Key Insights

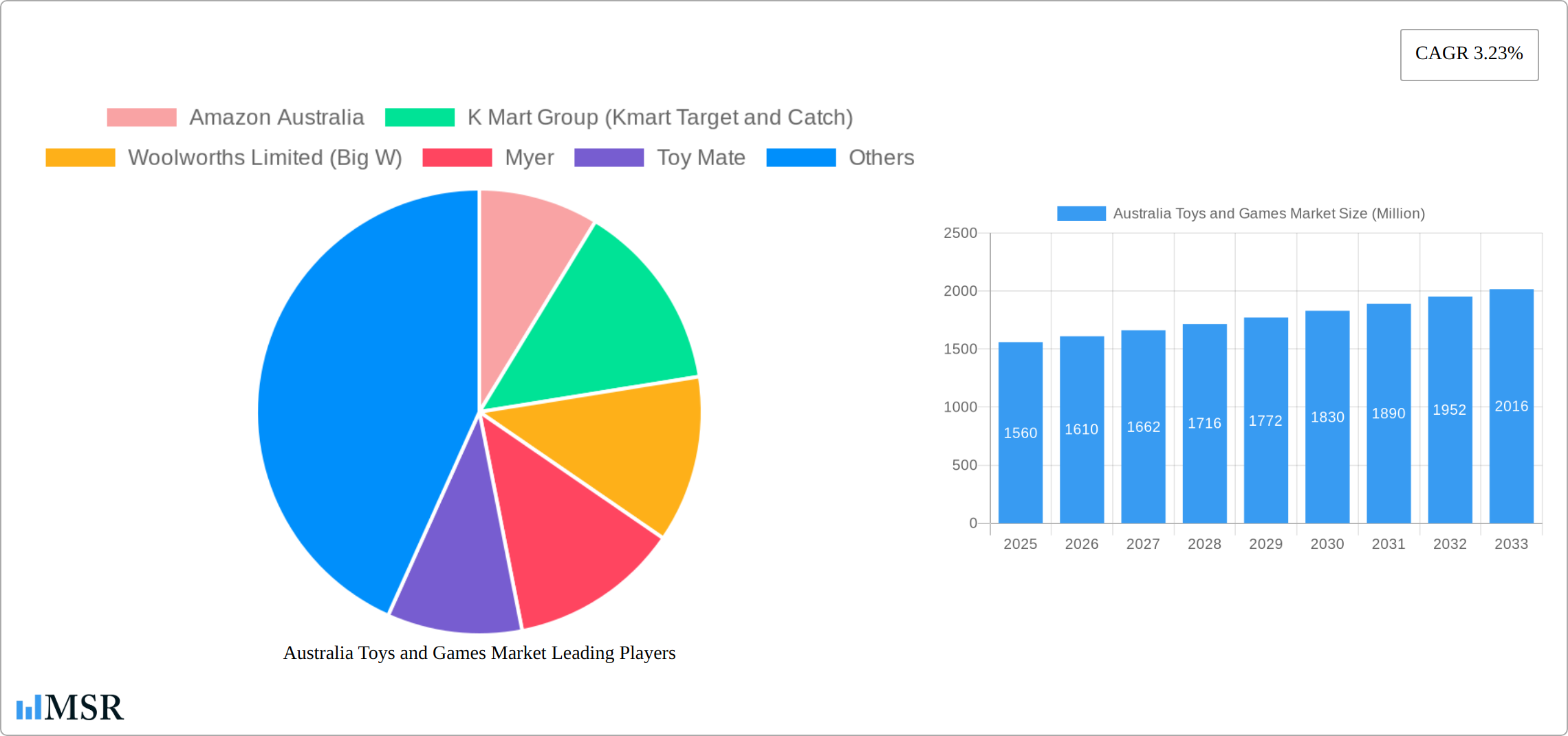

The Australian toys and games market, valued at approximately $1.56 billion in 2025, is projected to experience steady growth, with a Compound Annual Growth Rate (CAGR) of 3.23% from 2025 to 2033. This growth is fueled by several key factors. Increasing disposable incomes among Australian households, coupled with a rising birth rate and a strong preference for experiential learning and play-based education, are driving demand for a diverse range of toys and games. The popularity of online retail channels, exemplified by the success of Amazon Australia, Kmart, and Catch, has significantly expanded market access and facilitated competitive pricing. Furthermore, continuous innovation in toy technology, encompassing interactive and educational toys, contributes to sustained consumer interest and drives market expansion. However, potential restraints include fluctuations in economic conditions, potentially impacting consumer spending on non-essential items. The market is segmented by product type (e.g., action figures, board games, educational toys, video games, plush toys), price point, and distribution channels (online vs. brick-and-mortar). Major players like Amazon Australia, Kmart, Woolworths (Big W), and Myer dominate the market landscape, showcasing both the scale of the sector and the increasing role of e-commerce in shaping consumer buying behavior.

Australia Toys and Games Market Market Size (In Billion)

The competitive landscape is characterized by both large multinational corporations and specialized toy retailers. The presence of both online and offline channels provides consumers with diverse purchasing options. Successful market players strategically utilize promotional campaigns, seasonal offerings, and loyalty programs to engage customers and drive sales. The market's future growth will depend on adapting to evolving consumer preferences, incorporating sustainable practices, and maintaining a balance between online and offline retail strategies to cater to diverse consumer needs and preferences. Innovation in product design, technological integration, and sustainable manufacturing will be crucial in driving future market expansion. The growing influence of social media and influencer marketing also presents opportunities for market players to engage effectively with their target audience.

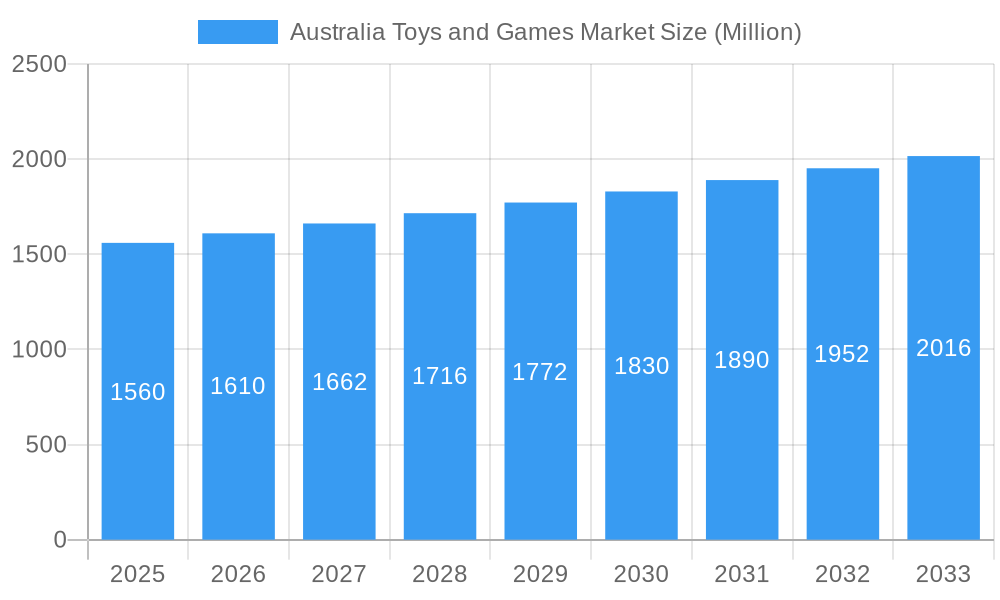

Australia Toys and Games Market Company Market Share

Australia Toys and Games Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Australia Toys and Games Market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers critical data and actionable intelligence to inform strategic decision-making. The Australian toys and games market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Australia Toys and Games Market Market Concentration & Dynamics

The Australian toys and games market is characterized by a moderately concentrated competitive landscape, with a significant presence of large, established retailers and a growing number of agile online players. Key dominant forces include Amazon Australia, the formidable K Mart Group (encompassing Kmart, Target, and Catch), Woolworths Limited (operating Big W), and high-end department stores like Myer. Beyond these giants, a diverse ecosystem of smaller, specialized retailers such as Toy Mate, David Jones, Mighty Ape, and Toyworld effectively serves distinct niche segments. The digital realm is further populated by prominent online marketplaces like eBay, and specialized entertainment retailers including EB Games and JB Hi-Fi, all contributing to a dynamic and multi-faceted market. The increasing influence of online-only retailers, exemplified by Kogan, Temple & Webster, and Costco, has significantly amplified competitive pressures across the board.

- Market Share: While specific figures fluctuate, it's estimated that Amazon Australia commands a substantial market share, closely followed by the K Mart Group and Woolworths Limited. The remaining share is distributed among a constellation of other significant players, encompassing specialized retailers and a burgeoning online presence.

- M&A Activity: The period between 2019 and 2024 saw a moderate level of M&A activity, suggesting a trend towards strategic consolidation. Projections for the forecast period (2025-2033) anticipate an acceleration in mergers and acquisitions. This is likely driven by the strategic imperative for major players to achieve greater economies of scale, expand their market footprint, and enhance their competitive standing in an evolving retail environment.

- Innovation Ecosystems: Australia boasts a robust innovation ecosystem within the toys and games sector. This vibrant environment is nurtured by independent toy designers pushing creative boundaries, rapid advancements in interactive and tech-enabled toys, and the widespread adoption of sophisticated digital marketing strategies and e-commerce platforms.

- Regulatory Frameworks: The Australian Competition and Consumer Commission (ACCC) plays a pivotal role in upholding fair competition and ensuring robust consumer protection within the industry. Its oversight significantly shapes market dynamics, influences strategic decisions, and impacts the landscape for M&A activities.

- Substitute Products: The pervasive influence of digital entertainment, particularly the widespread popularity of video games and immersive online interactive experiences, presents a substantial competitive alternative to traditional toys and games.

- End-User Trends: A noticeable shift in consumer preferences is underway, with a growing emphasis on educational toys, STEM-focused games designed to foster critical thinking, and an increasing demand for sustainable and ethically produced products. These evolving end-user priorities are actively reshaping product development and market strategies.

Australia Toys and Games Market Industry Insights & Trends

The Australian toys and games market has witnessed robust growth, driven by several key factors. Rising disposable incomes, coupled with increasing urbanization and a growing population of children, fuels demand. Technological advancements, particularly in interactive toys and augmented reality (AR)/virtual reality (VR) games, are disrupting the traditional toy market. Evolving consumer behaviors towards experience-based entertainment and the growing preference for online shopping further shape market dynamics.

Market growth is also influenced by seasonal factors (Christmas in particular) and the introduction of new licensed products based on popular movies and TV shows. The increasing importance of e-commerce platforms for sales and marketing is also a major contributing factor.

Key Markets & Segments Leading Australia Toys and Games Market

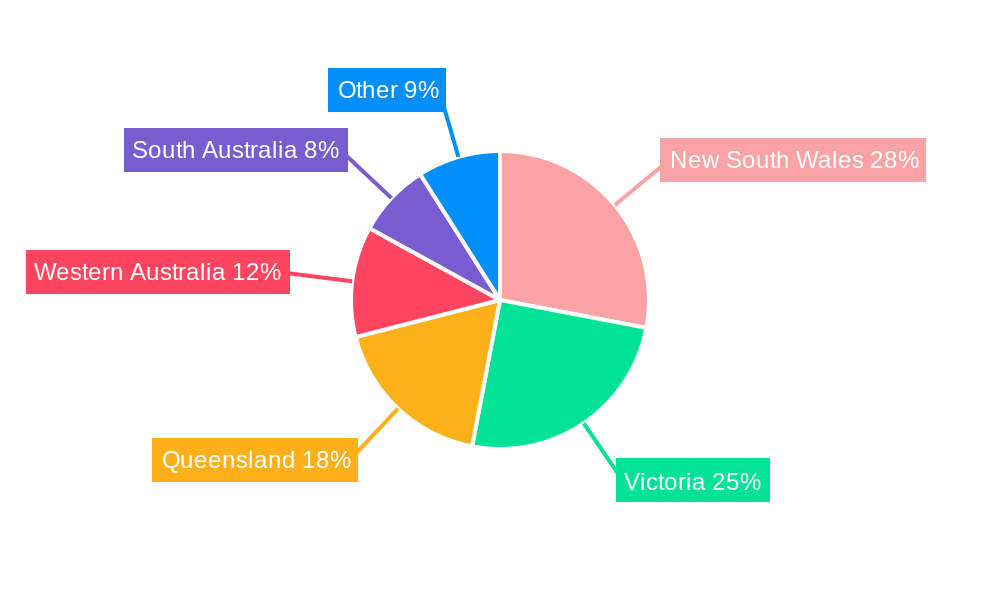

The Australian toys and games market exhibits a clear geographic concentration within its major metropolitan hubs, including Sydney, Melbourne, Brisbane, and Perth. These urban centers act as primary drivers of market activity due to a confluence of factors.

- Drivers of Dominance:

- Higher disposable incomes and significant purchasing power concentrated in these urban areas.

- A greater density of retail outlets, including both brick-and-mortar stores and a strong online presence, facilitating accessibility.

- These locations serve as early adopters and trendsetters for new product launches and emerging play patterns.

While growth is observed across most product categories, certain segments are experiencing particularly rapid expansion, outpacing others:

- Educational Toys & Games: This segment is experiencing robust growth, primarily fueled by heightened parental awareness regarding the critical role of early childhood development and the value of play-based learning.

- Interactive & Tech-Enabled Toys: Demonstrating rapid expansion, this category is propelled by continuous technological innovation and a strong consumer appetite for engaging and cutting-edge play experiences.

- Collectibles & Licensed Merchandise: This segment maintains consistent growth, largely driven by the enduring popularity and widespread appeal of major movie franchises, television shows, and popular video games.

For a granular analysis of market dominance across specific regions and a comprehensive breakdown of market sizing and segmentation, please refer to the full market report.

Australia Toys and Games Market Product Developments

Recent product innovations include the integration of artificial intelligence (AI) and augmented reality (AR) in toys, creating interactive and engaging experiences. The market is also seeing a surge in sustainable and ethically sourced toys, reflecting changing consumer preferences. These developments offer businesses competitive advantages by providing unique and appealing products catering to the evolving market demand.

Challenges in the Australia Toys and Games Market Market

The Australian toys and games market navigates a complex landscape of challenges that can impact its growth trajectory and operational efficiency:

- Supply Chain Disruptions: Global supply chain vulnerabilities continue to pose a significant challenge, leading to potential product stockouts and increased manufacturing and logistics costs.

- Intensified Competition: The market is characterized by a highly competitive environment, with a constant interplay between well-established industry leaders and agile new entrants vying for consumer attention and market share.

- Economic Downturns: Fluctuations in the broader economy can directly affect consumer spending on non-essential items such as toys and games. In a severe recessionary scenario, the market could face potential revenue losses estimated in the tens of millions of dollars.

Forces Driving Australia Toys and Games Market Growth

Several key factors are driving the growth of the Australian toys and games market, including:

- Technological advancements: The integration of technology into toys and games creates interactive and engaging experiences for children.

- Rising disposable incomes: Increased disposable incomes, particularly amongst middle-class families, fuel demand for toys and games.

- Favorable demographic trends: Australia's relatively young population supports strong demand for children's products.

Long-Term Growth Catalysts in the Australia Toys and Games Market

Long-term growth in the Australian toys and games market will be fueled by continuous innovation in product design, technological integration, strategic partnerships amongst market players, and expansion into new markets (both online and geographically). Expansion into rural markets and further leveraging of the online retail channel offers significant potential for sustained expansion.

Emerging Opportunities in Australia Toys and Games Market

The Australian toys and games market is poised to capitalize on several promising emerging opportunities:

- Expansion into Niche Markets: Developing targeted product lines and marketing strategies to cater to specific age demographics or specialized interests offers significant untapped growth potential.

- Development of Sustainable and Ethically Produced Toys: Aligning with a growing consumer consciousness, there is a substantial opportunity to develop and promote toys that are environmentally friendly and ethically manufactured.

- Leveraging the Metaverse and Augmented Reality: The burgeoning fields of the metaverse and augmented reality present exciting prospects for creating novel, immersive, and highly engaging play experiences that can redefine traditional play.

Leading Players in the Australia Toys and Games Market Sector

- Amazon Australia

- K Mart Group (Kmart, Target, and Catch)

- Woolworths Limited (Big W)

- Myer

- Toy Mate

- David Jones

- Mighty Ape

- Toyworld

- eBay

- EB Games

- JB Hi-Fi

- Other Prominent Retailers (Online Toys Australia, Kogan, Temple & Webster, Costco etc.)

Key Milestones in Australia Toys and Games Market Industry

- January 2023: The launch of Amazon Web Services' (AWS) second infrastructure region in Australia marked a significant advancement in the nation's digital backbone. This development is expected to bolster e-commerce capabilities and provide enhanced digital infrastructure crucial for the growth of the toys and games sector.

- June 2023: The acquisition of ImmediateScripts by API, now integrated into Wesfarmers' health division, underscores a growing convergence between technology and healthcare. This trend could potentially inspire the development of innovative educational and therapeutic toys that incorporate health and wellness aspects.

Strategic Outlook for Australia Toys and Games Market Market

The Australian toys and games market presents a promising outlook, driven by ongoing technological advancements, evolving consumer preferences, and the potential for expansion into new markets and segments. Companies adopting innovative strategies to meet the evolving needs of consumers and taking advantage of technological opportunities stand to gain significant market share in this dynamic sector. The market is expected to show significant growth over the forecast period, primarily influenced by the continuing shift towards digital entertainment and interactive toys.

Australia Toys and Games Market Segmentation

-

1. Type

- 1.1. Card Games

- 1.2. Construction Sets and Models

- 1.3. Dolls and Stuffed Toys

- 1.4. Plastic and Other Toys

- 1.5. Puzzles

- 1.6. Toys for Toddlers and Kids

- 1.7. Video Game Consoles

-

2. Distribution Channel

- 2.1. Online

- 2.2. Offline

Australia Toys and Games Market Segmentation By Geography

- 1. Australia

Australia Toys and Games Market Regional Market Share

Geographic Coverage of Australia Toys and Games Market

Australia Toys and Games Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Eco-Friendly and Sustainable Toys; Increasing Awareness of Early Childhood Development

- 3.3. Market Restrains

- 3.3.1. Growing Demand for Eco-Friendly and Sustainable Toys; Increasing Awareness of Early Childhood Development

- 3.4. Market Trends

- 3.4.1. Rise in the Number of People Buying Video Games

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Toys and Games Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Card Games

- 5.1.2. Construction Sets and Models

- 5.1.3. Dolls and Stuffed Toys

- 5.1.4. Plastic and Other Toys

- 5.1.5. Puzzles

- 5.1.6. Toys for Toddlers and Kids

- 5.1.7. Video Game Consoles

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Amazon Australia

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 K Mart Group (Kmart Target and Catch)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Woolworths Limited (Big W)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Myer

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Toy Mate

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 David Jones

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mighty Ape

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Toyworld

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ebay

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 EB Games

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 JB Hifi

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Other Prominent Retailers (Online Toys Australia KoganTemple & Webster Costco etc )**List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Amazon Australia

List of Figures

- Figure 1: Australia Toys and Games Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia Toys and Games Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Toys and Games Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Australia Toys and Games Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Australia Toys and Games Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Australia Toys and Games Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: Australia Toys and Games Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Australia Toys and Games Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Australia Toys and Games Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Australia Toys and Games Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: Australia Toys and Games Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Australia Toys and Games Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Australia Toys and Games Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Australia Toys and Games Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Toys and Games Market?

The projected CAGR is approximately 3.23%.

2. Which companies are prominent players in the Australia Toys and Games Market?

Key companies in the market include Amazon Australia, K Mart Group (Kmart Target and Catch), Woolworths Limited (Big W), Myer, Toy Mate, David Jones, Mighty Ape, Toyworld, ebay, EB Games, JB Hifi, Other Prominent Retailers (Online Toys Australia KoganTemple & Webster Costco etc )**List Not Exhaustive.

3. What are the main segments of the Australia Toys and Games Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.56 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Eco-Friendly and Sustainable Toys; Increasing Awareness of Early Childhood Development.

6. What are the notable trends driving market growth?

Rise in the Number of People Buying Video Games.

7. Are there any restraints impacting market growth?

Growing Demand for Eco-Friendly and Sustainable Toys; Increasing Awareness of Early Childhood Development.

8. Can you provide examples of recent developments in the market?

January 2023: Amazon Web Services (AWS) introduced the second AWS infrastructure Region in Australia, constituting a global physical site with clustered data centers. The recently launched AWS Asia-Pacific (Melbourne) Region aims to bring advanced AWS technologies, including computing, storage, artificial intelligence (AI), and machine learning, in closer proximity to a broader customer base. This initiative aims to reduce network latency, enabling customers to meet local data residency regulations more effectively.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Toys and Games Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Toys and Games Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Toys and Games Market?

To stay informed about further developments, trends, and reports in the Australia Toys and Games Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence