Key Insights

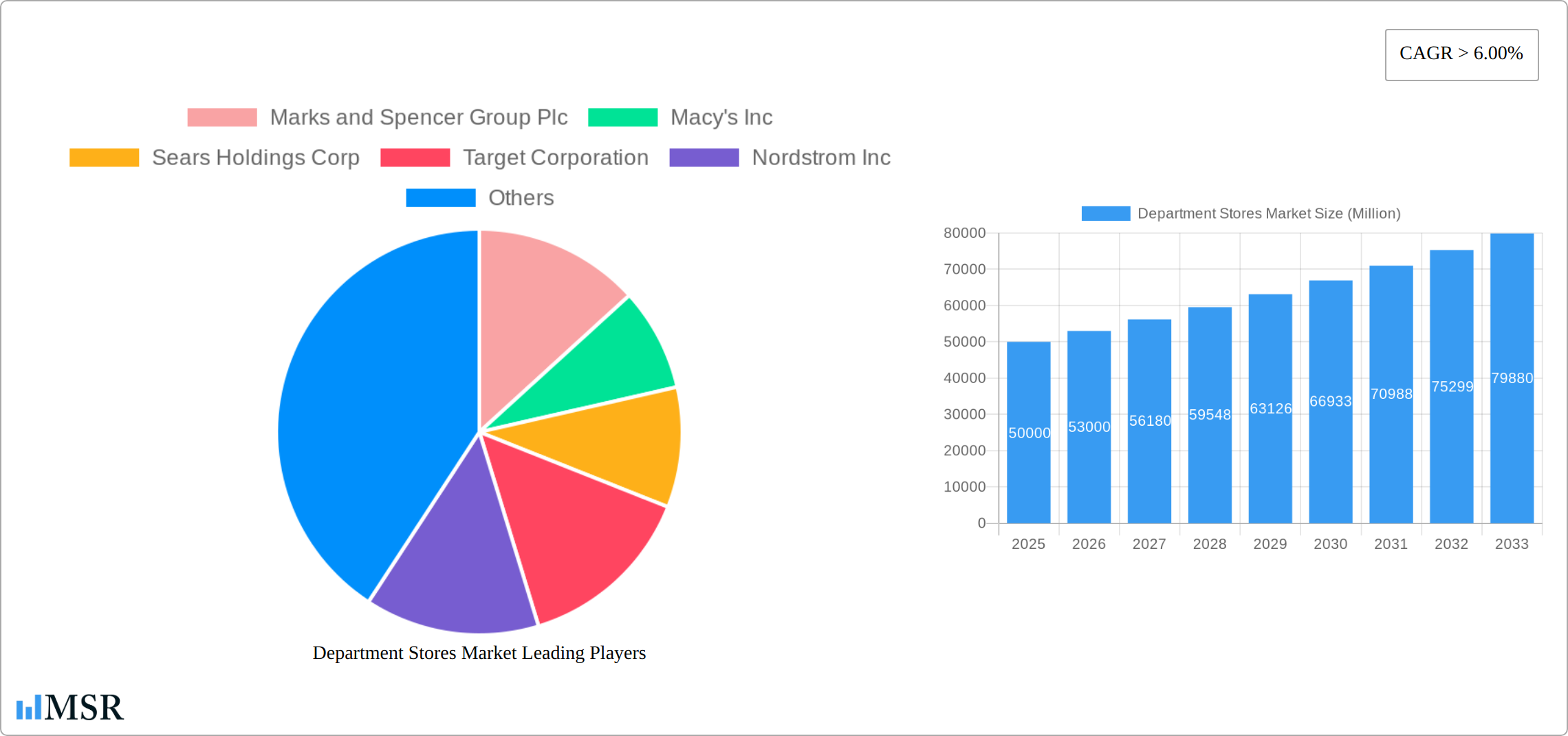

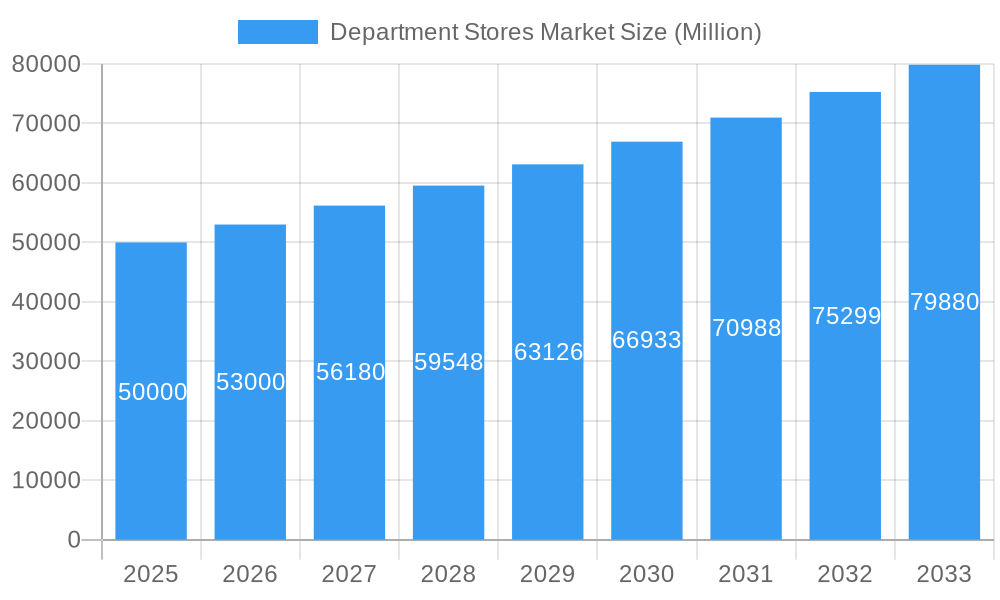

The global department store market, valued at approximately $XX million in 2025 (assuming a reasonable market size based on comparable retail sectors and the provided CAGR), is projected to experience robust growth with a Compound Annual Growth Rate (CAGR) exceeding 6.00% from 2025 to 2033. This expansion is fueled by several key drivers. The increasing preference for curated shopping experiences, offering a blend of product variety and personalized service, continues to attract consumers. Furthermore, strategic investments in omnichannel strategies, seamlessly integrating online and offline retail, are enhancing customer engagement and driving sales. The rise of experiential retail, with department stores incorporating restaurants, entertainment venues, and personalized styling services, is another significant factor contributing to market growth. However, the market faces challenges such as intense competition from e-commerce giants and discount retailers, necessitating continuous innovation and adaptation to retain market share. The changing consumer preferences, particularly among younger demographics who favor online shopping and specialized boutiques, also pose a significant restraint.

Department Stores Market Market Size (In Billion)

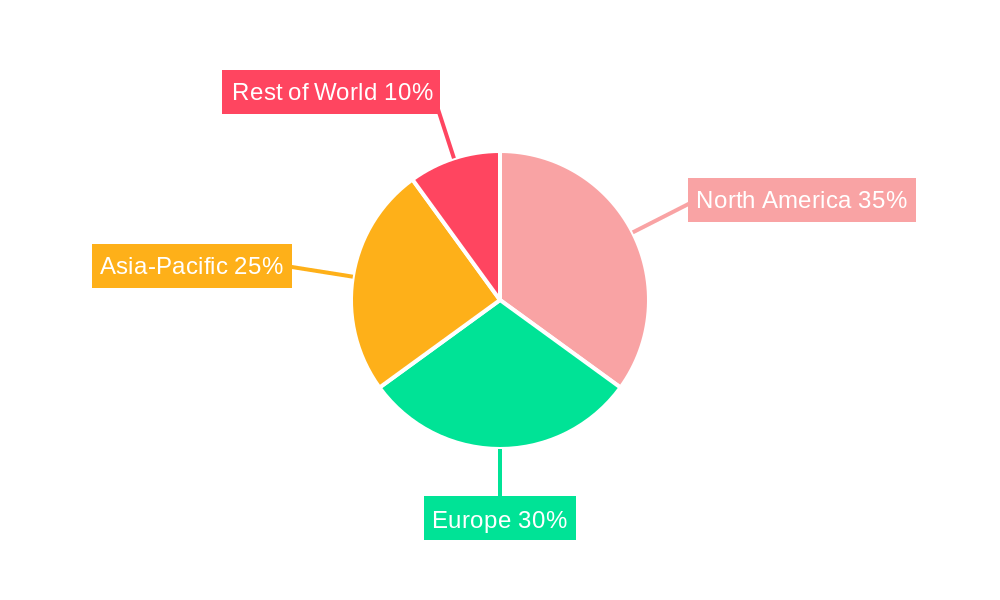

The market segmentation reveals a diverse landscape, with varying performance across different product categories and geographic regions. While established players like Marks & Spencer, Macy's, and Walmart maintain significant market presence, the emergence of innovative business models and digitally native brands is reshaping competitive dynamics. Regional variations in market growth will likely be influenced by factors such as economic development, consumer spending patterns, and government regulations. North America and Europe are anticipated to dominate the market in the forecast period, although the Asia-Pacific region is poised for considerable expansion driven by rising disposable incomes and urbanization. Success in this evolving market requires a focus on delivering a compelling value proposition, optimizing the customer journey across all channels, and leveraging data-driven insights to personalize the shopping experience. Companies are actively investing in supply chain optimization and sustainability initiatives to enhance operational efficiency and appeal to environmentally conscious consumers.

Department Stores Market Company Market Share

Department Stores Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the global Department Stores Market, covering historical performance (2019-2024), the current state (2025), and future projections (2025-2033). The study meticulously examines market dynamics, key players, emerging trends, and growth opportunities, offering invaluable insights for stakeholders across the retail landscape. This report is essential for businesses, investors, and researchers seeking to understand the complexities and future trajectory of the department store industry. The report includes detailed analyses of market concentration, segmentation, and competitive landscapes, supplemented with actionable insights and strategic recommendations. The global market size is estimated at xx Million in 2025, with a projected CAGR of xx% during the forecast period.

Department Stores Market Concentration & Dynamics

The Department Stores Market exhibits a moderately concentrated landscape, with a few dominant players commanding significant market share. However, the presence of numerous regional and niche players contributes to a dynamic competitive environment. Market share data for 2025 reveals that Walmart Inc. holds the largest share, followed by Macy's Inc. and Target Corporation. Other key players include Marks and Spencer Group Plc, Nordstrom Inc., Sears Holdings Corp, Isetan Mitsukoshi Holdings Ltd, Kohl's Corporation, Chongqing Department Store Co Ltd, and Lotte Department Store. The market is influenced by several factors:

- Innovation Ecosystems: Department stores are constantly adapting to incorporate new technologies, such as omnichannel strategies, personalized shopping experiences, and data-driven inventory management.

- Regulatory Frameworks: Government regulations regarding retail practices, consumer protection, and environmental sustainability significantly impact the industry's operations.

- Substitute Products: The rise of e-commerce and online retailers poses a significant competitive threat, acting as a substitute for traditional department stores.

- End-User Trends: Changing consumer preferences, including a growing demand for personalized experiences and sustainable products, are reshaping the department store landscape.

- M&A Activities: Mergers and acquisitions are common, with larger players seeking to expand their market share and diversify their product offerings. The number of M&A deals in the period 2019-2024 totalled approximately xx, indicating a significant level of consolidation.

Department Stores Market Industry Insights & Trends

The Department Stores Market experienced a period of transformation during the study period (2019-2024), marked by significant shifts in consumer behavior and technological advancements. The market size in 2024 stood at xx Million, reflecting the challenges faced by traditional retailers. However, strategic initiatives focused on omnichannel integration and enhanced customer experiences are driving growth. The market is projected to reach xx Million by 2025. This growth is fueled by various factors:

- Market Growth Drivers: The increasing disposable incomes in developing economies and the growth of online shopping are significant drivers.

- Technological Disruptions: E-commerce, mobile commerce, and the adoption of advanced analytics are transforming operations and customer engagement.

- Evolving Consumer Behaviors: Consumers are increasingly seeking personalized shopping experiences, convenience, and value for money, compelling department stores to adapt.

Key Markets & Segments Leading Department Stores Market

The North American region continues to assert its dominance in the Department Stores Market, fueled by a substantial consumer base and a highly developed retail infrastructure. Within this leading region, the United States stands out as the largest individual market, making a significant contribution to the overall market valuation.

- Factors Underpinning North American Leadership:

- Robust consumer expenditure and discretionary spending power.

- An extensive and efficient retail infrastructure supporting widespread accessibility.

- High and growing adoption rates of online and mobile shopping channels.

- The established presence and expansive reach of major, recognized department store chains.

The prominent position of North America is further solidified by the influence of key players such as Macy's, Target, Nordstrom, and Walmart. These retailers leverage their vast store networks, strong brand equity, and sophisticated omnichannel strategies to maintain their competitive edge. While other global regions present promising avenues for growth, North America's mature market, economic stability, and deeply ingrained retail giants ensure its sustained leadership in the department stores sector.

Department Stores Market Product Developments

Product innovation in the department store sector focuses on expanding product assortments, enhancing quality, and promoting private labels. Technological advancements are driving personalization, improving supply chain efficiency, and enabling data-driven decision-making. The introduction of new technologies and innovations leads to a competitive edge by enhancing customer experience, improving efficiency, and expanding market reach.

Challenges in the Department Stores Market Market

The Department Stores Market is navigating a complex landscape characterized by significant challenges. Intense competition from agile e-commerce platforms, coupled with rapidly shifting consumer preferences towards digital-first experiences, puts traditional brick-and-mortar models under pressure. Furthermore, escalating operational costs, including labor and real estate, alongside persistent supply chain disruptions, are impacting profitability. These combined pressures are contributing to tighter profit margins and slower growth rates in specific market segments. The escalating preference for online shopping, offering convenience and wider selection, presents a substantial disruptive force for conventional department store operations.

Forces Driving Department Stores Market Growth

The Department Stores Market is driven by several factors. Technological advancements, like omnichannel retailing and personalized shopping, are enhancing customer experiences and increasing efficiency. Economic growth, particularly in developing economies, is boosting consumer spending and expanding the market. Favorable government policies and regulations also support the sector’s growth.

Challenges in the Department Stores Market Market

The Department Stores Market is navigating a complex landscape characterized by significant challenges. Intense competition from agile e-commerce platforms, coupled with rapidly shifting consumer preferences towards digital-first experiences, puts traditional brick-and-mortar models under pressure. Furthermore, escalating operational costs, including labor and real estate, alongside persistent supply chain disruptions, are impacting profitability. These combined pressures are contributing to tighter profit margins and slower growth rates in specific market segments. The escalating preference for online shopping, offering convenience and wider selection, presents a substantial disruptive force for conventional department store operations.

Emerging Opportunities in Department Stores Market

Emerging opportunities include the expansion into new markets, particularly in developing economies with growing middle classes. The development of sustainable and ethical product lines aligns with growing consumer preferences. Further leveraging data analytics for personalized marketing and improved inventory management presents significant opportunities.

Leading Players in the Department Stores Market Sector

- Marks and Spencer Group Plc

- Macy's Inc

- Sears Holdings Corp

- Target Corporation

- Nordstrom Inc

- Walmart Inc

- Isetan Mitsukoshi Holdings Ltd

- Kohl's Corporation

- Chongqing Department Store Co Ltd

- Lotte Department Store

Key Milestones in Department Stores Market Industry

- January 2023: Marks and Spencer announced a substantial investment of nearly half a billion dollars dedicated to the modernization and upgrade of its store network across the UK. This initiative is projected to create over 3,400 new jobs, signaling a strong commitment to enhancing the physical retail experience and adapting to evolving consumer expectations.

- February 2023: Macy's strategically expanded its beauty offerings with the launch of PATTERN Beauty. This move demonstrates the company's agility in responding to diverse consumer needs and its capacity to collaborate with innovative, niche brands, thereby broadening its appeal and market reach.

Strategic Outlook for Department Stores Market Market

The Department Stores Market is poised for significant future expansion, propelled by ongoing technological advancements, the continuous evolution of consumer behaviors, and the formation of strategic alliances. By fully embracing integrated omnichannel strategies that seamlessly blend online and offline experiences, investing heavily in advanced data analytics to understand and predict consumer behavior, and prioritizing sustainability and hyper-personalization, department stores can effectively capture substantial market share and unlock enduring growth opportunities. Furthermore, proactive expansion into previously overlooked or underserved markets and the development of innovative, differentiated product lines will be indispensable for securing future success and maintaining a competitive edge.

Department Stores Market Segmentation

-

1. Product Type

- 1.1. Apparel and Accessories

- 1.2. FMCG

- 1.3. Hardline and Softline

Department Stores Market Segmentation By Geography

-

1. North America

- 1.1. U

-

2. Canada

- 2.1. Rest of North America

-

3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. Italy

- 3.4. U

-

4. Spain

- 4.1. Rest of Europe

-

5. Asia Pacific

- 5.1. China

- 5.2. Japan

- 5.3. South Korea

- 5.4. India

- 5.5. Australia

- 5.6. Rest of Asia Pacific

-

6. Middle East and Africa

- 6.1. Saudi Arab

- 6.2. South Africa

- 6.3. UAE

- 6.4. Rest of Middle East and Africa

-

7. South America

- 7.1. Brazil

- 7.2. Mexico

- 7.3. Rest of South America

Department Stores Market Regional Market Share

Geographic Coverage of Department Stores Market

Department Stores Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increase in Retail E-Commerce Sales have the Negative Impact on Department Stores Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Department Stores Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Apparel and Accessories

- 5.1.2. FMCG

- 5.1.3. Hardline and Softline

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Canada

- 5.2.3. Europe

- 5.2.4. Spain

- 5.2.5. Asia Pacific

- 5.2.6. Middle East and Africa

- 5.2.7. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Department Stores Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Apparel and Accessories

- 6.1.2. FMCG

- 6.1.3. Hardline and Softline

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada Department Stores Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Apparel and Accessories

- 7.1.2. FMCG

- 7.1.3. Hardline and Softline

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Department Stores Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Apparel and Accessories

- 8.1.2. FMCG

- 8.1.3. Hardline and Softline

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Spain Department Stores Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Apparel and Accessories

- 9.1.2. FMCG

- 9.1.3. Hardline and Softline

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Department Stores Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Apparel and Accessories

- 10.1.2. FMCG

- 10.1.3. Hardline and Softline

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Middle East and Africa Department Stores Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Apparel and Accessories

- 11.1.2. FMCG

- 11.1.3. Hardline and Softline

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. South America Department Stores Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Apparel and Accessories

- 12.1.2. FMCG

- 12.1.3. Hardline and Softline

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Competitive Analysis

- 13.1. Global Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Marks and Spencer Group Plc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Macy's Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Sears Holdings Corp

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Target Corporation

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Nordstrom Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Walmart Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Isetan Mitsukoshi Holdings Ltd

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Kohl's Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Chongqing Department Store Co Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Lotte Department Store**List Not Exhaustive

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Marks and Spencer Group Plc

List of Figures

- Figure 1: Global Department Stores Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Department Stores Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 3: North America Department Stores Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Department Stores Market Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America Department Stores Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Canada Department Stores Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 7: Canada Department Stores Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 8: Canada Department Stores Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: Canada Department Stores Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Department Stores Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 11: Europe Department Stores Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Department Stores Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Department Stores Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Spain Department Stores Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 15: Spain Department Stores Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Spain Department Stores Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Spain Department Stores Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Department Stores Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 19: Asia Pacific Department Stores Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Asia Pacific Department Stores Market Revenue (undefined), by Country 2025 & 2033

- Figure 21: Asia Pacific Department Stores Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Middle East and Africa Department Stores Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 23: Middle East and Africa Department Stores Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 24: Middle East and Africa Department Stores Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East and Africa Department Stores Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Department Stores Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 27: South America Department Stores Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: South America Department Stores Market Revenue (undefined), by Country 2025 & 2033

- Figure 29: South America Department Stores Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Department Stores Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global Department Stores Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global Department Stores Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 4: Global Department Stores Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: U Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: Global Department Stores Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 7: Global Department Stores Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: Rest of North America Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Global Department Stores Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 10: Global Department Stores Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: Germany Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: France Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Italy Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: U Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Global Department Stores Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 16: Global Department Stores Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Rest of Europe Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Global Department Stores Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 19: Global Department Stores Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: China Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Japan Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: South Korea Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: India Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Australia Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Global Department Stores Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 27: Global Department Stores Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 28: Saudi Arab Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: South Africa Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: UAE Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East and Africa Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Department Stores Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 33: Global Department Stores Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 34: Brazil Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Mexico Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Department Stores Market?

The projected CAGR is approximately 5.1%.

2. Which companies are prominent players in the Department Stores Market?

Key companies in the market include Marks and Spencer Group Plc, Macy's Inc, Sears Holdings Corp, Target Corporation, Nordstrom Inc, Walmart Inc, Isetan Mitsukoshi Holdings Ltd, Kohl's Corporation, Chongqing Department Store Co Ltd, Lotte Department Store**List Not Exhaustive.

3. What are the main segments of the Department Stores Market?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increase in Retail E-Commerce Sales have the Negative Impact on Department Stores Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Macy's launches PATTERN Beauty with the brand's extensive assortment of washes, treatments, styling tools, and more. As the brand's first-ever department store partner, PATTERN expands Macy's portfolio of hair care products, specifically in the curl category.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Department Stores Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Department Stores Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Department Stores Market?

To stay informed about further developments, trends, and reports in the Department Stores Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence