Key Insights

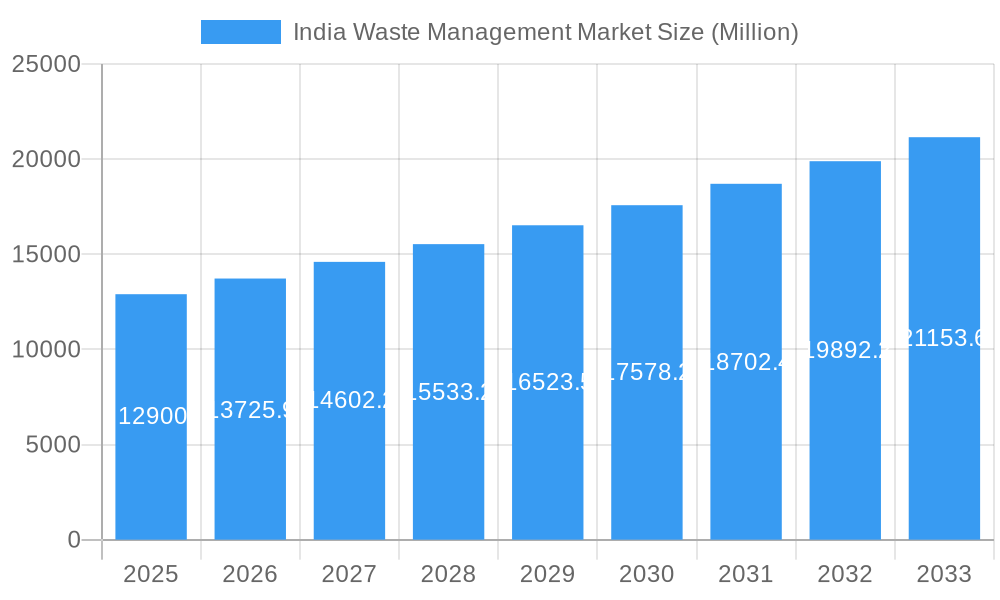

The India waste management market, valued at $12.90 billion in 2025, is projected to experience robust growth, driven by increasing urbanization, rising environmental awareness, and stringent government regulations aimed at improving sanitation and waste disposal. A Compound Annual Growth Rate (CAGR) of 6.10% from 2025 to 2033 indicates a significant market expansion. Key drivers include the burgeoning need for efficient waste collection, processing, and disposal solutions in rapidly growing cities. The increasing adoption of sustainable waste management practices, such as recycling and composting, further fuels market growth. While challenges remain, including infrastructure limitations in certain regions and a lack of awareness in some areas, the market is expected to overcome these obstacles through technological advancements in waste-to-energy conversion, improved waste segregation techniques, and increased private sector investment. This positive trend is attracting numerous companies, both domestic and international, leading to heightened competition and innovation within the sector. The market is segmented based on waste type (municipal solid waste, industrial waste, hazardous waste, etc.), technology used (landfilling, incineration, composting, recycling), and service type (collection, transportation, processing, disposal).

India Waste Management Market Market Size (In Billion)

Government initiatives promoting public-private partnerships (PPPs) and investments in advanced waste management technologies are crucial factors influencing market expansion. The rising demand for sustainable and environmentally friendly solutions is pushing the adoption of innovative technologies, such as anaerobic digestion for biogas production and advanced recycling processes. Moreover, the growing focus on circular economy principles is encouraging waste-to-resource conversion, further enhancing market opportunities. The market’s growth will likely be geographically uneven, with metropolitan areas and economically developed regions witnessing faster growth compared to rural areas. This disparity highlights the need for targeted policy interventions and infrastructure development to ensure equitable access to efficient waste management services across India. Future growth will depend on continuous innovation, sustainable practices, and effective policy implementation.

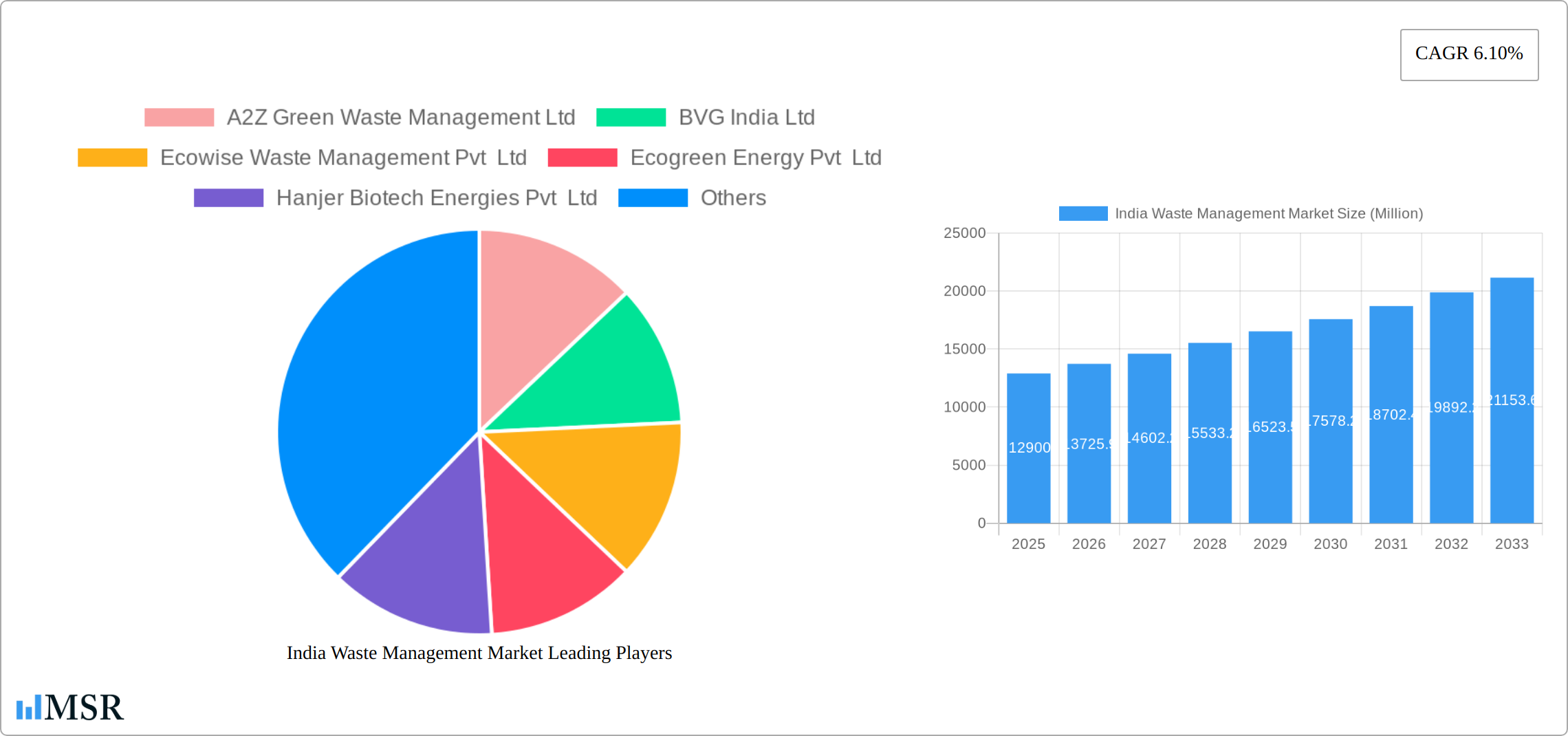

India Waste Management Market Company Market Share

India Waste Management Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the India Waste Management Market, offering valuable insights for industry stakeholders, investors, and policymakers. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report meticulously examines market dynamics, trends, and opportunities within the rapidly evolving Indian waste management sector. The report includes detailed analysis of key players like A2Z Green Waste Management Ltd, BVG India Ltd, Ecowise Waste Management Pvt Ltd, and more. The market is projected to reach XX Million by 2033, exhibiting a CAGR of XX%.

India Waste Management Market Market Concentration & Dynamics

The Indian waste management market is characterized by a dynamic blend of established large-scale operators and a vibrant ecosystem of smaller, agile regional players. Market concentration is a multifaceted phenomenon, influenced by a player's ability to leverage geographical reach, deploy advanced technological solutions, and secure robust financial backing. The current market landscape suggests that the top five entities collectively command approximately **XX%** of the market share, presenting a fertile ground for both organic expansion and strategic consolidation. This presents significant opportunities for players to enhance their operational capacity and market footprint.

Innovation is a key catalyst in this evolving sector, spearheaded by breakthroughs in waste-to-energy (WtE) technologies, the integration of smart waste management solutions, and the widespread adoption of circular economy principles. A supportive regulatory environment, exemplified by the critical Solid Waste Management Rules, 2016, provides a foundational framework for market development. However, achieving uniform and consistent implementation of these regulations across diverse geographical regions remains a persistent challenge. Competition between substitute waste disposal methods, such as incineration versus traditional landfilling, is increasingly driven by a nuanced evaluation of cost-effectiveness alongside their respective environmental footprints. Furthermore, evolving end-user behaviors, particularly evident in urban centers, are marked by a heightened emphasis on meticulous waste segregation and proactive recycling, directly influencing the demand for sophisticated and sustainable waste management solutions.

Mergers and acquisitions (M&A) are emerging as a significant strategic lever within the Indian waste management industry. An estimated **XX M&A deals** have been successfully concluded in the past five years, underscoring a strategic imperative among companies to expand their operational capabilities, integrate cutting-edge technologies, and broaden their geographical coverage to capture a larger market share.

- Market Share: Top 5 players hold approximately XX%

- M&A Deal Count (2019-2024): XX

- Key Regulatory Frameworks: Solid Waste Management Rules, 2016; Plastic Waste Management Rules, 2016; E-Waste (Management) Rules, 2016

- Competitive Landscape: Moderately concentrated with a mix of large national players and numerous regional MSMEs.

- Key Growth Drivers: Urbanization, government mandates, technological advancements, and increasing environmental consciousness.

India Waste Management Market Industry Insights & Trends

The India Waste Management Market is currently experiencing a period of accelerated growth, propelled by a confluence of powerful factors. Rapid urbanization, coupled with a burgeoning environmental consciousness across the populace, is creating an unprecedented demand for effective waste management infrastructure. This is further amplified by increasingly stringent government regulations and a collective recognition of the urgent need for sustainable waste handling practices. The market, valued at an estimated XX Million in 2024, is poised for substantial expansion, projected to reach XX Million by 2033, reflecting a robust Compound Annual Growth Rate (CAGR) of XX%. Several pivotal elements are fueling this upward trajectory:

- Accelerating Urbanization: The relentless pace of urban migration and growth is directly correlating with an exponential rise in waste generation, thereby intensifying the demand for sophisticated and scalable waste management solutions.

- Proactive Government Initiatives and Policy Support: The Indian government's commitment to environmental sustainability, manifested through supportive policies and stringent regulations, is acting as a significant catalyst for increased investments and innovation within the sector.

- Transformative Technological Advancements: The industry is being reshaped by continuous innovations in critical areas such as waste-to-energy conversion, advanced recycling methodologies, and the implementation of smart waste management technologies that enhance operational efficiency and data-driven decision-making.

- Evolving Consumer Behavior and Sustainability Focus: A discernible shift in consumer awareness and preferences towards environmental stewardship is increasingly influencing purchasing decisions and driving a demand for more responsible waste management practices and eco-friendly products.

Key Markets & Segments Leading India Waste Management Market

The key markets driving growth in the India waste management market include major metropolitan areas like Mumbai, Delhi, Bangalore, and Chennai. These cities face significant waste management challenges owing to their dense populations and high waste generation rates. The Municipal Solid Waste (MSW) segment is currently the most dominant, accounting for a substantial share of the overall market.

- Drivers for Dominant Regions:

- High Population Density: Leading to substantial waste generation.

- Economic Growth: Increased consumerism and industrial activity contribute to higher waste volumes.

- Government Initiatives: Focused investments and policy support in key cities.

- Developed Infrastructure: Facilitates efficient waste collection and processing.

India Waste Management Market Product Developments

The India Waste Management Market is witnessing a significant paradigm shift driven by relentless technological innovation and the development of novel solutions. This includes groundbreaking advancements in waste-to-energy (WtE) conversion technologies, optimizing energy recovery from various waste streams. Furthermore, the sector is embracing sophisticated advanced recycling techniques that improve the efficiency and purity of recycled materials. The integration of smart bins, equipped with sensors for fill-level monitoring and route optimization, alongside advanced waste tracking systems, is revolutionizing operational efficiency and data management. These technological leaps not only enhance the effectiveness of waste management processes but also significantly reduce their environmental impact. Companies are prioritizing the development of sustainable, cost-effective, and scalable solutions to meet the escalating demand. The emergence of tailored solutions for specific waste streams, such as the specialized handling and recycling of e-waste and medical waste, further underscores the market's dynamism and its responsiveness to diverse environmental challenges.

Challenges in the India Waste Management Market Market

Despite its robust growth, the Indian waste management sector grapples with a complex set of challenges that impede its full potential. A primary concern is the pervasive lack of adequate and modern infrastructure across many regions, particularly in rural and semi-urban areas, hindering efficient collection and processing. The inconsistent and often fragmented implementation of existing waste management regulations across different states and municipalities creates an uneven playing field and complicates compliance for businesses. The high upfront cost associated with adopting advanced waste management technologies also presents a significant barrier for many players. The informal waste sector, while providing livelihoods, often operates outside formal structures, creating complexities in integration and regulation. Furthermore, securing adequate financing for large-scale infrastructure projects and a persistent shortage of skilled manpower trained in modern waste management techniques continue to stifle growth. The cumulative impact of these challenges is estimated to result in an annual loss of potential revenue amounting to approximately XX Million.

Forces Driving India Waste Management Market Growth

The India Waste Management Market is experiencing strong momentum driven by a confluence of powerful forces. An escalating awareness of environmental sustainability and the urgent need for responsible resource management is a primary catalyst. This is complemented by increasingly stringent government regulations and policy frameworks that mandate sustainable waste management practices and encourage investment in the sector. The rapid expansion of industries that inherently generate substantial waste volumes, such as manufacturing, construction, and electronics, also contributes significantly to market growth. Technological advancements in waste processing, sorting, and recycling are continuously improving efficiency and enabling the development of innovative solutions. For instance, the heightened focus on responsible e-waste recycling, driven by growing environmental consciousness and proactive government initiatives, exemplifies the market's response to emerging waste streams and sustainability imperatives.

Long-Term Growth Catalysts in the India Waste Management Market

Long-term growth will be fueled by continuous technological innovation, strategic partnerships between public and private entities, and the expansion of waste management services into underserved regions. This includes exploring innovative financing models and strengthening the regulatory framework for greater effectiveness. Furthermore, fostering a culture of waste segregation and recycling amongst citizens will be crucial for sustainable growth.

Emerging Opportunities in India Waste Management Market

Emerging opportunities lie in the development and adoption of advanced waste-to-energy technologies, the growth of the circular economy, and the increasing demand for specialized waste management solutions for specific waste streams like e-waste and medical waste. Further opportunities exist in rural areas where waste management infrastructure remains underdeveloped.

Leading Players in the India Waste Management Market Sector

- A2Z Green Waste Management Ltd

- BVG India Ltd

- Ecowise Waste Management Pvt Ltd

- Ecogreen Energy Pvt Ltd

- Hanjer Biotech Energies Pvt Ltd

- Tatva Global Environment Ltd

- Waste Ventures India Pvt Ltd

- Hydroair Tectonics (PCD) Ltd

- IL&FS Environmental Infrastructure and Services Ltd

- Jindal ITF Urban Infrastructure Ltd

- Ramky Enviro Engineers Ltd

- SPML Infra Ltd (List Not Exhaustive)

Key Milestones in India Waste Management Market Industry

- August 2023: The Brihanmumbai Municipal Corporation (BMC) adopted elements from Indore's successful waste management model to improve solid waste management in Mumbai.

- March 2023: Bharat Petroleum Corporation Limited (BPCL) launched the "Sound Management of Waste Disposal (SMWD)" initiative, focusing on e-waste reduction and recycling, aiming for zero-waste-to-landfill certification by 2025.

Strategic Outlook for India Waste Management Market Market

The India Waste Management Market presents significant opportunities for growth and investment. The combination of stringent regulations, increasing environmental awareness, and technological advancements positions the market for substantial expansion over the forecast period. Strategic partnerships, innovative financing models, and a focus on sustainable solutions will be crucial for capitalizing on this growth potential. Companies focusing on technological innovation and expansion into underserved markets are expected to reap significant rewards.

India Waste Management Market Segmentation

-

1. Waste Type

- 1.1. Industrial Waste

- 1.2. Municipal Solid Waste

- 1.3. Hazardous Waste

- 1.4. E-waste

- 1.5. Plastic Waste

- 1.6. Bio-medical Waste

-

2. Disposal Methods

- 2.1. Landfill

- 2.2. Incineration

- 2.3. Dismantling

- 2.4. Recycling

-

3. Type of Ownership

- 3.1. Public

- 3.2. Private

- 3.3. Public-private Partnership

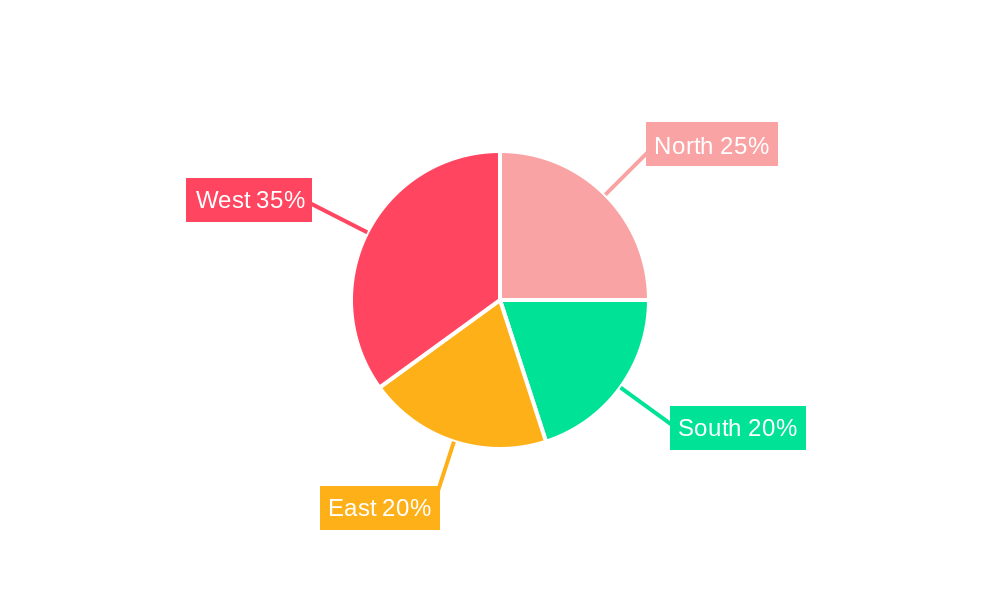

India Waste Management Market Segmentation By Geography

- 1. India

India Waste Management Market Regional Market Share

Geographic Coverage of India Waste Management Market

India Waste Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological advances and shortend life cycle of electronics products leading to increase E-Waste; Rising demand for waste management services from emerging economics due to rapid industrialization

- 3.3. Market Restrains

- 3.3.1. Technological advances and shortend life cycle of electronics products leading to increase E-Waste; Rising demand for waste management services from emerging economics due to rapid industrialization

- 3.4. Market Trends

- 3.4.1. Increase in amount of waste generated

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Waste Type

- 5.1.1. Industrial Waste

- 5.1.2. Municipal Solid Waste

- 5.1.3. Hazardous Waste

- 5.1.4. E-waste

- 5.1.5. Plastic Waste

- 5.1.6. Bio-medical Waste

- 5.2. Market Analysis, Insights and Forecast - by Disposal Methods

- 5.2.1. Landfill

- 5.2.2. Incineration

- 5.2.3. Dismantling

- 5.2.4. Recycling

- 5.3. Market Analysis, Insights and Forecast - by Type of Ownership

- 5.3.1. Public

- 5.3.2. Private

- 5.3.3. Public-private Partnership

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Waste Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 A2Z Green Waste Management Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BVG India Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ecowise Waste Management Pvt Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ecogreen Energy Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hanjer Biotech Energies Pvt Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Tatva Global Environment Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Waste Ventures India Pvt Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hydroair Tectonics (PCD) Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 IL&FS Environmental Infrastructure and Services Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Jindal ITF Urban Infrastructure Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Ramky Enviro Engineers Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 SPML Infra Ltd**List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 A2Z Green Waste Management Ltd

List of Figures

- Figure 1: India Waste Management Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Waste Management Market Share (%) by Company 2025

List of Tables

- Table 1: India Waste Management Market Revenue Million Forecast, by Waste Type 2020 & 2033

- Table 2: India Waste Management Market Volume Billion Forecast, by Waste Type 2020 & 2033

- Table 3: India Waste Management Market Revenue Million Forecast, by Disposal Methods 2020 & 2033

- Table 4: India Waste Management Market Volume Billion Forecast, by Disposal Methods 2020 & 2033

- Table 5: India Waste Management Market Revenue Million Forecast, by Type of Ownership 2020 & 2033

- Table 6: India Waste Management Market Volume Billion Forecast, by Type of Ownership 2020 & 2033

- Table 7: India Waste Management Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: India Waste Management Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: India Waste Management Market Revenue Million Forecast, by Waste Type 2020 & 2033

- Table 10: India Waste Management Market Volume Billion Forecast, by Waste Type 2020 & 2033

- Table 11: India Waste Management Market Revenue Million Forecast, by Disposal Methods 2020 & 2033

- Table 12: India Waste Management Market Volume Billion Forecast, by Disposal Methods 2020 & 2033

- Table 13: India Waste Management Market Revenue Million Forecast, by Type of Ownership 2020 & 2033

- Table 14: India Waste Management Market Volume Billion Forecast, by Type of Ownership 2020 & 2033

- Table 15: India Waste Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: India Waste Management Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Waste Management Market?

The projected CAGR is approximately 6.10%.

2. Which companies are prominent players in the India Waste Management Market?

Key companies in the market include A2Z Green Waste Management Ltd, BVG India Ltd, Ecowise Waste Management Pvt Ltd, Ecogreen Energy Pvt Ltd, Hanjer Biotech Energies Pvt Ltd, Tatva Global Environment Ltd, Waste Ventures India Pvt Ltd, Hydroair Tectonics (PCD) Ltd, IL&FS Environmental Infrastructure and Services Ltd, Jindal ITF Urban Infrastructure Ltd, Ramky Enviro Engineers Ltd, SPML Infra Ltd**List Not Exhaustive.

3. What are the main segments of the India Waste Management Market?

The market segments include Waste Type, Disposal Methods, Type of Ownership.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Technological advances and shortend life cycle of electronics products leading to increase E-Waste; Rising demand for waste management services from emerging economics due to rapid industrialization.

6. What are the notable trends driving market growth?

Increase in amount of waste generated.

7. Are there any restraints impacting market growth?

Technological advances and shortend life cycle of electronics products leading to increase E-Waste; Rising demand for waste management services from emerging economics due to rapid industrialization.

8. Can you provide examples of recent developments in the market?

August 2023: The Brihanmumbai Municipal Corporation (BMC) analyzed the highly successful 'Indore model' of waste management to enhance solid waste management (SWM) in Mumbai. This approach has contributed to Indore, known as the 'Mini Mumbai' of Madhya Pradesh, maintaining its position as the cleanest city in India for six consecutive years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Waste Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Waste Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Waste Management Market?

To stay informed about further developments, trends, and reports in the India Waste Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence