Key Insights

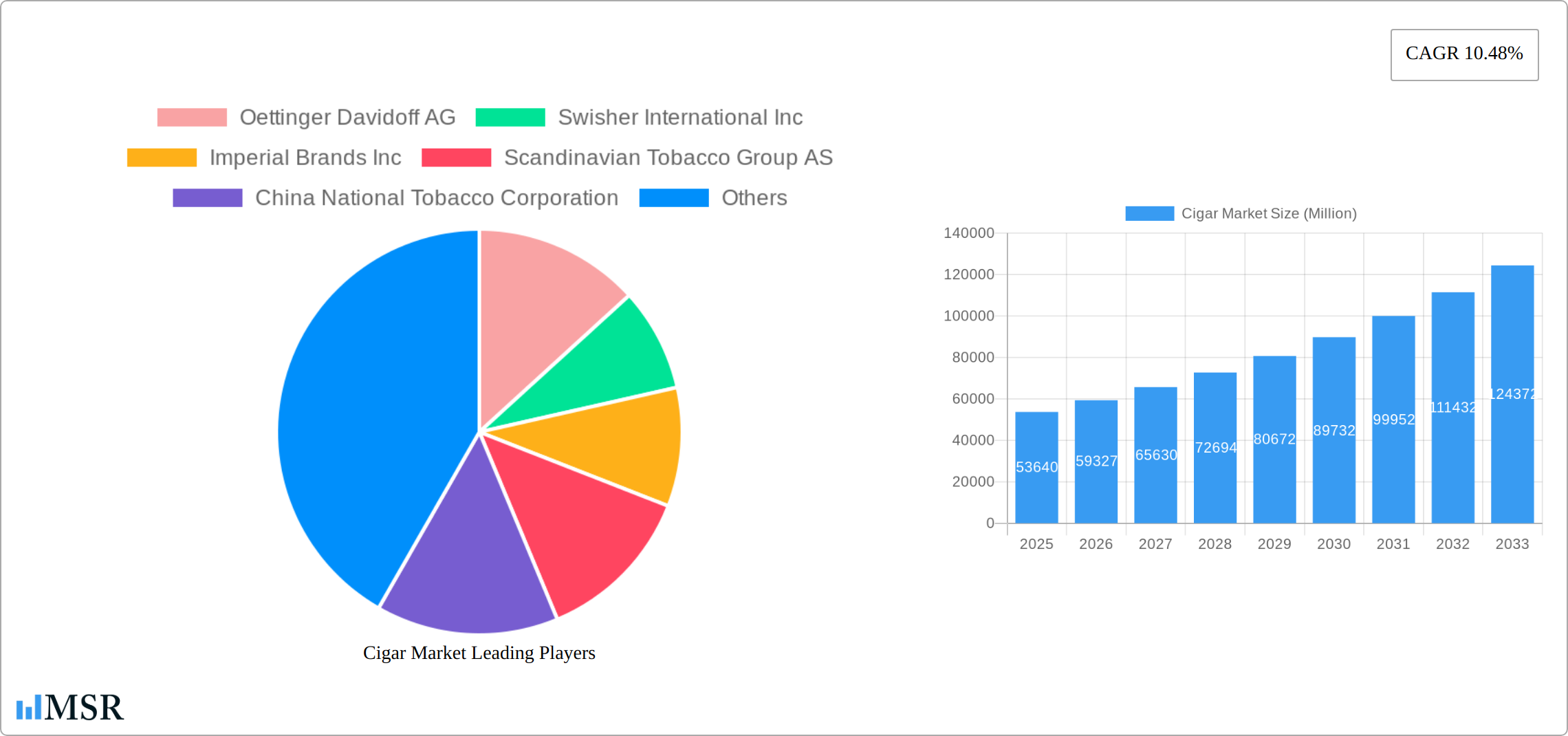

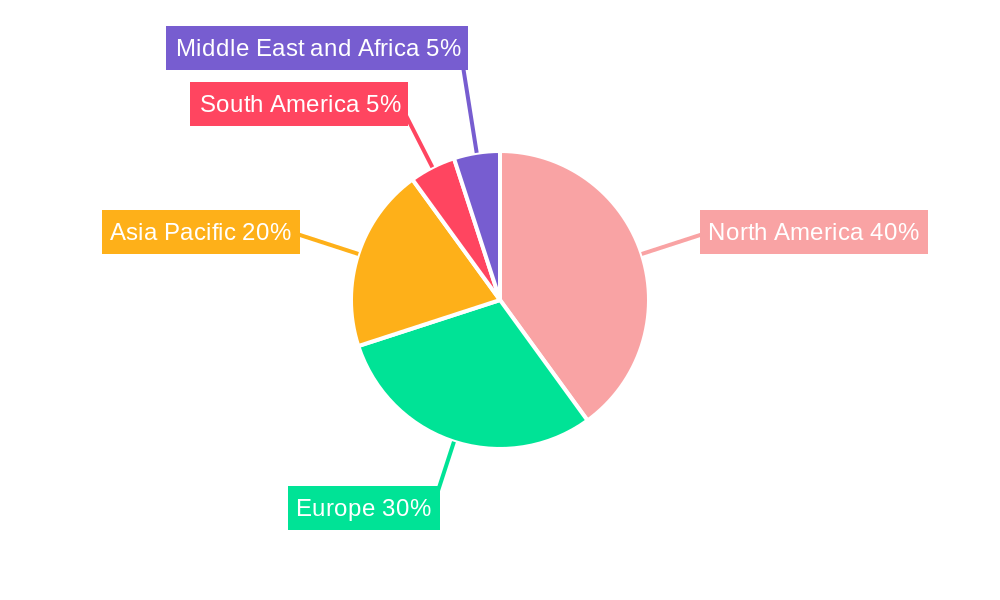

The global cigar market, valued at $53.64 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 10.48% from 2025 to 2033. This expansion is driven by several key factors. The increasing disposable incomes in emerging economies, coupled with a growing preference for premium and specialty cigars among affluent consumers, fuels market demand. Furthermore, effective marketing campaigns highlighting the sophisticated image and ritualistic experience associated with cigar smoking contribute significantly to market growth. The rise of e-commerce platforms offering a wider selection and convenient purchasing options is another vital driver. However, stringent government regulations on tobacco consumption, increasing health awareness concerning the harmful effects of smoking, and the escalating price of tobacco leaves pose significant challenges to market growth. The market segmentation reveals a clear preference for premium cigars over conventional ones, reflecting a shift towards higher-quality products. Online retail channels are gaining traction, albeit slowly, demonstrating the potential for future growth in this segment. North America and Europe currently dominate the market share, but the Asia-Pacific region is expected to show significant growth potential due to rising disposable incomes and a burgeoning middle class. Competition is fierce amongst established players like Oettinger Davidoff AG, Swisher International Inc., and Imperial Brands Inc., with smaller boutique cigar makers also carving out significant niche markets.

Cigar Market Market Size (In Billion)

The forecast period (2025-2033) anticipates considerable market expansion, particularly in emerging markets. The increasing popularity of cigar lounges and dedicated smoking areas within hotels and restaurants further contributes to the market's growth. However, sustained consumer education campaigns focused on the health risks associated with tobacco consumption pose a significant long-term threat. Strategic diversification by major players, including product innovation (e.g., flavored cigars, cigarillos) and expansion into new markets, will be crucial to maintaining a competitive edge. Furthermore, the industry will need to adapt to changing consumer preferences and evolving regulatory landscapes. The successful players will be those that balance the appeal of a sophisticated product with responsible marketing and address the escalating concerns around public health and environmental sustainability.

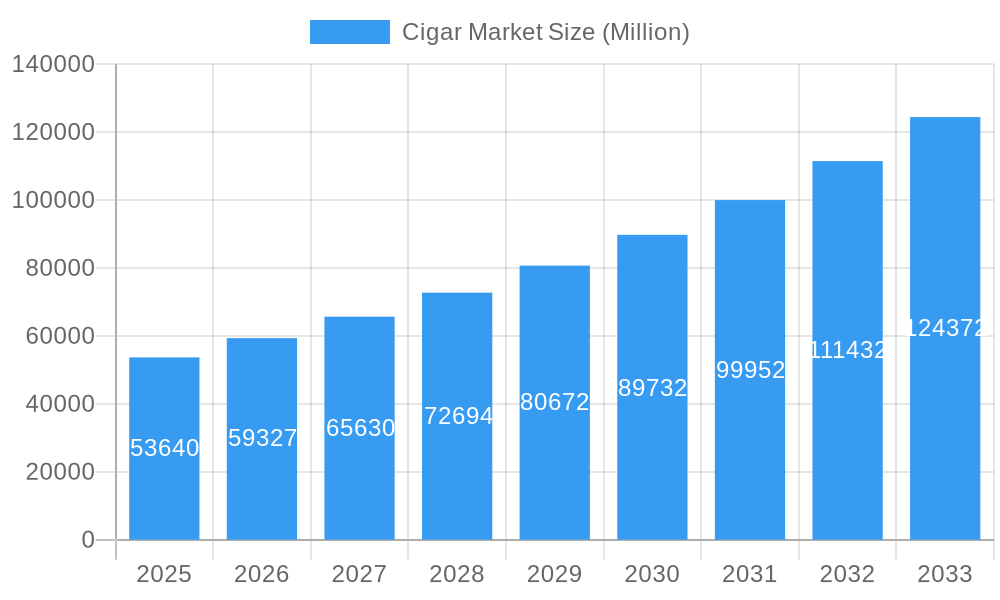

Cigar Market Company Market Share

Cigar Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the global cigar market, encompassing market dynamics, industry trends, key segments, and leading players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers actionable insights for industry stakeholders, investors, and businesses seeking to navigate the complexities of this evolving market. The market size is estimated at XX Million USD in 2025, exhibiting a CAGR of XX% during the forecast period.

Cigar Market Market Concentration & Dynamics

The global cigar market exhibits a moderately concentrated structure, with key players like Oettinger Davidoff AG, Swisher International Inc., Imperial Brands Inc., and Scandinavian Tobacco Group AS holding significant market share. However, regional players and smaller boutique brands also contribute substantially, particularly in the premium segment. Market concentration is further influenced by mergers and acquisitions (M&A) activities, with an estimated XX M&A deals recorded between 2019 and 2024.

- Market Share: Top 5 players hold approximately XX% of the global market share (2024).

- Innovation Ecosystem: Innovation is driven by both established players and smaller niche brands focusing on unique blends, flavors, and packaging.

- Regulatory Frameworks: Stringent regulations concerning tobacco products, varying across geographies, significantly impact market dynamics and growth.

- Substitute Products: The market faces competition from other tobacco products like cigarettes and vaping devices, along with non-tobacco alternatives.

- End-User Trends: Growing preference for premium cigars, fueled by increased disposable income in developing economies and a shift towards luxury goods, is shaping market growth. Changes in smoking habits and health consciousness are also having an effect.

- M&A Activities: Consolidation continues, driving market concentration. Larger players are seeking acquisitions to expand their product portfolios and geographical reach.

Cigar Market Industry Insights & Trends

The global cigar market is experiencing robust expansion, driven by a confluence of escalating consumer demand, particularly in burgeoning emerging economies, and a noticeable shift in lifestyle preferences. Rising disposable incomes are a significant catalyst, empowering consumers to indulge in premium and luxury cigar offerings. This trend is especially pronounced among high-net-worth individuals seeking sophisticated and high-quality experiences. The global market, valued at approximately XX Million USD in 2024, is projected to reach an impressive XX Million USD by 2033, reflecting a strong compound annual growth rate (CAGR).

Technological advancements are playing a pivotal role, from innovative tobacco cultivation techniques that enhance leaf quality to sophisticated processing methods that refine the cigar-making craft. Consumer behavior is also evolving, with an increasing appreciation for unique flavor profiles, artisanal craftsmanship, and aesthetically appealing, premium packaging. This emphasis on nuanced experiences and sophisticated presentation is spurring continuous innovation and market segmentation. Furthermore, distribution channels are undergoing a transformation, with a notable surge in the adoption of online retail platforms, offering consumers greater accessibility and convenience.

Key Markets & Segments Leading Cigar Market

The Americas (particularly the US) dominate the global cigar market, followed by Europe and Asia. Within the product type segment, Premium Cigars command a higher price point and demonstrate stronger growth potential than Conventional Cigars. Offline retail stores currently hold the largest market share in distribution channels; however, the online retail segment is experiencing rapid growth.

- Dominant Region: Americas

- Drivers: Strong established market, high consumer spending, and diverse product offerings.

- Dominant Product Type: Premium Cigars

- Drivers: Higher profit margins, increased consumer preference for quality and unique flavors.

- Dominant Distribution Channel: Offline Retail Stores

- Drivers: Established infrastructure, direct customer interaction, and sensory experience.

Cigar Market Product Developments

Recent product innovations include limited-edition releases tied to cultural events (e.g., Chinese Zodiac cigars) and exclusive online-only brands designed to cater to specific consumer preferences. Technological advancements in tobacco cultivation and processing techniques are leading to improved quality and consistency in premium cigars, further enhancing the overall consumer experience and expanding the market.

Challenges in the Cigar Market Market

Despite its upward trajectory, the cigar market navigates a landscape fraught with considerable challenges. Stringent and evolving regulatory frameworks governing tobacco products worldwide present a significant hurdle, impacting production, marketing, and sales. Growing public health awareness and anti-smoking campaigns continue to cast a shadow, influencing consumer perception and potentially dampening demand. Fluctuations in the cost and availability of premium tobacco leaf, the primary raw material, can significantly affect profitability and product pricing strategies. Moreover, unforeseen supply chain disruptions, exacerbated by global events, can lead to production delays and increased costs. The competitive pressure from substitute products, including e-cigarettes and other nicotine delivery systems, also poses a threat to sustained market growth. Collectively, these challenges are estimated to reduce the potential market growth by approximately XX Million USD annually.

Forces Driving Cigar Market Growth

The sustained growth of the cigar market is propelled by a multifaceted set of powerful drivers. A primary catalyst is the consistent increase in disposable incomes globally, especially within developing nations, which fuels the demand for aspirational and luxury goods such as premium cigars. The evolving social landscape, marked by the growing popularity of dedicated cigar lounges, sophisticated social gatherings, and curated cigar-pairing events, actively encourages consumption and fosters a sense of community and enjoyment around the product. Technological advancements are another key contributor; innovations in tobacco curing, fermentation, and blending are leading to superior product quality, the development of novel and complex flavor profiles, and enhanced production efficiencies. This technological integration ensures that cigars continue to meet and exceed the expectations of discerning consumers. The enduring appeal and cultural significance of cigars as a traditional, artisanal product also continue to resonate with a dedicated consumer base, underpinning its ongoing market expansion.

Long-Term Growth Catalysts in the Cigar Market

Long-term growth will be driven by the expansion of premium cigar offerings to cater to an increasingly discerning consumer base. Strategic partnerships between manufacturers and retailers will enhance distribution and brand visibility. The successful introduction of new product lines and flavors and expansion into new global markets, leveraging e-commerce, will significantly bolster growth over the forecast period.

Emerging Opportunities in Cigar Market

Emerging opportunities lie in the expansion of e-commerce platforms for cigar sales, catering to a broader consumer base. The growth of niche markets for specialty cigars will offer attractive revenue streams. Furthermore, new product development focusing on health-conscious alternatives (e.g., reduced nicotine levels or alternative tobacco substitutes, whilst remaining compliant with applicable regulations), and sustainable sourcing practices, will cater to evolving consumer preferences.

Leading Players in the Cigar Market Sector

- Oettinger Davidoff AG

- Swisher International Inc

- Imperial Brands Inc

- Scandinavian Tobacco Group AS

- China National Tobacco Corporation

- Japan Tobacco Inc

- Manifatture Sigaro Toscano SPA

- JC Newman Cigar Co

- Philip Morris International Inc

- Altria Group Inc

Key Milestones in Cigar Market Industry

- November 2023: Drew Estate strategically launched its luxurious Chateau Real brand, specifically curated for online retail channels, featuring a distinguished Connecticut Shade blend.

- September 2023: Imperial Brands' Altadis U.S.A. expanded its premium offerings with the release of Trinidad Espiritu No. 3, available in five distinct sizes and showcasing a rich Mexican San Andreas wrapper.

- November 2022: China National Tobacco Corp demonstrated its commitment to cultural celebrations by releasing a limited-edition Year of the Rabbit cigar, continuing its popular Chinese Zodiac series.

Strategic Outlook for Cigar Market Market

The future of the cigar market is promising, with continued growth driven by premiumization, innovative product development, and expansion into new markets. Strategic acquisitions and collaborations will further strengthen market leadership. Focusing on e-commerce expansion and targeted marketing campaigns to reach specific demographics will prove vital for long-term success.

Cigar Market Segmentation

-

1. Product Type

- 1.1. Conventional Cigar

- 1.2. Premium Cigar

-

2. Distribution Channel

- 2.1. Offline Retail Stores

- 2.2. Online Retail Stores

Cigar Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Italy

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Cigar Market Regional Market Share

Geographic Coverage of Cigar Market

Cigar Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.48% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Cigar as a Status Symbol; Premiumization & Product Differentiation Play a Key Role

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations & Health Factors; Stiff Competition From Substitutes

- 3.4. Market Trends

- 3.4.1. Offline Retail Channels are the Widely Preferred Distribution Channel

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cigar Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Conventional Cigar

- 5.1.2. Premium Cigar

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Offline Retail Stores

- 5.2.2. Online Retail Stores

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Cigar Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Conventional Cigar

- 6.1.2. Premium Cigar

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Offline Retail Stores

- 6.2.2. Online Retail Stores

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Cigar Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Conventional Cigar

- 7.1.2. Premium Cigar

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Offline Retail Stores

- 7.2.2. Online Retail Stores

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Cigar Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Conventional Cigar

- 8.1.2. Premium Cigar

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Offline Retail Stores

- 8.2.2. Online Retail Stores

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Cigar Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Conventional Cigar

- 9.1.2. Premium Cigar

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Offline Retail Stores

- 9.2.2. Online Retail Stores

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Cigar Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Conventional Cigar

- 10.1.2. Premium Cigar

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Offline Retail Stores

- 10.2.2. Online Retail Stores

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Oettinger Davidoff AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Swisher International Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Imperial Brands Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Scandinavian Tobacco Group AS

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 China National Tobacco Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Japan Tobacco Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Manifatture Sigaro Toscano SPA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 JC Newman Cigar Co

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Philip Morris International Inc *List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Altria Group Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Oettinger Davidoff AG

List of Figures

- Figure 1: Global Cigar Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Cigar Market Revenue (Million), by Product Type 2025 & 2033

- Figure 3: North America Cigar Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Cigar Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 5: North America Cigar Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Cigar Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Cigar Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Cigar Market Revenue (Million), by Product Type 2025 & 2033

- Figure 9: Europe Cigar Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Cigar Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 11: Europe Cigar Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Cigar Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Cigar Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Cigar Market Revenue (Million), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Cigar Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Cigar Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 17: Asia Pacific Cigar Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Asia Pacific Cigar Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Cigar Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Cigar Market Revenue (Million), by Product Type 2025 & 2033

- Figure 21: South America Cigar Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Cigar Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: South America Cigar Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America Cigar Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Cigar Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Cigar Market Revenue (Million), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Cigar Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Cigar Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: Middle East and Africa Cigar Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East and Africa Cigar Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Cigar Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cigar Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Cigar Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Cigar Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Cigar Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: Global Cigar Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Cigar Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Global Cigar Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: Global Cigar Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Cigar Market Revenue Million Forecast, by Country 2020 & 2033

- Table 14: Germany Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: France Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Russia Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Spain Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Italy Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Global Cigar Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 22: Global Cigar Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Cigar Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: China Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Japan Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: India Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Australia Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global Cigar Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 30: Global Cigar Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 31: Global Cigar Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Brazil Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Argentina Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Cigar Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 36: Global Cigar Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global Cigar Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: South Africa Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Saudi Arabia Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Cigar Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cigar Market?

The projected CAGR is approximately 10.48%.

2. Which companies are prominent players in the Cigar Market?

Key companies in the market include Oettinger Davidoff AG, Swisher International Inc, Imperial Brands Inc, Scandinavian Tobacco Group AS, China National Tobacco Corporation, Japan Tobacco Inc, Manifatture Sigaro Toscano SPA, JC Newman Cigar Co, Philip Morris International Inc *List Not Exhaustive, Altria Group Inc.

3. What are the main segments of the Cigar Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 53.64 Million as of 2022.

5. What are some drivers contributing to market growth?

Cigar as a Status Symbol; Premiumization & Product Differentiation Play a Key Role.

6. What are the notable trends driving market growth?

Offline Retail Channels are the Widely Preferred Distribution Channel.

7. Are there any restraints impacting market growth?

Stringent Government Regulations & Health Factors; Stiff Competition From Substitutes.

8. Can you provide examples of recent developments in the market?

November 2023: Drew Estate’s Chateau Real brand was exclusively made available at Drew Diplomat Digital retailers, and its products were packaged in 20-count boxes. Drew Estate launched this brand specifically for the Drew Diplomat online premium cigar retailers. The Drew Estate Chateau Real brand was claimed to be a luxurious blend of premium cigars crafted to highlight the cigar’s compelling Connecticut Shade-forward flavor.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cigar Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cigar Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cigar Market?

To stay informed about further developments, trends, and reports in the Cigar Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence