Key Insights

The global e-cigarette market, including rechargeable and disposable devices, is poised for substantial expansion. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 2.6%, reaching a valuation of $988.7 billion by 2025. This growth is propelled by several key drivers, including the increasing adoption of smoking cessation initiatives and the perception of e-cigarettes as a less harmful alternative to traditional tobacco products, particularly among younger demographics. Continuous innovation in product design and technology, such as improved battery life, enhanced flavor options, and discreet vaping experiences, further stimulates market dynamism.

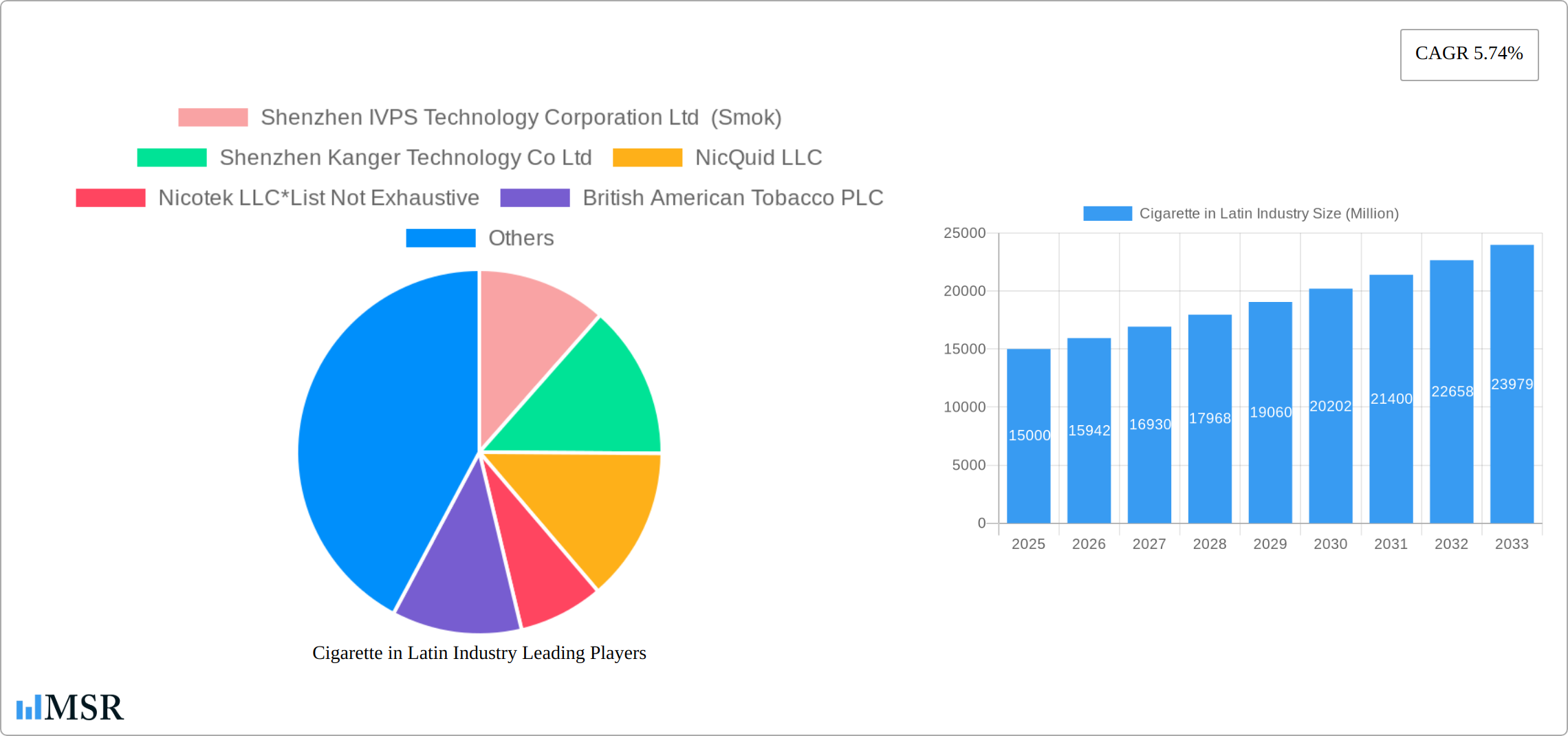

Cigarette in Latin Industry Market Size (In Billion)

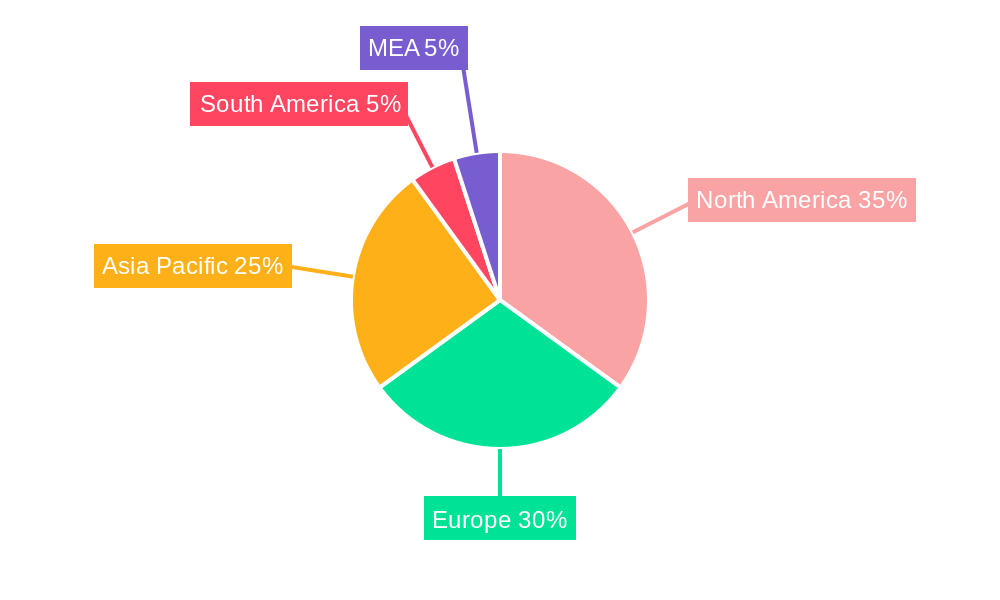

Market segmentation analysis indicates a strong preference for convenience, with both fully disposable and rechargeable disposable cartomizer models capturing significant market share. Geographically, North America and Europe currently dominate the market, supported by established regulatory frameworks and higher disposable incomes. However, the Asia-Pacific region is anticipated to experience rapid growth due to its large population and increasing awareness of e-cigarette alternatives. The competitive landscape is intense, featuring established tobacco corporations and specialized e-cigarette manufacturers vying for market leadership. Despite potential challenges from regulatory hurdles and health concerns, the overall market outlook remains positive, forecasting sustained growth throughout the projection period.

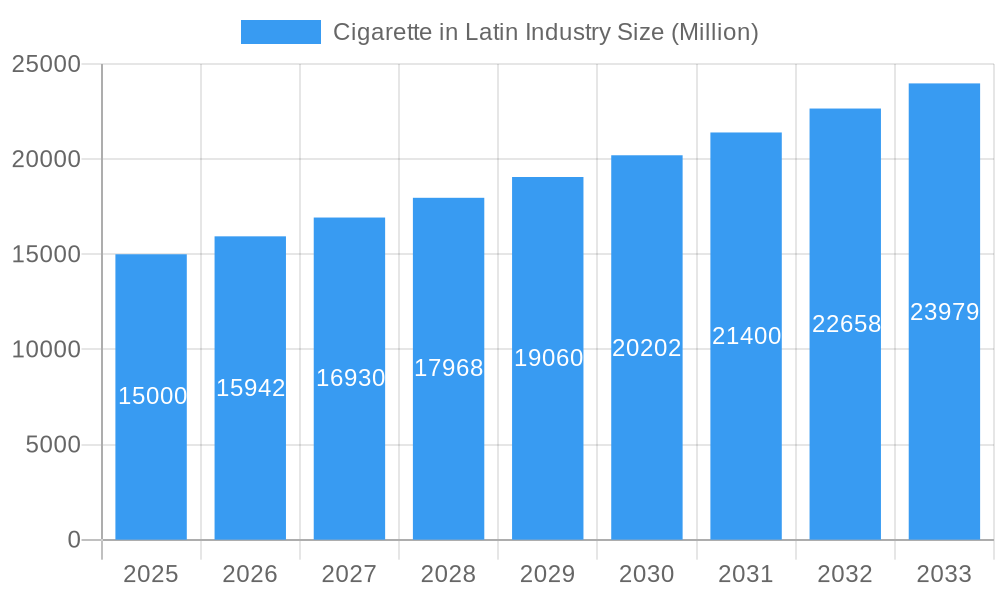

Cigarette in Latin Industry Company Market Share

The market's diverse product offerings cater to a broad spectrum of consumer needs. E-cigarette battery modes, both automatic and manual, accommodate varying user preferences for control and experience. The prominence of disposable product types underscores consumer demand for convenience. Regional market dynamics are notable, with mature markets in North America and Europe trending towards premium, personalized vaporizers, while emerging markets in Asia-Pacific and South America show a preference for more accessible and convenient options. Future market trends suggest advancements in nicotine delivery systems, the development of sophisticated flavor profiles, and ongoing regulatory evaluation, all of which are expected to shape product development and market segmentation. Despite potential challenges, the market is expected to maintain a positive growth trajectory, driven by consumer demand and technological innovation.

Cigarette in Latin America Industry: Market Analysis & Forecast 2019-2033

This comprehensive report provides a detailed analysis of the Cigarette (e-cigarette and heated tobacco) in Latin America industry, offering invaluable insights for stakeholders, investors, and businesses operating within this dynamic market. The report covers the period 2019-2033, with a focus on the 2025-2033 forecast period. The estimated market size in 2025 is projected at XXX Million, representing a Compound Annual Growth Rate (CAGR) of XX% during the forecast period.

Cigarette in Latin America Industry Market Concentration & Dynamics

The Latin American e-cigarette and heated tobacco market is characterized by a mix of established multinational players and emerging regional brands. Market concentration is moderate, with a few dominant players holding significant shares but facing increasing competition. The industry is highly dynamic, driven by rapid technological advancements, evolving consumer preferences, and fluctuating regulatory landscapes.

- Market Share: British American Tobacco PLC and Philip Morris International Inc hold substantial market share, estimated at XX Million and YY Million respectively in 2025, but face competitive pressure from regional players like Shenzhen IVPS Technology Corporation Ltd (Smok) and Innokin Technology.

- Innovation Ecosystems: Significant innovation is occurring in areas such as battery technology (automatic and manual e-cigarettes), product design (completely disposable, rechargeable but disposable cartomizers, personalized vaporizers), and liquid formulations.

- Regulatory Frameworks: Varying regulations across Latin American countries present both challenges and opportunities, impacting market access and product development strategies. A consistent regulatory framework is absent in most LATAM countries.

- Substitute Products: Traditional cigarettes remain a significant substitute, although the market share of e-cigarettes and heated tobacco products is steadily growing, driven by perception of harm reduction.

- End-User Trends: Growing awareness of health risks associated with traditional smoking, coupled with increasing disposable incomes in certain regions, is fueling demand for alternatives. Consumer preferences vary across demographics and countries.

- M&A Activities: The number of M&A deals in the Latin American e-cigarette industry has increased in recent years, with a total of XX deals recorded between 2019 and 2024. This indicates consolidation and expansion strategies by major players.

Cigarette in Latin America Industry Industry Insights & Trends

The Latin American e-cigarette and heated tobacco market is experiencing robust growth, driven by a multitude of factors. The market size is projected to reach ZZZ Million by 2033. Several key trends are shaping industry dynamics:

- Market Growth Drivers: Rising health awareness, changing consumer preferences towards reduced-risk products, and increasing disposable incomes across several LATAM countries are major growth catalysts.

- Technological Disruptions: Continuous advancements in battery technology, device design, and e-liquid formulations are improving user experience, leading to broader market adoption. The launch of innovative products like water-based vaporizers showcases the industry's commitment to innovation.

- Evolving Consumer Behaviors: Consumers are increasingly seeking personalized vaping experiences, demanding a wider array of flavors, nicotine strengths, and device functionalities. A trend towards disposable devices adds another dimension to this evolving landscape.

Key Markets & Segments Leading Cigarette in Latin America Industry

While precise data is scarce and varies by country, Brazil and Mexico are anticipated to dominate the Latin American market due to their large populations and increasing disposable incomes. Within product segments:

- Dominant Segments: Completely disposable models are experiencing high growth driven by ease of use and affordability. Personalized vaporizers, offering customization options, are also gaining traction among tech-savvy consumers.

- Market Drivers (Brazil & Mexico):

- Economic Growth: Rising middle class fuels demand for premium products.

- Urbanization: Increased population density in urban areas facilitates broader market access.

- Tourism: International tourism contributes to sales, particularly in coastal regions.

- Regulatory Environment: Although complex, this contributes to consumer awareness and product adaptation.

Cigarette in Latin America Industry Product Developments

Recent innovations encompass improved battery technology for longer-lasting devices, innovative heating mechanisms in heated tobacco products, and the emergence of water-based e-liquids. These advancements are not only enhancing user experiences but also addressing consumer concerns regarding health and environmental impact. For example, the introduction of SMOK's SOLUS 2 series exemplifies advancements in vaping technology aimed at enhancing user experience and cost-effectiveness. Similarly, Innokin Technology's partnership with Aquios Labs showcases a move towards innovative water-based vaporizers. The IQOS ILUMA launch exemplifies efforts to improve user experiences for tobacco heating systems.

Challenges in the Cigarette in Latin America Market

The industry faces several key challenges:

- Regulatory Uncertainty: Inconsistent regulations across countries create market access barriers and increase compliance costs.

- Supply Chain Disruptions: Global supply chain issues can impact the availability of raw materials and components.

- Competition: Intense competition from established tobacco companies and emerging e-cigarette brands creates price pressure. The competitive landscape is ever changing.

Forces Driving Cigarette in Latin America Industry Growth

Key growth drivers include:

- Technological Advancements: Continuous innovation in device technology and e-liquid formulations.

- Economic Growth: Rising disposable incomes in certain regions increase spending on discretionary items.

- Favorable Demographics: Large populations in certain countries provide a vast potential customer base.

- Health Concerns: Growing concerns about traditional cigarette smoking are driving the switch to alternatives.

Long-Term Growth Catalysts in the Cigarette in Latin America Market

Long-term growth is expected to be driven by continued innovation in product design and technology, strategic partnerships that expand market reach, and expansion into new regional markets. The development of improved battery technology will continue to improve the user experience.

Emerging Opportunities in Cigarette in Latin America Industry

Emerging opportunities include the expansion into underserved markets, the development of new product categories such as water-based e-liquids, and the exploration of novel nicotine delivery methods. Increasing consumer awareness will drive the market.

Leading Players in the Cigarette in Latin America Sector

- Shenzhen IVPS Technology Corporation Ltd (Smok)

- Shenzhen Kanger Technology Co Ltd

- NicQuid LLC

- Nicotek LLC

- British American Tobacco PLC

- Innokin Technology

- Philip Morris International Inc

- Japan Tobacco Inc

- NJOY Inc

- International Vapor Group

Key Milestones in Cigarette in Latin America Industry

- August 2022: SMOK launches the SOLUS 2 series, improving vaping experience and cost-effectiveness.

- May 2022: Innokin Technology partners with Aquios Labs to launch the water-based vaporizer 'Lota'.

- August 2021: Philip Morris International Inc launches IQOS ILUMA, a bladeless, induction-heating tobacco heating system.

Strategic Outlook for Cigarette in Latin America Market

The Latin American e-cigarette and heated tobacco market presents significant growth opportunities. Strategic investments in research and development, targeted marketing campaigns that adapt to regional preferences, and proactive engagement with regulatory bodies will prove crucial for success. The market is expected to reach significant growth in the coming decade, despite regulatory challenges and competition.

Cigarette in Latin Industry Segmentation

-

1. Product Type

- 1.1. Completely Disposable Model

- 1.2. Rechargeable but Disposable Cartomizer

- 1.3. Personalized Vaporizer

-

2. Battery Mode

- 2.1. Automatic E-cigarette

- 2.2. Manual E-cigarette

-

3. Geography

- 3.1. Chile

- 3.2. Ecuador

- 3.3. Honduras

- 3.4. Paraguay

- 3.5. Costa Rica

- 3.6. Rest of Latin America

Cigarette in Latin Industry Segmentation By Geography

- 1. Chile

- 2. Ecuador

- 3. Honduras

- 4. Paraguay

- 5. Costa Rica

- 6. Rest of Latin America

Cigarette in Latin Industry Regional Market Share

Geographic Coverage of Cigarette in Latin Industry

Cigarette in Latin Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Inclination Toward Healthy Lifestyle; Strategic Expansion by Health & Fitness Clubs

- 3.3. Market Restrains

- 3.3.1. Rise in Popularity of Outdoor Activities

- 3.4. Market Trends

- 3.4.1. Rising Prevalence of Smoking among Young Population

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cigarette in Latin Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Completely Disposable Model

- 5.1.2. Rechargeable but Disposable Cartomizer

- 5.1.3. Personalized Vaporizer

- 5.2. Market Analysis, Insights and Forecast - by Battery Mode

- 5.2.1. Automatic E-cigarette

- 5.2.2. Manual E-cigarette

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Chile

- 5.3.2. Ecuador

- 5.3.3. Honduras

- 5.3.4. Paraguay

- 5.3.5. Costa Rica

- 5.3.6. Rest of Latin America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Chile

- 5.4.2. Ecuador

- 5.4.3. Honduras

- 5.4.4. Paraguay

- 5.4.5. Costa Rica

- 5.4.6. Rest of Latin America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Chile Cigarette in Latin Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Completely Disposable Model

- 6.1.2. Rechargeable but Disposable Cartomizer

- 6.1.3. Personalized Vaporizer

- 6.2. Market Analysis, Insights and Forecast - by Battery Mode

- 6.2.1. Automatic E-cigarette

- 6.2.2. Manual E-cigarette

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Chile

- 6.3.2. Ecuador

- 6.3.3. Honduras

- 6.3.4. Paraguay

- 6.3.5. Costa Rica

- 6.3.6. Rest of Latin America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Ecuador Cigarette in Latin Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Completely Disposable Model

- 7.1.2. Rechargeable but Disposable Cartomizer

- 7.1.3. Personalized Vaporizer

- 7.2. Market Analysis, Insights and Forecast - by Battery Mode

- 7.2.1. Automatic E-cigarette

- 7.2.2. Manual E-cigarette

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Chile

- 7.3.2. Ecuador

- 7.3.3. Honduras

- 7.3.4. Paraguay

- 7.3.5. Costa Rica

- 7.3.6. Rest of Latin America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Honduras Cigarette in Latin Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Completely Disposable Model

- 8.1.2. Rechargeable but Disposable Cartomizer

- 8.1.3. Personalized Vaporizer

- 8.2. Market Analysis, Insights and Forecast - by Battery Mode

- 8.2.1. Automatic E-cigarette

- 8.2.2. Manual E-cigarette

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Chile

- 8.3.2. Ecuador

- 8.3.3. Honduras

- 8.3.4. Paraguay

- 8.3.5. Costa Rica

- 8.3.6. Rest of Latin America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Paraguay Cigarette in Latin Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Completely Disposable Model

- 9.1.2. Rechargeable but Disposable Cartomizer

- 9.1.3. Personalized Vaporizer

- 9.2. Market Analysis, Insights and Forecast - by Battery Mode

- 9.2.1. Automatic E-cigarette

- 9.2.2. Manual E-cigarette

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Chile

- 9.3.2. Ecuador

- 9.3.3. Honduras

- 9.3.4. Paraguay

- 9.3.5. Costa Rica

- 9.3.6. Rest of Latin America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Costa Rica Cigarette in Latin Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Completely Disposable Model

- 10.1.2. Rechargeable but Disposable Cartomizer

- 10.1.3. Personalized Vaporizer

- 10.2. Market Analysis, Insights and Forecast - by Battery Mode

- 10.2.1. Automatic E-cigarette

- 10.2.2. Manual E-cigarette

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Chile

- 10.3.2. Ecuador

- 10.3.3. Honduras

- 10.3.4. Paraguay

- 10.3.5. Costa Rica

- 10.3.6. Rest of Latin America

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Rest of Latin America Cigarette in Latin Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Completely Disposable Model

- 11.1.2. Rechargeable but Disposable Cartomizer

- 11.1.3. Personalized Vaporizer

- 11.2. Market Analysis, Insights and Forecast - by Battery Mode

- 11.2.1. Automatic E-cigarette

- 11.2.2. Manual E-cigarette

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. Chile

- 11.3.2. Ecuador

- 11.3.3. Honduras

- 11.3.4. Paraguay

- 11.3.5. Costa Rica

- 11.3.6. Rest of Latin America

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Shenzhen IVPS Technology Corporation Ltd (Smok)

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Shenzhen Kanger Technology Co Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 NicQuid LLC

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Nicotek LLC*List Not Exhaustive

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 British American Tobacco PLC

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Innokin Technology

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Philip Morris International Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Japan Tobacco Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 NJOY Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 International Vapor Group

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Shenzhen IVPS Technology Corporation Ltd (Smok)

List of Figures

- Figure 1: Global Cigarette in Latin Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Chile Cigarette in Latin Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 3: Chile Cigarette in Latin Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: Chile Cigarette in Latin Industry Revenue (billion), by Battery Mode 2025 & 2033

- Figure 5: Chile Cigarette in Latin Industry Revenue Share (%), by Battery Mode 2025 & 2033

- Figure 6: Chile Cigarette in Latin Industry Revenue (billion), by Geography 2025 & 2033

- Figure 7: Chile Cigarette in Latin Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 8: Chile Cigarette in Latin Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Chile Cigarette in Latin Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Ecuador Cigarette in Latin Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 11: Ecuador Cigarette in Latin Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Ecuador Cigarette in Latin Industry Revenue (billion), by Battery Mode 2025 & 2033

- Figure 13: Ecuador Cigarette in Latin Industry Revenue Share (%), by Battery Mode 2025 & 2033

- Figure 14: Ecuador Cigarette in Latin Industry Revenue (billion), by Geography 2025 & 2033

- Figure 15: Ecuador Cigarette in Latin Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Ecuador Cigarette in Latin Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Ecuador Cigarette in Latin Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Honduras Cigarette in Latin Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 19: Honduras Cigarette in Latin Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Honduras Cigarette in Latin Industry Revenue (billion), by Battery Mode 2025 & 2033

- Figure 21: Honduras Cigarette in Latin Industry Revenue Share (%), by Battery Mode 2025 & 2033

- Figure 22: Honduras Cigarette in Latin Industry Revenue (billion), by Geography 2025 & 2033

- Figure 23: Honduras Cigarette in Latin Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Honduras Cigarette in Latin Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Honduras Cigarette in Latin Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Paraguay Cigarette in Latin Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Paraguay Cigarette in Latin Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Paraguay Cigarette in Latin Industry Revenue (billion), by Battery Mode 2025 & 2033

- Figure 29: Paraguay Cigarette in Latin Industry Revenue Share (%), by Battery Mode 2025 & 2033

- Figure 30: Paraguay Cigarette in Latin Industry Revenue (billion), by Geography 2025 & 2033

- Figure 31: Paraguay Cigarette in Latin Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 32: Paraguay Cigarette in Latin Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Paraguay Cigarette in Latin Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Costa Rica Cigarette in Latin Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 35: Costa Rica Cigarette in Latin Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Costa Rica Cigarette in Latin Industry Revenue (billion), by Battery Mode 2025 & 2033

- Figure 37: Costa Rica Cigarette in Latin Industry Revenue Share (%), by Battery Mode 2025 & 2033

- Figure 38: Costa Rica Cigarette in Latin Industry Revenue (billion), by Geography 2025 & 2033

- Figure 39: Costa Rica Cigarette in Latin Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Costa Rica Cigarette in Latin Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Costa Rica Cigarette in Latin Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Rest of Latin America Cigarette in Latin Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 43: Rest of Latin America Cigarette in Latin Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 44: Rest of Latin America Cigarette in Latin Industry Revenue (billion), by Battery Mode 2025 & 2033

- Figure 45: Rest of Latin America Cigarette in Latin Industry Revenue Share (%), by Battery Mode 2025 & 2033

- Figure 46: Rest of Latin America Cigarette in Latin Industry Revenue (billion), by Geography 2025 & 2033

- Figure 47: Rest of Latin America Cigarette in Latin Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 48: Rest of Latin America Cigarette in Latin Industry Revenue (billion), by Country 2025 & 2033

- Figure 49: Rest of Latin America Cigarette in Latin Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cigarette in Latin Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Cigarette in Latin Industry Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 3: Global Cigarette in Latin Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Global Cigarette in Latin Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Cigarette in Latin Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Global Cigarette in Latin Industry Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 7: Global Cigarette in Latin Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Global Cigarette in Latin Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Cigarette in Latin Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: Global Cigarette in Latin Industry Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 11: Global Cigarette in Latin Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Global Cigarette in Latin Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Cigarette in Latin Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Global Cigarette in Latin Industry Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 15: Global Cigarette in Latin Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Global Cigarette in Latin Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global Cigarette in Latin Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: Global Cigarette in Latin Industry Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 19: Global Cigarette in Latin Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Global Cigarette in Latin Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global Cigarette in Latin Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Global Cigarette in Latin Industry Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 23: Global Cigarette in Latin Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 24: Global Cigarette in Latin Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Global Cigarette in Latin Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 26: Global Cigarette in Latin Industry Revenue billion Forecast, by Battery Mode 2020 & 2033

- Table 27: Global Cigarette in Latin Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: Global Cigarette in Latin Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cigarette in Latin Industry?

The projected CAGR is approximately 2.6%.

2. Which companies are prominent players in the Cigarette in Latin Industry?

Key companies in the market include Shenzhen IVPS Technology Corporation Ltd (Smok), Shenzhen Kanger Technology Co Ltd, NicQuid LLC, Nicotek LLC*List Not Exhaustive, British American Tobacco PLC, Innokin Technology, Philip Morris International Inc, Japan Tobacco Inc, NJOY Inc, International Vapor Group.

3. What are the main segments of the Cigarette in Latin Industry?

The market segments include Product Type, Battery Mode, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 988.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Inclination Toward Healthy Lifestyle; Strategic Expansion by Health & Fitness Clubs.

6. What are the notable trends driving market growth?

Rising Prevalence of Smoking among Young Population.

7. Are there any restraints impacting market growth?

Rise in Popularity of Outdoor Activities.

8. Can you provide examples of recent developments in the market?

August 2022: SMOK, the brand from Shenzhen IVPS Technology, which specializes in the research, development, production, and sale of e-cigarettes, launched its new SOLUS 2 series. After nearly 200 days in development, the SOLUS 2 has come to represent improved vaping experiences and cost-effectiveness for vapers worldwide.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cigarette in Latin Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cigarette in Latin Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cigarette in Latin Industry?

To stay informed about further developments, trends, and reports in the Cigarette in Latin Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence