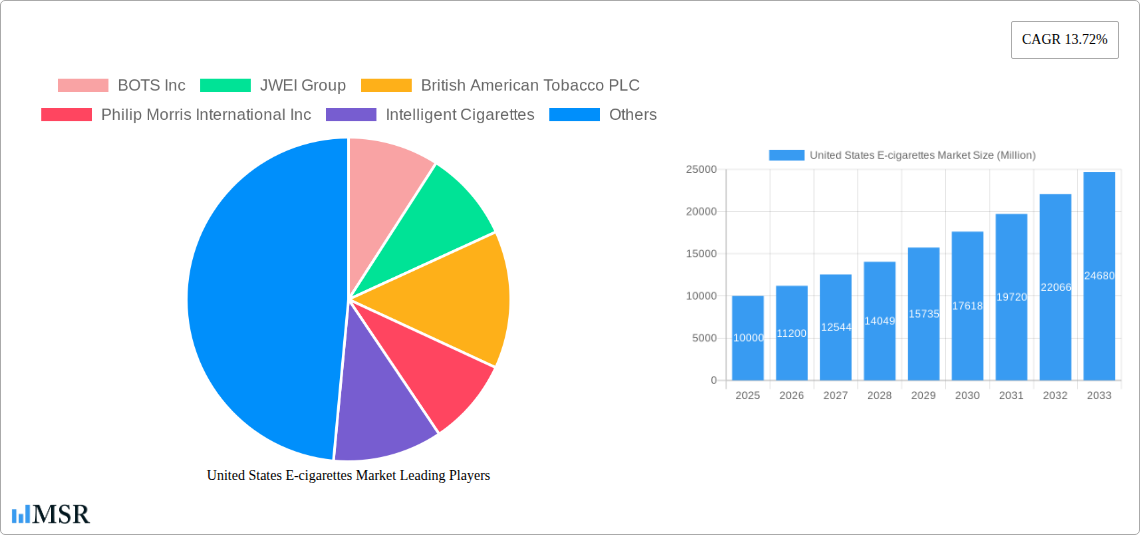

United States E-cigarettes Market Company Market Share

United States E-cigarettes Market: A Comprehensive Report (2019-2033)

This comprehensive report offers an in-depth analysis of the dynamic United States e-cigarettes market, providing invaluable insights for stakeholders across the industry. From market size and growth projections to competitive landscape and emerging trends, this report equips you with the knowledge to navigate this rapidly evolving sector. Covering the period from 2019 to 2033, with a focus on 2025, this research unravels the complexities of the US e-cigarette market, revealing key opportunities and potential challenges.

United States E-cigarettes Market Market Concentration & Dynamics

The US e-cigarette market exhibits a moderately concentrated landscape, dominated by a few major players alongside numerous smaller competitors. Market share fluctuates based on product innovation, regulatory changes, and marketing strategies. While precise figures for market share vary across segments, key players like Juul Labs Inc, Philip Morris International Inc, and British American Tobacco PLC hold significant positions. The innovation ecosystem is highly active, fueled by continuous product development in areas such as device technology, flavor profiles, and nicotine delivery systems. Regulatory frameworks, particularly concerning nicotine and flavor restrictions, exert substantial influence on market dynamics. Substitute products, including traditional cigarettes and other nicotine delivery systems, present ongoing competitive pressure. End-user trends, driven by evolving health concerns and shifting consumer preferences, significantly impact market demand. Finally, mergers and acquisitions (M&A) activities are frequent, demonstrating the sector's dynamism. The number of M&A deals varies yearly, but 2022 witnessed a significant increase, particularly involving major international players seeking to establish or expand their presence in the US market.

- Market Concentration: Moderately concentrated, with significant players holding substantial market share.

- Innovation Ecosystem: Highly active, focusing on device technology, flavors, and nicotine delivery.

- Regulatory Framework: A major influence, with significant impact from nicotine and flavor regulations.

- Substitute Products: Traditional cigarettes and other nicotine alternatives pose ongoing competition.

- End-User Trends: Health concerns and evolving consumer preferences are key demand drivers.

- M&A Activity: Frequent, indicating the dynamic and competitive nature of the market. xx M&A deals were recorded in 2022.

United States E-cigarettes Market Industry Insights & Trends

The US e-cigarette market exhibits substantial growth potential, driven by factors such as the increasing prevalence of smoking cessation efforts and the growing appeal of vaping as a perceived "less harmful" alternative to traditional cigarettes. However, the market faces ongoing regulatory scrutiny and shifting consumer preferences regarding nicotine products. Market size in 2025 is estimated at $xx Million, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth trajectory is influenced by technological advancements, such as the introduction of innovative vaping devices with enhanced features and functionalities, alongside evolving consumer behaviors including increased demand for personalized vaping experiences and discreet, portable devices. Technological disruptions, including advancements in battery technology, flavor delivery systems, and heating mechanisms, continually shape market dynamics. The market is also witnessing a growing demand for improved safety features and regulatory compliance, impacting the design and production of e-cigarettes. Consumer behaviors are shifting toward a preference for disposables and reduced-risk products, particularly among younger demographics. This dynamic landscape demands continuous adaptation and innovation from market players.

Key Markets & Segments Leading United States E-cigarettes Market

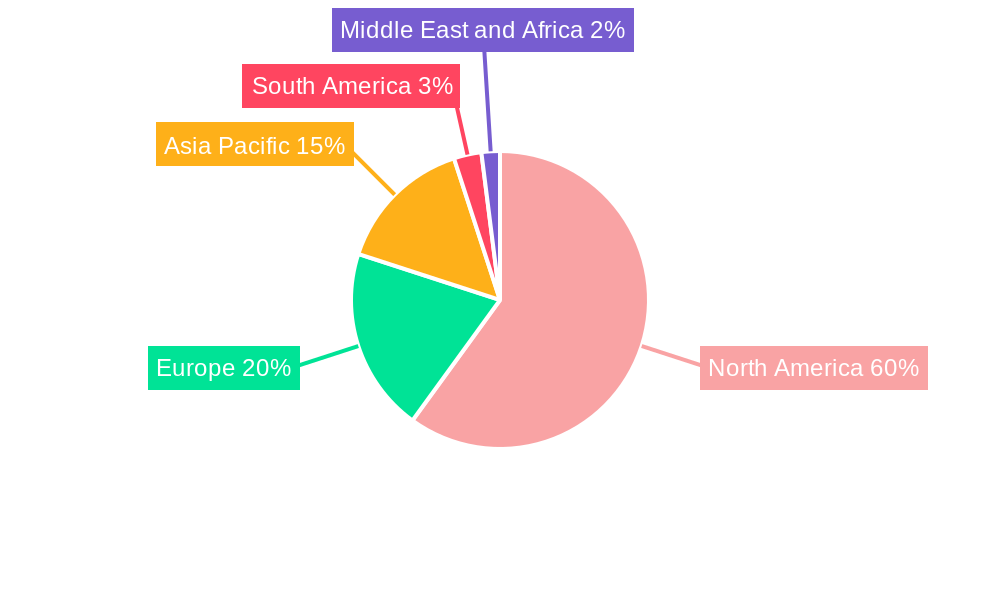

The US e-cigarette market demonstrates regional variations in growth and consumption patterns. While specific data on regional dominance requires further analysis, it's expected that densely populated areas with higher smoking prevalence will show stronger market performance.

Product Type:

- Completely Disposable Models: This segment is experiencing rapid growth due to convenience and affordability, leading the market in terms of unit sales.

- Rechargeable but Disposable Cartomizer: This segment maintains a steady market share, appealing to users seeking a balance between convenience and cost-effectiveness.

- Personalized Vaporizers: This segment holds a smaller, yet steadily growing market share, driven by customization options and advanced features.

Battery Mode:

- Automatic E-cigarettes: This type is widely popular for its ease of use, particularly amongst new users.

- Manual E-cigarettes: This segment appeals to experienced users who value greater control over their vaping experience.

Distribution Channel:

- Offline Retail: This channel still maintains a strong presence, especially in regions with limited online access.

- Online Retail: This channel has witnessed significant growth due to its convenience and wide product selection. The online sector is expected to continue to expand in the forecast period.

Drivers: Economic factors including disposable income levels, population density, and technological advancements play a crucial role. Improved retail infrastructure also enhances market accessibility.

United States E-cigarettes Market Product Developments

The e-cigarette market showcases continuous product innovation, driven by advancements in battery technology, flavor delivery systems, and heating mechanisms. Companies are focused on creating more user-friendly devices, improved safety features, and discreet designs to appeal to a wider consumer base. These advancements enhance the vaping experience, while simultaneously addressing safety and health concerns. This continuous cycle of technological innovation contributes to the competitiveness of the market and to its evolution.

Challenges in the United States E-cigarettes Market Market

The US e-cigarette market faces several significant challenges. Stringent regulations concerning nicotine content, flavor additives, and marketing restrictions exert considerable pressure on market growth. Supply chain disruptions, including material shortages and manufacturing constraints, impact production capacity and market stability. Intense competitive pressures from established players and new entrants necessitate continuous product innovation and marketing strategies. These factors collectively impact market expansion and profitability for companies operating in this sector.

Forces Driving United States E-cigarettes Market Growth

Several factors propel the growth of the US e-cigarette market. Technological advancements, including the development of innovative devices with enhanced features, contribute to market expansion. Economic factors, such as increasing disposable incomes in certain demographics, influence purchasing power. Furthermore, favorable regulatory environments in some states contribute to market growth, though this is counterbalanced by tightening restrictions in others.

Long-Term Growth Catalysts in the United States E-cigarettes Market

Long-term growth catalysts for the US e-cigarette market include continuous product innovation, strategic partnerships among manufacturers and distributors, and the potential expansion into new markets. Developing innovative technologies focusing on safer and more efficient nicotine delivery systems, coupled with strategic collaborations that enhance market reach and distribution, will contribute to sustaining market growth over the long term.

Emerging Opportunities in United States E-cigarettes Market

Emerging opportunities within the US e-cigarette market include the potential for new nicotine delivery methods (e.g. improved heated tobacco products), the development of personalized vaping experiences tailored to individual user preferences, and increasing demand for reduced-risk products among health-conscious consumers. Exploring new marketing channels tailored to specific demographics will also unlock further growth potential.

Leading Players in the United States E-cigarettes Market Sector

- BOTS Inc

- JWEI Group

- British American Tobacco PLC

- Philip Morris International Inc

- Intelligent Cigarettes

- Nicoventures Trading Limited

- Japan Tobacco Inc

- NJOY Inc

- Imperial Brands PLC

- Juul Labs Inc

Key Milestones in United States E-cigarettes Market Industry

- November 2022: R.J. Reynolds Tobacco Company patents a composite tobacco-containing material for "smokeless" tobacco consumption. This demonstrates a shift towards alternative nicotine delivery methods.

- November 2022: Philip Morris acquires 93% of Swedish Match, aiming to expand its presence in the US market for reduced-risk products, including e-cigarettes. This signals a major strategic move to compete with existing players.

- June 2022: Japan Tobacco Inc. publishes a patent application for a flavor inhaler system, suggesting future innovations in flavor delivery and potential new product categories. This illustrates ongoing technological advancements in the sector.

Strategic Outlook for United States E-cigarettes Market Market

The future of the US e-cigarette market holds substantial potential for growth, driven by sustained technological innovation, strategic partnerships, and an expanding consumer base seeking alternative nicotine products. Companies that effectively navigate evolving regulatory landscapes, adapt to changing consumer preferences, and invest in research and development will be best positioned to capture market share and achieve long-term success. The market’s continued evolution hinges on its ability to balance innovation with responsible practices and address ongoing public health concerns.

United States E-cigarettes Market Segmentation

-

1. Product Type

- 1.1. Completely Disposable Model

- 1.2. Rechargeable but Disposable Cartomizer

- 1.3. Personalized Vaporizer

-

2. Battery Mode

- 2.1. Automatic E-cigarettes

- 2.2. Manual E-cigarettes

-

3. Distribution Channel

- 3.1. Offline Retail

- 3.2. Online Retail

United States E-cigarettes Market Segmentation By Geography

- 1. United States

United States E-cigarettes Market Regional Market Share

Geographic Coverage of United States E-cigarettes Market

United States E-cigarettes Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.72% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Enhanced Participation In Water Sports; Popularity Of Beach Culture And Adventure Tourism

- 3.3. Market Restrains

- 3.3.1. Presence of counterfeit products

- 3.4. Market Trends

- 3.4.1. Increasing Health Concern Among Smoking Population Drives the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States E-cigarettes Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Completely Disposable Model

- 5.1.2. Rechargeable but Disposable Cartomizer

- 5.1.3. Personalized Vaporizer

- 5.2. Market Analysis, Insights and Forecast - by Battery Mode

- 5.2.1. Automatic E-cigarettes

- 5.2.2. Manual E-cigarettes

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Offline Retail

- 5.3.2. Online Retail

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BOTS Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 JWEI Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 British American Tobacco PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Philip Morris International Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Intelligent Cigarettes

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nicoventures Trading Limited*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Japan Tobacco Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 NJOY Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Imperial Brands PLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Juul Labs Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 BOTS Inc

List of Figures

- Figure 1: United States E-cigarettes Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States E-cigarettes Market Share (%) by Company 2025

List of Tables

- Table 1: United States E-cigarettes Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: United States E-cigarettes Market Revenue Million Forecast, by Battery Mode 2020 & 2033

- Table 3: United States E-cigarettes Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: United States E-cigarettes Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: United States E-cigarettes Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: United States E-cigarettes Market Revenue Million Forecast, by Battery Mode 2020 & 2033

- Table 7: United States E-cigarettes Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: United States E-cigarettes Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States E-cigarettes Market?

The projected CAGR is approximately 13.72%.

2. Which companies are prominent players in the United States E-cigarettes Market?

Key companies in the market include BOTS Inc, JWEI Group, British American Tobacco PLC, Philip Morris International Inc, Intelligent Cigarettes, Nicoventures Trading Limited*List Not Exhaustive, Japan Tobacco Inc, NJOY Inc, Imperial Brands PLC, Juul Labs Inc.

3. What are the main segments of the United States E-cigarettes Market?

The market segments include Product Type, Battery Mode, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 34.49 Million as of 2022.

5. What are some drivers contributing to market growth?

Enhanced Participation In Water Sports; Popularity Of Beach Culture And Adventure Tourism.

6. What are the notable trends driving market growth?

Increasing Health Concern Among Smoking Population Drives the Market.

7. Are there any restraints impacting market growth?

Presence of counterfeit products.

8. Can you provide examples of recent developments in the market?

November 2022: A patent for composite tobacco-containing materials from R.J. Reynolds Tobacco Company shows that tobacco can be consumed in a reportedly "smokeless" form. The use of smokeless tobacco products often involves placing processed tobacco or a formulation containing tobacco in the user's mouth.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States E-cigarettes Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States E-cigarettes Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States E-cigarettes Market?

To stay informed about further developments, trends, and reports in the United States E-cigarettes Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence