Key Insights

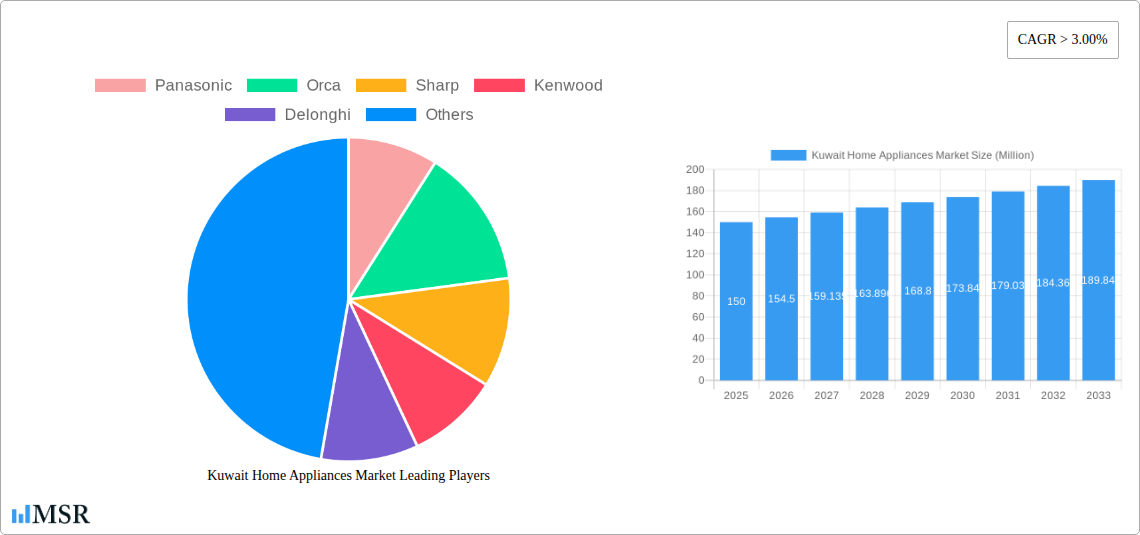

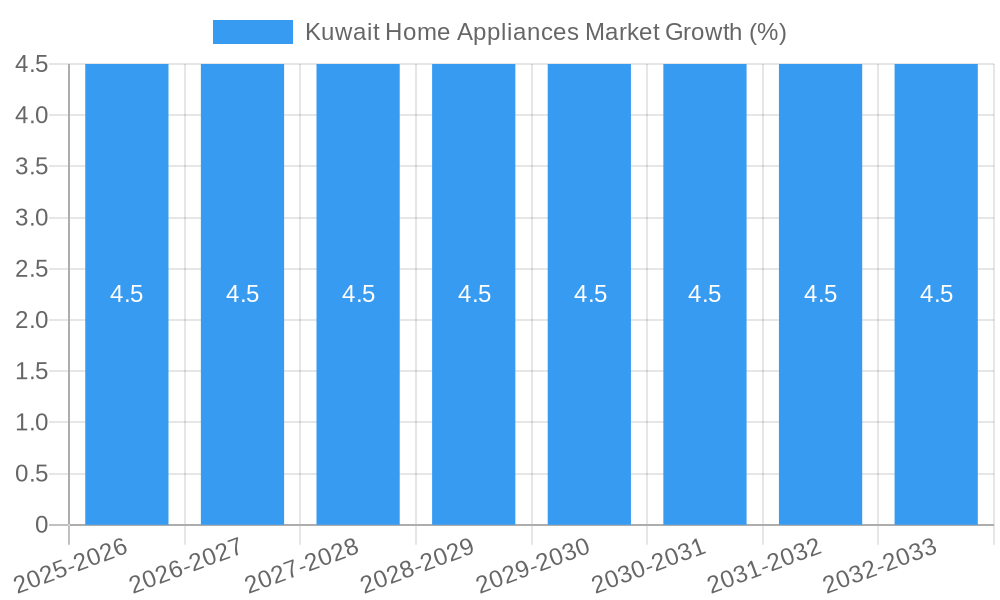

The Kuwait home appliances market, valued at approximately $150 million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 3% from 2025 to 2033. This growth is fueled by several key drivers. Rising disposable incomes within Kuwait are empowering consumers to upgrade their appliances, favoring premium brands and technologically advanced models. A burgeoning population and increasing urbanization contribute to a larger consumer base demanding home appliances. Furthermore, the government's focus on infrastructure development and improving living standards further stimulates market expansion. The market is segmented by product type (major and small appliances) and distribution channels (multi-branded stores, specialty stores, and online platforms). Major appliances, encompassing refrigerators, washing machines, and air conditioners, constitute a significant portion of the market, while the growing popularity of smart home technology is driving demand for sophisticated small appliances. Online sales channels are gaining traction, driven by increased internet penetration and convenience, though traditional retail channels remain dominant. Key players such as Panasonic, Orca, Sharp, Kenwood, Delonghi, Moulinex, Whirlpool, Braun, Bosch, and Midea compete fiercely, focusing on product innovation, brand building, and strategic distribution partnerships to capture market share.

The market's growth trajectory, however, faces certain restraints. Fluctuations in oil prices, a crucial component of Kuwait's economy, can impact consumer spending patterns. Competition among established brands is intense, necessitating continuous product innovation and aggressive marketing strategies. Furthermore, the market's relatively small size compared to regional counterparts limits potential scalability for certain players. Despite these challenges, the long-term outlook remains positive, driven by sustained economic growth and evolving consumer preferences. The market is expected to see a shift towards energy-efficient and smart appliances in the coming years, presenting opportunities for brands focusing on sustainability and technological advancement. This trend, coupled with expanding e-commerce adoption, will reshape the competitive landscape and drive further market evolution.

Kuwait Home Appliances Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Kuwait home appliances market, covering the period 2019-2033. It delves into market dynamics, industry trends, key segments, leading players, and future growth opportunities, offering valuable insights for industry stakeholders, investors, and businesses operating within this dynamic sector. The report uses 2025 as the base year and provides forecasts until 2033. The market size is predicted to reach xx Million by 2025 and is expected to grow at a CAGR of xx% during the forecast period.

Kuwait Home Appliances Market Market Concentration & Dynamics

The Kuwait home appliances market exhibits a moderately concentrated landscape, with a few major players holding significant market share. Panasonic, Orca, Sharp, Kenwood, Delonghi, Moulinex, Whirlpool, Braun, Bosch, and Midea are among the key brands competing in this space. Market share dynamics are influenced by factors such as brand reputation, product innovation, pricing strategies, and distribution network reach. The market witnesses consistent product innovation driven by technological advancements and evolving consumer preferences. The regulatory framework, while generally supportive, plays a role in shaping market practices. Substitute products, particularly those emphasizing energy efficiency, pose a competitive threat. Furthermore, M&A activities, though not overly frequent, influence market consolidation.

- Market Share: Panasonic holds approximately xx% market share in 2025, followed by Orca with xx%, and others with the remaining share.

- M&A Deal Count: An average of xx M&A deals were recorded annually during the historical period (2019-2024).

- End-User Trends: A rising preference for smart home appliances and energy-efficient models is driving market growth.

Kuwait Home Appliances Market Industry Insights & Trends

The Kuwait home appliances market is witnessing robust growth fueled by rising disposable incomes, urbanization, and a preference for modern, convenient appliances. Technological disruptions, particularly in areas like smart home integration and energy efficiency, are reshaping the competitive landscape. Consumers are increasingly adopting connected devices, leading to a surge in demand for smart refrigerators, washing machines, and other appliances. The market also reflects a growing emphasis on sustainability and environmentally friendly products. This trend, combined with government initiatives promoting energy efficiency, is driving the adoption of energy-saving appliances. The overall market size is estimated to be xx Million in 2025, projected to reach xx Million by 2033, driven by a CAGR of xx%.

Key Markets & Segments Leading Kuwait Home Appliances Market

Dominant Segments:

- Product: Major appliances (refrigerators, washing machines, air conditioners) represent a larger market share compared to small appliances (blenders, toasters, etc.) This is largely due to higher purchase value and longer replacement cycles.

- Distribution Channel: Multi-branded stores currently hold the largest market share followed by specialty stores and online channels. However, the online channel is growing at a faster rate than other channels.

Growth Drivers:

- Economic Growth: Rising disposable incomes are a key driver of growth in the home appliances market.

- Infrastructure Development: Improved infrastructure facilitates better distribution and reach for appliance manufacturers.

- Tourism: The thriving tourism sector boosts demand for appliances in hotels and hospitality establishments.

The dominance of major appliances is largely attributed to their higher price points and necessity in modern households. Multi-branded stores benefit from their wider reach and established customer base, while online channels are gaining traction due to convenience and competitive pricing.

Kuwait Home Appliances Market Product Developments

Recent years have witnessed significant product innovations in the Kuwait home appliances market. Smart home technology integration has become a key differentiator, with manufacturers offering appliances with Wi-Fi connectivity, voice control, and remote monitoring capabilities. Energy efficiency remains a crucial factor, with manufacturers emphasizing appliances with higher energy star ratings to meet growing consumer demand. Moreover, there's an increasing focus on aesthetic design and customization options, reflecting a broader shift towards personalized consumer experiences. These innovations provide manufacturers with a competitive edge and cater to evolving consumer preferences.

Challenges in the Kuwait Home Appliances Market Market

The Kuwait home appliances market faces several challenges. Intense competition from both international and local brands puts pressure on pricing and profit margins. Fluctuations in global commodity prices can impact production costs and affordability. Supply chain disruptions, particularly those caused by geopolitical events or logistical hurdles, can hamper product availability and increase lead times. Furthermore, stricter regulatory requirements and environmental concerns add to the operational complexities for manufacturers. These factors collectively affect the market's overall performance and growth trajectory. For example, xx% of manufacturers reported supply chain delays in 2024.

Forces Driving Kuwait Home Appliances Market Growth

Several factors contribute to the growth of the Kuwait home appliances market. The rising disposable incomes of the Kuwaiti population fuel demand for higher-end appliances. Government initiatives promoting energy efficiency are driving the adoption of energy-saving appliances. Technological advancements, like smart home integration and improved energy efficiency, are creating new product categories and enhancing consumer appeal. Furthermore, the expansion of retail infrastructure and improved online shopping experiences have boosted market accessibility.

Challenges in the Kuwait Home Appliances Market Market

Long-term growth in the Kuwait home appliances market will depend on ongoing innovation, strategic partnerships, and market expansion. Focusing on sustainability and energy efficiency will be crucial to meet evolving consumer preferences. Collaboration with technology companies to integrate smart home features will enhance product value propositions. Exploring new markets within the region and diversifying product offerings will further expand market reach and revenue streams.

Emerging Opportunities in Kuwait Home Appliances Market

The market presents significant opportunities for manufacturers willing to embrace new trends. The increasing adoption of smart home technology opens new avenues for innovation. Catering to specific consumer needs and preferences, for example through customization or specialized appliance models, is a key opportunity. Expansion into underserved segments, such as commercial applications and the hospitality sector, represents further potential for growth.

Leading Players in the Kuwait Home Appliances Market Sector

Key Milestones in Kuwait Home Appliances Market Industry

- June 2022: TCL partners with Jashanmal to launch its new range of ACs, significantly expanding its reach in the Kuwaiti market.

- August 2021: GE Appliances' partnership with Google Cloud signals a major shift towards smart home technology integration within the market.

Strategic Outlook for Kuwait Home Appliances Market Market

The Kuwait home appliances market holds substantial long-term potential, driven by consistent economic growth, technological advancements, and evolving consumer preferences. Manufacturers who successfully adapt to these trends, emphasizing innovation, sustainability, and smart home integration, will be best positioned to capitalize on emerging opportunities. Strategic partnerships and market expansion initiatives will be critical for sustained growth and market leadership.

Kuwait Home Appliances Market Segmentation

-

1. Product

-

1.1. Major Appliances

- 1.1.1. Refrigerators

- 1.1.2. Freezers

- 1.1.3. Dishwashing Machines

- 1.1.4. Washing Machines

- 1.1.5. Ovens

- 1.1.6. Air Conditioners

- 1.1.7. Other Major Appliances

-

1.2. Small Appliances

- 1.2.1. Coffee/Tea Makers

- 1.2.2. Food Processors

- 1.2.3. Grills and Roasters

- 1.2.4. Vacuum Cleaners

- 1.2.5. Other Small Appliances

-

1.1. Major Appliances

-

2. Distribution Channel

- 2.1. Multi-Branded Stores

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Other Distribution Channels

Kuwait Home Appliances Market Segmentation By Geography

- 1. Kuwait

Kuwait Home Appliances Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Home Improvement Projects are Driving the Growth of the Market; A Positive Trend in Real-Estate Industry also Helps in Boosting the Growth

- 3.3. Market Restrains

- 3.3.1. Changing Consumer Preferences and Lifestyle Trends Influencing Demand for Certain Appliances

- 3.4. Market Trends

- 3.4.1. Urban Areas Account for Majority of Sales in Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Kuwait Home Appliances Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Major Appliances

- 5.1.1.1. Refrigerators

- 5.1.1.2. Freezers

- 5.1.1.3. Dishwashing Machines

- 5.1.1.4. Washing Machines

- 5.1.1.5. Ovens

- 5.1.1.6. Air Conditioners

- 5.1.1.7. Other Major Appliances

- 5.1.2. Small Appliances

- 5.1.2.1. Coffee/Tea Makers

- 5.1.2.2. Food Processors

- 5.1.2.3. Grills and Roasters

- 5.1.2.4. Vacuum Cleaners

- 5.1.2.5. Other Small Appliances

- 5.1.1. Major Appliances

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Multi-Branded Stores

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Kuwait

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Panasonic

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Orca

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sharp

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Kenwood

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Delonghi

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Moulinex

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Whirlpool

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Braun

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bosch

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Midea

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Panasonic

List of Figures

- Figure 1: Kuwait Home Appliances Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Kuwait Home Appliances Market Share (%) by Company 2024

List of Tables

- Table 1: Kuwait Home Appliances Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Kuwait Home Appliances Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Kuwait Home Appliances Market Revenue Million Forecast, by Product 2019 & 2032

- Table 4: Kuwait Home Appliances Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 5: Kuwait Home Appliances Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: Kuwait Home Appliances Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 7: Kuwait Home Appliances Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Kuwait Home Appliances Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Kuwait Home Appliances Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Kuwait Home Appliances Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Kuwait Home Appliances Market Revenue Million Forecast, by Product 2019 & 2032

- Table 12: Kuwait Home Appliances Market Volume K Unit Forecast, by Product 2019 & 2032

- Table 13: Kuwait Home Appliances Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 14: Kuwait Home Appliances Market Volume K Unit Forecast, by Distribution Channel 2019 & 2032

- Table 15: Kuwait Home Appliances Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Kuwait Home Appliances Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Kuwait Home Appliances Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Kuwait Home Appliances Market?

Key companies in the market include Panasonic, Orca, Sharp, Kenwood, Delonghi, Moulinex, Whirlpool, Braun, Bosch, Midea.

3. What are the main segments of the Kuwait Home Appliances Market?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Home Improvement Projects are Driving the Growth of the Market; A Positive Trend in Real-Estate Industry also Helps in Boosting the Growth.

6. What are the notable trends driving market growth?

Urban Areas Account for Majority of Sales in Market.

7. Are there any restraints impacting market growth?

Changing Consumer Preferences and Lifestyle Trends Influencing Demand for Certain Appliances.

8. Can you provide examples of recent developments in the market?

June 2022: TCL partners with Jashanmal to launch it's new range of AC's. The partnership will enable TCL to reach a wider customer base with its top-of-the-line home appliances and air conditioners (AC).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Kuwait Home Appliances Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Kuwait Home Appliances Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Kuwait Home Appliances Market?

To stay informed about further developments, trends, and reports in the Kuwait Home Appliances Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence