Key Insights

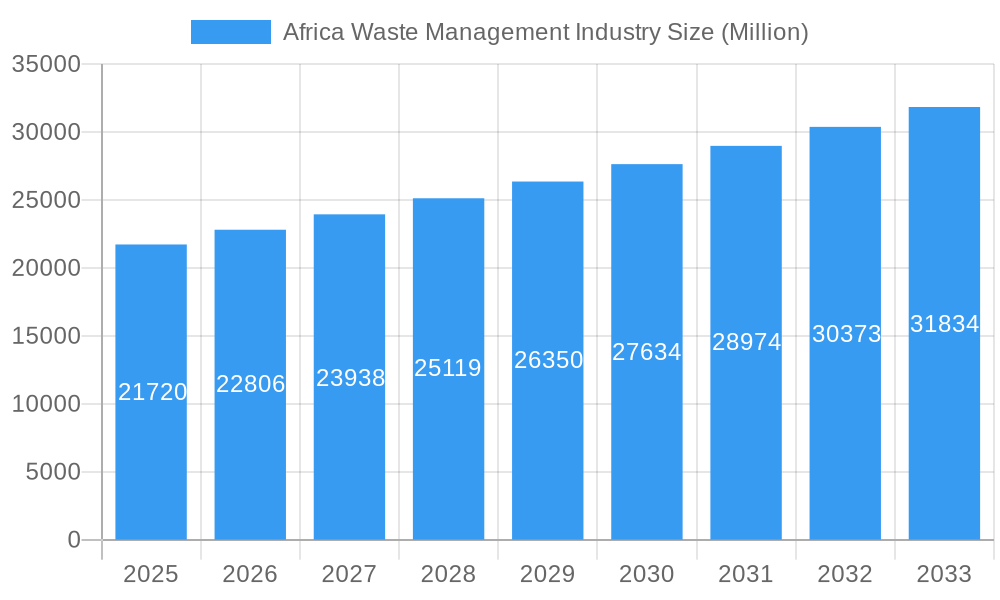

The Africa Waste Management market, valued at $21.72 billion in 2025, is projected to experience robust growth, driven by increasing urbanization, rising environmental awareness, and stringent government regulations. A compound annual growth rate (CAGR) of 4.98% from 2025 to 2033 indicates a significant expansion of the sector. Key drivers include the burgeoning population, increasing industrial activity generating substantial waste, and a growing demand for sustainable waste management solutions. This is further fueled by a rising middle class with increased disposable income, leading to higher consumption and consequent waste generation. While challenges remain, such as inadequate infrastructure in certain regions and limited funding, the market is poised for substantial growth, particularly in major urban centers.

Africa Waste Management Industry Market Size (In Billion)

The market is segmented by waste type (municipal solid waste, industrial waste, hazardous waste, e-waste, etc.), collection methods (kerbside collection, transfer stations, etc.), and waste treatment technologies (landfilling, incineration, composting, recycling). Companies like Averda, Enviroserv, Interwaste, and others are actively shaping the industry, investing in technology and infrastructure to address the growing waste management needs. While the data for precise regional breakdowns is currently unavailable, it is likely that the fastest growth will be seen in rapidly urbanizing regions experiencing significant population growth. Future growth hinges on continued investment in infrastructure, technological advancements (like improved recycling technologies and waste-to-energy solutions), and effective public-private partnerships to manage the ever-increasing volumes of waste across the diverse African landscape.

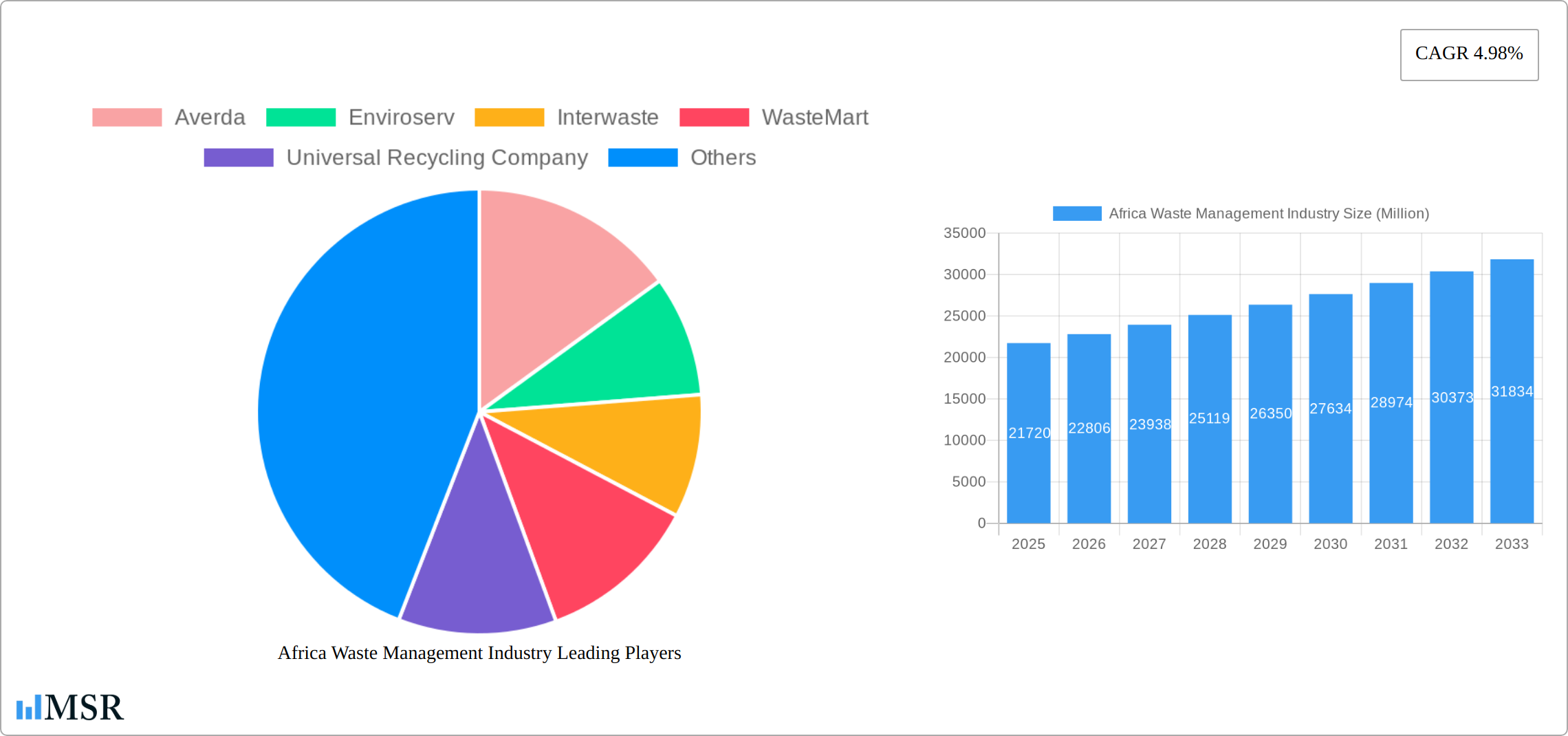

Africa Waste Management Industry Company Market Share

Africa Waste Management Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the Africa waste management industry, offering invaluable insights for investors, industry stakeholders, and strategic decision-makers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report leverages historical data (2019-2024) to predict future market trends and growth opportunities within the rapidly evolving African waste management landscape. The report covers market size, CAGR, M&A activity, key players, and emerging technologies, equipping readers with actionable intelligence to navigate this dynamic sector. Market values are expressed in Millions.

Africa Waste Management Industry Market Concentration & Dynamics

The African waste management market exhibits a moderately concentrated landscape, with several large players like Averda, Enviroserv, and Interwaste holding significant market share, though the exact figures remain proprietary information. However, smaller, regional players and specialized recyclers also contribute significantly. The market is characterized by a diverse innovation ecosystem, with technological advancements driving efficiency and sustainability. Regulatory frameworks vary across different African countries, presenting both opportunities and challenges. Substitute products, such as composting and anaerobic digestion, are gaining traction, while end-user trends are shifting toward increased recycling and waste reduction initiatives.

- Market Share: Dominated by a few large players (xx%), with a significant proportion held by smaller, regional operators (xx%). Data limitations prevent precise quantification.

- M&A Activity: Significant M&A activity observed (xx deals in the past 5 years), reflecting industry consolidation and foreign investment. The recent acquisition of EnviroServ by SUEZ exemplifies this trend.

- Innovation Ecosystem: Growing adoption of smart waste management technologies, including waste-to-energy solutions and digital waste tracking systems.

- Regulatory Landscape: Highly fragmented, with varying regulations across countries, impacting investment and operational strategies.

Africa Waste Management Industry Industry Insights & Trends

The African waste management industry is experiencing robust growth, driven by factors such as rapid urbanization, rising environmental awareness, and increasing government regulations. The market size in 2025 is estimated at $xx Million, with a projected CAGR of xx% during the forecast period (2025-2033). Technological disruptions, such as the implementation of smart bins and advanced recycling technologies, are improving efficiency and sustainability. Evolving consumer behaviors, including increased demand for eco-friendly waste disposal solutions, are further fueling market expansion. This growth is influenced by factors such as increasing urbanization and a growing middle class creating higher waste volumes. Government initiatives focusing on environmental sustainability, coupled with private sector investments, are accelerating market growth. Challenges, however, remain in terms of infrastructure development, waste segregation practices, and inconsistent regulatory frameworks.

Key Markets & Segments Leading Africa Waste Management Industry

Determining the single most dominant region or segment within Africa's diverse waste management landscape requires comprehensive data analysis. However, South Africa stands out as a key market, showcasing significant growth driven by its comparatively advanced infrastructure and a more robust regulatory framework. Other regions are at varying stages of development in terms of waste management infrastructure, reflecting the continent's heterogeneous nature. Municipal solid waste currently dominates the market, but industrial waste management presents substantial growth potential as industrialization accelerates across the continent.

- Growth Drivers:

- Rapid Urbanization and Economic Growth: A significant portion of Africa's population is migrating to urban centers, resulting in increased waste generation and creating demand for improved waste management solutions.

- Infrastructure Development: Growing investments in waste collection, processing, and disposal infrastructure, particularly in major cities, are gradually improving service delivery.

- Strengthening Government Regulations: Increased enforcement of environmental regulations is driving the adoption of better waste management practices and holding stakeholders accountable.

- Foreign Direct Investment (FDI): Attracting significant capital injections from international companies is bringing expertise and resources into the sector, boosting its capacity.

- Public-Private Partnerships (PPPs): Collaborative efforts between governments and private sector companies are proving effective in developing and financing sustainable waste management solutions.

Africa Waste Management Industry Product Developments

The African waste management industry is witnessing a surge in innovative product development, focusing on solutions tailored to the unique challenges of the African context. Advanced recycling technologies, waste-to-energy plants, and smart waste management systems are transforming waste management practices, enhancing efficiency, promoting sustainability, and reducing reliance on landfills. Companies are actively competing through technological differentiation, improved service offerings, and a commitment to environmentally responsible operations. The integration of circular economy principles is also gaining traction, promoting resource recovery and reducing environmental impact.

Challenges in the Africa Waste Management Industry Market

Despite significant growth potential, the African waste management market faces considerable challenges. Inadequate infrastructure remains a major obstacle, hindering efficient waste collection and disposal, particularly in rural areas. Limited funding, a shortage of skilled professionals, and inconsistent waste collection and disposal practices across regions contribute to operational inefficiencies and higher costs. Regulatory inconsistencies across different nations create complexities for businesses operating across multiple jurisdictions. These challenges not only impede market penetration but also hinder the implementation of comprehensive and sustainable waste management strategies. Competition is intensifying, but a lack of standardized metrics makes it difficult to precisely measure market share and growth.

Forces Driving Africa Waste Management Industry Growth

Key growth drivers include increasing urbanization, rising environmental consciousness, stricter government regulations, and substantial investments in waste management infrastructure. Technological advancements such as smart bins and waste-to-energy plants are contributing to improved efficiency. Furthermore, partnerships between the public and private sectors are fostering innovation and scalability. Foreign direct investment plays a vital role in providing capital and technology needed for advancements.

Long-Term Growth Catalysts in the Africa Waste Management Industry

Long-term growth will hinge on continued infrastructure development, technological innovation, and strategic partnerships. Investing in advanced recycling technologies and promoting circular economy models will be critical. The expansion of waste-to-energy facilities and the development of robust waste management policies offer significant potential for long-term growth. Further investment and collaboration across stakeholders will be crucial.

Emerging Opportunities in Africa Waste Management Industry

Emerging opportunities include the development of new waste-to-energy technologies, expanded recycling infrastructure, and increased adoption of smart waste management solutions. Focus on specialized waste streams, such as e-waste and medical waste, presents substantial growth prospects. Furthermore, the growing awareness of the circular economy presents opportunities for innovative solutions and business models.

Leading Players in the Africa Waste Management Industry Sector

- Averda

- Enviroserv

- Interwaste

- WasteMart

- Universal Recycling Company

- Desco

- PETCO

- The Glass Recycling Company

- Oricol Environmental Services SA (PTY) LTD

- WeCyclers

- The Waste Group (Pty) Ltd

- SA Waste (PTY) Ltd

- (List Not Exhaustive)

Key Milestones in Africa Waste Management Industry

- October 2022: SUEZ, RBH, and AIIM finalized the acquisition of EnviroServ, significantly strengthening SUEZ's presence and operational capacity within the African waste management market.

- May 2022: IFC provided a USD 30 Million loan to Averda, supporting its expansion across Africa and the Middle East and showcasing the growing interest from international financial institutions in the sector.

- [Add other relevant milestones with verifiable sources. Include dates, companies involved, and a brief description of the milestone's significance.]

Strategic Outlook for Africa Waste Management Industry Market

The Africa waste management market holds immense future potential, driven by sustained economic growth, urbanization, and rising environmental awareness. Strategic opportunities lie in technological innovation, public-private partnerships, and the development of sustainable waste management solutions. Companies that prioritize efficiency, sustainability, and regulatory compliance are well-positioned to capitalize on the long-term growth prospects of this dynamic market.

Africa Waste Management Industry Segmentation

-

1. Waste type

- 1.1. Industrial waste

- 1.2. Municipal solid waste

- 1.3. Hazardous Waste

- 1.4. E-waste

- 1.5. Plastic waste

- 1.6. Bio-medical waste

-

2. Disposal methods

- 2.1. Landfill

- 2.2. Incineration

- 2.3. Dismantling

- 2.4. Recycling

Africa Waste Management Industry Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

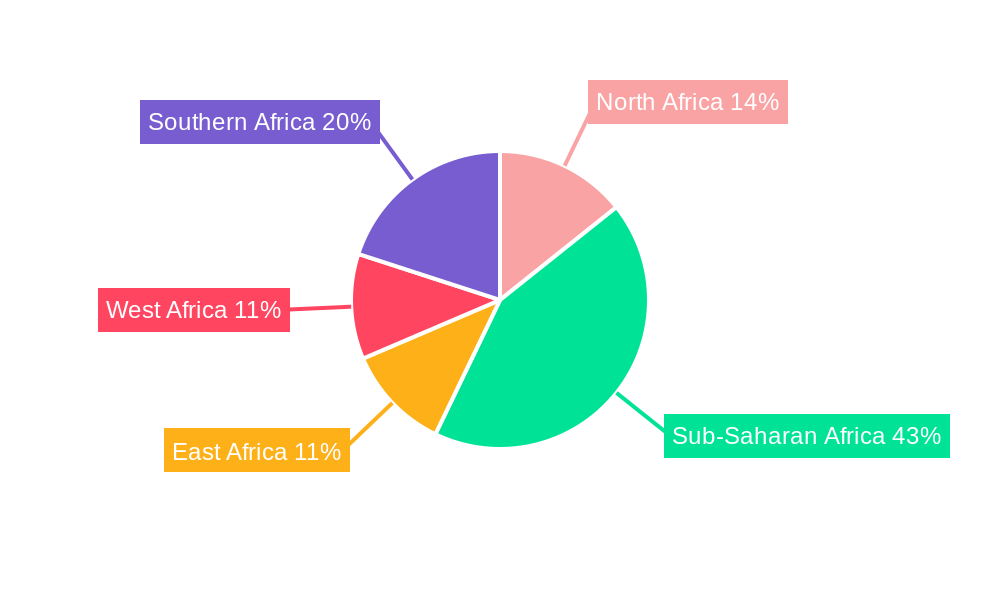

Africa Waste Management Industry Regional Market Share

Geographic Coverage of Africa Waste Management Industry

Africa Waste Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.98% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Awareness towards the Waste Management

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Waste Management Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Waste type

- 5.1.1. Industrial waste

- 5.1.2. Municipal solid waste

- 5.1.3. Hazardous Waste

- 5.1.4. E-waste

- 5.1.5. Plastic waste

- 5.1.6. Bio-medical waste

- 5.2. Market Analysis, Insights and Forecast - by Disposal methods

- 5.2.1. Landfill

- 5.2.2. Incineration

- 5.2.3. Dismantling

- 5.2.4. Recycling

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Waste type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Averda

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Enviroserv

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Interwaste

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 WasteMart

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Universal Recycling Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Desco

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PETCO

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 The Glass Recycling Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Oricol Environmental Services SA (PTY) LTD

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 WeCyclers

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 The Waste Group (Pty) Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 SA Waste (PTY) Ltd **List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Averda

List of Figures

- Figure 1: Africa Waste Management Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Africa Waste Management Industry Share (%) by Company 2025

List of Tables

- Table 1: Africa Waste Management Industry Revenue Million Forecast, by Waste type 2020 & 2033

- Table 2: Africa Waste Management Industry Volume Billion Forecast, by Waste type 2020 & 2033

- Table 3: Africa Waste Management Industry Revenue Million Forecast, by Disposal methods 2020 & 2033

- Table 4: Africa Waste Management Industry Volume Billion Forecast, by Disposal methods 2020 & 2033

- Table 5: Africa Waste Management Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Africa Waste Management Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Africa Waste Management Industry Revenue Million Forecast, by Waste type 2020 & 2033

- Table 8: Africa Waste Management Industry Volume Billion Forecast, by Waste type 2020 & 2033

- Table 9: Africa Waste Management Industry Revenue Million Forecast, by Disposal methods 2020 & 2033

- Table 10: Africa Waste Management Industry Volume Billion Forecast, by Disposal methods 2020 & 2033

- Table 11: Africa Waste Management Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Africa Waste Management Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Nigeria Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Nigeria Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: South Africa Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: South Africa Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Egypt Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Egypt Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Kenya Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Kenya Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Ethiopia Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Ethiopia Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Morocco Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Morocco Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Ghana Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Ghana Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Algeria Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Algeria Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Tanzania Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Tanzania Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Ivory Coast Africa Waste Management Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Ivory Coast Africa Waste Management Industry Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Waste Management Industry?

The projected CAGR is approximately 4.98%.

2. Which companies are prominent players in the Africa Waste Management Industry?

Key companies in the market include Averda, Enviroserv, Interwaste, WasteMart, Universal Recycling Company, Desco, PETCO, The Glass Recycling Company, Oricol Environmental Services SA (PTY) LTD, WeCyclers, The Waste Group (Pty) Ltd, SA Waste (PTY) Ltd **List Not Exhaustive.

3. What are the main segments of the Africa Waste Management Industry?

The market segments include Waste type, Disposal methods.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.72 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Awareness towards the Waste Management.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

October 2022- In line with the conditions stated on June 9, 2022, SUEZ, Royal Bafokeng Holdings (RBH), and African Infrastructure Investment Managers (AIIM) finalized the acquisition of EnviroServ Proprietary Holdings Ltd and its subsidiaries (collectively, "EnviroServ") after receiving permission from the regional antitrust authorities. By this purchase, SUEZ will be able to solidify both its presence in Africa and its position as a global leader in the treatment of municipal and industrial waste.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Waste Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Waste Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Waste Management Industry?

To stay informed about further developments, trends, and reports in the Africa Waste Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence