Key Insights

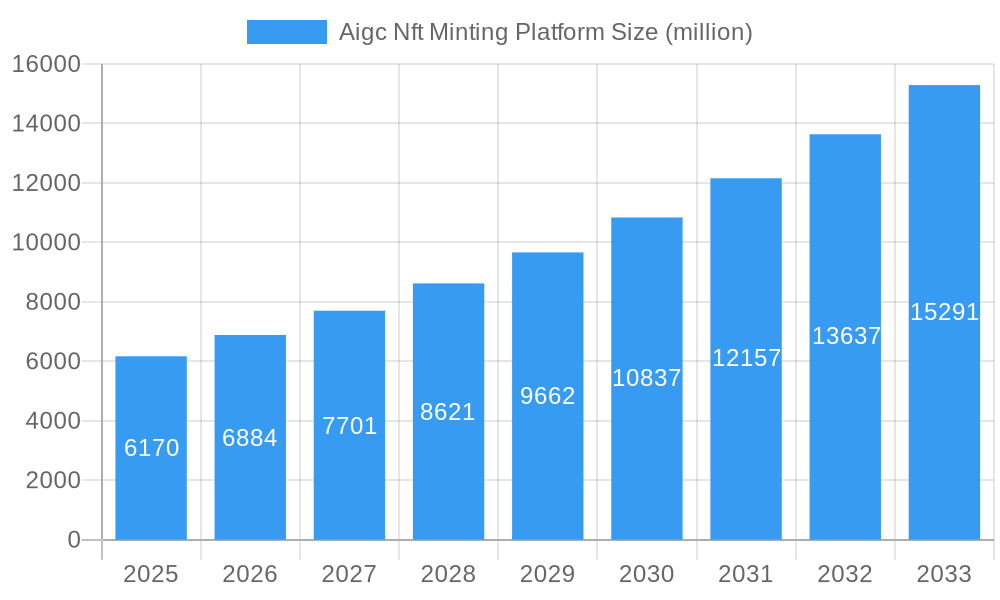

The Artificial Intelligence-Generated Content (AIGC) NFT minting platform market is poised for explosive growth, with an estimated market size of $6.17 billion in 2025. This burgeoning sector is driven by the increasing demand for unique digital assets, the democratization of art creation through AI tools, and the expanding metaverse and blockchain ecosystems. The market is projected to expand at a robust CAGR of 11.54%, indicating a sustained upward trajectory as more individuals and enterprises leverage AIGC for digital collectibles, in-game assets, and intellectual property monetization. Key drivers include advancements in AI art generation models, growing artist adoption, and the increasing ease of minting NFTs on various blockchain networks, lowering the barrier to entry for creators and collectors alike. The integration of AIGC into diverse applications, from personalized digital art to dynamic NFTs, is fueling this expansion.

Aigc Nft Minting Platform Market Size (In Billion)

The market's evolution is characterized by several key trends, including the rise of generative adversarial networks (GANs) and diffusion models in art creation, the development of specialized AIGC platforms offering intuitive user interfaces, and the growing emphasis on royalty structures for creators. While the market is experiencing a surge, certain restraints, such as the potential for AI-generated art to be perceived as less valuable than human-created art and the environmental concerns associated with some blockchain technologies, need to be addressed. Nevertheless, the platform's segmentation reveals a strong demand from both enterprise and individual users, with revenue models primarily based on recurring fees and creation fees, reflecting the ongoing service and platform development. Prominent companies like Open AI, Stability AI, StarryAI, and NightCafe are at the forefront, shaping the competitive landscape and driving innovation across key regions including North America, Europe, and Asia Pacific, with China and India showing significant potential.

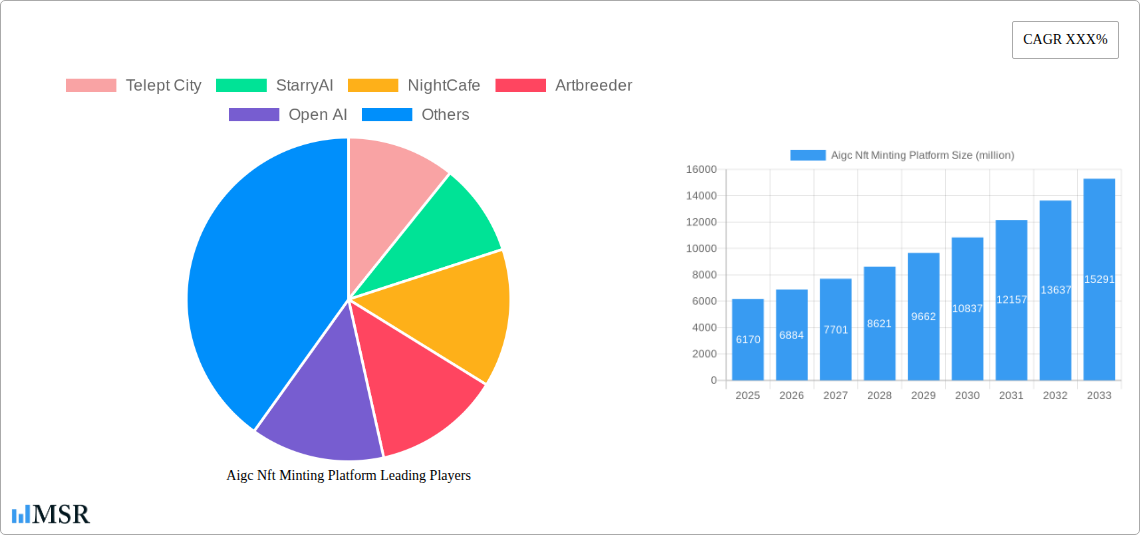

Aigc Nft Minting Platform Company Market Share

This comprehensive report delves into the dynamic and rapidly evolving Aigc NFT Minting Platform market, providing in-depth analysis, strategic insights, and future projections. Spanning the historical period of 2019-2024, with a base year of 2025 and a forecast period extending to 2033, this report is an essential resource for understanding the current landscape, identifying growth opportunities, and navigating the challenges within this burgeoning sector.

Aigc Nft Minting Platform Market Concentration & Dynamics

The Aigc NFT Minting Platform market exhibits a dynamic and evolving concentration landscape. While fragmented in its early stages, key players are consolidating their positions, driven by significant technological advancements and increasing adoption. The innovation ecosystem is robust, with companies like Open AI, Stability AI, and Artbreeder at the forefront, continuously pushing the boundaries of generative AI for digital asset creation. Regulatory frameworks are still nascent but are rapidly developing, posing both challenges and opportunities for platform providers. Substitute products, primarily traditional digital art marketplaces and platforms not leveraging AIGC, are facing increasing pressure as AIGC-generated NFTs offer unique value propositions. End-user trends indicate a strong surge in demand from both individual creators and enterprises seeking to leverage NFTs for digital ownership, community building, and brand engagement. Mergers and acquisitions (M&A) are anticipated to become more prevalent as larger entities seek to acquire innovative technologies and established user bases. The market share distribution is expected to see shifts as new entrants leverage advanced AI models and niche platform offerings gain traction. The number of M&A deals is projected to grow significantly, indicating a consolidation phase as the market matures.

Aigc Nft Minting Platform Industry Insights & Trends

The Aigc NFT Minting Platform industry is projected to experience substantial growth, fueled by a confluence of technological advancements, evolving consumer behaviors, and expanding applications. The global market size is estimated to reach $70 billion by 2025 and is forecast to grow at a Compound Annual Growth Rate (CAGR) of approximately 35% during the forecast period of 2025-2033. This impressive growth is largely driven by the increasing accessibility and sophistication of Artificial Intelligence (AI) models capable of generating unique and high-quality digital art.

Technological disruptions are at the heart of this expansion. Breakthroughs in generative adversarial networks (GANs), diffusion models, and large language models (LLMs) have empowered platforms to create diverse and intricate digital assets with unprecedented ease. This democratizes digital art creation, allowing individuals without traditional artistic skills to participate in the NFT market. Furthermore, the integration of AI with blockchain technology offers innovative solutions for smart contract automation, royalty management, and decentralized ownership, thereby enhancing the value proposition of Aigc NFT minting platforms.

Evolving consumer behaviors are also playing a pivotal role. There's a growing demand for unique, verifiable digital ownership and collectibles. AIGC NFTs cater to this by offering one-of-a-kind digital assets that can be authenticated on the blockchain. This trend is further amplified by the rise of the metaverse and the increasing need for digital assets within virtual worlds for avatars, in-game items, and virtual real estate. Gamification and interactive experiences built around AIGC NFTs are attracting a wider audience, including younger demographics who are digital natives and are more receptive to emerging technologies.

The increasing adoption by enterprises for branding, marketing, and customer loyalty programs presents another significant growth driver. Companies are recognizing the potential of AIGC NFTs to create unique digital merchandise, reward loyal customers, and build immersive brand experiences. The ability to generate a high volume of diverse NFTs efficiently and cost-effectively makes AIGC platforms an attractive solution for large-scale campaigns.

Key Markets & Segments Leading Aigc Nft Minting Platform

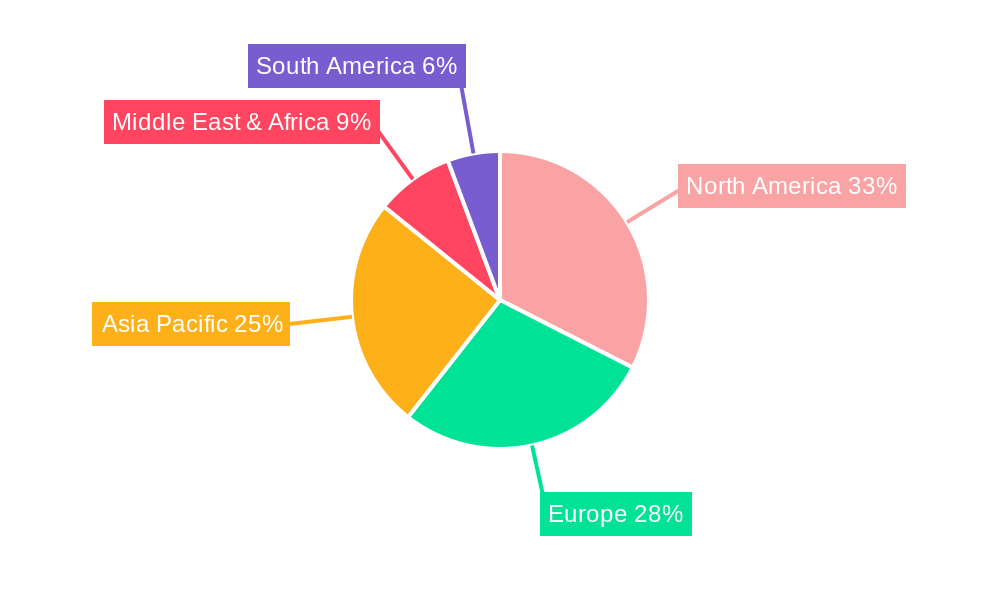

The Aigc NFT Minting Platform market is experiencing robust growth across various regions and segments, with distinct drivers shaping its trajectory.

Dominant Region: North America is currently a leading market, driven by a strong technological infrastructure, significant venture capital investment in AI and blockchain technologies, and a culture of early adoption of emerging digital trends. The United States, in particular, is a hub for both AI research and NFT innovation, with a high concentration of leading companies and a substantial individual and enterprise user base.

Key Segment Drivers (Application):

- Enterprise Application: Enterprises are increasingly leveraging Aigc NFT minting platforms for a variety of strategic purposes.

- Marketing and Branding: Companies are minting unique digital collectibles, loyalty tokens, and promotional NFTs to enhance brand engagement and reach new customer segments.

- Digital Asset Management: AIGC platforms facilitate the creation of proprietary digital assets for virtual worlds, metaverse experiences, and decentralized applications (dApps).

- Customer Loyalty Programs: Rewarding customers with exclusive NFTs for purchases or engagement drives retention and builds stronger community ties.

- Supply Chain Transparency: Potential applications in verifying the authenticity and origin of digital and even physical goods through unique NFT tokens.

- Individual Application: The individual user segment remains a cornerstone of the Aigc NFT market.

- Digital Art Creation and Monetization: Artists and creators of all levels can now generate unique digital artworks and sell them as NFTs, opening up new revenue streams.

- Collectible Ownership: Individuals are investing in and collecting AIGC-generated NFTs as digital memorabilia and speculative assets.

- Gaming and Metaverse Engagement: Users acquire NFTs for in-game items, avatar customization, and virtual land within burgeoning metaverse ecosystems.

- Community Building: Participating in NFT projects often involves joining communities, fostering social connections around shared digital interests.

Key Segment Drivers (Type):

- Recurring Fee Models: These are becoming increasingly popular for platforms offering ongoing AI model access, subscription-based minting services, or premium features.

- Predictable Revenue Streams: Provides stability for platform providers and predictable operational costs for users.

- Continuous Value Addition: Encourages ongoing engagement and development of new AI models and platform features.

- Scalability: Well-suited for platforms serving a large and growing user base.

- Creating Fee Models: A per-mint or per-asset creation fee structure is common, particularly for one-off or project-based NFT generation.

- Direct Monetization: Directly links revenue to the usage of the minting service.

- Accessibility for Occasional Users: Appeals to individuals or businesses who may not require continuous access.

- Value-Based Pricing: Fees can be tiered based on the complexity, uniqueness, or blockchain network used for minting.

The dominance of these segments is driven by economic growth, increasing digital literacy, and the ongoing expansion of blockchain infrastructure. As these factors continue to strengthen, the Aigc NFT Minting Platform market is poised for further expansion across all key geographical and segment areas.

Aigc Nft Minting Platform Product Developments

Product innovations in the Aigc NFT Minting Platform sector are rapidly advancing, focusing on enhancing generative AI capabilities, streamlining minting processes, and expanding blockchain interoperability. Platforms are integrating more sophisticated AI models, like those from Open AI and Stability AI, to produce higher-fidelity and more diverse digital art, 3D assets, and even generative music. User-friendly interfaces are being developed to lower the barrier to entry for both individual creators and enterprises. Enhanced features include automated metadata generation, royalty management integration, and multi-chain minting options. The market relevance is underscored by the increasing demand for unique, AI-generated digital assets for the metaverse, gaming, and digital collectibles. Competitive edges are being forged through proprietary AI algorithms, exclusive art styles, and robust security features for smart contracts.

Challenges in the Aigc Nft Minting Platform Market

Despite its promising growth, the Aigc NFT Minting Platform market faces several significant challenges. Regulatory uncertainty surrounding NFTs and digital assets, particularly in terms of intellectual property rights and taxation, continues to be a major hurdle. Supply chain issues are less direct for digital assets but can manifest as network congestion and high gas fees on certain blockchains, impacting the cost and speed of minting. Competitive pressures are intense, with a constant influx of new platforms and AI models vying for market share, leading to potential price wars and a need for continuous innovation.

Forces Driving Aigc Nft Minting Platform Growth

The Aigc NFT Minting Platform market is propelled by several key growth drivers. Technologically, advancements in AI generative models offer increasingly sophisticated and unique digital asset creation capabilities. Economically, the growing creator economy and the increasing adoption of NFTs for digital ownership and monetization present substantial opportunities. Regulatory factors, while presenting challenges, are also evolving towards greater clarity, which will likely foster further mainstream adoption. The expansion of the metaverse and the demand for digital assets within these virtual worlds are significant catalysts.

Challenges in the Aigc Nft Minting Platform Market

Looking ahead, long-term growth catalysts for the Aigc NFT Minting Platform market will be driven by continued innovation in AI, the maturation of blockchain technology, and the expansion of the digital economy. Strategic partnerships between AI companies and established NFT marketplaces will accelerate user adoption and market penetration. Furthermore, the development of decentralized autonomous organizations (DAOs) for collective ownership and governance of AIGC-generated art collections will foster new engagement models. Expansion into new industries beyond art and collectibles, such as gaming, fashion, and even real estate tokenization, will unlock significant future potential.

Emerging Opportunities in Aigc Nft Minting Platform

Emerging opportunities in the Aigc NFT Minting Platform market are abundant and diverse. The burgeoning metaverse presents a vast landscape for unique digital asset creation for avatars, virtual real estate, and in-world experiences. Advancements in AI are enabling more personalized and interactive NFT experiences, moving beyond static images to dynamic and evolving digital creations. Consumer preferences are shifting towards verifiable digital scarcity and ownership, which AIGC NFTs perfectly fulfill. New markets are opening in areas like personalized digital merchandise, AI-generated music NFTs, and unique brand activations.

Leading Players in the Aigc Nft Minting Platform Sector

- Telept City

- StarryAI

- NightCafe

- Artbreeder

- Open AI

- Stability AI

- Fotor

- AutoMinter

- WOMBO

- AiForge

Key Milestones in Aigc Nft Minting Platform Industry

- 2019-2020: Early development and public release of foundational generative AI models enabling broader creative applications.

- 2021: Surge in NFT market popularity, driving initial interest and experimentation with AIGC for NFT creation. NightCafe gains significant traction.

- Early 2022: Introduction of more advanced diffusion models and GANs, leading to higher quality AIGC outputs. StarryAI and Artbreeder see increased adoption.

- Mid-2022: Emergence of dedicated AIGC NFT minting platforms and tools like AutoMinter and specialized solutions from companies like Fotor.

- Late 2022: Increased enterprise exploration of AIGC NFTs for marketing campaigns and brand activations.

- 2023: Refinement of AI models for greater control and customization in NFT generation. WOMBO and AiForge explore unique generative approaches.

- 2024: Growing focus on ethical AI, copyright considerations, and the integration of AIGC NFTs with metaverse platforms. Telept City emerges as a platform focusing on immersive digital experiences.

Strategic Outlook for Aigc Nft Minting Platform Market

The strategic outlook for the Aigc NFT Minting Platform market is exceptionally positive, characterized by continuous innovation and expanding utility. Growth accelerators will include the deepening integration of AI with blockchain technology for enhanced functionality and security, the increasing adoption by mainstream enterprises for branding and customer engagement, and the burgeoning demand for digital assets within the metaverse. Strategic opportunities lie in developing specialized AI models for niche markets, offering robust tools for creators and enterprises, and fostering vibrant communities around NFT projects. The future market potential is immense, driven by the democratization of digital asset creation and the evolving landscape of digital ownership.

Aigc Nft Minting Platform Segmentation

-

1. Application

- 1.1. Enterprise

- 1.2. Individual

-

2. Type

- 2.1. Recurring Fee

- 2.2. Creating Fee

Aigc Nft Minting Platform Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Aigc Nft Minting Platform Regional Market Share

Geographic Coverage of Aigc Nft Minting Platform

Aigc Nft Minting Platform REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.54% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aigc Nft Minting Platform Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Enterprise

- 5.1.2. Individual

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Recurring Fee

- 5.2.2. Creating Fee

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Aigc Nft Minting Platform Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Enterprise

- 6.1.2. Individual

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Recurring Fee

- 6.2.2. Creating Fee

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Aigc Nft Minting Platform Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Enterprise

- 7.1.2. Individual

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Recurring Fee

- 7.2.2. Creating Fee

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Aigc Nft Minting Platform Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Enterprise

- 8.1.2. Individual

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Recurring Fee

- 8.2.2. Creating Fee

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Aigc Nft Minting Platform Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Enterprise

- 9.1.2. Individual

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Recurring Fee

- 9.2.2. Creating Fee

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Aigc Nft Minting Platform Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Enterprise

- 10.1.2. Individual

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Recurring Fee

- 10.2.2. Creating Fee

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Telept City

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 StarryAI

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 NightCafe

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Artbreeder

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Open AI

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Stability AI

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Fotor

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 AutoMinter

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 WOMBO

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 AiForge

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Telept City

List of Figures

- Figure 1: Global Aigc Nft Minting Platform Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Aigc Nft Minting Platform Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Aigc Nft Minting Platform Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Aigc Nft Minting Platform Revenue (undefined), by Type 2025 & 2033

- Figure 5: North America Aigc Nft Minting Platform Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Aigc Nft Minting Platform Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Aigc Nft Minting Platform Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Aigc Nft Minting Platform Revenue (undefined), by Application 2025 & 2033

- Figure 9: South America Aigc Nft Minting Platform Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Aigc Nft Minting Platform Revenue (undefined), by Type 2025 & 2033

- Figure 11: South America Aigc Nft Minting Platform Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America Aigc Nft Minting Platform Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Aigc Nft Minting Platform Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Aigc Nft Minting Platform Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe Aigc Nft Minting Platform Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Aigc Nft Minting Platform Revenue (undefined), by Type 2025 & 2033

- Figure 17: Europe Aigc Nft Minting Platform Revenue Share (%), by Type 2025 & 2033

- Figure 18: Europe Aigc Nft Minting Platform Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Aigc Nft Minting Platform Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Aigc Nft Minting Platform Revenue (undefined), by Application 2025 & 2033

- Figure 21: Middle East & Africa Aigc Nft Minting Platform Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Aigc Nft Minting Platform Revenue (undefined), by Type 2025 & 2033

- Figure 23: Middle East & Africa Aigc Nft Minting Platform Revenue Share (%), by Type 2025 & 2033

- Figure 24: Middle East & Africa Aigc Nft Minting Platform Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Aigc Nft Minting Platform Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Aigc Nft Minting Platform Revenue (undefined), by Application 2025 & 2033

- Figure 27: Asia Pacific Aigc Nft Minting Platform Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Aigc Nft Minting Platform Revenue (undefined), by Type 2025 & 2033

- Figure 29: Asia Pacific Aigc Nft Minting Platform Revenue Share (%), by Type 2025 & 2033

- Figure 30: Asia Pacific Aigc Nft Minting Platform Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Aigc Nft Minting Platform Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aigc Nft Minting Platform Revenue undefined Forecast, by Region 2020 & 2033

- Table 2: Global Aigc Nft Minting Platform Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global Aigc Nft Minting Platform Revenue undefined Forecast, by Type 2020 & 2033

- Table 4: Global Aigc Nft Minting Platform Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Aigc Nft Minting Platform Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global Aigc Nft Minting Platform Revenue undefined Forecast, by Type 2020 & 2033

- Table 7: Global Aigc Nft Minting Platform Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: United States Aigc Nft Minting Platform Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Canada Aigc Nft Minting Platform Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Mexico Aigc Nft Minting Platform Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Global Aigc Nft Minting Platform Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: Global Aigc Nft Minting Platform Revenue undefined Forecast, by Type 2020 & 2033

- Table 13: Global Aigc Nft Minting Platform Revenue undefined Forecast, by Country 2020 & 2033

- Table 14: Brazil Aigc Nft Minting Platform Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Argentina Aigc Nft Minting Platform Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Rest of South America Aigc Nft Minting Platform Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Global Aigc Nft Minting Platform Revenue undefined Forecast, by Application 2020 & 2033

- Table 18: Global Aigc Nft Minting Platform Revenue undefined Forecast, by Type 2020 & 2033

- Table 19: Global Aigc Nft Minting Platform Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: United Kingdom Aigc Nft Minting Platform Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Germany Aigc Nft Minting Platform Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: France Aigc Nft Minting Platform Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Italy Aigc Nft Minting Platform Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Spain Aigc Nft Minting Platform Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Russia Aigc Nft Minting Platform Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Benelux Aigc Nft Minting Platform Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Nordics Aigc Nft Minting Platform Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Rest of Europe Aigc Nft Minting Platform Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Global Aigc Nft Minting Platform Revenue undefined Forecast, by Application 2020 & 2033

- Table 30: Global Aigc Nft Minting Platform Revenue undefined Forecast, by Type 2020 & 2033

- Table 31: Global Aigc Nft Minting Platform Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Turkey Aigc Nft Minting Platform Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Israel Aigc Nft Minting Platform Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: GCC Aigc Nft Minting Platform Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: North Africa Aigc Nft Minting Platform Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: South Africa Aigc Nft Minting Platform Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Rest of Middle East & Africa Aigc Nft Minting Platform Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Global Aigc Nft Minting Platform Revenue undefined Forecast, by Application 2020 & 2033

- Table 39: Global Aigc Nft Minting Platform Revenue undefined Forecast, by Type 2020 & 2033

- Table 40: Global Aigc Nft Minting Platform Revenue undefined Forecast, by Country 2020 & 2033

- Table 41: China Aigc Nft Minting Platform Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: India Aigc Nft Minting Platform Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: Japan Aigc Nft Minting Platform Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: South Korea Aigc Nft Minting Platform Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: ASEAN Aigc Nft Minting Platform Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Oceania Aigc Nft Minting Platform Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: Rest of Asia Pacific Aigc Nft Minting Platform Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aigc Nft Minting Platform?

The projected CAGR is approximately 11.54%.

2. Which companies are prominent players in the Aigc Nft Minting Platform?

Key companies in the market include Telept City, StarryAI, NightCafe, Artbreeder, Open AI, Stability AI, Fotor, AutoMinter, WOMBO, AiForge.

3. What are the main segments of the Aigc Nft Minting Platform?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aigc Nft Minting Platform," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aigc Nft Minting Platform report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aigc Nft Minting Platform?

To stay informed about further developments, trends, and reports in the Aigc Nft Minting Platform, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence