Key Insights

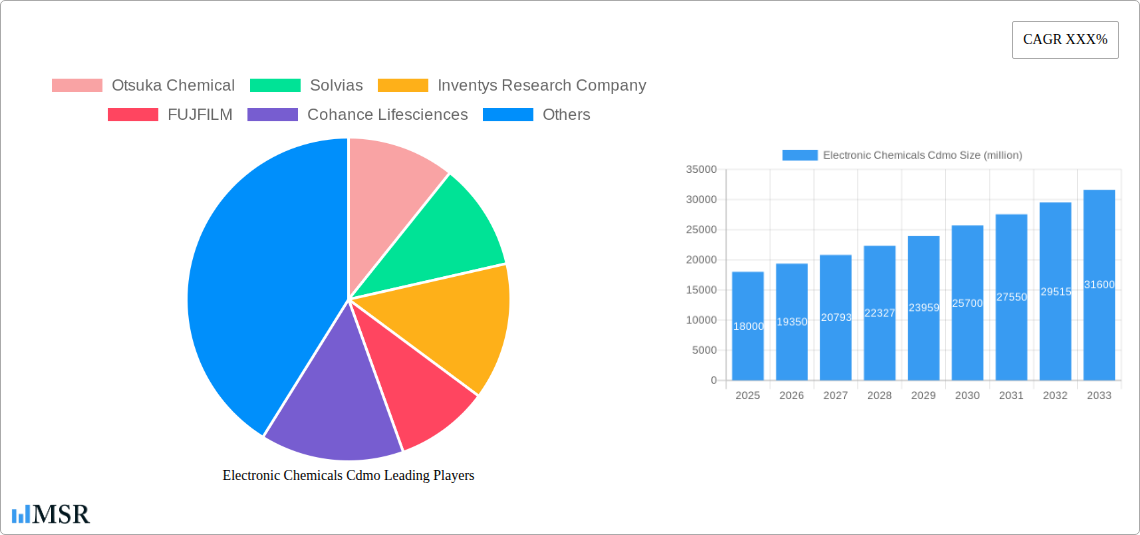

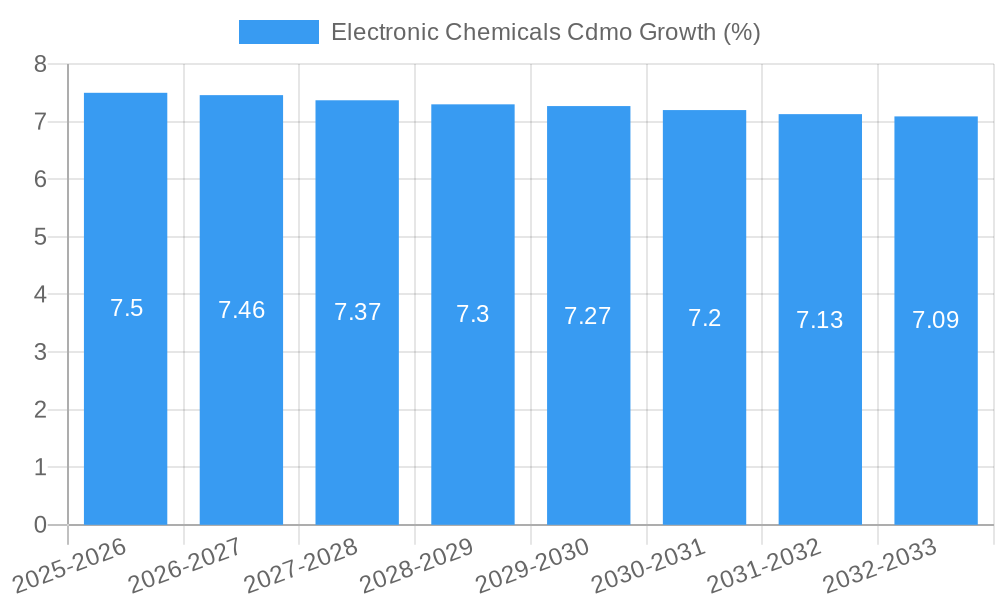

The Electronic Chemicals Contract Development and Manufacturing Organization (CDMO) market is poised for significant expansion, driven by the relentless demand for advanced electronic components and the increasing complexity of semiconductor manufacturing processes. With an estimated market size of approximately USD 18,000 million in 2025, the industry is projected to grow at a robust Compound Annual Growth Rate (CAGR) of around 7.5% through 2033. This growth is underpinned by critical drivers such as the burgeoning consumer electronics sector, the rapid adoption of electric vehicles (EVs) necessitating high-performance batteries, and the ongoing miniaturization and integration within semiconductors and integrated circuits. The need for specialized, high-purity chemicals, innovative formulations, and reliable manufacturing partnerships empowers CDMOs to play an indispensable role in the electronic supply chain, offering expertise in material science, process optimization, and scalable production.

The market's dynamic landscape is further shaped by emerging trends and strategic opportunities. Advancements in materials science, particularly in areas like novel polymers and advanced metal pastes, are fueling innovation and creating new avenues for CDMO engagement. The increasing focus on sustainability and environmental regulations is also pushing manufacturers to seek greener chemical solutions and more efficient production methods, a space where CDMOs can leverage their R&D capabilities. However, certain restraints, such as stringent regulatory compliance, intellectual property concerns, and the high capital investment required for advanced manufacturing facilities, present challenges. Despite these hurdles, the specialized nature of electronic chemicals, coupled with the desire for outsourced expertise and reduced operational risk, ensures a strong and sustained demand for CDMO services across key applications like batteries, semiconductors, and consumer electronics, with Asia Pacific anticipated to lead market expansion.

This comprehensive Electronic Chemicals CDMO Market Report offers an in-depth analysis of the dynamic landscape of contract development and manufacturing organizations (CDMOs) serving the critical electronics industry. Covering the Study Period: 2019–2033, with a Base Year: 2025, Estimated Year: 2025, and an extensive Forecast Period: 2025–2033, this report provides unparalleled insights for industry stakeholders. We delve into market concentration, growth drivers, segment dominance, product innovations, challenges, and emerging opportunities, equipping you with the intelligence to navigate this rapidly evolving sector. Understand the pivotal role of electronic specialty gases, metals and pastes, and polymer compounds in shaping the future of semiconductors, integrated circuits, batteries, and consumer electronics.

Electronic Chemicals CDMO Market Concentration & Dynamics

The electronic chemicals CDMO market exhibits a moderate to high concentration, driven by the stringent quality requirements, specialized expertise, and significant capital investment demanded by the electronics sector. Key players are investing heavily in advanced manufacturing capabilities and R&D to meet the evolving needs of semiconductor fabrication, integrated circuit manufacturing, and the burgeoning battery market. Innovation ecosystems are flourishing, with CDMOs collaborating closely with semiconductor foundries, chip designers, and battery manufacturers to co-develop novel materials and processes. Regulatory frameworks, particularly concerning environmental compliance and material safety, are becoming increasingly sophisticated, influencing sourcing strategies and manufacturing practices. The threat of substitute products remains a constant, especially with ongoing advancements in material science, pushing CDMOs to continuously innovate and offer superior performance. End-user trends, such as the miniaturization of devices, the demand for higher processing power, and the drive for sustainable energy solutions, are significantly shaping the CDMO landscape. Mergers and acquisitions (M&A) activity is expected to increase as larger players seek to consolidate market share, acquire specialized technologies, and expand their geographical reach. M&A deal counts are predicted to rise by approximately 15% over the forecast period.

Electronic Chemicals CDMO Industry Insights & Trends

The global electronic chemicals CDMO market is projected to witness robust growth, driven by the insatiable demand for advanced electronic components and devices. Market size is estimated to reach $150 million by 2025 and is poised for significant expansion through 2033. A Compound Annual Growth Rate (CAGR) of approximately 9.5% is anticipated over the forecast period. This growth is fueled by several key factors. The relentless pursuit of smaller, faster, and more energy-efficient semiconductors and integrated circuits necessitates highly specialized and pure electronic chemicals. The exponential growth of the battery market, particularly for electric vehicles (EVs) and portable electronics, is creating unprecedented demand for advanced battery materials and manufacturing services. Furthermore, the proliferation of consumer electronics, from smartphones and wearables to smart home devices and advanced displays, continuously requires a steady supply of innovative electronic materials. Technological disruptions, such as the advent of next-generation lithography techniques, advanced packaging technologies, and novel display materials, are creating new avenues for CDMOs to offer specialized development and manufacturing services. Evolving consumer behaviors, including the demand for personalized electronics, higher device performance, and sustainable products, are further shaping the requirements for electronic materials and the role of CDMOs in delivering these solutions. The increasing complexity of electronic component manufacturing and the high cost of establishing in-house manufacturing capabilities are compelling more electronics manufacturers to outsource their development and production needs to specialized CDMOs, further accelerating market expansion. The Others application segment, encompassing areas like advanced sensors, IoT devices, and specialized industrial electronics, is also showing promising growth.

Key Markets & Segments Leading Electronic Chemicals CDMO

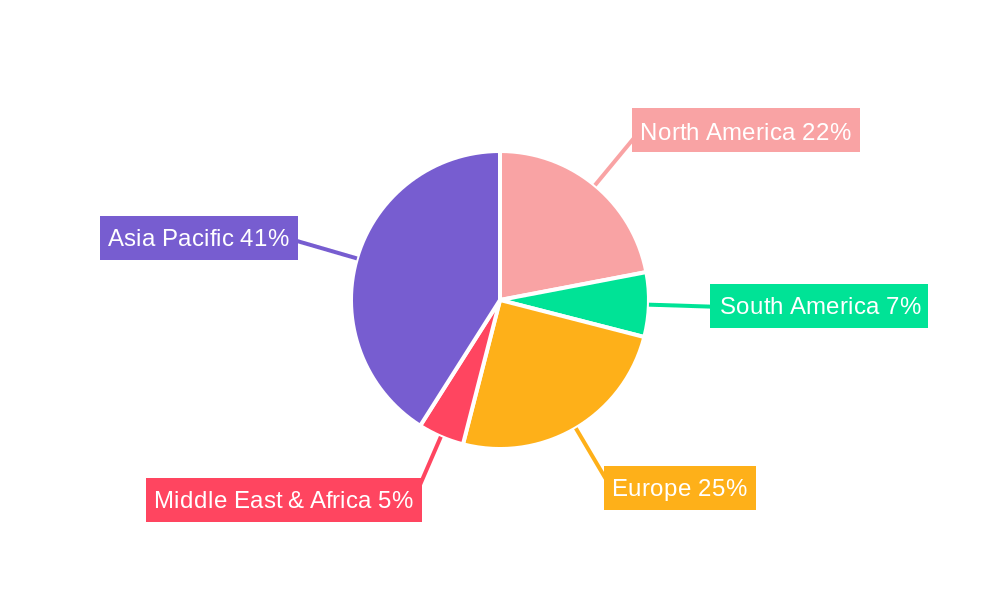

The Asia-Pacific region is the dominant force in the electronic chemicals CDMO market, driven by its established manufacturing prowess, significant investments in advanced technology, and the presence of major electronics hubs. Countries like China, South Korea, Taiwan, and Japan are leading the charge, supported by robust economic growth, extensive infrastructure development, and government initiatives promoting technological innovation.

Dominant Segments:

- Application: Semiconductor & Integrated Circuit: These segments represent the largest and fastest-growing applications for electronic chemicals CDMOs.

- Drivers: The ever-increasing demand for high-performance computing, artificial intelligence, 5G infrastructure, and the Internet of Things (IoT) fuels the need for cutting-edge semiconductor and integrated circuit technologies. Continuous miniaturization and architectural advancements in chip design require highly specialized and ultra-pure electronic chemicals for fabrication processes like photolithography, etching, and deposition.

- Dominance Analysis: The complexity and precision required for semiconductor manufacturing make it a cornerstone for CDMOs offering advanced material development, purification, and scaled production. The high capital expenditure and technical expertise needed to operate in this space naturally favor specialized CDMOs.

- Type: Electronic Specialty Gases: These gases are critical for various processes in semiconductor and integrated circuit manufacturing, including etching, cleaning, and deposition.

- Drivers: The transition to advanced nodes in semiconductor manufacturing demands novel and high-purity electronic specialty gases with precise compositions and properties. Innovations in gas delivery systems and on-site generation technologies are also contributing to market growth.

- Dominance Analysis: The stringent purity requirements and the hazardous nature of many electronic specialty gases necessitate specialized handling, purification, and supply chain management, making CDMOs with expertise in this area highly sought after.

- Application: Battery: This segment is experiencing explosive growth due to the global shift towards electrification and renewable energy storage.

- Drivers: The burgeoning electric vehicle (EV) market, coupled with the demand for efficient energy storage solutions for grid stabilization and portable electronics, is driving substantial investment in battery technology and manufacturing. This includes the development of next-generation battery chemistries and advanced materials for anodes, cathodes, and electrolytes.

- Dominance Analysis: CDMOs are playing a crucial role in scaling up the production of battery materials and components, offering services from material synthesis to cell assembly. The need for customized material solutions and faster production ramp-ups makes CDMOs indispensable in this rapidly evolving sector.

While Consumer Electronics and Others applications are also significant contributors, the foundational demand from Semiconductor, Integrated Circuit, and the rapid expansion in Battery applications, supported by specialized Electronic Specialty Gases, solidify their leadership within the electronic chemicals CDMO market.

Electronic Chemicals CDMO Product Developments

Product innovations within the electronic chemicals CDMO sector are primarily focused on developing ultra-high purity materials, novel formulations, and sustainable alternatives. CDMOs are actively engaged in creating advanced photoresists, etching chemicals, deposition precursors, and specialized cleaning solutions essential for next-generation semiconductor and integrated circuit fabrication. In the battery segment, focus is on novel electrolyte formulations, high-performance cathode and anode materials, and solid-state battery components. These advancements aim to enhance device performance, reduce energy consumption, and improve the lifespan of electronic components. The market relevance of these developments is directly tied to the ability of CDMOs to offer scalable, cost-effective, and environmentally conscious manufacturing solutions that meet the stringent specifications of leading electronics manufacturers. Technological advancements in precision synthesis, purification techniques, and process control are key differentiators.

Challenges in the Electronic Chemicals CDMO Market

The electronic chemicals CDMO market faces several significant challenges that can impact growth and profitability. Regulatory hurdles, particularly concerning environmental, health, and safety (EHS) standards, are becoming increasingly stringent globally, requiring substantial investment in compliance and process optimization. The supply chain volatility, exacerbated by geopolitical factors and raw material scarcity, can lead to production delays and increased costs, with potential impacts of up to 10% on operational budgets. Intense competitive pressures from both established players and new entrants, particularly from low-cost manufacturing regions, necessitate continuous innovation and cost optimization. Furthermore, the high capital expenditure required for advanced manufacturing facilities and specialized equipment presents a barrier to entry for smaller CDMOs.

Forces Driving Electronic Chemicals CDMO Growth

Several key forces are propelling the electronic chemicals CDMO market forward. The technological advancements in semiconductors, driven by AI, 5G, and IoT, continuously demand novel and highly pure electronic chemicals. The economic growth in emerging markets, coupled with significant investments in advanced manufacturing infrastructure, is creating new opportunities for CDMOs. Furthermore, favorable regulatory landscapes in certain regions that encourage innovation and investment in high-tech industries are acting as growth catalysts. The increasing trend of outsourcing by major electronics manufacturers to leverage specialized expertise and reduce capital expenditure also plays a pivotal role.

Challenges in the Electronic Chemicals CDMO Market

Long-term growth catalysts in the electronic chemicals CDMO market are underpinned by continuous innovation in material science and process technology. The development of sustainable and eco-friendly electronic chemicals is becoming a critical differentiator. Strategic partnerships and collaborations between CDMOs, material suppliers, and end-users are essential for co-development and faster market penetration. Furthermore, market expansions into emerging sectors like advanced displays, flexible electronics, and next-generation sensors present significant growth potential. The increasing demand for customized solutions and integrated services will also drive long-term expansion.

Emerging Opportunities in Electronic Chemicals CDMO

Emerging trends and opportunities in the electronic chemicals CDMO market are diverse and promising. The rapid growth of the electric vehicle (EV) sector is creating substantial demand for advanced battery materials and manufacturing expertise. The expanding 5G infrastructure requires high-performance materials for antennas, chips, and network components. The increasing adoption of artificial intelligence (AI) and machine learning (ML) is driving the need for more powerful and efficient processing units, necessitating advanced semiconductor materials. The rise of advanced packaging technologies presents opportunities for CDMOs to develop specialized interconnect materials and encapsulation solutions. Furthermore, the growing emphasis on sustainability is creating a market for bio-based or recyclable electronic chemicals.

Leading Players in the Electronic Chemicals CDMO Sector

- Otsuka Chemical

- Solvias

- Inventys Research Company

- FUJFILM

- Cohance Lifesciences

- Astena Holdings

- Shin-Etsu

- Covestro

- Songwon

- Actylis

- ARBROWN GLOBAL

- Asahi Glass Co

- Eurofins CDMO Alphora Inc

- Sajjan India Limited

- SUMITOMO CHEMICAL

Key Milestones in Electronic Chemicals CDMO Industry

- 2019: Increased investment in high-purity chemicals for advanced semiconductor nodes.

- 2020: Surge in demand for battery materials driven by EV market growth.

- 2021: Significant R&D focus on sustainable and eco-friendly electronic chemicals.

- 2022: Expansion of CDMO capabilities for complex semiconductor packaging materials.

- 2023: Strategic partnerships formed to accelerate the development of next-generation display materials.

- 2024: Increased M&A activity targeting specialized chemical manufacturers.

- 2025 (Estimated): Launch of new CDMO facilities with advanced automation for higher throughput.

- 2026-2033 (Forecast): Continued growth in customized material solutions for emerging electronics applications.

Strategic Outlook for Electronic Chemicals CDMO Market

- 2019: Increased investment in high-purity chemicals for advanced semiconductor nodes.

- 2020: Surge in demand for battery materials driven by EV market growth.

- 2021: Significant R&D focus on sustainable and eco-friendly electronic chemicals.

- 2022: Expansion of CDMO capabilities for complex semiconductor packaging materials.

- 2023: Strategic partnerships formed to accelerate the development of next-generation display materials.

- 2024: Increased M&A activity targeting specialized chemical manufacturers.

- 2025 (Estimated): Launch of new CDMO facilities with advanced automation for higher throughput.

- 2026-2033 (Forecast): Continued growth in customized material solutions for emerging electronics applications.

Strategic Outlook for Electronic Chemicals CDMO Market

The strategic outlook for the electronic chemicals CDMO market is characterized by sustained growth and innovation. Key accelerators include the ongoing miniaturization and performance enhancement of semiconductors, the rapid expansion of the electric vehicle and renewable energy storage markets, and the proliferation of smart devices and IoT applications. CDMOs that can offer specialized expertise, ensure ultra-high purity and consistent quality, and demonstrate agility in adapting to new technological demands will be best positioned for success. Strategic opportunities lie in investing in R&D for advanced materials, expanding manufacturing capacity, and forging strong collaborative relationships across the electronics value chain. The focus on sustainable practices and the development of eco-friendly alternatives will also be a critical component of long-term growth and competitive advantage.

Electronic Chemicals Cdmo Segmentation

-

1. Application

- 1.1. Battery

- 1.2. Semiconductor

- 1.3. Integrated Circuit

- 1.4. Consumer Electronics

- 1.5. Others

-

2. Type

- 2.1. Metals and Pastes

- 2.2. Electronic Specialty Gases

- 2.3. Polymer Compounds

- 2.4. Others

Electronic Chemicals Cdmo Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Electronic Chemicals Cdmo REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electronic Chemicals Cdmo Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Battery

- 5.1.2. Semiconductor

- 5.1.3. Integrated Circuit

- 5.1.4. Consumer Electronics

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Metals and Pastes

- 5.2.2. Electronic Specialty Gases

- 5.2.3. Polymer Compounds

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Electronic Chemicals Cdmo Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Battery

- 6.1.2. Semiconductor

- 6.1.3. Integrated Circuit

- 6.1.4. Consumer Electronics

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Metals and Pastes

- 6.2.2. Electronic Specialty Gases

- 6.2.3. Polymer Compounds

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Electronic Chemicals Cdmo Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Battery

- 7.1.2. Semiconductor

- 7.1.3. Integrated Circuit

- 7.1.4. Consumer Electronics

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Metals and Pastes

- 7.2.2. Electronic Specialty Gases

- 7.2.3. Polymer Compounds

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Electronic Chemicals Cdmo Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Battery

- 8.1.2. Semiconductor

- 8.1.3. Integrated Circuit

- 8.1.4. Consumer Electronics

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Metals and Pastes

- 8.2.2. Electronic Specialty Gases

- 8.2.3. Polymer Compounds

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Electronic Chemicals Cdmo Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Battery

- 9.1.2. Semiconductor

- 9.1.3. Integrated Circuit

- 9.1.4. Consumer Electronics

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Metals and Pastes

- 9.2.2. Electronic Specialty Gases

- 9.2.3. Polymer Compounds

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Electronic Chemicals Cdmo Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Battery

- 10.1.2. Semiconductor

- 10.1.3. Integrated Circuit

- 10.1.4. Consumer Electronics

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Metals and Pastes

- 10.2.2. Electronic Specialty Gases

- 10.2.3. Polymer Compounds

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Otsuka Chemical

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Solvias

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Inventys Research Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 FUJFILM

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cohance Lifesciences

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Astena Holdings

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Shin-Etsu

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Covestro

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Songwon

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Actylis

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ARBROWN GLOBAL

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Asahi Glass Co

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Eurofins CDMO Alphora Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Sajjan India Limited

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 SUMITOMO CHEMICAL

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Otsuka Chemical

List of Figures

- Figure 1: Global Electronic Chemicals Cdmo Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Electronic Chemicals Cdmo Revenue (million), by Application 2024 & 2032

- Figure 3: North America Electronic Chemicals Cdmo Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Electronic Chemicals Cdmo Revenue (million), by Type 2024 & 2032

- Figure 5: North America Electronic Chemicals Cdmo Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Electronic Chemicals Cdmo Revenue (million), by Country 2024 & 2032

- Figure 7: North America Electronic Chemicals Cdmo Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Electronic Chemicals Cdmo Revenue (million), by Application 2024 & 2032

- Figure 9: South America Electronic Chemicals Cdmo Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Electronic Chemicals Cdmo Revenue (million), by Type 2024 & 2032

- Figure 11: South America Electronic Chemicals Cdmo Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Electronic Chemicals Cdmo Revenue (million), by Country 2024 & 2032

- Figure 13: South America Electronic Chemicals Cdmo Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Electronic Chemicals Cdmo Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Electronic Chemicals Cdmo Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Electronic Chemicals Cdmo Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Electronic Chemicals Cdmo Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Electronic Chemicals Cdmo Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Electronic Chemicals Cdmo Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Electronic Chemicals Cdmo Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Electronic Chemicals Cdmo Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Electronic Chemicals Cdmo Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Electronic Chemicals Cdmo Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Electronic Chemicals Cdmo Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Electronic Chemicals Cdmo Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Electronic Chemicals Cdmo Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Electronic Chemicals Cdmo Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Electronic Chemicals Cdmo Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Electronic Chemicals Cdmo Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Electronic Chemicals Cdmo Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Electronic Chemicals Cdmo Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Electronic Chemicals Cdmo Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Electronic Chemicals Cdmo Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Electronic Chemicals Cdmo Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Electronic Chemicals Cdmo Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Electronic Chemicals Cdmo Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Electronic Chemicals Cdmo Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Electronic Chemicals Cdmo Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Electronic Chemicals Cdmo Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Electronic Chemicals Cdmo Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Electronic Chemicals Cdmo Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Electronic Chemicals Cdmo Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Electronic Chemicals Cdmo Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Electronic Chemicals Cdmo Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Electronic Chemicals Cdmo Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Electronic Chemicals Cdmo Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Electronic Chemicals Cdmo Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Electronic Chemicals Cdmo Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Electronic Chemicals Cdmo Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Electronic Chemicals Cdmo Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Electronic Chemicals Cdmo Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Electronic Chemicals Cdmo Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Electronic Chemicals Cdmo Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Electronic Chemicals Cdmo Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Electronic Chemicals Cdmo Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Electronic Chemicals Cdmo Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Electronic Chemicals Cdmo Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Electronic Chemicals Cdmo Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Electronic Chemicals Cdmo Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Electronic Chemicals Cdmo Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Electronic Chemicals Cdmo Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Electronic Chemicals Cdmo Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Electronic Chemicals Cdmo Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Electronic Chemicals Cdmo Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Electronic Chemicals Cdmo Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Electronic Chemicals Cdmo Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Electronic Chemicals Cdmo Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Electronic Chemicals Cdmo Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Electronic Chemicals Cdmo Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Electronic Chemicals Cdmo Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Electronic Chemicals Cdmo Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Electronic Chemicals Cdmo Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Electronic Chemicals Cdmo Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Electronic Chemicals Cdmo Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Electronic Chemicals Cdmo Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Electronic Chemicals Cdmo Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Electronic Chemicals Cdmo Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Electronic Chemicals Cdmo Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electronic Chemicals Cdmo?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Electronic Chemicals Cdmo?

Key companies in the market include Otsuka Chemical, Solvias, Inventys Research Company, FUJFILM, Cohance Lifesciences, Astena Holdings, Shin-Etsu, Covestro, Songwon, Actylis, ARBROWN GLOBAL, Asahi Glass Co, Eurofins CDMO Alphora Inc, Sajjan India Limited, SUMITOMO CHEMICAL.

3. What are the main segments of the Electronic Chemicals Cdmo?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electronic Chemicals Cdmo," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electronic Chemicals Cdmo report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electronic Chemicals Cdmo?

To stay informed about further developments, trends, and reports in the Electronic Chemicals Cdmo, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence