Key Insights

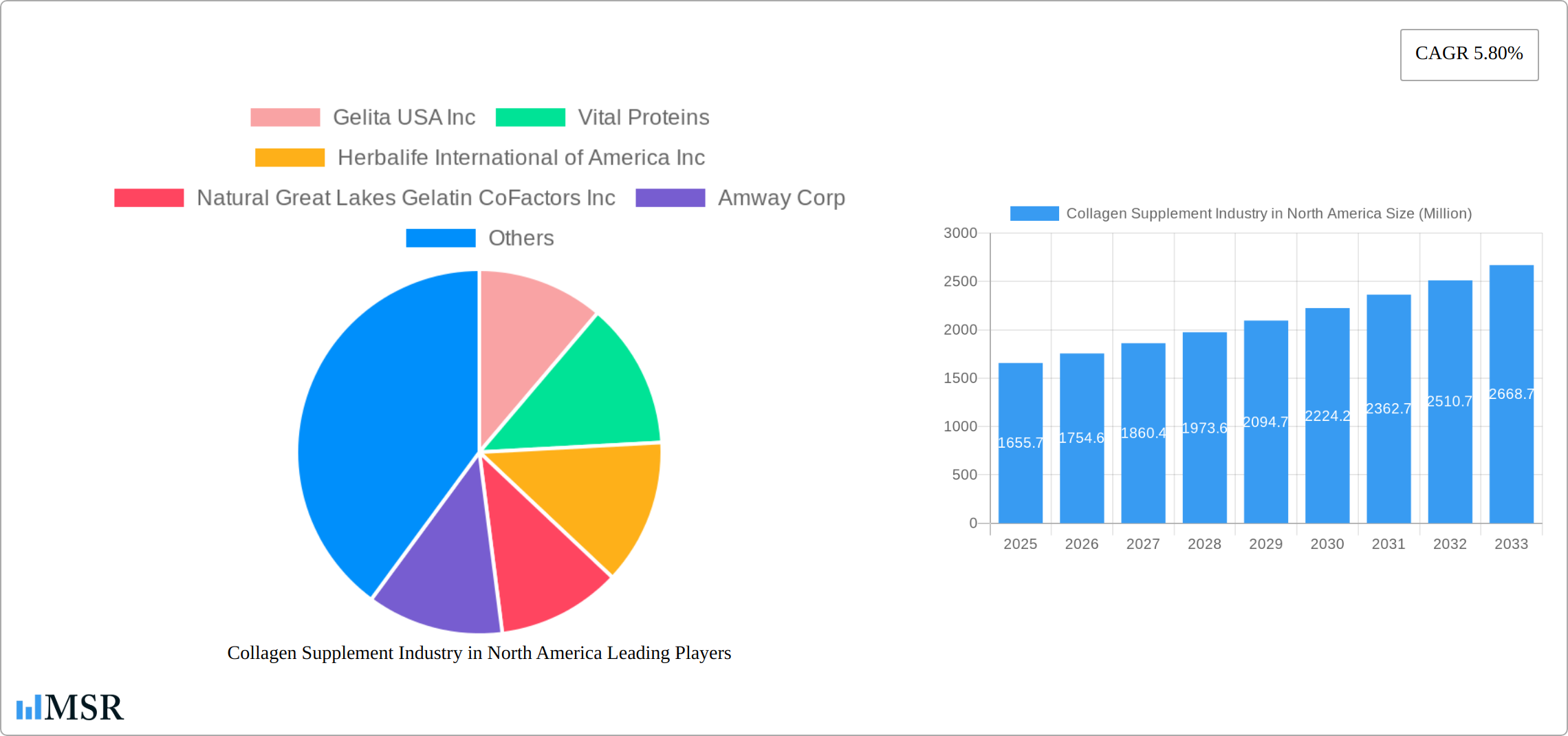

The North American collagen supplement market, valued at approximately $1,655.7 million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 5.80% from 2025 to 2033. This growth is fueled by several key factors. Increasing consumer awareness of collagen's benefits for skin health, joint mobility, and gut health is a primary driver. The rising popularity of wellness and preventative healthcare trends among consumers, particularly millennials and Gen Z, further contributes to market expansion. Furthermore, the increasing availability of collagen supplements in diverse forms, including powders, capsules, and gummies, caters to varied consumer preferences, boosting accessibility and market penetration. The market is segmented by source (animal-based, marine-based) and distribution channels (hypermarkets/supermarkets, pharmacies, online retail, others), with online retail witnessing significant growth due to its convenience and wider reach. Leading companies like Gelita USA Inc, Vital Proteins, and Herbalife International of America Inc are driving innovation and competition within the sector, introducing new product formulations and marketing strategies to capture market share.

The North American market's dominance is largely attributable to high consumer spending on health and wellness products, coupled with a strong focus on anti-aging solutions. While specific regional data within North America (US, Canada, Mexico) is not provided, the US is expected to hold the largest share due to its larger population and higher per capita spending on supplements. However, growth is anticipated across all regions within North America, driven by increasing health consciousness and the expanding middle class. Challenges include concerns about the sourcing and sustainability of collagen production, which companies are addressing through increased transparency and the adoption of sustainable practices. Regulatory changes regarding supplement labeling and claims also present potential challenges, requiring manufacturers to maintain compliance. Despite these challenges, the long-term outlook for the North American collagen supplement market remains positive, with continued growth projected through 2033.

Unlock Growth Potential: The North American Collagen Supplement Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the booming North American collagen supplement industry, offering invaluable insights for stakeholders, investors, and industry professionals. From market dynamics and key segments to leading players and future opportunities, this report is your essential guide to navigating this rapidly expanding sector. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The market size in 2025 is estimated at $xx Million.

Collagen Supplement Industry in North America Market Concentration & Dynamics

The North American collagen supplement market exhibits a moderately concentrated landscape, with several key players commanding significant market share. Gelita USA Inc, Vital Proteins, Herbalife International of America Inc, Natural Great Lakes Gelatin CoFactors Inc, Amway Corp, Nutrawise Health & Beauty Corporation, and Natures Bounty are among the prominent companies, although the market also includes numerous smaller players and emerging brands. Market share data for 2025 indicates that the top 5 players hold approximately 60% of the market.

- Market Concentration: High, with a few dominant players.

- Innovation Ecosystems: Strong emphasis on developing new collagen types, delivery methods (e.g., hydrolysates, peptides), and formulations tailored to specific health benefits.

- Regulatory Frameworks: Subject to FDA regulations regarding labeling and ingredient safety, influencing product development and marketing strategies.

- Substitute Products: Competition from other beauty and wellness supplements (e.g., hyaluronic acid, vitamin C) impacting market share.

- End-User Trends: Growing consumer awareness of collagen’s benefits for skin health, joint mobility, and gut health is a primary growth driver.

- M&A Activities: The past five years have seen a moderate number of M&A deals (xx), primarily focused on smaller players being acquired by larger companies to expand their product portfolios and market reach.

Collagen Supplement Industry in North America Industry Insights & Trends

The North American collagen supplement market is experiencing robust growth, driven by escalating consumer demand for beauty and wellness products. The market size is projected to reach $xx Million by 2033, expanding at a CAGR of xx% during the forecast period (2025-2033). This significant expansion is fueled by several key factors: rising health consciousness amongst consumers, increased disposable incomes in many regions, and the proliferation of online retail channels. Technological advancements, such as improved extraction methods and enhanced bioavailability of collagen peptides, are further propelling market expansion. Evolving consumer preferences towards natural and clean label products also influence product formulation and marketing strategies. Furthermore, the growing popularity of collagen-infused foods and beverages presents exciting new opportunities for market growth.

Key Markets & Segments Leading Collagen Supplement Industry in North America

By Source:

- Animal-Based Collagen: This segment dominates the market, accounting for approximately 75% of the total market value in 2025. Its dominance is due to factors such as readily available raw materials, established supply chains, and widely accepted efficacy.

- Marine-Based Collagen: This segment shows significant growth potential, owing to increasing consumer interest in sustainable and ethically sourced products. However, higher production costs and limited supply compared to animal-based collagen currently limit market share.

By Distribution Channel:

- Internet Retailing: This channel is experiencing the fastest growth, fueled by consumer preference for online shopping convenience and the increasing reach of e-commerce platforms.

- Hypermarket/Supermarket: This remains a significant distribution channel, offering a wide reach and established consumer base.

- Pharmacies: This channel plays a crucial role, particularly for consumers seeking professional guidance on supplement usage.

Regional Dominance: The United States remains the largest market in North America, driven by high consumer spending on health and wellness products, a robust regulatory framework, and extensive distribution networks.

Collagen Supplement Industry in North America Product Developments

Recent years have witnessed significant advancements in collagen supplement formulations. Innovations include the development of hydrolyzed collagen peptides for improved absorption and bioavailability, collagen-infused beverages and food products for greater consumer convenience, and collagen formulations targeting specific health benefits such as improved skin elasticity and joint health. These advancements enhance consumer appeal and expand market potential. Competitors are differentiating their offerings through unique formulations, advanced delivery systems, and strategic marketing campaigns, creating a highly dynamic product landscape.

Challenges in the Collagen Supplement Industry in North America Market

The North American collagen supplement market faces several challenges: intense competition from both established players and new entrants, fluctuating raw material prices that can impact profitability, stringent regulatory compliance requirements that increase production costs, and potential supply chain disruptions. These factors can negatively impact market growth if not properly addressed through strategic planning and efficient operations.

Forces Driving Collagen Supplement Industry in North America Growth

Several factors are propelling the growth of the North American collagen supplement market. These include the rising health-conscious consumer base, the increasing availability of products through diverse channels (online and offline), and advancements in manufacturing technologies. Additionally, the increasing availability of scientific evidence supporting the efficacy of collagen supplements in improving health and wellness contributes to market growth. Finally, the growing trend of using collagen in functional food and beverages presents significant growth opportunities.

Long-Term Growth Catalysts in the Collagen Supplement Industry in North America

Sustained growth in the collagen supplement market is expected due to several factors: ongoing technological improvements, strategic collaborations between manufacturers and retailers, and expansion into newer markets. The introduction of innovative product forms and formulations will continue to drive market growth, alongside increasing consumer awareness of the benefits of collagen. Furthermore, the exploration of new collagen sources and sustainable production methods will play a critical role in the long-term health of the market.

Emerging Opportunities in Collagen Supplement Industry in North America

Emerging trends indicate significant growth opportunities, particularly in specialized collagen formulations targeting niche health concerns (e.g., gut health, athletic performance). Expansion into new geographical markets within North America, particularly in areas with growing health consciousness, also presents considerable potential. Lastly, the development of personalized collagen supplementation strategies, tailored to individual needs and genetic predispositions, is a highly promising avenue for future growth.

Leading Players in the Collagen Supplement Industry in North America Sector

- Gelita USA Inc

- Vital Proteins

- Herbalife International of America Inc

- Natural Great Lakes Gelatin CoFactors Inc

- Amway Corp

- Nutrawise Health & Beauty Corporation

- Natures Bounty

*List Not Exhaustive

Key Milestones in Collagen Supplement Industry in North America Industry

- 2020: Increased investment in research and development by major players, leading to innovations in collagen peptide formulations.

- 2021: Several key players launched new collagen-infused products in the food and beverage segment.

- 2022: Significant growth in online sales of collagen supplements, highlighting the importance of e-commerce channels.

- 2023: Expansion of product lines to include collagen formulations tailored to specific demographic needs (e.g., athletes, vegetarians).

- 2024: Increased emphasis on sustainability and ethical sourcing of collagen raw materials.

Strategic Outlook for Collagen Supplement Industry in North America Market

The North American collagen supplement market demonstrates strong potential for continued expansion, driven by escalating consumer demand and sustained innovation. Strategic growth opportunities lie in developing advanced formulations, focusing on personalized nutrition, leveraging digital marketing, and fostering partnerships across the value chain. A focus on sustainable sourcing practices and exploring new market segments will be crucial for long-term success in this competitive and dynamic industry.

Collagen Supplement Industry in North America Segmentation

-

1. Sources

- 1.1. Animal-Based Collagen

- 1.2. Marine-Based Collagen

-

2. Distribution Channel

- 2.1. Hypermarket/Supermarket

- 2.2. Pharmacies

- 2.3. Internet Retailing

- 2.4. Other Distribution Channels

-

3. Geography

-

3.1. North America

- 3.1.1. United States

- 3.1.2. Canada

- 3.1.3. Mexico

- 3.1.4. Rest of North America

-

3.1. North America

Collagen Supplement Industry in North America Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

Collagen Supplement Industry in North America REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Nutricosmetics Among Millennials; Growing Beauty and Wellness Trend

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations and Product Guidelines

- 3.4. Market Trends

- 3.4.1. United States is the dominating the Overall Sales in the region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Collagen Supplement Industry in North America Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sources

- 5.1.1. Animal-Based Collagen

- 5.1.2. Marine-Based Collagen

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hypermarket/Supermarket

- 5.2.2. Pharmacies

- 5.2.3. Internet Retailing

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. North America

- 5.3.1.1. United States

- 5.3.1.2. Canada

- 5.3.1.3. Mexico

- 5.3.1.4. Rest of North America

- 5.3.1. North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Sources

- 6. United States Collagen Supplement Industry in North America Analysis, Insights and Forecast, 2019-2031

- 7. Canada Collagen Supplement Industry in North America Analysis, Insights and Forecast, 2019-2031

- 8. Mexico Collagen Supplement Industry in North America Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America Collagen Supplement Industry in North America Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Gelita USA Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Vital Proteins

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Herbalife International of America Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Natural Great Lakes Gelatin CoFactors Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Amway Corp

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Nutrawise Health & Beauty Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Natures Bounty*List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.1 Gelita USA Inc

List of Figures

- Figure 1: Collagen Supplement Industry in North America Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Collagen Supplement Industry in North America Share (%) by Company 2024

List of Tables

- Table 1: Collagen Supplement Industry in North America Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Collagen Supplement Industry in North America Revenue Million Forecast, by Sources 2019 & 2032

- Table 3: Collagen Supplement Industry in North America Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Collagen Supplement Industry in North America Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Collagen Supplement Industry in North America Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Collagen Supplement Industry in North America Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States Collagen Supplement Industry in North America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Collagen Supplement Industry in North America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Collagen Supplement Industry in North America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America Collagen Supplement Industry in North America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Collagen Supplement Industry in North America Revenue Million Forecast, by Sources 2019 & 2032

- Table 12: Collagen Supplement Industry in North America Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 13: Collagen Supplement Industry in North America Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: Collagen Supplement Industry in North America Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States Collagen Supplement Industry in North America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada Collagen Supplement Industry in North America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico Collagen Supplement Industry in North America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of North America Collagen Supplement Industry in North America Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Collagen Supplement Industry in North America?

The projected CAGR is approximately 5.80%.

2. Which companies are prominent players in the Collagen Supplement Industry in North America?

Key companies in the market include Gelita USA Inc, Vital Proteins, Herbalife International of America Inc, Natural Great Lakes Gelatin CoFactors Inc, Amway Corp, Nutrawise Health & Beauty Corporation, Natures Bounty*List Not Exhaustive.

3. What are the main segments of the Collagen Supplement Industry in North America?

The market segments include Sources, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 1,655.7 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Nutricosmetics Among Millennials; Growing Beauty and Wellness Trend.

6. What are the notable trends driving market growth?

United States is the dominating the Overall Sales in the region.

7. Are there any restraints impacting market growth?

Stringent Government Regulations and Product Guidelines.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Collagen Supplement Industry in North America," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Collagen Supplement Industry in North America report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Collagen Supplement Industry in North America?

To stay informed about further developments, trends, and reports in the Collagen Supplement Industry in North America, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence