Key Insights

The Europe Organic Baby Food Market is projected for substantial growth, with an estimated market size of $19.56 billion by 2025, and a Compound Annual Growth Rate (CAGR) of 5.85% expected through 2033. This expansion is driven by increasing parental awareness of organic nutrition benefits and growing apprehension towards conventional food production. Consumers are prioritizing products free from pesticides, synthetic fertilizers, and GMOs, opting for certified organic options for their children's well-being. Evolving lifestyle trends, emphasizing premium and healthy eating for all family members, further fuel this demand. Prepared Baby Food and Milk Formula are leading product segments due to their convenience and nutritional value.

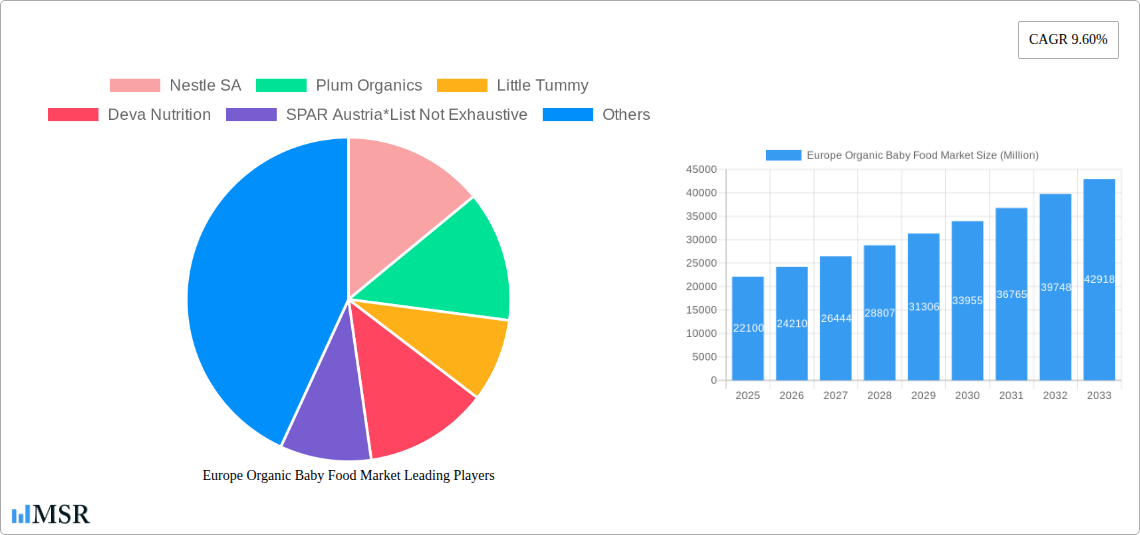

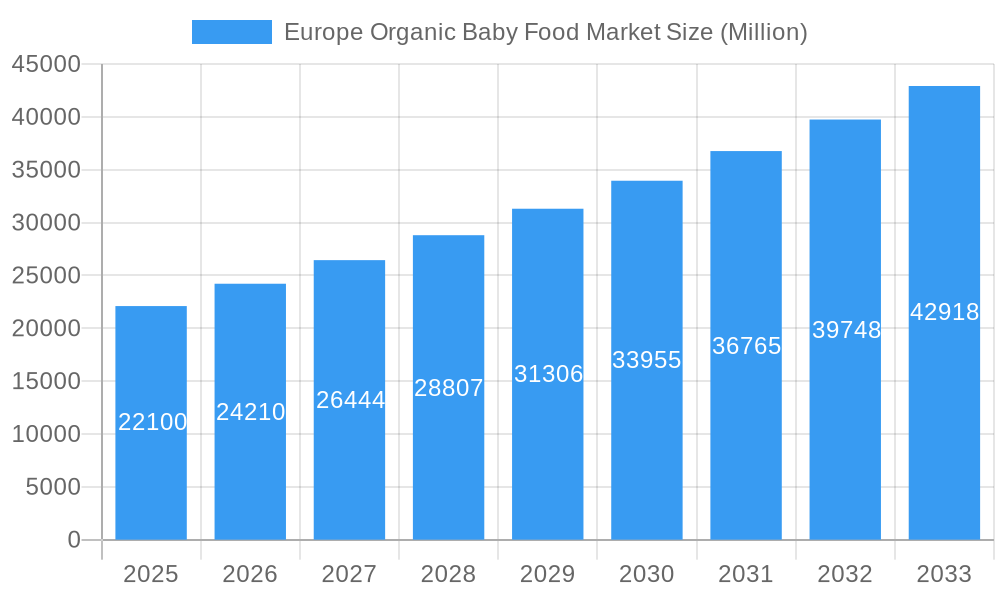

Europe Organic Baby Food Market Market Size (In Billion)

Distribution channels are shifting, with Online Retail emerging as a dominant platform offering convenience and extensive product selection. Supermarkets and Hypermarkets remain vital for accessibility, while Specialty Stores cater to niche demand. Key players like Nestle SA, Danone SA, and HiPP UK Ltd are investing in product innovation, expanding organic portfolios, and utilizing digital channels. Emerging brands are gaining traction through specialized organic formulations and transparent sourcing. Challenges include the premium pricing of organic baby food, potentially impacting affordability. However, the overarching trend towards health-conscious and ethically-minded consumers in Europe strongly supports continued robust growth and innovation in the organic baby food sector.

Europe Organic Baby Food Market Company Market Share

This comprehensive report analyzes the dynamic landscape of infant nutrition in Europe, providing strategic insights for industry stakeholders. The study covers the base year 2025, with detailed forecasts for the period 2025–2033 and historical data from 2019–2024. Understand market concentration, key industry developments, and the driving forces behind the future of organic baby food in Europe.

Europe Organic Baby Food Market Market Concentration & Dynamics

The Europe Organic Baby Food Market exhibits a moderately concentrated structure, with key players investing significantly in innovation and strategic collaborations. The innovation ecosystem is robust, driven by a growing demand for premium, healthy baby food and increasing parental awareness of the benefits of organic ingredients. Regulatory frameworks, particularly concerning food safety and labeling, are stringent and continuously evolving, influencing product development and market entry strategies. Substitute products, such as homemade baby food, pose a consistent challenge, though the convenience and nutritional assurance of commercially available organic infant formula and prepared baby food often prevail. End-user trends reveal a strong preference for transparent sourcing, minimal processing, and allergen-free options. Mergers & Acquisitions (M&A) activities are a crucial driver of market consolidation and expansion, with strategic acquisitions aiming to broaden product portfolios and geographical reach. For instance, the market has witnessed several key M&A deals in recent years, contributing to increased market share for acquiring entities and a dynamic shift in competitive positioning.

Europe Organic Baby Food Market Industry Insights & Trends

The Europe Organic Baby Food Market is poised for significant expansion, projected to reach a market size of $XX Billion by 2025, growing at a Compound Annual Growth Rate (CAGR) of XX% during the forecast period. Several key growth drivers are fueling this upward trajectory. Paramount among these is the escalating parental consciousness regarding infant health and well-being, leading to a pronounced shift towards organic baby food products. This heightened awareness is directly correlated with an increased willingness among European consumers to invest in premium-priced organic baby food options. Furthermore, rising disposable incomes across many European nations empower parents to prioritize quality and nutritional value in their purchasing decisions for their infants. Technological disruptions are also playing a pivotal role. Advancements in food processing techniques, coupled with innovative packaging solutions, are enhancing the shelf-life, nutritional integrity, and convenience of organic baby food. The proliferation of online retail channels has democratized access, allowing smaller brands to reach a wider audience and increasing competition, thereby driving down prices and fostering innovation. Evolving consumer behaviors underscore a demand for transparency in ingredient sourcing, sustainable production practices, and a preference for products free from artificial additives, preservatives, and genetically modified organisms (GMOs). This trend is compelling manufacturers to adopt more natural and ethically sourced ingredients, further solidifying the appeal of organic baby food. The market also benefits from supportive government initiatives and certifications that promote organic farming and food production, fostering a favorable environment for organic infant nutrition.

Key Markets & Segments Leading Europe Organic Baby Food Market

Germany stands as a dominant force in the Europe Organic Baby Food Market, driven by a deeply ingrained consumer preference for organic and health-conscious products. The country's robust economy, coupled with high disposable incomes, allows parents to readily invest in premium organic baby food. This strong consumer demand fuels growth across all key segments.

Product Type Dominance:

- Prepared Baby Food: This segment consistently leads due to its convenience and a wide variety of meal options catering to different developmental stages. Parents appreciate the ready-to-serve nature, especially for busy lifestyles, making organic baby purees and organic baby meals highly sought after.

- Milk Formula: The organic milk formula segment remains a cornerstone, driven by the fundamental nutritional needs of infants and a growing trust in organic alternatives for formula feeding.

- Dried Baby Food: While a smaller segment, organic baby cereals and organic baby snacks are gaining traction as complementary feeding options.

Distribution Channel Dominance:

- Supermarkets and Hypermarkets: These remain the primary distribution channels, offering broad accessibility and a wide selection of brands, making them the go-to for most parents seeking organic baby food.

- Online Retail Channels: This segment is experiencing rapid growth, driven by the convenience of home delivery, competitive pricing, and the ability to access niche or specialized organic brands. The ease of reordering organic baby formula and organic baby purees online further propels its expansion.

- Specialty Stores: While smaller, these stores cater to a discerning consumer base looking for premium and unique organic baby food offerings.

The consistent demand for healthy, safe, and nutritious options ensures that organic baby food continues to be a priority for German parents, positioning the country as a key market influencer. Other significant markets include the United Kingdom, France, and the Netherlands, each contributing to the overall growth and diversification of the Europe Organic Baby Food Market.

Europe Organic Baby Food Market Product Developments

Product innovation in the Europe Organic Baby Food Market is a continuous stream, focusing on enhancing nutritional profiles and catering to evolving dietary needs. Manufacturers are introducing novel product formats, such as convenient pouches for organic baby snacks and organic baby meals, alongside fortified organic milk formulas with added prebiotics and probiotics. The trend towards plant-based and allergen-free options is also prominent, with a surge in vegan baby food and gluten-free baby food ranges. These developments aim to provide parents with a wider array of choices that align with specific infant health requirements and dietary preferences, offering a competitive edge in this discerning market.

Challenges in the Europe Organic Baby Food Market Market

Despite robust growth, the Europe Organic Baby Food Market faces several challenges. Stringent and varied organic certification standards across different European countries can create complex compliance hurdles for manufacturers aiming for pan-European distribution. Fluctuations in the price and availability of organic raw materials can impact production costs and profit margins. Intense competition from both established players and emerging brands, coupled with the growing popularity of homemade baby food, necessitates continuous innovation and effective marketing strategies. Additionally, navigating diverse consumer preferences and cultural eating habits within Europe requires tailored product offerings and localized marketing approaches.

Forces Driving Europe Organic Baby Food Market Growth

Several powerful forces are propelling the Europe Organic Baby Food Market. Growing parental awareness of the long-term health benefits associated with organic consumption for infants is a primary driver. Increasing disposable incomes empower consumers to opt for premium organic baby food products. Supportive governmental policies promoting organic farming and subsidies for organic produce further foster market expansion. Technological advancements in processing and packaging ensure the quality and convenience of organic infant nutrition. The expanding e-commerce landscape also plays a crucial role, enhancing accessibility and convenience for consumers purchasing organic baby formula and organic baby food pouches.

Challenges in the Europe Organic Baby Food Market Market

Long-term growth catalysts for the Europe Organic Baby Food Market lie in continued innovation and strategic market expansion. The development of personalized organic baby food solutions tailored to individual infant needs, potentially leveraging AI and advanced nutritional science, presents a significant opportunity. Strategic partnerships between organic farms and baby food manufacturers can ensure a stable supply of high-quality ingredients. Furthermore, expanding into underserved regions within Europe and exploring novel product categories, such as advanced organic infant supplements, will be crucial for sustained growth. The increasing focus on sustainability throughout the supply chain will also become a key differentiator.

Emerging Opportunities in Europe Organic Baby Food Market

Emerging opportunities in the Europe Organic Baby Food Market are vast and diverse. The growing demand for plant-based baby food and specialized dietary options, such as lactose-free baby food and allergy-friendly baby food, presents a significant untapped market. The rise of subscription-based organic baby food services, offering personalized meal plans and convenient delivery, is another promising avenue. Innovations in functional ingredients, incorporating probiotics, prebiotics, and omega-3 fatty acids into organic baby food, will cater to parents seeking enhanced nutritional benefits. Furthermore, the increasing adoption of eco-friendly packaging solutions will resonate with environmentally conscious consumers, creating a competitive advantage.

Leading Players in the Europe Organic Baby Food Market Sector

- Nestle SA

- Plum Organics

- Little Tummy

- Deva Nutrition

- SPAR Austria

- Abbott Laboratories

- Danone SA

- Lebenswert

- HiPP UK Ltd

- Hero Group

- Holle baby food AG

Key Milestones in Europe Organic Baby Food Market Industry

- July 2022: Organix, a UK-based organic baby and toddler food brand, unveiled 29 new products and two new ranges, "Baby Meals" and "Organix Kids," with initial introductions in Asda and the Organix Online Shop. Further additions to its finger food and snack ranges were also announced.

- June 2021: SPAR Austria launched a new range of organic baby food for infants aged five to 12 months, featuring flavors like apples and pears with strawberries, parsnips with potatoes and beef, and spaghetti bolognese.

- January 2021: Hero Group acquired Baby Gourmet, a Canadian organic meal and snacks brand for babies and toddlers, including its Slammers Snacks brand.

Strategic Outlook for Europe Organic Baby Food Market Market

The strategic outlook for the Europe Organic Baby Food Market is exceptionally positive, driven by sustained demand for premium, healthy, and ethically produced infant nutrition. Key growth accelerators include a continued focus on product innovation, particularly in areas of personalized nutrition and plant-based alternatives. Expanding distribution networks, especially through robust online channels and strategic partnerships with retailers, will be critical. Manufacturers should prioritize transparency in sourcing and sustainable practices to align with evolving consumer values. Investment in marketing and consumer education campaigns highlighting the benefits of organic baby food will further solidify market penetration and drive long-term brand loyalty.

Europe Organic Baby Food Market Segmentation

-

1. product Type

- 1.1. Milk Formula

- 1.2. Prepared Baby Food

- 1.3. Dried Baby Food

-

2. Distibution Channel

- 2.1. Supermarkets and Hypermarkets

- 2.2. Convenience Stores

- 2.3. Specialty Stores

- 2.4. Online Retail Channels

- 2.5. Other Distribution Channels

Europe Organic Baby Food Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Organic Baby Food Market Regional Market Share

Geographic Coverage of Europe Organic Baby Food Market

Europe Organic Baby Food Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.85% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Convenience Food; Increasing Demand for Plant-Based and Organic Ingredients

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Increasing Preference For Breastfeeding Alternatives

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Organic Baby Food Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by product Type

- 5.1.1. Milk Formula

- 5.1.2. Prepared Baby Food

- 5.1.3. Dried Baby Food

- 5.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.2.1. Supermarkets and Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialty Stores

- 5.2.4. Online Retail Channels

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by product Type

- 6. Germany Europe Organic Baby Food Market Analysis, Insights and Forecast, 2020-2032

- 7. France Europe Organic Baby Food Market Analysis, Insights and Forecast, 2020-2032

- 8. Italy Europe Organic Baby Food Market Analysis, Insights and Forecast, 2020-2032

- 9. United Kingdom Europe Organic Baby Food Market Analysis, Insights and Forecast, 2020-2032

- 10. Netherlands Europe Organic Baby Food Market Analysis, Insights and Forecast, 2020-2032

- 11. Sweden Europe Organic Baby Food Market Analysis, Insights and Forecast, 2020-2032

- 12. Rest of Europe Europe Organic Baby Food Market Analysis, Insights and Forecast, 2020-2032

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Nestle SA

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Plum Organics

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Little Tummy

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Deva Nutrition

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 SPAR Austria*List Not Exhaustive

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Abbott Laboratories

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Danone SA

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Lebenswert

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 HiPP UK Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Hero Group

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Holle baby food AG

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Nestle SA

List of Figures

- Figure 1: Europe Organic Baby Food Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Organic Baby Food Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Organic Baby Food Market Revenue billion Forecast, by Region 2020 & 2033

- Table 2: Europe Organic Baby Food Market Revenue billion Forecast, by product Type 2020 & 2033

- Table 3: Europe Organic Baby Food Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 4: Europe Organic Baby Food Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Organic Baby Food Market Revenue billion Forecast, by Country 2020 & 2033

- Table 6: Germany Europe Organic Baby Food Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: France Europe Organic Baby Food Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Italy Europe Organic Baby Food Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: United Kingdom Europe Organic Baby Food Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Netherlands Europe Organic Baby Food Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Sweden Europe Organic Baby Food Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of Europe Europe Organic Baby Food Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Europe Organic Baby Food Market Revenue billion Forecast, by product Type 2020 & 2033

- Table 14: Europe Organic Baby Food Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 15: Europe Organic Baby Food Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: United Kingdom Europe Organic Baby Food Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Germany Europe Organic Baby Food Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: France Europe Organic Baby Food Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Europe Organic Baby Food Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Spain Europe Organic Baby Food Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Netherlands Europe Organic Baby Food Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Belgium Europe Organic Baby Food Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Sweden Europe Organic Baby Food Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Norway Europe Organic Baby Food Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Poland Europe Organic Baby Food Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Denmark Europe Organic Baby Food Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Organic Baby Food Market?

The projected CAGR is approximately 5.85%.

2. Which companies are prominent players in the Europe Organic Baby Food Market?

Key companies in the market include Nestle SA, Plum Organics, Little Tummy, Deva Nutrition, SPAR Austria*List Not Exhaustive, Abbott Laboratories, Danone SA, Lebenswert, HiPP UK Ltd, Hero Group, Holle baby food AG.

3. What are the main segments of the Europe Organic Baby Food Market?

The market segments include product Type, Distibution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.56 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Convenience Food; Increasing Demand for Plant-Based and Organic Ingredients.

6. What are the notable trends driving market growth?

Increasing Preference For Breastfeeding Alternatives.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

In July 2022, The United Kingdom-based organic baby and toddler food brand, Organix unveiled 29 new products and two new ranges namely Baby Meals and Organix Kids and announced that these will be introduced initially in Asda and the Organix Online Shop. It also announced that it will bring further additions to its current finger food and snack ranges.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Organic Baby Food Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Organic Baby Food Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Organic Baby Food Market?

To stay informed about further developments, trends, and reports in the Europe Organic Baby Food Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence