Key Insights

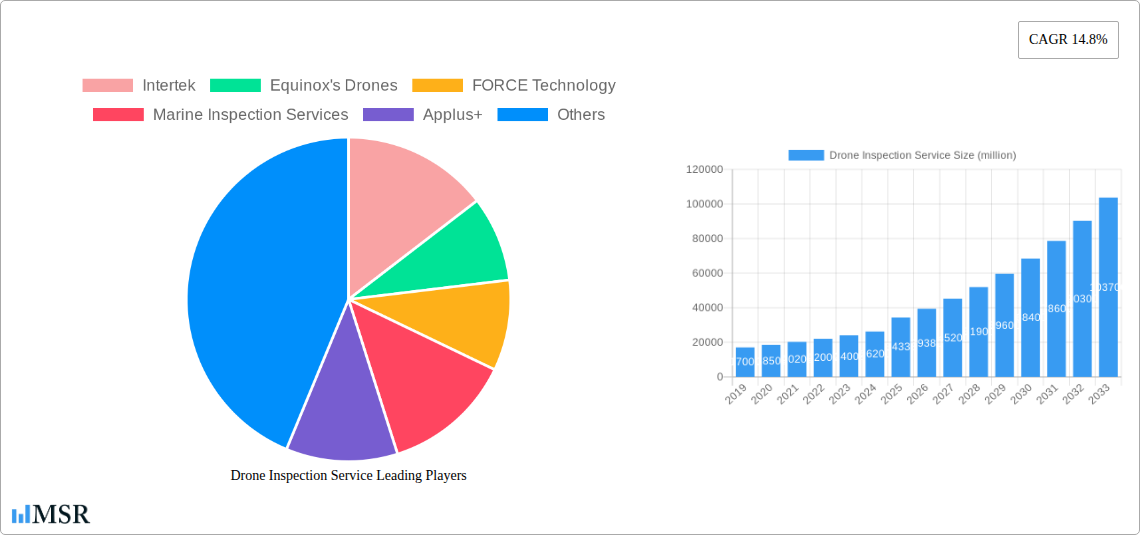

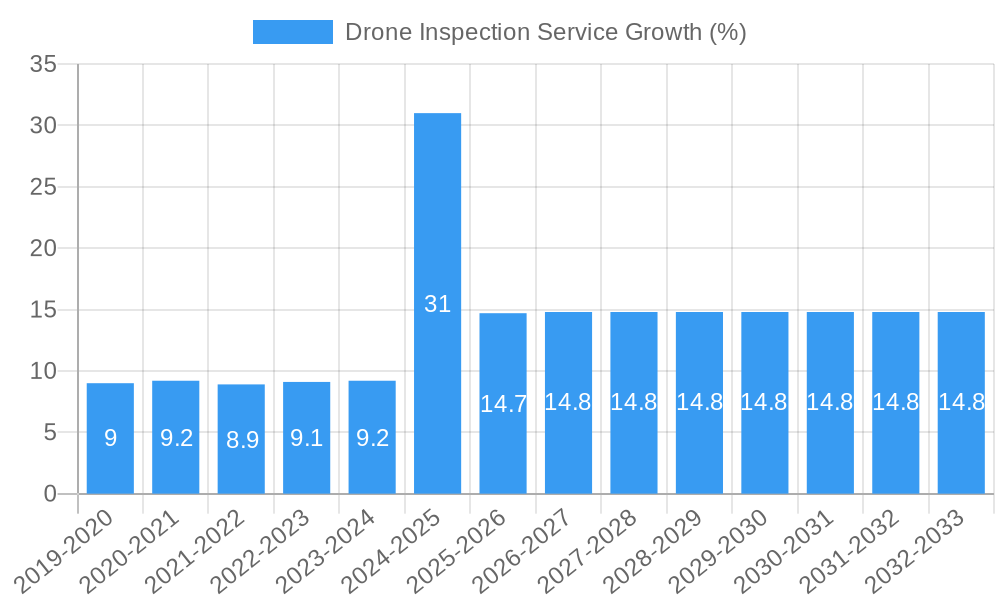

The global drone inspection services market is poised for substantial expansion, projected to reach an estimated market size of $34,330 million by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of 14.8% through 2033. This significant growth is propelled by a confluence of factors, primarily driven by the increasing demand for cost-effective and efficient inspection solutions across various industries. The construction sector, in particular, is a major beneficiary, leveraging drone technology for site surveying, progress monitoring, and structural integrity assessments, thereby reducing labor costs and enhancing safety. The oil and gas industry continues to rely heavily on drones for inspecting pipelines, offshore platforms, and refineries, mitigating risks associated with hazardous environments. Furthermore, the burgeoning renewable energy sector, especially wind farms, is adopting drone inspections for turbine blade maintenance and site analysis, optimizing operational efficiency and longevity. The communication sector also contributes to this growth through drone-based inspections of cell towers and communication infrastructure.

Beyond these primary drivers, emerging trends like the increasing sophistication of AI and machine learning integrated into drone inspection platforms are enhancing data analytics capabilities and predictive maintenance. Autonomous drone inspection is gaining traction, promising further efficiency gains and reduced human intervention in complex or remote inspections. However, the market faces certain restraints, including evolving regulatory frameworks governing drone operations and the need for skilled personnel to operate and interpret data from these advanced systems. Data security and privacy concerns also present challenges that the industry is actively addressing. Despite these hurdles, the overarching benefits of improved safety, reduced operational costs, enhanced data accuracy, and faster inspection turnaround times are firmly establishing drone inspection services as an indispensable tool across a wide spectrum of industrial applications, paving the way for sustained market development.

[Report Title]: Drone Inspection Service Market: Global Analysis & Forecast 2019–2033

This in-depth report provides a definitive analysis of the global Drone Inspection Service market, a rapidly evolving sector revolutionizing how industries assess and maintain critical infrastructure. Spanning a comprehensive study period of 2019–2033, with a base year of 2025 and a forecast period from 2025–2033, this report offers unparalleled insights into market dynamics, growth trajectories, and future opportunities. Dive deep into the applications within the Construction Industry, Oil and Gas, Wind Farm, Communication, Photovoltaic, and Others segments. Explore the advancements in Autonomous Drone Inspection and Manual Drone Inspection types. This essential resource is meticulously crafted for industry stakeholders, investors, and decision-makers seeking to leverage the power of drone technology for enhanced safety, efficiency, and cost savings, achieving an estimated market size of $50,000 million by 2025.

Drone Inspection Service Market Concentration & Dynamics

The global Drone Inspection Service market exhibits a moderately concentrated landscape, characterized by a mix of established industrial service giants and agile, specialized drone operators. Innovation ecosystems are vibrant, fueled by continuous technological advancements in drone hardware, AI-powered analytics, and sensor technology. Regulatory frameworks, while maturing, remain a significant factor, with evolving airspace regulations and certification requirements influencing market entry and operational scalability. Substitute products, primarily traditional manual inspection methods, are gradually being displaced by the superior efficiency, safety, and data-rich output of drone services, with an estimated 15% decline in traditional inspection market share projected annually. Merger and acquisition (M&A) activities are on the rise as larger players seek to integrate specialized drone capabilities into their service portfolios, aiming for a projected 500+ M&A deals during the forecast period. Key market share players are expected to see their dominance grow as they offer integrated solutions.

- Market Concentration: Moderately concentrated, with key players capturing significant portions of the market.

- Innovation Ecosystems: Highly dynamic, driven by advancements in AI, robotics, and sensor technology.

- Regulatory Frameworks: Evolving, with a significant impact on operational models and market access.

- Substitute Products: Traditional manual inspection methods are being increasingly supplanted by drone solutions.

- End-User Trends: Growing demand for real-time data, improved safety, and reduced operational costs.

- M&A Activities: Increasing as companies seek to enhance their drone inspection capabilities.

Drone Inspection Service Industry Insights & Trends

The global Drone Inspection Service market is poised for exceptional growth, driven by a confluence of technological innovation, increasing demand for enhanced safety, and the undeniable economic benefits derived from efficient infrastructure assessment. The market is projected to expand at a compound annual growth rate (CAGR) of 22%, reaching an estimated $150,000 million by the end of the forecast period in 2033. Market growth drivers are intrinsically linked to the accelerating digital transformation across various industries, particularly those with extensive physical assets. The inherent advantages of drone inspections—reduced human risk in hazardous environments, faster data acquisition, and more comprehensive visual and thermal data—are compelling for sectors like Oil and Gas, where offshore and remote site inspections are critical. Similarly, the burgeoning Wind Farm sector benefits immensely from detailed rotor blade analysis and tower integrity checks, minimizing downtime and maximizing energy output. The Construction Industry is increasingly adopting drones for site progress monitoring, quality control, and safety compliance, saving an estimated $20,000 million annually in project delays and rework. Furthermore, advancements in sensor technology, including LiDAR, hyperspectral imaging, and thermal cameras, are expanding the scope of drone inspections beyond simple visual checks, enabling predictive maintenance and anomaly detection with unprecedented accuracy. The integration of artificial intelligence (AI) and machine learning (ML) algorithms for automated data analysis is a significant disruptor, transforming raw imagery into actionable intelligence and further enhancing the value proposition of drone inspection services. End-user behaviors are shifting towards proactive asset management, where drones play a pivotal role in identifying potential issues before they escalate into costly failures.

Key Markets & Segments Leading Drone Inspection Service

The global Drone Inspection Service market's dominance is not uniform, with specific regions and industry segments spearheading adoption and innovation. The Oil and Gas sector stands out as a primary driver, demanding extensive inspections of pipelines, refineries, offshore platforms, and storage facilities. This segment's reliance on drone technology is propelled by the inherent dangers and logistical complexities of traditional inspection methods, with an estimated $30,000 million market size within this sector alone by 2025. The Wind Farm segment is another critical area of growth, driven by the global push for renewable energy and the need for efficient maintenance of wind turbines. Regular inspections of blades, towers, and foundations are crucial for operational efficiency and safety, contributing an estimated $25,000 million to the market. The Construction Industry is rapidly embracing drone inspections for its comprehensive project oversight capabilities, from initial site surveys and progress tracking to structural integrity assessments and safety compliance. Economic growth and infrastructure development worldwide are key catalysts for this segment's expansion, with an anticipated market value of $15,000 million.

Application Segment Dominance:

- Oil and Gas: Driven by the need for enhanced safety, reduced operational costs, and access to remote or hazardous locations for asset integrity management. Economic incentives for preventing costly accidents and environmental disasters are paramount.

- Wind Farm: Fueled by the expansion of renewable energy infrastructure and the imperative for efficient and safe maintenance of wind turbines. The ability to conduct detailed blade inspections without human risk is a significant advantage.

- Construction Industry: Supported by the demand for improved project management, quality control, and site safety. Economic growth, urbanization, and large-scale infrastructure projects worldwide underpin its strong performance.

- Photovoltaic: Growing demand for inspections of solar panel arrays for efficiency monitoring, damage detection, and maintenance, particularly in large-scale solar farms.

- Communication: Essential for inspecting cell towers, telecommunication infrastructure, and remote transmission lines, ensuring network reliability and safety.

- Others: Encompasses diverse applications in utilities, mining, agriculture, and emergency services, demonstrating the versatility of drone inspection solutions.

Type Segment Dominance:

- Autonomous Drone Inspection: This segment is experiencing rapid growth due to its potential for scalability, reduced human error, and the ability to cover vast areas with pre-programmed flight paths. Advancements in AI and GPS technology are enabling increasingly sophisticated autonomous missions.

- Manual Drone Inspection: While autonomous solutions are gaining traction, manual drone inspections remain crucial for complex scenarios requiring human judgment, adaptability, and on-the-spot decision-making. This type is vital for initial adoption and for tasks that demand a higher degree of human oversight.

Drone Inspection Service Product Developments

Product development in the Drone Inspection Service market is characterized by a relentless pursuit of enhanced capabilities and data accuracy. Innovations are focused on developing drones with increased flight endurance, higher payload capacities for advanced sensors, and greater resilience in challenging weather conditions. Key advancements include the integration of AI-powered object recognition for automated defect detection, real-time data streaming for immediate analysis, and sophisticated photogrammetry and 3D modeling software. These developments are creating a competitive edge by offering more efficient, precise, and cost-effective inspection solutions, significantly improving decision-making for asset owners.

Challenges in the Drone Inspection Service Market

Despite its robust growth, the Drone Inspection Service market faces several significant challenges. Regulatory hurdles, including evolving airspace management policies and stringent data privacy laws, can hinder widespread adoption and operational scalability, leading to an estimated 10% increase in compliance costs. Technical limitations such as battery life, payload capacity, and the need for skilled pilots and data analysts also present barriers. Cybersecurity concerns regarding data breaches and unauthorized access to sensitive inspection data are a growing apprehension. Furthermore, market fragmentation and the high initial investment for advanced drone systems can be prohibitive for smaller enterprises.

- Regulatory Compliance and Evolving Airspace Laws

- Limitations in Drone Flight Endurance and Payload Capacity

- Need for Skilled Pilots and Data Analysis Expertise

- Cybersecurity Threats and Data Protection Concerns

- High Initial Investment Costs for Advanced Drone Technology

Forces Driving Drone Inspection Service Growth

The Drone Inspection Service market is propelled by a powerful combination of technological advancements, economic imperatives, and evolving industry needs. The continuous improvement in drone hardware, including longer flight times, enhanced payload capabilities, and improved sensor technology (e.g., thermal, LiDAR), is a primary driver. Economic benefits, such as significant cost reductions in inspection processes compared to traditional methods, reduced downtime, and improved safety outcomes, are compelling for businesses. Furthermore, the increasing global demand for infrastructure maintenance and development, coupled with stricter safety regulations across industries like Oil and Gas and Wind Energy, directly fuels the adoption of drone inspection services. The growing awareness of the benefits of predictive maintenance, facilitated by the detailed data drones provide, is also a key growth catalyst, with an estimated 18% of companies now incorporating drone data into their maintenance strategies.

Challenges in the Drone Inspection Service Market

Long-term growth catalysts for the Drone Inspection Service market are rooted in ongoing innovation and strategic market expansion. The development of more advanced AI and machine learning algorithms for automated data analysis and predictive modeling will unlock new levels of insight and efficiency. Strategic partnerships between drone technology providers, software developers, and end-user industries will foster integrated solutions and broader market penetration. Expansion into new geographical markets and emerging application areas, such as infrastructure inspection in developing nations and advanced surveying for smart cities, will further solidify the market's growth trajectory. The increasing focus on sustainability and environmental monitoring will also create new avenues for drone-based inspections.

Emerging Opportunities in Drone Inspection Service

Emerging opportunities in the Drone Inspection Service market are vast and varied, driven by technological advancements and evolving industry demands. The integration of drones with other IoT devices and cloud platforms for comprehensive asset management systems represents a significant growth area. The development of specialized drone solutions for niche applications, such as underwater inspections or inspections of highly complex industrial environments, will open new market segments. The increasing demand for drone-as-a-service (DaaS) models, which lower the barrier to entry for businesses, is expected to drive widespread adoption. Furthermore, the potential for drone swarms and collaborative inspection missions promises enhanced efficiency and coverage for large-scale projects.

Leading Players in the Drone Inspection Service Sector

- Intertek

- Equinox's Drones

- FORCE Technology

- Marine Inspection Services

- Applus+

- Viper Drones

- Preformed Line Products

- Valmont Utility

- Maverick Inspection

- MISTRAS Services

- Dexon Inspection Technologies

- Sutro Group

- MRS Training & Rescue

- Pointivo

- Skykam Drone Inspections

- Ventus Group

- Acuren

- Falcon 3D

- Axess Group

- Hovrtek

- Sky-Futures

- GEV Wind Power

- Swire Energy Services

- Mech-V

- mCloud Technologies Corp

- Helvetis

- Skyspecs

Key Milestones in Drone Inspection Service Industry

- 2019: Increased adoption of AI in drone data analytics for automated defect detection.

- 2020: Expansion of regulatory frameworks in key regions, enabling broader commercial drone operations.

- 2021: Significant advancements in battery technology, extending drone flight times and operational range.

- 2022: Rise of specialized drone inspection services for Wind Farms and Photovoltaic installations.

- 2023: Growing trend of M&A activity as large industrial service providers acquire drone technology companies.

- 2024: Introduction of more sophisticated sensor payloads, including hyperspectral and LiDAR capabilities.

- 2025 (Base Year): Estimated market size of $50,000 million.

- 2026: Expected further refinement of autonomous flight planning and execution for complex assets.

- 2027: Increased integration of drone inspection data with digital twin technologies.

- 2028: Maturation of regulatory environments, leading to more streamlined commercial operations.

- 2029: Emergence of drone-as-a-service (DaaS) as a mainstream offering.

- 2030: Widespread use of AI for predictive maintenance based on drone inspection data.

- 2031: Expansion into new geographical markets with developing infrastructure needs.

- 2032: Advanced drone solutions for environmental monitoring and disaster response.

- 2033 (End of Forecast Period): Projected market value of $150,000 million.

Strategic Outlook for Drone Inspection Service Market

- 2019: Increased adoption of AI in drone data analytics for automated defect detection.

- 2020: Expansion of regulatory frameworks in key regions, enabling broader commercial drone operations.

- 2021: Significant advancements in battery technology, extending drone flight times and operational range.

- 2022: Rise of specialized drone inspection services for Wind Farms and Photovoltaic installations.

- 2023: Growing trend of M&A activity as large industrial service providers acquire drone technology companies.

- 2024: Introduction of more sophisticated sensor payloads, including hyperspectral and LiDAR capabilities.

- 2025 (Base Year): Estimated market size of $50,000 million.

- 2026: Expected further refinement of autonomous flight planning and execution for complex assets.

- 2027: Increased integration of drone inspection data with digital twin technologies.

- 2028: Maturation of regulatory environments, leading to more streamlined commercial operations.

- 2029: Emergence of drone-as-a-service (DaaS) as a mainstream offering.

- 2030: Widespread use of AI for predictive maintenance based on drone inspection data.

- 2031: Expansion into new geographical markets with developing infrastructure needs.

- 2032: Advanced drone solutions for environmental monitoring and disaster response.

- 2033 (End of Forecast Period): Projected market value of $150,000 million.

Strategic Outlook for Drone Inspection Service Market

The strategic outlook for the Drone Inspection Service market is exceptionally positive, characterized by sustained innovation and increasing integration across industries. Future growth will be accelerated by the development of highly autonomous inspection systems capable of operating with minimal human intervention. Partnerships and collaborations will be crucial for delivering comprehensive end-to-end solutions, from data acquisition to actionable insights. Expansion into emerging markets and niche applications will offer significant new revenue streams. The continued focus on safety, efficiency, and cost reduction will ensure that drone inspection services remain a critical component of modern infrastructure management. The market is set to evolve into a sophisticated ecosystem of integrated data and advanced analytics, driving substantial value for asset owners.

Drone Inspection Service Segmentation

-

1. Application

- 1.1. Construction Industry

- 1.2. Oil and Gas

- 1.3. Wind Farm

- 1.4. Communication

- 1.5. Photovoltaic

- 1.6. Others

-

2. Type

- 2.1. Autonomous Drone Inspection

- 2.2. Manual Drone Inspection

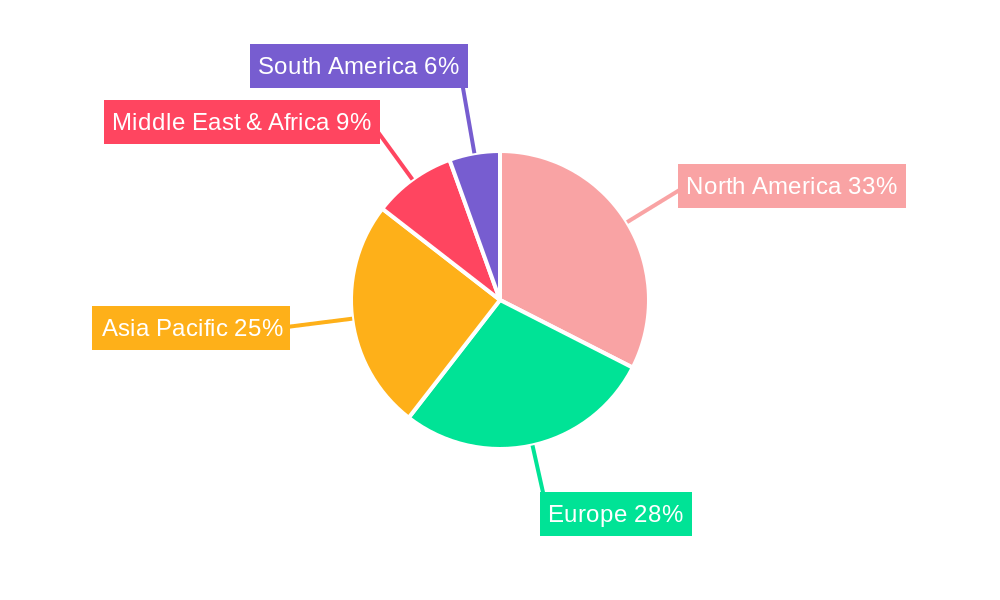

Drone Inspection Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Drone Inspection Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.8% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Drone Inspection Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Construction Industry

- 5.1.2. Oil and Gas

- 5.1.3. Wind Farm

- 5.1.4. Communication

- 5.1.5. Photovoltaic

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Autonomous Drone Inspection

- 5.2.2. Manual Drone Inspection

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Drone Inspection Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Construction Industry

- 6.1.2. Oil and Gas

- 6.1.3. Wind Farm

- 6.1.4. Communication

- 6.1.5. Photovoltaic

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Autonomous Drone Inspection

- 6.2.2. Manual Drone Inspection

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Drone Inspection Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Construction Industry

- 7.1.2. Oil and Gas

- 7.1.3. Wind Farm

- 7.1.4. Communication

- 7.1.5. Photovoltaic

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Autonomous Drone Inspection

- 7.2.2. Manual Drone Inspection

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Drone Inspection Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Construction Industry

- 8.1.2. Oil and Gas

- 8.1.3. Wind Farm

- 8.1.4. Communication

- 8.1.5. Photovoltaic

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Autonomous Drone Inspection

- 8.2.2. Manual Drone Inspection

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Drone Inspection Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Construction Industry

- 9.1.2. Oil and Gas

- 9.1.3. Wind Farm

- 9.1.4. Communication

- 9.1.5. Photovoltaic

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Autonomous Drone Inspection

- 9.2.2. Manual Drone Inspection

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Drone Inspection Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Construction Industry

- 10.1.2. Oil and Gas

- 10.1.3. Wind Farm

- 10.1.4. Communication

- 10.1.5. Photovoltaic

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Autonomous Drone Inspection

- 10.2.2. Manual Drone Inspection

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Intertek

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Equinox's Drones

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 FORCE Technology

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Marine Inspection Services

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Applus+

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Viper Drones

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Preformed Line Products

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Valmont Utility

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Maverick Inspection

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 MISTRAS Services

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Dexon Inspection Technologies

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Sutro Group

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 MRS Training & Rescue

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Pointivo

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Skykam Drone Inspections

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Ventus Group

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Acuren

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Falcon 3D

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Axess Group

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Hovrtek

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Sky-Futures

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 GEV Wind Power

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Swire Energy Services

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Mech-V

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 mCloud Technologies Corp

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 Helvetis

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.27 Skyspecs

- 11.2.27.1. Overview

- 11.2.27.2. Products

- 11.2.27.3. SWOT Analysis

- 11.2.27.4. Recent Developments

- 11.2.27.5. Financials (Based on Availability)

- 11.2.1 Intertek

List of Figures

- Figure 1: Global Drone Inspection Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Drone Inspection Service Revenue (million), by Application 2024 & 2032

- Figure 3: North America Drone Inspection Service Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Drone Inspection Service Revenue (million), by Type 2024 & 2032

- Figure 5: North America Drone Inspection Service Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Drone Inspection Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America Drone Inspection Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Drone Inspection Service Revenue (million), by Application 2024 & 2032

- Figure 9: South America Drone Inspection Service Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Drone Inspection Service Revenue (million), by Type 2024 & 2032

- Figure 11: South America Drone Inspection Service Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Drone Inspection Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America Drone Inspection Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Drone Inspection Service Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Drone Inspection Service Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Drone Inspection Service Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Drone Inspection Service Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Drone Inspection Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Drone Inspection Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Drone Inspection Service Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Drone Inspection Service Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Drone Inspection Service Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Drone Inspection Service Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Drone Inspection Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Drone Inspection Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Drone Inspection Service Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Drone Inspection Service Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Drone Inspection Service Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Drone Inspection Service Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Drone Inspection Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Drone Inspection Service Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Drone Inspection Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Drone Inspection Service Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Drone Inspection Service Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Drone Inspection Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Drone Inspection Service Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Drone Inspection Service Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Drone Inspection Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Drone Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Drone Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Drone Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Drone Inspection Service Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Drone Inspection Service Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Drone Inspection Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Drone Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Drone Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Drone Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Drone Inspection Service Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Drone Inspection Service Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Drone Inspection Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Drone Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Drone Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Drone Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Drone Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Drone Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Drone Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Drone Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Drone Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Drone Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Drone Inspection Service Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Drone Inspection Service Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Drone Inspection Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Drone Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Drone Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Drone Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Drone Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Drone Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Drone Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Drone Inspection Service Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Drone Inspection Service Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Drone Inspection Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Drone Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Drone Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Drone Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Drone Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Drone Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Drone Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Drone Inspection Service Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Drone Inspection Service?

The projected CAGR is approximately 14.8%.

2. Which companies are prominent players in the Drone Inspection Service?

Key companies in the market include Intertek, Equinox's Drones, FORCE Technology, Marine Inspection Services, Applus+, Viper Drones, Preformed Line Products, Valmont Utility, Maverick Inspection, MISTRAS Services, Dexon Inspection Technologies, Sutro Group, MRS Training & Rescue, Pointivo, Skykam Drone Inspections, Ventus Group, Acuren, Falcon 3D, Axess Group, Hovrtek, Sky-Futures, GEV Wind Power, Swire Energy Services, Mech-V, mCloud Technologies Corp, Helvetis, Skyspecs.

3. What are the main segments of the Drone Inspection Service?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 34330 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Drone Inspection Service," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Drone Inspection Service report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Drone Inspection Service?

To stay informed about further developments, trends, and reports in the Drone Inspection Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence