Key Insights

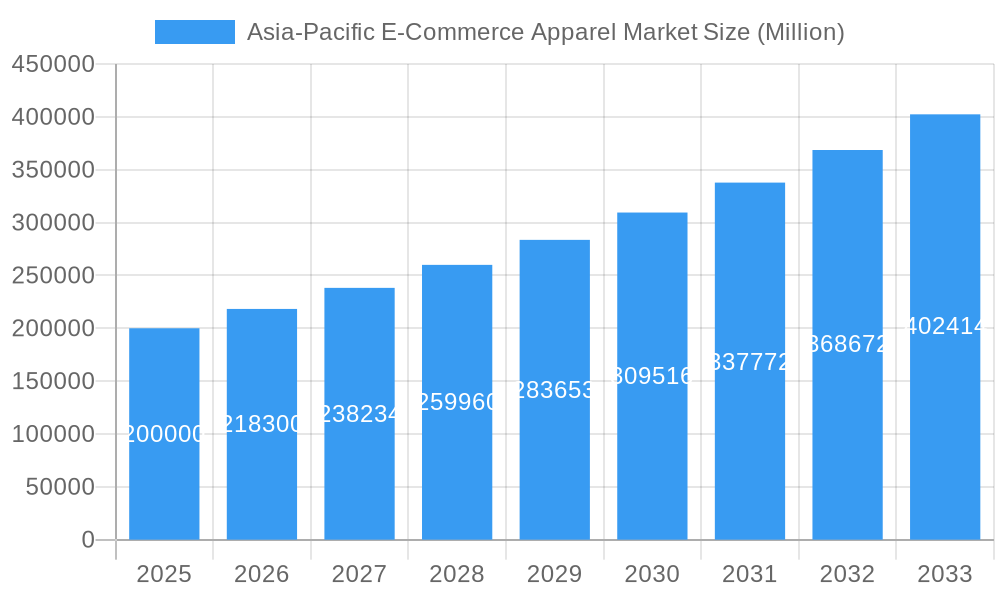

The Asia-Pacific e-commerce apparel market is projected for significant expansion, fueled by heightened internet and smartphone adoption, escalating disposable incomes, and a consumer pivot towards the convenience of online retail. With an estimated market size of $779.3 billion in 2025, the region's vast population and growing middle class underpin this substantial valuation. Key growth catalysts include the enduring popularity of fast fashion, the demand for personalized online shopping experiences, and the enhancement of e-commerce logistics infrastructure, notably in China and India. The market's segmentation by product type (e.g., formal wear, casual wear, sportswear), end-user demographics (men, women, children), and sales channels (third-party retailers, direct-to-consumer websites) facilitates targeted marketing and strategic investments. While obstacles like product authenticity concerns, returns management, and delivery inconsistencies persist, technological advancements and refined supply chain operations are actively mitigating these challenges. The continuous development of e-commerce infrastructure, alongside increasing digital literacy and confidence in online transactions, forecasts sustained growth for the Asia-Pacific e-commerce apparel market through 2033, with a compound annual growth rate (CAGR) of 9.15%.

Asia-Pacific E-Commerce Apparel Market Market Size (In Billion)

The competitive arena is intense, featuring global leaders such as Adidas, Inditex, and Nike, alongside formidable regional contenders like Aditya Birla Group and Arvind Lifestyle Brands Limited. Market success will be dictated by brands' agility in responding to shifting consumer desires, their capacity to offer competitive pricing and exceptional customer service, and their proficiency in utilizing data analytics to personalize the online shopping journey. Growth will be especially prominent in nations with rapidly expanding internet penetration and a youthful, digitally-native demographic. Furthermore, strategic alliances with logistics partners and the integration of innovative technologies, including augmented reality and virtual try-on capabilities, will be pivotal for establishing a competitive edge in this dynamic market. The market's robust growth trajectory and considerable untapped potential continue to attract ongoing investment and innovation.

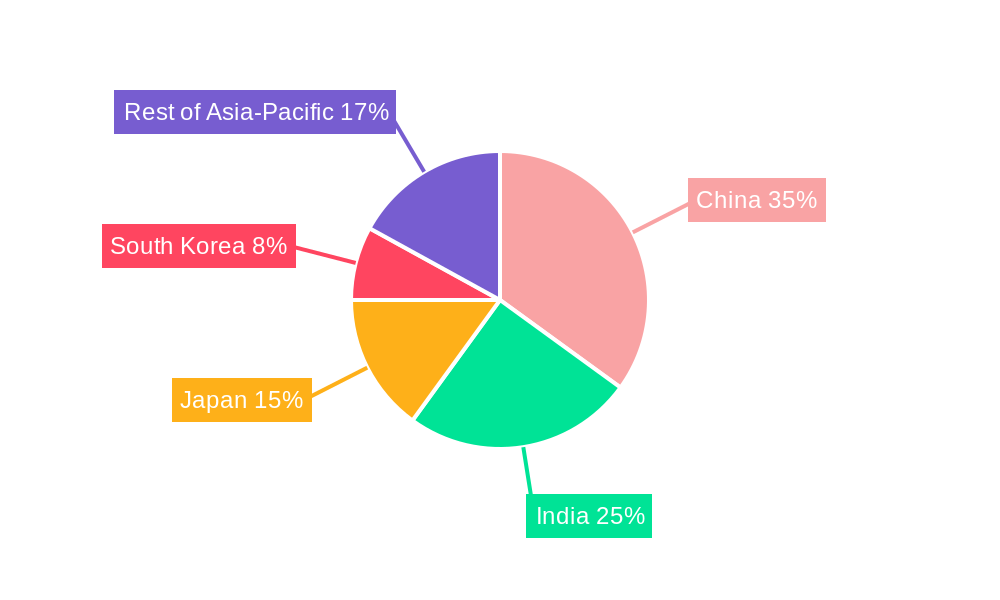

Asia-Pacific E-Commerce Apparel Market Company Market Share

Asia-Pacific E-Commerce Apparel Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific e-commerce apparel market, offering invaluable insights for industry stakeholders. We delve into market dynamics, growth drivers, key segments, leading players, and future opportunities, covering the period from 2019 to 2033. The report is packed with actionable data and projections, empowering you to make informed strategic decisions. Our analysis incorporates data from the historical period (2019-2024), the base year (2025), and provides estimations for 2025 and a detailed forecast from 2025-2033. The market is segmented by product type (Formal Wear, Casual Wear, Sportswear, Nightwear, Other Types), end-user (Men, Women, Kids/Children), and platform type (Third Party Retailer, Company's Own Website). Key players such as Adidas AG, Inditex, Aditya Birla Group, and Nike Inc. are thoroughly examined.

Asia-Pacific E-Commerce Apparel Market Market Concentration & Dynamics

The Asia-Pacific e-commerce apparel market is characterized by a dynamic interplay of factors influencing its concentration and overall dynamics. While a few major players hold significant market share, the market exhibits a relatively fragmented structure due to the presence of numerous smaller brands and emerging online retailers. The market share of the top 5 players is estimated to be xx%, reflecting the presence of both established global brands and regional players.

- Market Concentration: The market exhibits moderate concentration, with a Herfindahl-Hirschman Index (HHI) of approximately xx.

- Innovation Ecosystems: Significant innovation is driven by technological advancements in areas such as personalized recommendations, virtual try-ons, and augmented reality shopping experiences. Furthermore, the rise of social commerce and influencer marketing is significantly impacting market dynamics.

- Regulatory Frameworks: Varying regulatory landscapes across different countries in the Asia-Pacific region influence market operations, particularly concerning data privacy, consumer protection, and cross-border e-commerce regulations.

- Substitute Products: The market faces competition from traditional brick-and-mortar stores, particularly in regions with robust retail infrastructure. Furthermore, the rise of secondhand clothing platforms and rental services offers viable alternatives.

- End-User Trends: Evolving consumer preferences, increasing demand for sustainable and ethically sourced apparel, and the growing popularity of fast fashion significantly impact market trends.

- M&A Activities: The past five years have witnessed xx M&A deals in the Asia-Pacific e-commerce apparel market, mainly driven by strategies of consolidation and expansion into new markets.

Asia-Pacific E-Commerce Apparel Market Industry Insights & Trends

The Asia-Pacific e-commerce apparel market is experiencing robust growth, driven by several key factors. The market size in 2025 is estimated at xx Million USD, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by rising internet penetration, increasing smartphone usage, and the growing preference for online shopping among consumers in the region. Technological advancements such as improved logistics and payment gateways further contribute to market expansion. Furthermore, the increasing adoption of mobile commerce, coupled with the rising disposable incomes and changing lifestyles, are contributing to higher online apparel purchases. The market is witnessing disruption from new business models like direct-to-consumer brands and subscription boxes, challenging established players. Consumer behaviour is evolving, with a shift towards personalized experiences, greater emphasis on brand authenticity, and increased demand for sustainable and ethical apparel. These trends are reshaping the competitive landscape and influencing the strategies of players within the market.

Key Markets & Segments Leading Asia-Pacific E-Commerce Apparel Market

China and India are the dominant markets within the Asia-Pacific region, contributing to a significant share of the overall market revenue. The casual wear segment holds the largest market share among product types, followed by sportswear. Women’s apparel constitutes the largest end-user segment, exhibiting strong growth potential. The dominance of these segments is attributable to several drivers:

China and India:

- High Population & Growing Middle Class: These countries boast massive populations with expanding middle classes, driving increased consumption.

- Rapid Urbanization: Urbanization leads to higher internet penetration and access to e-commerce platforms.

- Technological Infrastructure: Improved logistics and payment infrastructure facilitate online shopping experiences.

Casual Wear:

- Versatility & Affordability: Casual wear offers versatility and affordability, appealing to a broader consumer base.

- Fashion Trends: Continuous evolution of fashion trends drives higher demand for new styles.

Women's Apparel:

- Higher Spending Power: Women often constitute a higher portion of discretionary spending, positively impacting the segment.

- Diverse Fashion Options: The apparel market offers diverse styles and trends specifically catering to women.

Third-party retailers dominate the platform type, although company-owned websites are gaining traction, reflecting a growing focus on direct-to-consumer strategies.

Asia-Pacific E-Commerce Apparel Market Product Developments

Recent product innovations focus on enhancing customer experiences through features such as virtual try-on tools using augmented reality (AR) and artificial intelligence (AI)-powered personalized recommendations. Sustainable and ethically produced apparel is also gaining traction, reflecting increased consumer awareness. These innovations provide competitive advantages by improving customer satisfaction, driving engagement, and strengthening brand loyalty. Advancements in fabric technology, such as the use of recycled materials and innovative performance fabrics in sportswear, also contribute to the evolution of products within the market.

Challenges in the Asia-Pacific E-Commerce Apparel Market Market

The Asia-Pacific e-commerce apparel market faces challenges such as inconsistent logistics infrastructure in some regions, leading to delivery delays and increased costs. Counterfeit products pose a significant threat, impacting consumer trust and brand reputation. Intense competition, particularly from global brands and emerging local players, further adds pressure. Regulatory inconsistencies across different countries add complexity to market operations. These factors impact profitability and overall market growth. Supply chain disruptions, particularly those observed post-pandemic, have significantly affected the availability of raw materials and timely production, influencing cost structures and inventory management.

Forces Driving Asia-Pacific E-Commerce Apparel Market Growth

The market's growth is propelled by rising disposable incomes, increasing internet and smartphone penetration, particularly in developing economies. Government initiatives promoting digitalization and e-commerce further stimulate market expansion. Technological advancements, like improved payment gateways and logistics, create a more efficient and convenient online shopping experience. The growing adoption of social commerce and influencer marketing significantly boosts sales and brand awareness. Furthermore, evolving consumer preferences towards online shopping and personalized experiences play a crucial role in the continuous expansion of the market.

Challenges in the Asia-Pacific E-Commerce Apparel Market Market

Long-term growth hinges on overcoming challenges such as improving logistics infrastructure in less developed areas, effectively combating counterfeit products, and fostering consumer trust. Strengthening regulatory frameworks and harmonizing cross-border trade policies are critical for sustainable growth. Continuous innovation in areas such as virtual try-ons and personalized experiences will be pivotal in driving future market expansion. Strategic partnerships and mergers and acquisitions could allow companies to broaden their reach, enhance their product offerings, and ultimately gain a significant competitive advantage within the dynamic market environment.

Emerging Opportunities in Asia-Pacific E-Commerce Apparel Market

Emerging opportunities lie in tapping into the growing demand for sustainable and ethical apparel, capitalizing on the rising popularity of personalized experiences using AI and AR technologies. Expansion into untapped markets, particularly in Southeast Asia, presents significant growth potential. The integration of omnichannel strategies, blending online and offline retail channels, offers improved customer engagement and a more seamless shopping journey. The increasing focus on data analytics to better understand and cater to consumer preferences and trends will significantly impact the market's future development.

Leading Players in the Asia-Pacific E-Commerce Apparel Market Sector

- Adidas AG

- Industria de Diseño Textil S A (Inditex)

- Aditya Birla Group's

- Arvind Lifestyle Brands Limited

- V Ventures (Italian colony)

- Forever 21 Inc

- PVH Corp

- Raymond Group

- Hennes & Mauritz AB

- Fast Retailing Co Ltd

- BIBA Fashion Limited

- LVMH Moët Hennessy Louis Vuitton

- Nike Inc

Key Milestones in Asia-Pacific E-Commerce Apparel Market Industry

- February 2023: Forever 21 relaunched in Japan as an upscale brand, focusing on localization and online sales. This demonstrates a strategic shift towards higher-value segments and leveraging online channels for market penetration.

- March 2023: Italian Colony launched its online store in India, offering affordable Italian fashion. This signifies an expansion into a significant and rapidly growing market.

- March 2023: UNIQLO's Attack on Titan collaboration in Japan highlighted the power of brand partnerships and limited-edition products in driving online sales. This signifies the influence of pop-culture tie-ins on e-commerce strategies.

- May 2023: Alessandro Vittore announced its plans to enter the Indian market. This showcases the ongoing interest in tapping into the vast potential of the Indian e-commerce landscape.

Strategic Outlook for Asia-Pacific E-Commerce Apparel Market Market

The Asia-Pacific e-commerce apparel market presents significant long-term growth potential, driven by increasing digital adoption, rising disposable incomes, and evolving consumer preferences. Companies focusing on personalization, sustainability, and omnichannel strategies will be best positioned to capitalize on emerging opportunities. Strategic partnerships, technological innovation, and effective supply chain management are crucial for maintaining a competitive edge in this rapidly evolving market. The market is poised for continued expansion, driven by the intersection of technological advancements and evolving consumer demand.

Asia-Pacific E-Commerce Apparel Market Segmentation

-

1. Product Type

- 1.1. Formal Wear

- 1.2. Casual Wear

- 1.3. Sportswear

- 1.4. Nightwear

- 1.5. Other Types

-

2. End User

- 2.1. Men

- 2.2. Women

- 2.3. Kids/Children

-

3. Platform Type

- 3.1. Third Party Retailer

- 3.2. Company's Own Website

-

4. Geography

- 4.1. China

- 4.2. Japan

- 4.3. India

- 4.4. Australia

Asia-Pacific E-Commerce Apparel Market Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Australia

Asia-Pacific E-Commerce Apparel Market Regional Market Share

Geographic Coverage of Asia-Pacific E-Commerce Apparel Market

Asia-Pacific E-Commerce Apparel Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Strong Growth of Fashion Marketplaces; Increasing Brand Advertisements on Social Media

- 3.3. Market Restrains

- 3.3.1. Competition from Traditional Brick-and-Mortar Retail

- 3.4. Market Trends

- 3.4.1. Strong Growth of Fashion Marketplaces

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Formal Wear

- 5.1.2. Casual Wear

- 5.1.3. Sportswear

- 5.1.4. Nightwear

- 5.1.5. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Men

- 5.2.2. Women

- 5.2.3. Kids/Children

- 5.3. Market Analysis, Insights and Forecast - by Platform Type

- 5.3.1. Third Party Retailer

- 5.3.2. Company's Own Website

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. Australia

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. Japan

- 5.5.3. India

- 5.5.4. Australia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. China Asia-Pacific E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Formal Wear

- 6.1.2. Casual Wear

- 6.1.3. Sportswear

- 6.1.4. Nightwear

- 6.1.5. Other Types

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Men

- 6.2.2. Women

- 6.2.3. Kids/Children

- 6.3. Market Analysis, Insights and Forecast - by Platform Type

- 6.3.1. Third Party Retailer

- 6.3.2. Company's Own Website

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. Japan

- 6.4.3. India

- 6.4.4. Australia

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Japan Asia-Pacific E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Formal Wear

- 7.1.2. Casual Wear

- 7.1.3. Sportswear

- 7.1.4. Nightwear

- 7.1.5. Other Types

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Men

- 7.2.2. Women

- 7.2.3. Kids/Children

- 7.3. Market Analysis, Insights and Forecast - by Platform Type

- 7.3.1. Third Party Retailer

- 7.3.2. Company's Own Website

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. Japan

- 7.4.3. India

- 7.4.4. Australia

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. India Asia-Pacific E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Formal Wear

- 8.1.2. Casual Wear

- 8.1.3. Sportswear

- 8.1.4. Nightwear

- 8.1.5. Other Types

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Men

- 8.2.2. Women

- 8.2.3. Kids/Children

- 8.3. Market Analysis, Insights and Forecast - by Platform Type

- 8.3.1. Third Party Retailer

- 8.3.2. Company's Own Website

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. Japan

- 8.4.3. India

- 8.4.4. Australia

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Australia Asia-Pacific E-Commerce Apparel Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Formal Wear

- 9.1.2. Casual Wear

- 9.1.3. Sportswear

- 9.1.4. Nightwear

- 9.1.5. Other Types

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Men

- 9.2.2. Women

- 9.2.3. Kids/Children

- 9.3. Market Analysis, Insights and Forecast - by Platform Type

- 9.3.1. Third Party Retailer

- 9.3.2. Company's Own Website

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. Japan

- 9.4.3. India

- 9.4.4. Australia

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Adidas AG

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Industria de Diseño Textil S A (Inditex)

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Aditya Birla Group's

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Arvind Lifestyle Brands Limited

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 V Ventures (Italian colony)

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Forever 21 Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 PVH Corp

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Raymond Group

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Hennes & Mauritz AB

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Fast Retailing Co Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 BIBA Fashion Limited

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 LVMH Moët Hennessy Louis Vuitto

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Nike Inc

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 Adidas AG

List of Figures

- Figure 1: Asia-Pacific E-Commerce Apparel Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific E-Commerce Apparel Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 4: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 7: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by End User 2020 & 2033

- Table 8: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 9: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 12: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by End User 2020 & 2033

- Table 13: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 14: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 17: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by End User 2020 & 2033

- Table 18: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 19: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by End User 2020 & 2033

- Table 23: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Platform Type 2020 & 2033

- Table 24: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 25: Asia-Pacific E-Commerce Apparel Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific E-Commerce Apparel Market?

The projected CAGR is approximately 9.15%.

2. Which companies are prominent players in the Asia-Pacific E-Commerce Apparel Market?

Key companies in the market include Adidas AG, Industria de Diseño Textil S A (Inditex), Aditya Birla Group's, Arvind Lifestyle Brands Limited, V Ventures (Italian colony), Forever 21 Inc, PVH Corp, Raymond Group, Hennes & Mauritz AB, Fast Retailing Co Ltd, BIBA Fashion Limited, LVMH Moët Hennessy Louis Vuitto, Nike Inc.

3. What are the main segments of the Asia-Pacific E-Commerce Apparel Market?

The market segments include Product Type, End User, Platform Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 779.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Strong Growth of Fashion Marketplaces; Increasing Brand Advertisements on Social Media.

6. What are the notable trends driving market growth?

Strong Growth of Fashion Marketplaces.

7. Are there any restraints impacting market growth?

Competition from Traditional Brick-and-Mortar Retail.

8. Can you provide examples of recent developments in the market?

May 2023: Alessandro Vittore, a United Kingdom-based clothing company, announced its plans to launch the brand in Indian Market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific E-Commerce Apparel Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific E-Commerce Apparel Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific E-Commerce Apparel Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific E-Commerce Apparel Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence